The Week On-Chain (Week 27, 2020)

Despite uncharacteristically stable price behaviors, BTC's on-chain fundamentals remain bullish, with increased hodling and growing adoption.

Bitcoin Market Health

Bitcoin has remained remarkably stable for yet another week, continuing its trend of fluctuating just above $9k. Overall, BTC dropped ever so slightly throughout Week 27, opening at $9125 and closing out the week at $9070.

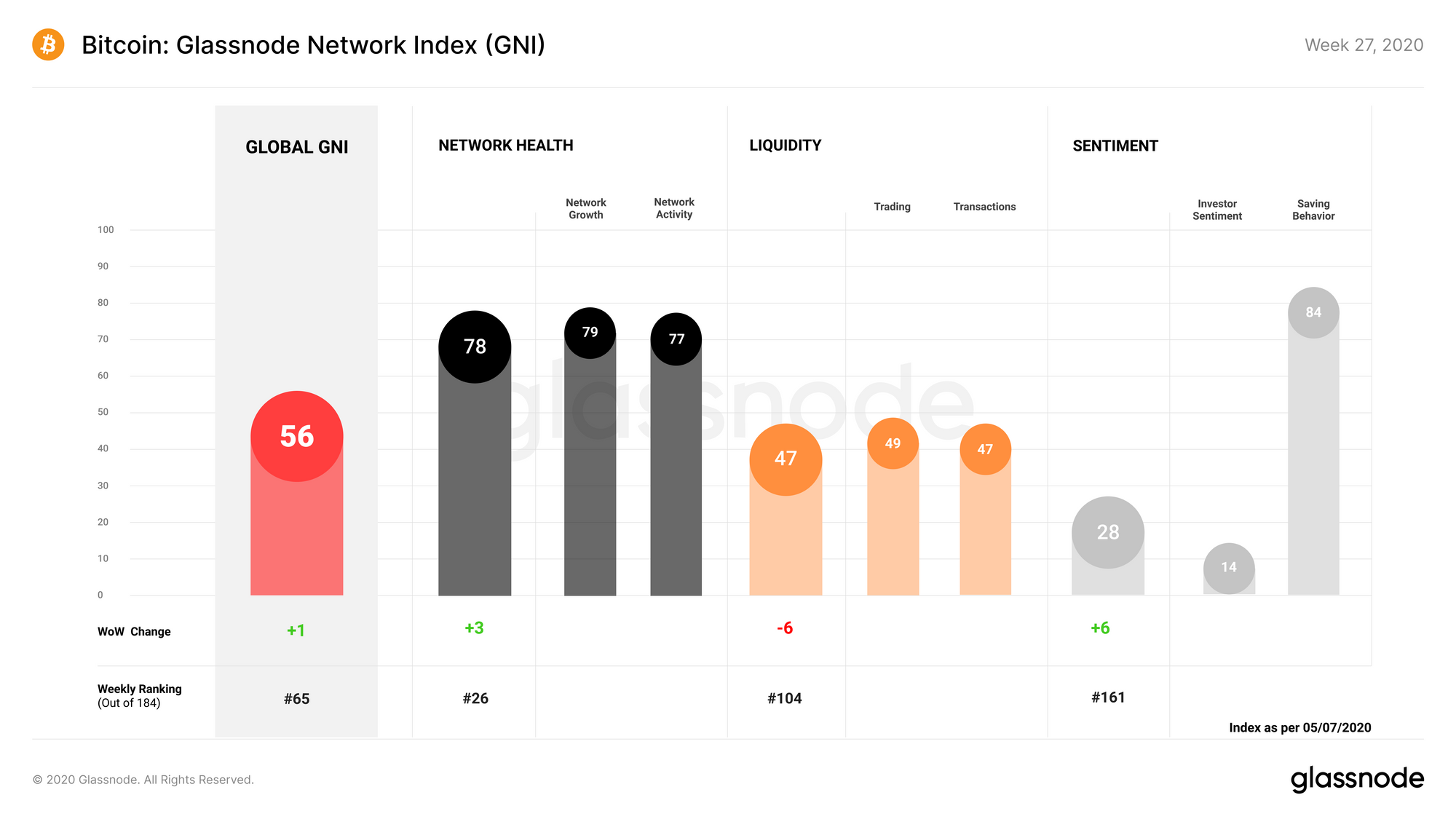

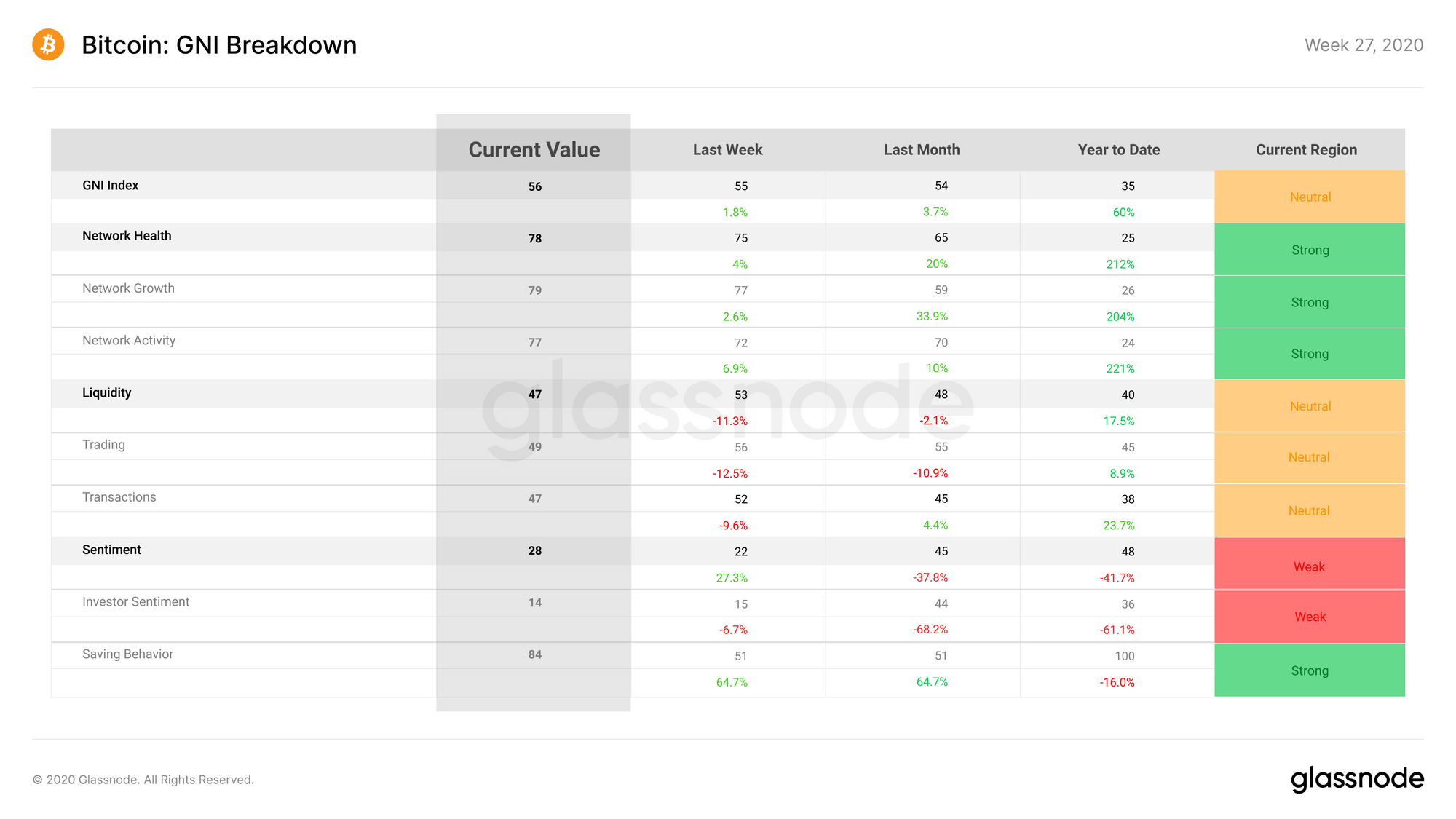

Bitcoin on-chain fundamentals rose slightly during Week 27. GNI increased by 1 point, reaching a score of 56 points. This was caused by a decent recovery of the Sentiment subindex, and a small increase in Network Health as well.

Network Health increased from 75 points to 78 for Week 27, with network growth and activity both seeing modest increases as a result of a greater number of active entities on-chain and more new entities joining the network.

Liquidity dropped by 6 points over the past week, losing ground in terms of both trading and transaction liquidity as exchange deposits and on-chain transactions decreased.

Sentiment increased after declining for the previous 2 weeks, signaling a reversal in its decline. This was caused by a large 64.7% increase in saving behavior as hodlers started acquiring more BTC.

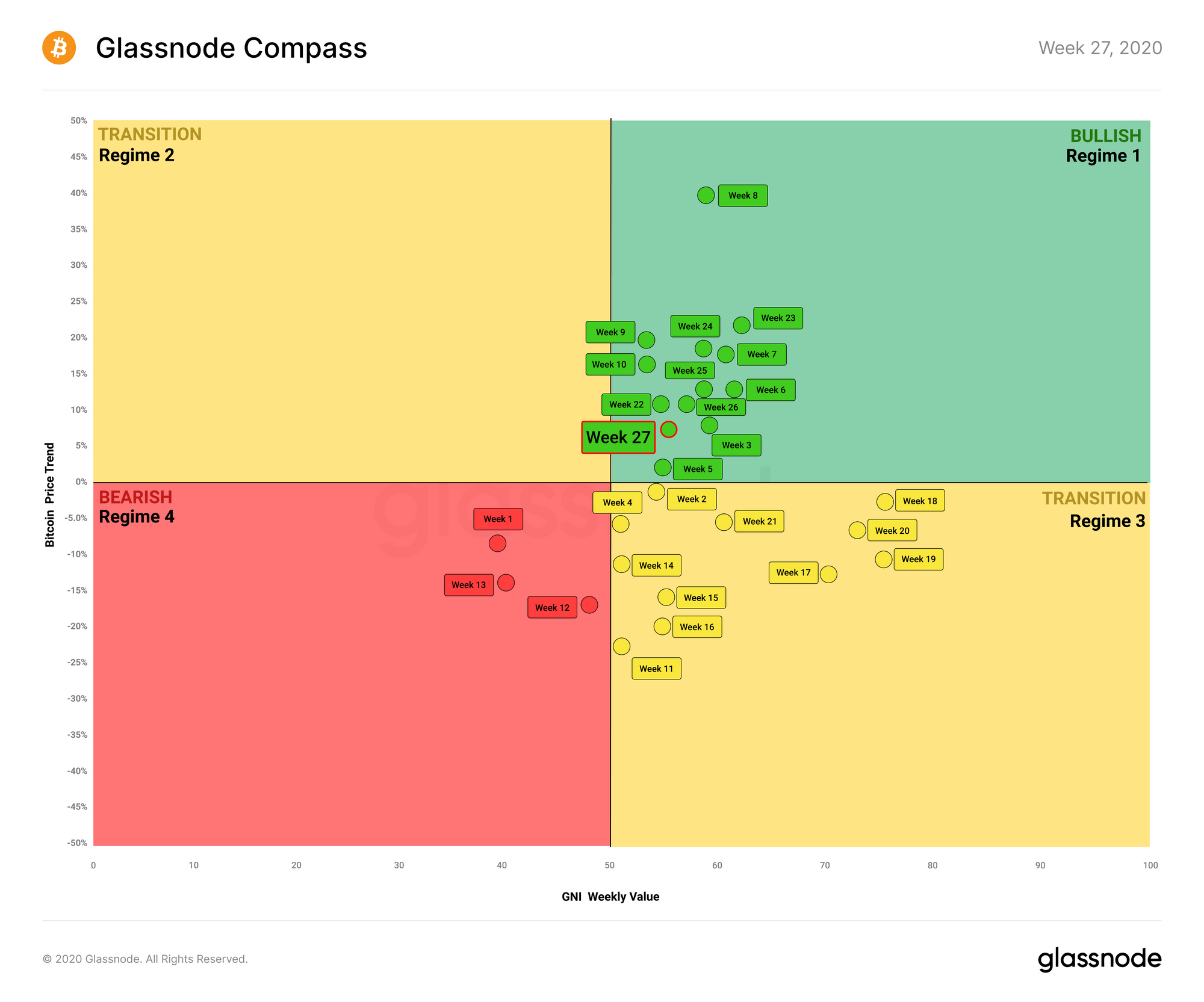

Glassnode Compass

The compass remains in a bullish position, staying in Regime 1 for the 6th week in a row, but drifting slightly downward in terms of both GNI and price performance, taking it closer to a more neutral zone.

Despite this slight decline, however, on-chain and price indicators still place the compass in an optimistic state. While BTC has remained surprisingly stable over the past couple of months, indicators are pointing to an imminent breakout, with fundamentals remaining consistently strong.

However, external factors such as bitcoin's as yet unconfirmed correlation with traditional financial markets mean that uncertainty remains in spite of positive signals within the market.

Bitcoin Whales Appear to be HODLing

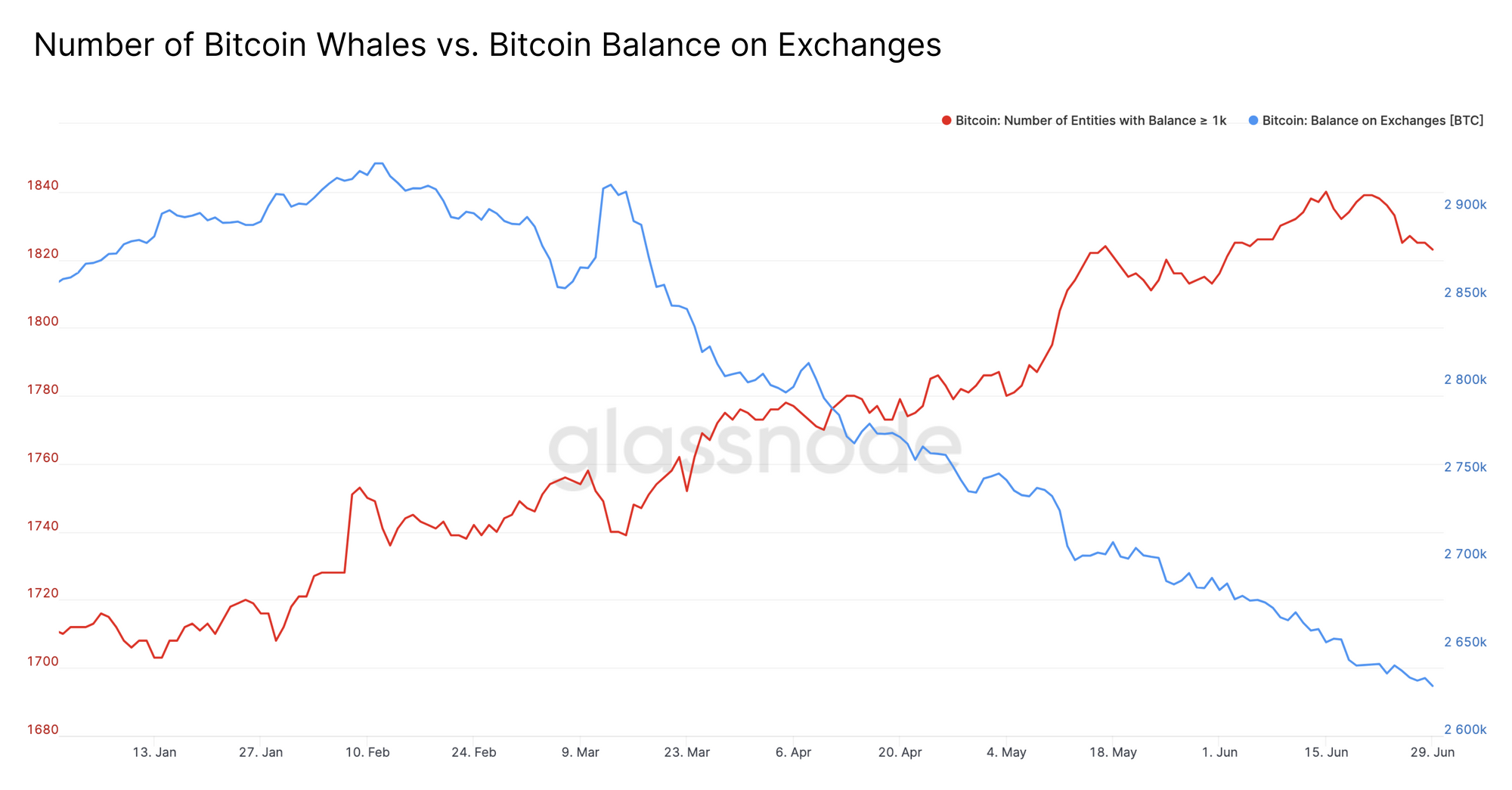

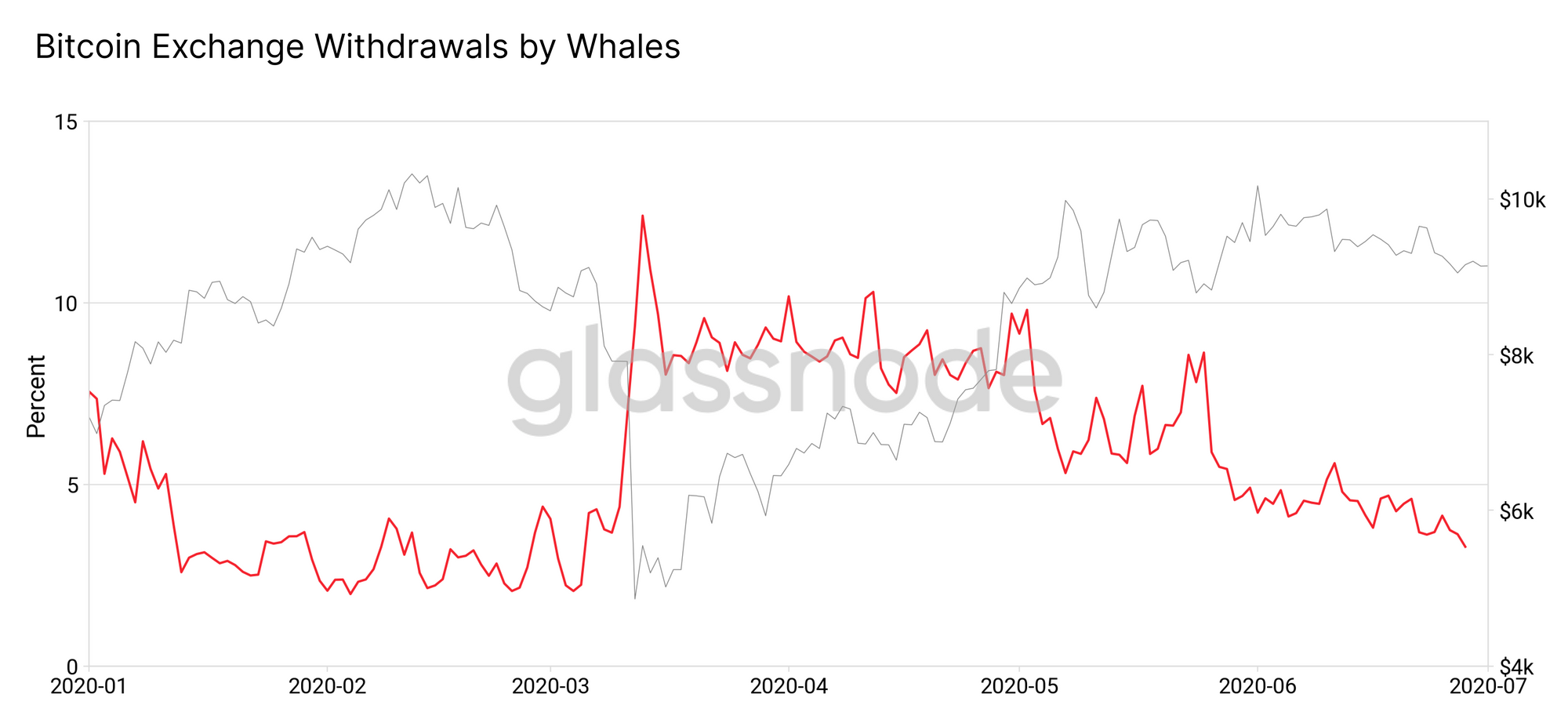

As we reported in-depth last week, Bitcoin's whale population is seeing its largest period of sustained growth since 2016. Much of this growth has coincided with a withdrawal of BTC from exchanges, suggesting that whales may be the reason for this exodus.

This is supported by the large increase in the proportion of exchange withdrawals being made by whales after Black Thursday.

As BTC balances on exchanges drop while on-chain whale holdings increase, we can deduce that whales may have used Black Thursday as an opportunity to get in at the bottom and then withdraw their bitcoin to HODL for the longer term in anticipation of the next bull run. Read our full analysis for the big picture:

Product Updates

Metrics and Assets

- USD Address Balance Bands (BTC, ETH) - New metrics showing total USD balance across a range of address size buckets.

- Miners' Balance (BTC) - New metric showing the total supply of BTC held in miner addresses.

Features

- Color Picker for Compare - Released a new color picker on the compare feature of Glassnode Studio, allowing users to modify visual aspects of the charts they generate.

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter