The Week On-Chain (Week 38, 2020)

Bitcoin's on-chain fundamentals grew stronger during Week 38, but Monday morning's stock market drop threatens to wipe out the gains from the past week.

Bitcoin Market Health

Bitcoin started to recover in Week 38, beginning the week at $10,340 and ending it at $10,900. BTC briefly moved above $11k on Wednesday and Saturday, but failed to find support at this level, falling back down into the high $10,000s. As of Monday morning, however, BTC has fallen to $10,450 as crypto markets drop along with the stock market.

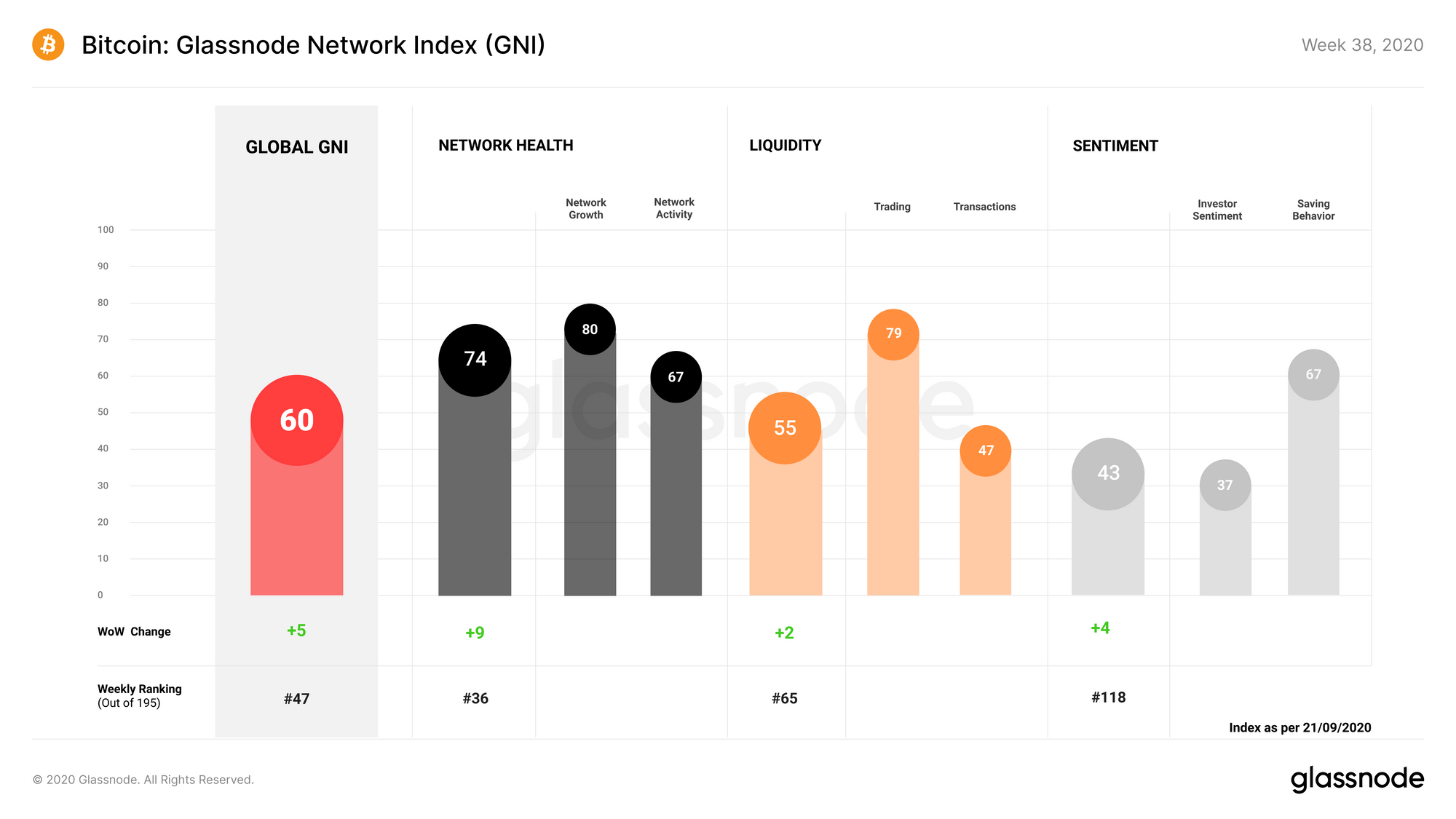

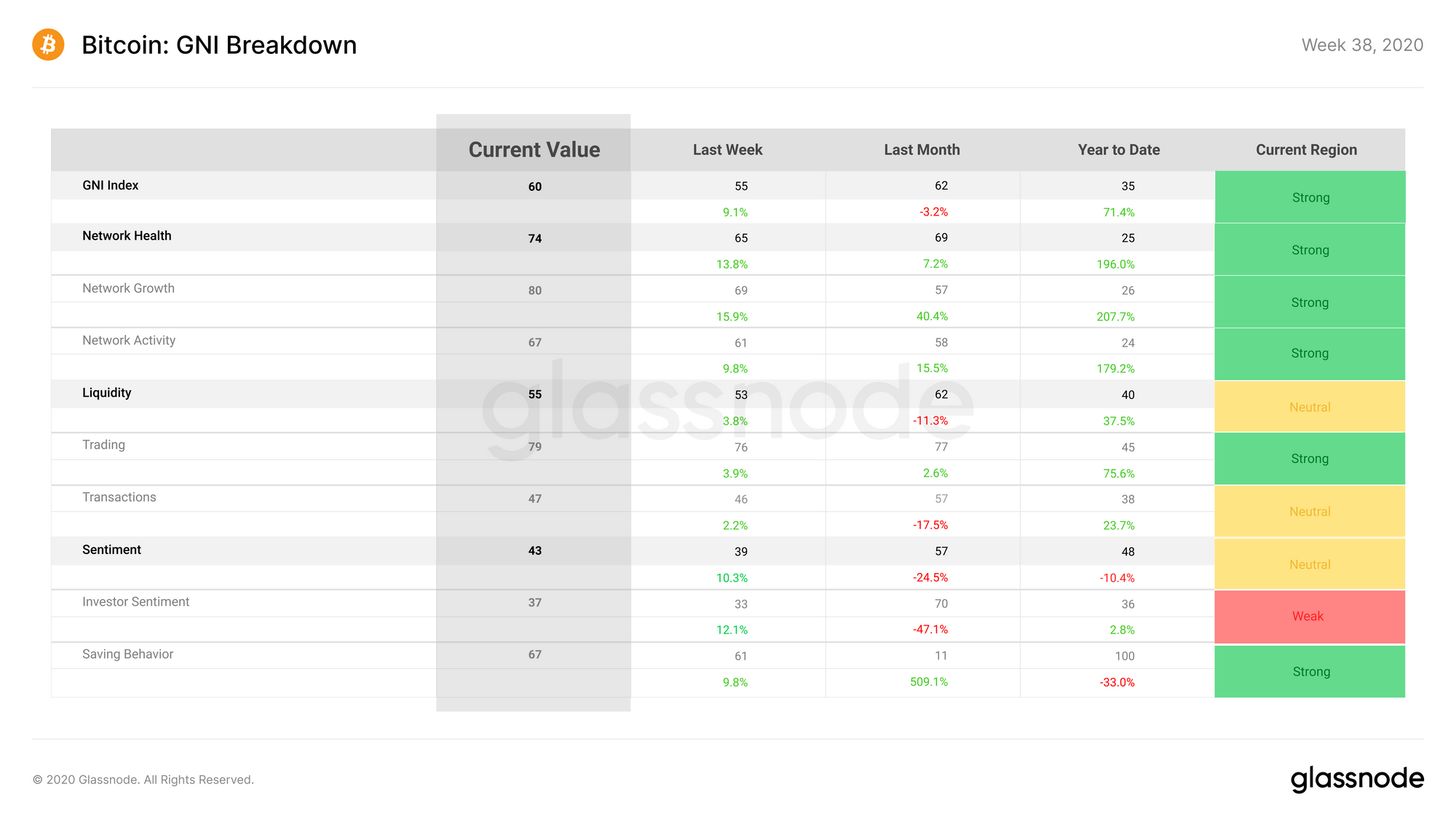

Bitcoin on-chain fundamentals increased over Week 38 after losing ground the previous week. GNI saw a 5 point increase, taking it back up to a score of 60 points. This increase was due to gains across all three subindices: Network Health, Liquidity, and Sentiment.

Network Health gained 9 points during Week 38, ending up at 74 points. Network growth saw a 16% increase as more bitcoin addresses were created, while network activity also grew due to a rise in the number of on-chain BTC transactions.

Liquidity saw a 2 point increase over the week, bringing it to a score of 55 points. Both the trading liquidity and transaction liquidity subcategories saw modest increases as a result of an increase in stablecoin supply and on-chain transaction count.

Sentiment increased by 4 points, due to spikes in both the investor sentiment and saving behavior subcategories. Investor sentiment rose due to the slight BTC price increase throughout the week, which saw more UTXOs move into a profitable state. Meanwhile, the rate at which hodlers acquired BTC also increased, bumping up the saving behavior subcategory.

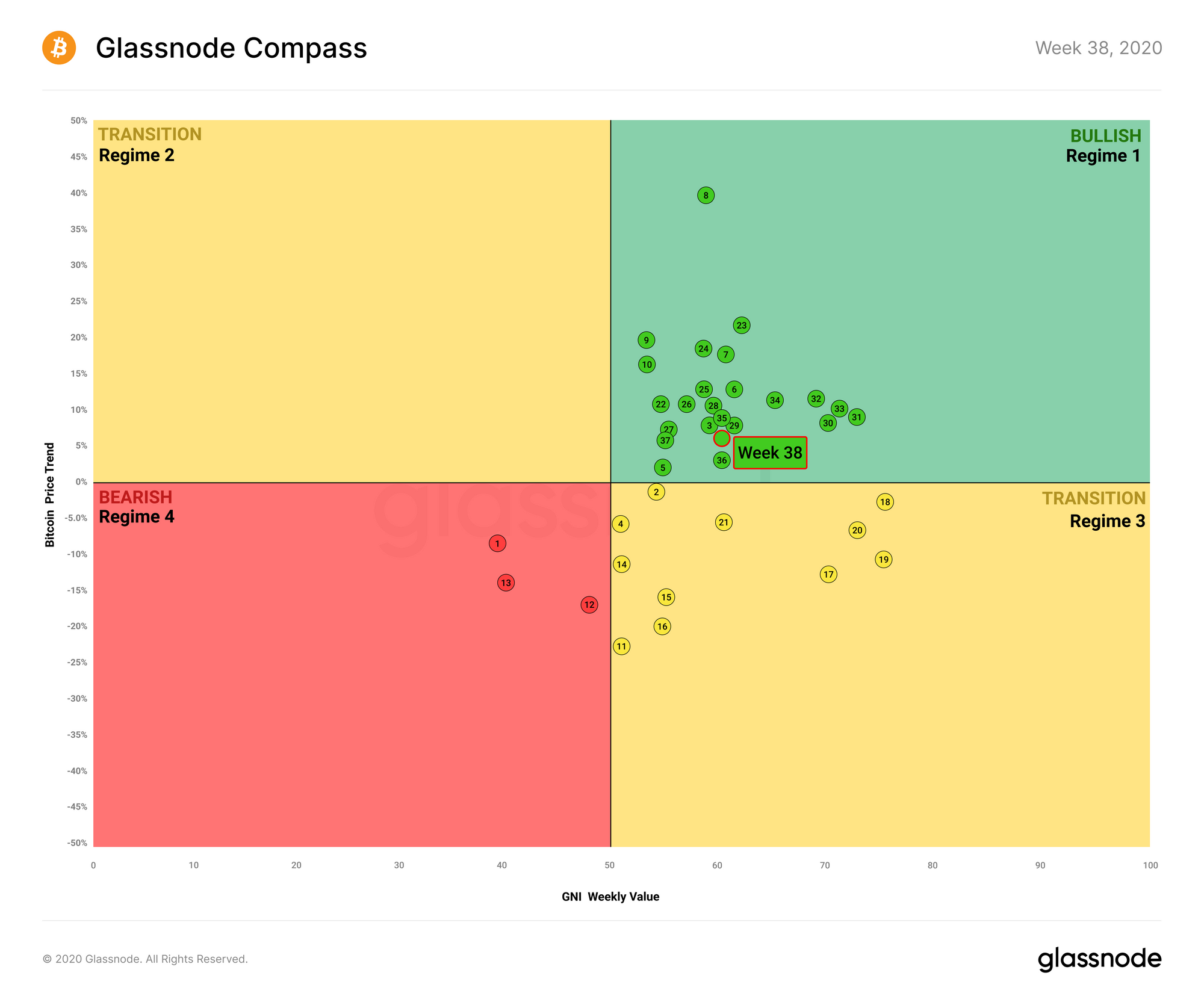

Glassnode Compass

The compass moved further into safer territory during Week 38, seeing increases in both GNI and price trend. This represents the 17th consecutive week that BTC remains in the bullish Regime 1 quadrant.

However, while BTC performed well during Week 38, Monday morning's events threaten to pull the price back down. This morning, Bitcoin fell to $10,450, seeing large losses along with the rest of the crypto market. This drop was almost certainly caused by a sharp drop in stock market futures.

Throughout 2020, we have consistently seen a strong correlation between crypto markets and traditional financial markets, and the crypto market's response to the 2.2% drop in Dow Jones futures this morning has reaffirmed this correlation.

As such, while the BTC price does appear to be stabilizing later into the day, investors should keep an eye on stock market movements to see whether they should prepare for a further drop in prices.

Altcoin Digest

Performance against BTC

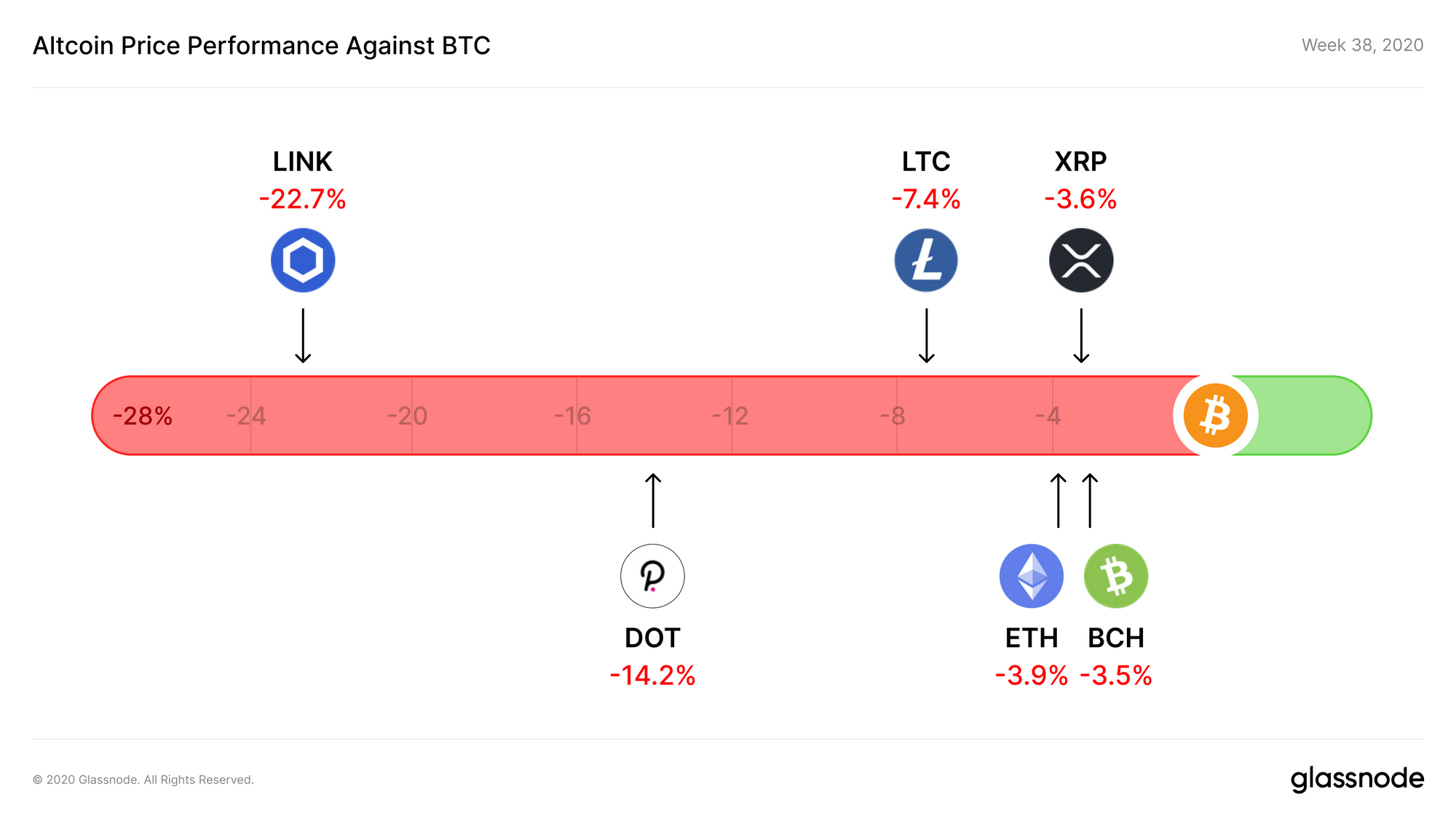

In Week 38, BTC saw strong performance against the rest of the crypto market; every major altcoin lost value next to BTC over the week. In its continued slide, LINK lost 22.7% of its value against BTC, while ETH fared better at only -3.9%.

Meanwhile, Bitcoin SV has slipped out of the top 10 altcoins thanks to the release of DOT and the increase in value of Crypto.com coin (CRO).

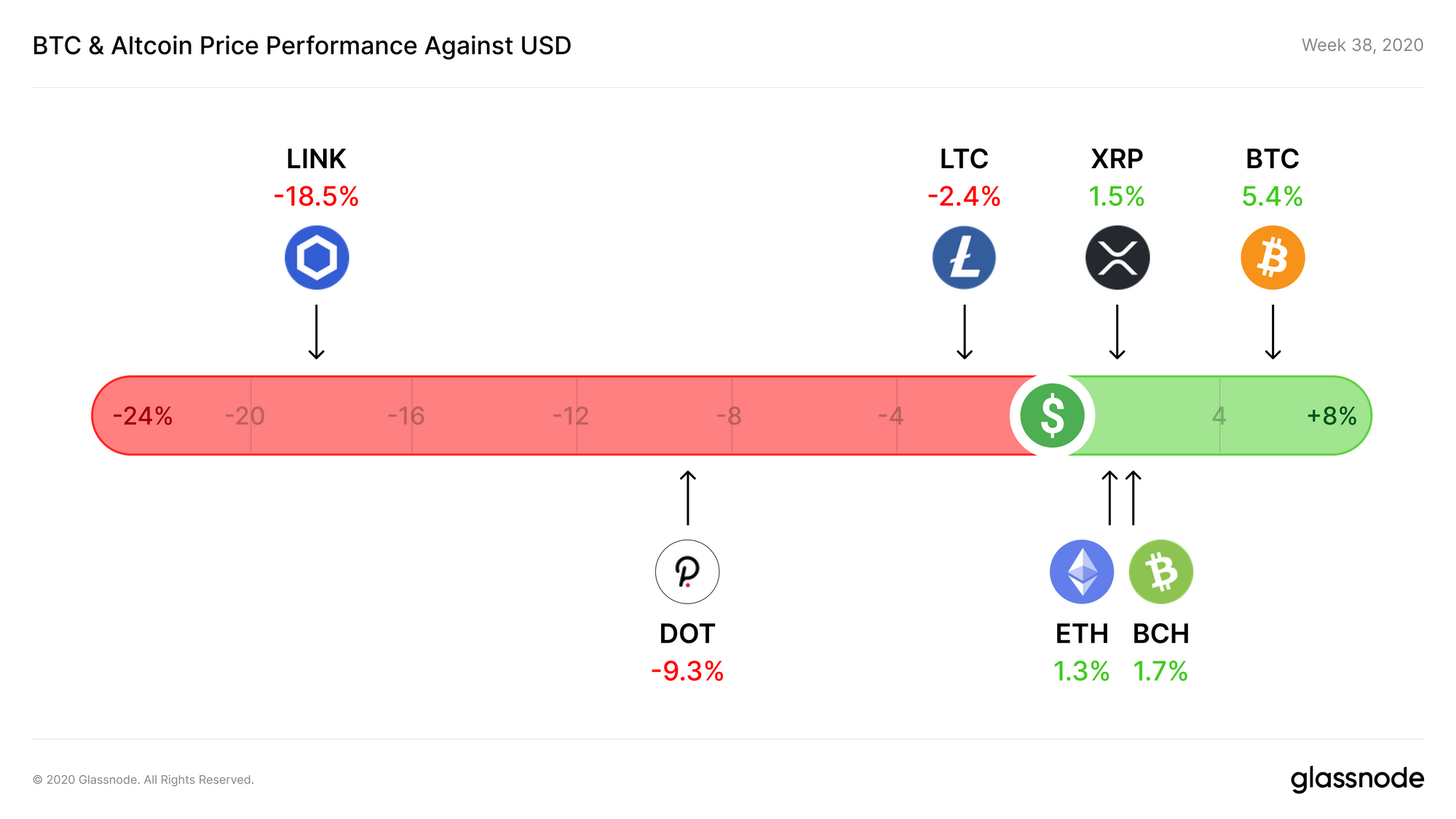

Performance against USD

The top coins had mixed performance against USD over the past week. BCH, XRP, and BCH all increased slightly in dollar value, while LTC, DOT, and LINK lost value.

BTC gained ground once again, increasing its market dominance back to 58.3%, up from 56.6% the previous week.

Which altcoins would you like to see us cover in future editions of The Week On-Chain? Let us know on Twitter.

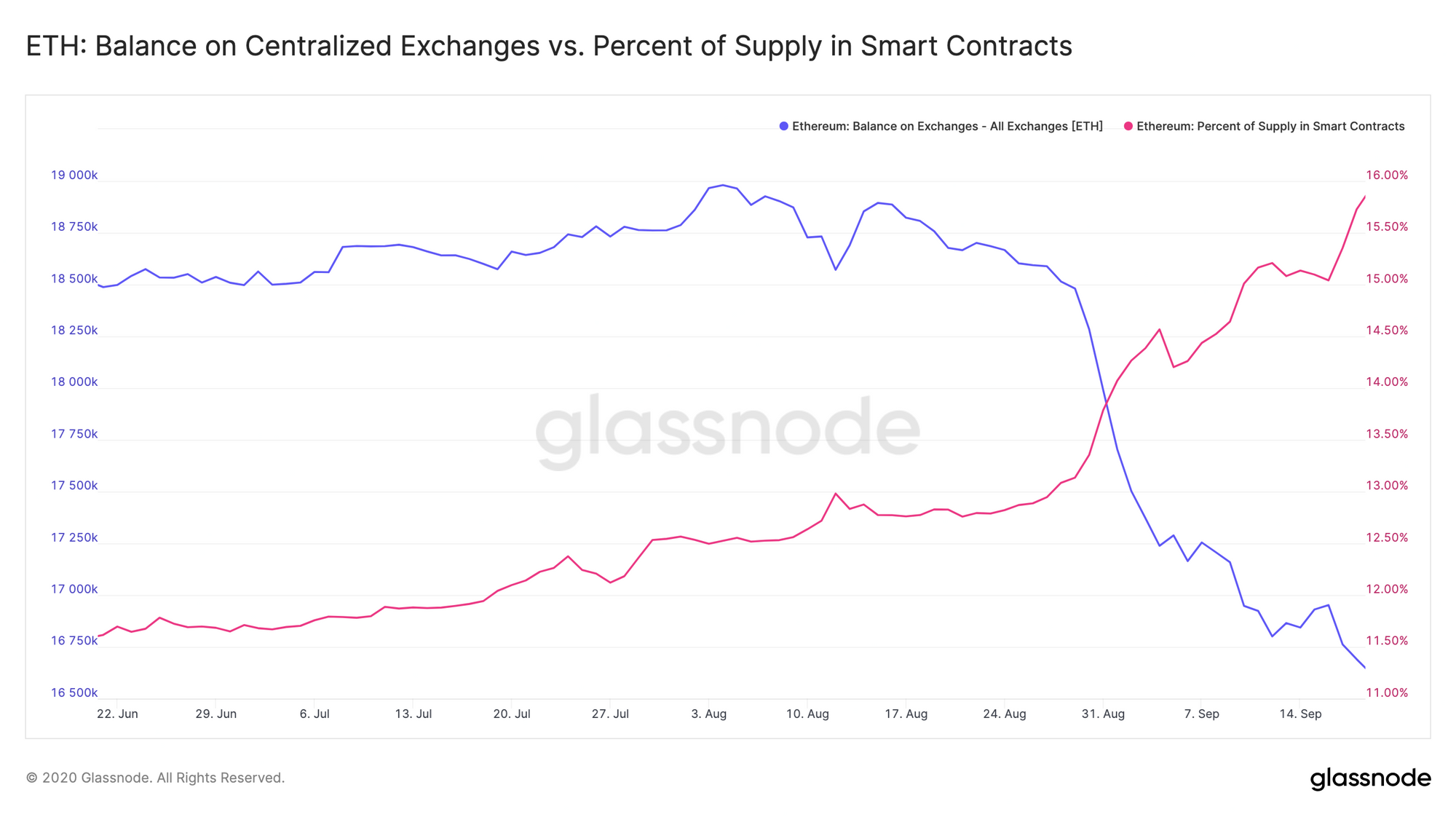

ETH Continues to Flow Out of Centralized Exchanges and Into Smart Contracts

As innovation in DeFi continues at a rapid pace, more and more ETH are flowing out of exchanges and into smart contracts.

Since 15 August, the balance of ETH on centralized exchanges has decreased by 11.6%, with 2.2 million ETH being withdrawn on net. Meanwhile, the amount of ETH in smart contracts has increased by 3.4 million ETH.

This means that not only is ETH being withdrawn from exchanges and moved into the DeFi ecosystem, but it is also moving from private wallets into smart contracts. Right now, the DeFi ecosystem has 8 million ETH locked up, in comparison with the 16.6 million ETH on centralized exchanges - and this figure is continually growing.

At the same time, ETH volume on centralized exchanges is stagnating while DEX volumes continue to increase as the ecosystem matures and moves increasingly toward on-chain transactions.

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter