CME + Glassnode: Ethereum Insights and Market Trends H1 2025

A joint publication by CME Group and Glassnode, this report explores Ethereum’s H1 2025 market structure - from protocol upgrades and inflation trends to derivatives and staking data - giving institutional investors critical insights to inform strategic decisions.

Ethereum’s H1 2025 market trajectory has sharply diverged from historical cycle patterns. Despite being the foundational layer for DeFi and smart contract ecosystems, ETH has underperformed relative to peers, with the ETH/BTC ratio hitting multi-year lows. Realized losses dominate on-chain activity, and investor sentiment remains cautious.

Yet, beneath the surface, structural resilience is evident - from staking participation to sustained derivatives activity on CME. The CME x Glassnode H1 2025 Ethereum Report provides a comprehensive, data-driven view of Ethereum’s position within the digital asset landscape and the key dynamics shaping its future.

Key Ethereum Trends to Watch

Ethereum’s subdued price action in H1 masks a number of deeper structural shifts - from protocol-level changes and staking trends to a changing patterns of institutional participation. Here’s a snapshot of what you’ll find in the report:

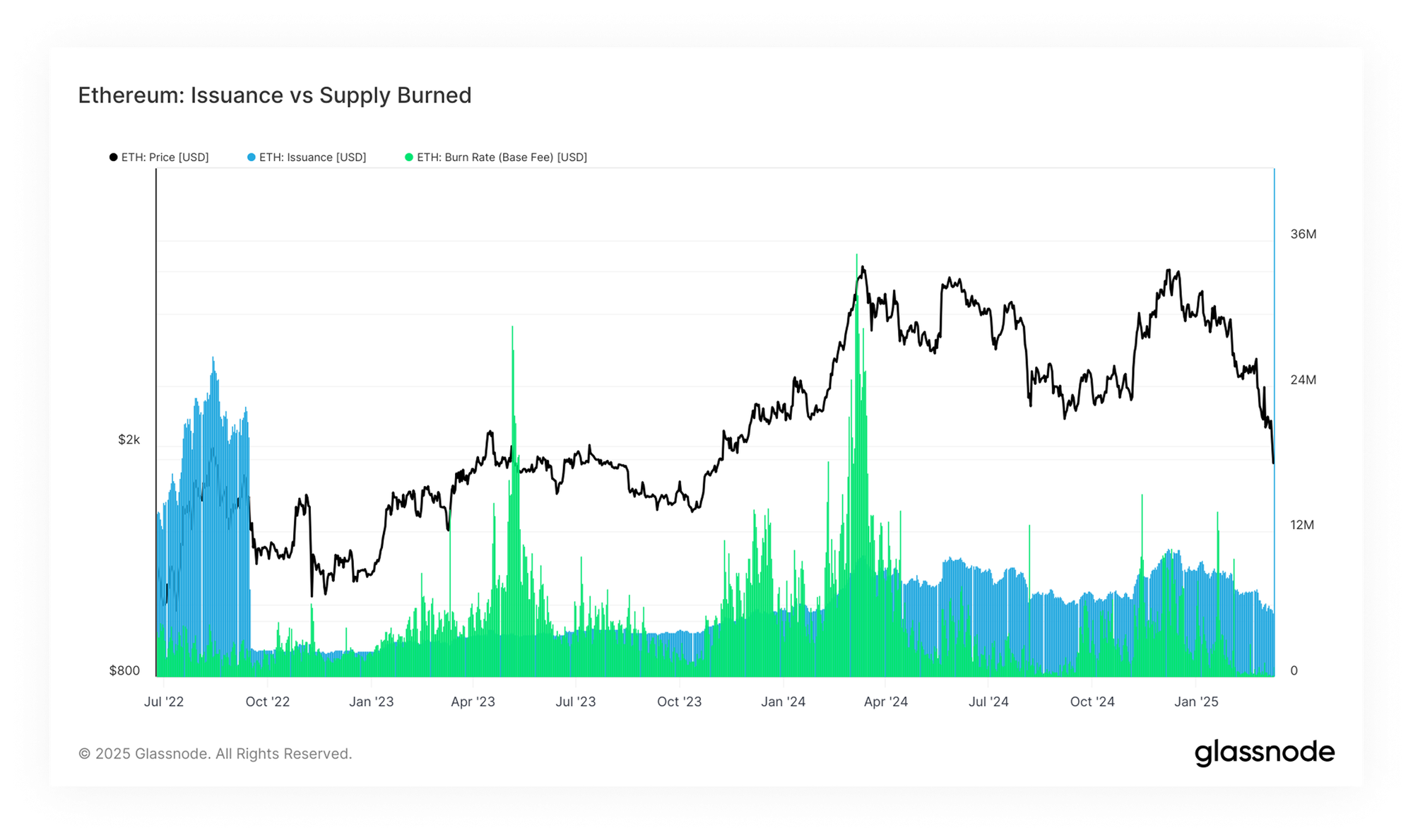

Ethereum Re-Enters Inflationary Regime

Following the Dencun upgrade and a reduction in network fees, ETH has transitioned back into net inflation - marking a reversal of the post-Merge deflationary thesis and raising questions about long-term value accrual.

