The Week On-Chain (Week 31, 2020)

BTC remained confidently above $10k throughout Week 31, and on-chain fundamentals point to the potential beginning of a bull market - but external market forces may still impact this potential.

Bitcoin Market Health

Bitcoin had another eventful week, rising and staying above $10k for the first time since August 2019. The price rose from $9880 to a high of $12,030, before dropping sharply to end Week 31 at around $11,120.

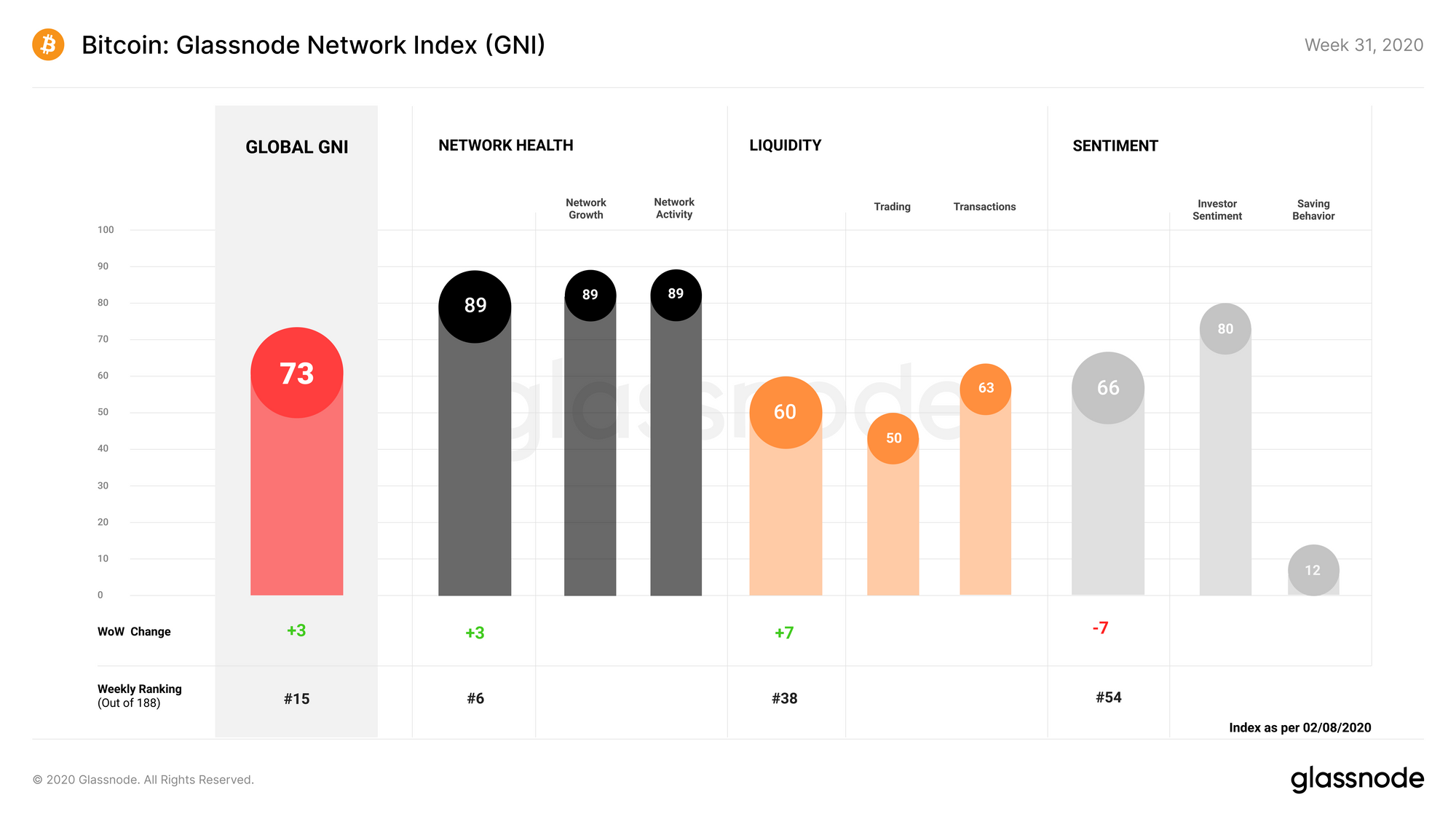

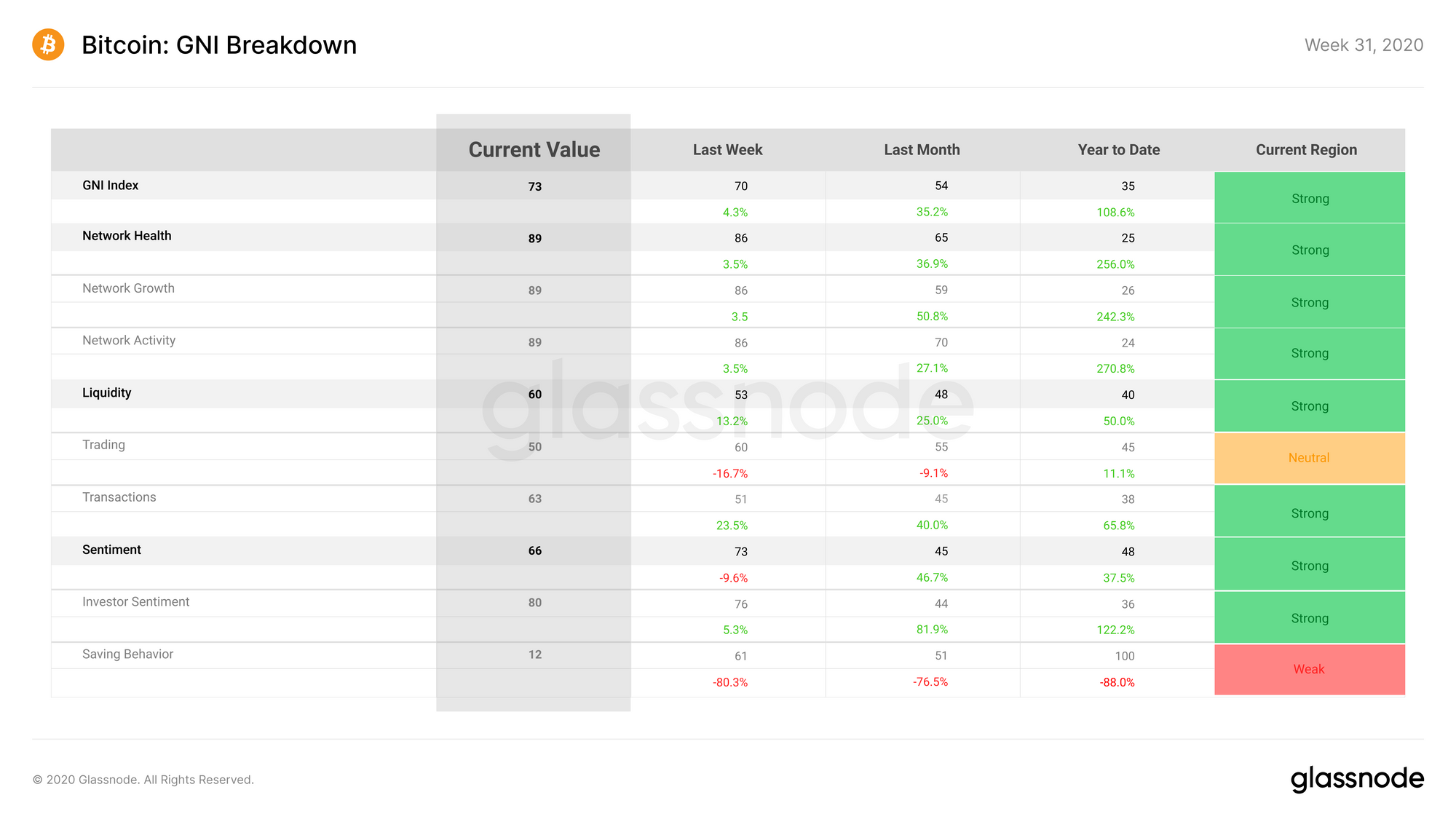

Bitcoin on-chain fundamentals rose once again during Week 31, along with the price of BTC. GNI increased by 3 points to reach a value of 73 points, with this uptick being driven by increases in the Network Health and Liquidity subindices.

Network Health gained 3 points over Week 31, with equal gains coming from the network growth and network liquidity subcategories, each at a score of 89 points. The number of new network users and active network users both increased over the past week.

Liquidity increased by 7 points overall. Transaction liquidity gained 12 points as on-chain volumes rose, while trading liquidity suffered due to a decrease in stablecoin supply relative to BTC.

Sentiment lost 7 points over the past week due to a large decrease in the saving behavior subcategory. While overall sentiment is positive for BTC, a drop in the amount of bitcoin being acquired by hodlers led to a decrease in perceived saving.

