What Are Ethereum Users Paying Fees For?

An on-chain analysis on how fees are distributed across distinct transaction categories in the Ethereum network.

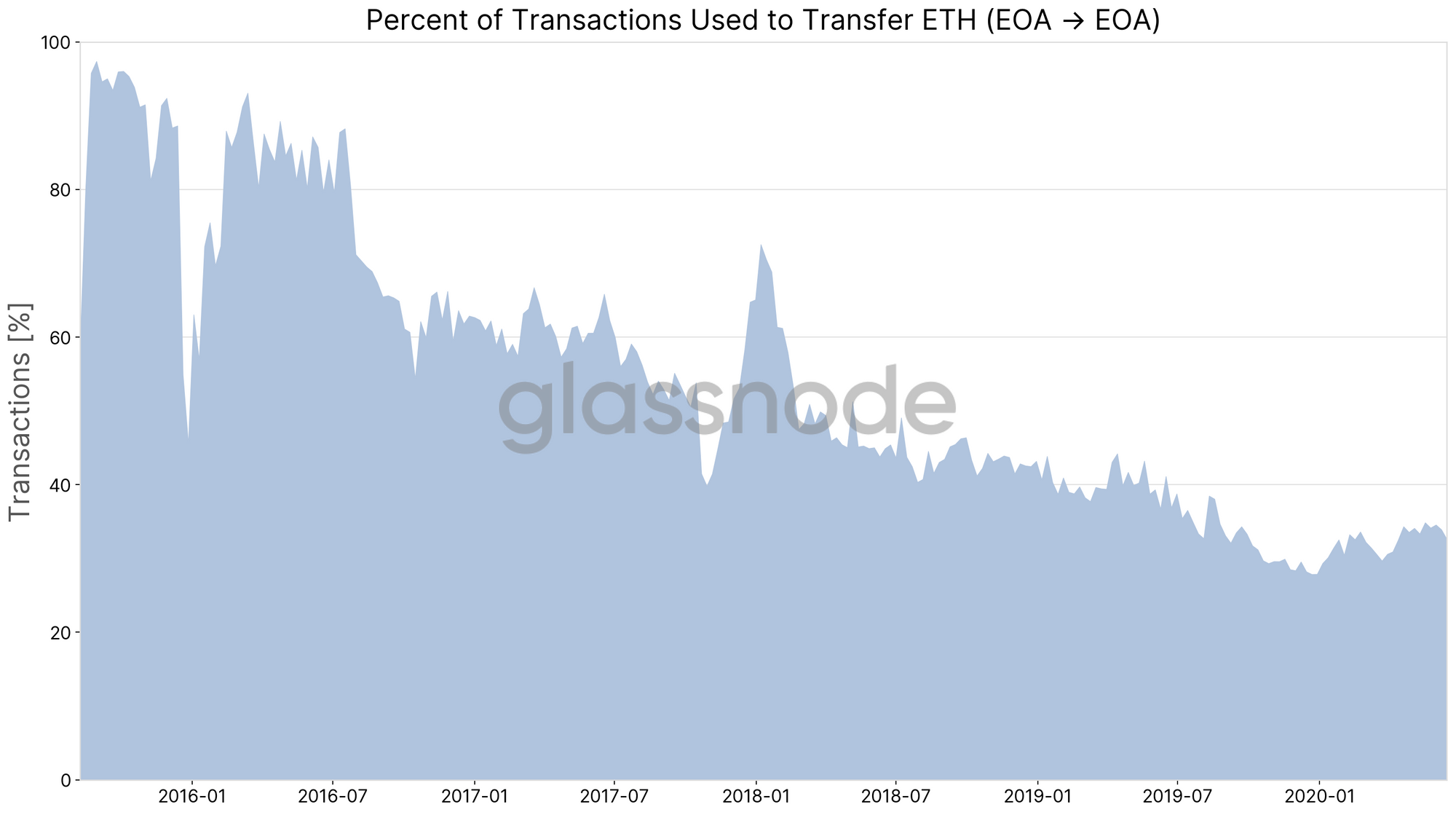

Since its inception, the Ethereum network has been used less and less as a simple payments system to transfer ETH between Externally Owned Accounts (EOAs).

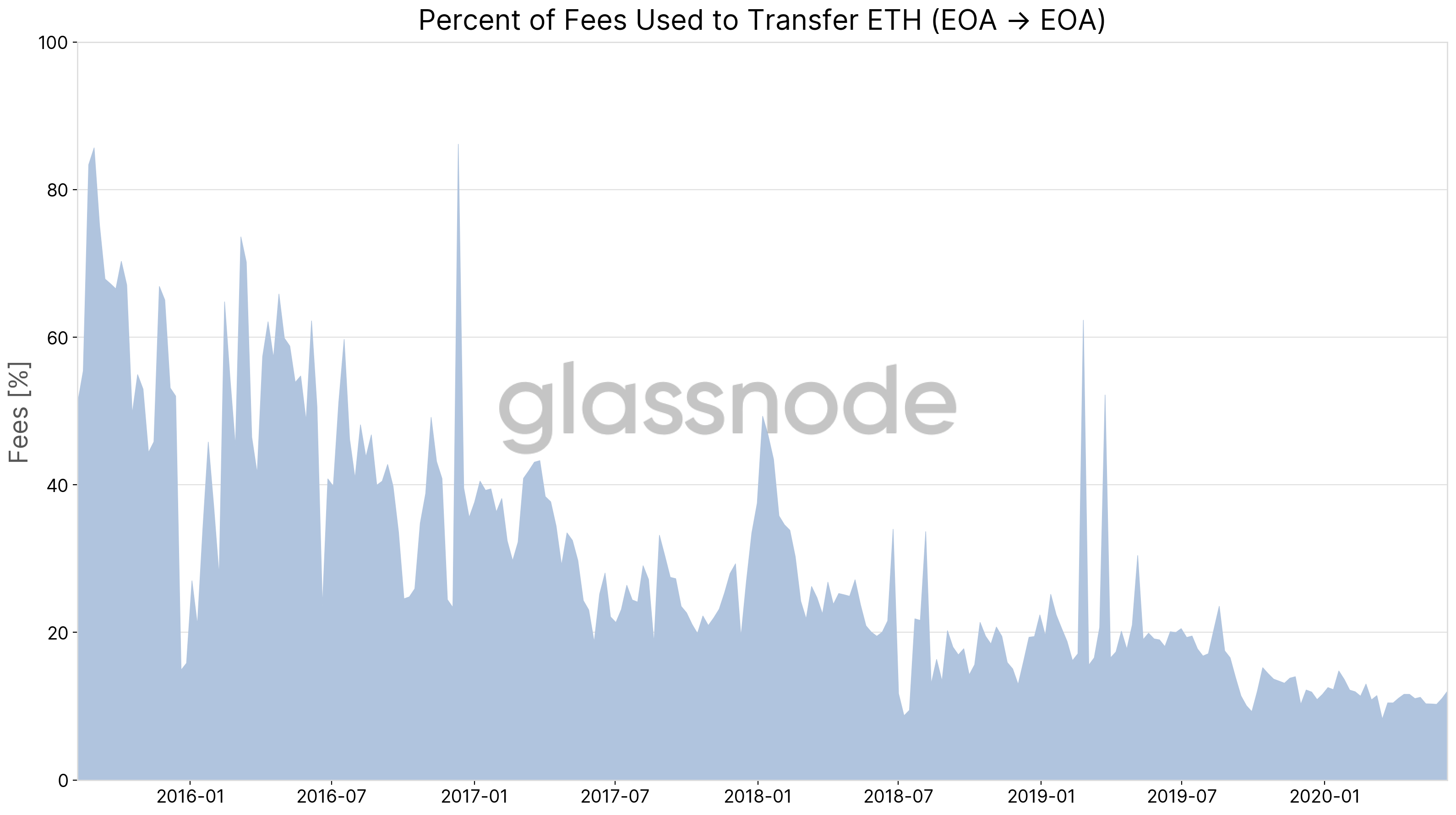

As of May 2020 a bit more than a third (34.2%) of network transactions are used to transfer ETH between EOAs, and only 10.7% of all fees are spent on transactions that send ETH to an externally owned account.

These numbers show that plain ether transfers between users are not Ethereum’s main use-case.

So what is the Ethereum network primarily used for? Specifically: What are network participants paying fees for, when they use Ethereum?

The Distribution of Transaction Fees

For the present analysis we make the distinction between the following transaction categories:

ETH (EOA)— Transactions that transfer ETH to EOAsETH (EOA, 0)— Transactions that transfer a zero amount of ETH to EOAsUSDT— Transactions that transfer USDTStablecoins (w/o USDT)— Transactions that transfer stablecoins other than USDT. These include: PAX, USDC, BUSD, HUSD, DAI, SAI, sUSD, EURS, USDK, GUSDERC20— Transactions that call an ERC20 contractERC721— Transactions that call an ERC721 contractOther Contracts— Transactions that call contracts that are neither ERC20 or ERC721

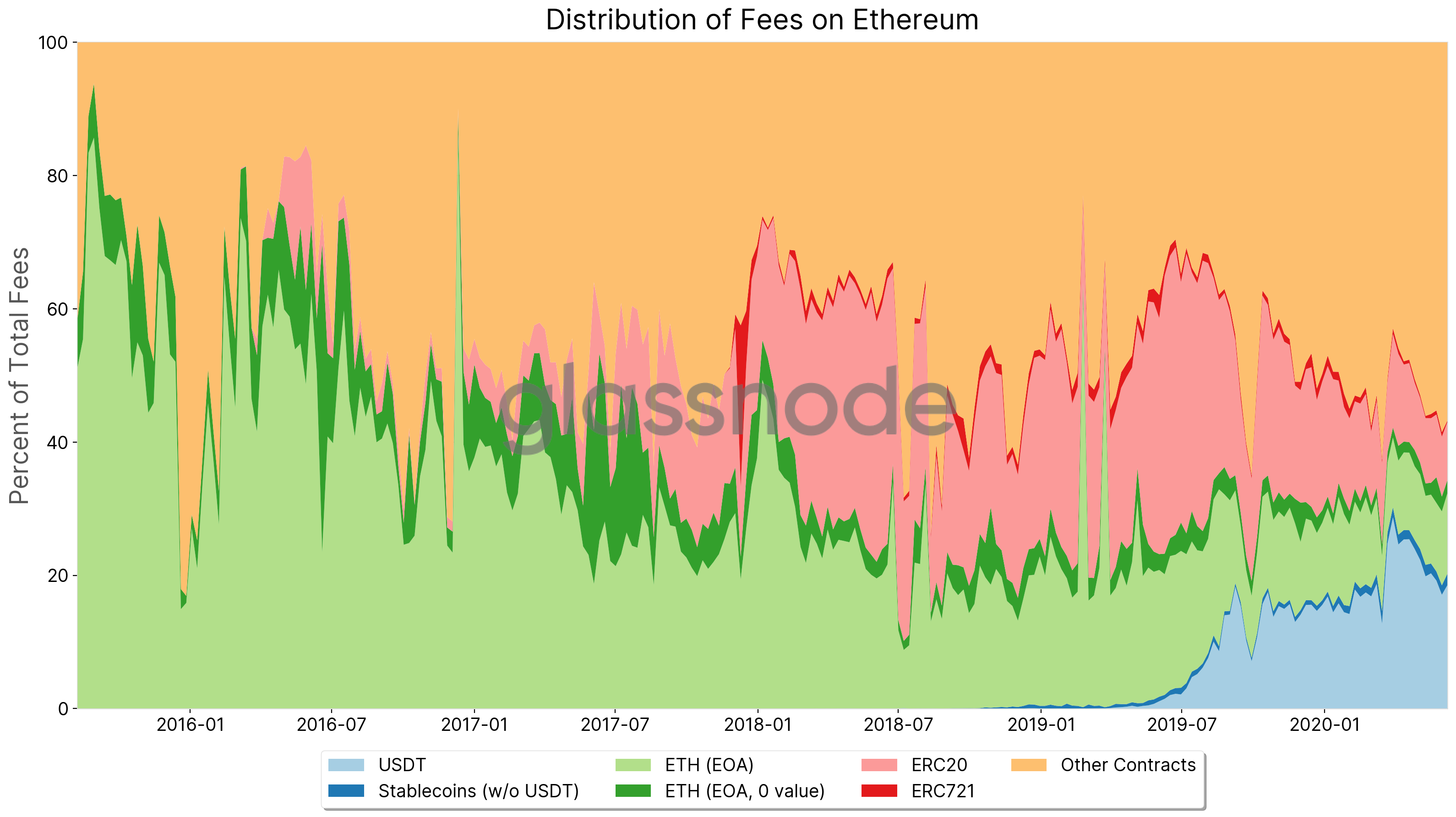

Figure 3 shows the relative distribution of fees over time across these categories.

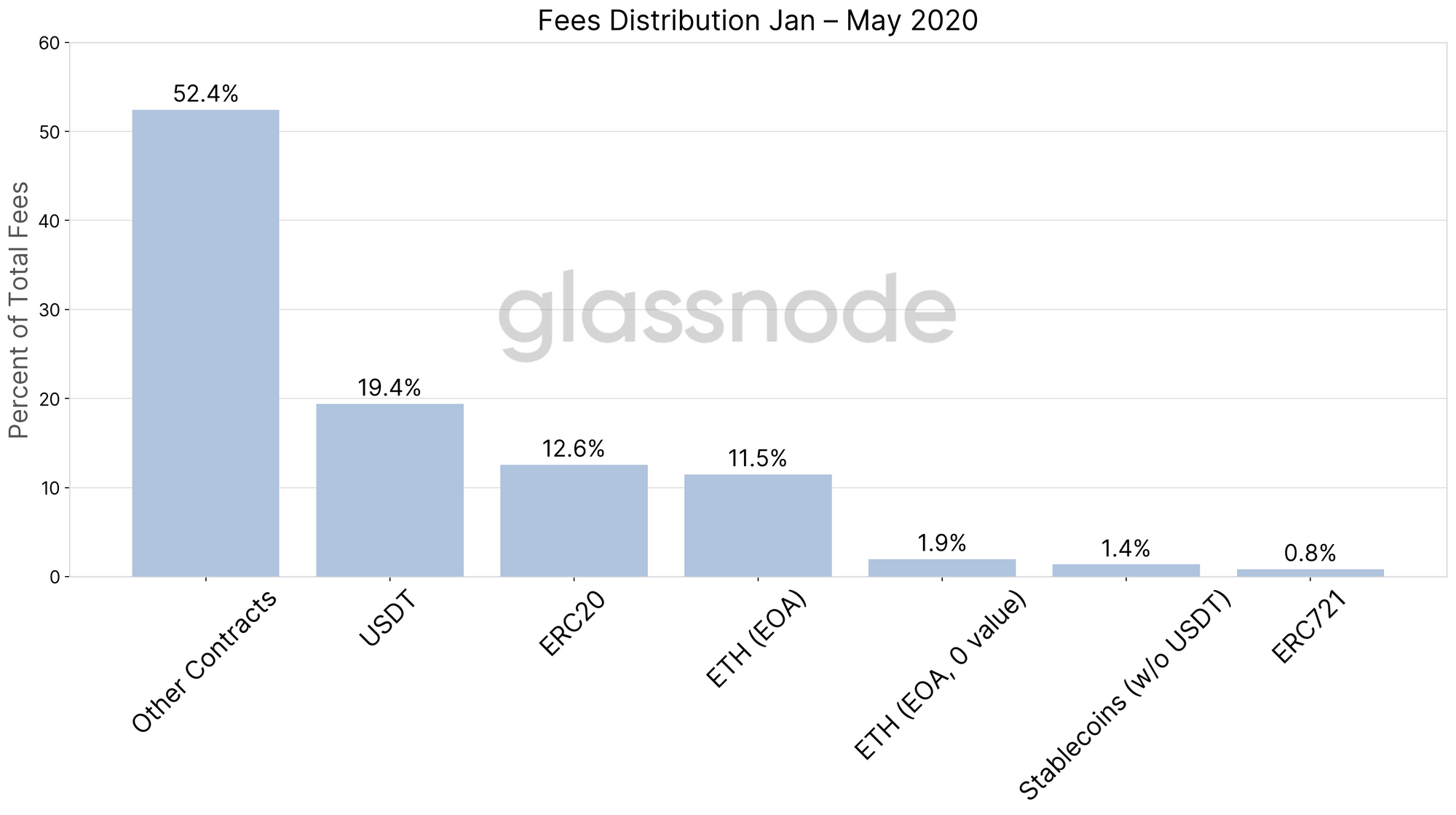

In 2020, more than half of all fees are being used for contracts that are neither ERC20 nor ERC721 standards (52.4%), followed by USDT which has increased from virtually zero in the beginning of 2019 to currently almost 20%. Other ERC20 contracts amount to 12.6%, and ETH transfers between EOAs 11.5%.

Zero-value ETH transfers to EOAs (1.9%), other stablecoin transactions (1.4%), and ERC721 contracts (0.8%) take a back seat.

Contract Fees: DeFi, Games, Tokens, and a Scam

With contracts (ERC20 + Other Contracts) making up 65% of all Ethereum fees, it deserves to take a closer look in order to understand on what exactly those fees are spent on.

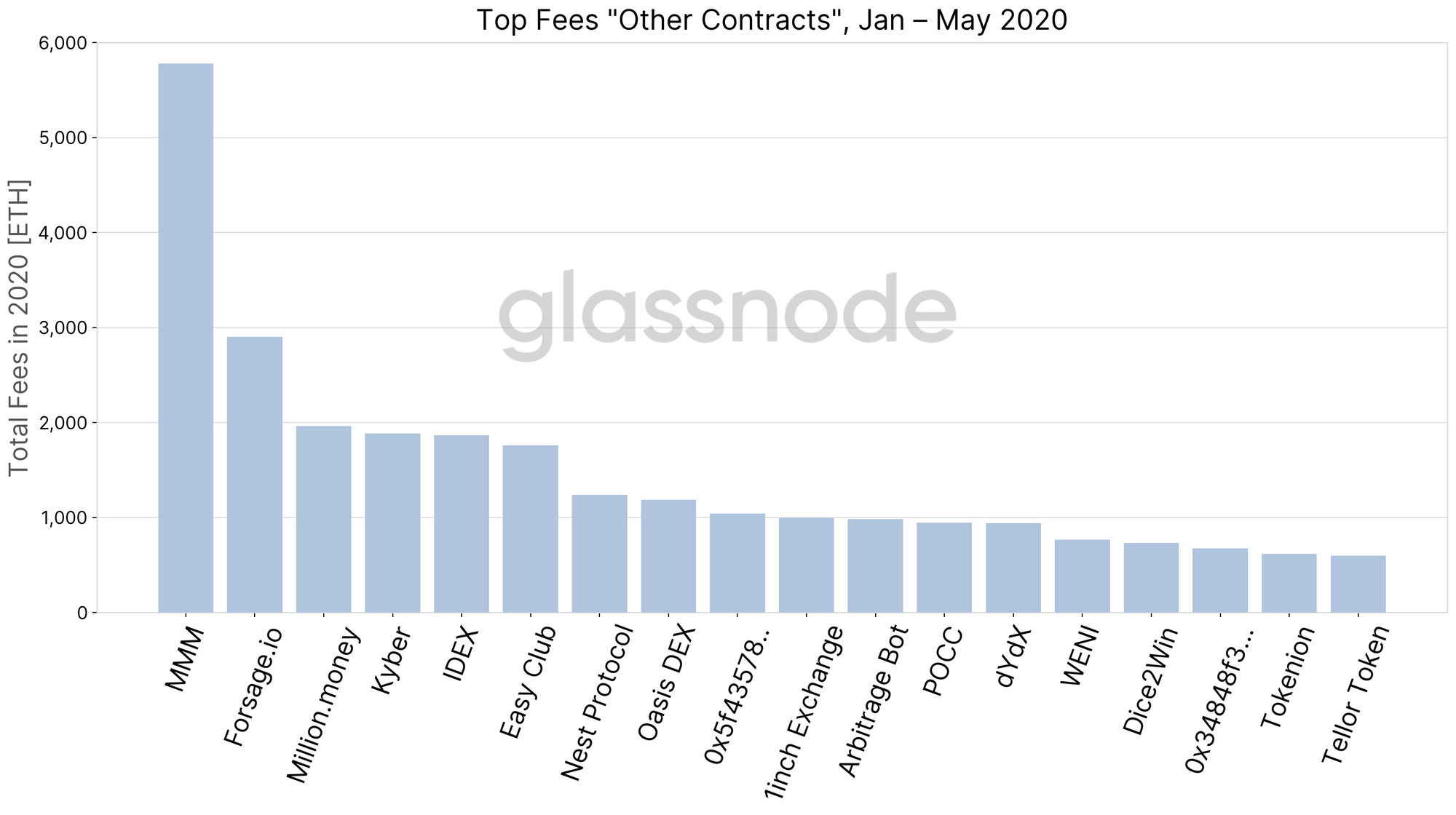

Figure 5 shows lists the top non-ERC20 contracts that have consumed most fees throughout 2020.

Leading the list is the contract associated with ponzi scheme company MMM.

In addition, the main use-cases are:

- DeFi (Kyber, IDEX, OASIS DEX, 1inch Exchange, dYdX, Nest Protocol),

- Games (Forsage.io, Million.money, Easy Club, Dice2Win), and

- Tokens (POCC, WENI, Tellor).

The top ERC20 tokens (USDT excluded) consuming most fees are shown in Figure 7, with WUC, SNX, LCS, LINK, and BAT at the top of the fee rank.

The Rise Of Stablecoins Is Dominated by USDT

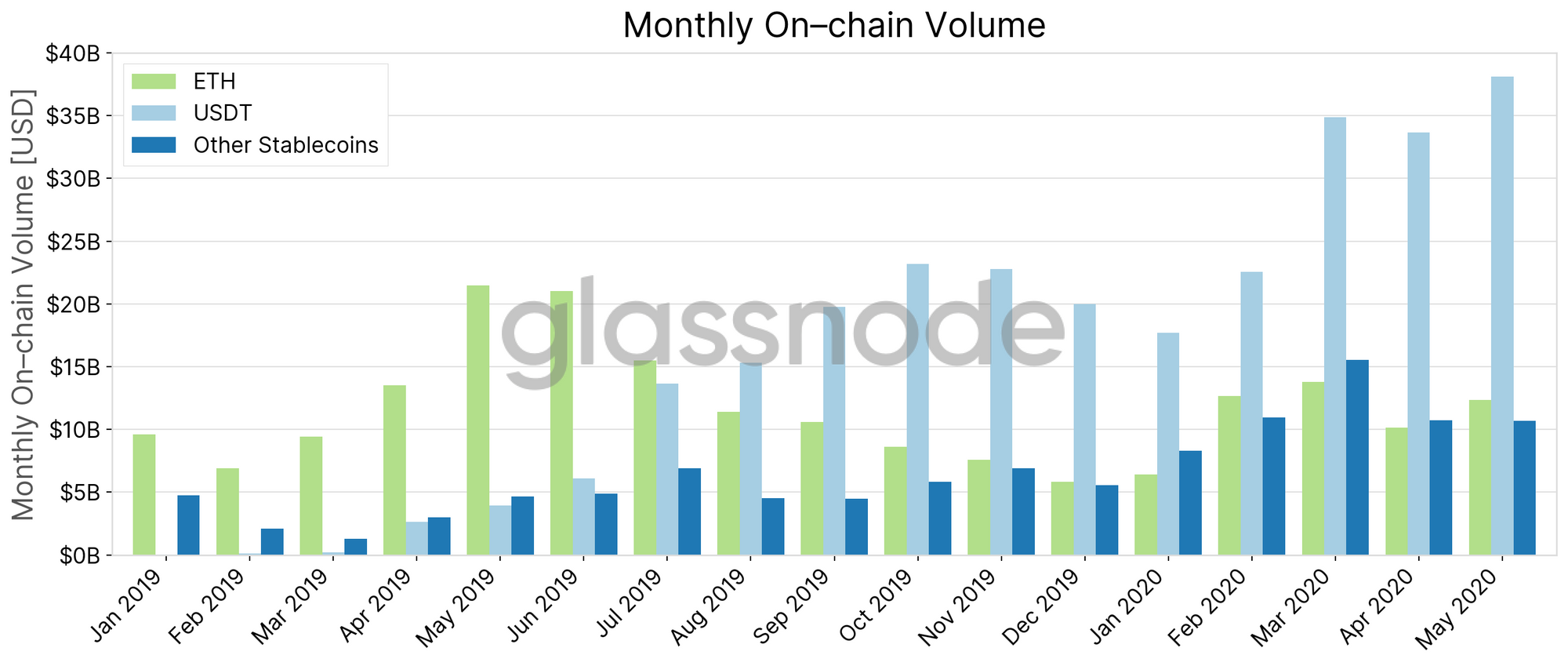

The usage of stablecoins on Etherem has seen an immense rise since 2019. This development has mainly been driven by USDT.

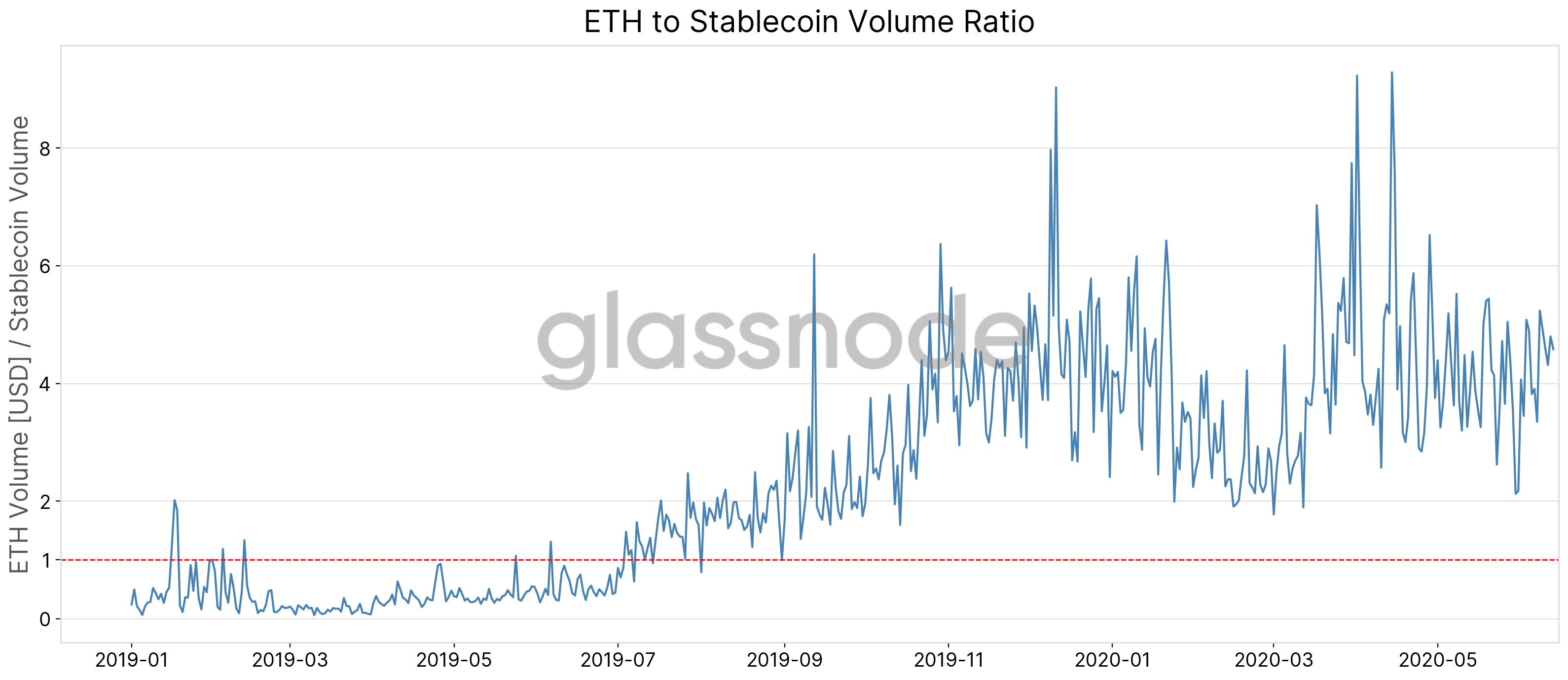

Figure 7 shows the increase in stablecoin volume. It illustrates that the monthly the USDT volume transferred in the network has surpassed ETH’s transfer volume since August 2019.

Taken together, the volume of stablecoins on Ethereum surpassed ETH’s on–chain volume a year ago, and is currently 5x higher.

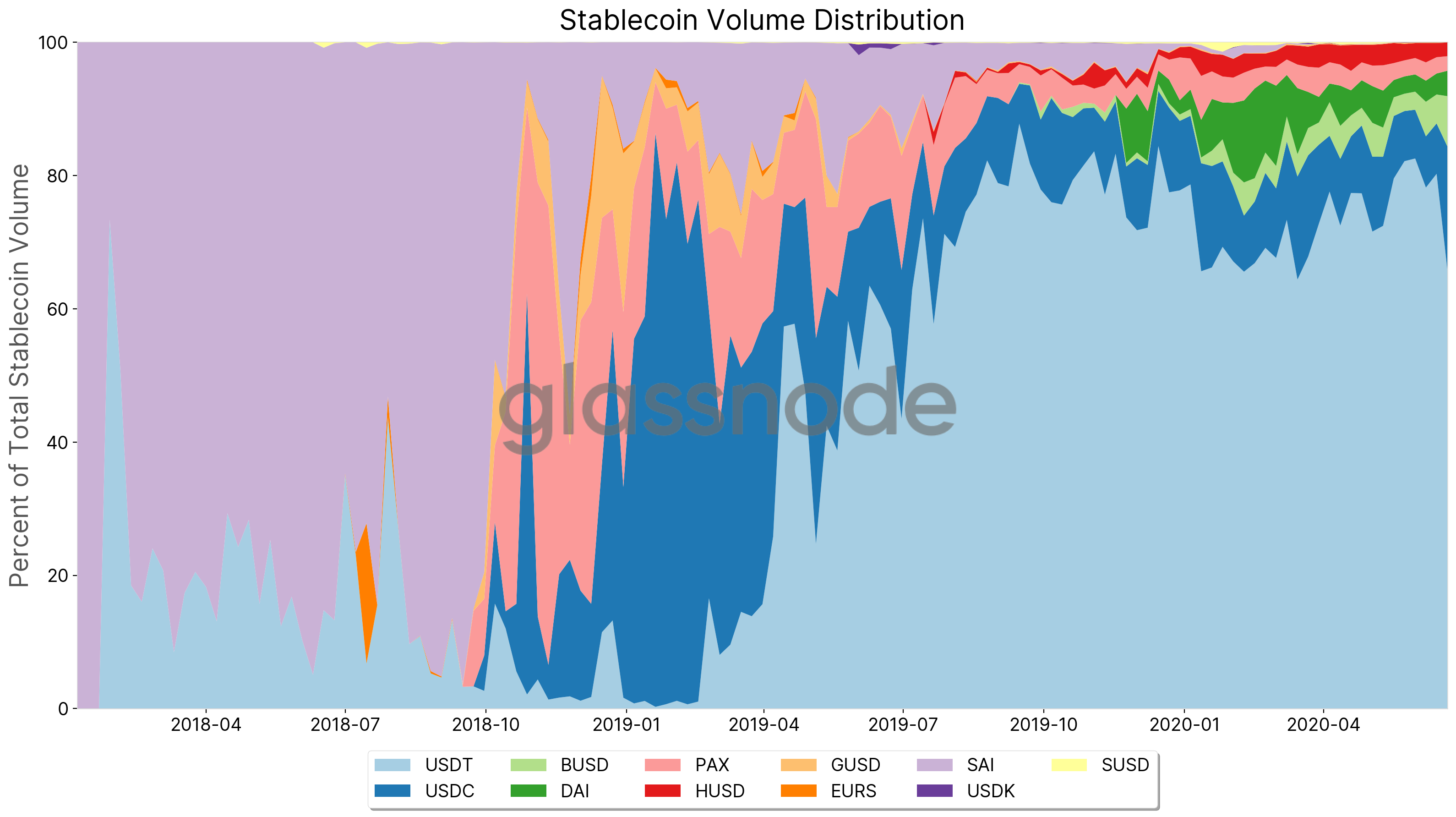

USDT holds a dominant position as the major stablecoin in the Ethereum ecosystem — virtually dwarfing all others.

Since mid 2019 USDT has been practically without major competition: In May 2020 79.1% of all stablecoin volume on Ethereum is settled via USDT, followed by USDC (8.9%), BUSD (5.0%), DAI (3.2%), PAX (2.6%), an HUSD (2.5%). All others make up less than 1%.

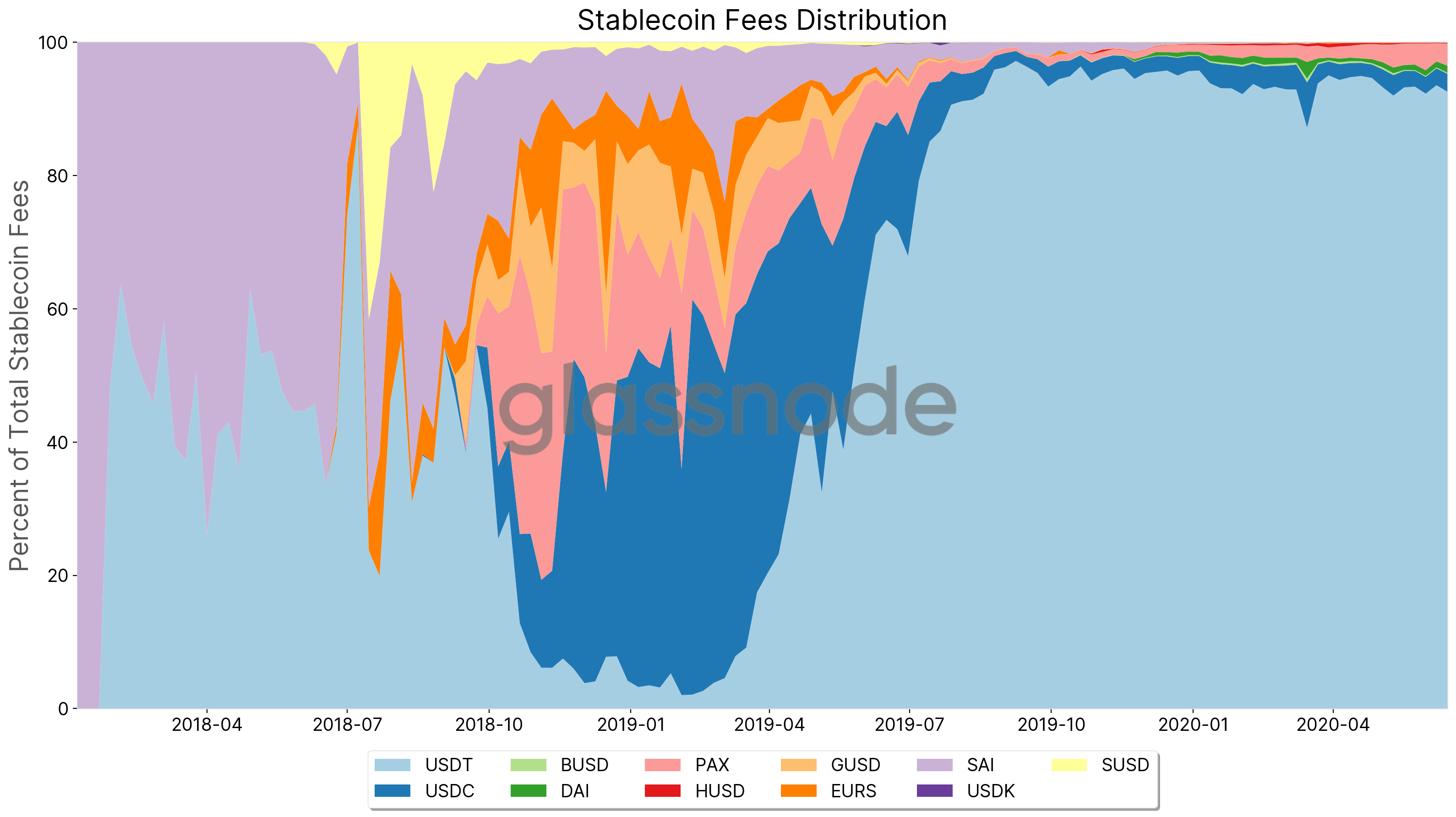

The distribution of fees across stablecoins (Figure 10) paints an even more extreme picture in favour Tether: In May 2020 92.8% of all fees spent on stablecoin transactions in Ethereum are used for USDT transfers, followed by PAX (3.2%), USDC (2.6%), and DAI (0.8%).

Excursion: Zero-Value ETH Transactions

There is a non-negligible amount of fees over the years has been spend for transactions to EOAs that send no ETH.

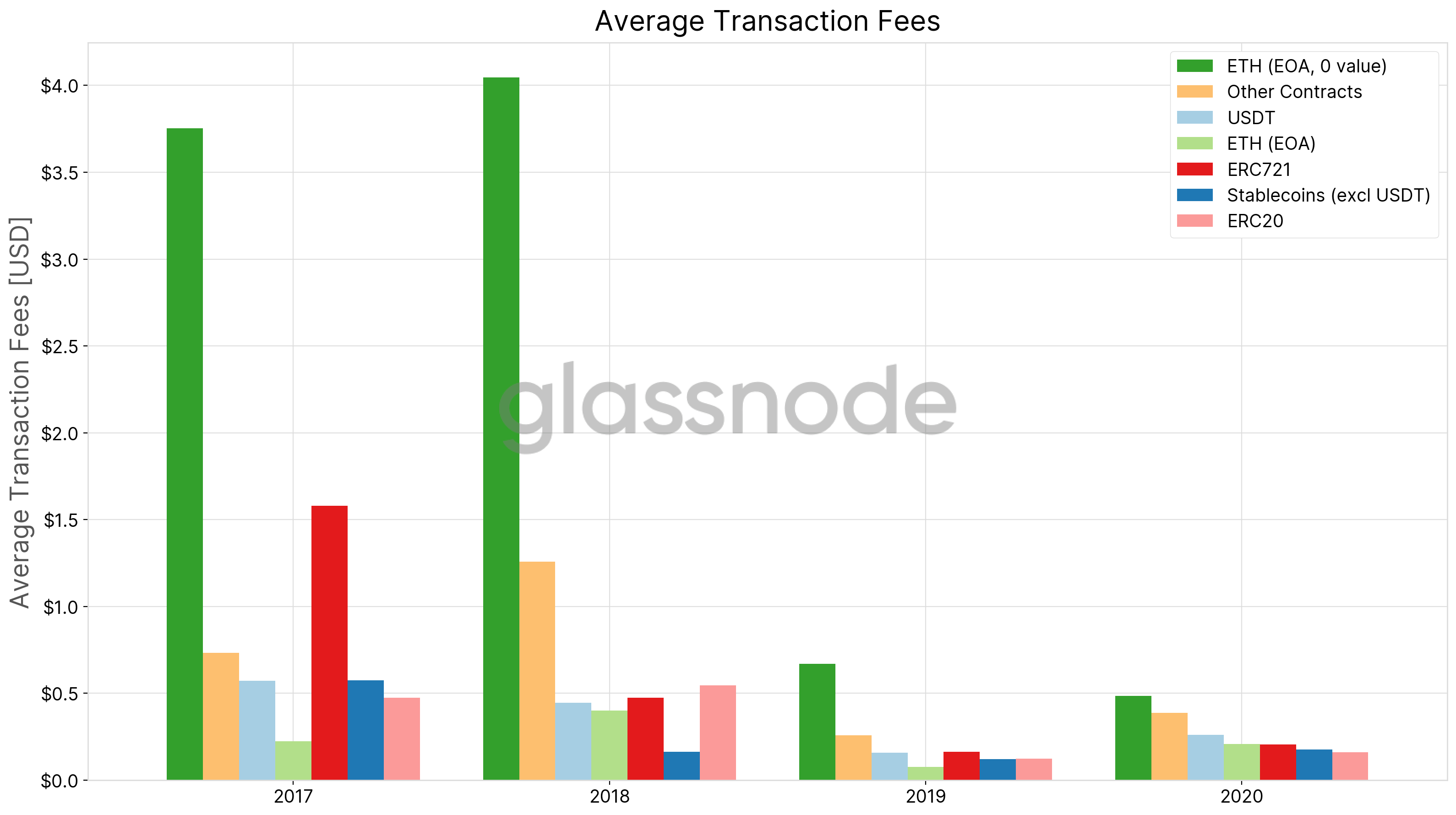

In fact, when we look at the average fees per category, we see that those transaction are, by far, the most expensive.

While it is common to have zero-value ETH transactions when calling smart contracts, the question arises why anyone would initiate transactions to externally owned accounts that transfer no value.

Possible explanations are:

- Proof of address ownership

- Miner charity

- Money laundering

- Cancelling transactions

While proof of address ownership doesn’t require high fees, and there are more straight-forward ways to donate to miners, the money laundering explanation is probably too far-fetched.

It is most likely that these transaction serve to cancel previous transactions — which require significantly higher fees for miners to prioritize these and make a previous (potentially high-value) transaction invalid. An additional argument comes from the fact that these transaction cancellations tend to happen more in times of high network usage (and therefore congestions) and/or volatile gas prices.

Many thanks to Rick Klomp for the support with the present analyses.

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter