BTC Market Pulse: Week 36

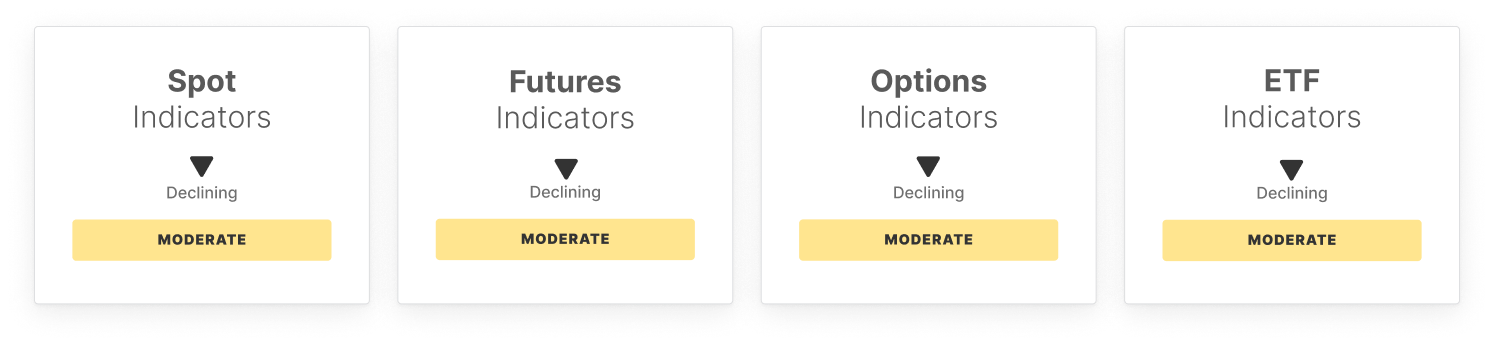

Bitcoin retreated to $107K, testing the short-term holder cost basis - a key level for market sentiment. The latest Market Pulse highlights oversold spot conditions, cautious futures positioning, renewed ETF inflows, and weak on-chain activity as fragility persists.

Overview

With price contracting further away from ATH to $107k, the market is now sitting at the cost basis of short-term holders. This key level has historically acted as a battleground between buyers and sellers, making current positioning particularly critical for near-term sentiment.

In the spot market, momentum weakened further as RSI slipped into oversold territory, while trading volumes declined, reflecting waning conviction. Spot CVD showed easing sell pressure, hinting at tentative stabilization, but overall signals point to fragile demand.

The futures market revealed cautious positioning. Open interest contracted, funding payments declined, and perpetual CVD improved slightly, suggesting reduced leverage and fading bullish appetite. Traders appear less willing to extend risk, underscoring a defensive stance after recent volatility.

In the options market, participation contracted as open interest fell, while volatility spreads narrowed, pointing to complacency. However, 25-delta skew surged above historical extremes, highlighting strong demand for downside protection and reinforcing a defensive tilt among options traders.

Flows through US spot ETFs showed mixed signals. Netflows reversed into positive territory with inflows, yet trade volumes contracted and MVRV ratios declined, pointing to cautious profit- taking behavior. Institutional interest remains present but far more selective after recent price weakness.

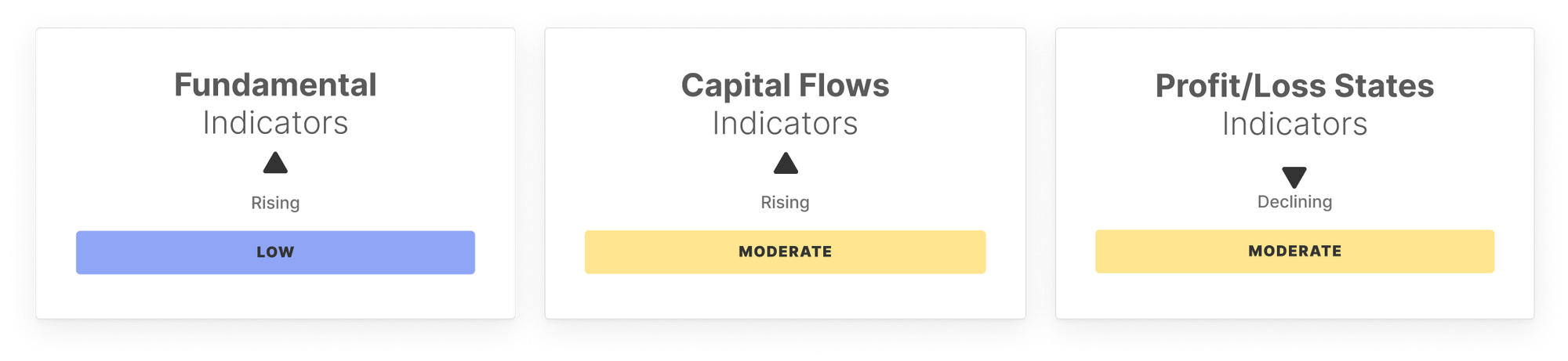

On the on-chain demand side, active addresses and fees remain subdued, signaling weak organic activity, though transfer volumes spiked as large entities repositioned amid volatility. This divergence highlights low grassroots participation, offset by strategic moves from larger players.

Capital flow metrics suggested cooling conviction. Realized Cap inflows slowed, Hot Capital Share pressed against its upper bound, and the STH/LTH supply ratio rose, reflecting greater speculative activity but fragile support from long-term holders.

Profit and loss states weakened notably. Percent Supply in Profit declined, NUPL moved closer to loss territory, and Realized P/L settled at equilibrium. Together, these trends confirm fading unrealized profits, fragile conviction, and cautious positioning across the investor base.

In sum, the market structure remains fragile, with bearish pressures dominating across spot, futures, and on-chain metrics. ETF inflows provided a temporary cushion, but contracting volumes and weakening profitability highlight the lack of conviction. While short-term bounce-backs are possible, sentiment overall remains defensive, with risks skewed toward further consolidation unless stronger demand re-emerges.

Off-Chain Indicators

On-Chain Indicators

- Follow us and reach out on X

- Join our Telegram channel

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies.

Please read our Transparency Notice when using exchange data.