Glassnode Compass

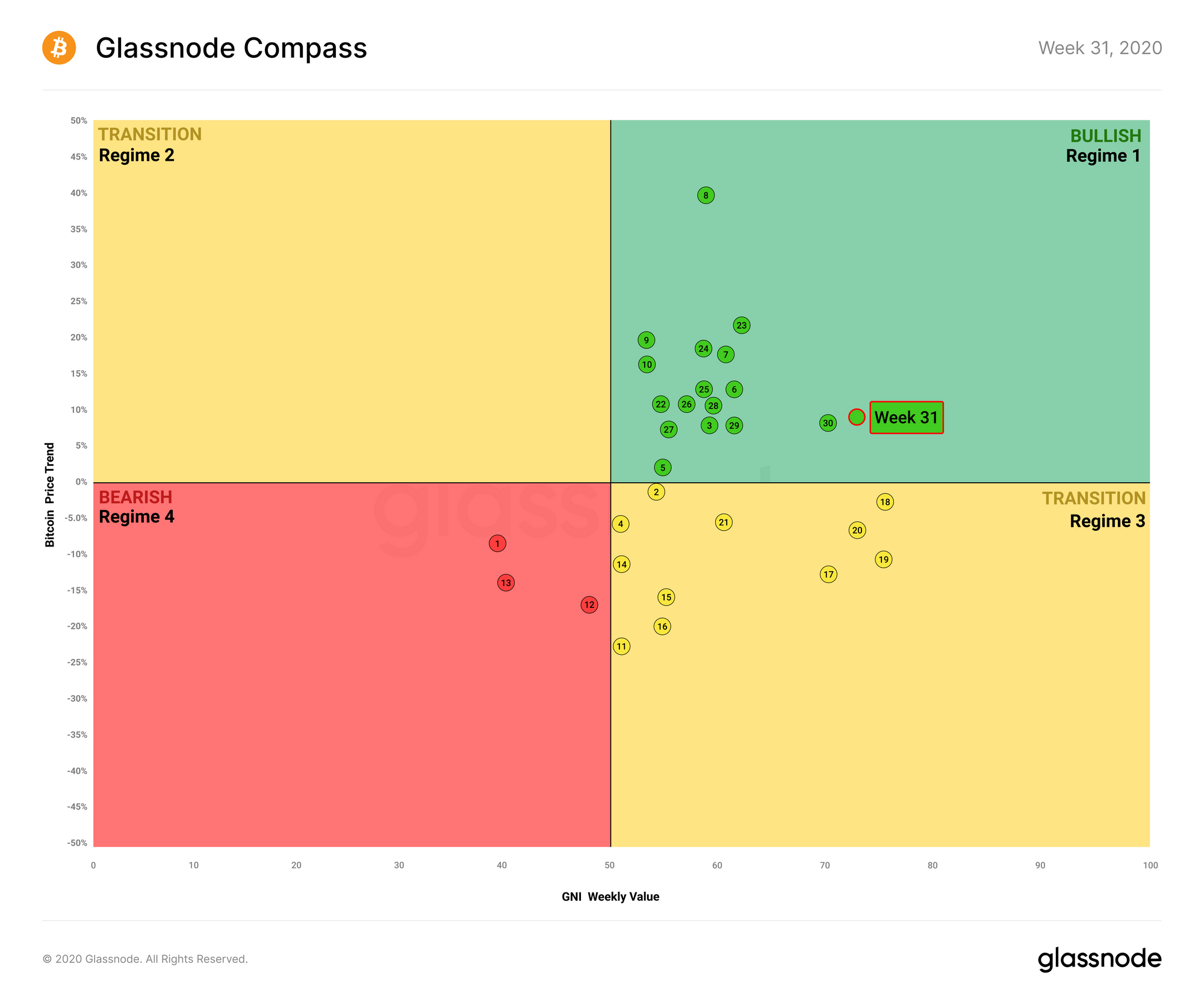

Now for the 10th week in a row, the compass remains in the bullish Regime 1, characterized by strong on-chain fundamentals and healthy quarterly price performance.

After over 2 months of indicating an upcoming price increase, the compass' position in the bullish zone is finally being reflected in the price of BTC. Consistently strong on-chain fundamentals suggest that this may indeed be the beginning of the next bull market.

However, despite strong sentiment, a crash in traditional markets (as has been forecast by many analysts) could halt this bull run in its tracks, as we saw on Black Thursday in March. As such, investors should remain cautious in their optimism, given the fragility of financial markets in the current day and age.

Close to 95% of Bitcoin UTXOs are in Profit

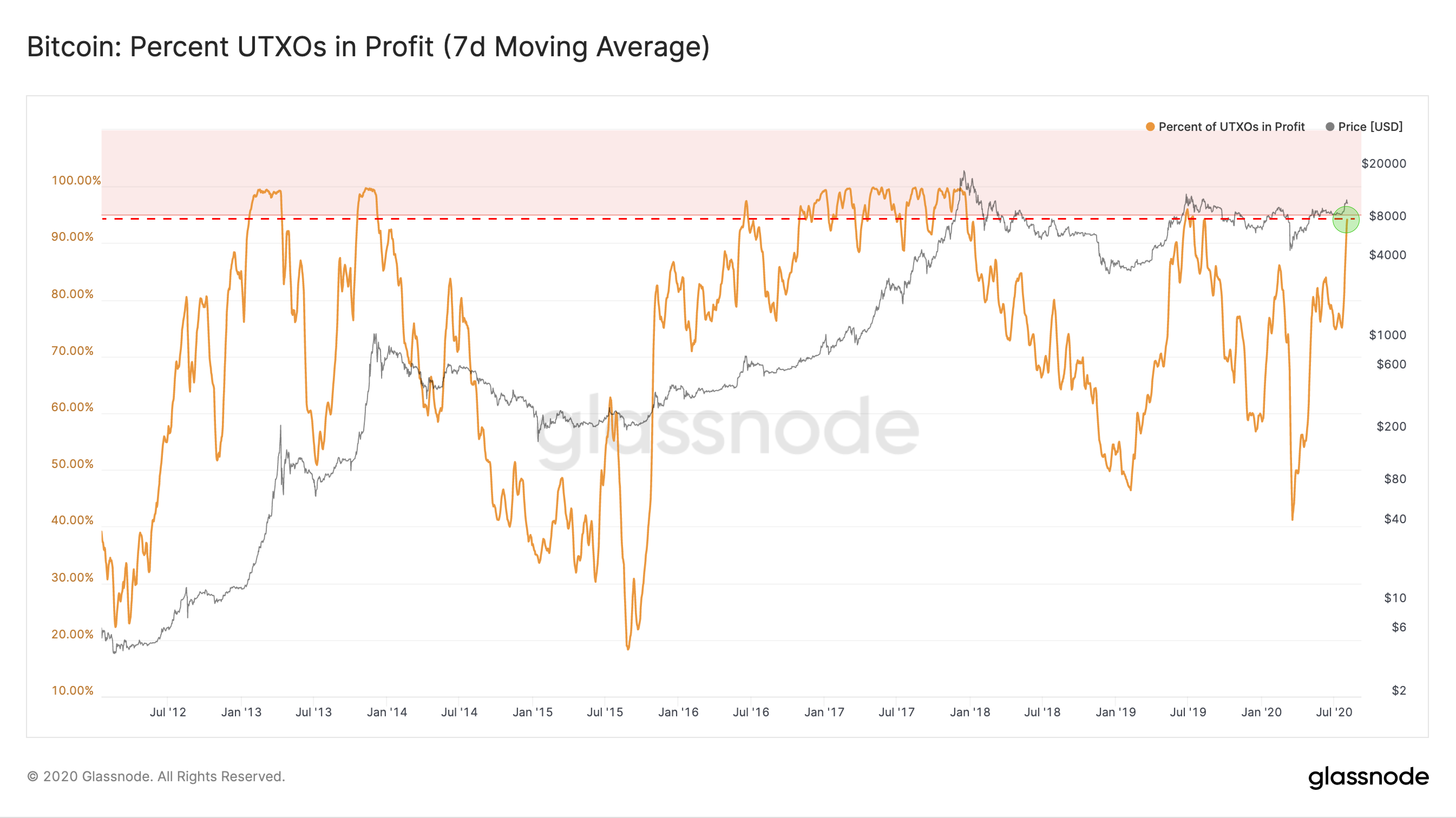

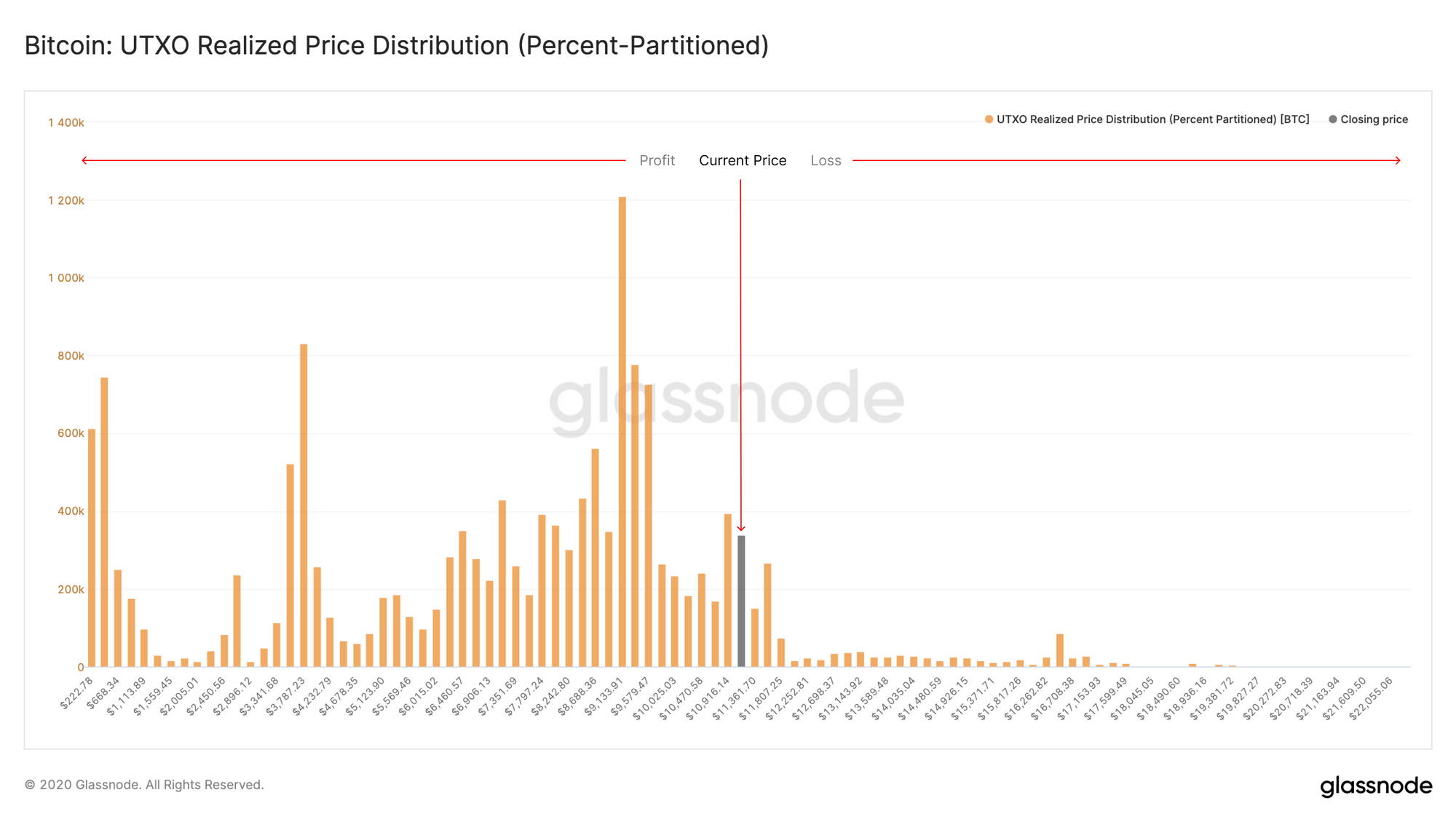

With the price of BTC surpassing $10k over the past week, around 95% of bitcoin UTXOs are now in a state of profit - in other words, the price of BTC has increased since these UTXOs were created.

To see the extent to which these UTXOs are in profit or loss, we can look at bitcoin's UTXO Realized Price Distribution, which shows the distribution of UTXOs created above and below the current price. This chart shows that a majority of UTXOs are indeed in profit, while very few are in loss.

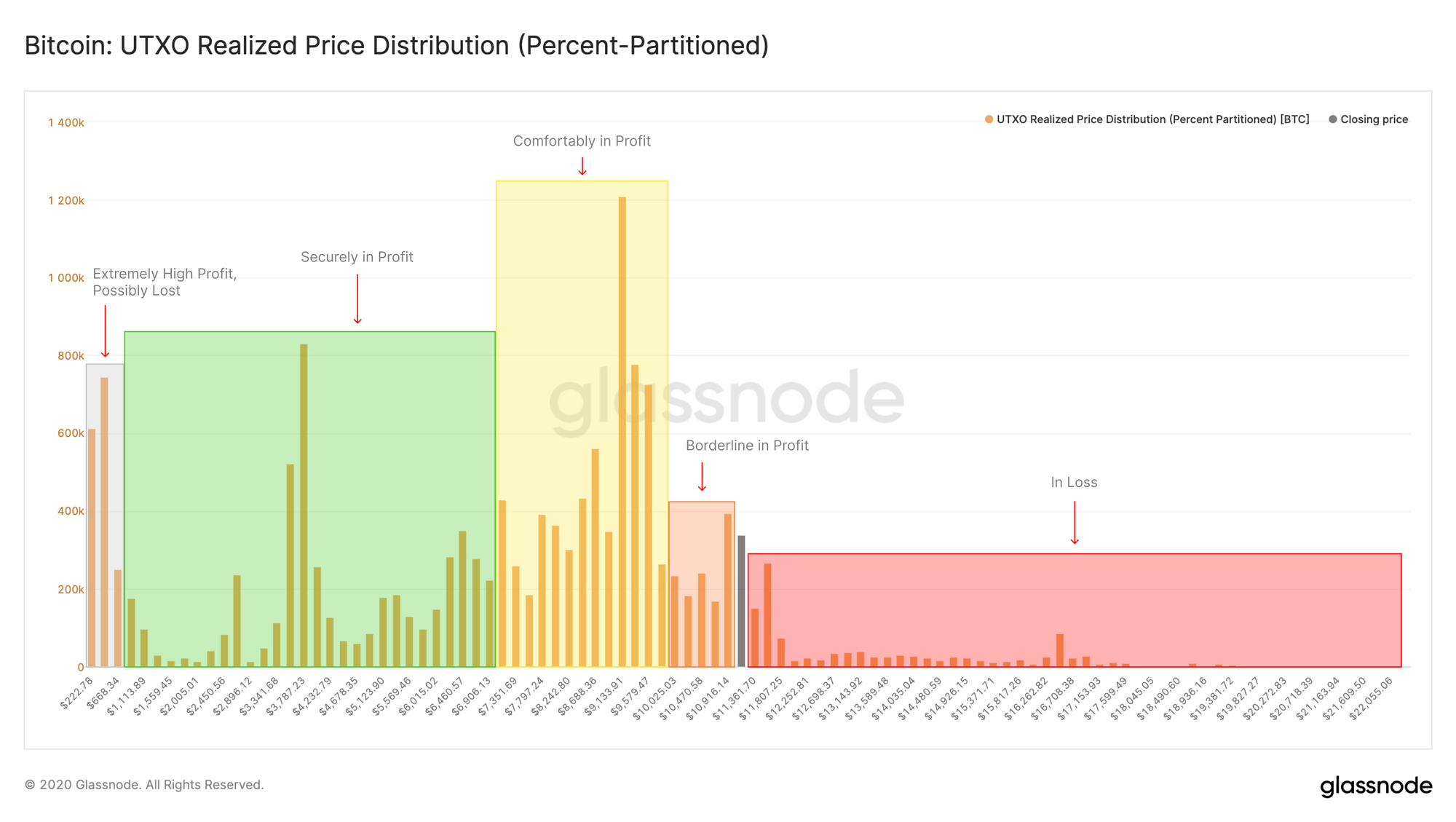

Breaking this chart down further, we see that a small number of UTXOs are borderline in profit (those between ~$10k and the current price), while a larger portion are more comfortably in profit, having been created between $6000 and $10,000.

This is optimistic, because it means that a large portion of BTC holders are sitting comfortably in profit, but have chosen not to sell yet, implying confidence that the price will continue to rise.

However, as mentioned above, investors should temper this optimism and stay informed about movements in global financial markets, as these have proven to be heavily correlated with cryptocurrencies as of late. If you haven't already, sign up to our email newsletter to receive the latest updates on the state of BTC and other crypto markets.

We want to make our Glassnode Insights content as high-quality and relevant as possible. In order to tailor our articles to our readers, we have published a short survey to get your feedback.

Complete the survey and be in to win a free Advanced subscription to Glassnode Studio for a year. The winner will be informed via email on 24 August.

Are you subscribed to our Glassnode Insights mailing list? If not, sign up here to receive The Week On-Chain in your inbox each week.

Product Updates

Metrics and Assets

- Price Drawdown From ATH (all assets) - The percent drawdown of the asset's price from the previous all-time high.

- Miner Revenue (Block Rewards) (BTC) - The total amount of newly minted coins (i.e. block rewards) over time.

- Miner Unspent Supply (BTC) - The total amount of coins in coinbase transactions that have never been moved.

- Miner Balance (Stacked) (BTC) - The total supply held in miner addresses, broken down by the most prominent miners.

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter