Ethereum's Staking Issue

The Ethereum community is debating a change to the ETH monetary policy, following a proposals aimed at constraining the rapid expansion of the staking pool. This is motivated by a surge in demand for Liquid Staking and Restaking protocols.

Executive Summary

- The Ethereum community is currently engaged in a heated debate regarding the ETH monetary policy following proposals to reduce the ETH issuance rate.

- New innovations such as Liquid Staking, Restaking, and Liquid Restaking have introduced additional yield opportunities, significantly boosting staking demand.

- Concerns are that the increasing prevalence of staking derivatives may dilute Ethereum's function as money, and shift the governance power of the network.

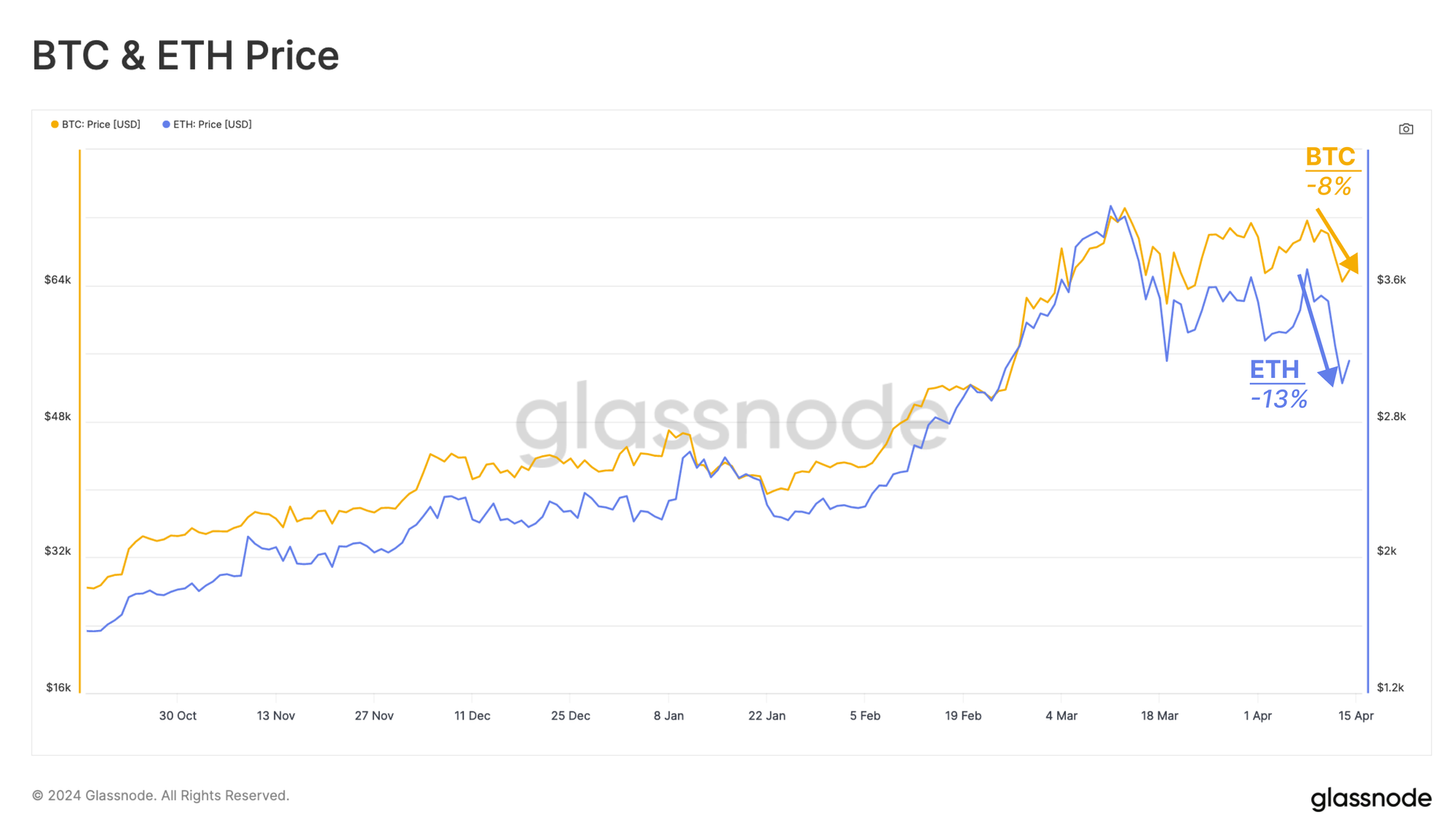

This weekend saw an uptick in geopolitical tension in the Middle East, culminating in drone attacks on Israel last Saturday. Given cryptocurrency markets are the only assets that trade over weekends, this triggered a notable downturn in digital asset markets. BTC fell by -8%, while ETH prices declined by -13%. Markets recovered slightly, but have continued trading sideways to downward, with investors cautious of longer term impacts.

In the Ethereum ecosystem, there has also been a significant ongoing debate regarding potential changes to its issuance rate. This discussion was sparked when proposals from two Ethereum researchers were made, suggesting to slow ETH issuance, and hence reduce staking rewards.

The overarching aim is to reduce the growth of the staking pool, in a bid to manage the rising dominance of new innovations such as Liquid Staking and Restaking, and protect Ethereum's function as money.

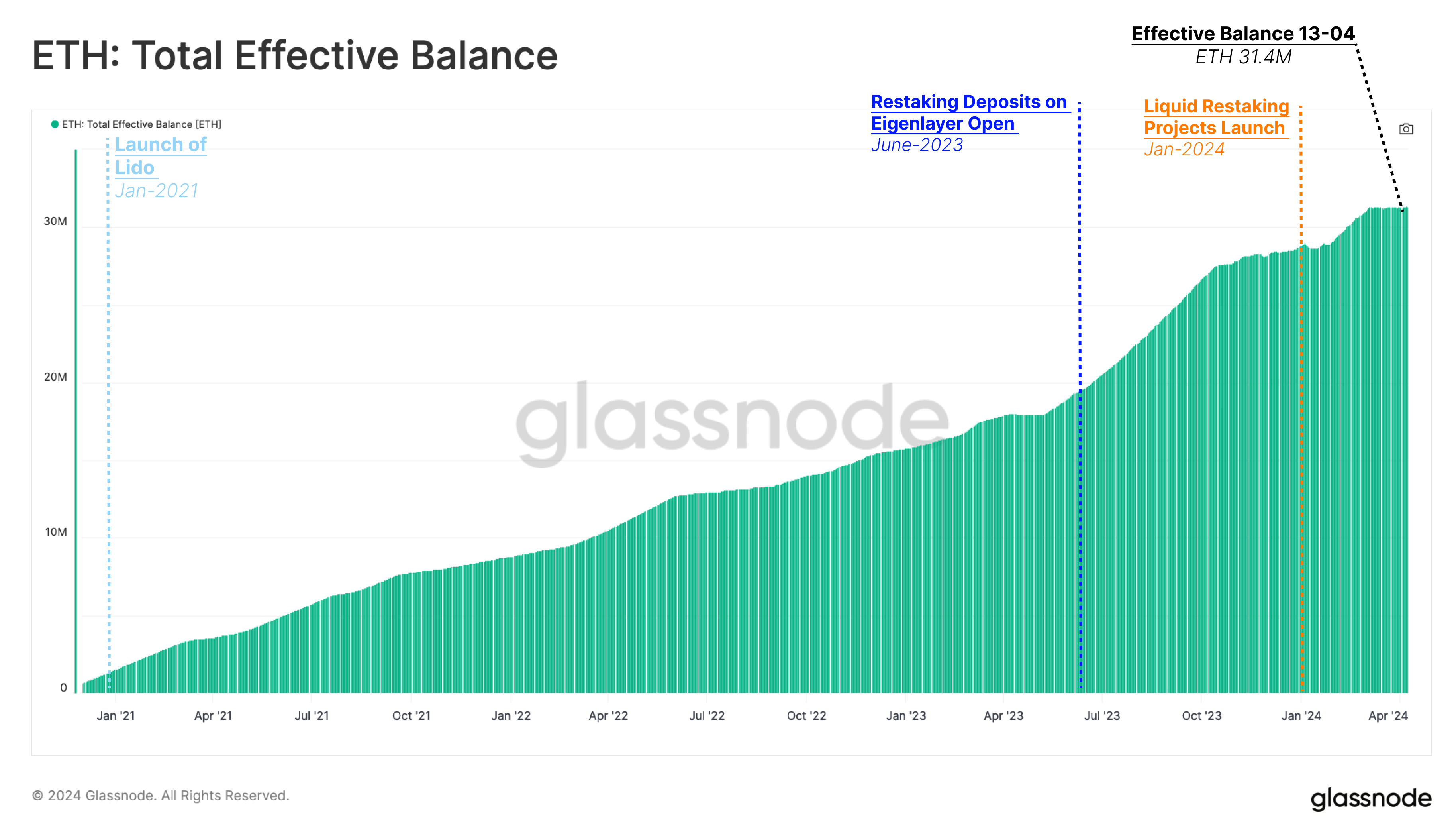

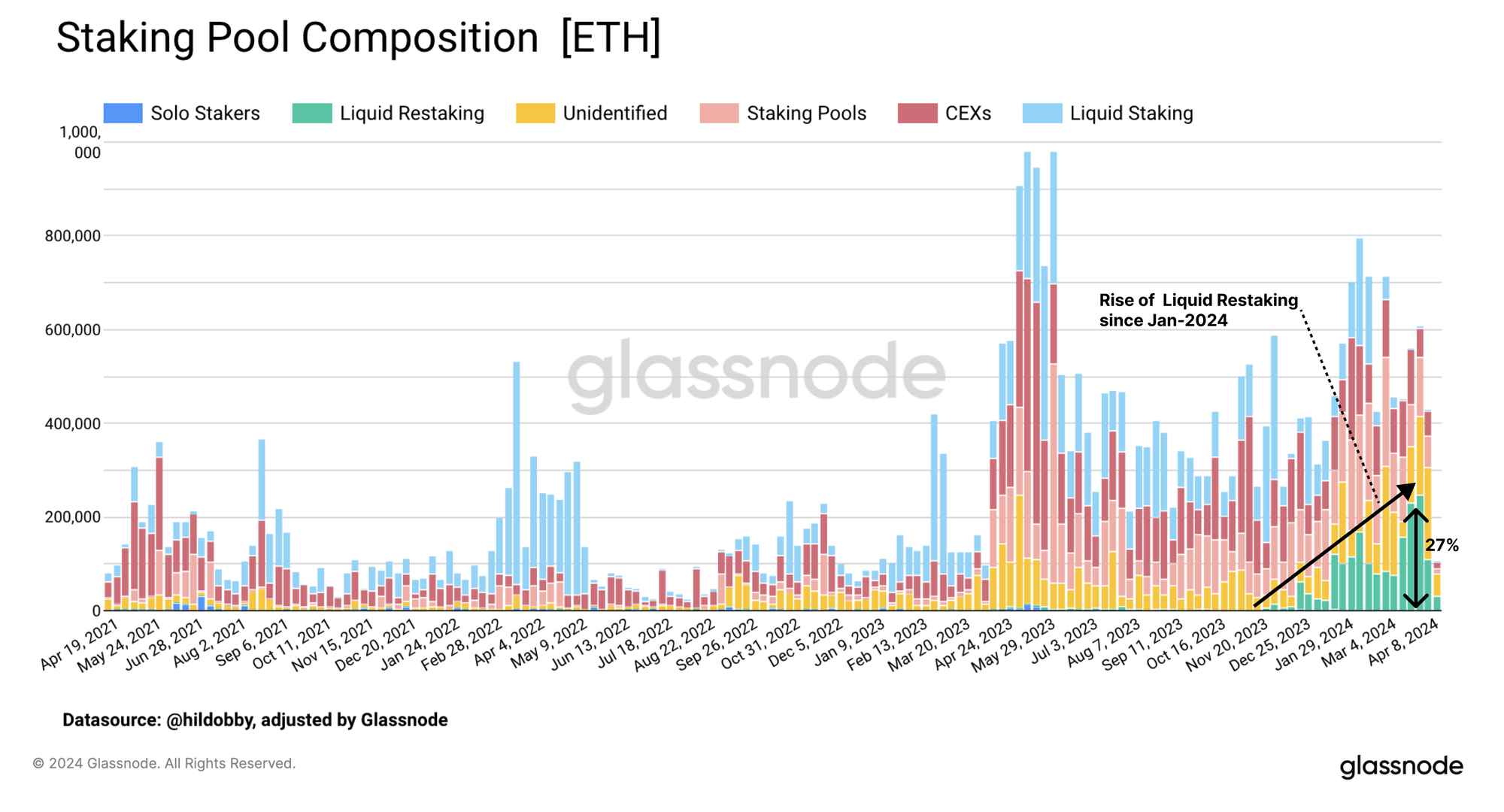

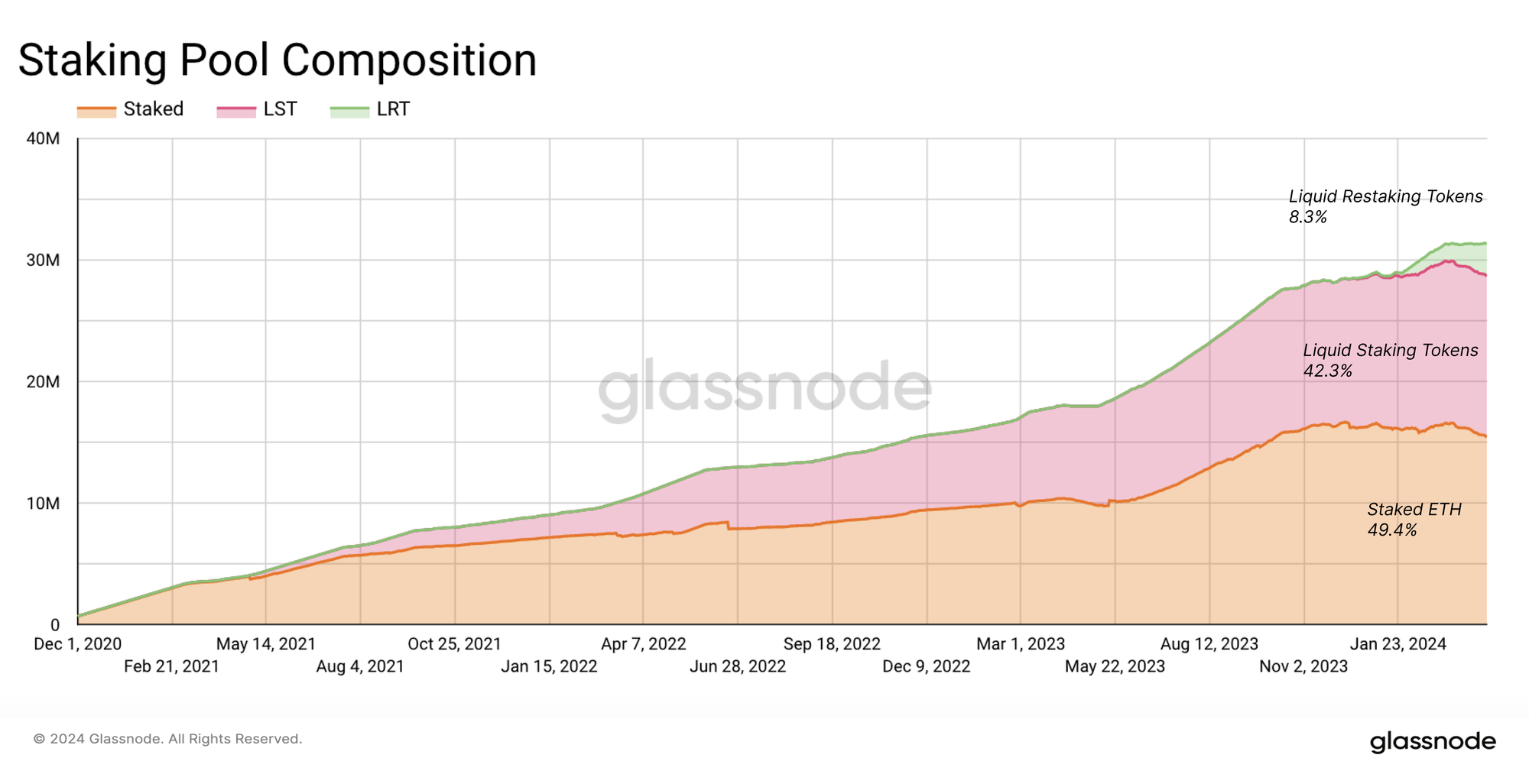

Staking on Ethereum has experienced unexpectedly high demand, with the amount of ETH actively participating in Ethereum's Proof-of-Stake currently stands at 31.4M ETH (~26% of the total supply). We can see that the growth rate of staked ETH is picking up in recent months. This is particularly following the introduction of new innovations such as the Eigenlayer Restaking protocol in June 2023, and the Liquid Restaking protocols in early 2024.

Distorted Incentives

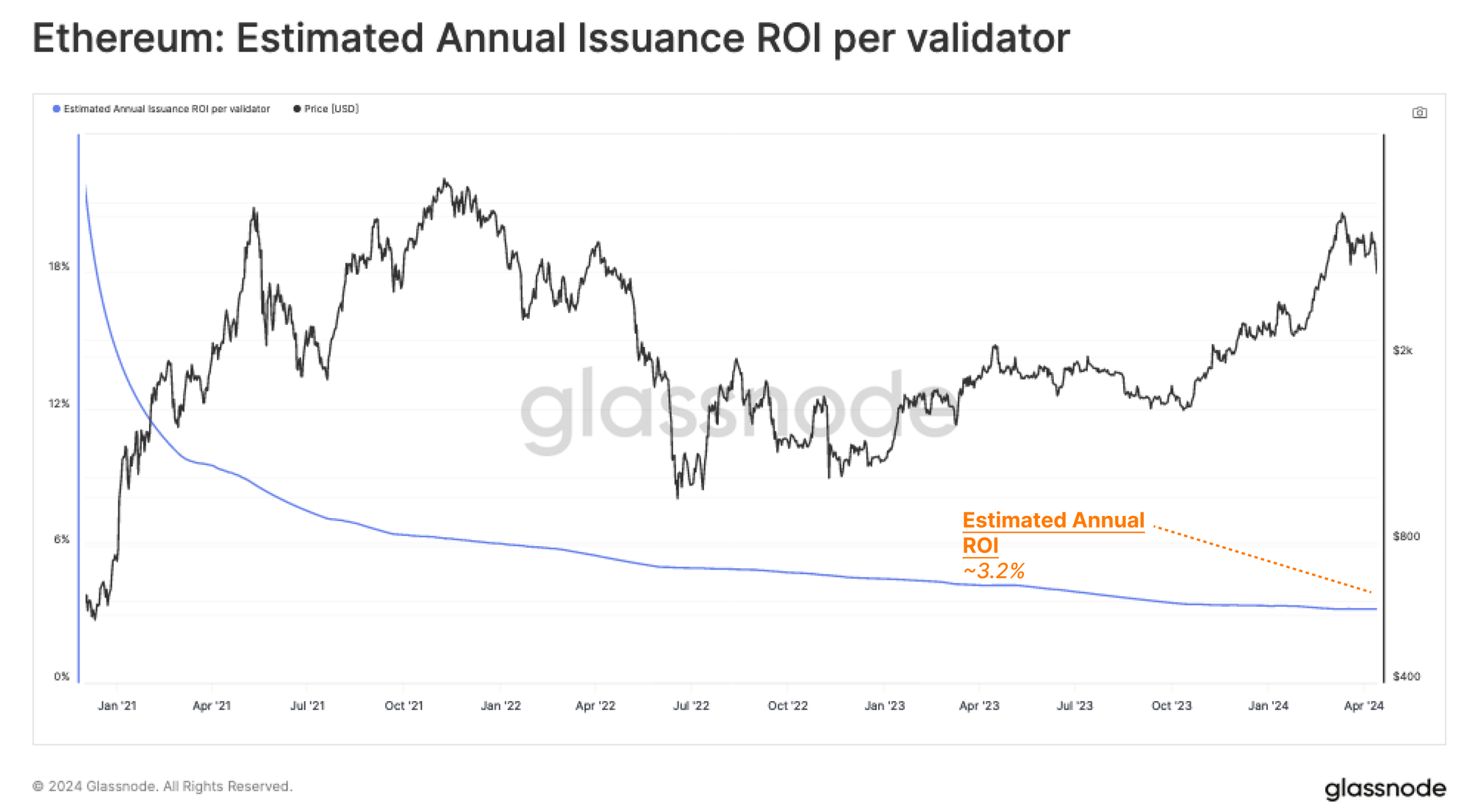

Originally, the Proof-of-Stake protocol was designed such that as more ETH is staked, the marginal revenue for each validator declines. This mechanism self-regulates the size of the staking pool, and with 31.4M ETH currently staked, the estimated annual APY per validator stands at around 3.2%.

However, new developments such as yield sourced from MEV, Liquid Staking, Restaking, and Liquid Restaking have introduced additional opportunities. As a result, the incentive and demand for users to stake is increasing beyond the original vision.

If we categorise staked deposits by their origin, it reveals a notable increase in ETH staked by Liquid Restaking providers since the beginning of the year. These protocols now account for 27% of newly staked ETH, whilst new deposits by Liquid Staking providers have dwindled since mid-March.

Restaking was introduced last year by the protocol EigenLayer. EigenLayer enables users to deposit their staked ETH or Liquid Staking Tokens into EigenLayer smart contracts. These assets can then be used as security collateral by other services such as rollups, oracles, and bridges. Restakers earn additional fees from these services, in addition to their native staking yield from the Ethereum mainchain.

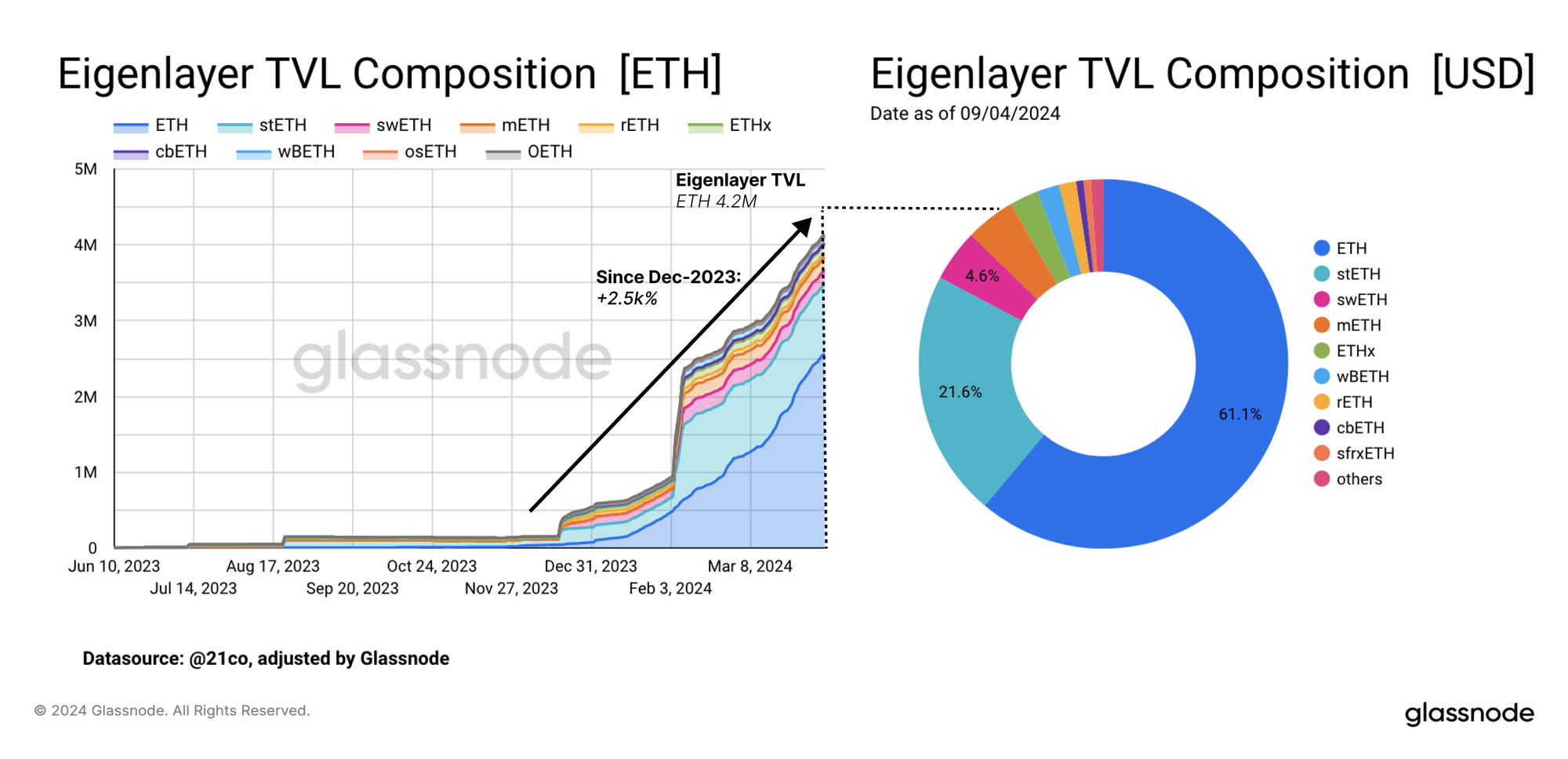

Staking on Eigenlayer has surged since the protocol's launch, with the total value locked (TVL) now over 14.2M ETH (~$13B). These high levels of demand for restaking is also partly due to the anticipation of an Eigenlayer airdrop campaign.

Over 61.1% of Eigenlayer's TVL comes from native staked ETH, while the remainder is made up of Liquid Staking Tokens, with Lido's stETH leading the pack, making up for 21.5% of the total TVL.

The Rise of Liquid Restaking

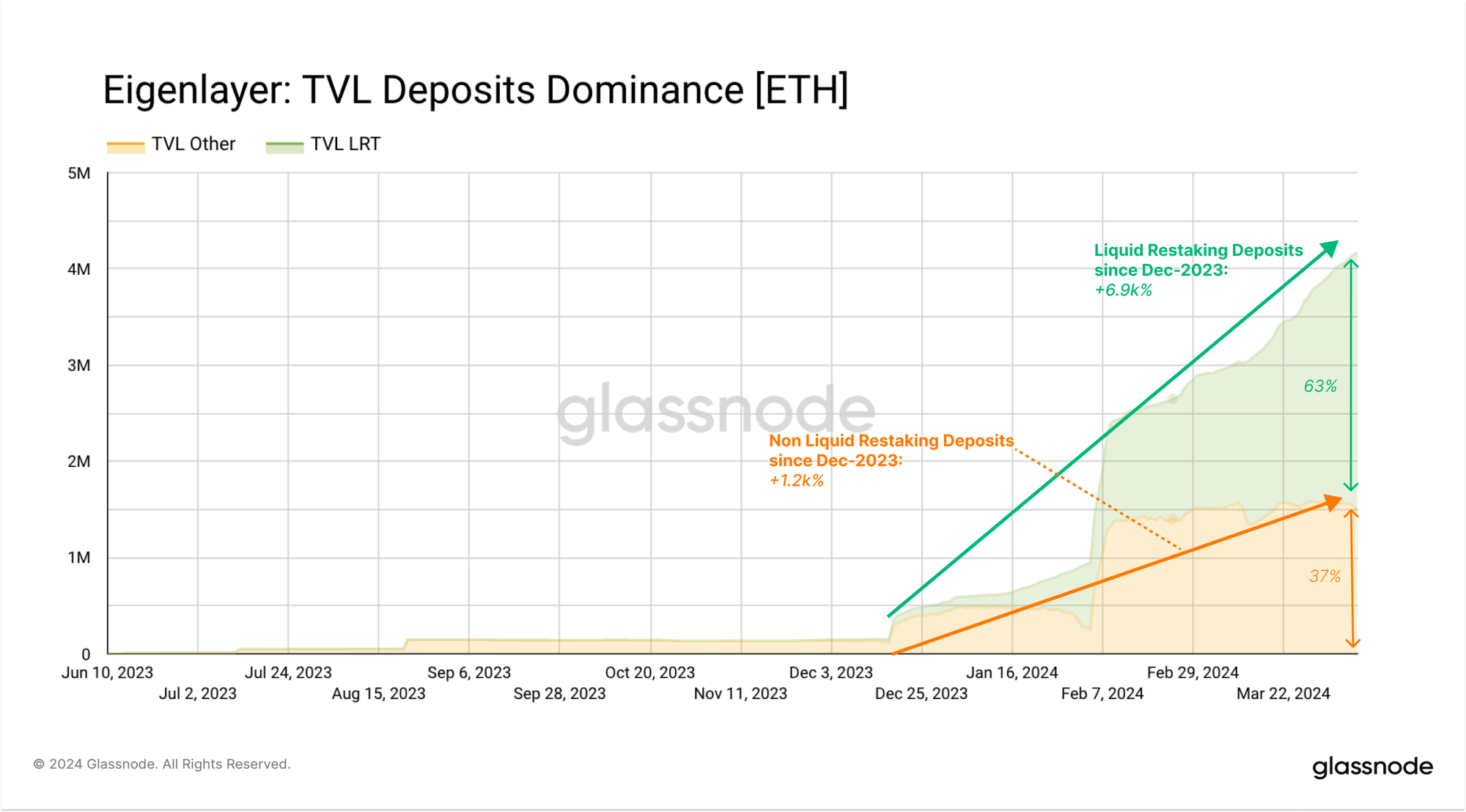

Liquid Restaking operates much like Liquid Staking, allowing users to restake their tokens and receive a liquid representation of their restaked assets in return. This is an option that seems to be preferred by Eigenlayer users, with 63% of deposits into Eigenlayer made through Liquid Restaking providers.

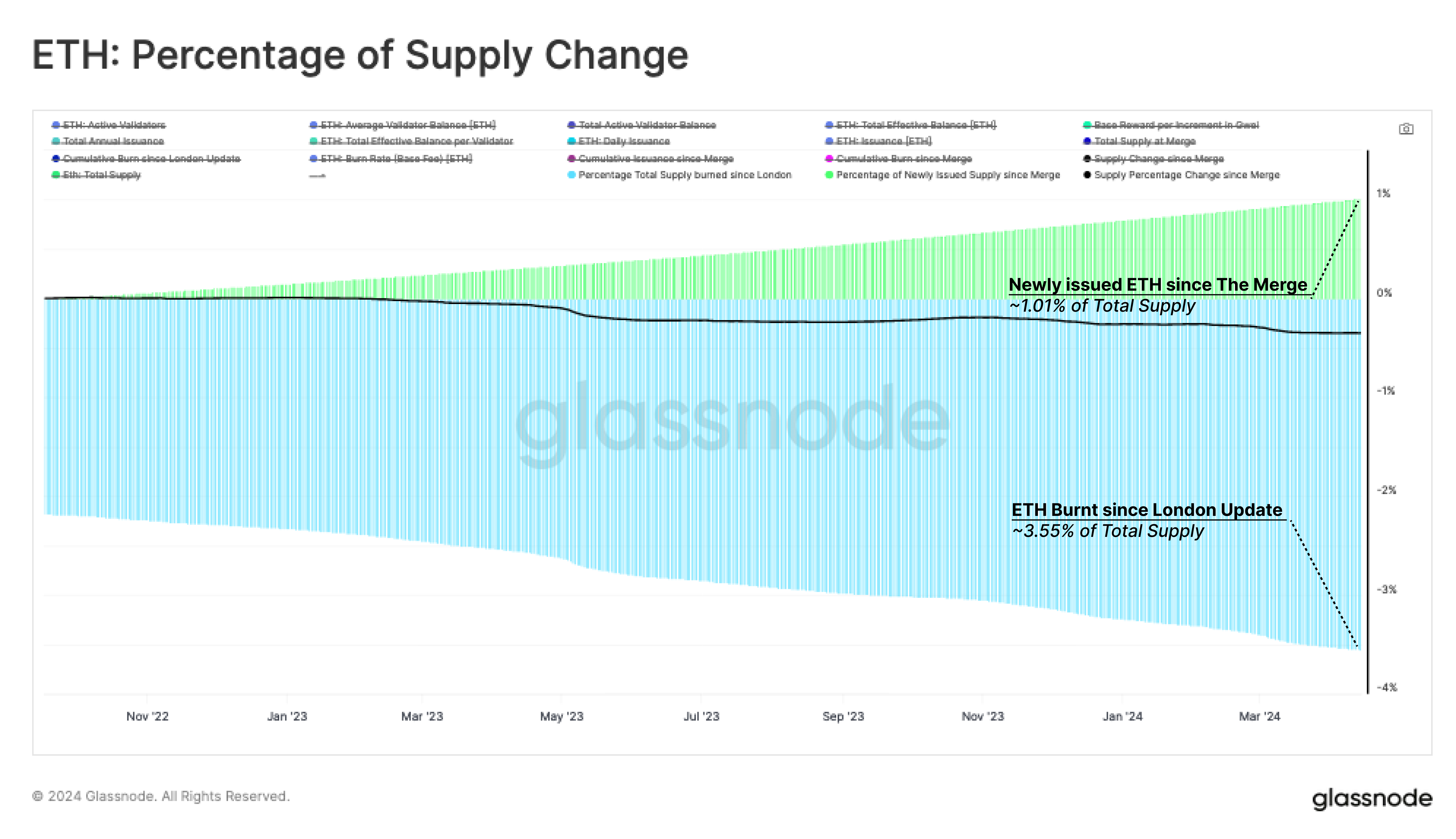

Researchers at the Ethereum Foundation have raised concerns about the high and growing staking rate. Whilst staking more ETH yields a lower reward rate per validator, the total rewards paid out may still contribute to inflation if the total amount of staked ETH becomes substantial. Currently around 1.01% of the total ETH supply consist of newly issued tokens since The Merge, although this is offset by ~3.55% of the supply burned over the same time.

As more ETH moves into staking pools, the impacts of inflation starts to impacts an increasingly small number of ETH holders. In other words, there is a wealth transfer taking place from a shrinking pool of non-staked ETH holders, towards a growing pool of staked ETH holders.

Over time, this 'real yield' component risks making holding ETH less appealing, and could erode ETH's function as a monetary asset within the Ethereum ecosystem. Instead, the role of 'money' could migrate towards Liquid Staking Tokens like stETH, or even to Liquid Restaking Tokens, which function as supercharged yield-bearing instrument. A side-effect of such a development would be the projects which issue these derivative tokens gaining an outsized influence over the governance and stability of Ethereum's execution and consensus layers.

Today, we already note that half of the staked ETH is provided through those derivative projects. 42% of the staked ETH is re-liquified by Liquid Staking Tokens, and an additional 8% through Liquid Restaking derivatives.

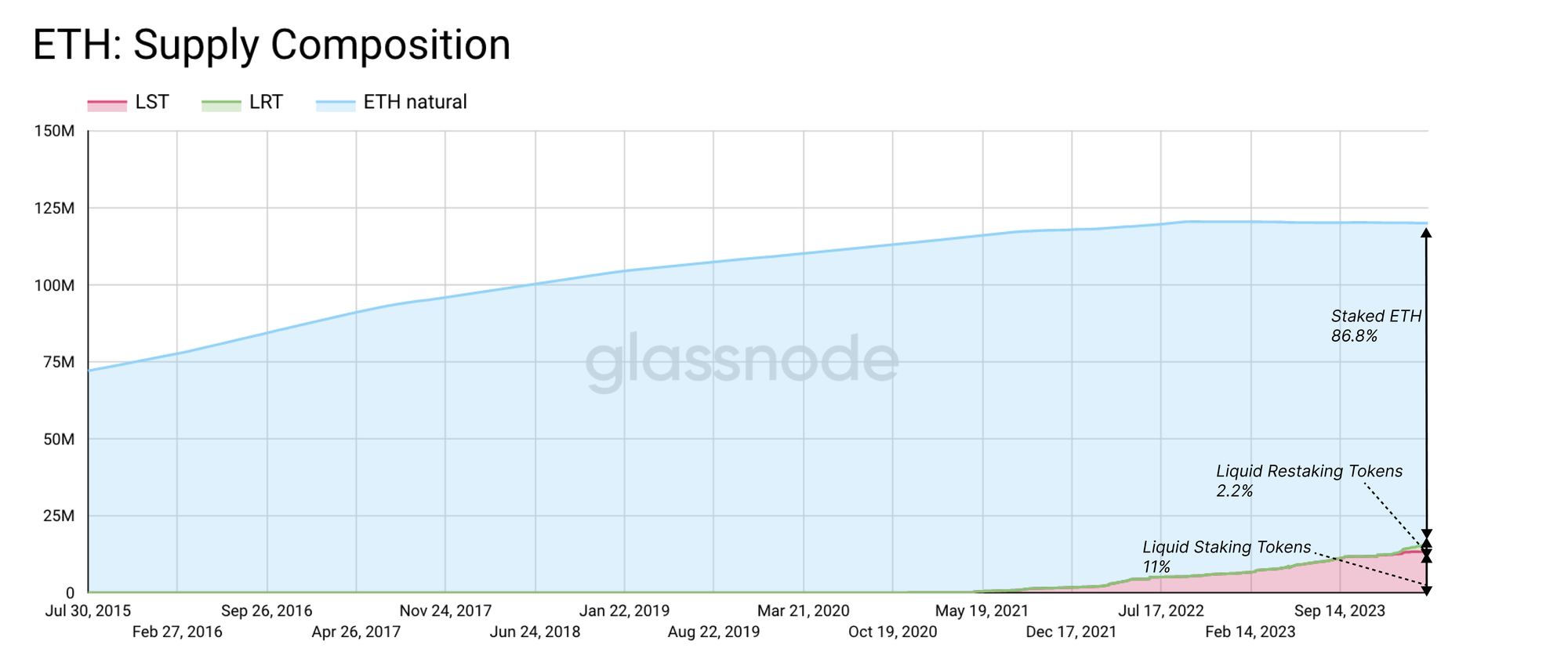

The Ethereum researcher;s concern that also applies to Ethereum's moneyness. Of the total ETH supply, 11% is held in Liquid Staking Tokens and 2.2% in Liquid Restaking Tokens.

The proposals made by the Ethereum Foundation aim to limit and constrain annual issuance, thus reducing the incentives for new stakers to enter the pool, and hopefully slowing staking growth rates.. The proposals have received significant pushback from the community, with many arguing that no change is currently necessary, and challenging the need to update the ETH monetary policy once again.

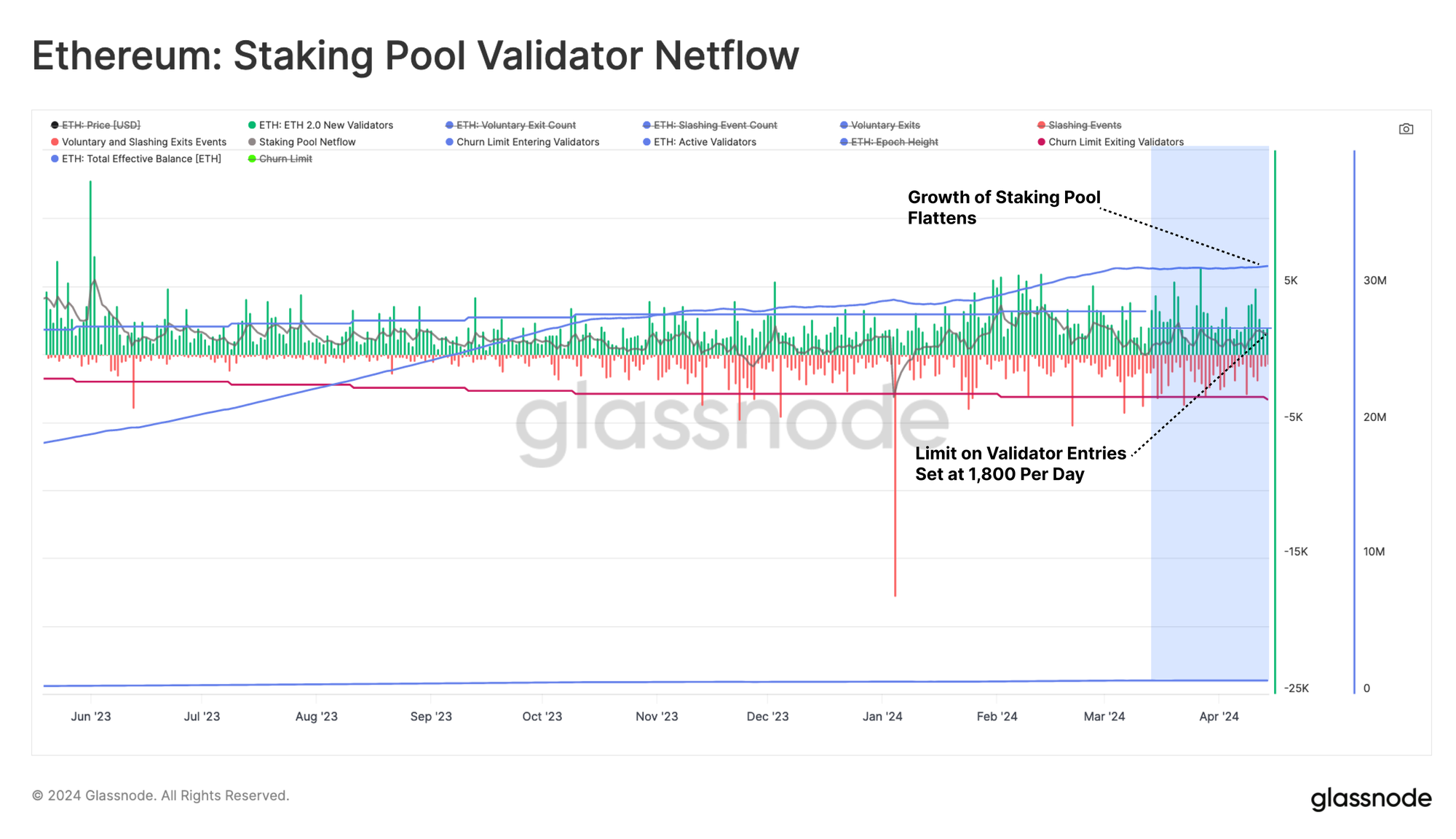

However, he growth of the staking pool was already constrained slightly during the last Decun upgrade. The hardfork introduced a limit of 8 new validators per 6.4-minute epoch, and replaced the churn limit function. This effectively capped the number of validators and the amount of stake that can enter the staking pool, providing very mild relief for the time being.

Summary and Conclusion

The Ethereum ecosystem is debating proposed changes the ETH issuance rate, aimed at slowing down the expansion of the staking pool. The goal is to mitigate the influence of innovations like Liquid Staking and Restaking, which are acting to enhance the yield opportunities, and thus demand from users.

The surge in staking—now at 31.4M ETH or roughly 26% of the total supply—has been driven by Restaking protocols like Eigenlayer. These developments are increasingly leading to the proliferation of of liquid staking tokens, which over the long-term may start to undermine Ethereum's role as a money asset. The Ethereum Foundation has suggested capping annual issuance to slow the growth of the staking pool, however these proposals have been met with significant resistance from the community.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies. Please read our Transparency Notice when using exchange data.

- Join our Telegram channel

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

- For automated alerts on core on-chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter