The Week On-chain (Week 26, 2021)

The Bitcoin market continues to fight for support as mining sell pressure increases, institutional demand remains slow, and a second capitulation occurs.

The Bitcoin market is working hard to hold the lows of the present trading range established since the sell-off in mid-May. The market traded down to a new local low of $28,993 early in the week before recovering to set an intra-day high of $35,487.

As mining hash-power continues to drop off the network during the largest migration of mining hardware in history, Bitcoin holders market wide appear to have capitulated at the lows once again. The market realised the largest absolute losses in history and we explore the cross section of the market most affected.

This week we also assess the overall demand dynamics related to institutions such as Grayscale's GBTC, various ETF products and the coin balance on Coinbase.

Capitulation Round 2

After breaking new records on absolute dollar denominated losses in May, the market capitulated yet again this week, realising a new ATH of $3.45B in losses. Losses are realised on-chain when a coin that was last moved (UTXO created) at higher prices is spent again at lower prices (UTXO destroyed), assuming it was sold for a loss. Note that as the Bitcoin market increases in valuation, larger absolute dollar values of profit and loss are possible.

What this means is that a very large volume of coins that were underwater were spent this week. Note that almost all Long-Term Holders are in profit and their spending actually offset around $383M in net losses (total realised loss was $3.833B!). Currently only 2.44% of the circulating supply is held by LTHs at an unrealised loss.

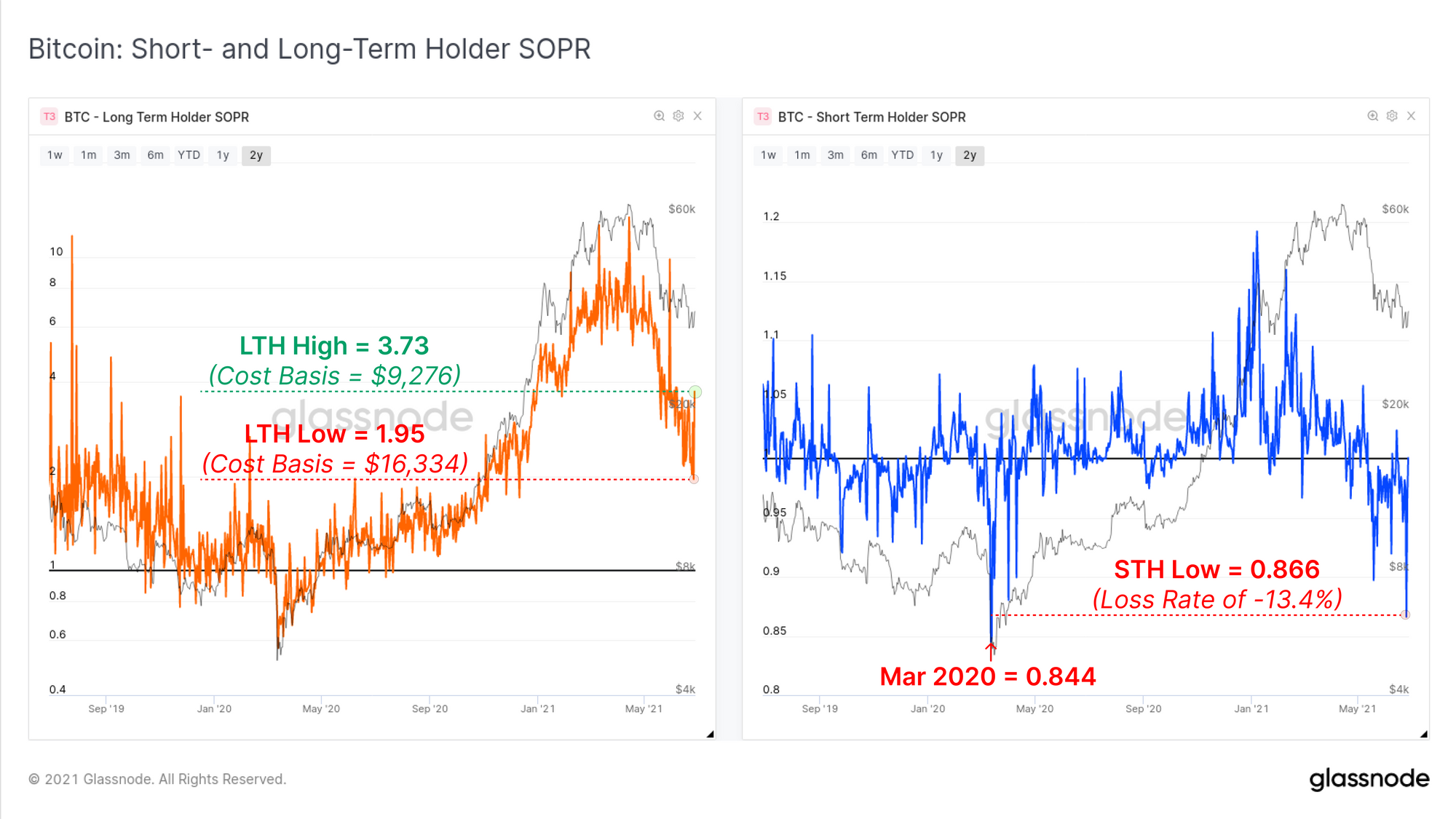

On a more relative basis, we can look to the Spent Output Profit Ratio (SOPR) to observe how this second capitulation compares on a relative basis. We look at SOPR metrics for two cohorts, Long- and Short-term holders. These two metrics have the same calculation, but need slightly different interpretations:

- Long-Term Holder SOPR (left, orange) may be thought of as the profit multiple realised as LTHs are generally well in the green. A LTH-SOPR value of 1.95 means on aggregate, long-term holders realised profits of 195% (an average cost basis around $16.3k at current prices).

- Short-Term Holder SOPR (right, blue) generally oscillates around a value of 1.0 as a result of coins recently moved being re-spent during market volatility. Falling to values well below 1.0 (and sustaining it) indicates significant losses are realised by this cohort.

This weeks downside price action appears to have created a panic in both LTHs and STHs as demonstrated by the volatility in LTH-SOPR, and deep capitulation in STH-SOPR. STHs have realised losses only slightly less than in the March 2020 capitulation event. LTHs were willing to spend coins with an average cost basis fluctuating between $9.2k and $16.3k this week, suggesting a high degree of uncertainty.

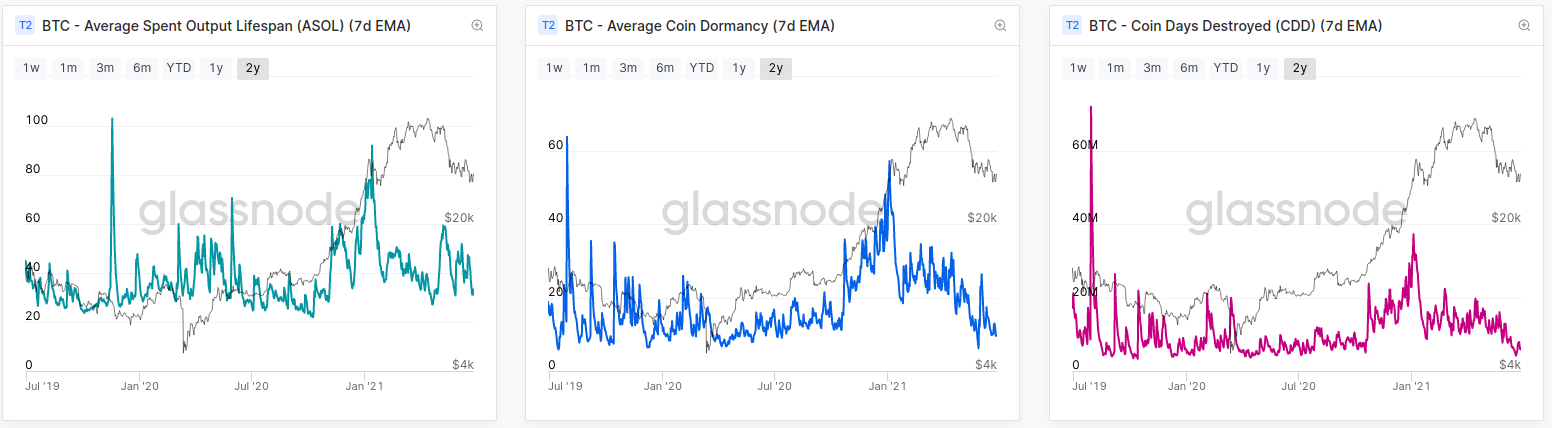

However, despite some evidence LTHs who spent coins were panic selling, almost all 'lifespan' based metrics that track coin age continue to break down towards pre-bull levels. One way we can interpret the above pieces of information are:

- Some LTHs spent their coins during market volatility, likely in a panic based on the spread of cost basis.

- Most LTHs did not spend their coins and thus the average age of coins that were on the move remains very young (despite the market realising $3.45B in net losses).

- Sell pressure is largely STHs who are almost entirely holding coins at an unrealised loss. 23.5% of all circulating supply are owned by STHs and underwater, compared with 3.4% that are in profit.

Miner Sell Pressure

As the largest migration in Bitcoin hash-power in history takes place, the market has been speculating as to the magnitude of miner sell pressure that may be creating headwinds for prices. There are two primary factors that may be driving an increase in miner sell pressure:

- Dramatic decline in revenue to the recent ~50% mark-down in prices leading to more coin sold to cover the same fiat denominated costs.

- Logistical expenses and risk incurred by miners to relocate or liquidate mining equipment necessitating liquidation of BTC held in their treasuries. These expenses are likely to be ongoing for some months.

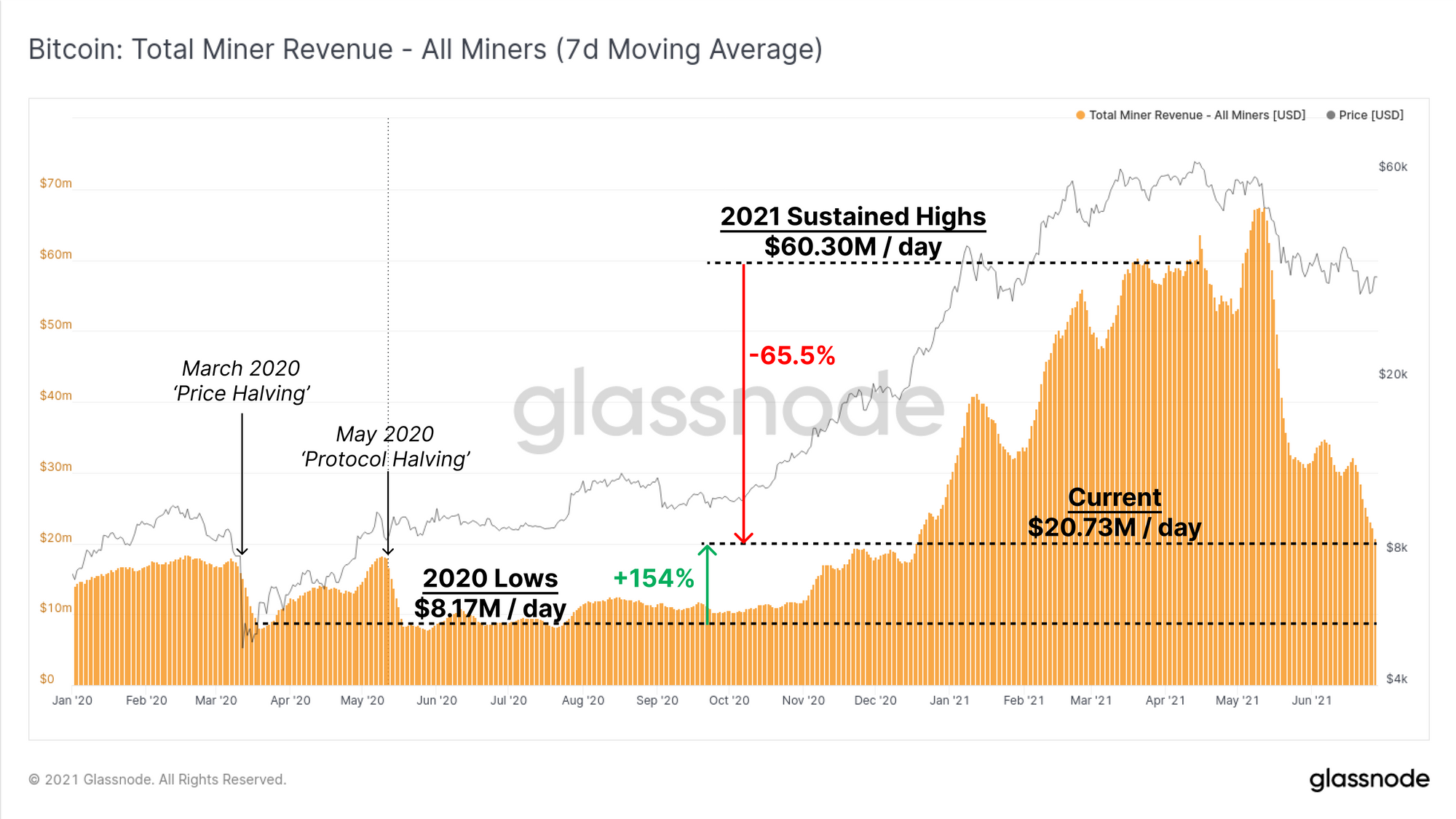

To start our analysis, we can assess the change in aggregate miner revenue (7DMA). This demonstrates that the mining market has experienced an approximately 65.5% decline in revenues since levels sustained in March and April. The 7-day average mining revenue currently sits at around $20.73M/day, which in context, is still 154% higher than it was at the time of the back-to-back halvings in 2020.

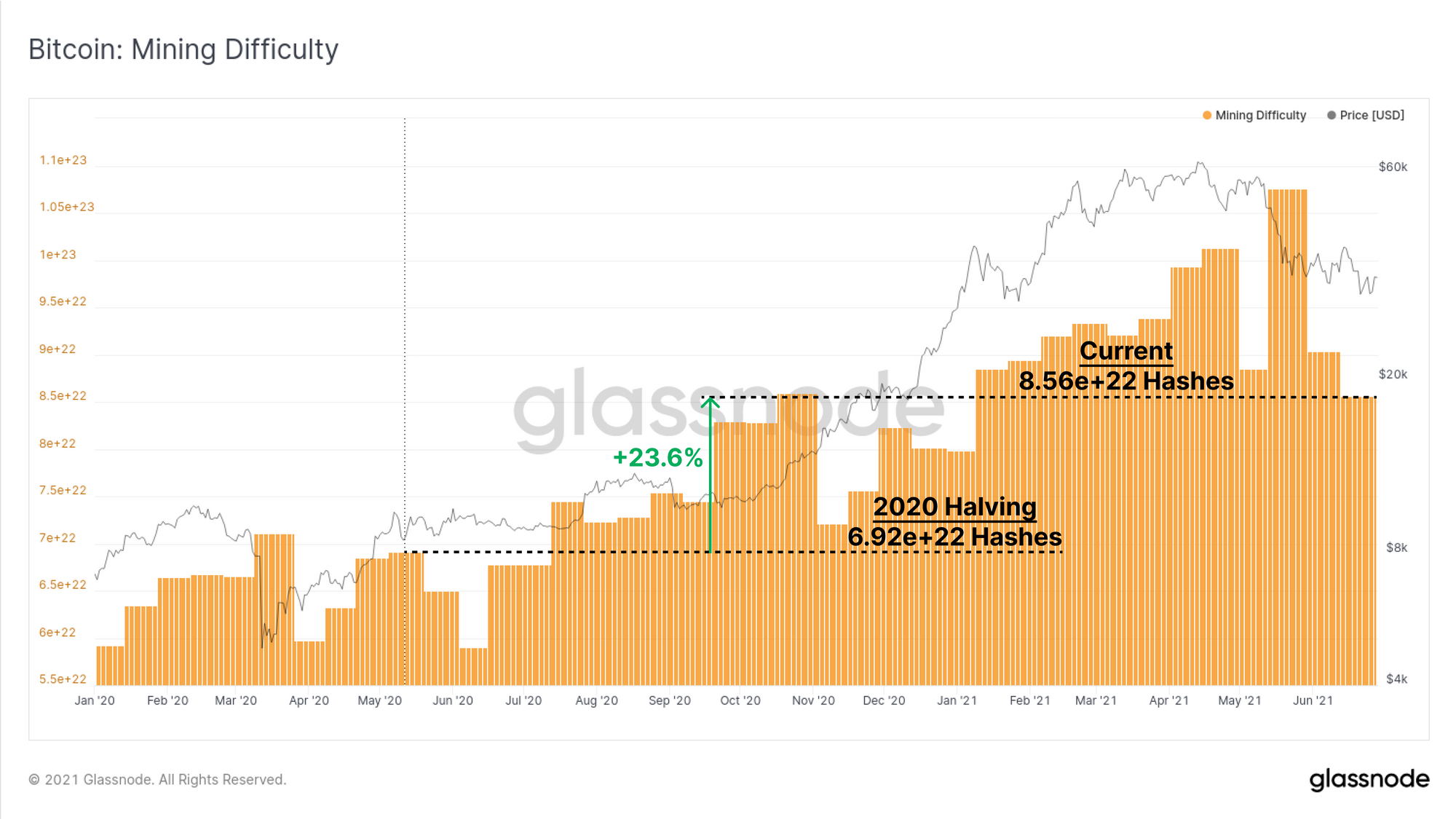

Over this same period, mining difficulty has only increased by only 23.6%. The mismatch between revenue and difficulty is primarily a result of the global shortage in semi-conductors that has limited the ability of miners to expand their operations. In practice, this mean that mining Bitcoin has been exceptionally profitable throughout 2021, and that some mining hardware that would otherwise be obsolete, remains profitable. This means fewer coins need to be sold to cover costs and miner treasury reserves can be built up.

The Bitcoin mining puzzle is 23.6% harder despite revenues being up 154% on a 7-day average basis. Since a very large proportion of hash-power is currently offline and in transit, and the next difficulty adjustment is estimated to be -25%. As such, miners who remain operational are likely to become even more profitable over the coming weeks, unless price corrects further or migrating hash-power comes back online.

This largely indicates that miners who are in operation are unlikely to exert excessive compulsory selling (Point 1) and thus it is more probable that Chinese miners liquidating treasuries is the dominant sell-side source (Point 2).

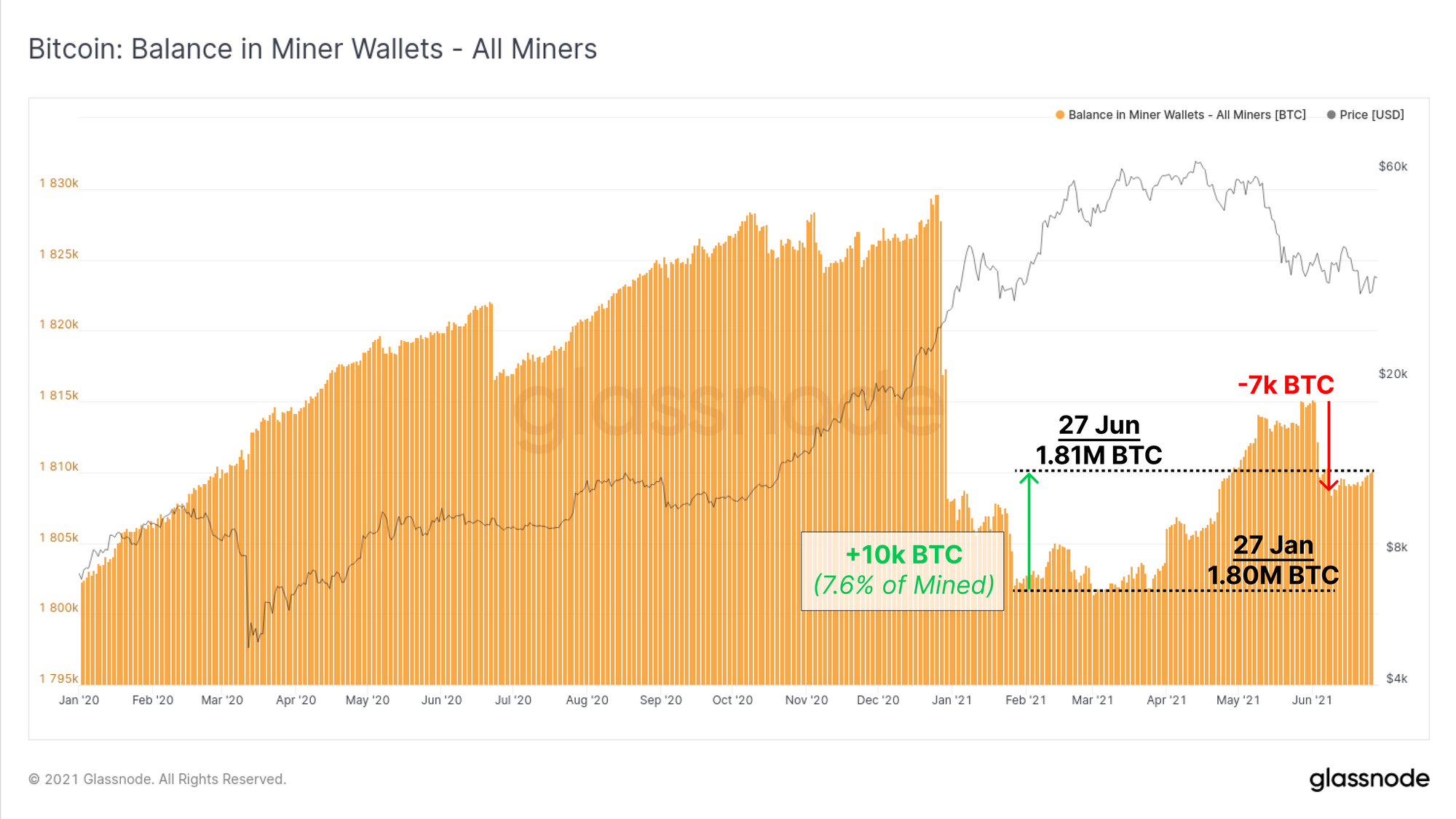

Thus, the second question is whether miners are liquidating their treasuries to cover the incurred risks and costs to relocate hash-power. Here we take a look at the aggregate balance held in miner wallets and see that in aggregate, miners have added 10k BTC to their treasuries since the low on 27-Jan. This represents 7.6% of all coins mined since then and indicates that miners generally have distributed 92.4% of their coins over this period.

We can also see an overall spend of 7k BTC that occurred in early June which may well be a miner or set of miners liquidating coins in preparation for the migration.

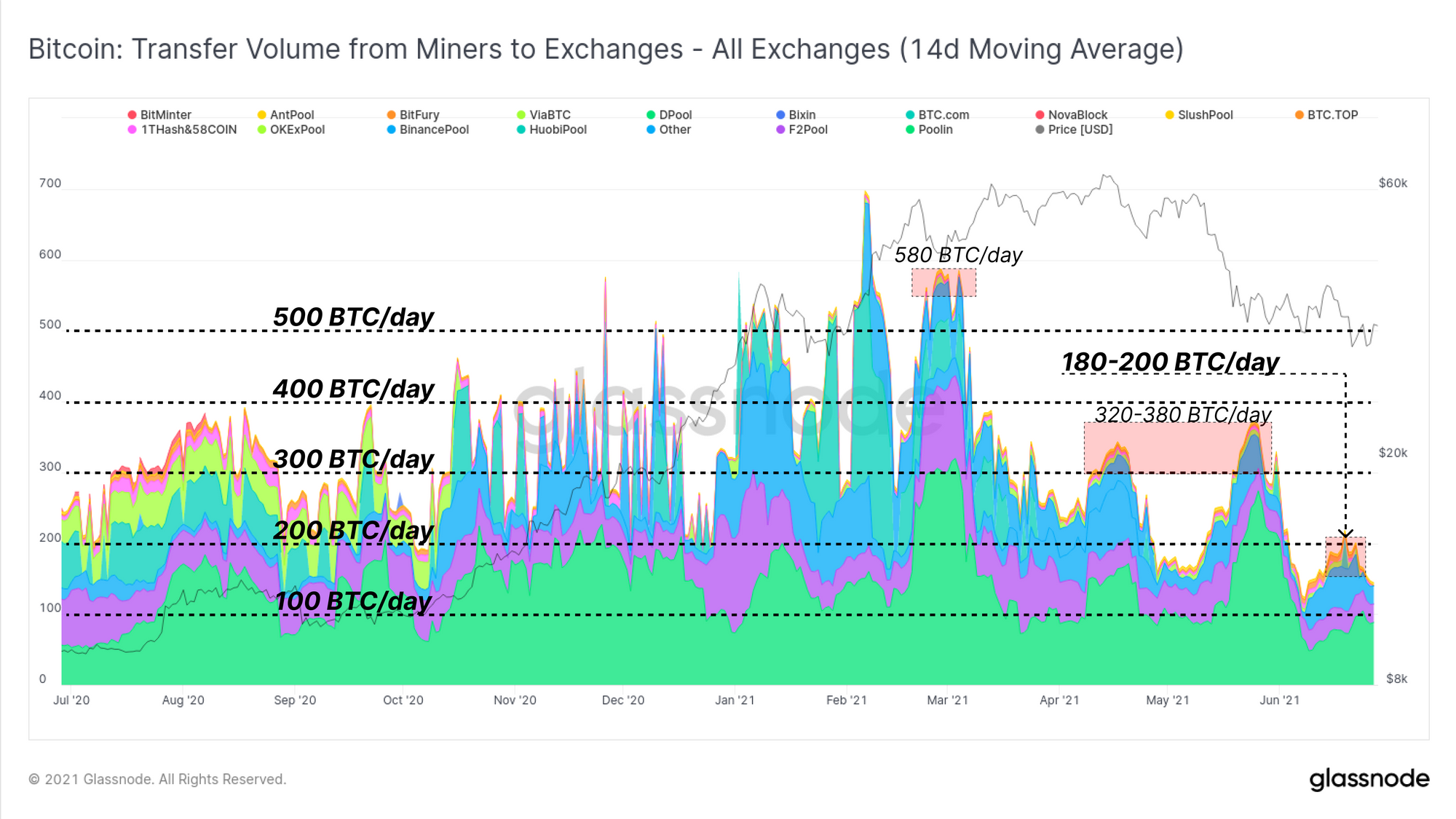

We can also track the rate of miners sending coins to exchanges to assess relative sell pressure. Here we use a 14-day moving average to smooth the data over the same period as the difficulty adjustment window.

Relative to 2020 and Q1 2021, miner sell pressure on exchanges has actually been notably less than the 300 to 500 BTC/day sustained over that period. Current miner inflows to exchanges has steadily declined from over 500 BTC/day in March to under 200 BTC/day in June.

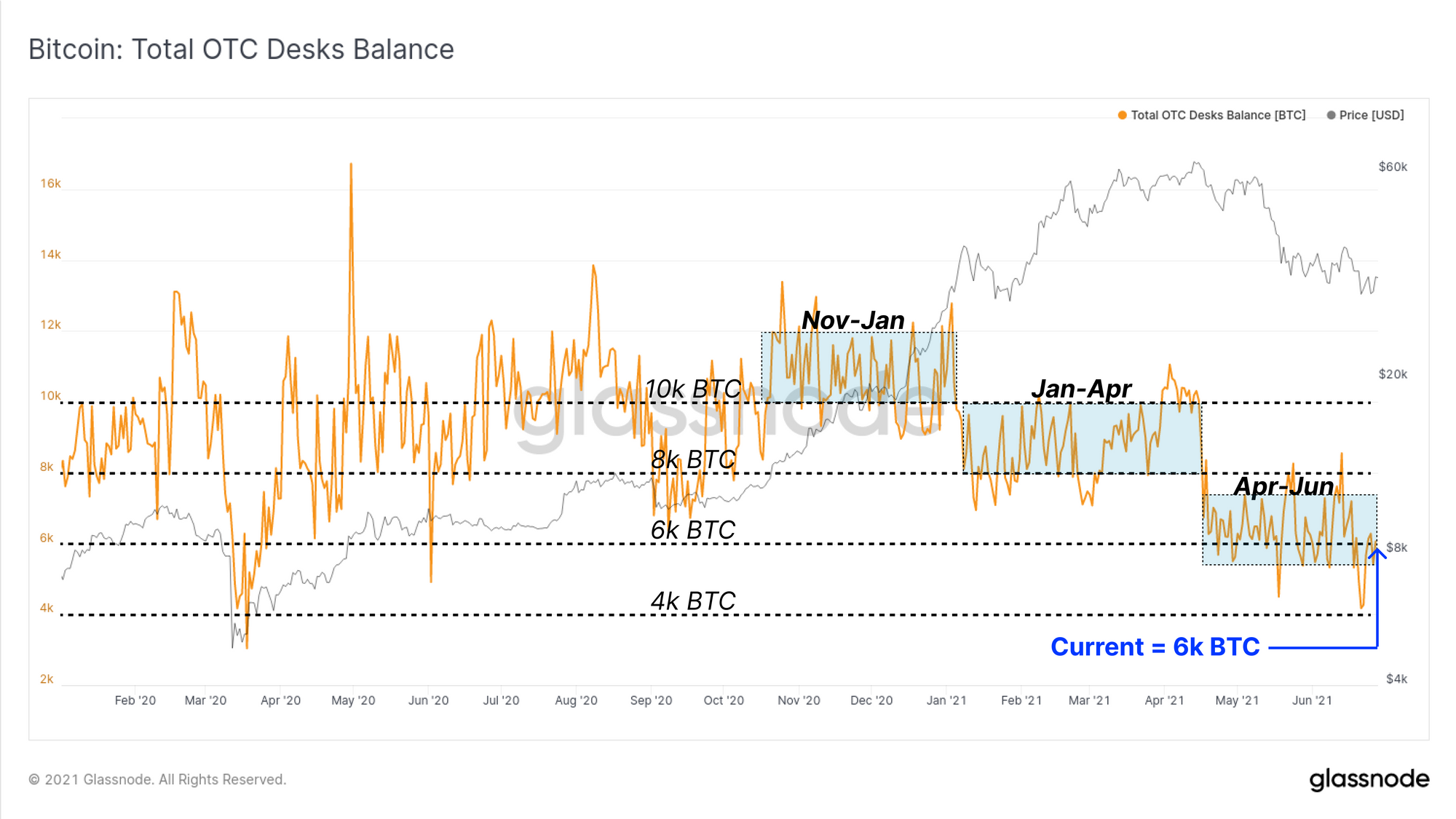

We also review the balance on the OTC desks we monitor, representing another principal destination for miners coins to match with larger buyers. Throughout 2021, there has been a progressive 'step-down' in OTC balances, with each leg down typically correlated with changes in market trend. From April to June, a total OTC balance of between 8k and 6k BTC has been maintained, with a net outflow of ~1,134 BTC over the last two weeks.

