The Week On-Chain (Week 1, 2021)

Moving into the first week of 2021, BTC continues to hit all-time highs as it shoots past $30k and continues to climb. But ETH is the real winner of the week, gaining over 37% in a single day.

Bitcoin Market Health

Bitcoin had yet another impressive week over the New Year period, reaching new all-time highs and exceeding $30k for the first time. After starting the week at $26,270, it increased continually, reaching a high of $34,550 before dipping slightly to end the week at $32,685.

For the Bulls

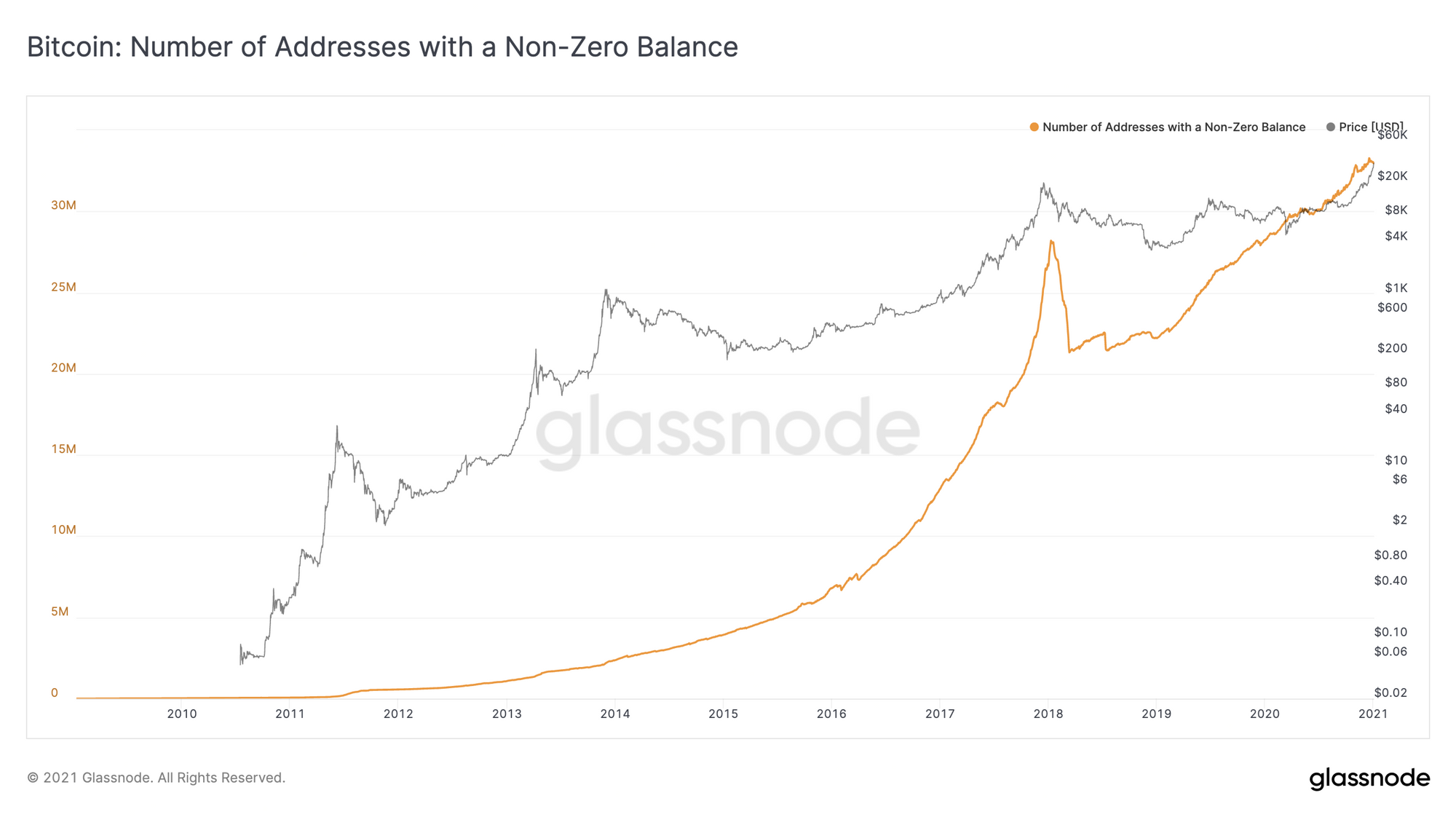

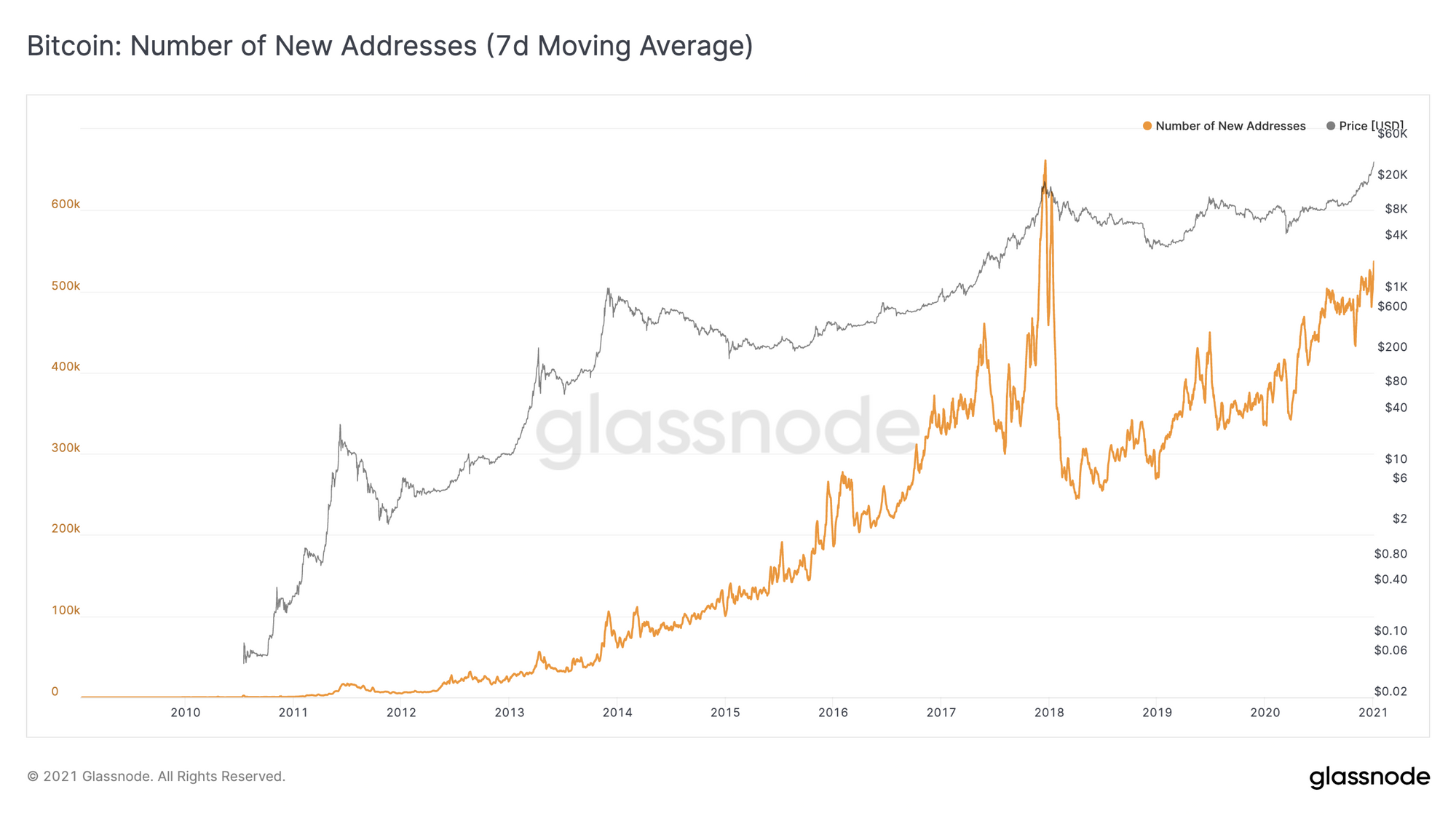

As BTC's price continues to rise, widespread retail interest in bitcoin is increasing, with the number of address holding a non-zero amount of BTC reaching an all-time high of over 33 million.

However, while news coverage and retail interest in bitcoin are rapidly growing, the number of daily new BTC addresses has still not reached 2017 levels. This metric's steady and consistent growth (as opposed to the sudden peak seen in the last major bull market) suggests that BTC is experiencing strong organic growth in adoption, but not the sort of viral growth typical of a bubble.

These metrics therefore paint a bullish picture of a market characterized by healthy, sustainable growth as opposed to hype.

A Bullish Comment from Willy Woo

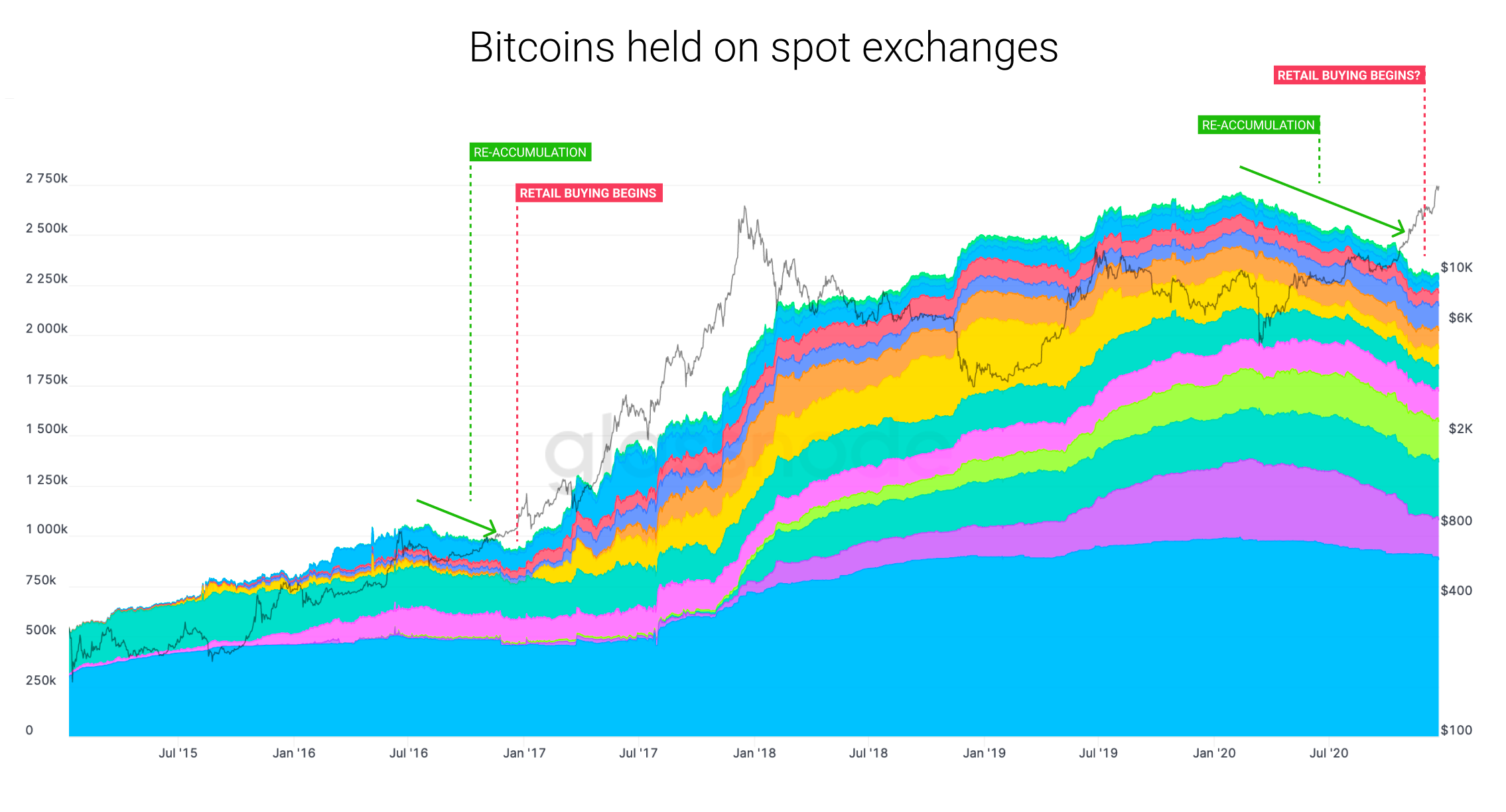

Woo's Take: In the long range, exchange inventory structure points to a good year ahead.

Inventory depletion on spot exchanges has stopped, signifying the re-accumulation phase of the macro cycle is likely complete. The chart below marks where we are in the overall macro cycle through the lens of spot inventory.

What causes inventory to increase in later stages of the bull market? Retail tends to store their coins on exchanges which attributes to a net inventory climb. This typifies the main phase of the bull market. Since we already know institutions are buying in large quantities, the flattening of spot inventory depletion is a sign that retail buyers are now entering in large volumes, attracted by recent price rises.

Read more from Willy Woo in his newsletter, The Bitcoin Forecast.

Altcoin Feature: ETH's Bull Run

ETH's spectacular Sunday bull run saw it gain over 37% in a single day, propelling it to the $1000 mark and representing an almost 750% price increase from the same point last year, when it sat below $140.

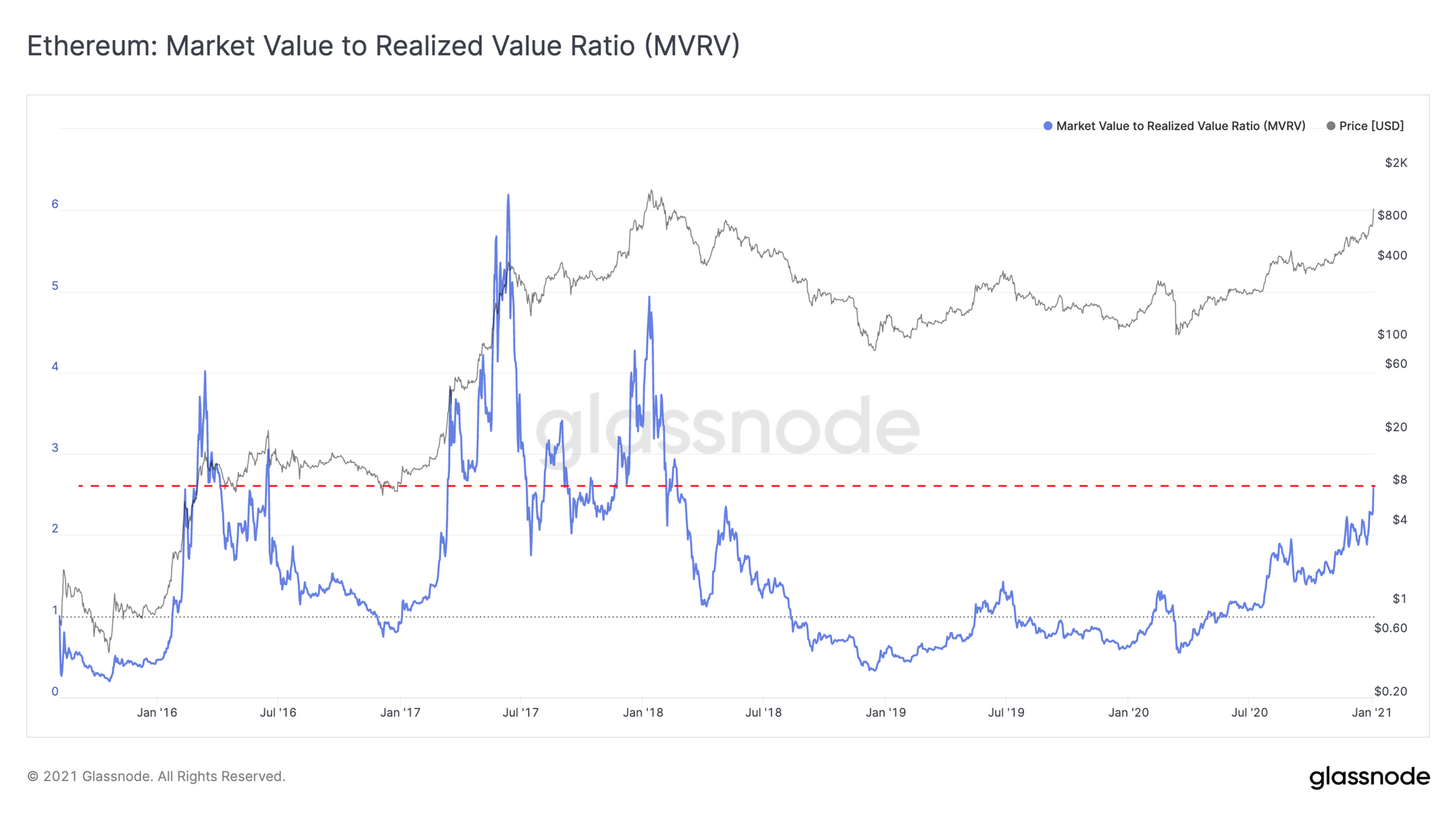

The last time ETH reached this price was 3 years ago, in January 2018, when it spent less than a month above $1000 before dropping back down into the triple digits. However, on-chain signals suggest that we are still in the earlier stages of a bull market, relative to the same price levels in 2018.

For example, its MVRV Ratio (which indicates when an asset may be overvalued) is still extremely low relative to early 2018, when the price was equivalent to current levels.

When MVRV was this low leading up to the 2017 bull run, ETH was still under $25, and experienced a massive 5800% increase before reaching its all-time high. This indicates that in the current market, there is room for significant further growth before ETH becomes overvalued.

Which altcoins would you like to see us cover in future editions of The Week On-Chain? Let us know on Twitter.

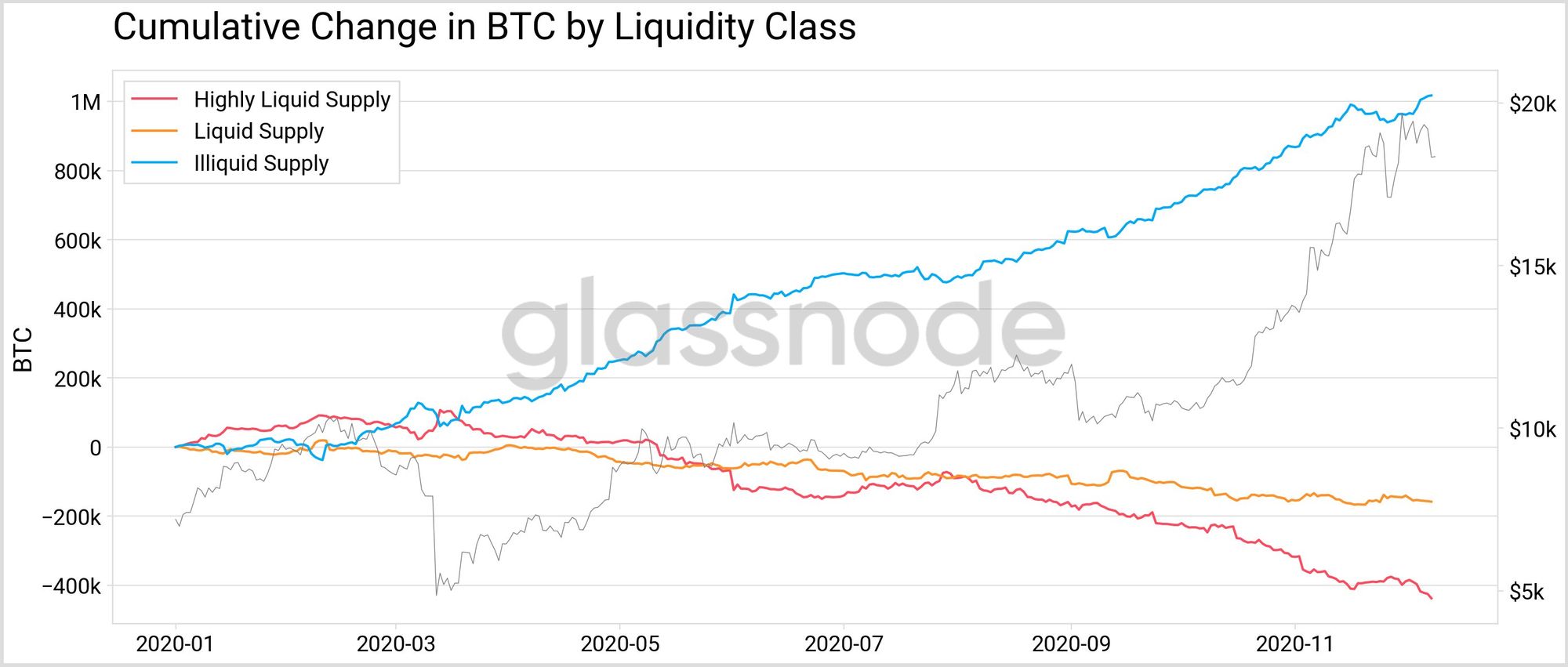

Weekly Feature: Bitcoin's Liquidity Crisis Continues

Bitcoin liquidity is continually getting squashed as investors continue hoarding and hodling, and the available supply is becoming scarcer.

Throughout 2020, the "Illiquid Supply" liquidity class for BTC has grown increasingly larger, while liquid and highly liquid supply are decreasing.

This is a highly bullish sign, as scarcity leads to an increase in demand relative to supply, driving up price. This chart also implies that the recent influx of new retail investors are more likely to be hodling rather than realizing gains at this point, suggesting more room for growth from both the retail and institutional sectors.

- Lesen Sie diesen Artikel jetzt auf Deutsch bei unserem offiziellen Partner Bitcoin2Go

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter