BTC Market Pulse: Week 12

Bitcoin could remain susceptible to further downward pressure unless we see a resurgence in liquidity inflows. While some speculative activity persists, the broader market remains defensive.

Overview

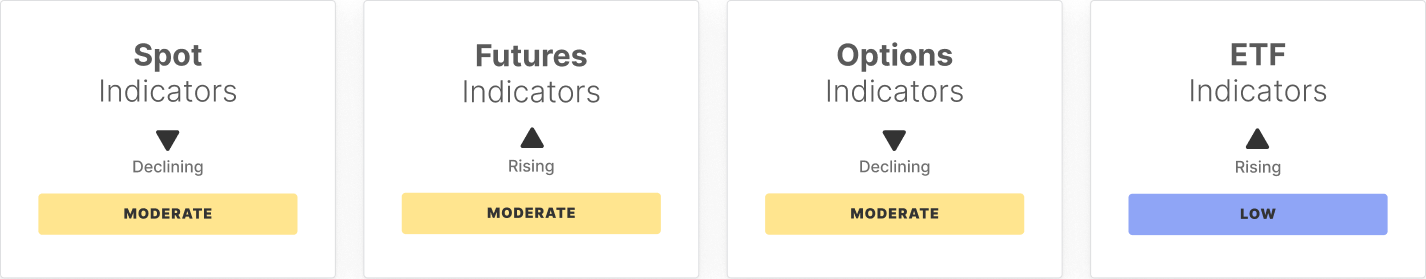

The Bitcoin market remains under pressure as liquidity conditions tighten and investor sentiment weakens. Spot market activity has shown modest resilience, with price momentum stabilizing and perpetual CVD flipping positive, suggesting localized speculative interest. However, spot volume and CVD have continued their multi-week contraction, reflecting reduced market participation and cautious buying behavior. ETF markets remain a key area of concern, with sustained outflows and trade volume nearing statistical lows, signaling institutional de-risking despite a slowdown in outflow intensity.

Derivatives markets exhibit mixed signals, as futures open interest stabilizes after recent declines, but funding rates have dropped sharply below the statistical band, indicating weak speculative demand for leveraged long positions. Meanwhile, options market activity is rising, with volatility spread remaining suppressed and 25 Delta Skew breaking above the statistical high band, underscoring elevated downside hedging demand and persistent risk aversion among investors.

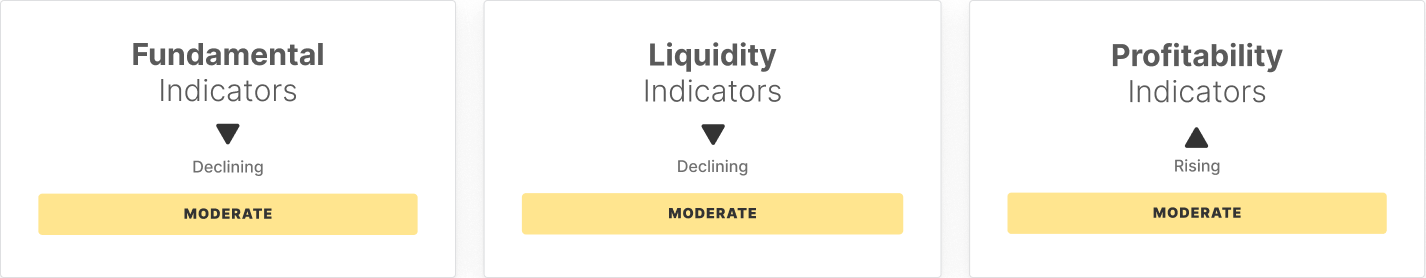

On-chain activity remains weak, with active addresses, transfer volume, and fee revenue declining further, indicating lower network participation and shrinking capital inflows. Liquidity metrics mirror this trend, as realized cap growth slows and hot capital share shrinks, highlighting a more cautious stance among investors. Profitability metrics have also declined, with Percent Supply in Profit and NUPL edging lower, nearing levels where investor stress and the risk of forced selling could escalate.

Overall, while some speculative activity persists, the broader market remains defensive. ETF outflows, weakening on-chain fundamentals, and increasing downside protection in options markets reinforce a risk-off environment. Bitcoin could remain susceptible to further downward pressure unless we see a resurgence in liquidity inflows.

Off-Chain Indicators

On-Chain Indicators

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies.

Please read our Transparency Notice when using exchange data.