Institutional Demand Remains Slow

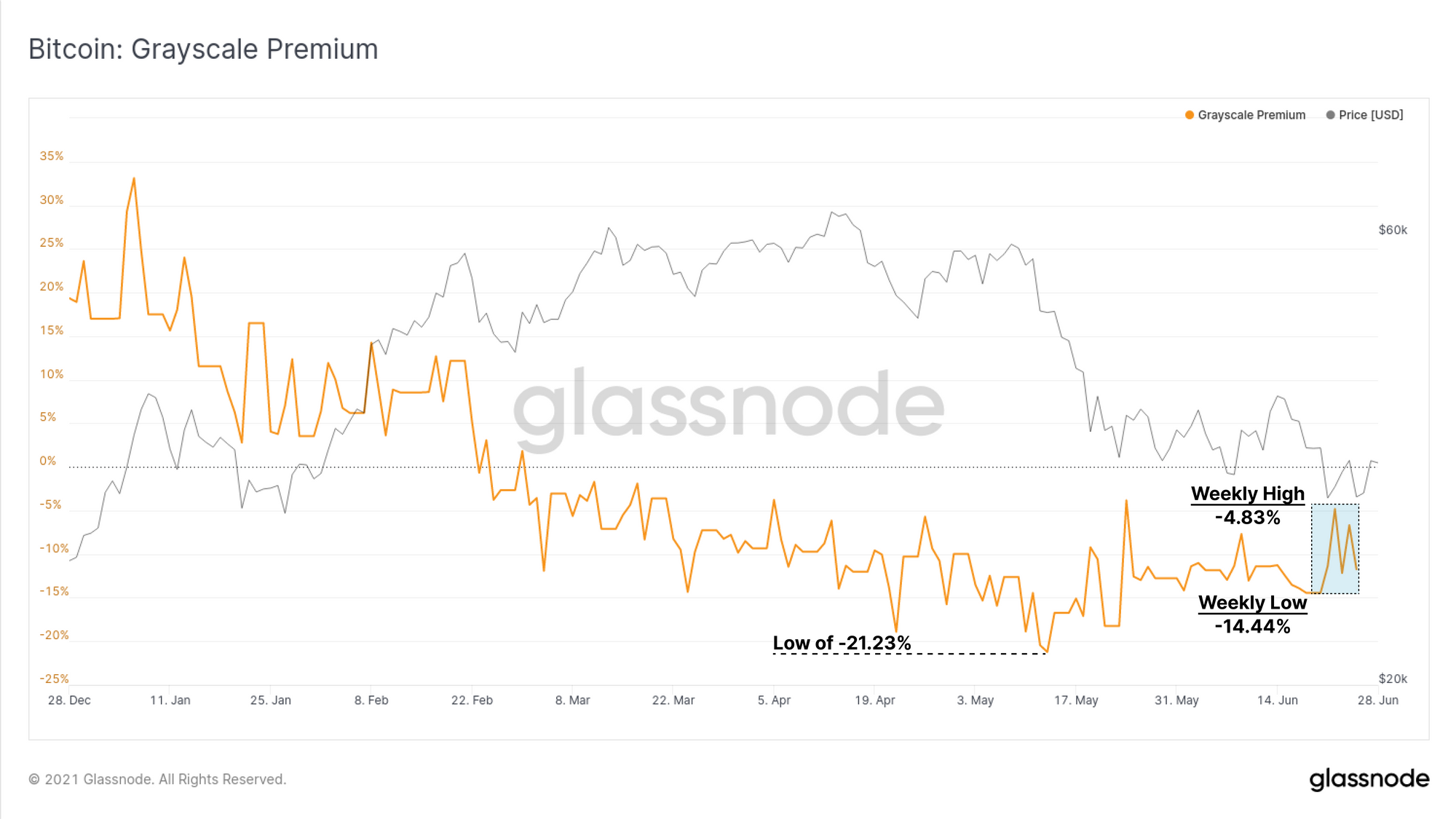

A primary driver for Bitcoin price appreciation in 2020 and 2021 was both the narrative, and the reality of institutional demand. One of the largest factors in this was the one-way flow of coins into Grayscale's GBTC trust fund as traders sought to arbitrage the high premium observed in 2020 and early 2021.

Since Feb 2021, the GBTC product has reversed to trade at a persistent discount to NAV, hitting the deepest discount of -21.23% in mid-May. Following the subsequent sell-off, the GBTC discount has started to close up, trading this week between a low of -14.44%, and a high of -4.83% to NAV.

Grayscale's GBTC trust currently holds over 651.5k BTC, a whopping 3.475% of the circulation Bitcoin supply.

There are two Bitcoin ETF products available in Canada which may also provide insight into institutional demand:

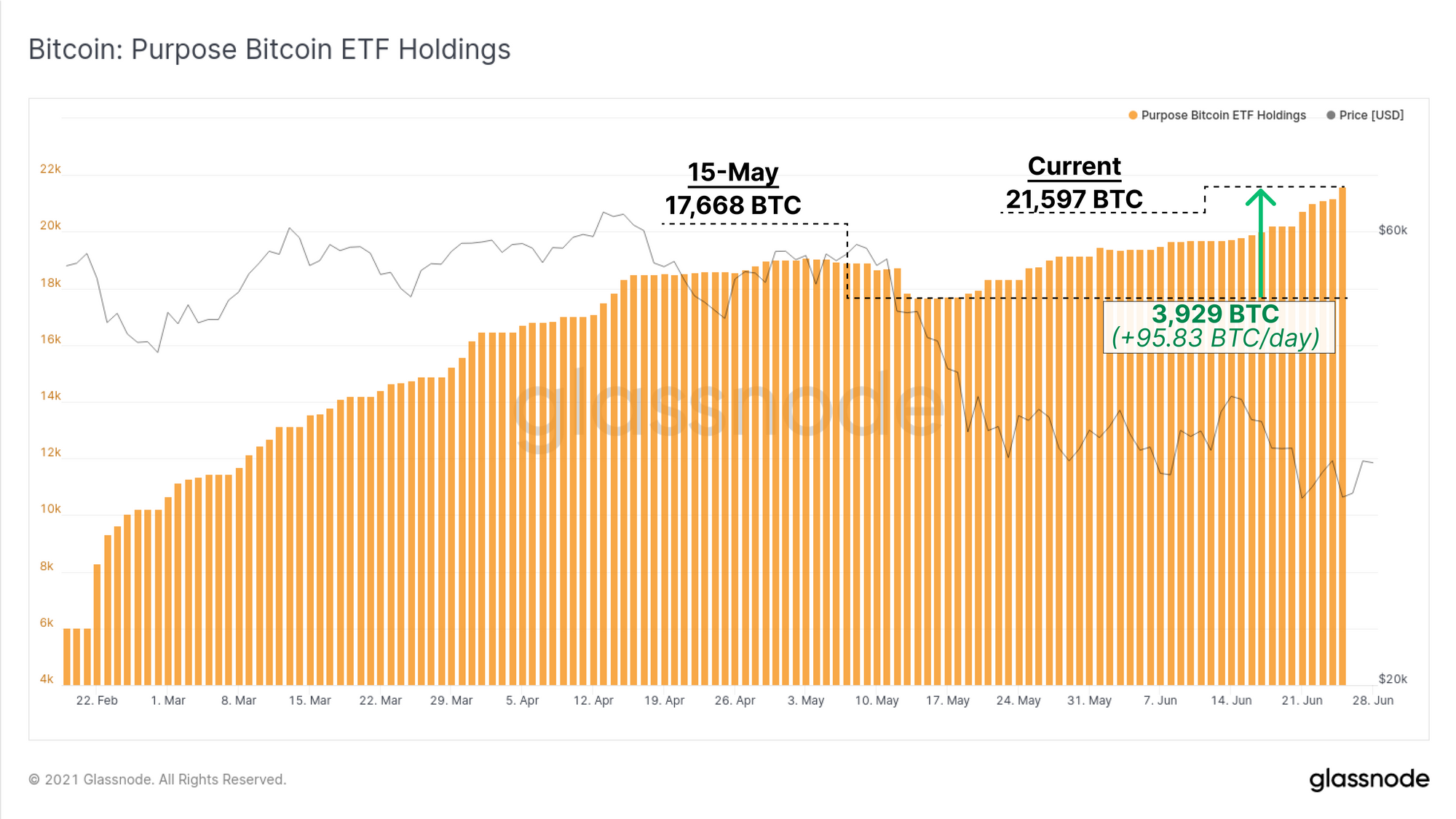

- The Purpose Bitcoin ETF

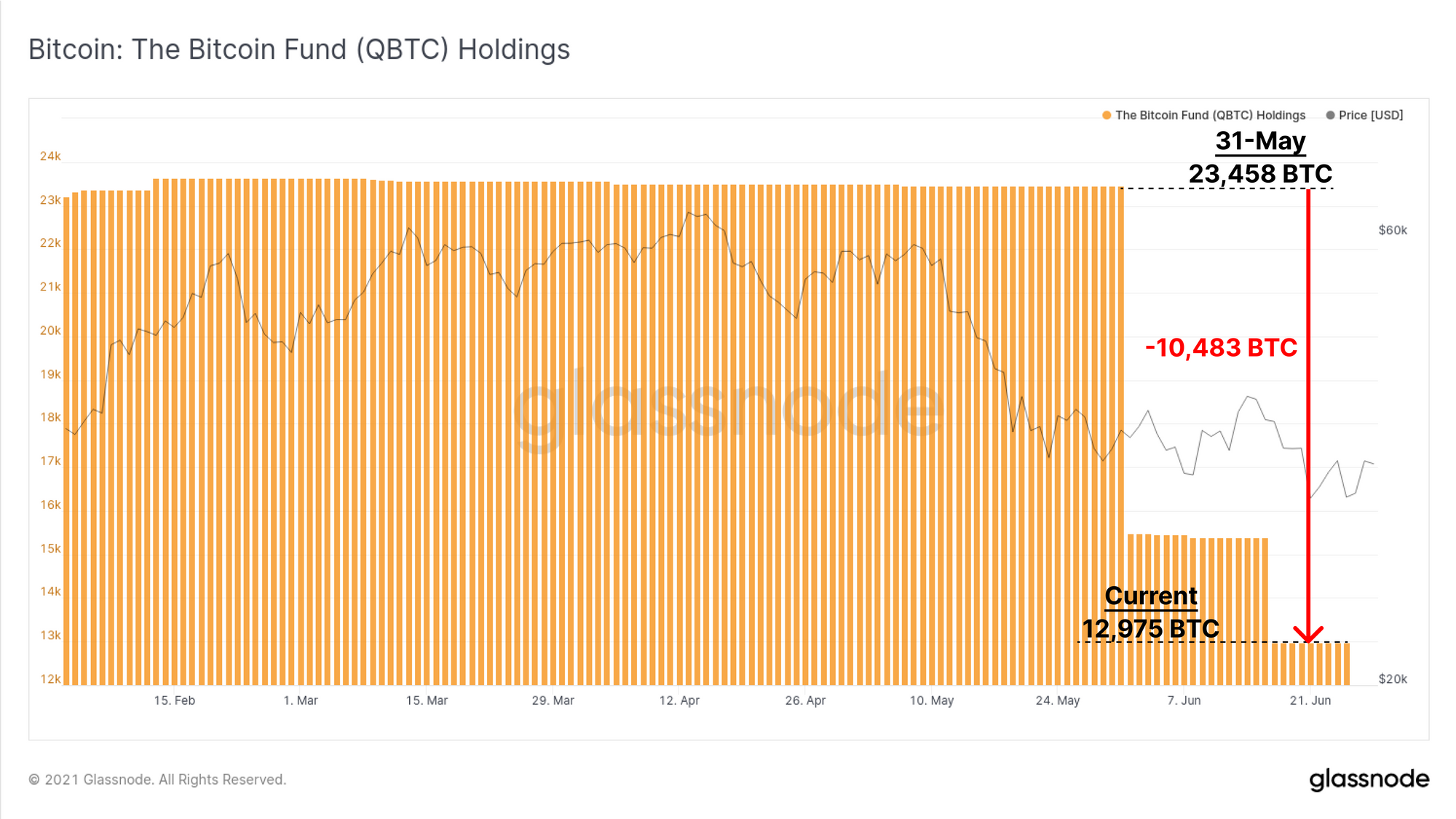

- The 3iQ Digital Asset Management QBTC ETF

The Purpose ETF has continued to grow in total BTC under management, with net inflows of 3,929 BTC since 15-May. This represents a daily inflow of 95.83 BTC/day (using a 7-day week) and brings the total ETF holdings up to 21,597 BTC.

Meanwhile, the QBTC ETF has seen significant net outflows over the last two months. Total holdings have declined in two notable steps by a total of -10,483 BTC. This brings current holdings down to 12,975 BTC.

As such, the Purpose ETF has now flipped the QBTC ETF in total coins under management. Nevertheless, when combining the net flows for both ETFs over the last month, a total of -8,037 BTC have flowed out of these ETF products.

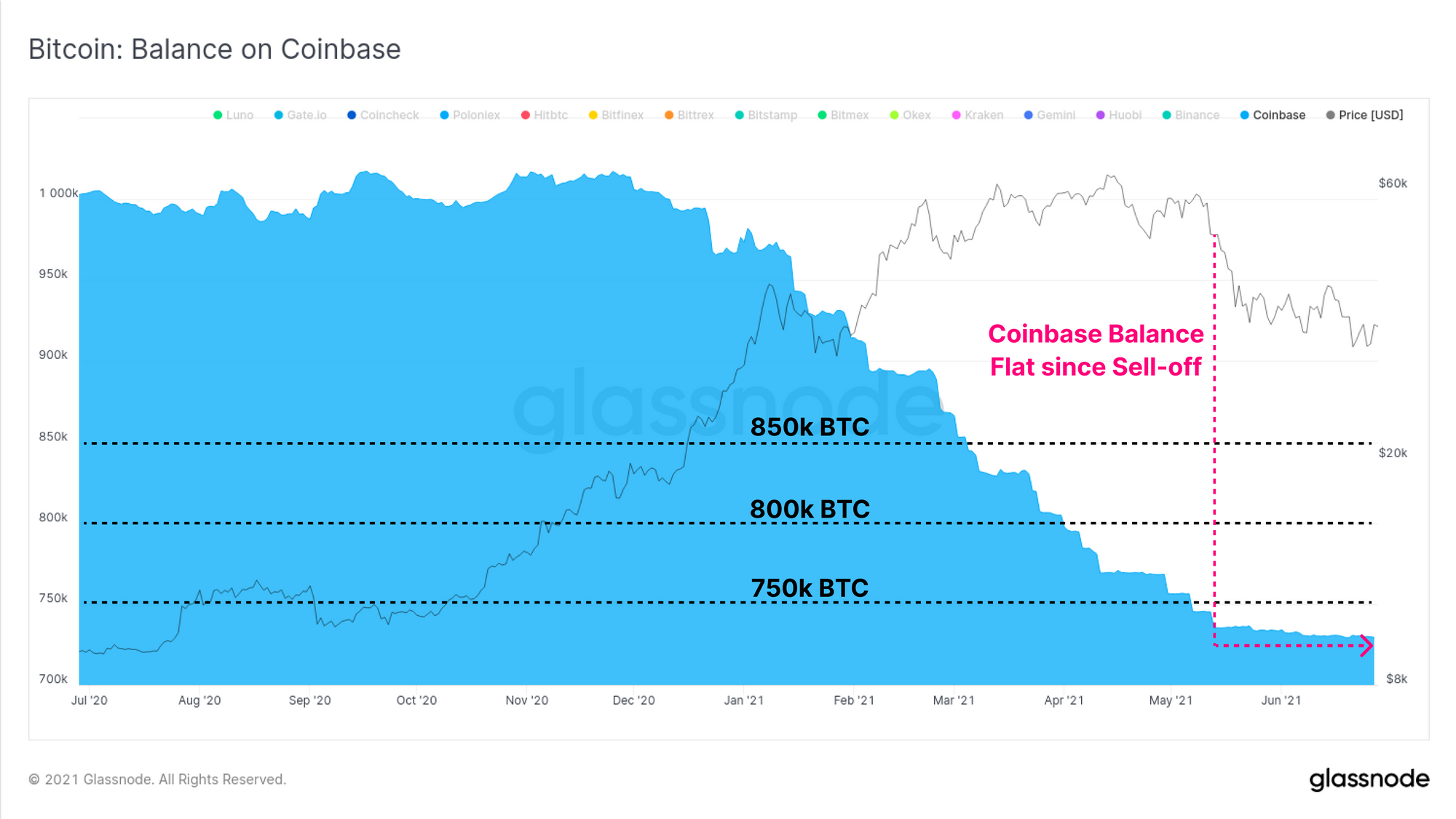

Finally on the institutional front, we can observe the net change in the coin balance held on Coinbase, a preferred venue for US institutions during the bull market. After a sustained period of net outflows since Dec 2020, the change in Coinbase balance has flattened out markedly.

Between observations of the GBTC premium, net outflows from the combined Purpose and QBTC ETFs, and a stagnant Coinbase balance, institutional demand appears to remain somewhat lacklustre.

Week On-chain Dashboard

The Week On-chain Newsletter now has a live dashboard for all featured charts