The Week On-Chain (Week 21, 2020)

As the price of BTC slips back below $9k, on-chain fundamentals are also showing signs of decline, pushing Bitcoin closer to bearish territory.

Bitcoin Market Health

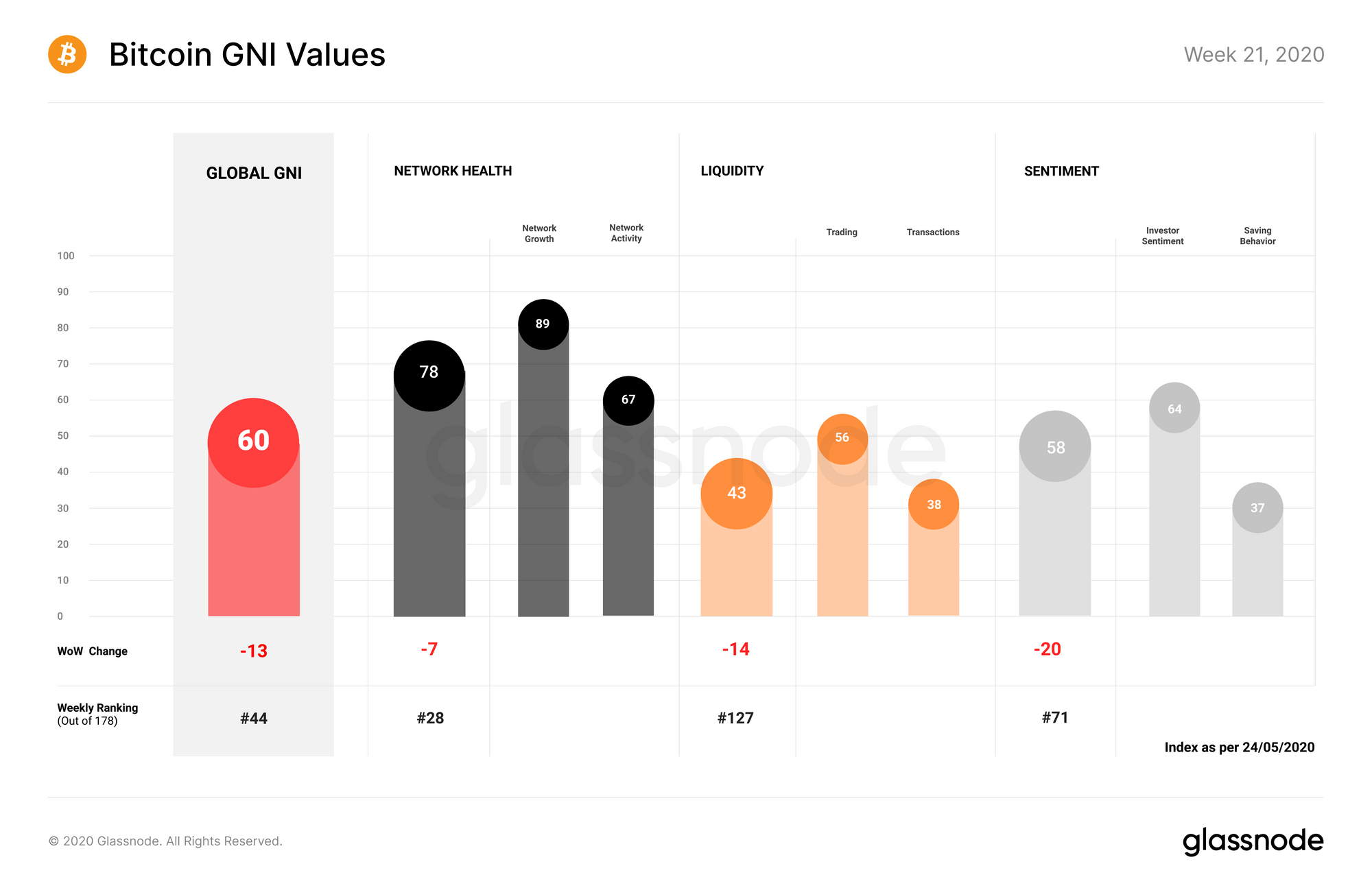

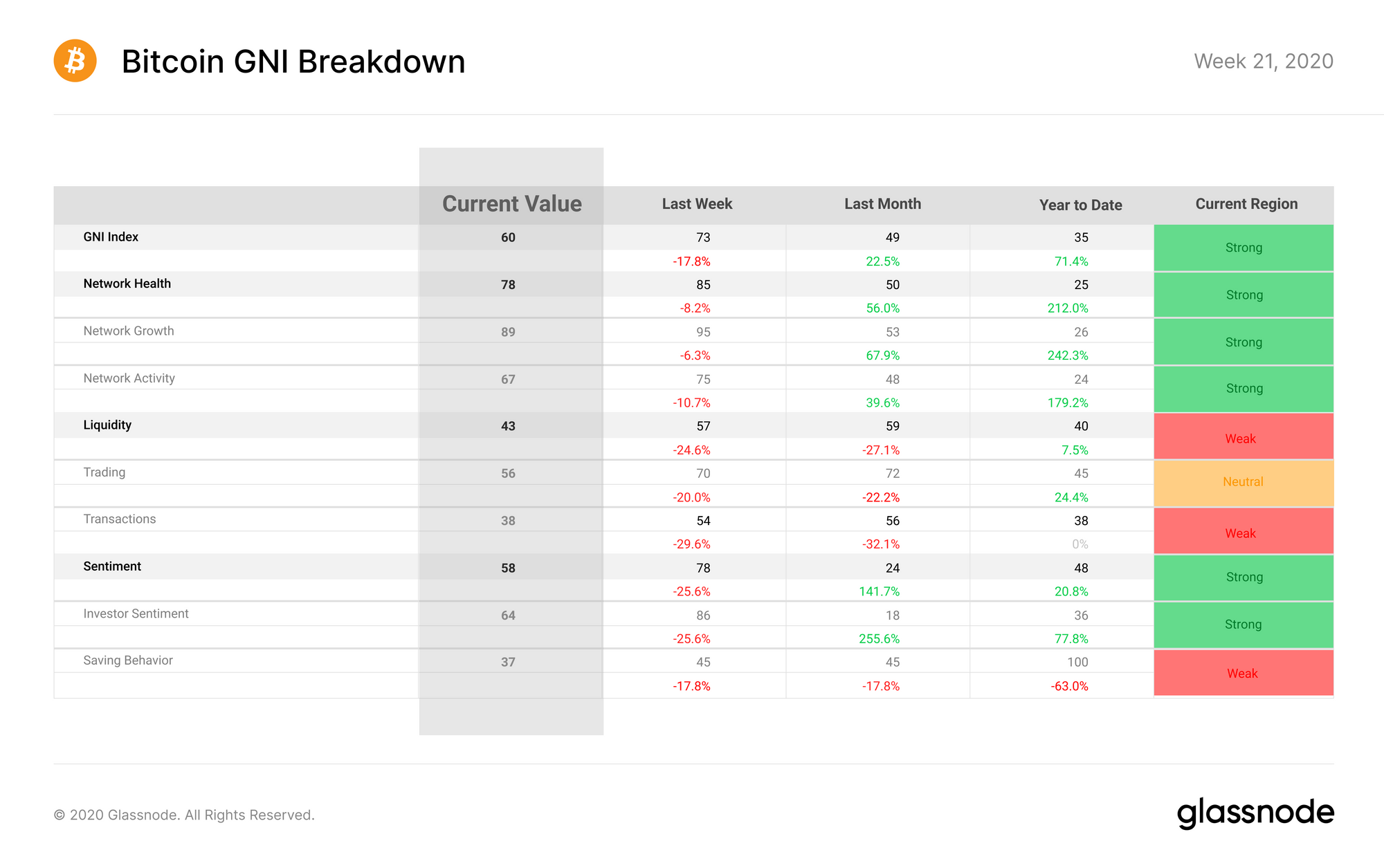

Bitcoin on-chain fundamentals saw a distinct decline during Week 21. GNI decreased by 13 points, down to a value of 60. This drop - mainly driven by decreases in Sentiment and Liquidity - solidifies the trajectory change seen in Week 20; for the time being, on-chain fundamentals are in decline, alongside Bitcoin's price.

Read more about how these values are broken down here.

Network Health is still relatively high, at a value of 78 points. However, the past week's decreases in growth and overall activity on the Bitcoin network have seen it drop by 7 points from last week. While still at high levels relative to the past year, investors should keep an eye on this index's current downward trajectory.

Liquidity's 14 point decrease last week brings it down to 43 points, its lowest value since January 2020. After gradually increasing since August last year, this sudden drop was caused in part by decreases in exchange inflows and on-chain transaction volumes.

Alongside this decline in Bitcoin's economic activity, Sentiment has dropped by 20 points. This has been driven by an overall decrease in economic activity in relation to the price of BTC, as well as a slowing down of hodlers' accumulation behavior; while hodlers are still accumulating, the rate at which they are doing so is declining.

Glassnode Compass

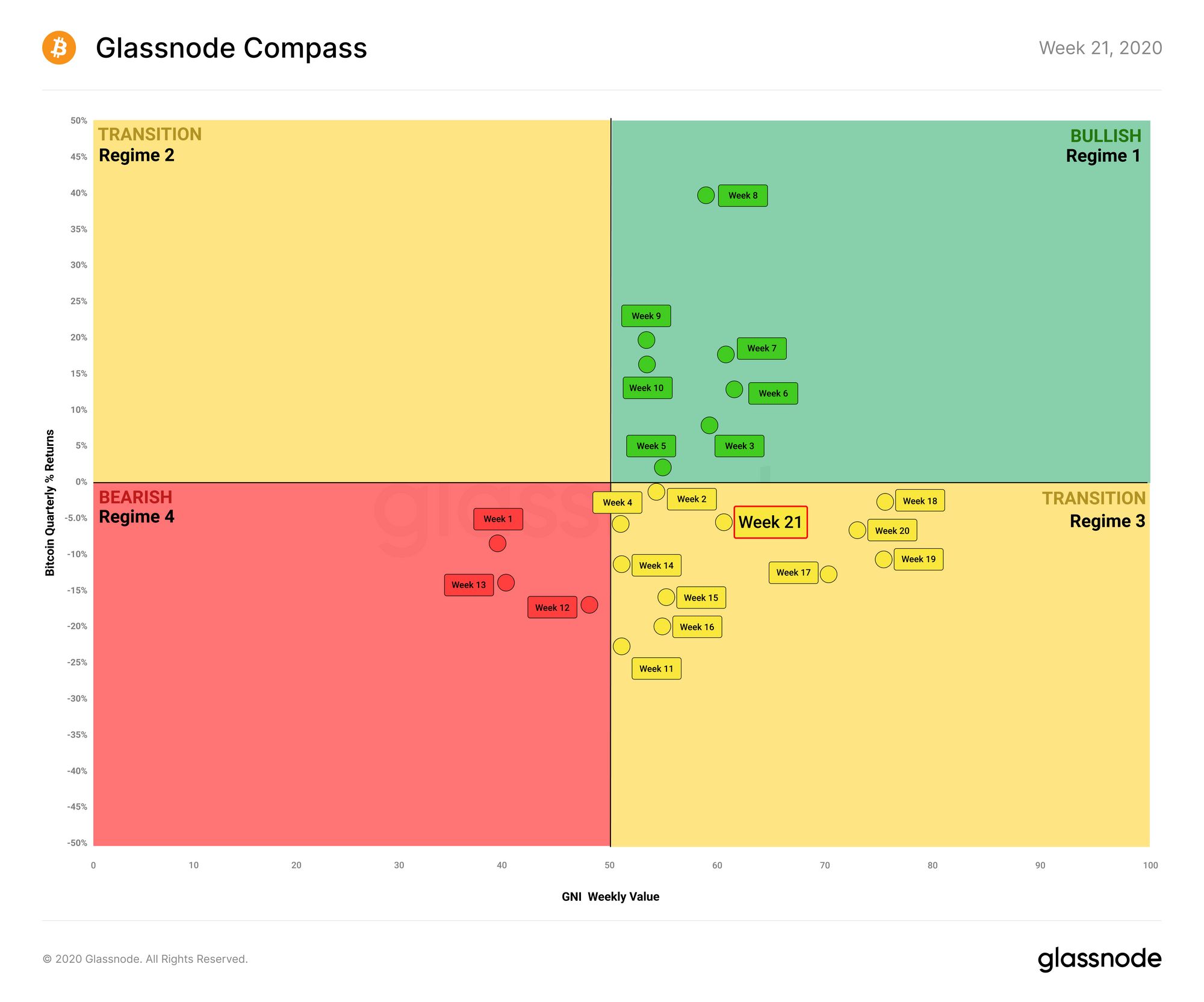

The Glassnode Compass outlines the general regime in which Bitcoin is currently located, based on its on-chain fundamentals (as determined by the GNI) and its recent price behavior.

The compass has slid closer to the bearish Regime 4 this week, due to GNI's 13 point drop. While a slight increase in BTC's quarterly returns pushed it up fractionally along the Y axis, the overall decrease in on-chain fundamentals threatens to undo this progress in the coming weeks.

With BTC no longer testing $10k, we may be seeing a regression back into bearish territory if on-chain activity and overall market health continue to decline. However, whether or not the halving is priced in remains to be seen; it took several months before BTC turned bullish after the last halving, and over a year for the price to increase by an order of magnitude.

Post-Halving, Bitcoin's Miner Revenue from Fees are Returning to Normal

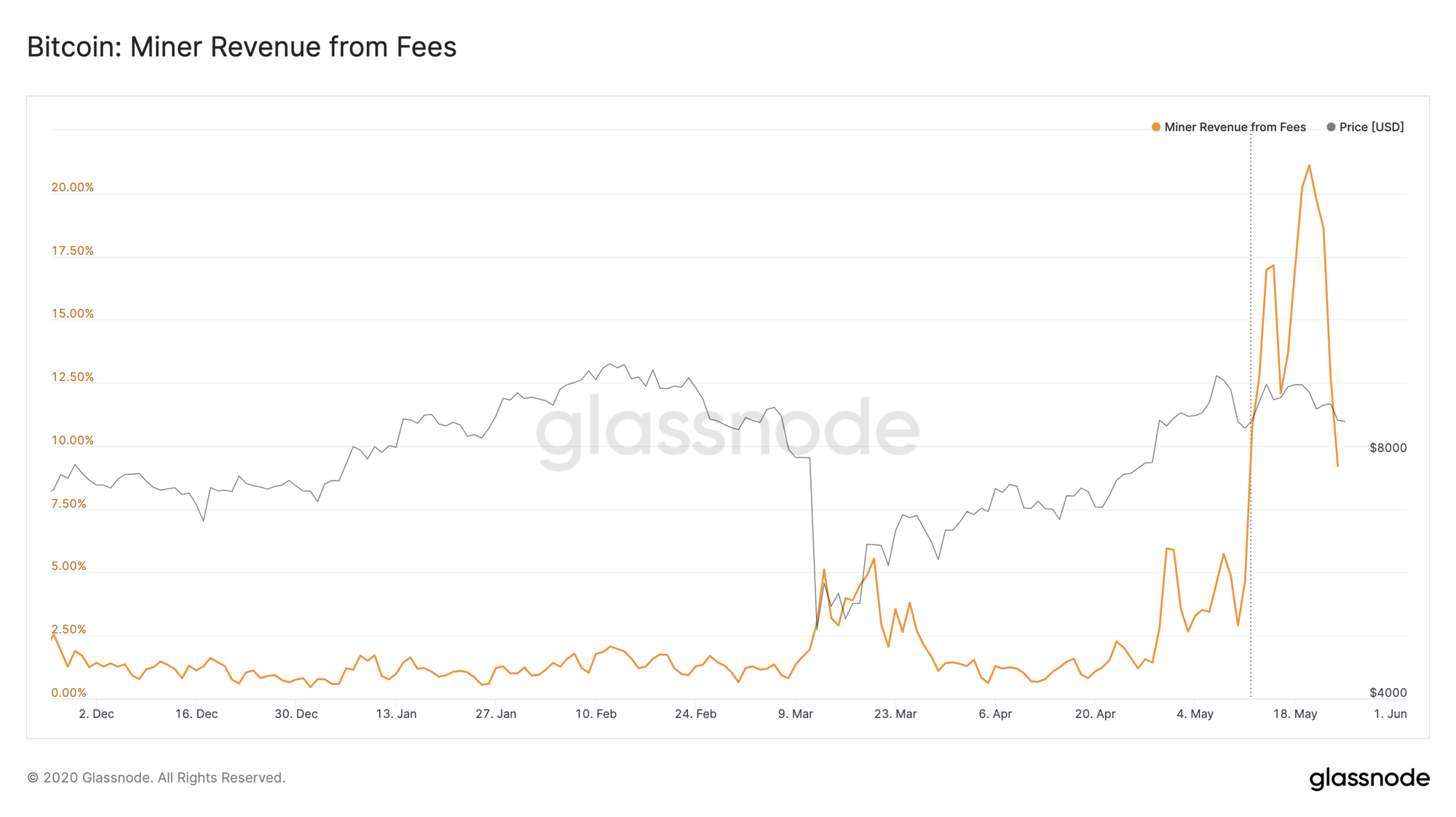

After experiencing a significant spike after the halving, the proportion of total revenue that Bitcoin miners are making from fees appears to be returning to normal.

In general, the higher on-chain transaction volumes are, the higher fees will be. However, the recent spike did not correlate with an increase in on-chain activity, but rather resulted from the prioritization of higher-fee transactions by miners in order to offset decreased revenue post-halving.

The subsequent decline over the past 5 days has likely been the result of a difficulty decrease, which has eased some of the financial pressure on the remaining miners. Despite this, we likely won't see a total return to previous levels of miner revenue from fees, as miners will need more time to adjust to the new economic realities of a 6.25 BTC block reward.

Product Updates

Metrics and Assets

- Fee Ratio Multiple (BTC, ETH, other major assets) - FRM is a measure of a blockchain's security and gives an assessment how secure a chain is once block rewards disappear.

- Distribution Metrics (ETH) - Added 1% Richlist Balance, Gini, Herfindahl Index, and Supply in Smart Contracts for ETH.

- Added support for WBTC and WETH.

Features

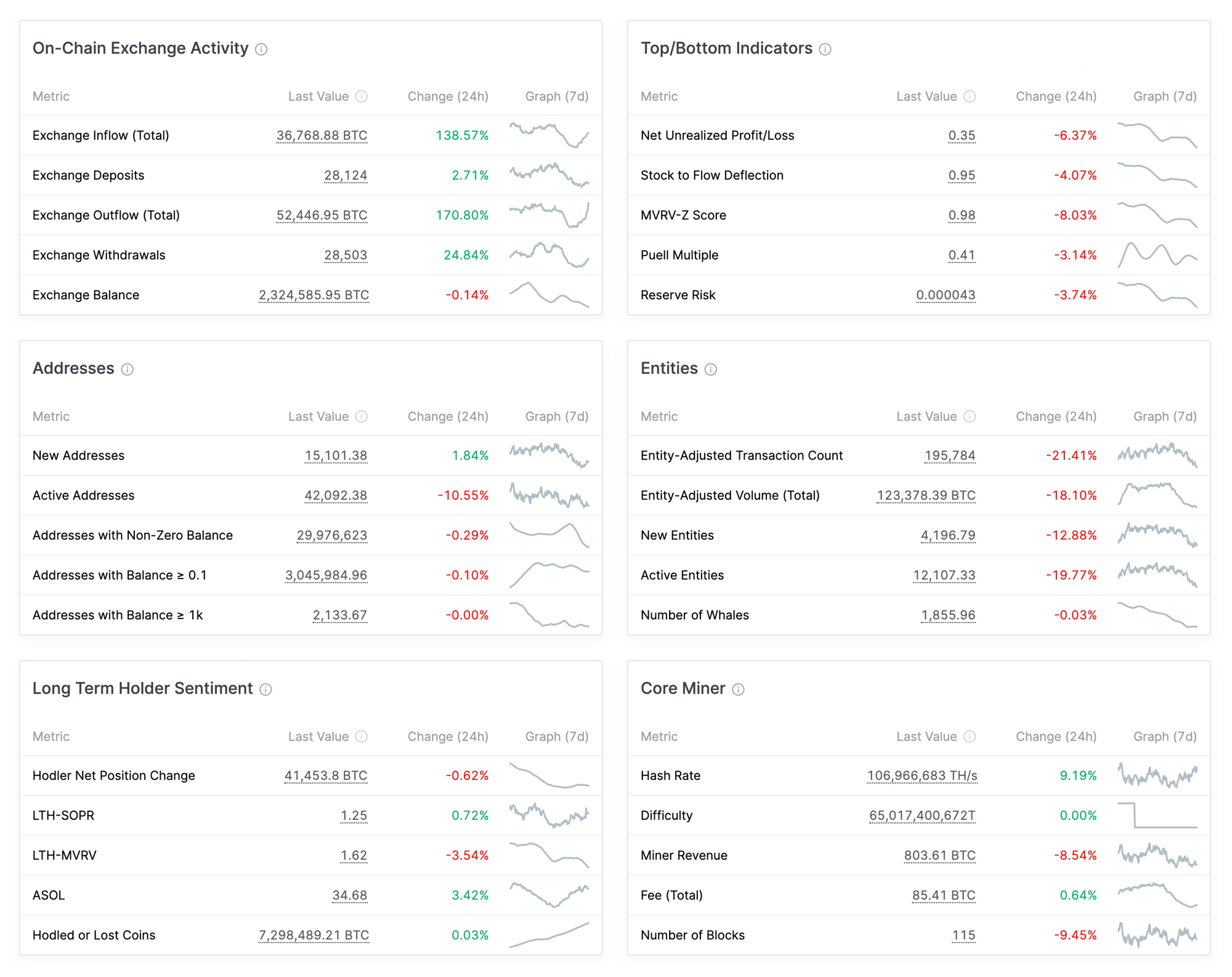

- Metric Overview - A new homepage for Glassnode Studio, showing core BTC and ETH metrics with their most up-to-date values and recent performance.

- Follow us and reach out on Twitter

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter