The Week On-Chain (18 Mar 2020 - 25 Mar 2020)

Bitcoin experienced a historical downward difficulty adjustment this week. Along with the recent price rebound, will this be enough to bring miners back into the network?

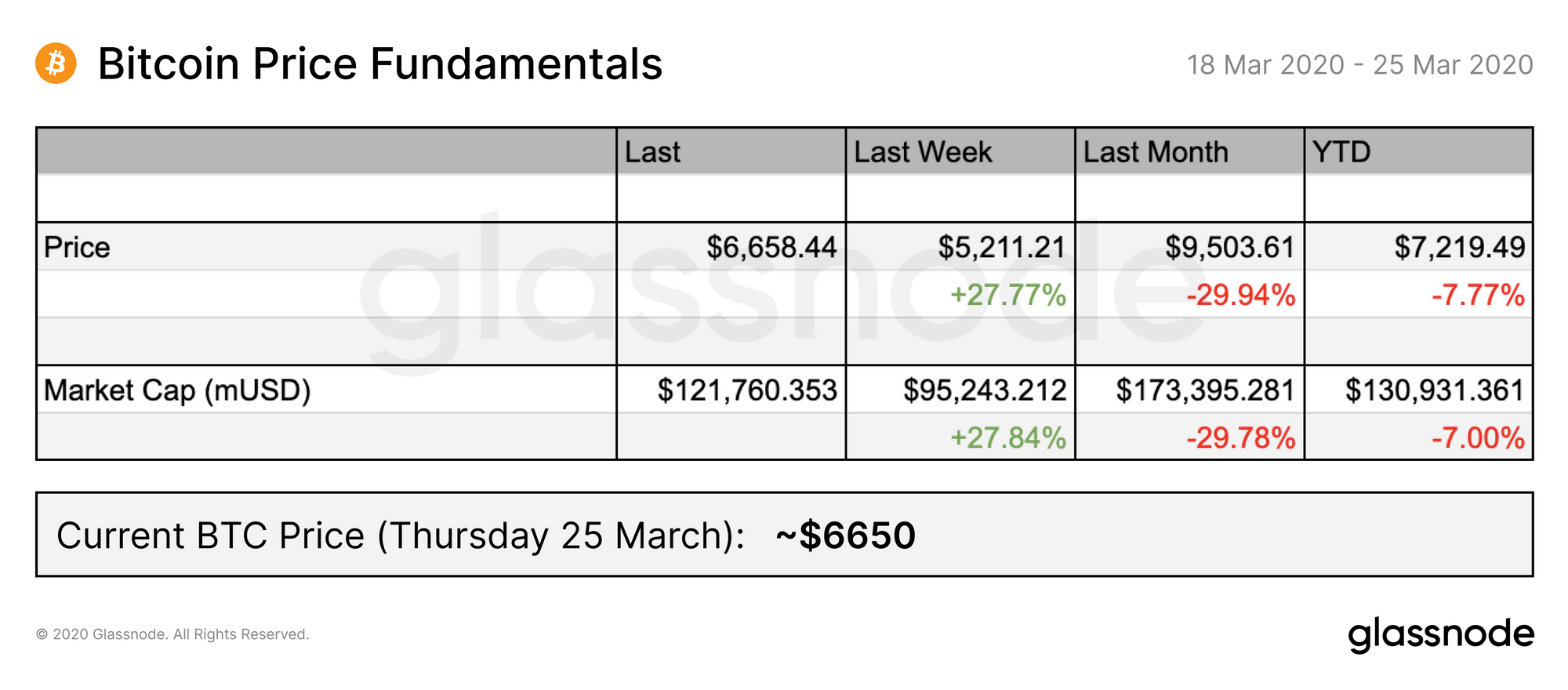

Bitcoin Market Health

Bitcoin has experienced some relief from the lows of last week, recovering to well above the $6000 mark. If it can break past $7k, we may see prices recovering to levels seen at the beginning of 2020.

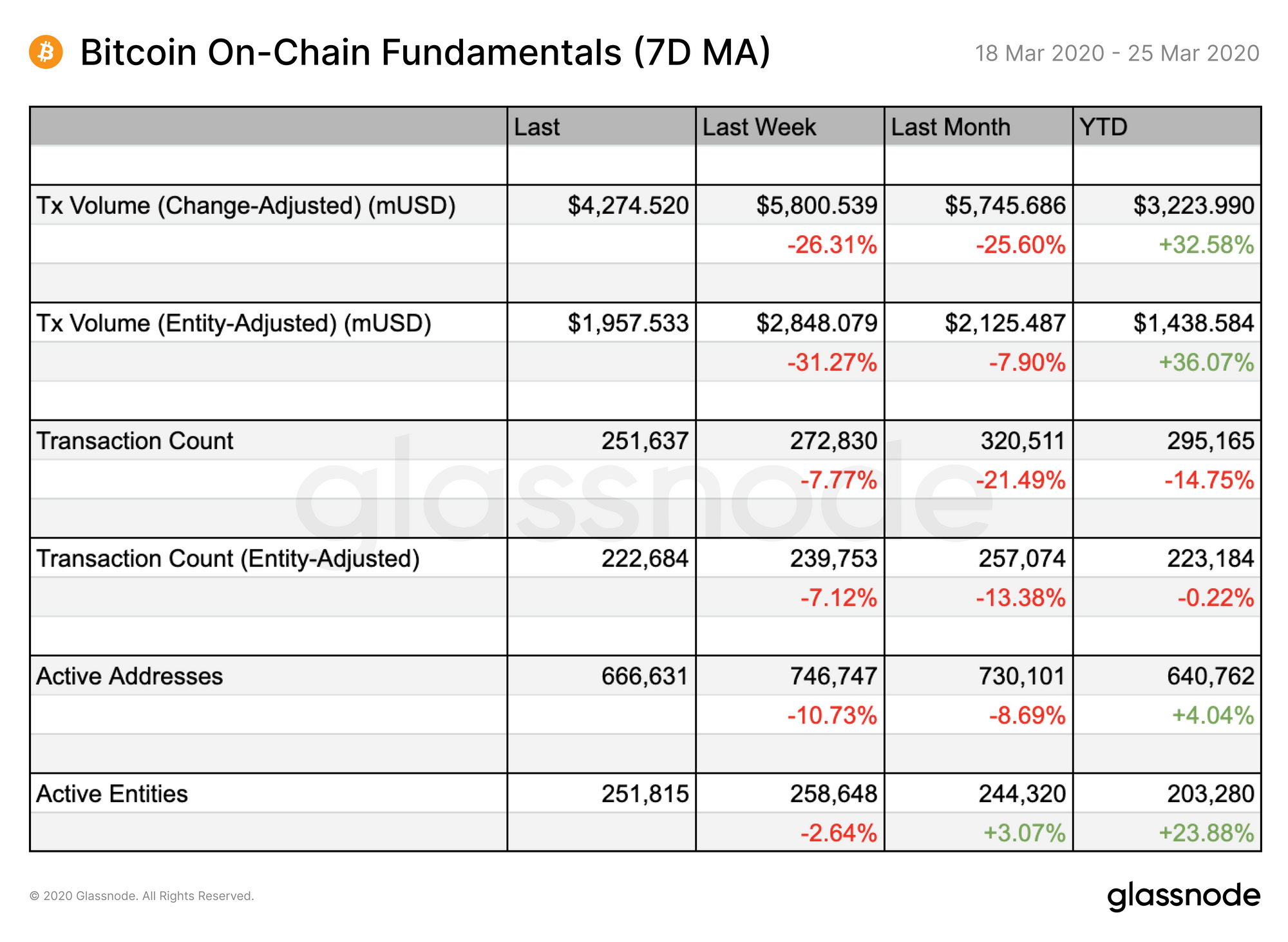

On-chain activity has seen decreases across the board as the price stabilizes and investors slow down with readjusting their portfolios.

Transaction count has stayed relatively stable in relation to transaction volume, which has decreased significantly since last week. This implies that on-chain activity is returning to more regular levels, with transactions being of lower value on average.

This stands in contrast with activity over the last two weeks, during which we saw fewer transactions but of much larger value as investors responded to the rapid price decrease. This return to more normal activity suggests that the panic triggered by the price crash is dissipating.

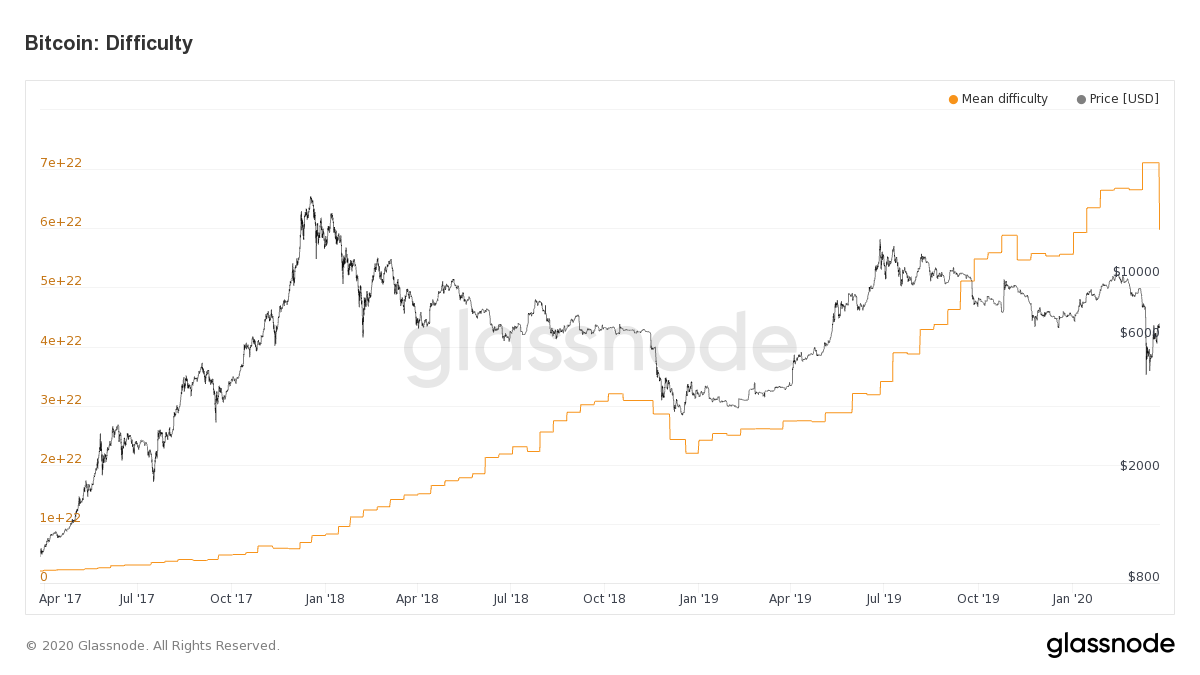

Bitcoin Hash Rate Shows Signs of Recovering after Significant Downward Difficulty Adjustment

Bitcoin has experienced its second-largest decrease in difficulty ever; a massive 15.95% drop.

This occurred after many miners removed their hashing power from the network, facing unprofitability following the recent price crash.

Since the network's difficulty readjusted, however, hash rate has started to bounce back, currently sitting at more than 10x higher than its lowest point yesterday (as can be seen on the hourly chart).

What does this all mean for price? While some commentators say that large downward difficulty adjustments mark a bottom in the market, others believe the price will go down, saying the downward adjustment signals miner capitulation.

However, given that miners are returning to the network now that mining has become easier, it appears that the recent hash rate decrease represented simple business-driven decision-making, rather than capitulation or lack of confidence.

That said, considering the uncertainty of the current economic state of affairs, the way the market and miners respond to this adjustment may not follow historical trends. Market participants should closely follow events and market data in this changing landscape in order to predict price movements.

Community Narrative

Content and insights derived from Glassnode data by our community

Recent events, both on the global stage and in the context of the Bitcoin network itself, pose significant uncertainty as to where BTC is headed. Twitter user @xbt_blvrg used Glassnode Studio's implementation of SOPR to highlight this uncertainty.

It’s interesting what $BTC #SOPR tells us about. Green-gray-red, that's the sequance. + crisis + recession + virus + miners' trouble + whales’ play + HALVING, #Bitcoin is facing an unknown insane situation rn. Are u ready?#BTC #crypto #glassnode @glassnode pic.twitter.com/UNAkANqKIG

— xbt_blvrg (@xbt_blvrg) March 26, 2020

The combination of the global economic crisis, COVID-19 pandemic, and recent miner and whale activity on the Bitcoin network means that predicting future price movements is harder than ever. However, we see in the tweet above that the recent crash has accelerated SOPR's cyclical decline.

Could this mean an earlier rebound? Or are we headed further down before we see a meaningful recovery?

Stay updated on the SOPR metric to keep watching this trend, and remember to send us your own content using Glassnode data to be featured in our next weekly update.

- Follow us and reach out on Twitter

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter

Disclaimer: This report does not provide any investment advice. All data is provided for information purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.