The Week On-chain (Week 16, 2021)

Bitcoin rallies to new ATHs before selling off by over 18%. This follows a slew of narratives around Coinbase, hash-rate black-outs and billions in liquidations.

Bitcoin Market Overview

The Bitcoin market ran into significant volatility this week, especially in comparison to the relatively calm consolidation in play since late February. This week, BTC price hit a new all-time-high of $64,717 in the lead-up to the much anticipated Coinbase direct listing. However this was short lived and was followed by a sell-off on Sunday with BTC trading down by more than -18% to a low of $52,829.

There was no market shortage of narratives attempting to explain this volatility, ranging from mismatched expectations vs reality around the Coinbase listing, a 40%+ drop in mining hash-rate, and billions of dollars in liquidations and flushed out leverage. This week we will assess the data behind these narratives as well as explore an accelerating trend of new and likely retail dominant entrants coming into the Bitcoin market.

Hash-rate Falls Significantly

One of the primary narratives circulating around Sunday's sell-off was a spooking of the market due to a precipitous drop in mining hash-rate (although the timing of Sunday's sell off is later than changes in hash-rate and thus is unlikely the primary driver). The hash-rate decline, started late on 15 April and is understood to be due to power outages and a coal mine accident in Xinjiang China, a major centre for the Bitcoin mining industry.

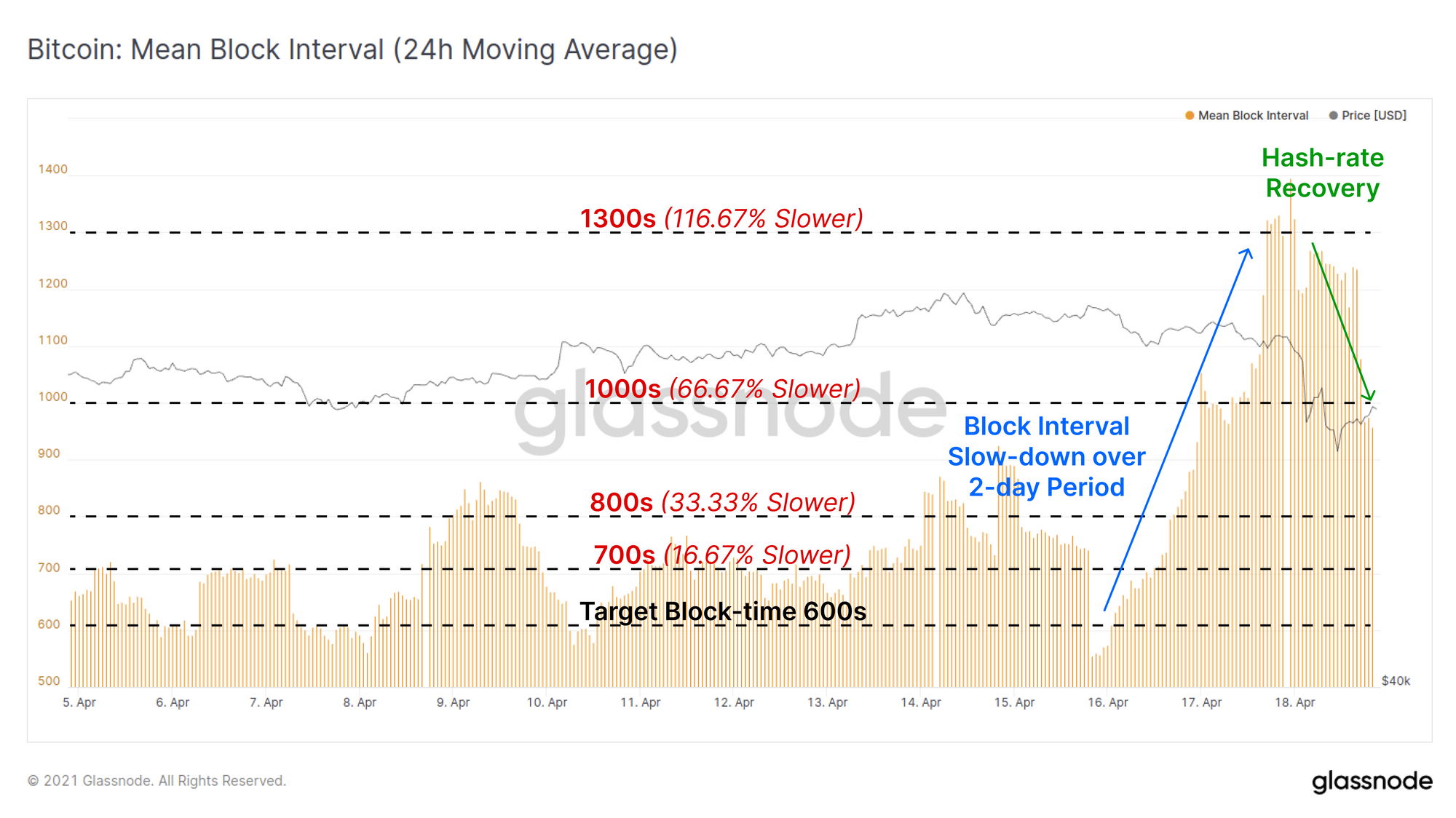

Mean block-intervals, which protocol difficulty targets to 600 seconds, began rising late on 15th, before peaking at over 1,300 seconds (21.6 mins) two days later. Hash-power has since started to recover with average block-intervals speeding back up to an average of 1,000 seconds (16.67 mins).

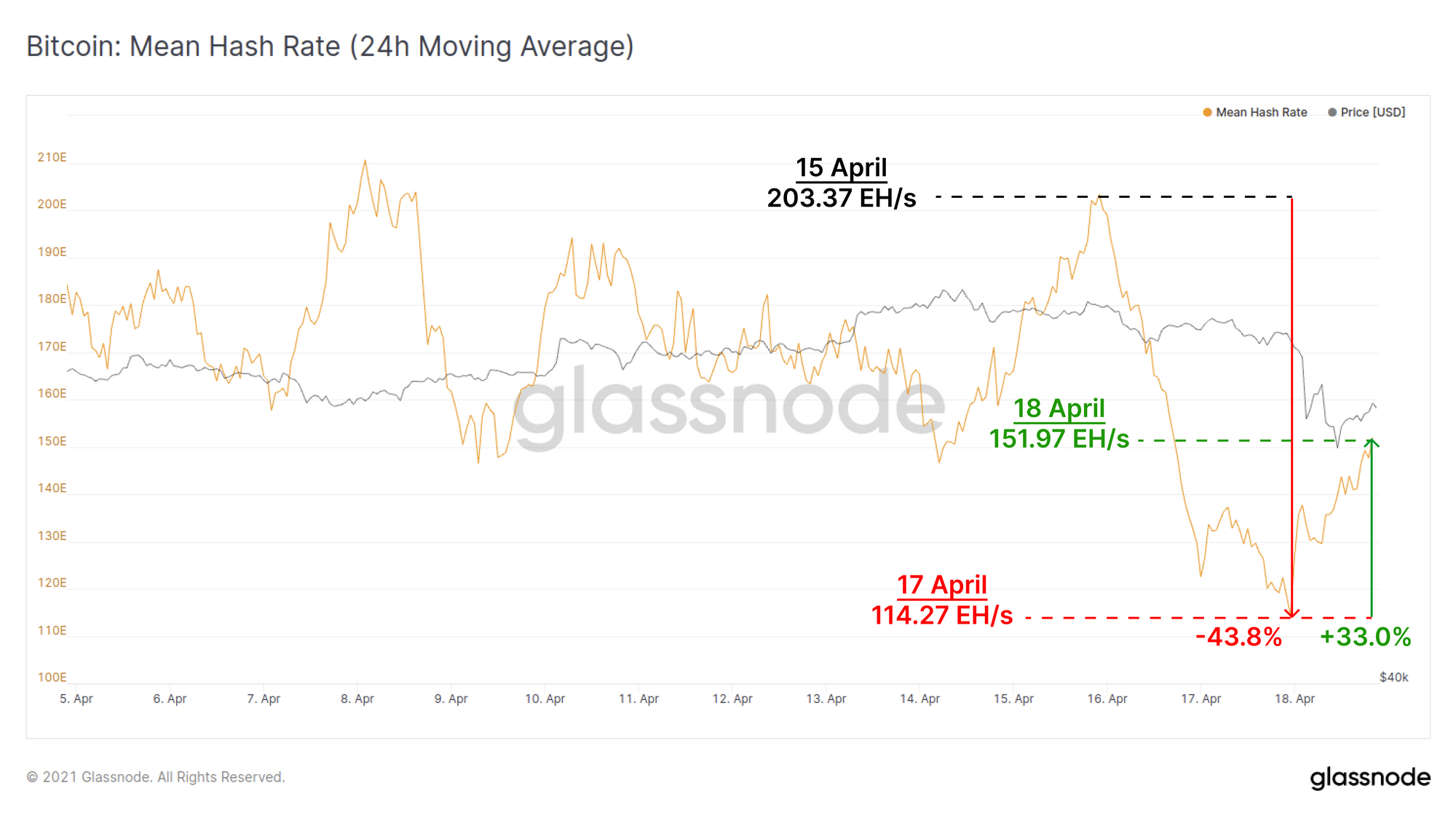

The impact on estimated hash-rate was a drop from 203.37 EH/s down to 114.27 EH/s at the lows, representing around 43.8% of the estimated network hash-power going offline. Hash-rate has since recovered by 33% to 151.97 EH/s.

It is important to note that hash-rate is not explicitly known and must be estimated based on the currently mining difficulty and the observed block-intervals. Given there is natural variance between blocks, especially over short time periods (< 1wk), it is common for hash-rate estimates to vary between sources and over different timescales. Thus, block-intervals generally provide a more meaningful and accurate metric for tracking day-to-day mining market mechanics and hash-rate values should be considered within this context.

Update 20-Apr: Further estimates from miners familiar with the incident in China have suggested that the net impact to global hash-rate was a fall of 20% to 25%, demonstrating the influence of natural block-interval variance on hash-rate estimations.

Due to an incident in Xinjiang, China, Bitcoin’s Hashrate dropped by an estimated 20-25% from April 15-16th. What did we learn from this? How could this effect the future of Bitcoin? Here are some thoughts:

— Mustafa Yilham (@MustafaYilham) April 19, 2021

Derivatives Flush Out Excess Leverage

As is customary in the Bitcoin market, excessive leverage is flushed out during rapid price moves, and this week was no exception. As many traders increased their leverage exposure, likely in anticipation of the Coinbase direct listing, the risk of a long squeeze and cascading liquidations had built up in the system.

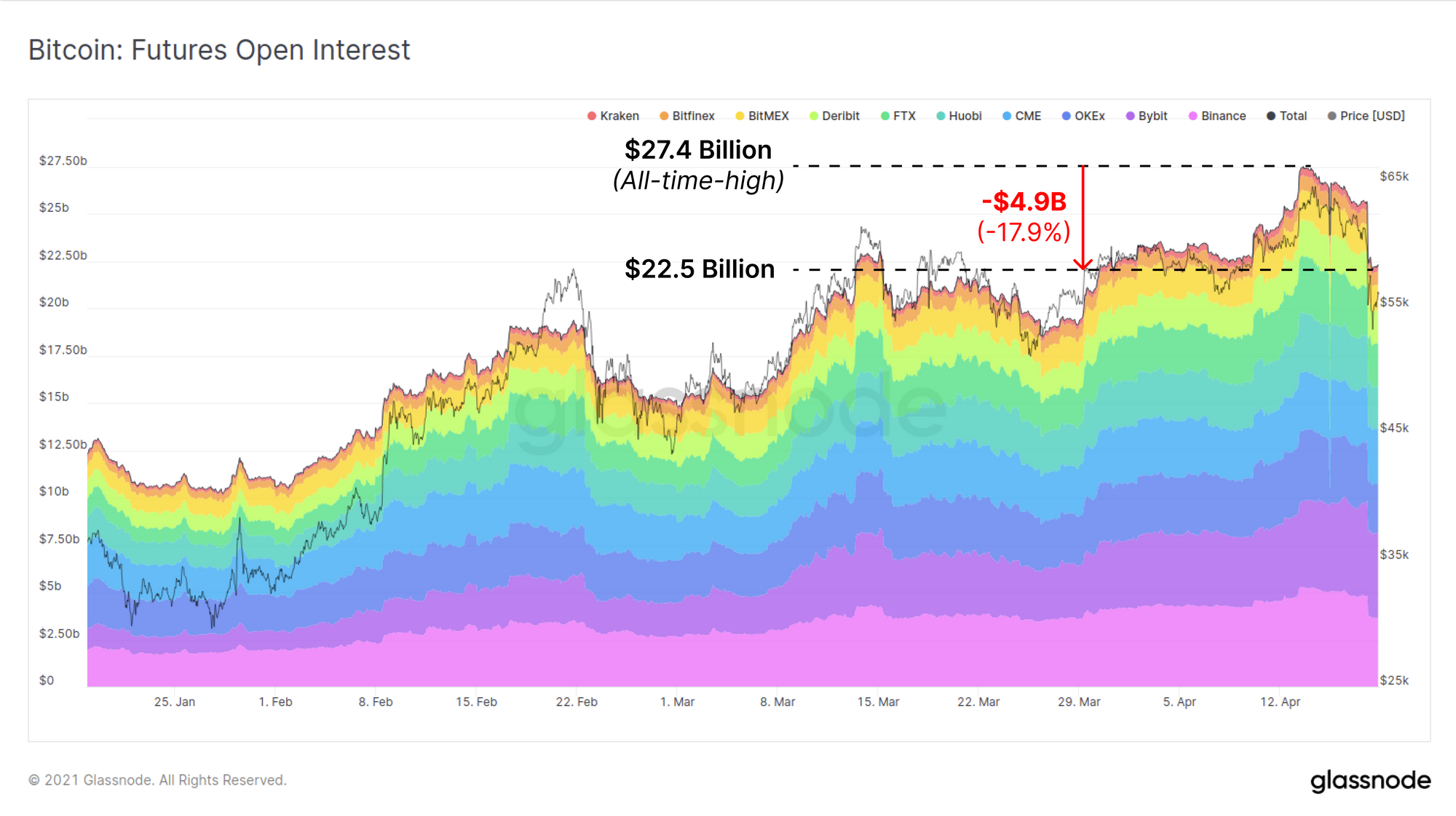

Open Interest across derivatives exchanges reached a new all-time-high of $27.4 Billion as price rallied to new highs. However, by Sunday afternoon, a total of $4.9 Billion in futures contracts had been closed out, with the majority of them occurring during the Sunday sell-off.

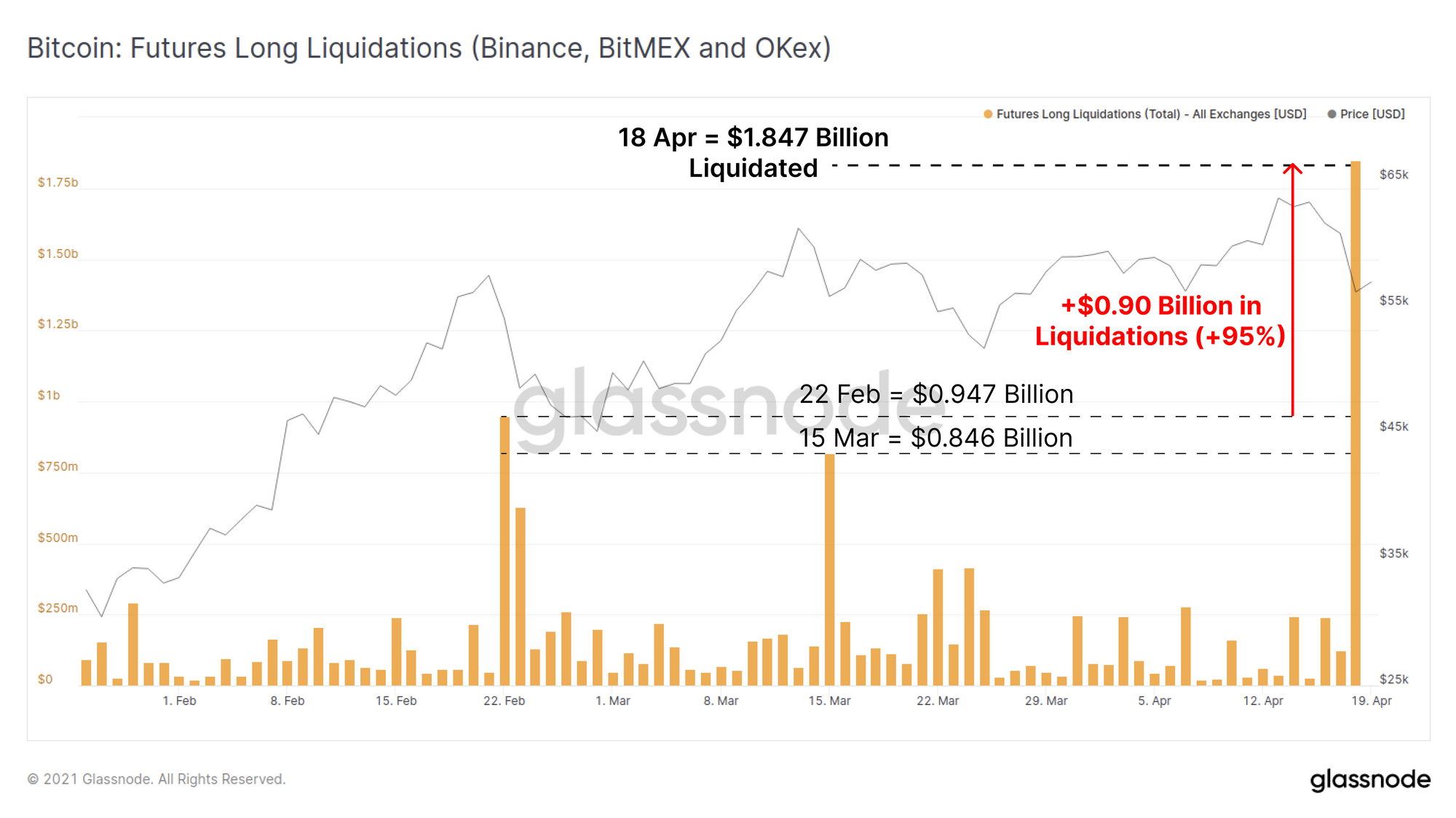

Long Liquidations across Binance, BitMEX and OKex peaked at $1.847 Billion, almost twice (+95%) the previous liquidation high set on 22 Feb. What is notable is how quickly Bitcoin market derivatives clear excessive leverage, with this entire liquidation event settling and clearing within a one hour window.

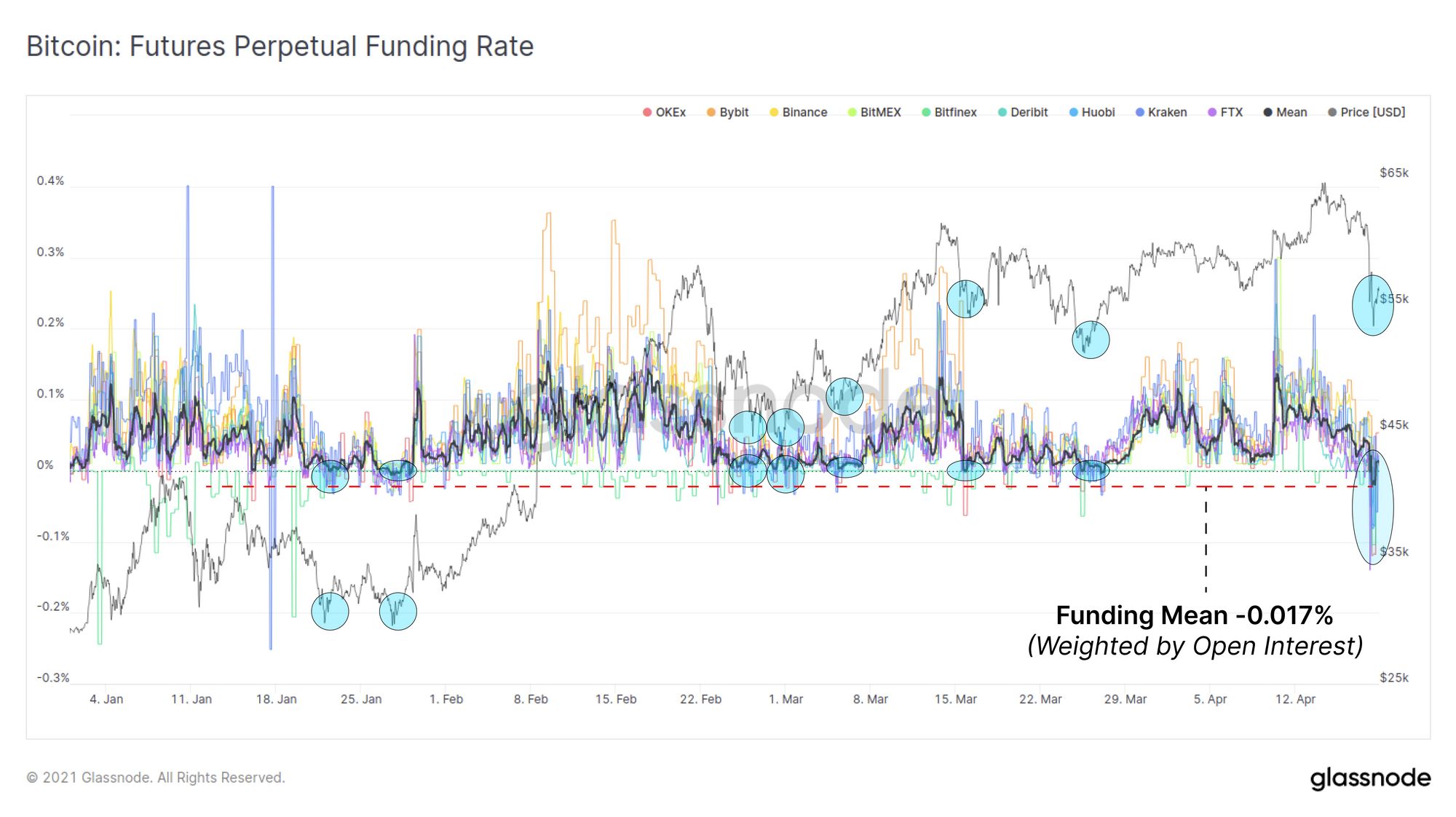

The funding rate for perpetual swap contracts fell well into negative territory, hitting a new cycle low for this bull market at -0.017% (average is weighted by exchange open interest). Previous instances of futures funding rates resetting to zero, or going slightly negative, have indicated a significant flush of leverage has occurred, and is often constructive for price in the weeks that follow.

On-chain Sentiment Overview

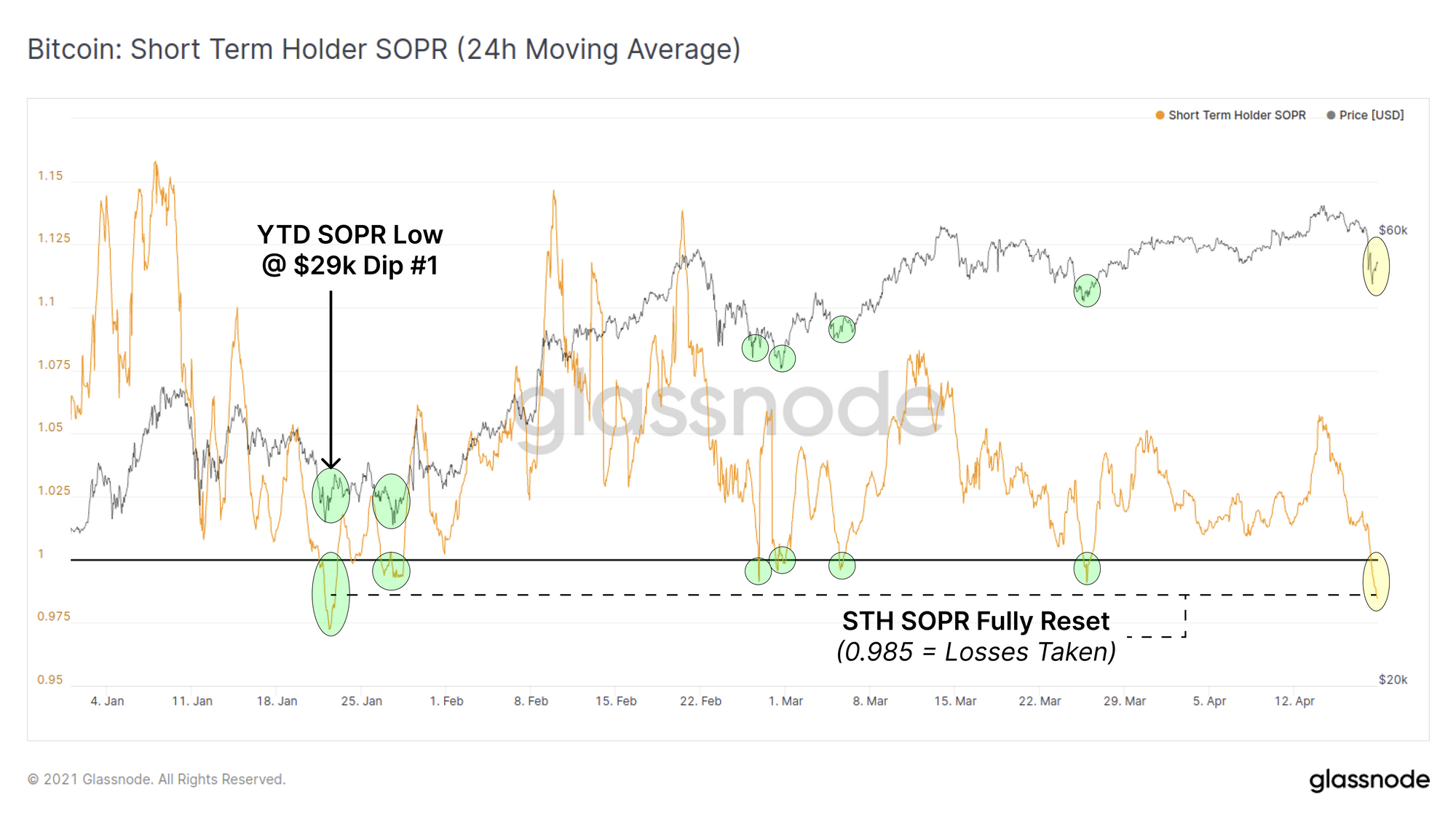

In the on-chain space, the Short Term Holder (STH) SOPR metric has also reset, dipping below 1.0 by the most significant extent since the $29k dip in back January. This metric tracks the amount of profit (> 1.0) or loss (< 1.0) realised by coins spent on-chain, however it considers only new entrants to the market (those holding coins younger than 155-days).

As the STH-SOPR has reset to a value below 1.0, it suggests that some of these new coin holders were shaken out at a loss during this dip. However a low SOPR also signals that new holders who are in profit were not shaken out, indicating relative market strength.

Similar to the futures funding rate, resetting the SOPR metric has historically been constructive for price in bull markets.

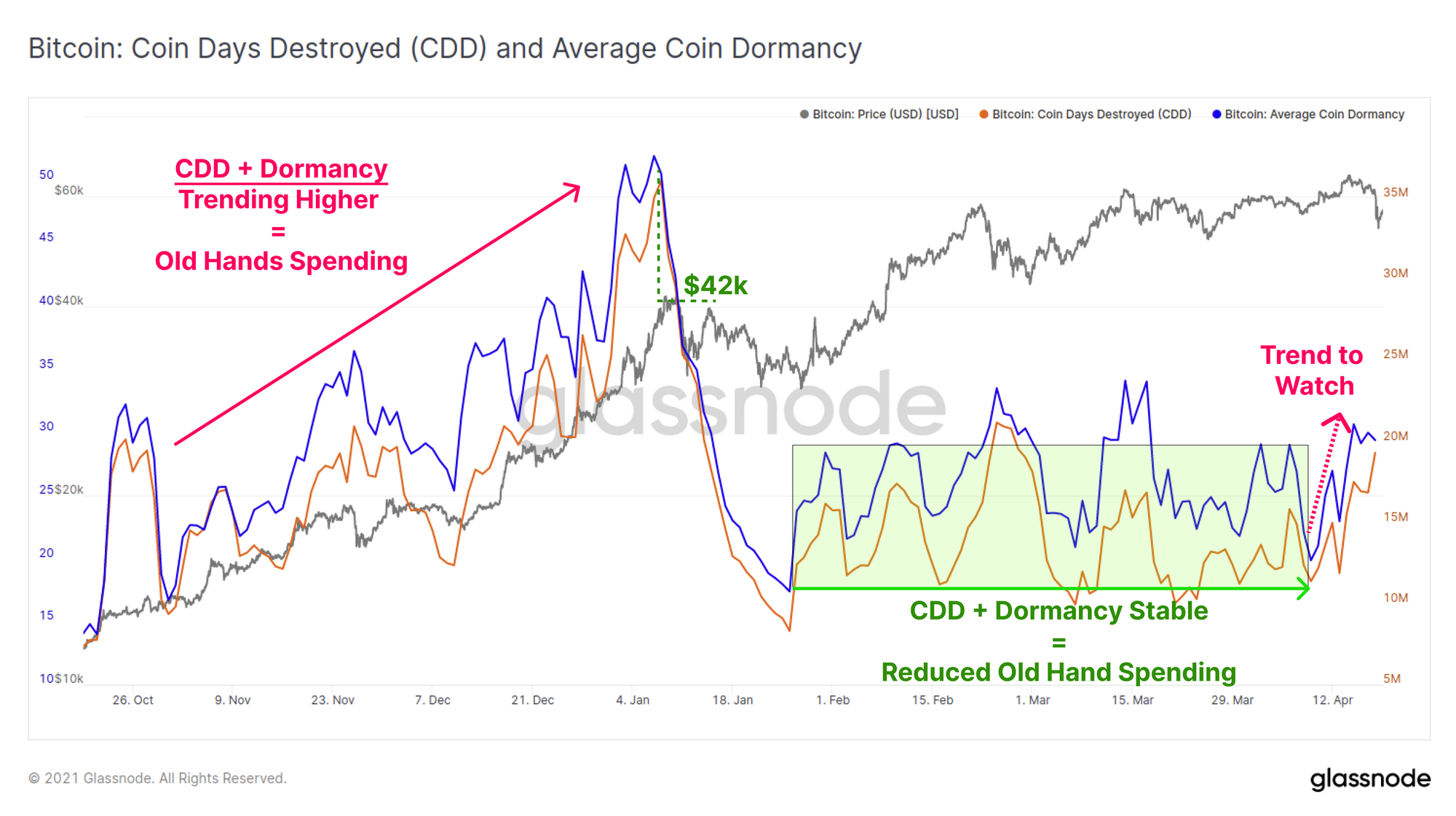

Looking at older coins, we can see that both the CDD and Dormancy metrics ticked upwards slightly this week, however both remain within the relatively stable range established since mid-January. Both of these metrics track the age of spent coins and will increase when older coins are spent on-chain. This is a trend that is worth keeping an eye on as any strong continuation to the upside may indicate older coins are starting to take profits on a more significant basis.

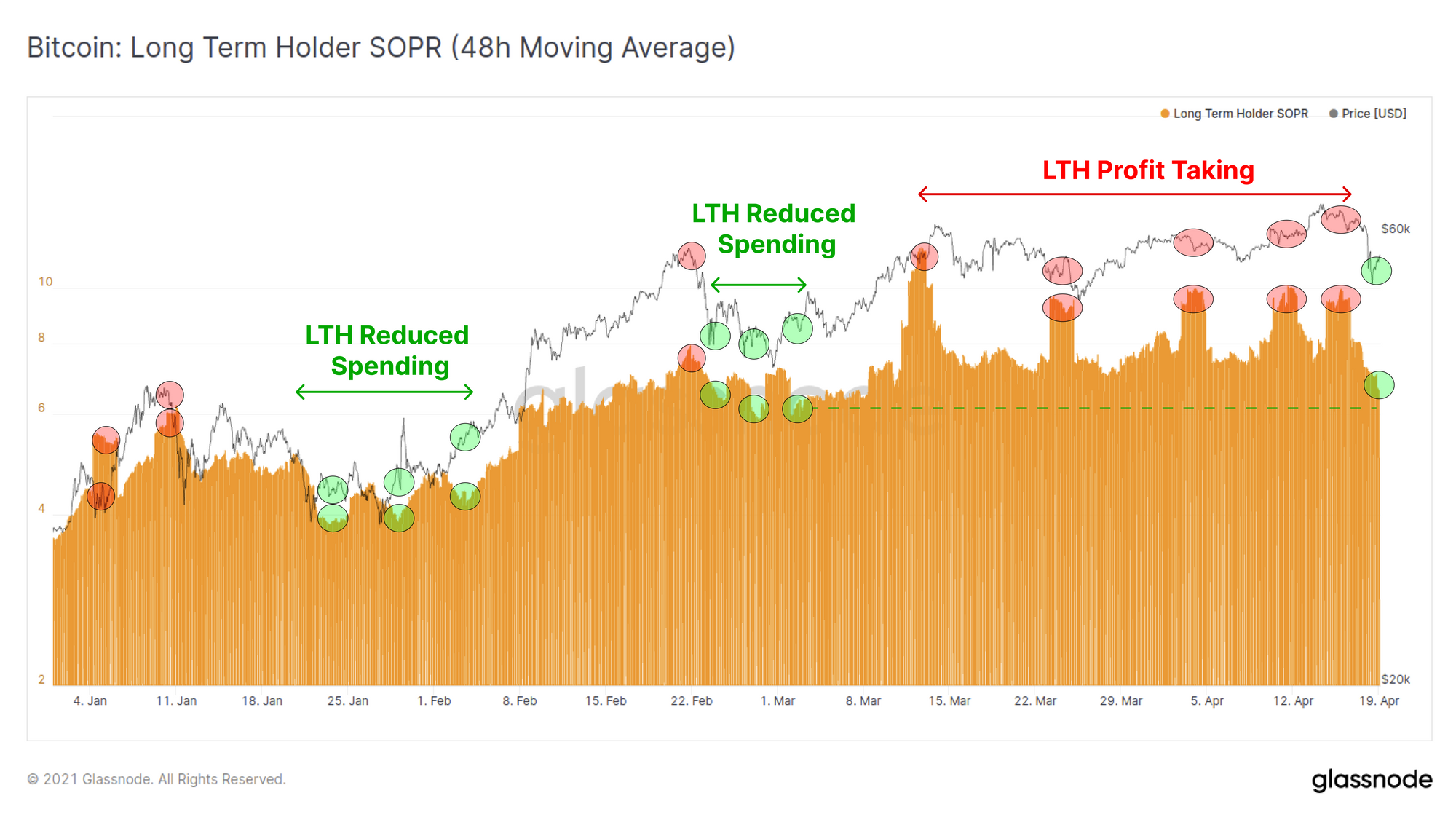

The LTH-SOPR metric tells a similar story and shows that old coins have been realising profits during the consolidation throughout March and April. Intermittent spikes in LTH-SOPR indicate profits were realised by long term holders which can increase the liquid supply, as dormant coins are re-activated in to circulation.

However during this weekend's sell-off, long term holders did not panic sell, and held onto their coins. The LTH-SOPR also reset back to relative lows, last seen around the $43k local bottom set back in late February.

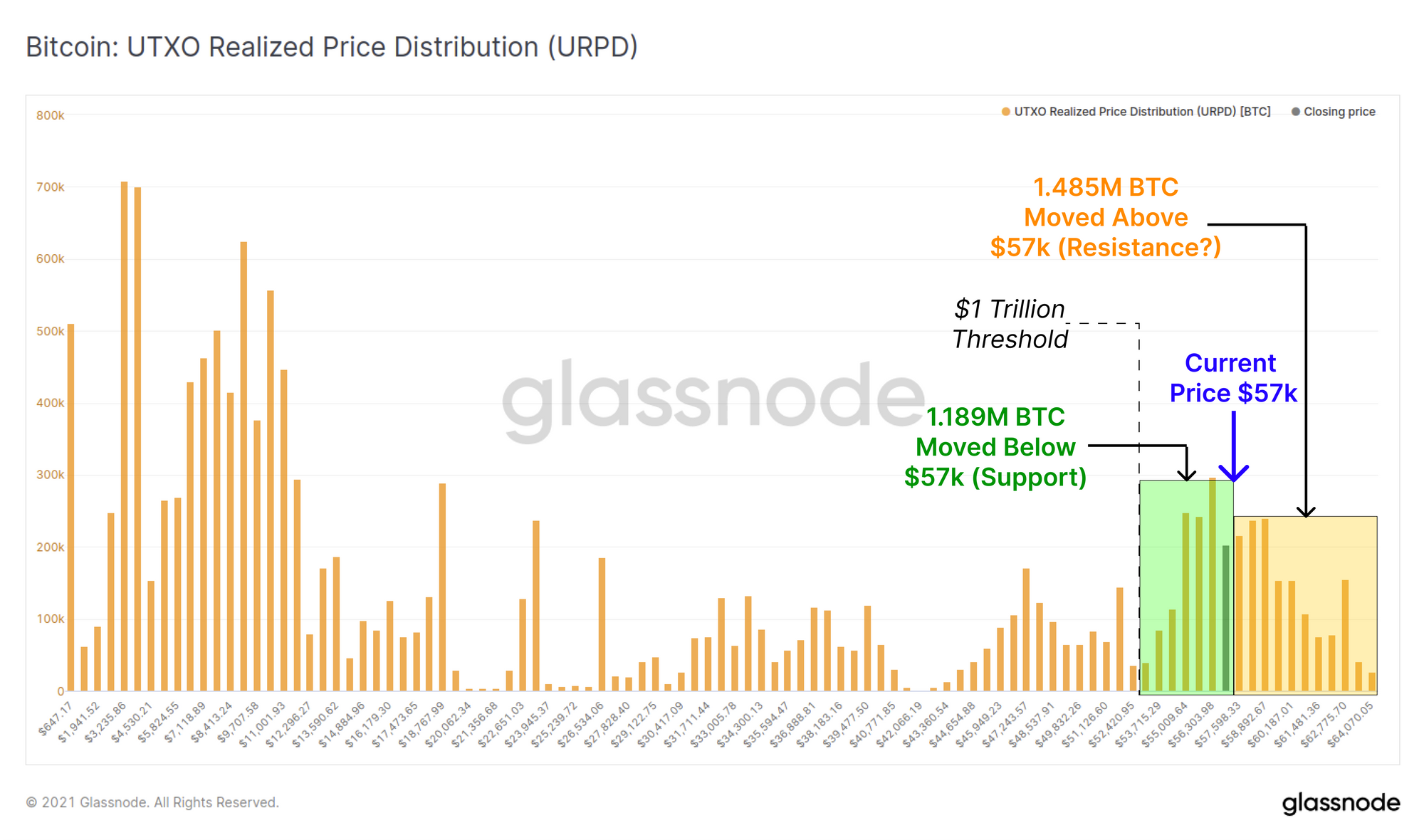

A potential risk associated with this weeks sell-off is that price has undercut the $53.5k level which defines the $1 Trillion valuation mark.

Price did see a strong bounce to close well above this threshold at $56,163. This puts the market back inside a strong cluster of volume moved on-chain. So far, BTC volume equivalent to 14.32% of the circulating supply has moved at prices above $53.5k.

Previous editions of this newsletter discussed how this on-chain volume cluster is likely to provide strong support and help justify the $1 Trillion valuation (so far, this is the case). In this Trillion dollar support zone, 1.189M BTC has moved above $53.5k but below the current price of $57.0k (equivalent to 6.37% of circulating supply).

However, this zone may also define the cost basis for a large portion of the market, and it is possible that some of these coins becomes overhead supply should market sentiment shift negative. A larger sum of 1.485M BTC has transacted above the current price (equivalent to 7.95% of circulating supply). As such, this volume profile, alongside metrics that follow older coin spending behaviour, are key on-chain indicators to keep an eye on as this market correction plays out.

Weekly Feature: New Market Entrants

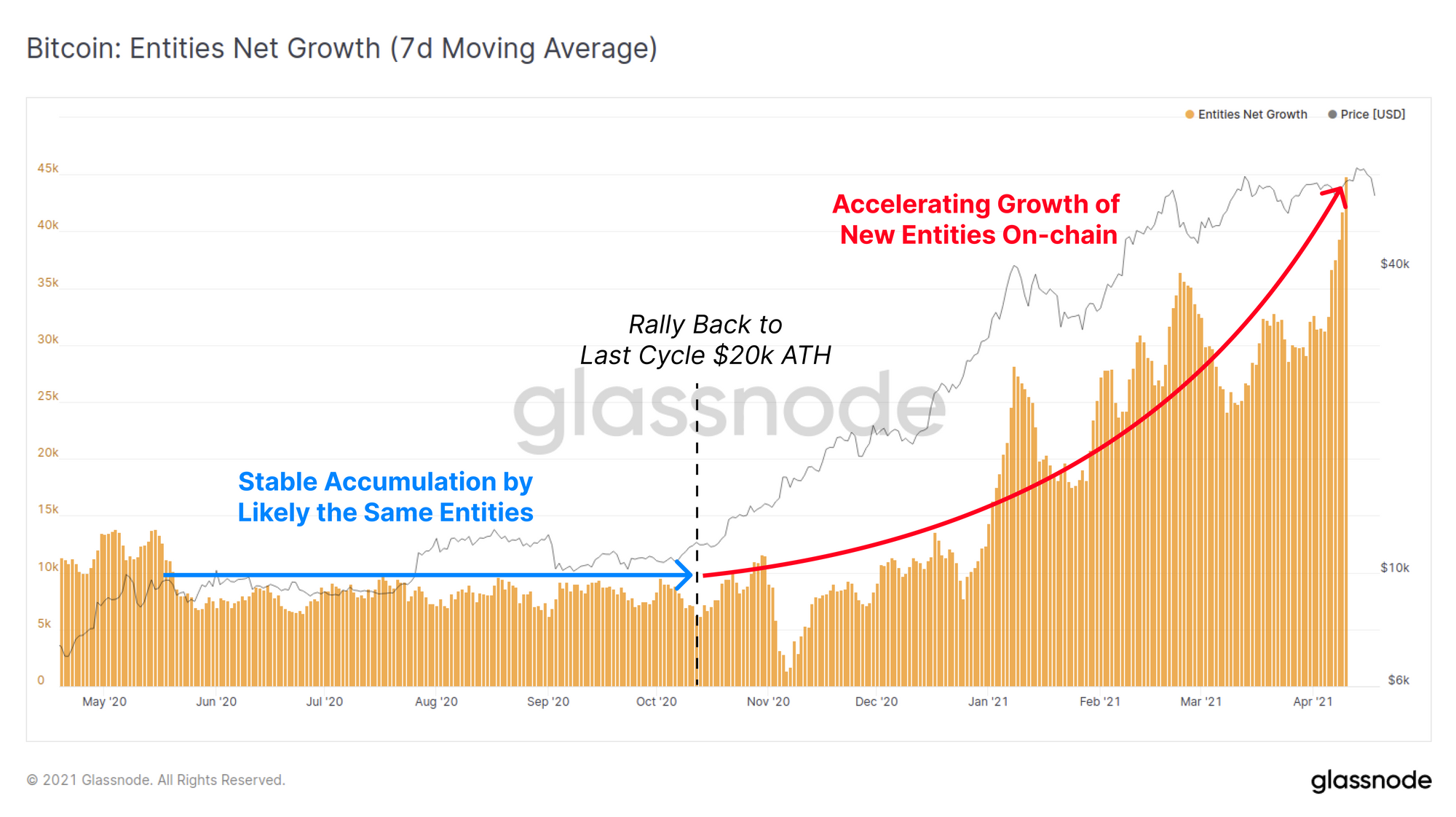

This week the trend of retail participation in the market has continued to accelerate with the growth in new entities on-chain continuing in a parabolic rise. We define the growth in net entities as the change in unique address clusters that are created (new UTXOs) vs destroyed (coins spent).

Prior to November 2020 (before the rally back to last cycles $20k ATH), net entity growth was relatively stable, most likely describing regular 'sat stackers' and accumulators. Since then, we have seen a parabolic increase in new entrants appearing on-chain, with new highs set early this week.

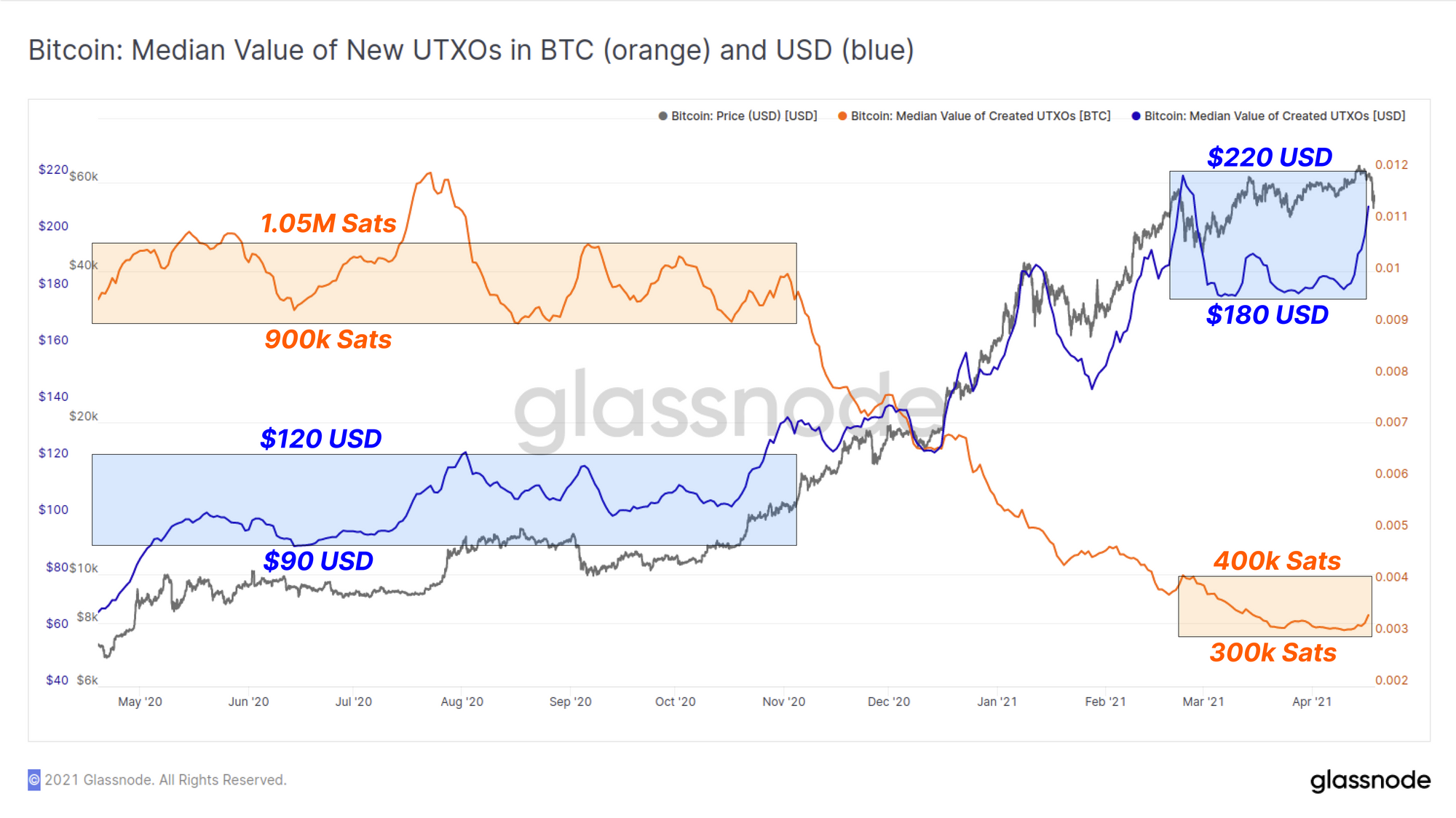

If we review the median size of new UTXOs created on-chain, we can assess the 'typical investment size' of newer entrants. We can see that during the late 2020 accumulation phase, the median UTXO value was around 1M sats (0.01 BTC), equivalent to between $90 and $120.

As both price and net entity growth expanded upwards, the median UTXO value has decreased to 300k to 400k sats (3x fewer sats) but has increased in fiat value to between $180 and $220 (2x more dollars). This demonstrates an approximate increase in BTC purchasing power of ~600% whilst the 'typical investment value' has doubled in fiat terms relative to late 2020.

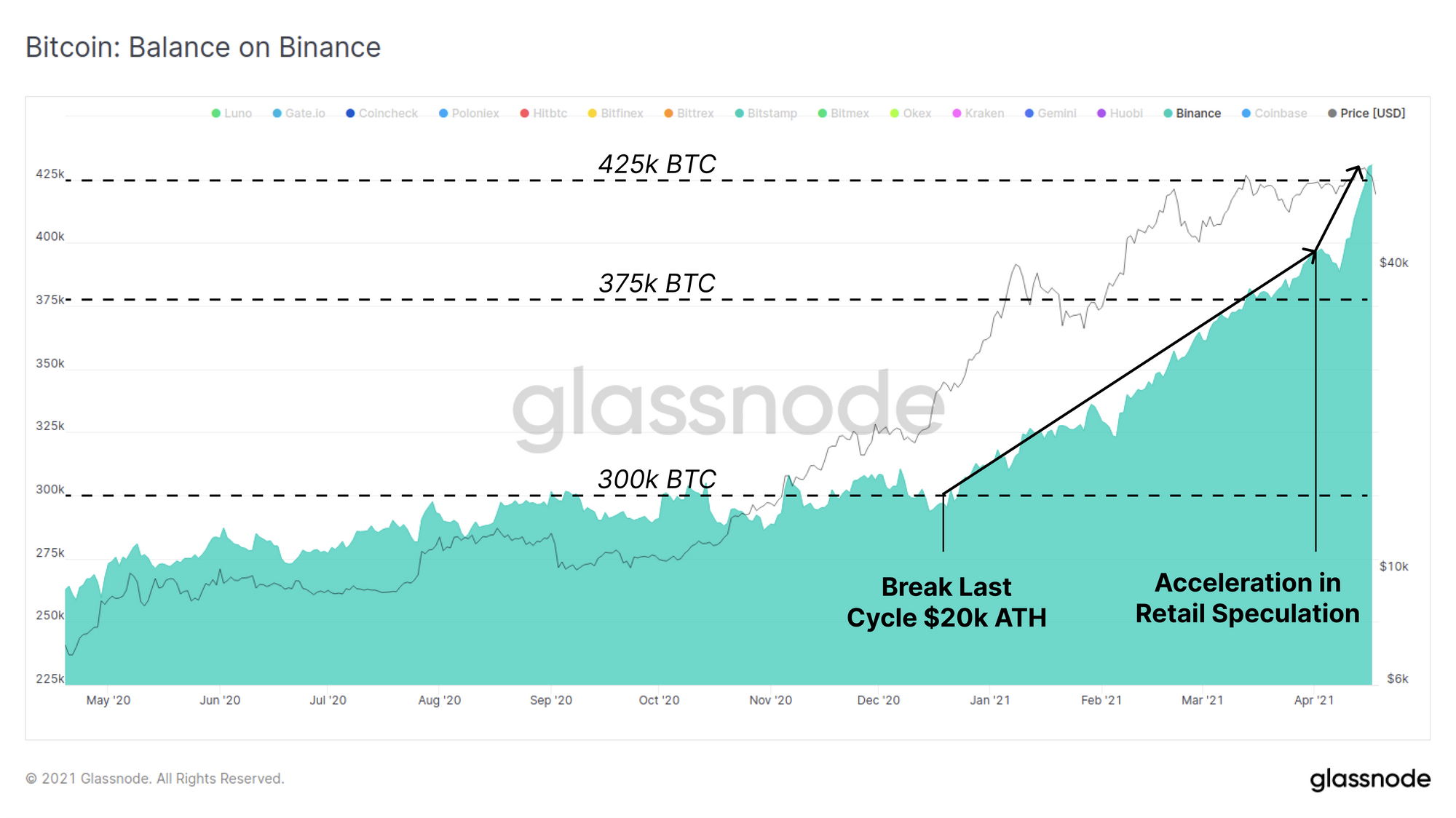

Finally, retail lead speculation appears to be on the rise as is reflected in the recent out-performance of a large portion of the alt-coin market. One of the favoured trading venues for retail speculation is Binance which has seen the most significant BTC inflows of any major exchange.

The BTC balance held on Binance balance has been in a steady increase since price broke above $20k, but has accelerated in the last two weeks, suggesting increased retail speculation.

Week On-chain Dashboard

The Week On-chain Newsletter now has a live dashboard for all featured charts here.

New Glassnode Content

Our Latest Newsletter: Uncharted

Check out out bi-weekly newsletter,