BTC Price Drop: How Are Long-Term Holders Responding?

Despite increased volatility and some heavy losses for BTC, long-term holders remain confident.

Long-Term Holders Haven't Lost Faith

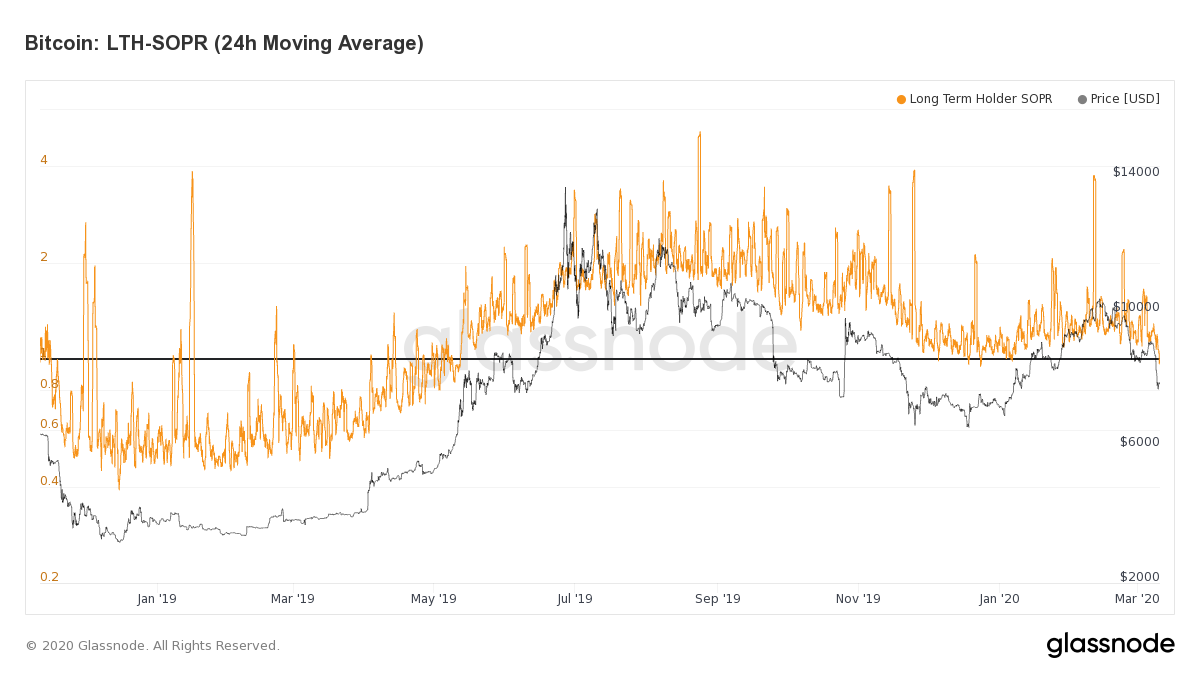

LTH-SOPR remains close to 1 despite the recent price drop, indicating that long-term holders haven't lost faith.

LTH-SOPR uses the SOPR (Spent Output Profit Ratio) metric, but applies it only to spent outputs that are at least 155 days old. As such, it provides a signal for whether long-term holders are, on average, selling at a profit or loss. When the value is above 1, investors are selling at a profit, whereas values below 1 indicate that investors are selling at a loss.

While LTH-SOPR has decreased with the recent price dip and is testing the 1-line, it appears not to be dropping too far past this point (especially when compared to STH-SOPR, which looks at the profit ratio of short-term holders).

As we have seen during previous sell-offs, long-term holders usually stay confident and wait for the price to increase again. This makes sense, considering that long-term holders:

- Have likely been through many ups and downs in crypto markets (depending on how long they have been holding), and are accustomed to volatility.

- Are less likely than short-term holders (such as FOMO investors or leverage traders) to need the money in the short- to medium-term, so can afford to wait out the dip.

- Are more likely to be invested for ideological reasons or because they believe in the fundamentals of bitcoin (so periodic peaks and troughs aren't enough to scare them into selling at a loss).

Considering the fact that on-chain fundamentals remain strong, these long-term holders are taking a rational approach instead of panic selling; hence why they are not selling at a loss, unlike short-term holders.

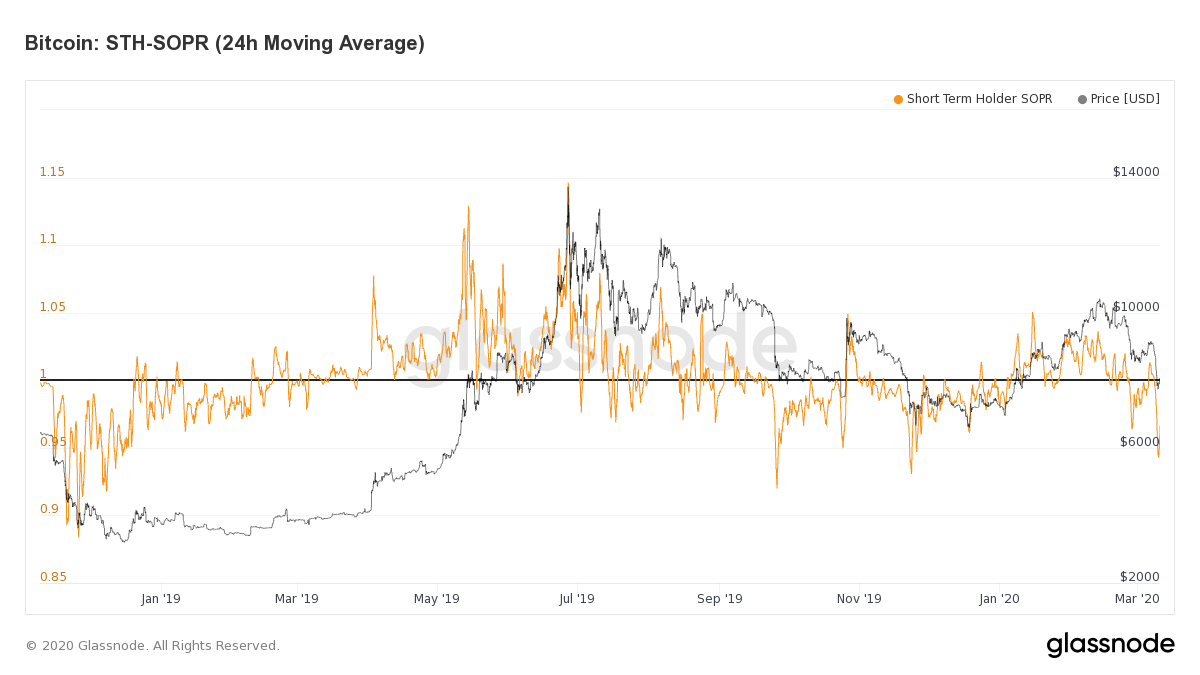

Short-Term Investors More Likely to Sell at a Loss

As STH-SOPR indicates, short-term holders are much more likely to sell at a loss than long-term holders:

This disparity is not surprising, seeing as short-term holders are more likely to consist of:

- Short-term traders who are more exposed to volatility (and who are selling at a loss in USD terms, but may or may not be selling at a net loss, depending on which pairs they are trading between).

- FOMO investors and panic sellers (such as the hairdressers and Uber drivers and friends' aunts' cousins who notoriously FOMOed into bitcoin as it rode up to $20k in early 2018).

Additionally, STH-SOPR is also more likely to drop below 1 because the line between profit/loss is much higher when investors bought recently (when the price was high), as opposed to long-term holders who bought when the price was lower. As such, the price of BTC generally has to be lower for long-term holders to be selling at a loss, as they (on average) bought at a lower price.

This means that LTH- and STH-SOPR alone can't tell us whether long-term holders are selling in greater volumes; only whether they are selling at a profit or loss. Hence, we need other metrics to paint a clearer story.

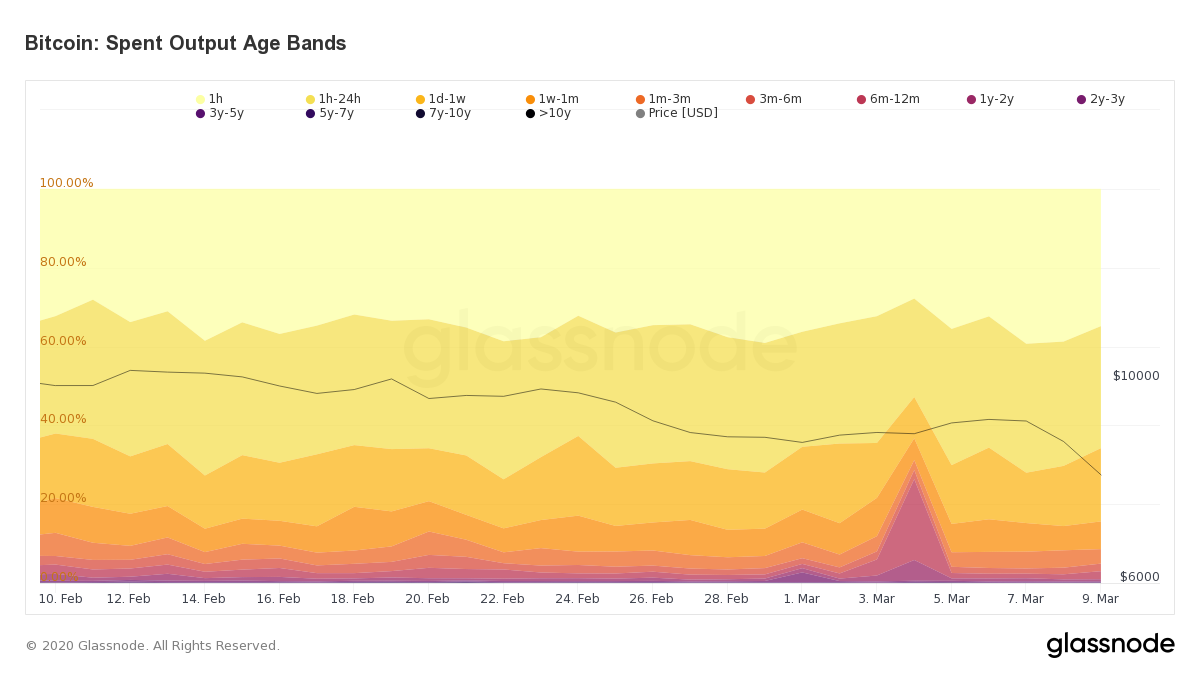

SOAB Shows Long-Term Holders Still Holding

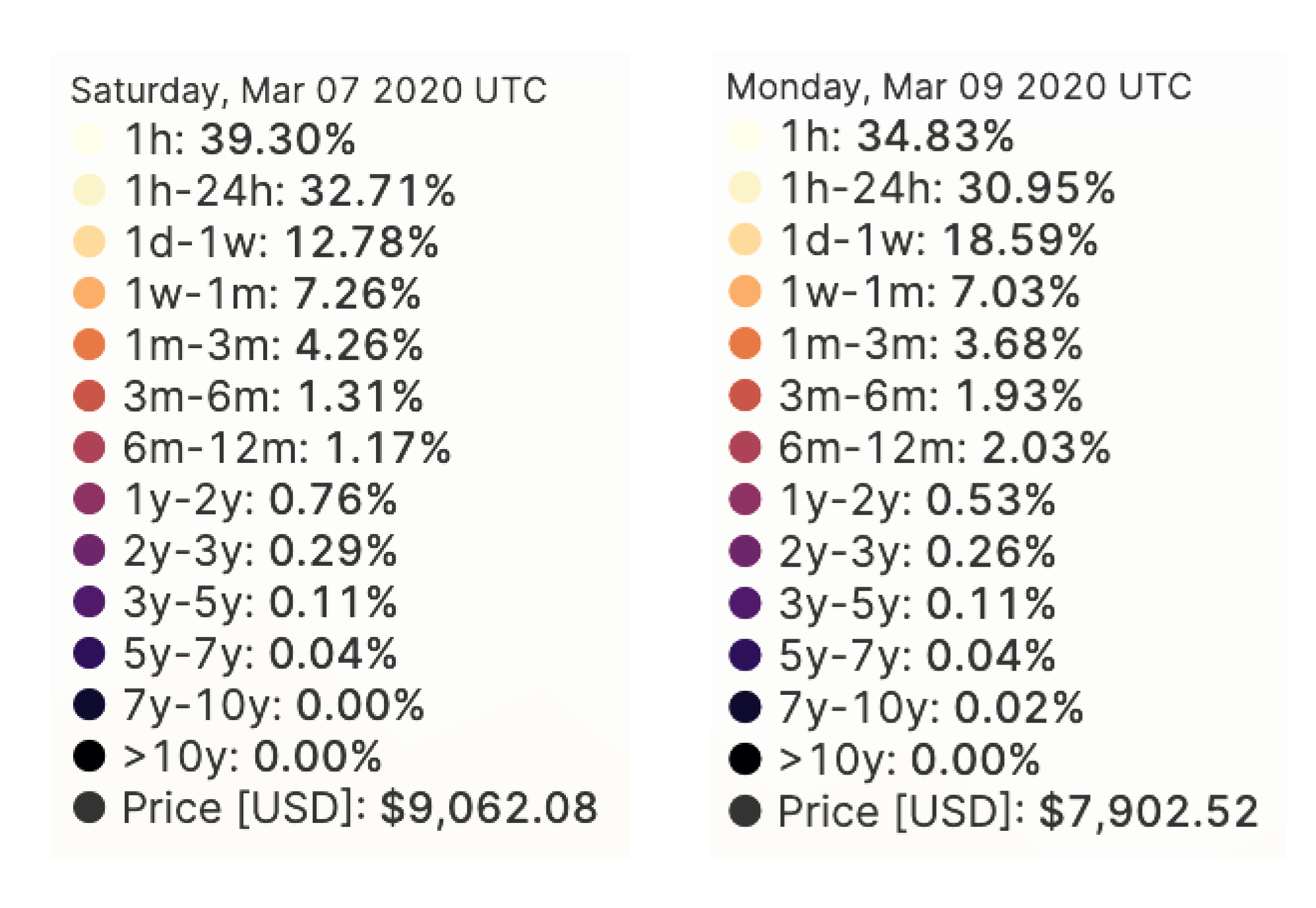

SOAB (Spent Output Age Bands) represents the percentage of spent outputs on a given day which were a certain age (e.g. X hours/days/weeks/months old). It allows us to see whether long-term holders or short-term holders are responsible for more of the total on-chain transactions in a given time period.

Since the price started dropping after 7 March, transactions from both short-term and long-term holders have remained within standard fluctuations, with neither taking up a meaningfully larger share of network activity.

(Note that the large spike on 4 March was caused by an exchange aggregating "dust", and does not represent on-chain economic activity or trading).

The biggest increase was seen in the (short-term) 1d-1w age band, whose share increased from 12.78% to 18.59% since 7 March.

Increases weren't limited to short-term age bands though. The 6m-12m age band (which represents LTH movements, being more than 155 days old) saw a meaningful increase from 1.17% to 2.03%. Given that a large number of people who bought in this age band would have purchased BTC at prices higher than the current price, this explains why LTH-SOPR is also decreasing (albeit not as drastically as STH-SOPR).

While SOAB indicates spent output lifespan as a fraction of total transactions, it doesn't shed light on the absolute volume of coins being moved in each transaction, meaning more granular metrics are required to determine whether recent on-chain movements are primarily based on movements by short-term or long-term investors.

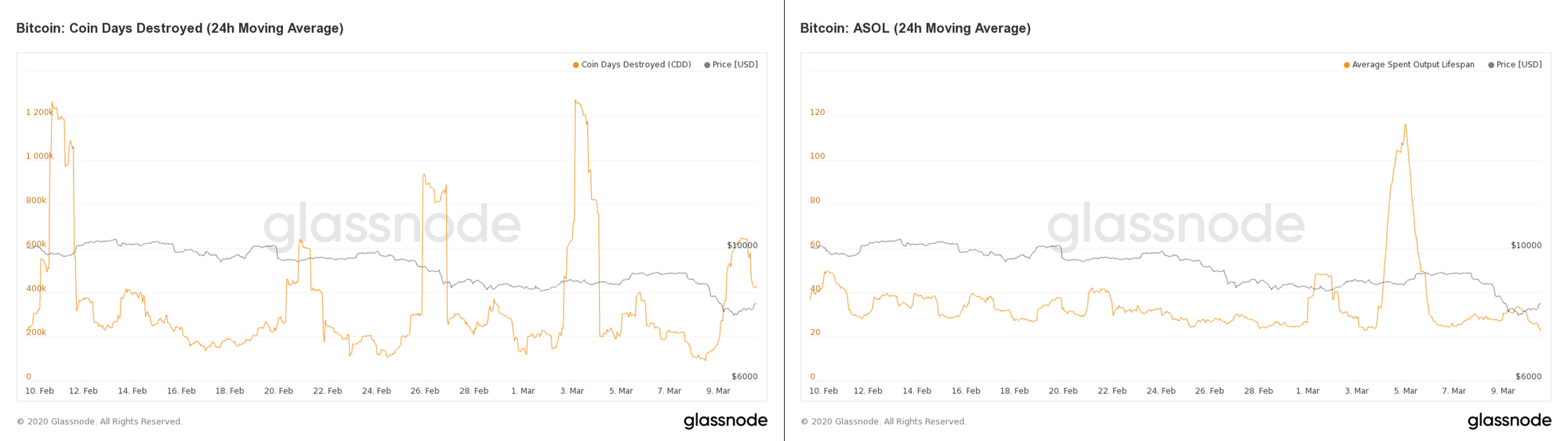

Recent Transactions Have Been High-Frequency, Low-Lifespan

CDD (Coin Days Destroyed) indicates the cumulative age of all spent outputs within a given time period. An increase in CDD, as has occurred in the past few days, means that coins being moved on-chain have a greater cumulative age, which may imply movements from long-term holders.

However, the average lifespan of spent outputs (ASOL) has actually decreased since the price started to drop, suggesting that the spike in CDD was caused by a larger number or higher value of transactions from short-term holders, rather than movements by long-term holders.

Along with conclusions drawn from STH- and LTH-SOPR, as well as SOAB, this low ASOL value (especially relative to CDD) supports the narrative that long-term holders are not selling in meaningful volumes at this point.

Conclusions

Overall, on-chain indicators overwhelmingly support the thesis that most long-term holders are staying confident, despite recent price dips. Along with this, on-chain fundamentals remain strong, and with the halving coming up soon, supply will be restricted, applying further upwards price pressure.

While some market commentators speculate that coronavirus fears and economic turmoil may uproot confidence in bitcoin and overturn long-existing narratives, for the time being, those invested in the underlying value of BTC appear to remain assured in its long-term potential.

- Follow us and reach out on Twitter

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter

Disclaimer: This report does not provide any investment advice. All data is provided for information purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.