The Week On-Chain (Week 20, 2020)

As Bitcoin tests the $10k mark again, investors continue withdrawing their BTC from exchanges even after the halving.

Bitcoin Market Health

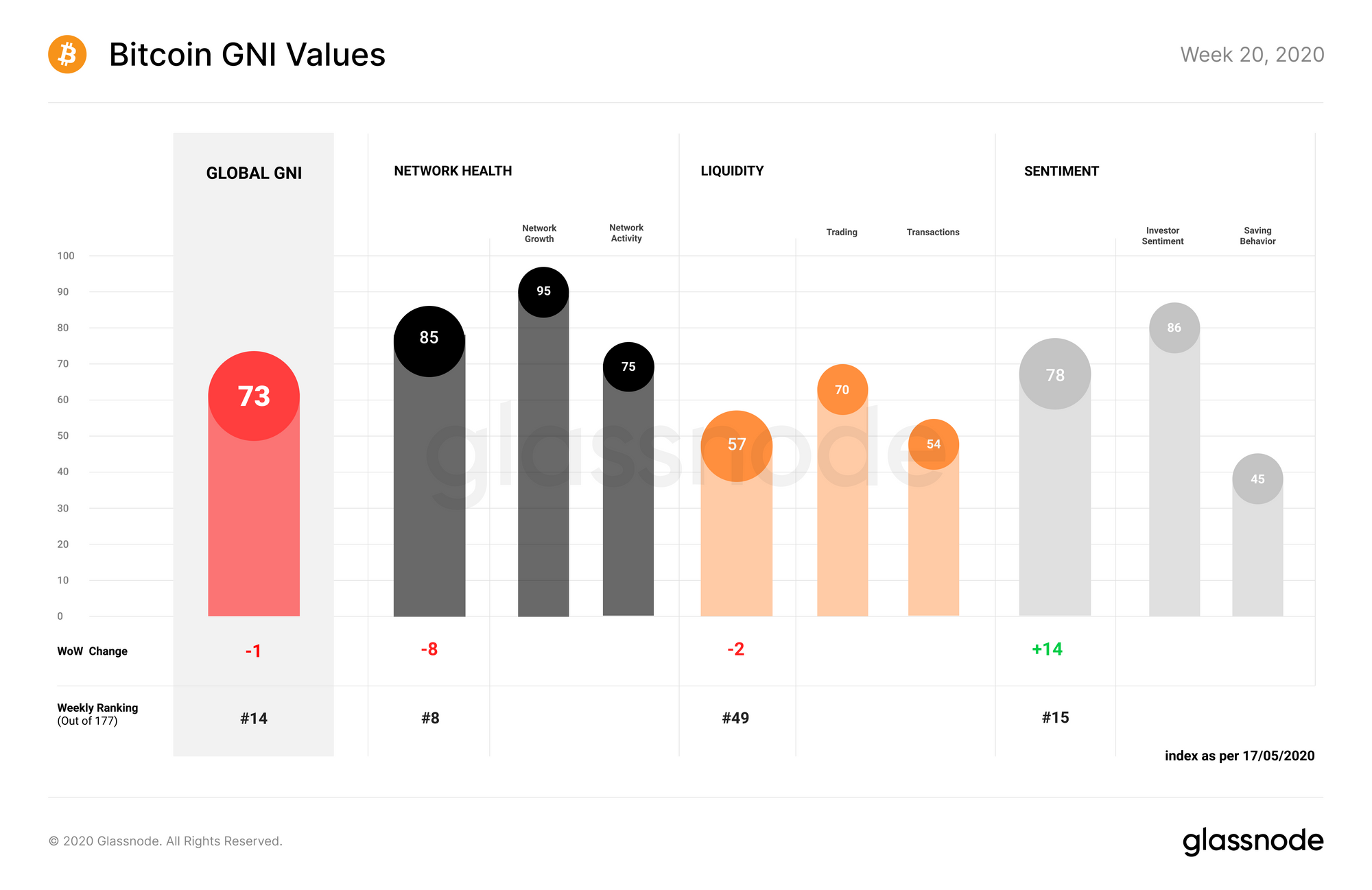

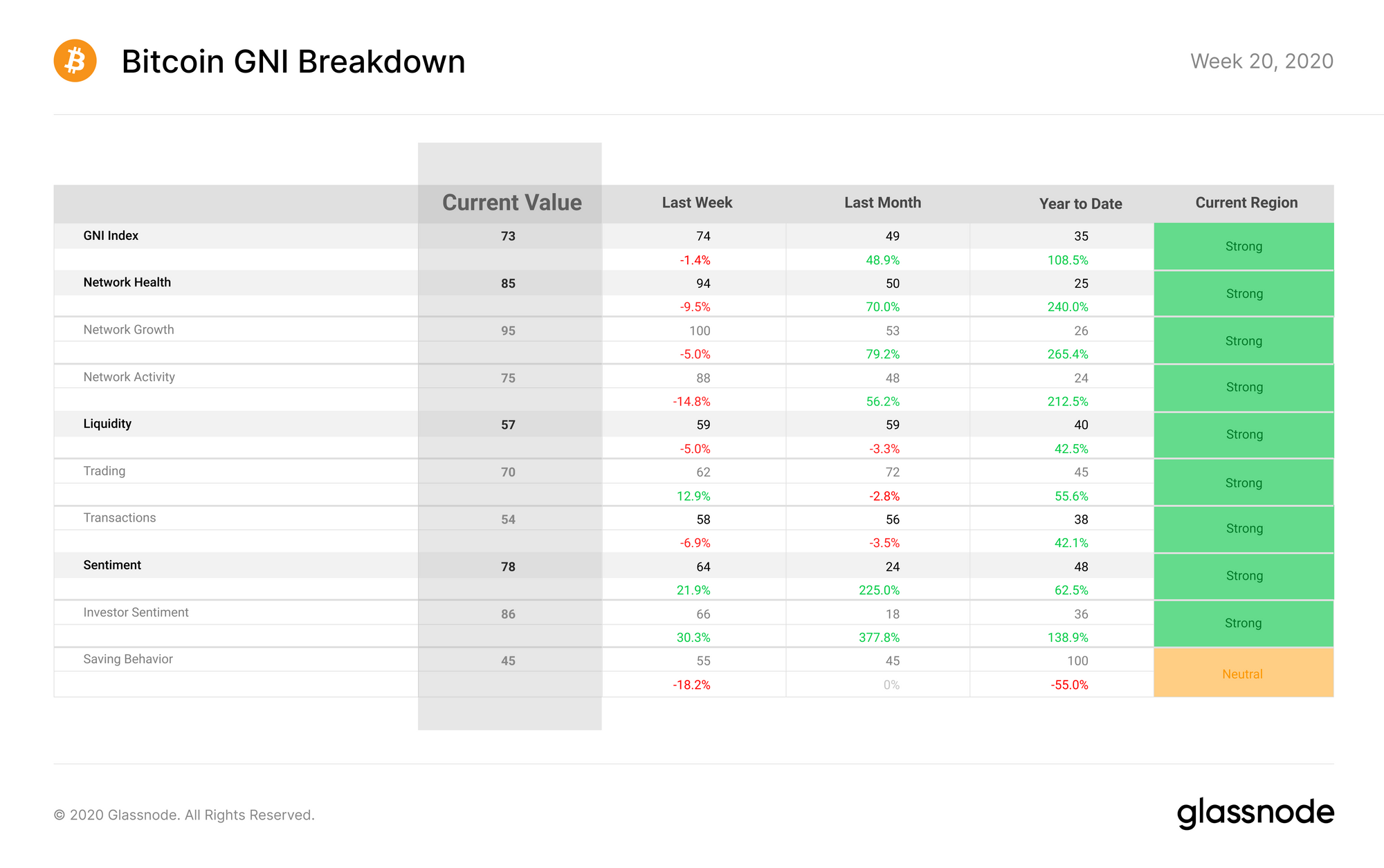

Bitcoin on-chain fundamentals dropped slightly in Week 20. GNI registered a 1 point decrease over the week, pushing its overall assessment of the Bitcoin ecosystem to 73 points. This downturn was mainly driven by the Network Health subindex, which decreased by 8 points.

Read more about how these values are broken down here.

Network Health was particularly high last week as a result of heightened activity leading up to the Bitcoin halving. As such, this week's 8 point decrease should not be taken to signify an unhealthy network, but rather a return to the network's previous growth trajectory. This subindex is still up 70% from last month, and 240% for the year.

Liquidity registered a small decrease of 2 points as a result of a lower number of on-chain transactions over the past week. However, an 8 point increase in trading liquidity meant that overall liquidity remained relatively steady.

After suffering a large decrease during Week 19, Sentiment has fully recovered, with a 14 point increase over the past week. This was driven by a large 20 point increase in investor sentiment, while saving behavior decreased by 10 points.

Glassnode Compass

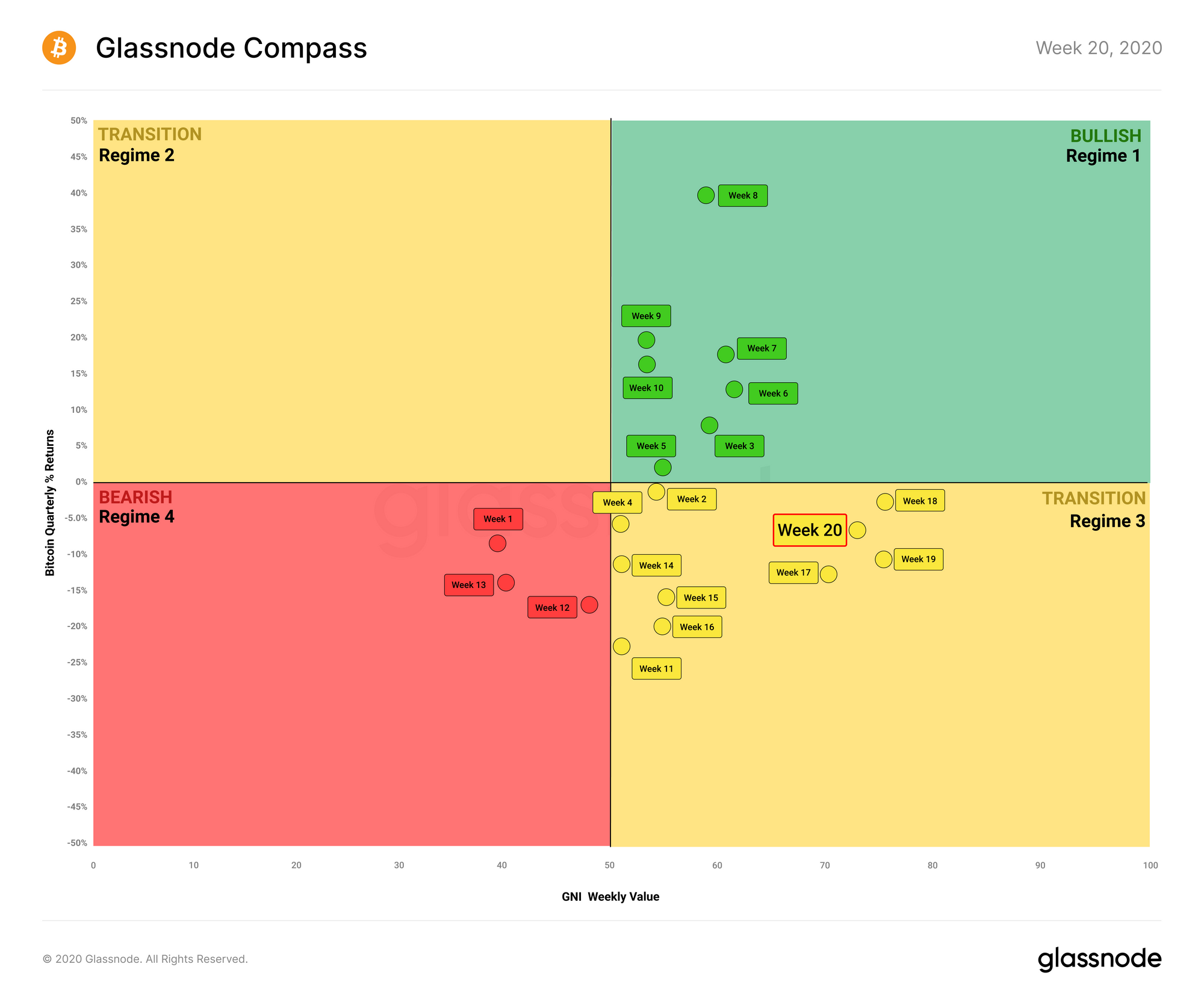

The Glassnode Compass outlines the general regime in which Bitcoin is currently located, based on its on-chain fundamentals (as determined by the GNI) and its recent price behavior.

This week, the compass has edged closer to the bullish Regime 1 as BTC's quarterly returns increased slightly. It currently remains in Regime 3, in a transition phase which represents strong on-chain fundamentals but non-exceptional price performance. With BTC testing $10k, Regime 1 is well within scope in the coming weeks, provided that the current price trend persists.

Overall, Bitcoin's market health remains strong, but indicators point to a forecast which is not overly bullish. While a post-halving price increase is not out of the question, it is likely that the halving is already priced in, and that a breakout in the near future would be optimistic.

BTC Balance on Exchanges Experiences its Largest Decrease in Bitcoin's History

The number of BTC on exchanges has been steadily decreasing since the crash in March, and is now approaching a 1 year low. This is the largest and most prolonged BTC exchange balance downtrend in Bitcoin's history.

A possible explanation for this decrease is that investors are withdrawing funds from exchanges to hold in cold storage, implying a longer-term outlook. This is supported by the continued increase in the number of BTC whales, as well as continued hodler accumulation over the past 2 months.

This trend towards withdrawing from exchanges may be partially due to the expectation that BTC will increase in price following the halving. However, this does not tell the whole story, as ETH also began experiencing a similar trend of exchange withdrawals around the same time (albeit not to the same extent as BTC), despite having grown near-consistently for 2 years.

Another partial explanation may be lack of trust; withdrawals from BitMEX, which experienced downtime during the March crash, have been more pronounced than withdrawals from other exchanges. Overall, however, withdrawal for hodling purposes seems to be having a greater effect than lack of trust.

Keep an eye on BTC Exchange Balance to see if this trend continues.

- Follow us and reach out on Twitter

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter