The Week On-Chain (Week 52, 2020)

BTC has continued to grow throughout the last week of the year, reaching a new ATH of over $28k. On-chain signals remain bullish, showing a significant supply side crisis for bitcoin.

Bitcoin Market Health

BTC continued its rapid bull run over the past week, continuing to hit new all-time highs and rapidly climbing to exceed $28,000. After starting the week at $23,480, it rose consistently, reaching a high of $28,289. However, on Sunday, it started to decrease slightly, closing out the week at $26,390.

For the Bulls

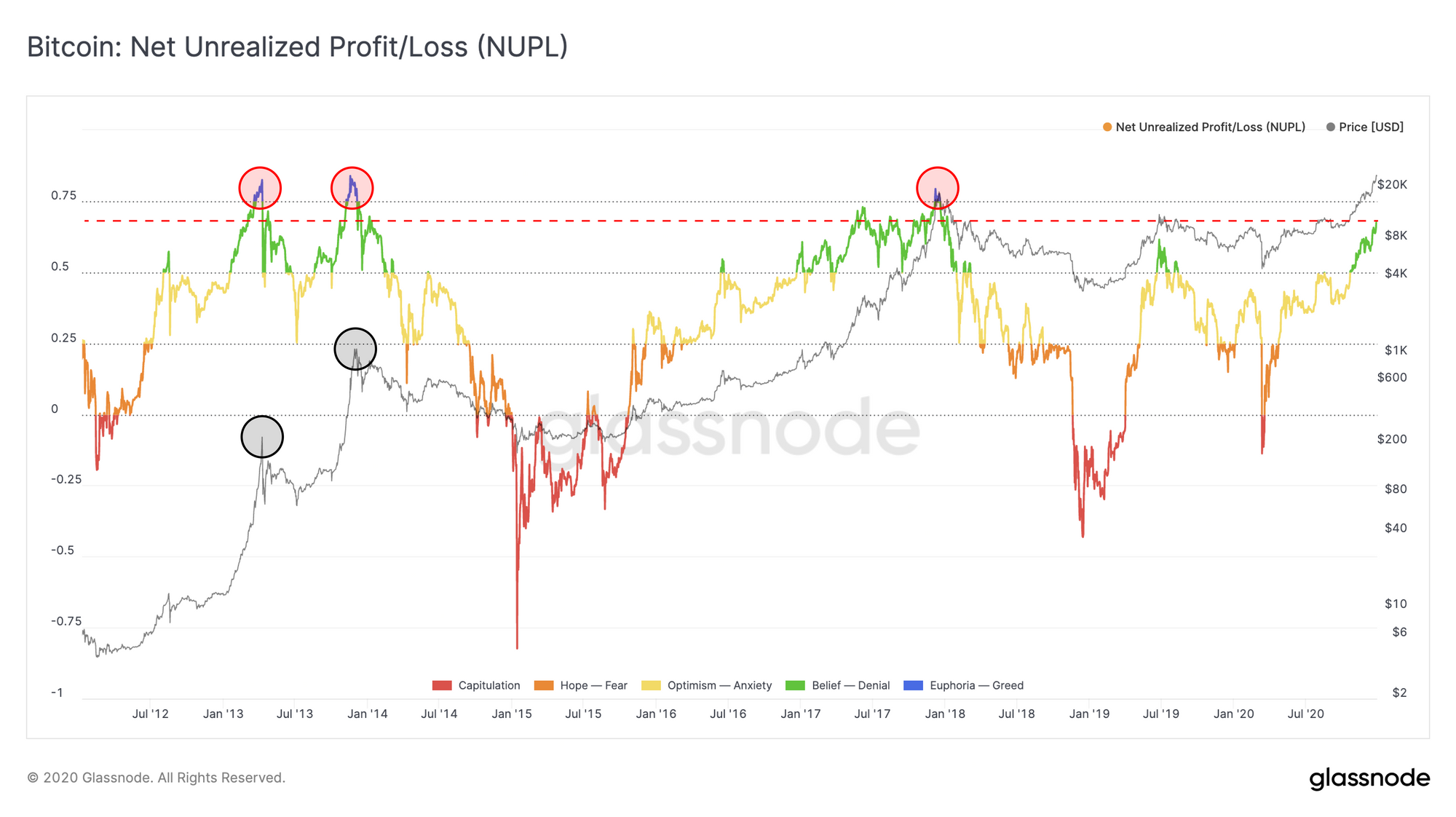

Despite BTC's extreme price gains over the past month, its Net Unrealized Profit/Loss (NUPL) is still relatively low, at a value of 0.67. This means it is still in the green "belief" zone, and hasn't yet reached the blue "euphoria" zone that usually represents market tops.

This relatively low NUPL value indicates that BTC has more room to grow before the top, despite being well above its previous all-time high already. For comparison, when NUPL was at its current value during the 2017 bull run, BTC was only $5622, and still increased by 248% before the top. If bitcoin follows this trend again, it would translate to a market top of $65,500.

This makes BTC's low NUPL value a bullish signal, as it demonstrates that bitcoin has plenty of room for growth before a market top is reached.

A Bullish Comment from Willy Woo

Woo's Take: $200k+ is possible in 2021

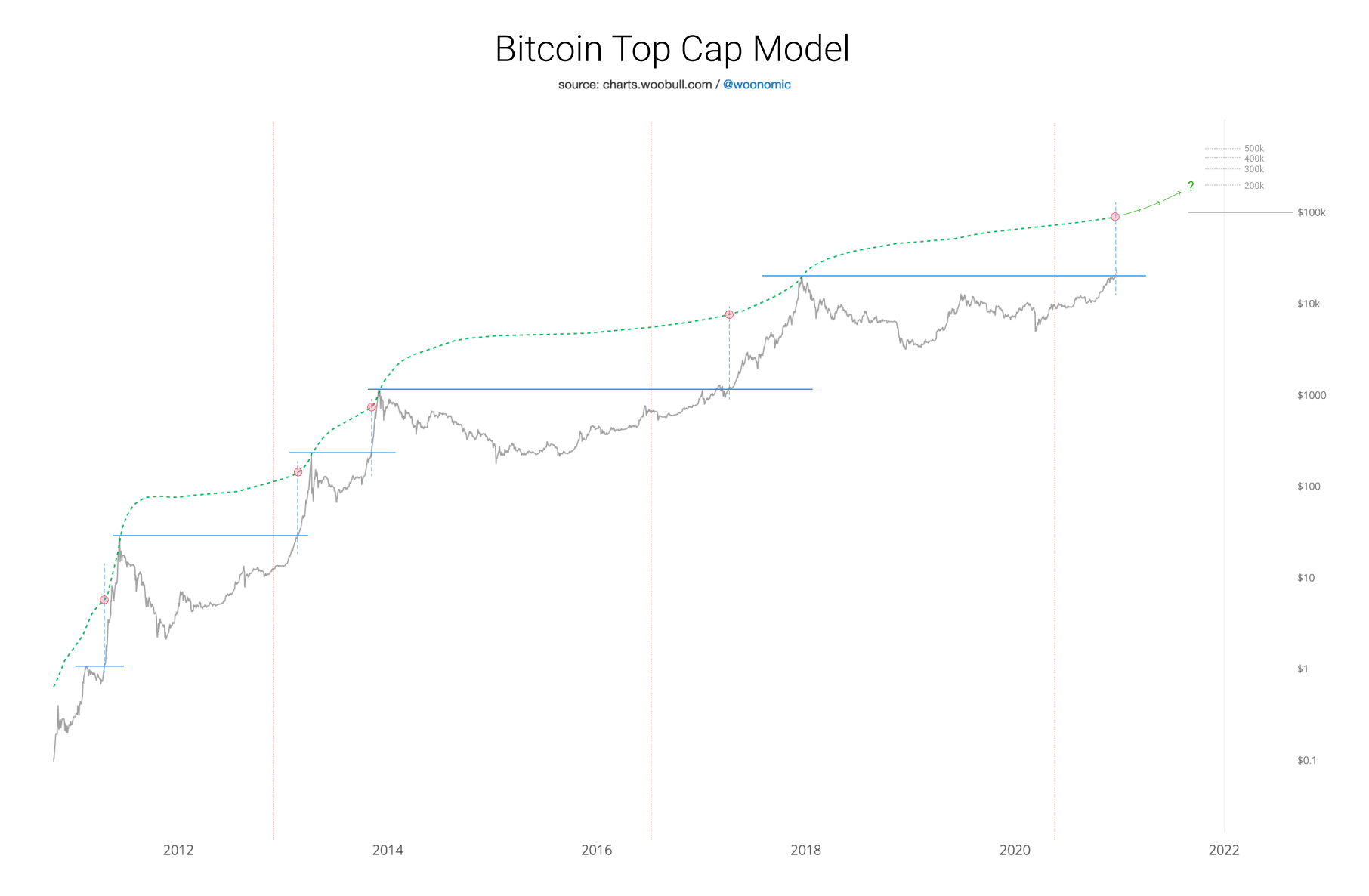

We are now past the all-time-high juncture where my Top Cap model starts curving upwards. While this model does not predict a price, it can estimate a ceiling on price for a point in the future, it has hit every macro market top in Bitcoins history.

Assuming the price tops out in December 2021 following prior market cycles, a $100k target would be overly conservative, a target of $200k-$300k would be considered realistic.

Read more from Willy Woo in his newsletter, The Bitcoin Forecast.

Altcoin Feature: ETH Balance on Exchanges is Increasing

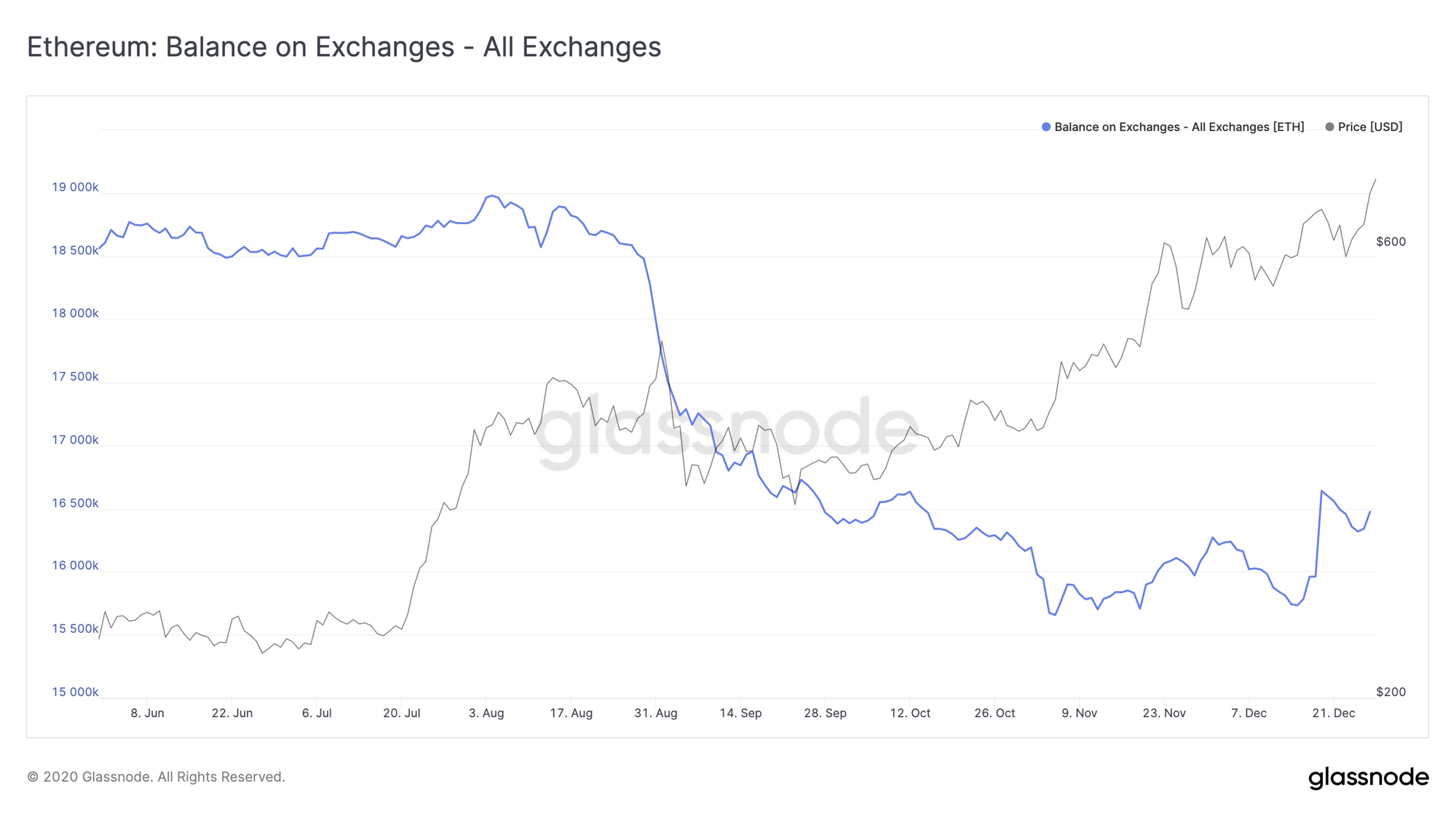

After decreasing for most of the year, the balance of ETH on centralized exchanges has begun to increase this month.

BTC and ETH both saw marked decreases in their exchange balance this year, as trust in centralized institutions fell and more investors withdrew their assets to hodl for the longer term. However, as of mid-December, the number of ETH on exchanges has started to increase again.

While this may be seen as bearish for ETH (as it could indicate intent to sell), there is an alternative explanation for this rise. Most of the increase in ether's exchange balance occurred on Bitfinex, which launched loans for BTC and ETH on 18 December.

As such, the increase can likely be explained by investors using Bitfinex Borrow to borrow ETH, an interpretation which is supported by a similar increase in the number of BTC on Bitfinex at the same time. This implies that investors are taking long positions rather than preparing to sell, which is a bullish signal for ETH.

Which altcoins would you like to see us cover in future editions of The Week On-Chain? Let us know on Twitter.

Weekly Feature: Bitcoin's Supply Side Crisis

On-chain metrics show extremely bullish signals surrounding BTC's available supply, suggesting that demand is far outstripping supply. This has been reflected in the recent price increases, which placed BTC at an all-time high as an increasing number of buyers drive the price up.

Our co-founder Rafael Schultze-Kraft recently identified some of the core metrics that show this supply and liquidity crisis.

#Bitcoin is in a supply and liquidity crisis.

— Rafael Schultze-Kraft (@n3ocortex) December 21, 2020

This is extremely bullish! And highly underrated.

I believe we will see this significantly reflected in Bitcoin's price in the upcoming months.

Let's take a look at the data.

A thread 👇👇👇 pic.twitter.com/vx6rJmiloE

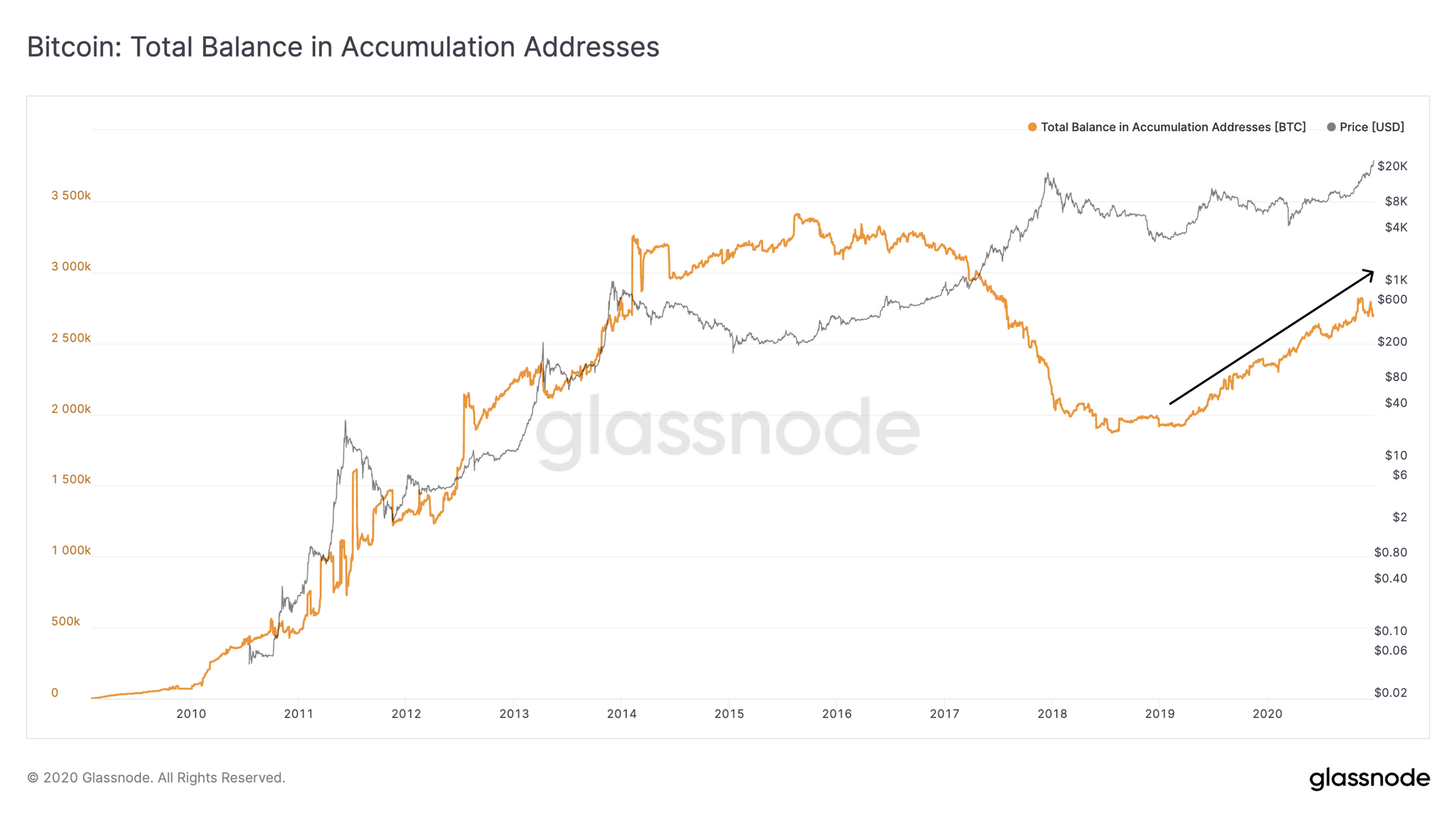

For example, the number of BTC in accumulation addresses is steadily increasing. Accumulation addresses are addresses which have only ever received BTC and have never spent them.

The number of BTC in these addresses represents 14.5% of the total supply, which is one of the many factors causing a massive restriction in supply.

In addition, bitcoin's Adjusted Circulating Supply shows that the total supply of BTC will only be around 16 million (rather the expected 21 million) due to lost coins. With high demand also coming from institutional investors, BTC's supply will likely continue to be restricted, paving the way for further increases in price.

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter