The Week On-Chain (4 Mar 2020 - 11 Mar 2020)

Despite healthy on-chain fundamentals, BTC moves from gradual decline into freefall as coronavirus fears shake up markets globally.

Bitcoin Market Health

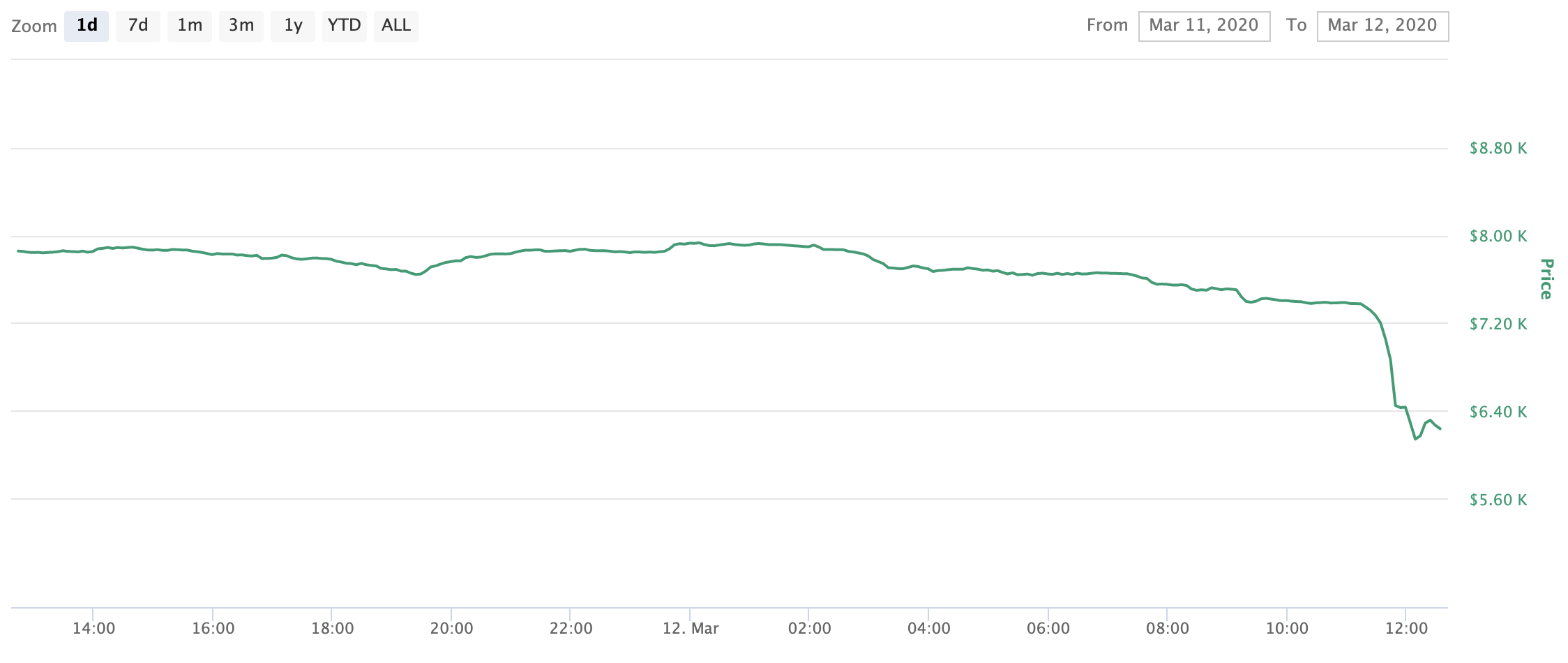

Bitcoin has fallen back down to $6k, in its worst day since 2017. Earlier today, the price dropped by 19% in a single hour as over half a billion USD worth of BTC longs were liquidated on BitMEX.

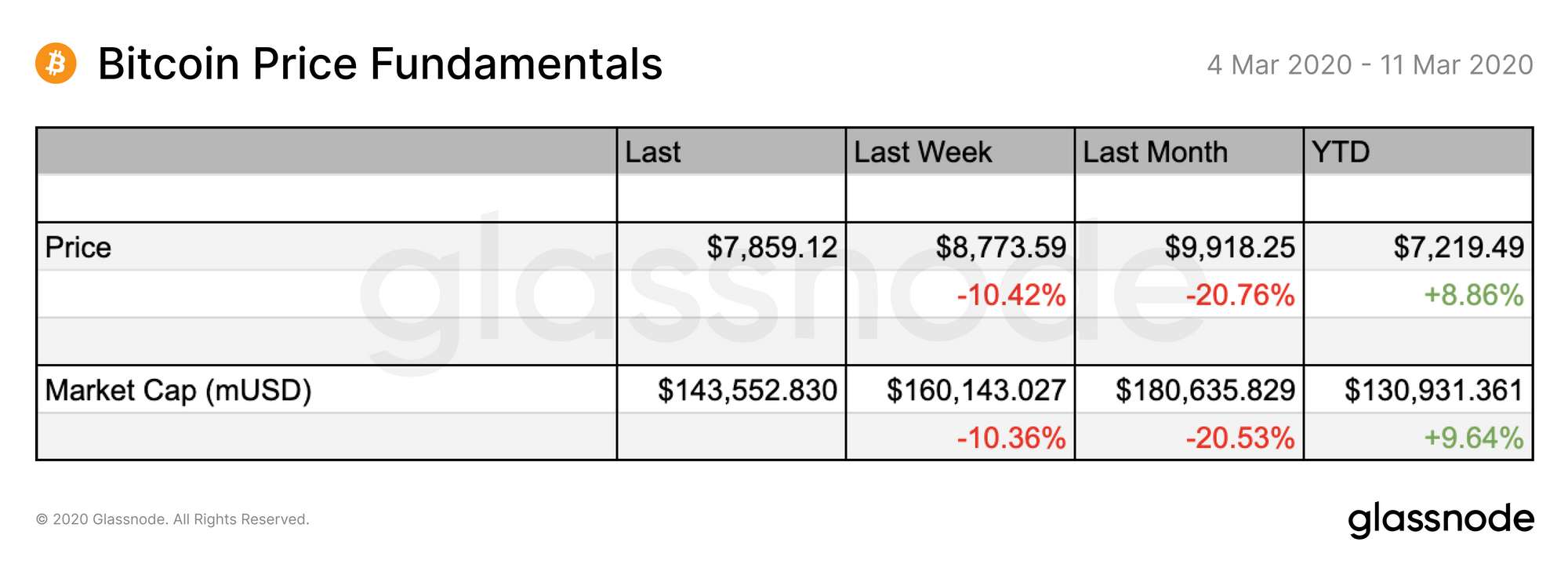

Over the past week, we saw BTC recover briefly to above $9k after dropping into the $8200-8800 range the previous week. However, it quickly sunk back below $9000, and then below $8000. As of the publication of the table below (Wednesday 11 March), bitcoin was still in the high $7000s:

But on Thursday morning, crypto markets plummeted, with BTC reaching lows close to $5000 on some exchanges.

This crash came after Trump announced a travel ban for those travelling from Europe into the US, but it is likely that a number of fears about coronavirus and its effect on the economy played a role.

Current BTC price (Thursday 12 March): ~$6100

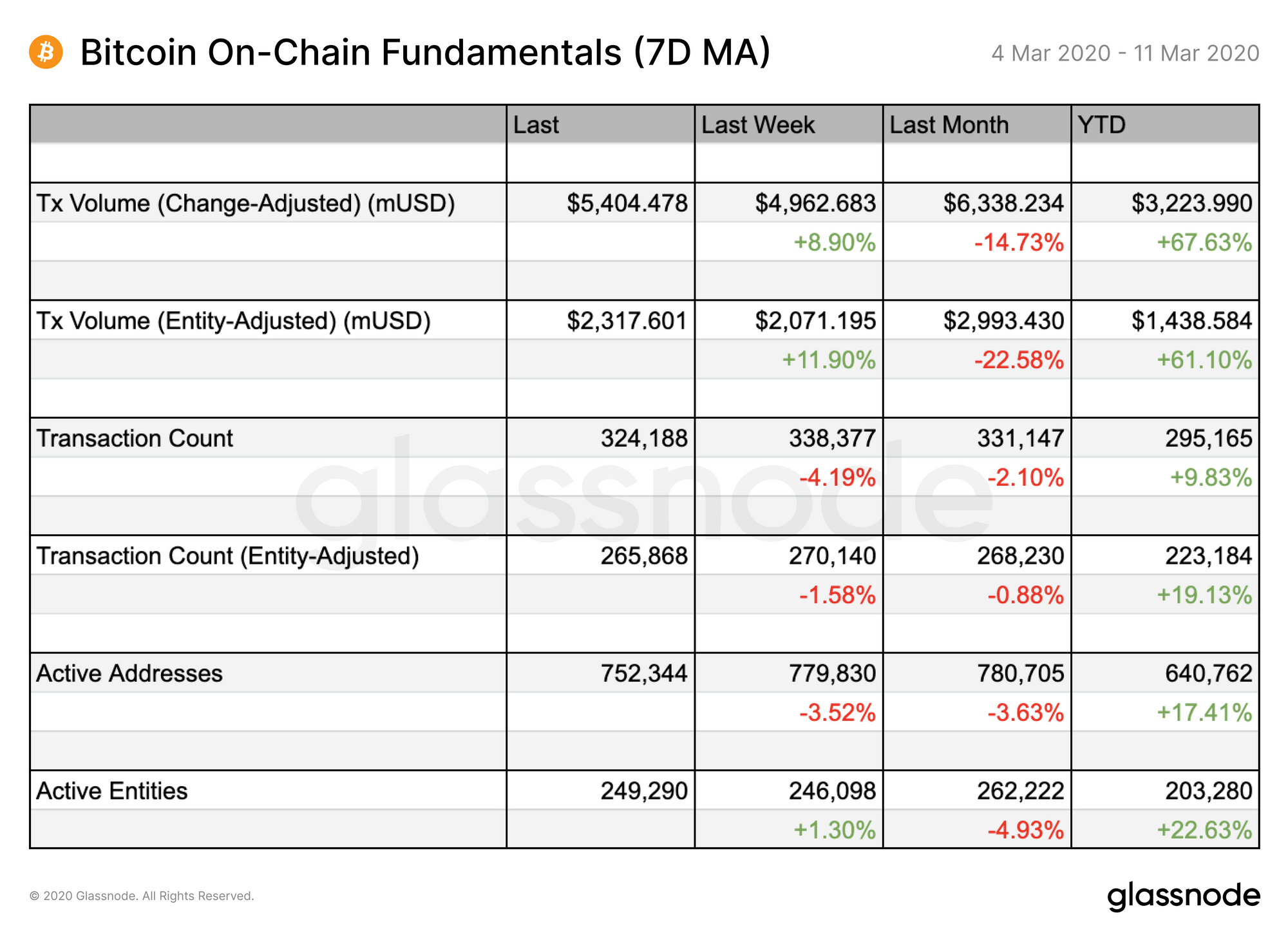

Aside from price movements, on-chain fundamentals have not experienced significant changes, and are all still up for the year.

This week, on-chain volume has experienced a notable increase, while the number of transactions has decreased - in other words, the average USD value per transaction has increased. This may suggest a shift from trading-based behaviour to buying and selling larger amounts as investors make decisions about whether or not to stay exposed to BTC.

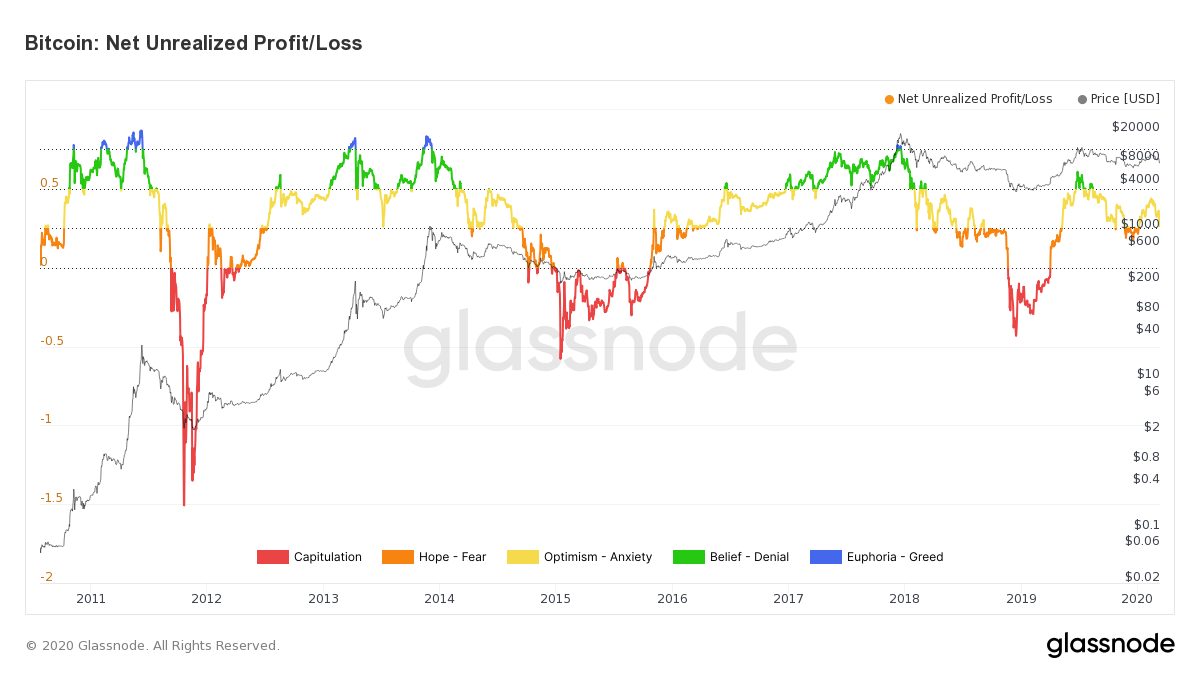

Net Unrealized Profit/Loss Falls into “Fear” Zone as Price Plummets

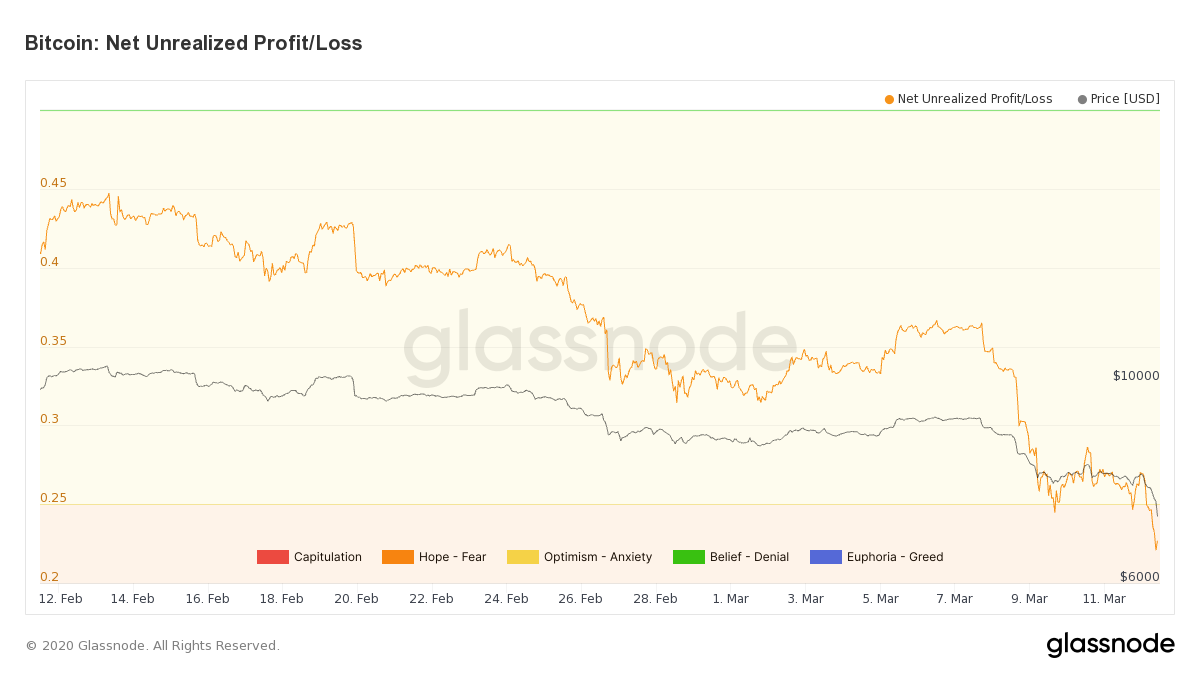

Bitcoin investor sentiment just crossed into the "Fear" zone according to Net Unrealized Profit/Loss (NUPL).

NUPL represents the difference between unrealized profit and unrealized loss to determine whether the network as a whole is currently in a state of profit or loss. Values above zero indicate a state of net profit, so the current value of ~0.22 means that despite the price dump, the network is still in a state of profit.

However, today's crash has taken this value significantly lower, well into the orange "Fear" zone. Historically, when this happens, NUPL usually drops all the way into the red "Capitulation" zone (net loss) before recovering to profitable levels.

If we don't see this value recovering soon, the market may take more significant losses before recovering into a state of net profit.

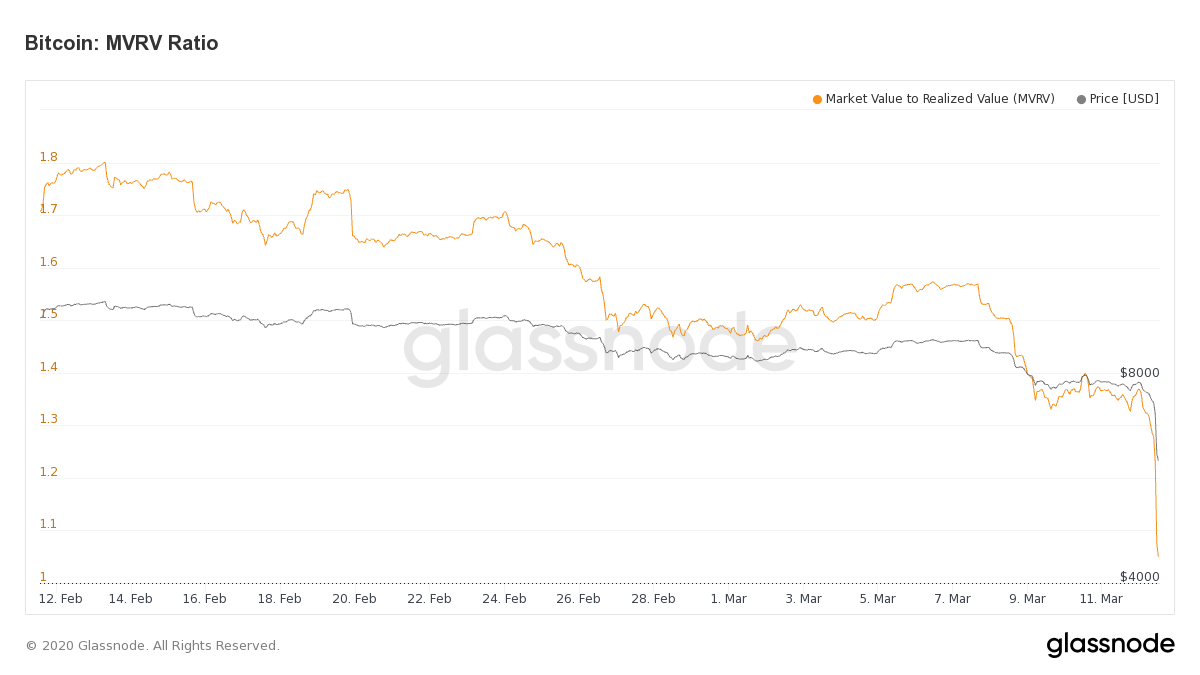

MVRV Ratio: Bitcoin's Market Cap Approaches Parity with Realized Cap

MVRV (market-value-to-realized-value) ratio is, as the name suggests, the ratio of an asset's market capitalization to its realized capitalization. By comparing these two metrics, MVRV can be used to get a sense of when price is above or below "fair value", thereby helping to spot market tops and bottoms.

Bitcoin's market cap is converging on its realized cap as the price decreases, bringing the asset closer to its "fair value" based on the average price when each coin was last moved. If MVRV falls below one, BTC will officially be "undervalued" as defined by this metric.

The question is whether the market will acknowledge this and rebound, or whether wider fears of economic turmoil will cause people to keep selling.

Stay tuned with data from Glassnode Studio.

- Follow us and reach out on Twitter

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter

Disclaimer: This report does not provide any investment advice. All data is provided for information purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.