LINK Hits Multiple All-Time Highs as Alt Markets Pump

As altcoin prices surge, LINK has emerged as one of the biggest winners. With liquidity pouring into the asset, it is hitting all-time highs not just in terms of price, but also on-chain adoption.

Amongst the altcoin surge of the past week, LINK has been one of the biggest winners, reaching a new all-time high at $8.33 yesterday (currently sitting at around $7.30).

Using on-chain data, we can examine where the liquidity for this price pump came from, and whether support for LINK has a strong base.

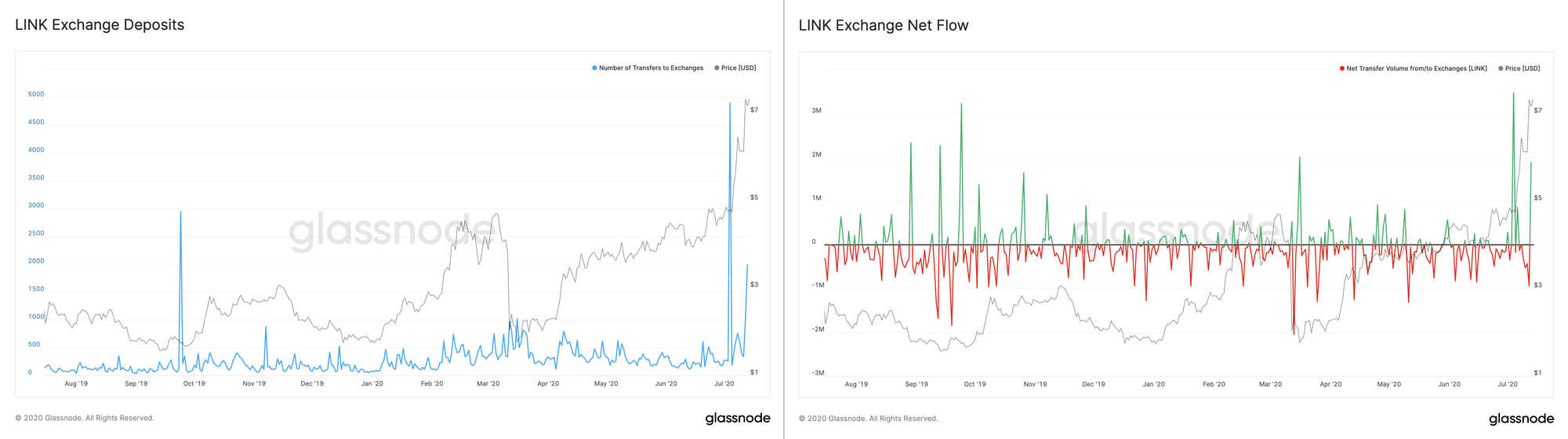

Exchange Inflow

On July 4th, the number of LINK exchange deposits reached an ATH, with ~5000 individual deposits totalling nearly 4 million LINK (worth almost $19 million at the time). As a result of this influx, the net flow of LINK to exchanges experienced a brief but notable spike, reaching its highest point in over a year.

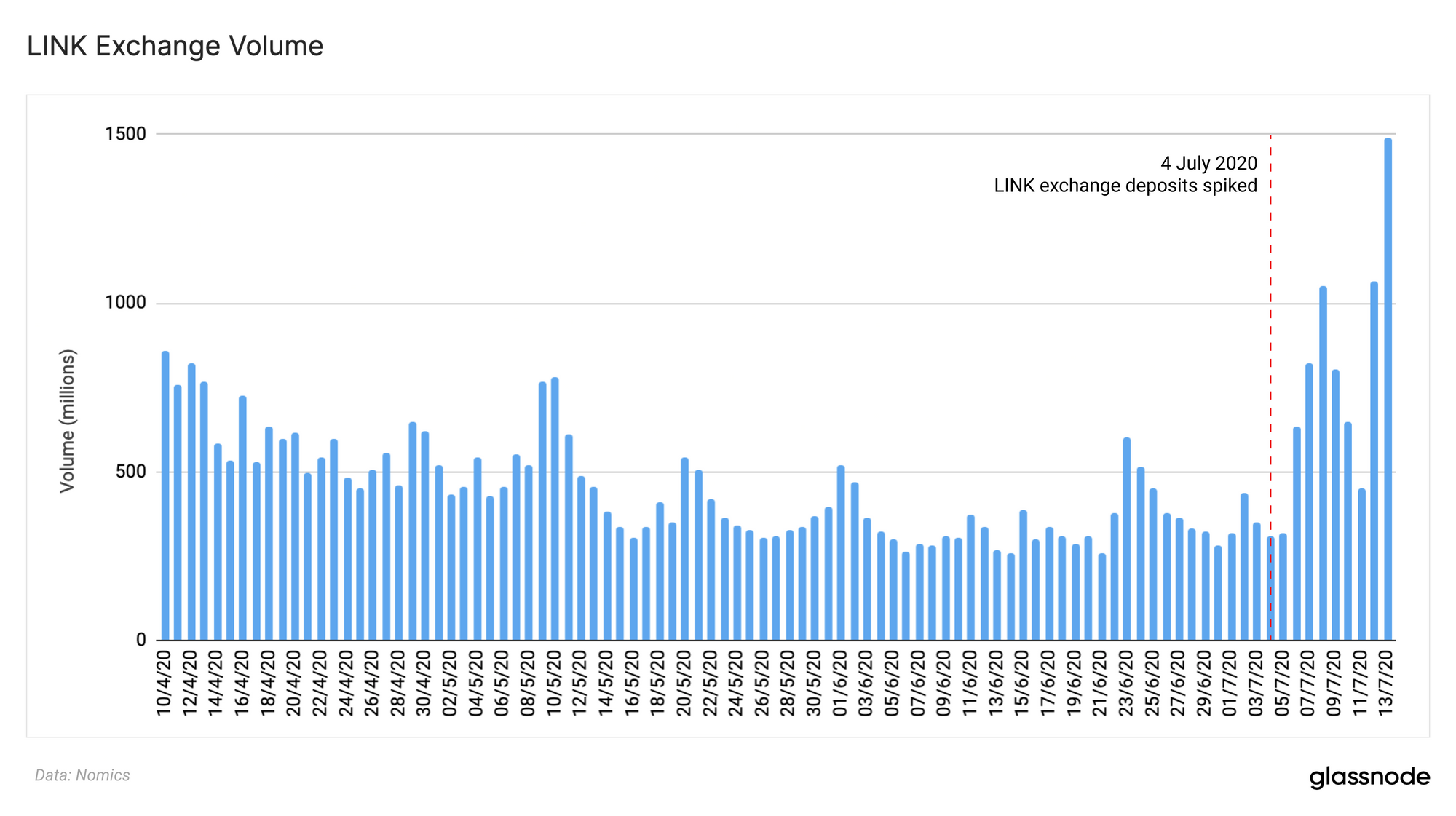

Then, on July 13th, LINK exchange deposits spiked again (albeit less intensely than the previous spike), bringing net flow back into the positive numbers again as more LINK flows to exchanges.

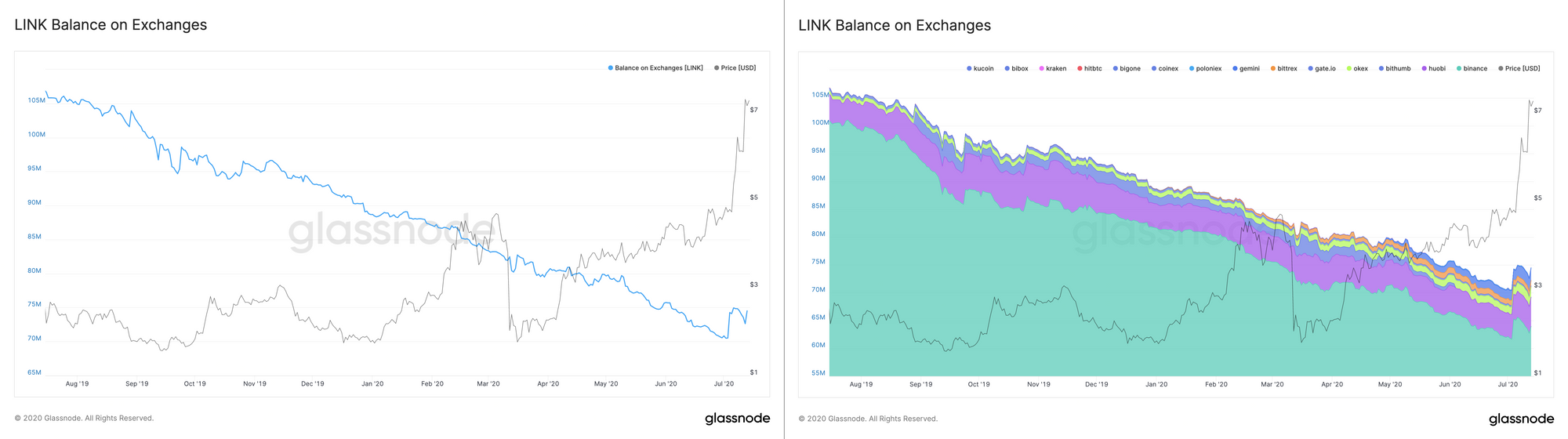

The July 4th spike caused the balance of LINK on exchanges to experience its first notable incline in over a year, with the majority of the inflow going to Binance. Yesterday's spike in exchange deposits caused yet another incline in LINK's balance on exchanges.

In the days following these waves of deposits, the volume of LINK being traded on exchanges has increased significantly - by some accounts exceeding $1.49 billion in a single day of trading - providing the liquidity behind the recent price spikes.

On-Chain LINK Adoption is Increasing

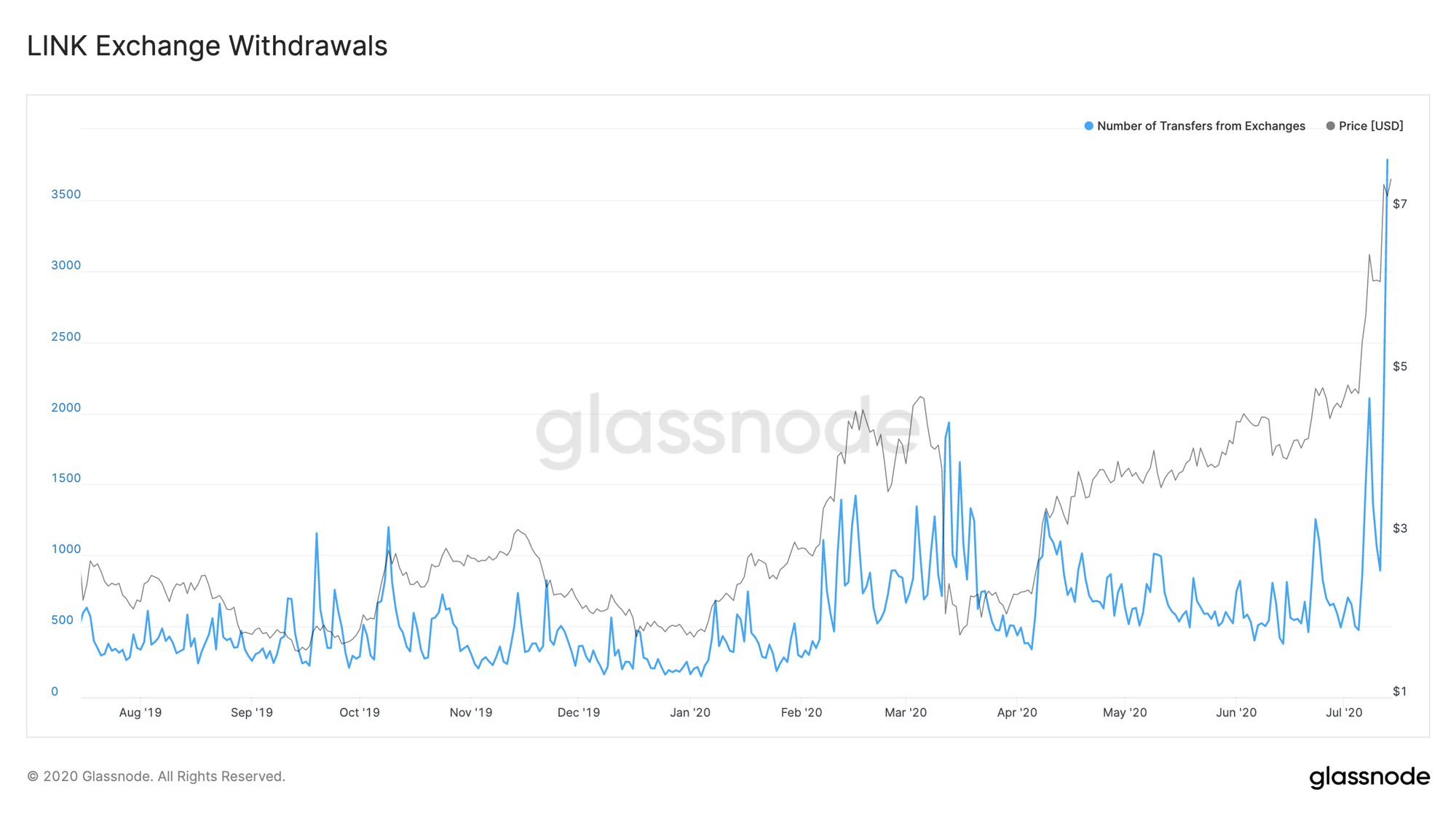

While LINK is becoming increasingly liquid on exchanges, on-chain holdings are also seeing increased popularity. Exchange withdrawals have spiked alongside deposits, with this metric reaching its second-highest point ever.

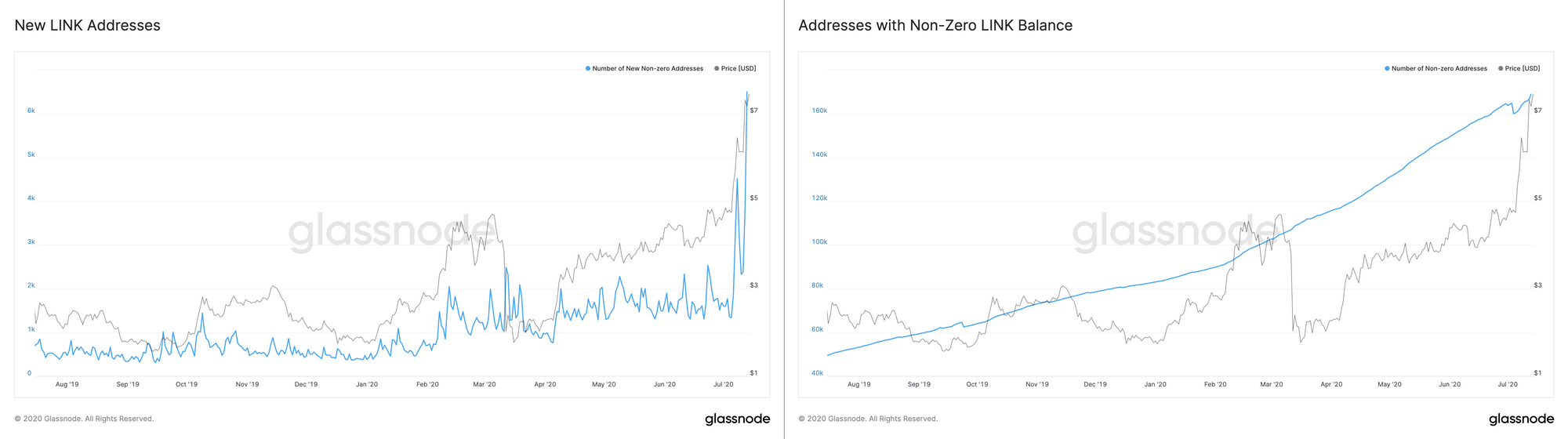

As a result of this, the number of new addresses acquiring LINK per day has reached an all-time high, and the total number of addresses holding LINK has risen back up to overtake its previous all-time high, after having dipped briefly earlier this month.

As such, while the waves of exchange deposits and high volumes signify that there is a significant market for trading LINK, it is clear that there is a meaningful contingent of LINK holders who intend to start and/or keep hodling for the time being.

Conclusions

Some market observers have pointed to the spike in exchange deposits as representing mounting sell pressure - but since these deposits occurred, the price of LINK has almost doubled, indicating even higher buy pressure.

Moreover, the significant number of withdrawals from exchanges indicates a strong base of confident LINK "marines" who are willing to hodl rather than realizing gains now.

While liquidity can be a double-edged sword, and the recent price pumps will almost certainly see some correction in the near-term, LINK appears to be growing ever-stronger in terms of both its dedicated follower base and its price fundamentals.

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter