DeFi Uncovered: Activity on DeFi Stalls

Despite activity on Ethereum DeFi stalling, protocol liquidity and product releases continue to drive the ecosystem forward.

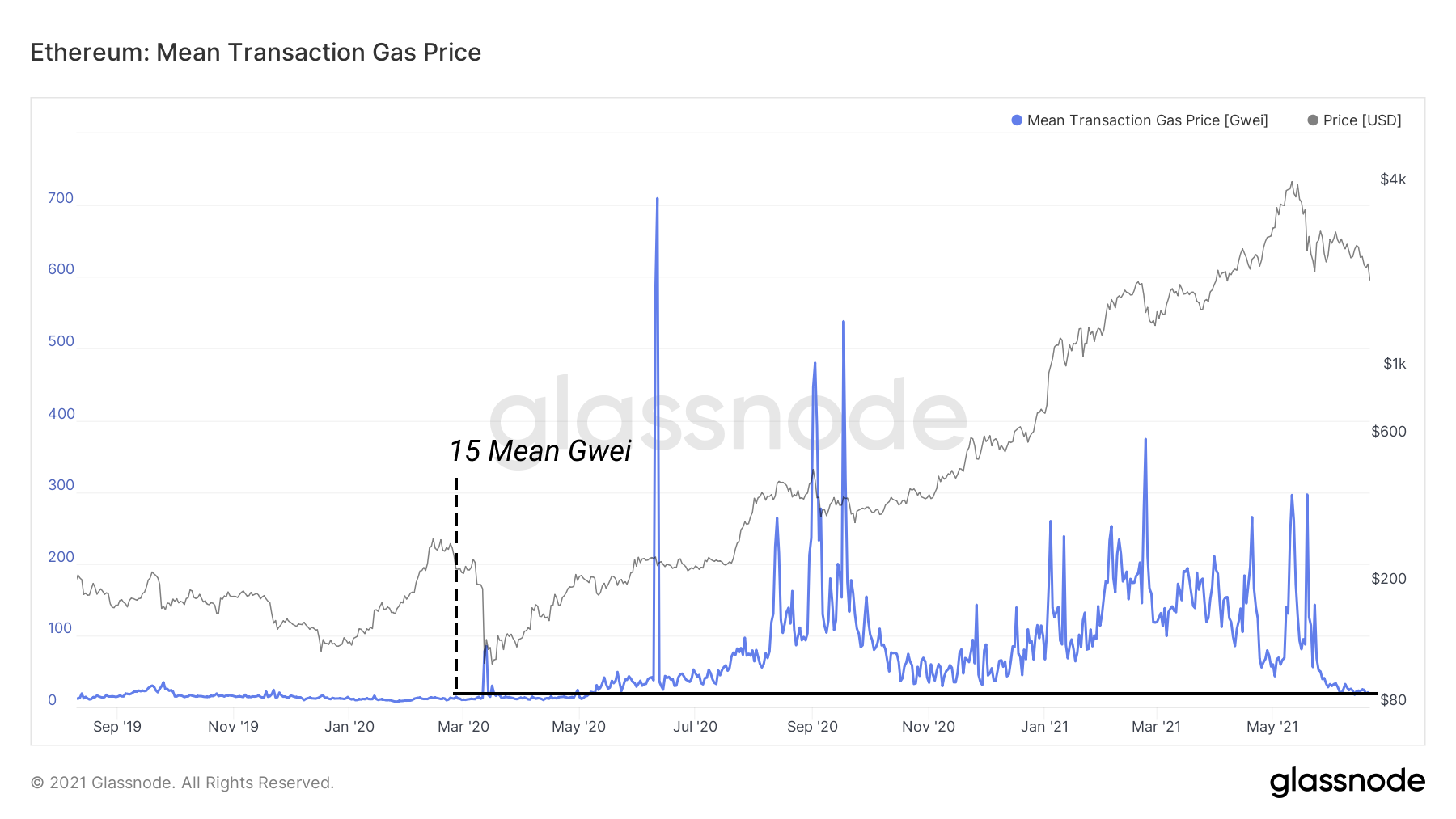

Ethereum and DeFi token prices continue to show weakness as activity on DeFi's main chain grinds to a halt. Gas prices have reached lows not seen since the beginning of DeFi Summer in 2020. As EIP-1559 knocks on Ethereum's door, it has prompted many to reconsider the magnitude of ETH deflation given token burns scale with usage.

Among the bearish sentiment, liquidity remains strong on-chain as core DeFi participants seek out the highest yields in stablecoins, accumulate governance tokens, and continue to hold spot ETH. Long-term ETH holders appear to remain strong-willed. Additionally, more products than ever are coming to market as dozens of VC-funded projects reach the end of 3-12 month development cycles.

To keep up to date with the latest Glassnode analysis of the DeFi ecosystem, be sure to subscribe to this DeFi specific content series here.

