Ark Invest + Glassnode: Introducing Cointime Economics

We introduce Cointime Economics, a new framework for analysis of the Bitcoin economy. It relates the concepts of time and supply to derive dynamic metrics of Bitcoins economic activity which account for both supply and demand forces.

In the vast world of on-chain data, understanding the intricate economic dynamics of Bitcoin can be a daunting task. Traditional on-chain methods focus on observations relating to UTXOs (Unspent Transaction Outputs), which require assumptions and heuristics to determine whether a coin is active, dormant, or lost.

Here we introduce a new framework, Cointime Economics, which we believe is a game-changer, offering a fresh perspective on Bitcoin's economic state. Cointime Economics was developed in a joint collaboration between ARK Invest (Part I) and Glassnode (Part II).

Let's dive deep into this new and novel approach.

A Fresh Perspective: Re-Evaluating Realized Value

At the heart of on-chain analysis lies the Pricestamping and Timestamping of UTXOs. It's a method where each UTXO is assigned a USD price and a Timestamp at the point of creation and destruction. A great example is the Realized Price, one of the most important UTXO derived pricing models. This metric paints a picture of the average acquisition price (cost basis) for investors, measured at the last time each coin was transacted on-chain. Whilst this approach has its merits, it comes up against three key challenges:

- Not every coin has transacted at a meaningful price, however we include all of them in the calculation (Realized Cap divided by Circulating Supply).

- Many coins are lost and will therefore never transact again. Thus, economic calculations considering them as 'active' will deviate from economic realities.

- The tremendous unrealized profit held within these lost coins can offset the unrealized losses carried by the more active investor base, masking economic realities.

The Essence of Cointime Economics

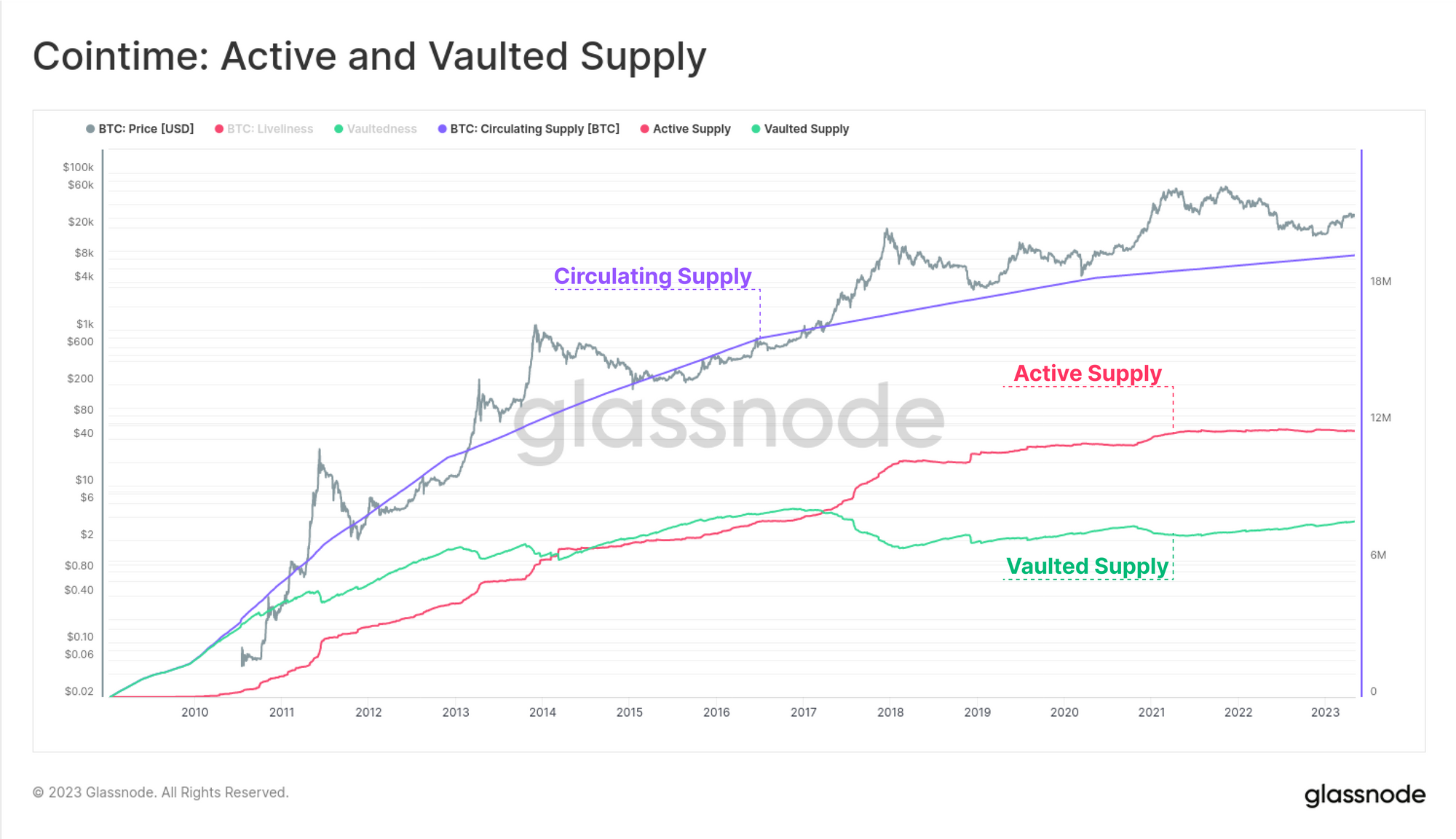

Cointime Economics introduces a simplified framework to efficiently discount the impact of lost supply, and amplify economic impacts on the truly active supply. Rather than applying proprietary heuristics and assumptions about the state of UTXOs, Cointime Economics uses simple and easy to measure inputs to bifucate the supply into Active, and Vaulted regions.

Immutable input metrics like blockheight, coinblocks destroyed and created, and coinblocks destroyed become the focal points. This results in a robust and computationally efficient method to analysing the Bitcoin economy, and ensures consistent results across all data providers.

UTXO vs. Cointime: A Comparative Glance

While UTXO based analysis zeroes in on individual transaction outputs and requires extensive datasets, Cointime Analysis takes a different route. Using a novel measurement of time as the primary unit of account, the coinblock, it derives a clear macro perspective of Bitcoin's economic dynamics.

This framework allows for more accurate analysis of the impacts of supply dilution and investor behavior, achieved by discounting the influence of non-economical, lost, or long-dormant coins.

Decoding the Primitives

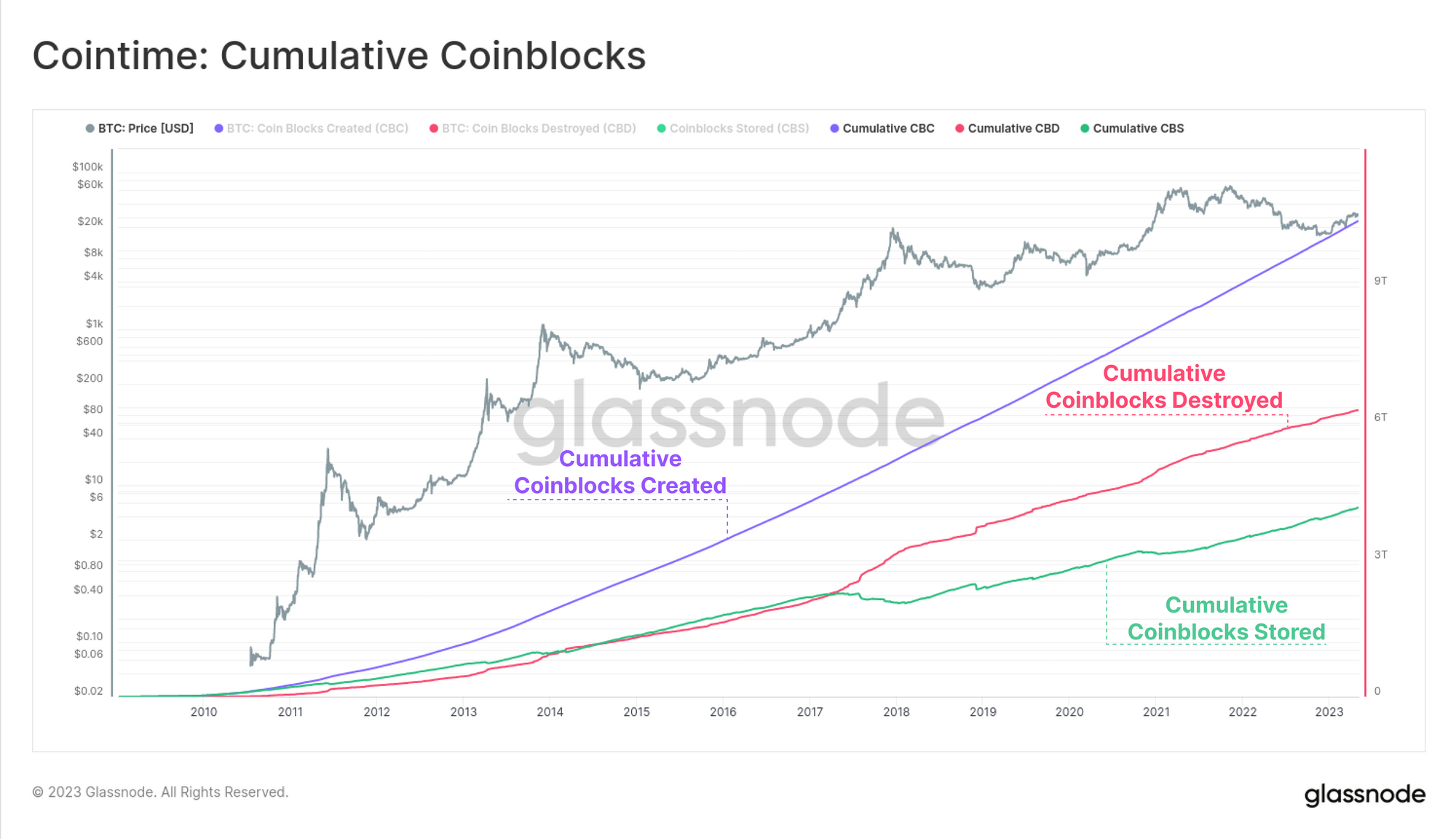

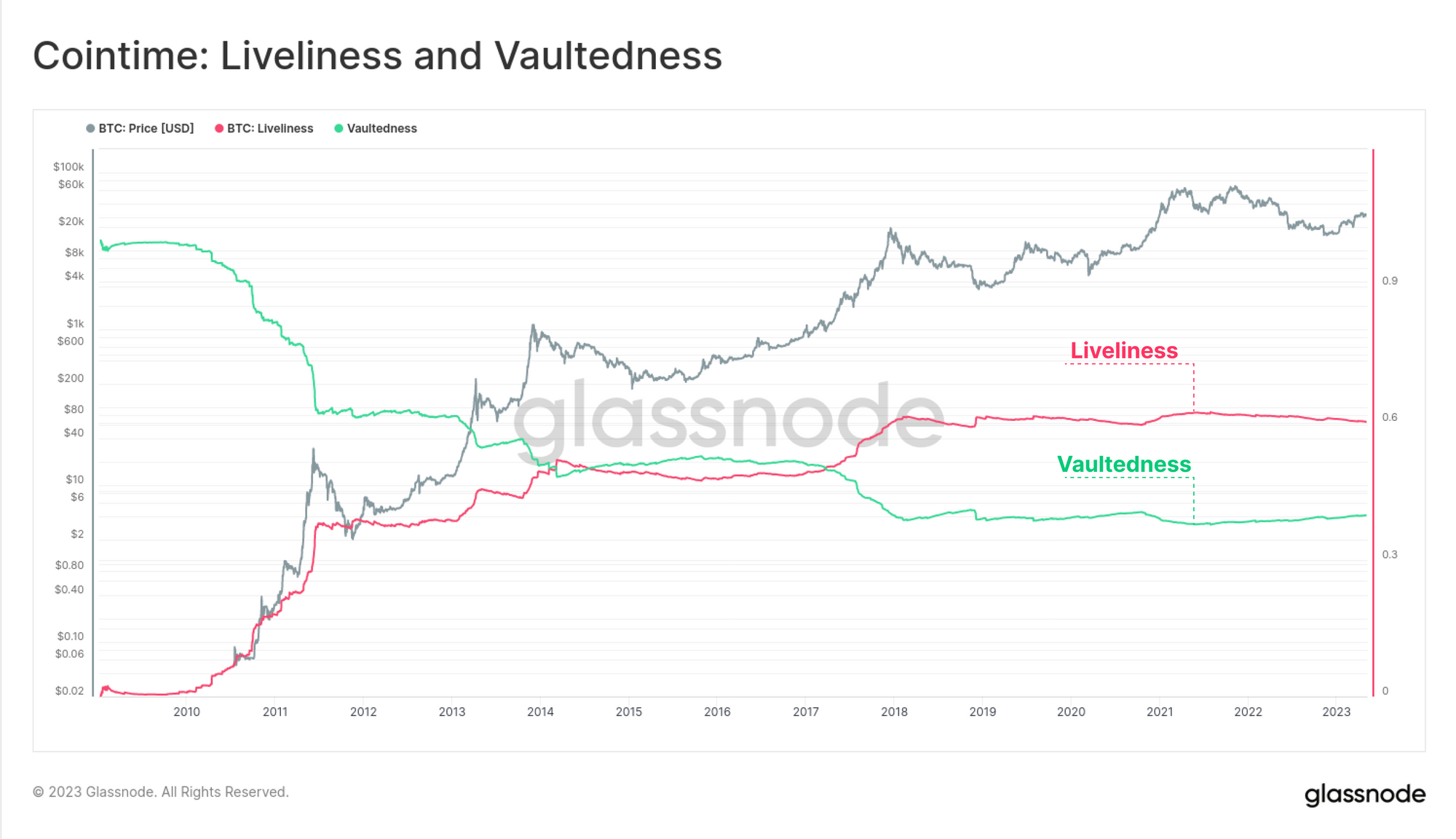

In Cointime Economics, coinblocks can transition between three states: Created, Destroyed, or Stored. Every new block added to the Bitcoin economy generates additional coinblocks, termed as Coinblocks Created (CBC). On the other hand, the act of spending accumulated coinblocks within UTXOs leads to their destruction, aptly named Coinblocks Destroyed (CBD). At a macro scale, the aggregate state of the network is defined by Liveliness and Vaultedness, describing the relative activity and inactivity of the supply, respectively.

A Glimpse into Supply Dynamics

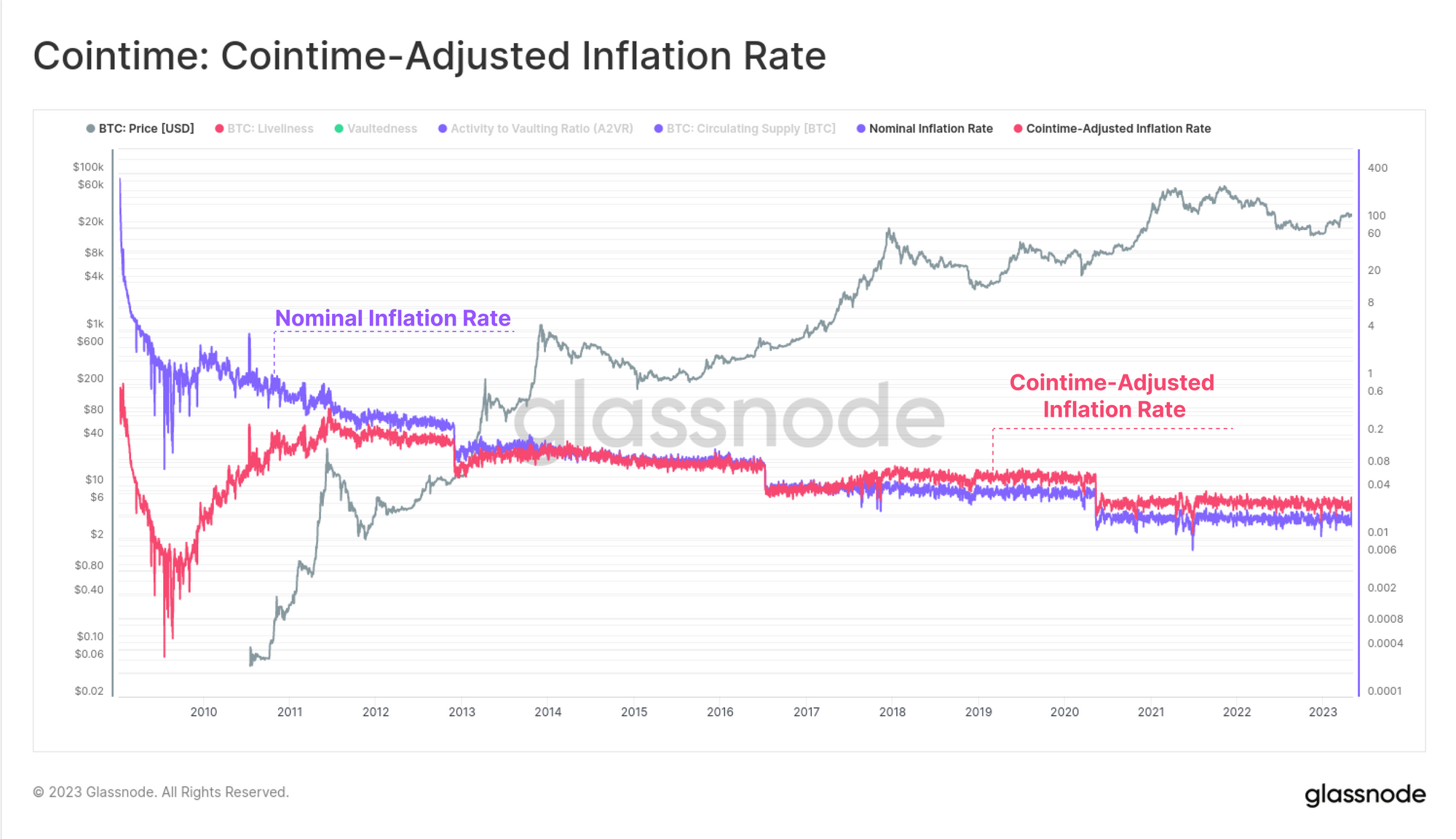

By breaking down the network into binary economically active and inactive components, we introduce Active and Vaulted Supply regions. These metrics become the ideal reference points for economic calculations By way of example, new issuance is unlikely to dilute lost coins, but it will do for coins held by active investors. This in turn opens up opportunities to develop superior measures of economic activity like inflation rates, vaulting rates, and stock-to-flow ratios that account for both supply and demand.

Seeking the Center - The true cost basis of Bitcoin

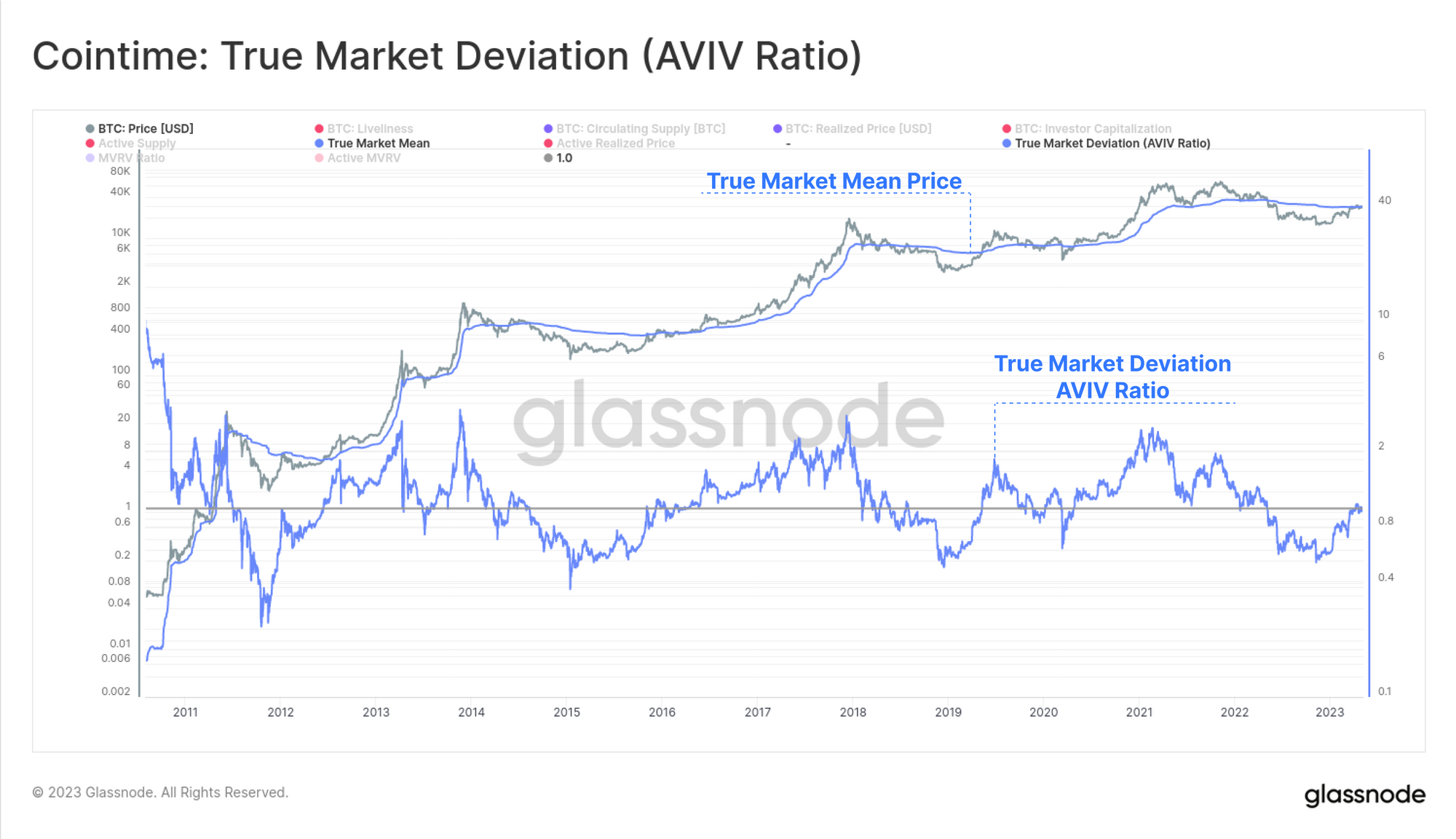

It is widely believed in the field of on-chain analysis that the Realized Price is the average acquisition price of Bitcoin. Through the lens of Cointime Economics, we demonstrate that the Realized Price actually underestimates this level.

This is due to the tremendous unrealized profits held within lost and inert supply which offsets the losses held by active investors. We propose a new suite of pricing models, one of which has a long term mean and median very close to one. This suggests that it is an ideal candidate for measuring the average investor cost basis, and market mean reversion.

In Conclusion

Cointime Economics is not just another analytical tool; it's a paradigm shift in understanding Bitcoin's economic landscape. By focusing on coinblocks and their intricate dance between creation, destruction, and storage, this framework offers invaluable insights into the heart of the Bitcoin ecosystem.

As the Bitcoin world continues to evolve, Cointime Economics stands out as a beacon, guiding enthusiasts and experts alike through the intricate maze of Bitcoin's economic dynamics.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

- Join our Telegram channel

- Follow us and reach out on Twitter

- Visit Glassnode Forum for long-form discussions and analysis.

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

- For automated alerts on core on-chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter