Glassnotes Issue #2

Glassnotes is a newsletter outlining the most recent on-chain market intelligence. It features analyses and commentary on the state of digital asset markets.

Introduction

Welcome Glassnotes, your source of on-chain market intelligence, brought to you by Glassnode.

Glassnotes gives you the most recent crypto network updates based on on-chain metrics, and features analyses and commentary on the state of the market to provide the fundamental insights you need to invest confidently in digital asset markets.

Subscribe to Glassnotes to receive regular industry updates directly in your inbox.

Weekly Ecosystem Updates

The raw on-chain data for these metrics are sourced from our Glassnode API. Further visualisations can be found on the Glassnode Studio.

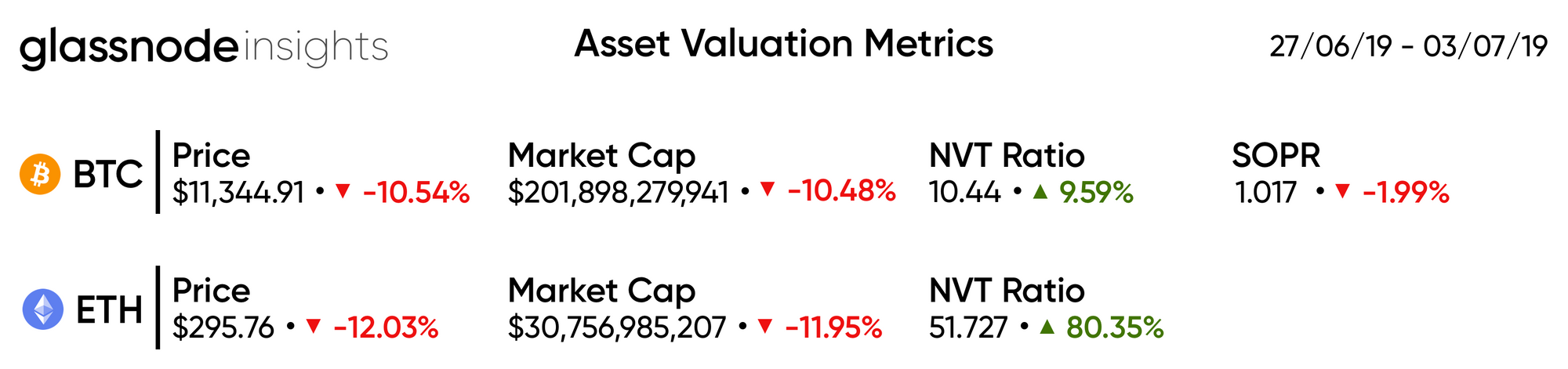

Asset Valuation Metrics

Valuation-based metrics take on-chain data and compare these with market data (such as price) to provide a clearer picture of the forces and trends driving the market.

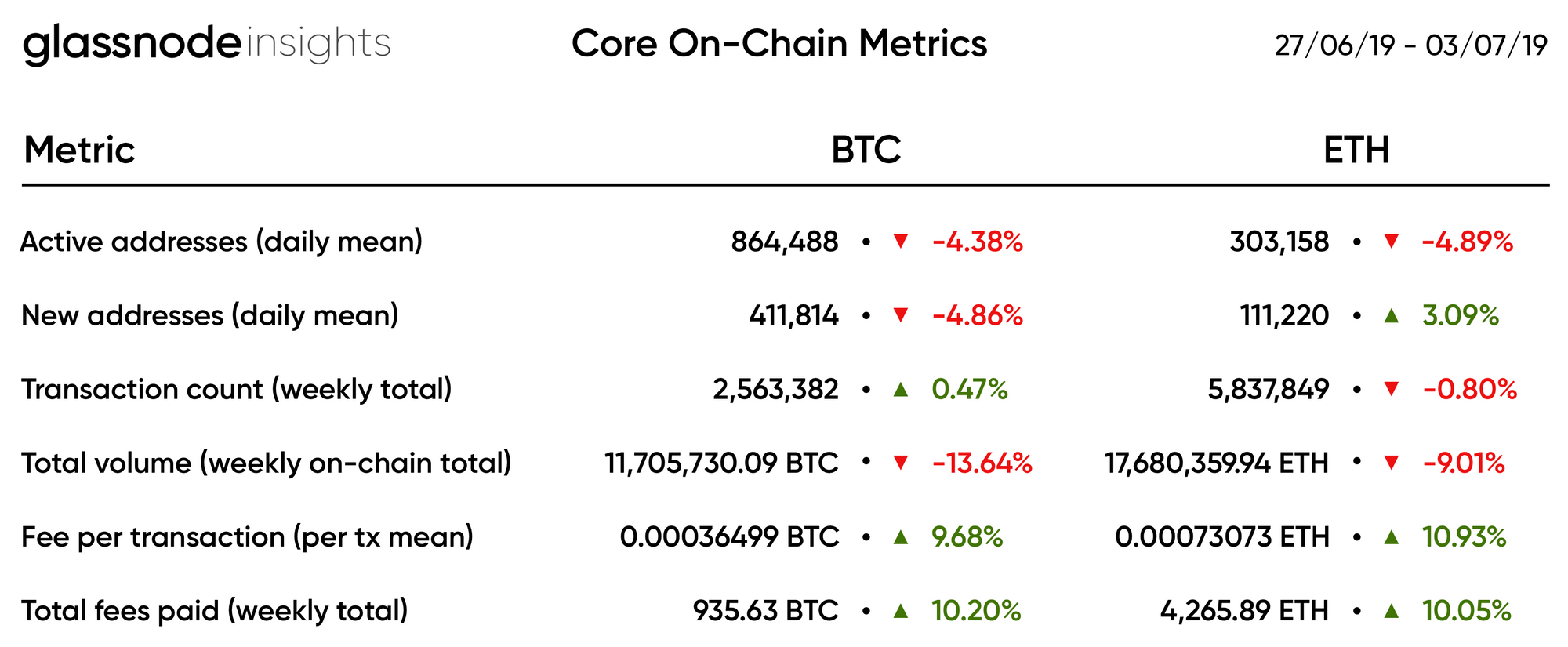

Core On-Chain Metrics

Core on-chain metrics look at the health of a given network as a whole through the lens of activity and engagement happening on the blockchain itself.

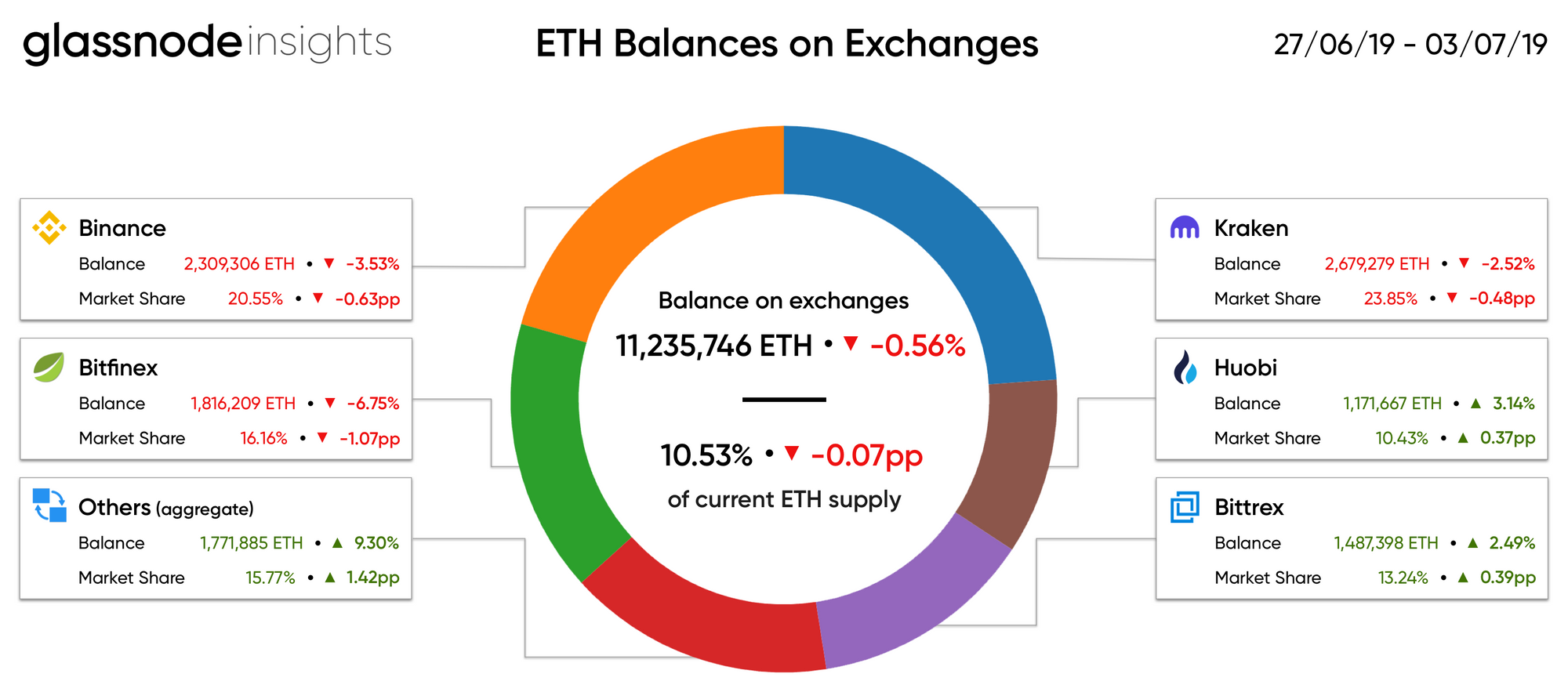

Exchange Distribution

The flow of funds moving between exchanges and privately controlled wallets often highlights imminent market events.

Ecosystem Feature: Chainlink's Rise to the Top 20

What is Chainlink?

Chainlink is a decentralised oracle network which allows Ethereum smart contracts to securely connect to external APIs, payment systems, and other data sources. To prevent the need for a trusted third party, multiple independent nodes collectively determine the accuracy of an external input before it is written into a smart contract.

The LINK token is used to pay node operators for retrieving data from off-chain feeds, formatting it into blockchain-compatible formats, and performing off-chain computation. It is also staked by node operators to guarantee uptime, correct data, and honest behaviour.

Recent LINK Price Movements

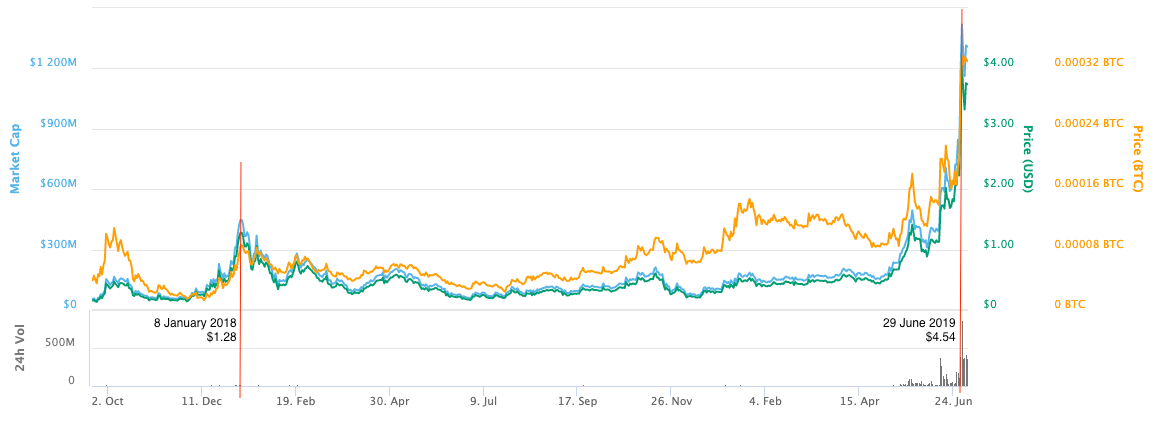

In the past 3 months, LINK has risen from a low of $0.43 to a high of $4.54, an almost 10x increase. Despite a downward correction, the price is still well above previous levels at around $3.50.

These price levels are especially impressive when compared to LINK's performance during the January 2018 peak. The recent high of $4.54 on June 29 marked an all time high for LINK, more than 3.5 times its previous ATH of $1.28.

A series of recent events involving Chainlink have contributed to these price increases:

- May 30 - Chainlink launches on Ethereum mainnet.

- June 13 - Google Cloud announces partnership with Chainlink.

- June 27 - Coinbase Pro enables full trading capabilities for LINK.

- June 28 - Coinbase retail exchange lists LINK token.

Many commentators and media outlets are attributing this increase to the so-called "Coinbase Effect"; the phenomenon whereby an asset's value surges after it is listed on Coinbase.

This is supported by the rapid price increase occurring immediately after LINK was listed on Coinbase, as well as the fact that LINK has never seen this level of growth despite having been tradable on Binance and several other exchanges for nearly 2 years. However, the value of the Google Cloud partnership and general increased awareness of the Chainlink platform have likely also had a significant effect in increasing confidence in LINK.

LINK Exchange Activity

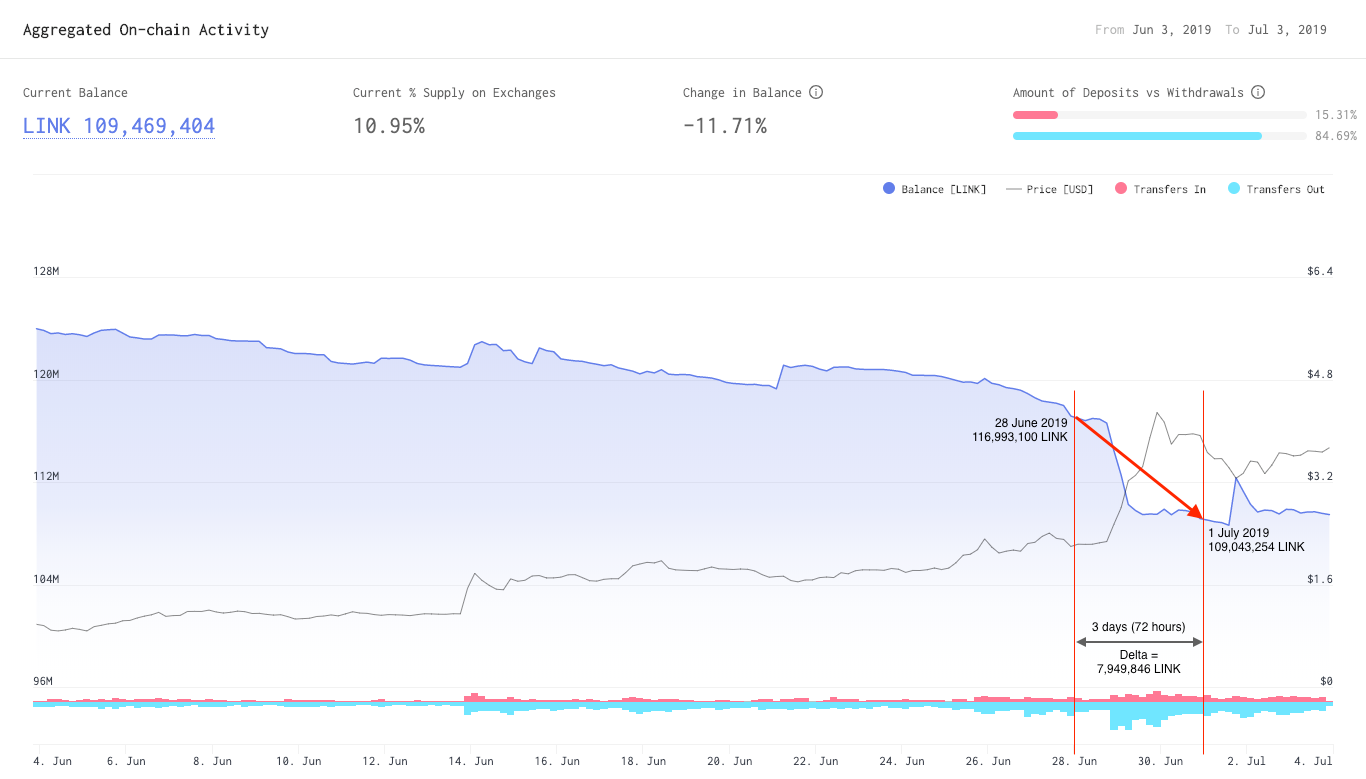

Over the past few months, the volume of LINK tokens on exchanges has hovered at around 12.5% of the total supply. Binance has consistently held over 90% of these tokens and accounted for a similar level of exchange trading volumes.

In the 3 days after the Coinbase listing, a total of 7,949,846 LINK (around 7% of all LINK on exchanges) moved off non-Coinbase exchanges (mostly Binance).

At the same time as LINK trading became available on Coinbase, the price increased rapidly, alongside significant withdrawals from Binance. Coinbase's wallet addresses are not publicly known, but the above correlations suggest that these outflows may represent people moving LINK onto Coinbase from Binance (and other exchanges).

This interpretation of the data would suggest that 5-10% of all LINK on exchanges is held on Coinbase (or Coinbase Pro). This correlates with Coinbase currently accounting for around 10% of LINK trading volumes.

LINK Wallet Activity

During the same 3 day time period outlined above, on-chain volumes totalled at 123,703,168 LINK.

When apparent inter-exchange transfers (e.g. transfers from Binance to Coinbase) are excluded, this amounts to 115,753,322 LINK being transferred out of private non-exchange wallets; 14.6 times as much as the volume transferred between exchanges during the same time period.

One potential narrative is that this may represent users moving LINK from private wallets onto Coinbase. We know these tokens were not moved in meaningful volumes onto any other exchange, as shown by our exchange data above, but because Coinbase's hot and cold storage wallet addresses remain unknown, it is difficult to determine whether or not these volumes represent transfers onto Coinbase or other kinds of activity.

However, it is unlikely such a high amount of early buyers or long-term holders with LINK in private wallets would be using an entry-level exchange like Coinbase, and Coinbase Pro volumes account for less than a third of this amount of LINK. The remainder of the volumes could potentially be explained by OTC trades, as supported by the large increase in receiving addresses during this time frame.

Regardless of the method of sale, it is likely that these funds moved out of private wallets as early buyers and long-term holders rushed to realise profits at the peak.

Chainlink Outlook

The recent Coinbase listing has exposed LINK to the market segment of non-technical investors, who have demonstrated clear demand but previously had little access to this asset. When the Chainlink platform becomes fully functional later this year, the utility value of the LINK token will become realisable, possibly increasing demand further.

LINK's upcoming staking functionality also introduces the potential for decreased supply and velocity, as tokens will be locked up for extended periods of time while investors seek passive returns through staking.

The anticipation of increased demand and decreased supply could explain LINK's sudden rise to the top 20, becoming the highest valued non-exchange utility token.

In the coming weeks, we will be publishing a more detailed report on the fundamentals of LINK, including its wallet distribution and several other on-chain metrics. Subscribe to Glassnotes and follow us on Twitter to stay informed.

Glassnode Updates

Company Updates

- We recently relocated to a brand new office in WeWork at Potsdamer Platz. Get in touch if you're in Berlin and would like to meet us.

- This week, we welcome Tom Fiodorov (Data Scientist) to the Glassnode team.

- We are hiring for a range of roles in Berlin. Visit our Careers page to check out our open roles, or send us a speculative application.

- We plan on regularly releasing new on-chain metrics through our Studio and API, which we will be announcing periodically on Glassnode Insights.

- Follow us and reach out on Twitter

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter

Disclaimer: This report does not provide any investment advice. All data is provided for information purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.