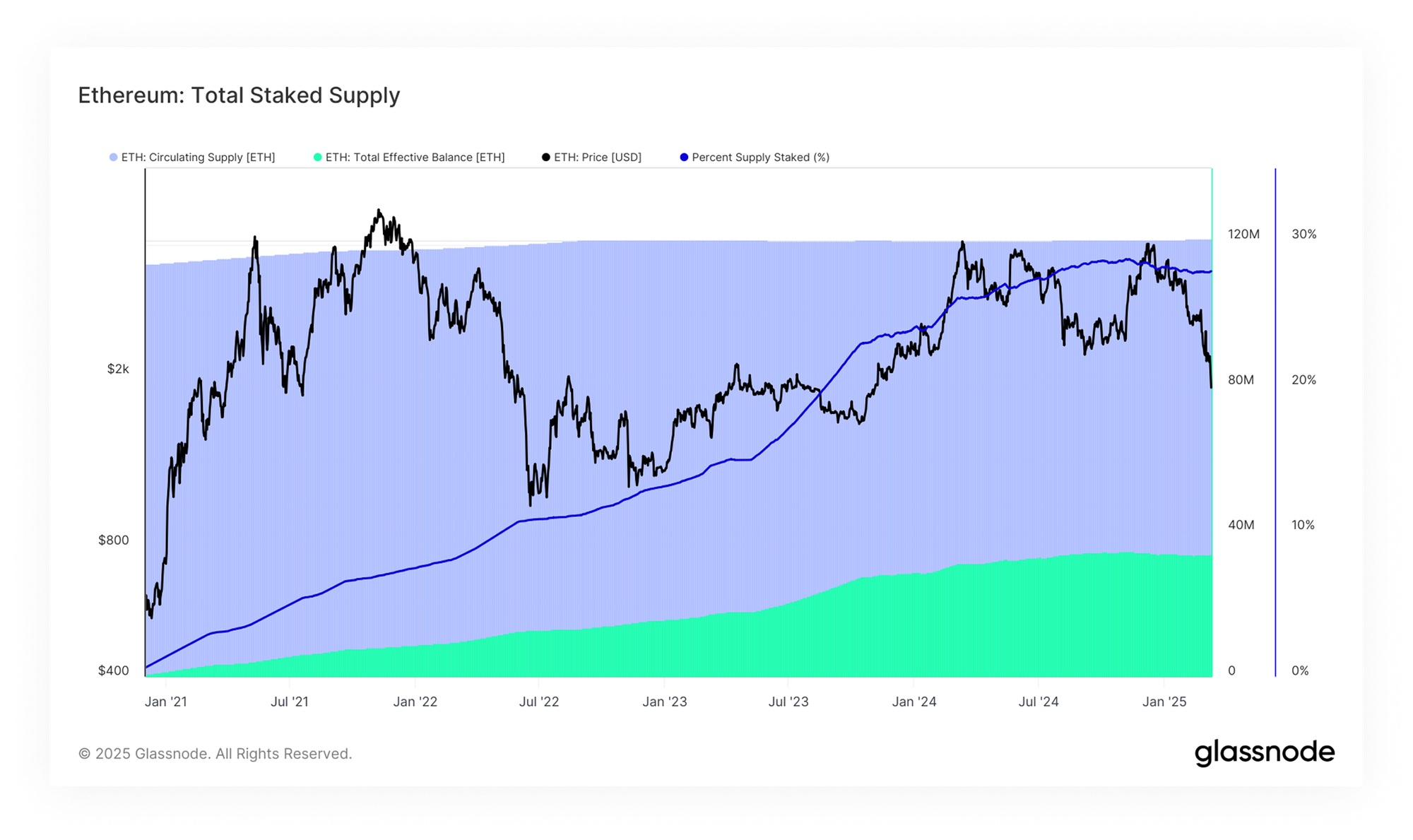

Validator Resilience Signals Long-Term Protocol Alignment

Despite a steep market drawdown, validator counts and staking volumes remain stable. This signals confidence in Ethereum’s long-term viability, particularly among institutions operating staking infrastructure.

Institutional Demand Grows for Regulated ETH Instruments

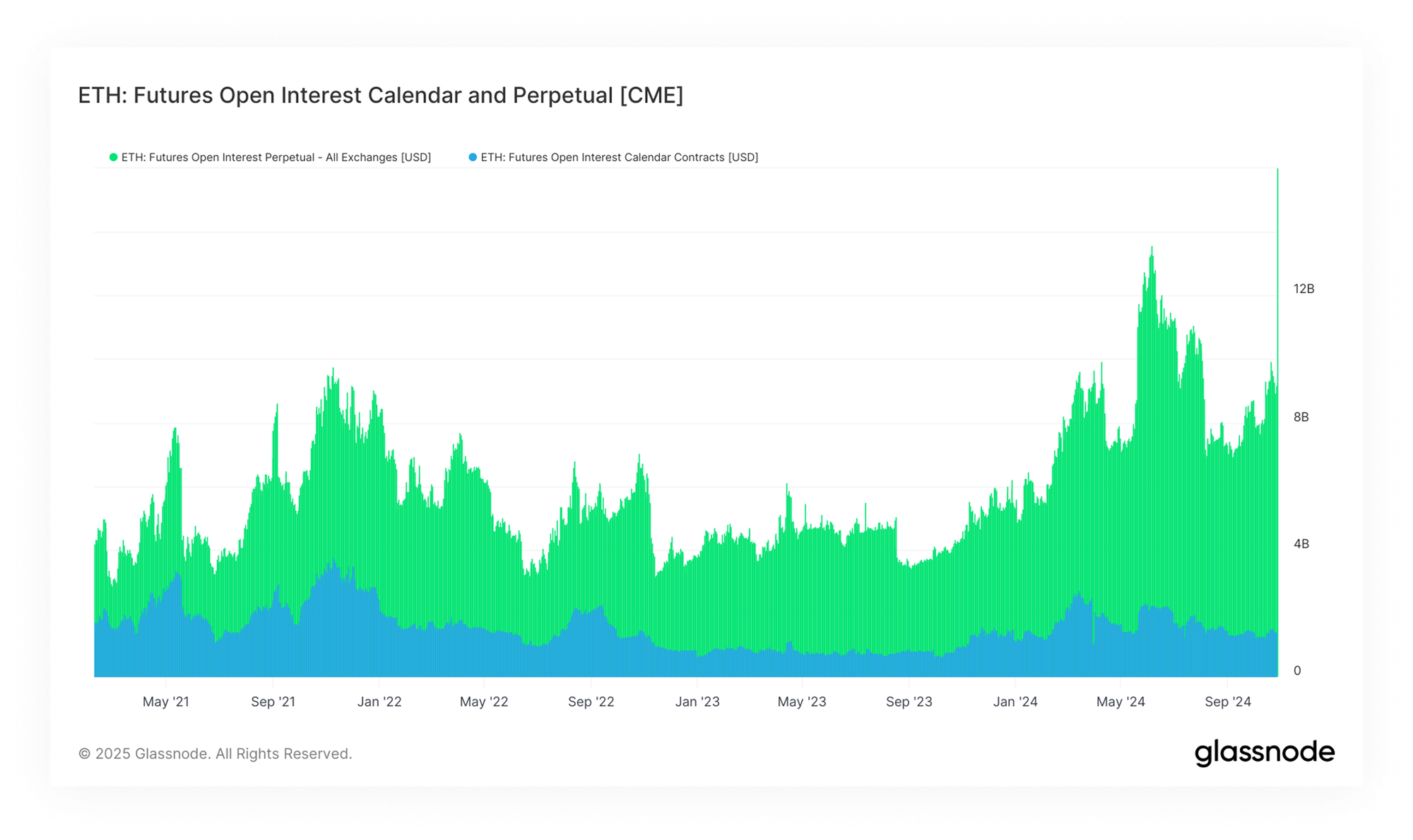

CME now commands 72% of ETH calendar futures open interest. Even amid price underperformance, institutions are increasingly using regulated CME tools to hedge and structure Ethereum exposure.

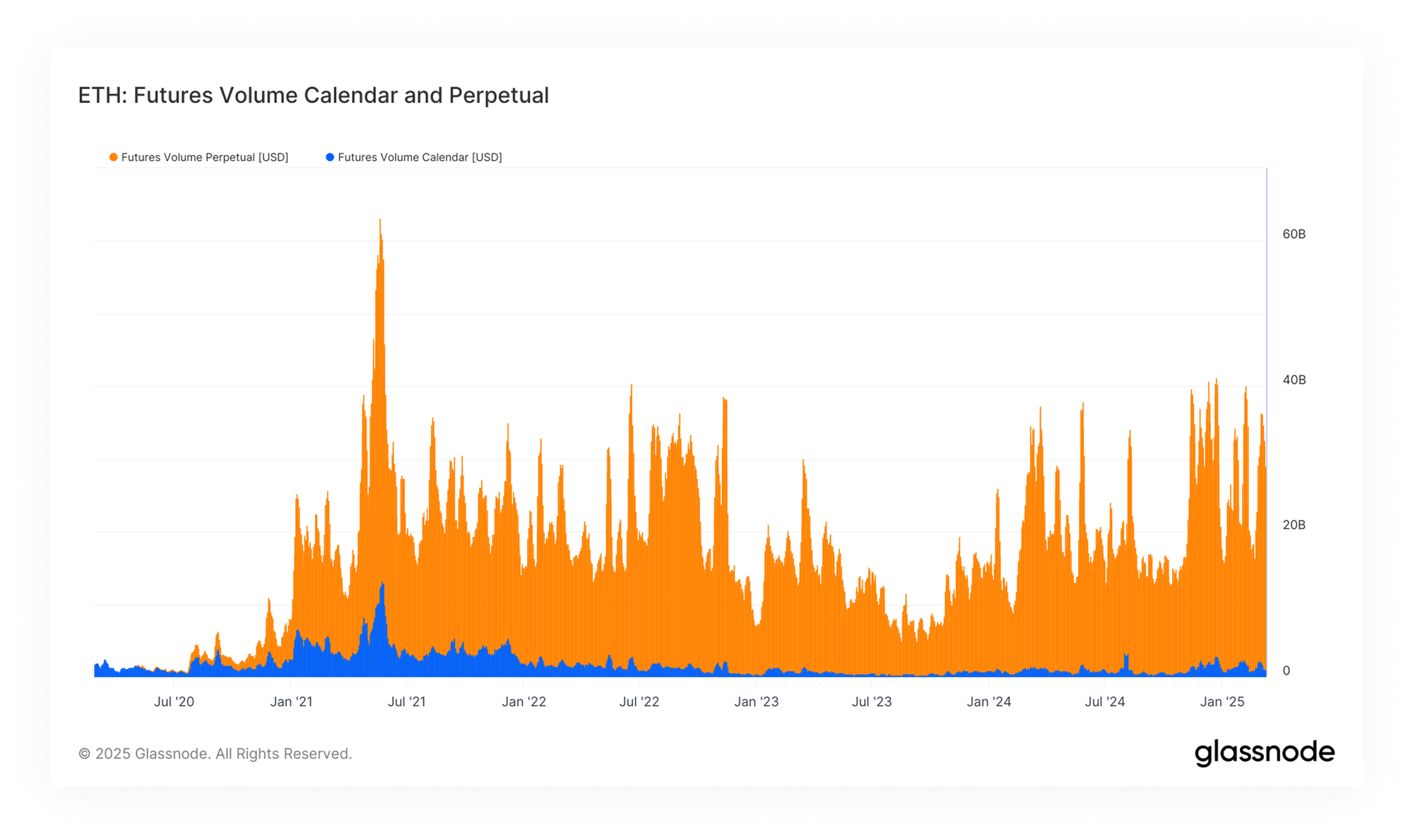

Ethereum Futures Volumes Hold Strong Despite Volatility

Futures trading volumes have remained robust, even through sharp price swings. This consistent activity highlights the growing depth and resilience of Ethereum’s institutional derivatives market.

Discover More

The CME x Glassnode Ethereum Report offers a nuanced institutional perspective on the Ethereum ecosystem. Inside the 32-page report, you’ll find:

- Analysis of capital flows, staking dynamics, and ETH supply changes

- Insights into validator participation and network health

- In-depth derivatives market data and CME usage trends

- ETF performance and cost-basis benchmarks

- Cycle comparisons and DeFi protocol implications

Whether you're an asset manager, risk analyst, or crypto market strategist, this report equips you with the insights to navigate Ethereum’s evolving market structure.

Glassnode is a trusted data provider partner to institutions in the financial world. Our expertise in on-chain analytics complements traditional price data, providing a holistic view of the digital asset markets. Contact us to explore our offerings for data, bespoke reports, and more.