Activity Slows Sector Wide

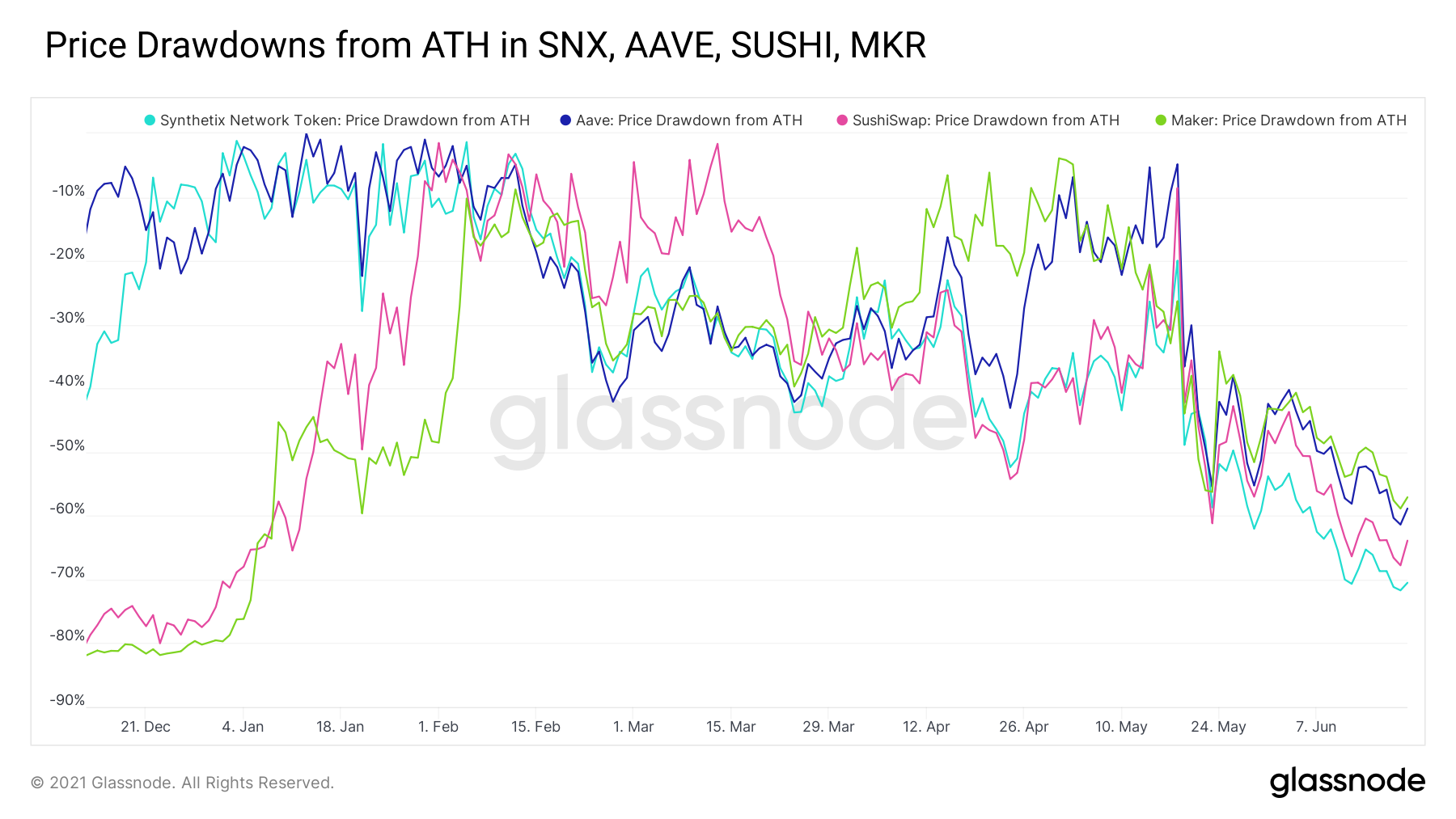

Activity has stalled from previously exponential growth as participants sit mostly idle during sideways moves. We can see brief bursts of activity during price volatility, however it quickly slows down as prices stabilize. Price drawdowns have continued to deepen across most major governance tokens.

Gas prices have returned to early DeFi Summer levels from 2020, so much so that traders willing to deploy patience can even get away with a single digit Gwei gas fee during off-hours.

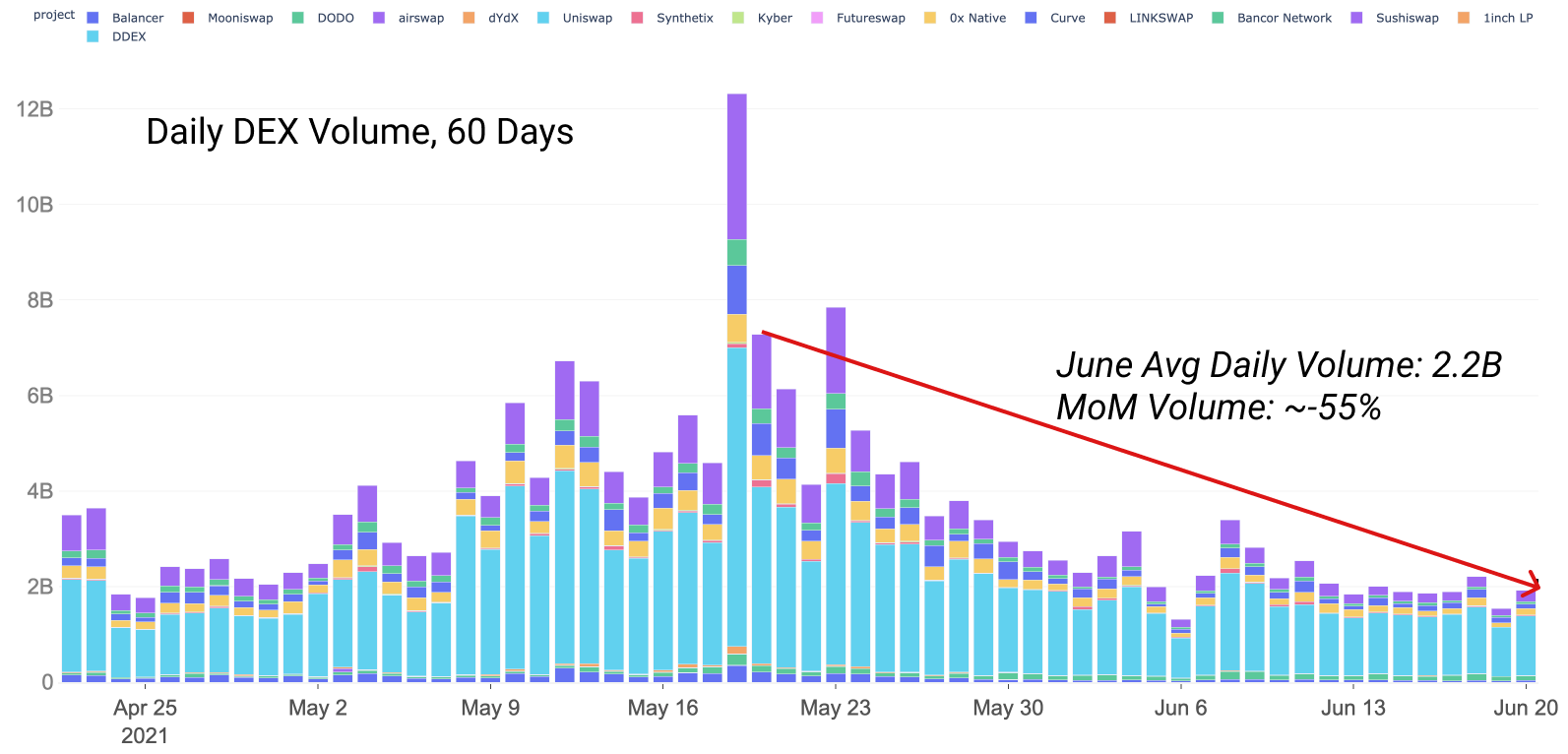

Throughout the 2021 bull run, DEX volume dominated gas consumption. This is still very much the case with Uniswap keeping its crown as top consumer of block space, even as volume across DEXs decline. Despite volumes declining, the year over year growth in monthly DEX volume remains up 5600%+. Volume has consolidated around the $2B daily level, with significant spikes during periods of heightened volatility, silence otherwise.

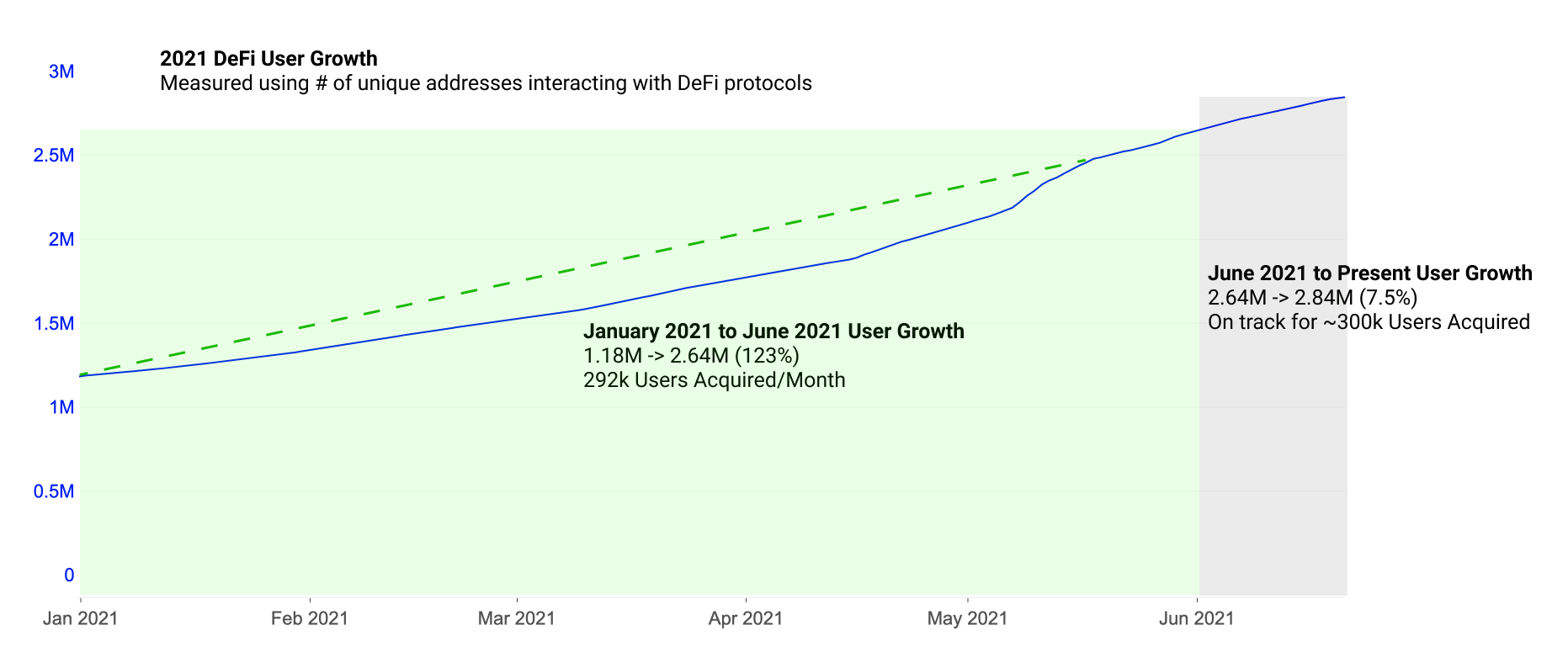

User growth (address growth) has stayed relatively steady, slowing down slightly from 18% month over month growth in April and 25% in May. In June, user growth is on pace to do ~12%. High user growth can be a bullish metric for holders as it is a key metric for adoption, but also a key metric for identifying if there are marginal token buyers. While growth by total user numbers remains strong, growth as a percentage is flattening the curve.

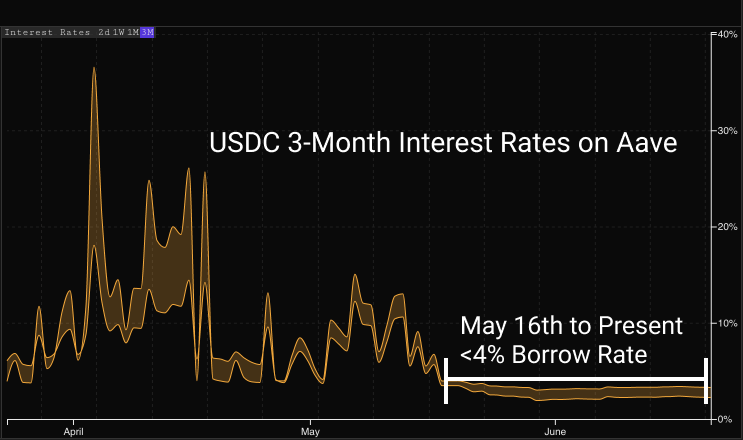

Yields have started to contract in major lending markets as demand for leverage on-chain slows. Among this decline in yields, low volatility interest rates have arisen. These low rates aren't all bad; they've given both stablecoin farmers and short sellers access to cheap borrow capital, something mostly unheard of during the bull run. As long as liquidity stays strong and demand for borrow lessens, yields will continue to stay low in borrow/lend markets.

This reflects the relationship between utilization and yields which we explored in our analysis on The State of DeFi.

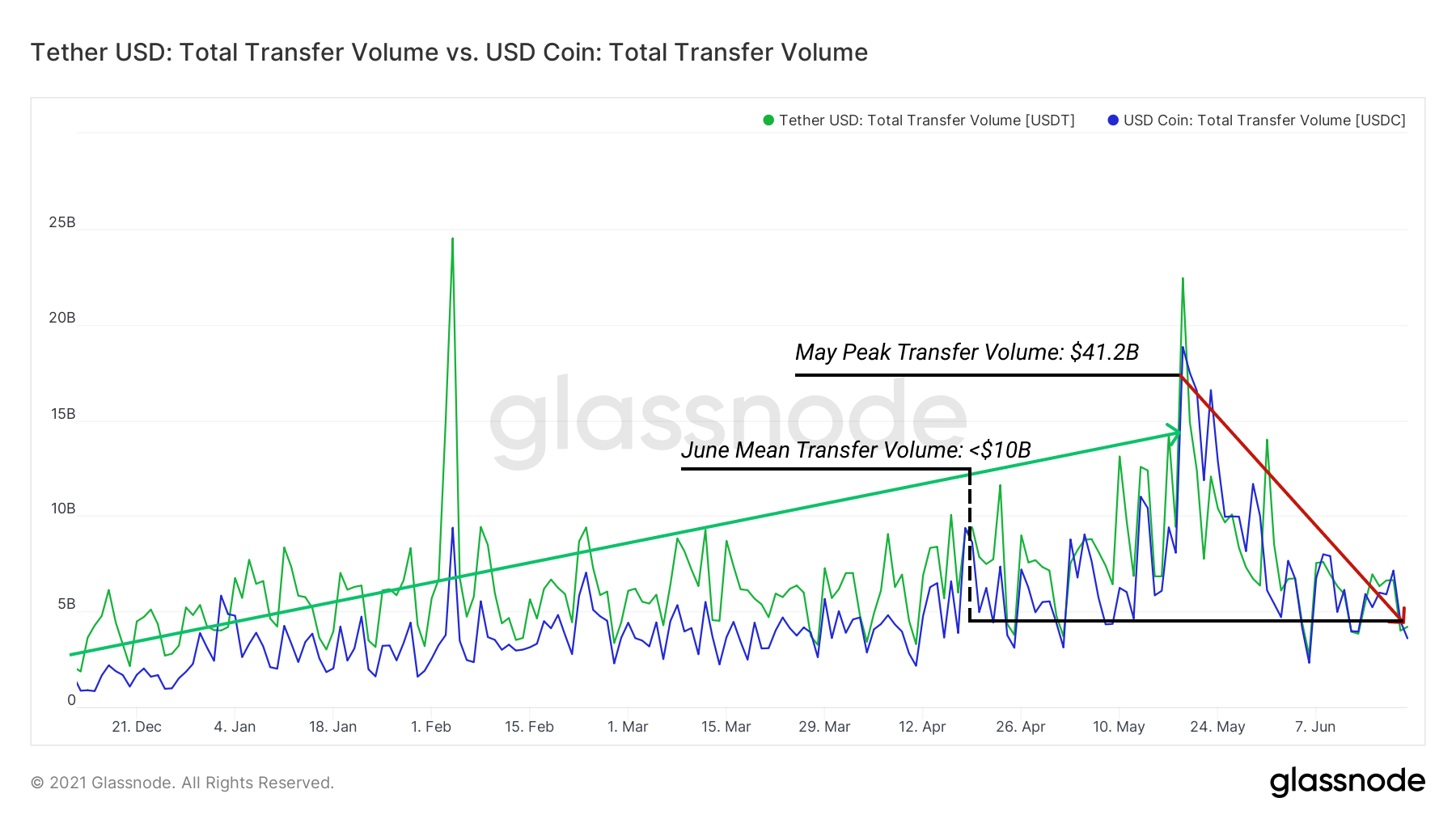

Stablecoin transfer volumes have ended an extended period of demand and increased volume. USDT transfers have historically been a top 10 gas consumer on Ethereum as holders of all size popularly use USDT to move assets across exchanges without taking on price volatility risk.

DeFi Pushes Forward

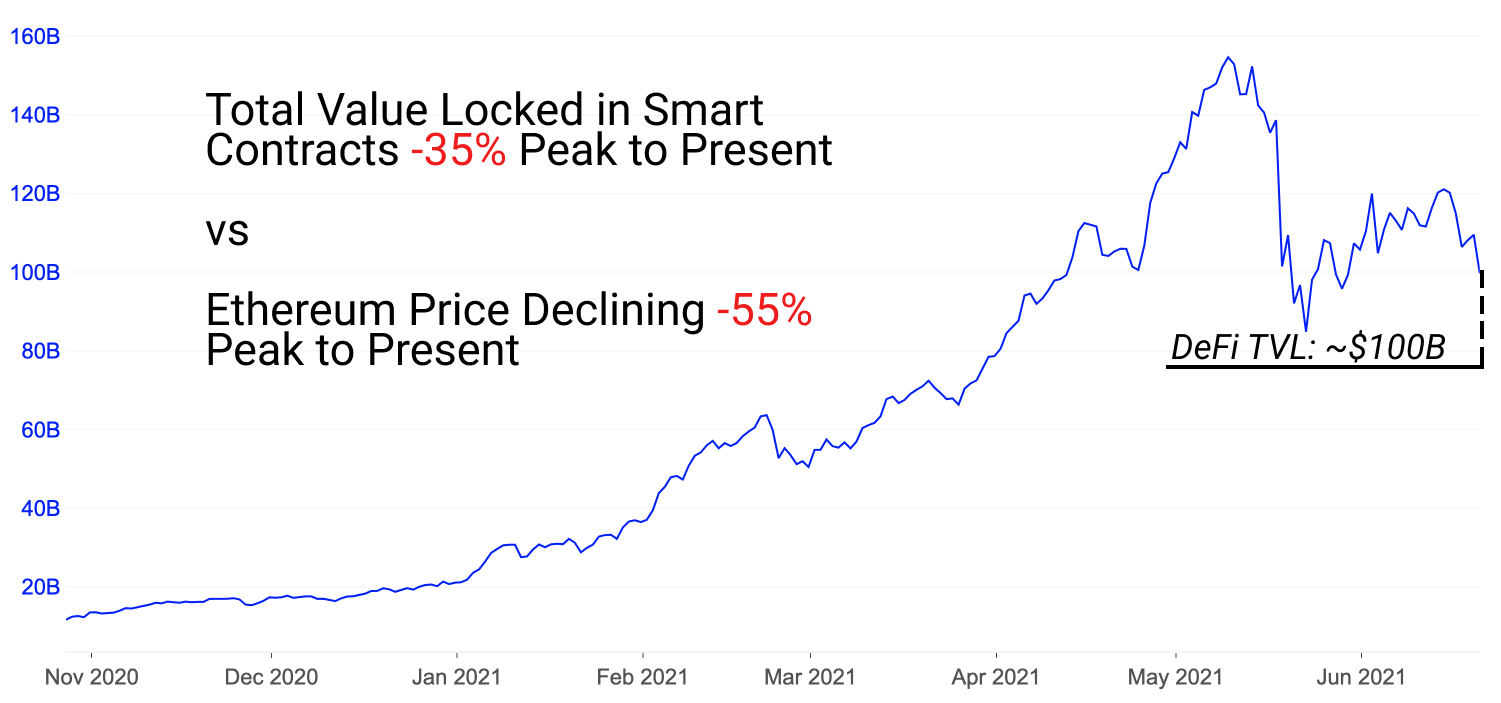

Many predicted a wide-scale drying up of liquidity and tightening of risk-free yields should a bear market arrive. Thus far, liquidity has remained strong during the correction as prices have outpaced total liquidity.

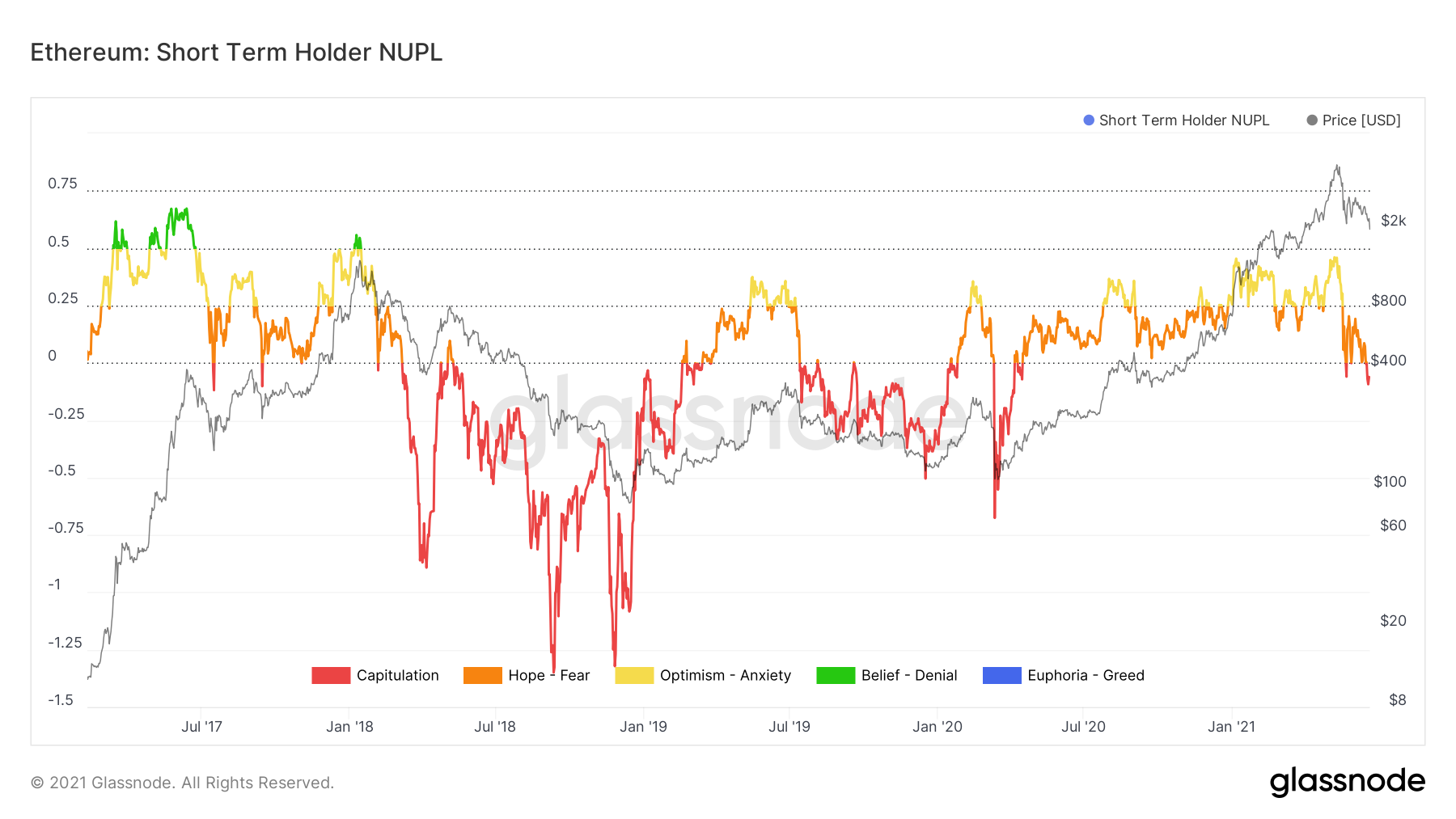

Short-term ETH holders (coins unmoved for <155 days) are currently watching their unrealized gains evaporate, as the net unrealized profit and loss metric enters the capitulation zone. This showcases how owners of recently purchased ETH tokens are seeing paper gains, become paper losses. After almost hitting 46% of the market cap in unrealized gain, short-term holders are now holding an aggregate paper loss of -25% of the market cap.

Given the magnitude of this STH-NUPL decline, we can conclude that significant volumes of ETH were purchased on the run up from around $2.2k to the ATH, all of which are now underwater. The risk is that these investors could liquidate as prices rally into their cost basis (STH-NUPL = 0). Conversely, if conviction remains high, they may well hold throughout whatever volatility comes next.

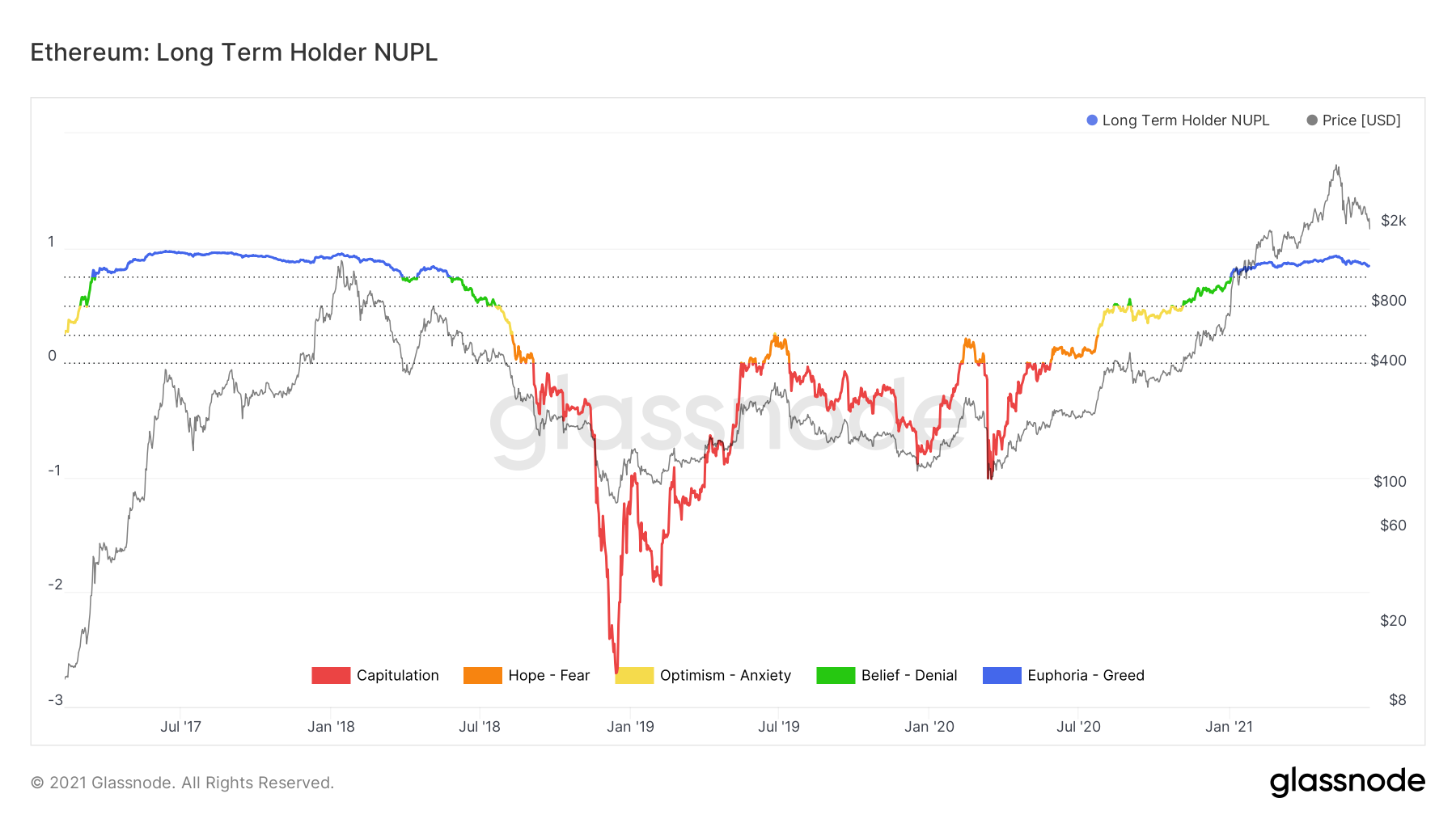

Long-term holders (>155 days) remain firmly in profit, holding paper gains equivalent to around 80% of the market cap. The LTH-NUPL remains flat as most long-term holders remain profitable, though should the market continues downward, they will observe their unrealized gains fall. Note the bounce in Jan 2018 which was followed by an eventual capitulation as holders became fatigued watching their paper gains disappear.

For now, long-term holders remain profitable, highlighting just how impressive the 2020/2021 run has been for many ETH holders. The conviction of these holders will be tested should the market trend downward.

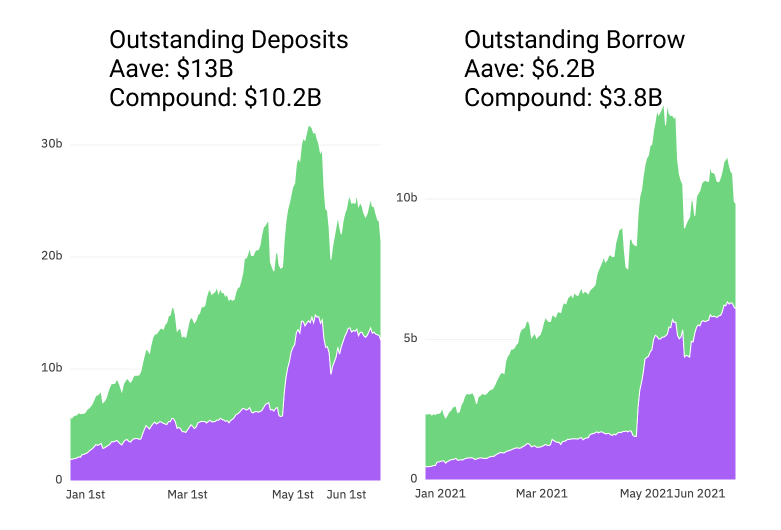

Unlike previous times of capitulation, many of these long-term holders can now deploy their assets in DeFi. ETH is widely deposited in lending protocols like Aave and Compound, where it currently sees over $4B outstanding desposits in Aave and Compound.

These protocols allow them to borrow stablecoins against their deposited ETH, which can then be used to garner attractive risk-off yields or speculate on token prices. These holders can accumulate governance tokens, grow their stablecoin balances, or buy into large dips, all while keeping the exposure they have to ETH as long-term lenders. Deposits and borrow in Aave and Compound remain strong.

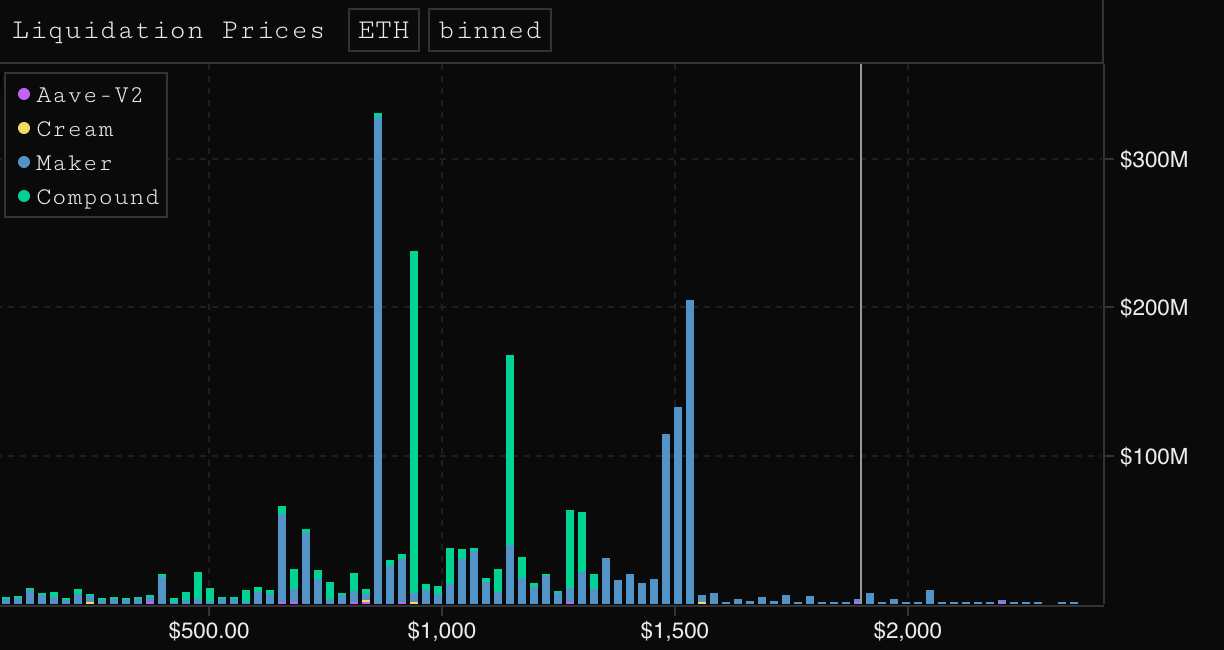

As we enter further volatility, it's interesting to see where the large borrowers have liquidation levels. Many of these are automated positions that will close when health factors reach dangerous levels. As prices reach liquidation levels additional collateral, closing position, or tolerating liquidation are on the menu for borrowers. As an example, here's a view for liquidation levels of ETH lenders, binned by price level for liquidations; note the large Maker positions at the $1,500 level and large Compound positions all the way through the $1,000s.

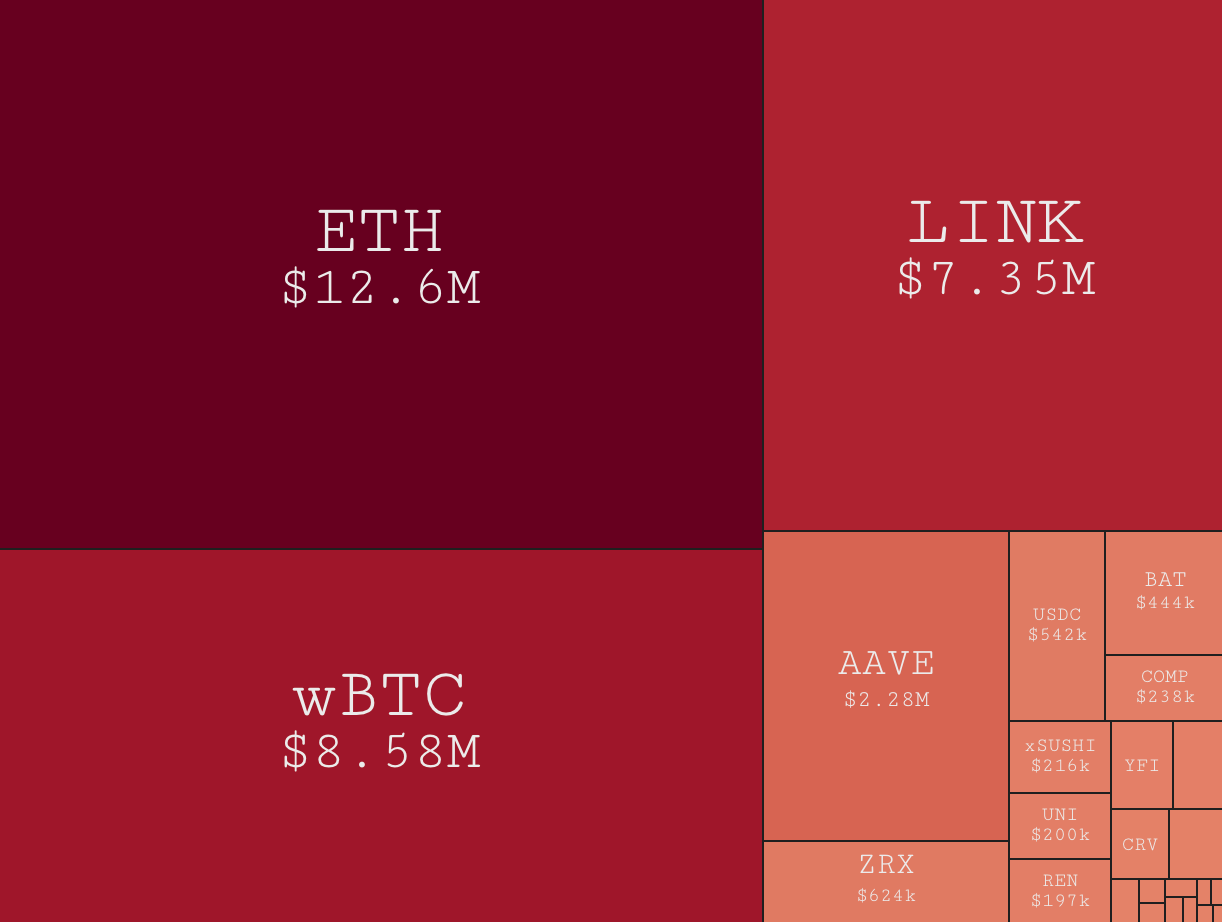

It's also interesting to see what assets are getting liquidated at highest rates, see the recent week of LINK liquidations as an example.

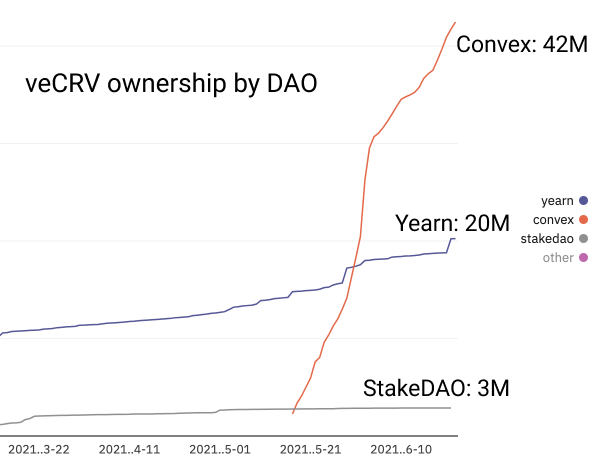

Stablecoin yield farmers remain healthy profiteers during downturns. The competition wages on in the Curve Finance ecosystem as Yearn, Convex Finance, and Stake DAO jostle for deposit dominance. veCRV owned by the protocol gives us a flavor of how many tokens each protocol are purchasing and locking up to boost rewards for their users.

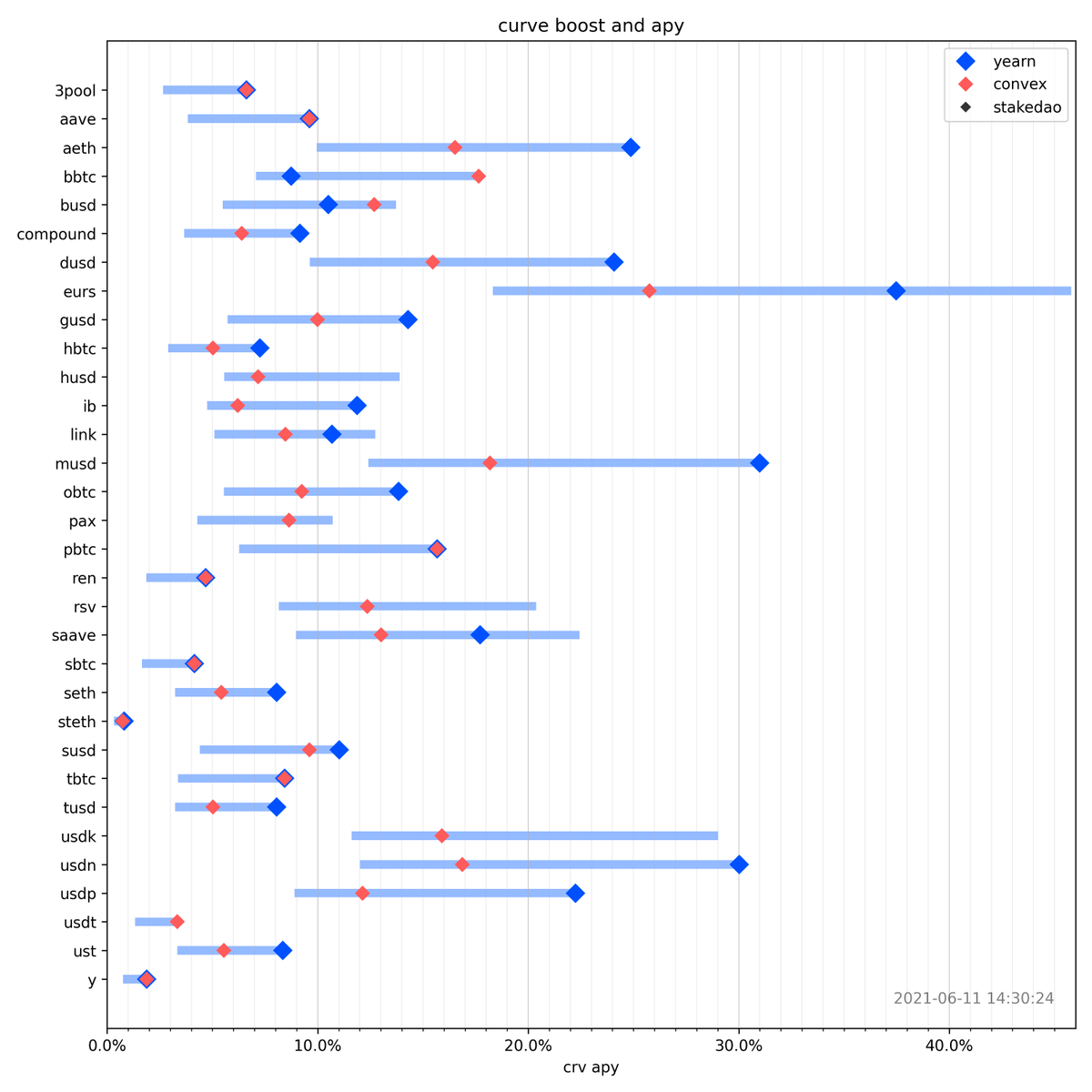

Yields remain strong across all three protocols, each offering certain pools with superior returns. Convex has taken the lead on many stables, Yearn remaining the leader on others. StakeDAO currently takes the lead on only EURS, offering the highest yield for the leading Euro stablecoin. 10-30%+ stablecoin yields are commonly found on all three platforms.

Concluding Remarks

Growth in new and existing activity throughout DeFi has taken a hit, as many participants move into a risk-off mindset amidst -60%+ dips from ATH across most governance tokens. While on-chain activity is no longer increasing as a % total month-over-month, year-over-year growth remains massive.

DeFi participants now look to risk-off yield farming opportunities and higher quality assets to best survive downside volatility. Liquidity remains mostly healthy across the ecosystem and long-term ETH holders remain strong-willed, with many of their tokens sitting solidly dormant in place.

Uncovering Alpha

This is our weekly segment that briefly discusses some of the most important developments of the prior and upcoming week.

Despite bearish on-chain activity, more innovation than ever is coming to DeFi as 3-12 month dev cycles come to fruition. Each week more and more projects are launched, major updates are pushed, and important ecosystem-changing events draw closer.

- Cozy Finance launches their protected yield product. Cozy was largely forgotten after getting plenty of hype last year when they initially announced their product under development. Cozy allows the user to enter a position with insurance built-in.

- Volmex launches their volatility products. One of many advanced trading products to be launched in the coming months. Look to DeFi to soon push futures, perps, tranches, interest rate swaps, and all sorts of other instruments ported over from legacy finance.

- Ribbon Finance adds a liquidity mining program. Ribbon added a liquidity mining program for their governance token RBN. However, their cap on deposits has kept most from being able to participate.

- Pendle launches their future yield product. Tokenizing yields is a hot topic as more projects experiment how to extend yield bearing products across the space.

- Rari Capital launches Fuse lending pools for Yearn pool positions. Rari joins Abracadabra.money (Spell) and others in their quest to let DeFi users extend the capability of their positions.

- OlympusDAO concludes their Fohmo2 event. Among the widely-attended community event came a new UI, major policy discussions, and other community led events.

- Alchemix announces an initial plan for returning to solvency. Alchemix is seeking returns of alETH from the exploit allowing depositors to withdraw ETH without paying back alETH. Holders who return their ETH will receive ALCX tokens and an NFT to mark the occasion. Their DAI/alUSD product remains unaffected.

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter

Disclaimer: This report does not provide any investment advice. All data is provided for information purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.