The Ultimate Guide to Bitcoin Futures and Options

Welcome to this comprehensive guide on Bitcoin futures and options—essential financial derivatives in the cryptocurrency market. Here, we'll dive into how these instruments work, their impact on the market, and strategies for effective risk management

Disclaimer: The analysis provided here offers a window into the world of Bitcoin futures and Bitcoin options. Please remember that this represents just one element in the multifaceted realm of cryptocurrency. While data from Glassnode can provide valuable insights, it's essential to approach this information holistically, as the beginning of your personal research journey.

This guide examines the mechanics and market implications of Bitcoin futures and options. As crypto derivatives gain prominence in financial markets, knowledge of these instruments is key for risk management and strategic planning.

The guide explores core concepts including futures, options, and volatility, providing an in-depth look into these complex markets. For further analysis, relevant specialized articles are linked.

Understanding the Anatomy of Bitcoin Futures

Basics of Bitcoin Futures

Bitcoin futures are standardized contracts obliging parties to transact Bitcoin at predetermined terms. Knowing these essentials allows traders and investors to navigate the market proficiently. For those interested in a deeper dive, our previous article "Decoding Bitcoin Futures" offers more insights.

Examples of Futures Contracts

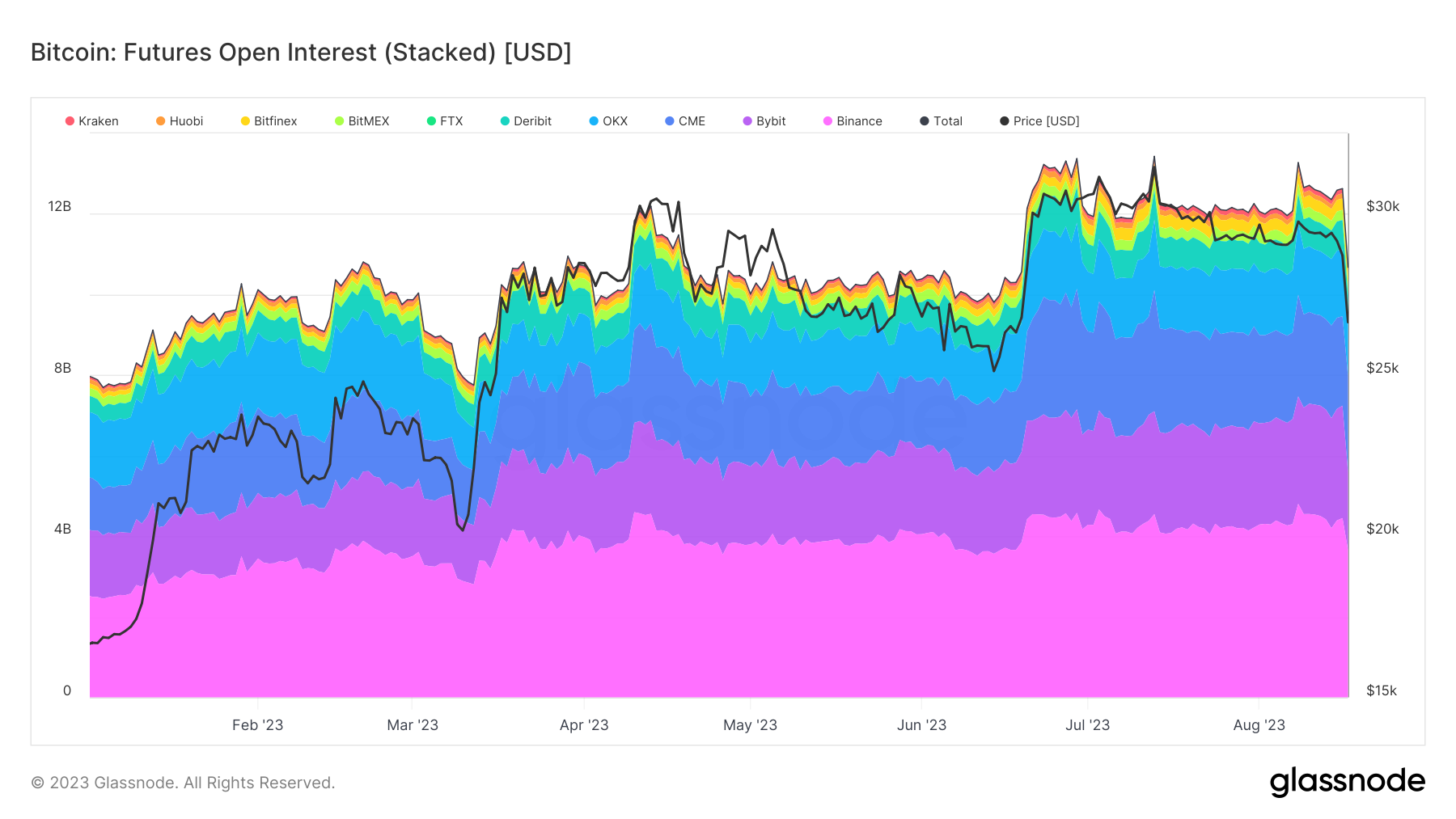

In the context of futures contracts specifying terms like purchasing one Bitcoin at $50,000 three months from now, Open Interest becomes particularly relevant. For example, if open interest in Bitcoin futures surged by 50.89% between January 1st and August 1st, 2023, it would signify that an increasing number of such contracts are being created and held. This growth in Open Interest could indicate more traders are betting that Bitcoin will reach or surpass the $50,000 mark by the contract's expiration, thereby increasing market activity and potentially enhancing liquidity.

This increase in Open Interest necessitates a closer examination of margins and leverage, which will be the focus of our next section

Margins and Leverage

The surge in Open Interest highlights the critical role of margins and leverage in futures trading. To participate traders provide a margin as a security deposit, a fraction of the contract's total value. This enables leverage, amplifying both potential gains and risks.

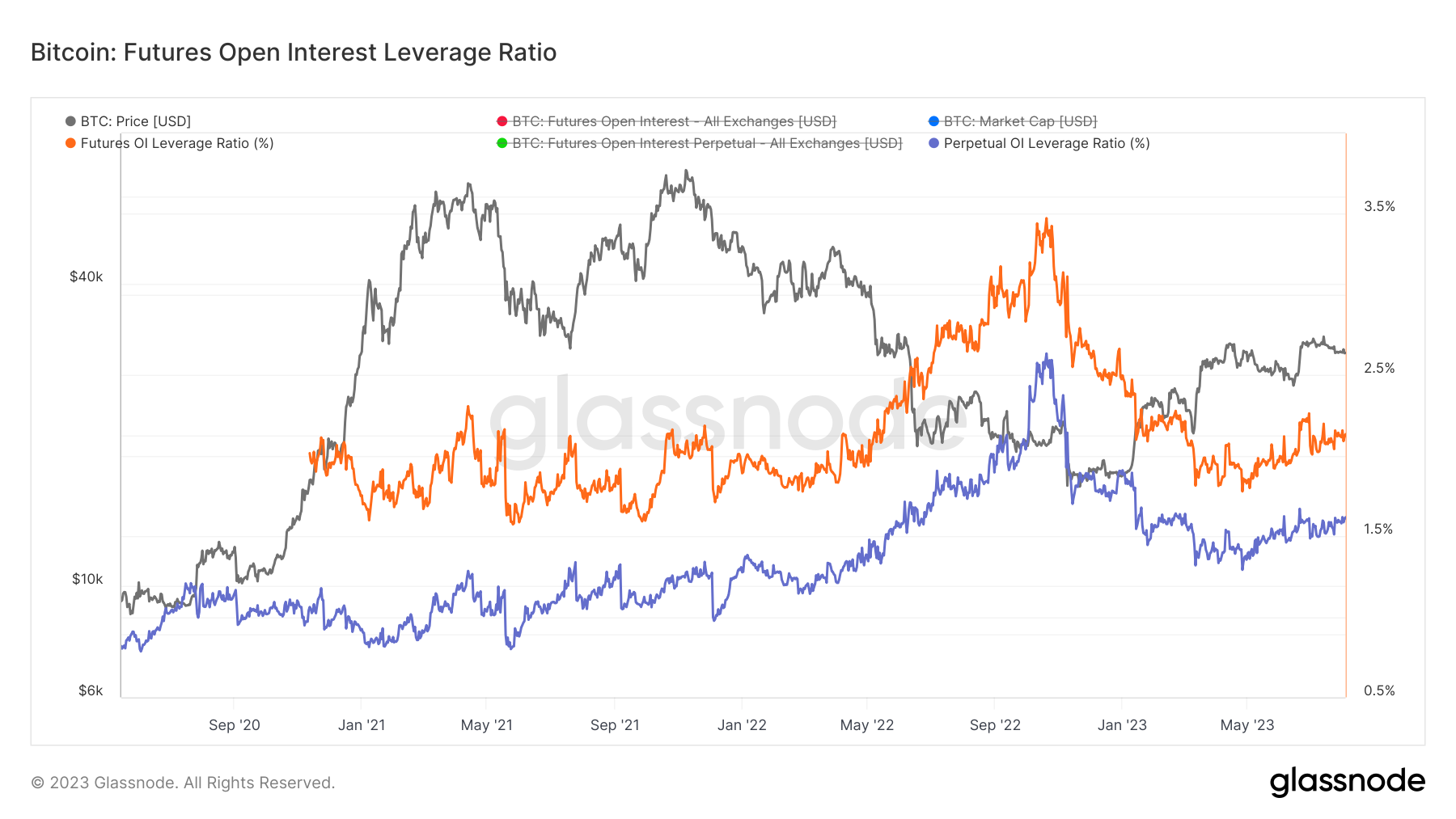

For example, metrics like the Futures Open Interest (OI) Leverage Ratio below serve as valuable indicators for understanding the scale and risk in the Bitcoin futures market. On January 2nd, 2023, the Futures OI Leverage Ratio was 2.47%, meaning that every $100 in a trader's margin was backing futures contracts worth $2.47. By August 3rd, the ratio decreased to 2.13%, even as Bitcoin's price rose.

The observed decline in these ratios, prior to the recent market crash, suggests that the derivatives market was shrinking in size relative to Bitcoin's overall market cap. While one might have initially interpreted this as a lower risk of market-induced volatility from derivatives, the subsequent crash underscores the need for caution. A sudden drop in these ratios could indeed serve as an early warning sign for significant market events, including forced liquidations.

Transitioning from futures, let's explore another financial instrument—Bitcoin options—that offers a different set of opportunities and challenges.

Bitcoin Options: A Strategic Framework for Risk Management

Basics of Bitcoin Options

Bitcoin options are contracts that offer the right—without the obligation—to buy or sell Bitcoin at a predetermined price and date. These instruments serve as versatile tools for both speculation and risk management.

Call and Put Options

Building on that understanding, Bitcoin options are categorized into call and put options. A call option gives the holder the right to buy Bitcoin at a set price within a specific timeframe, while a put option confers the right to sell. For more metrics like implied volatility or 25 delta skew, refer to our previous article, "Navigating Bitcoin Options".

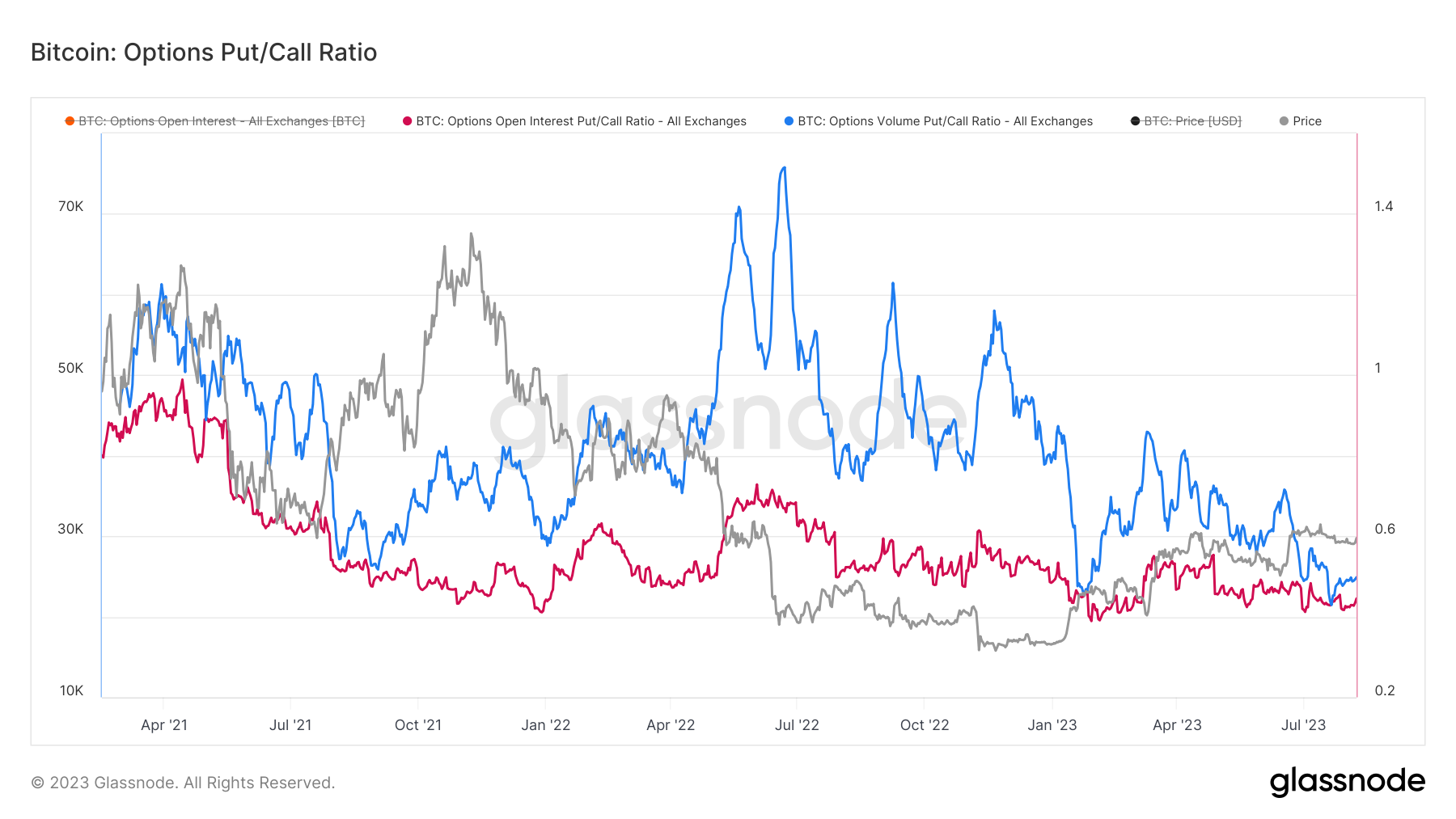

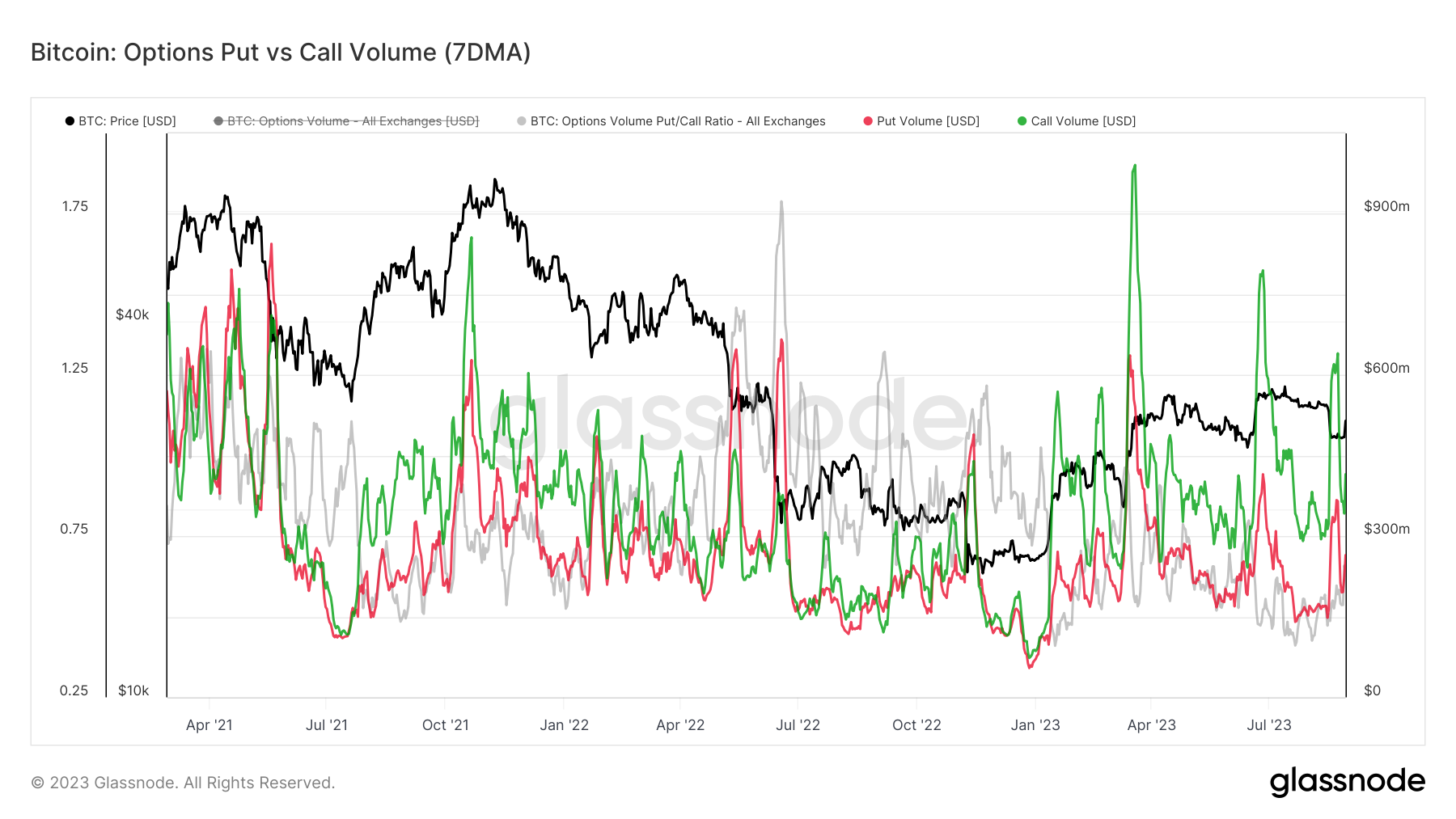

The Options Put/Call Ratio below is a metric that provides insights into the dynamics between the demand for put and call options.

The metrics for volume and traded volumes are currently at or near historic lows, registering values between 0.42 and 0.48. This low Put/Call Ratio typically aligns with bullish market sentiment. Despite recent market fluctuations, these metrics have remained relatively stable. The data suggests a consistent demand for call options over put options.

Options Open Interest: Another Dimension to Market Sentiment

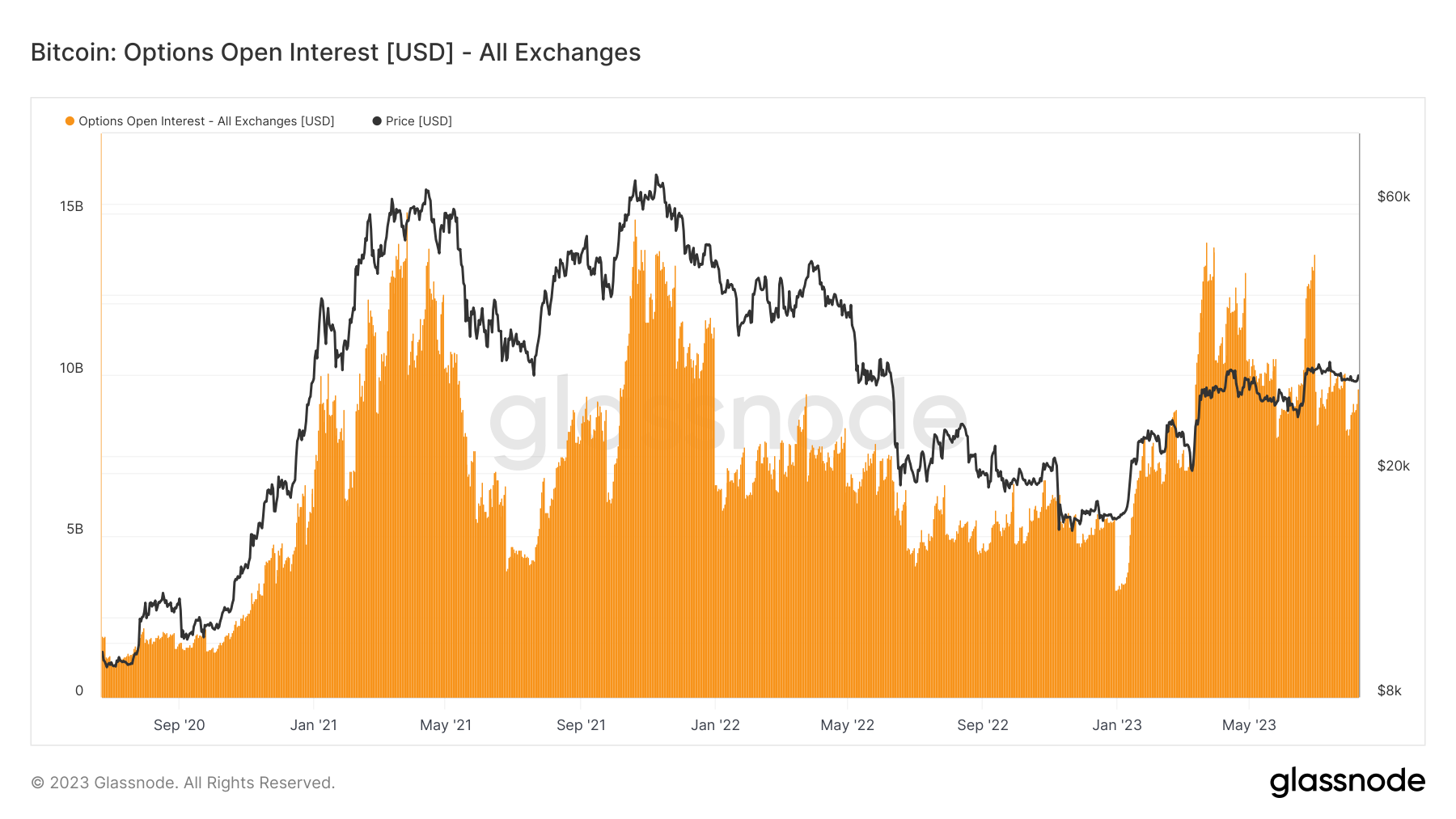

Following the analysis on Put/Call ratios, Open Interest is another metric that adds depth to our understanding of the Bitcoin options market, as we can see below. In 2023, total volume in Bitcoin options trading increased by approximately 133%, likely indicative of sustained interest from both institutional and retail sectors. Despite recent market downturns, open interest levels have remained stable.

Next, we turn our focus to recent market volatility, specifically through the lens of the recent Bitcoin crash.

The Recent Market Crash: A Case Study in Volatility

Analyzing the Crash Through the Lens of Futures and Options

The recent market downturn serves as a case study for the roles of futures and options during volatility. These instruments often act as hedges against downturns, a function increasingly important in cryptocurrency markets given their inherent volatility.

Implied Volatility and Options Put vs Call Volume During the Crash

Next, we delve into two specific metrics important for understanding market dynamics during the recent Bitcoin crash: Implied Volatility and Options Put vs Call Volume.

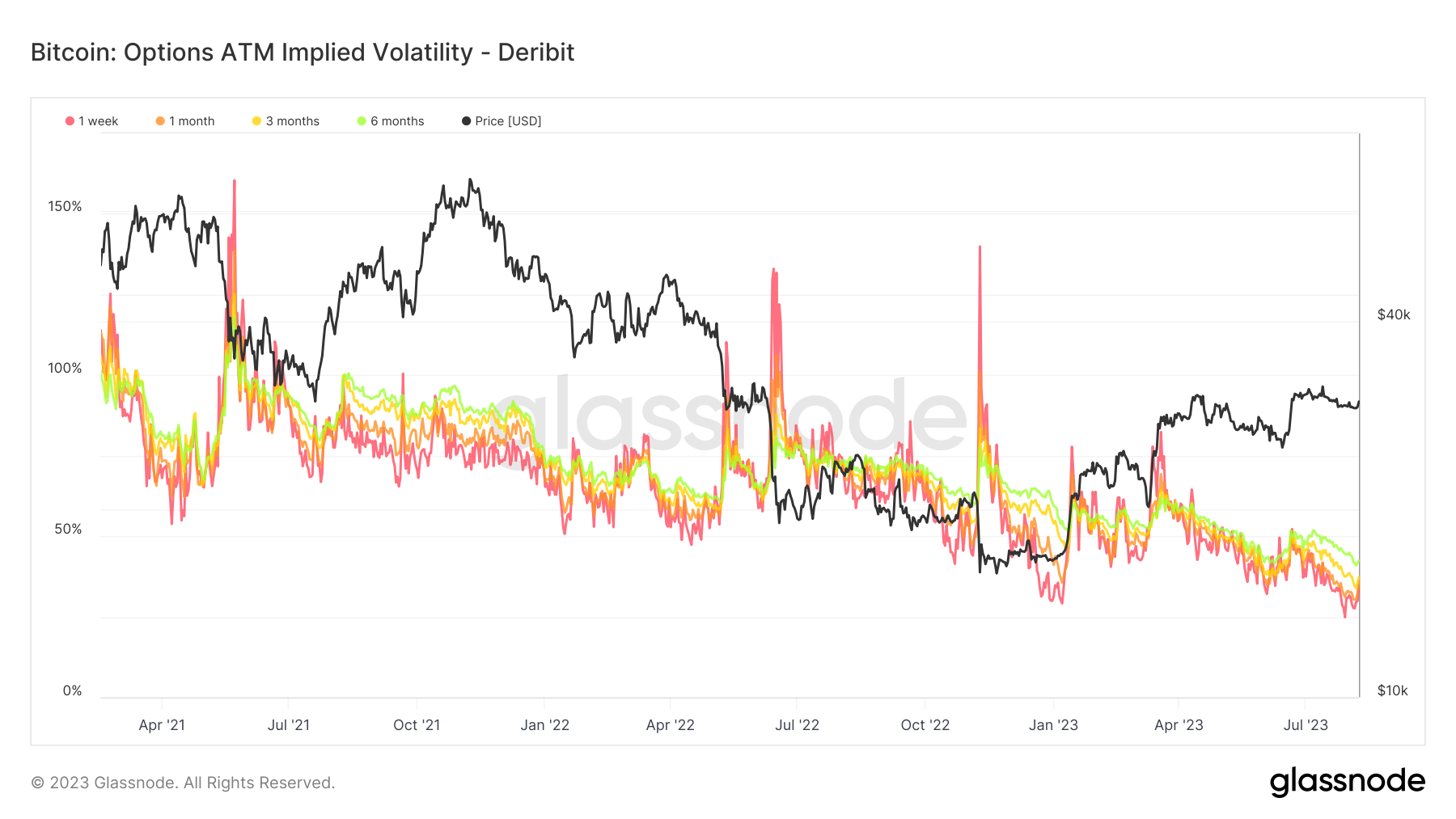

ATM Implied Volatility, as described earlier, serves as an indicator for anticipated market volatility. Historical data shows Bitcoin options markets usually trade at an implied volatility (IV) oscillating between 60% and even exceeding 100%. However, recent market movements tell a different story. The implied volatility plummeted to all-time lows by August 14th, only to surge dramatically as the market downturn unfolded a few days later on August 17th. This sharp repricing is significant, particularly in short-dated contracts set to expire by the end of September.

Complementing this is the Options Put vs Call Volume metric below. This metric presents the total value of Options Volume split into Put and Call options. During the crash, trade volume spiked by more than 200% to $620M/day for calls, and $326M/day for puts. This heightened activity in options trading further underscores the volatility observed in the market.

In sum, both the Implied Volatility and Options Put vs Call Volume metrics offer substantial insights into market sentiment and trading behavior, particularly during periods of market unrest. For those interested in more extensive analysis on these volatility metrics, our prior article, "The Question of Volatility", is a valuable resource.

Volatility and Its Impact on Derivatives

The recent Bitcoin flash crash provides a case study in market volatility. With BTC prices plummeting below $25k, approximately $2.5 billion worth of futures contracts were liquidated in a single day. This event also led to a dramatic re-pricing in options markets, with implied volatility more than doubling for short-dated contracts expiring by the end of September. Notably, 88.3% of the Short-Term Holder supply is now in an unrealized loss, highlighting the increased risk levels.

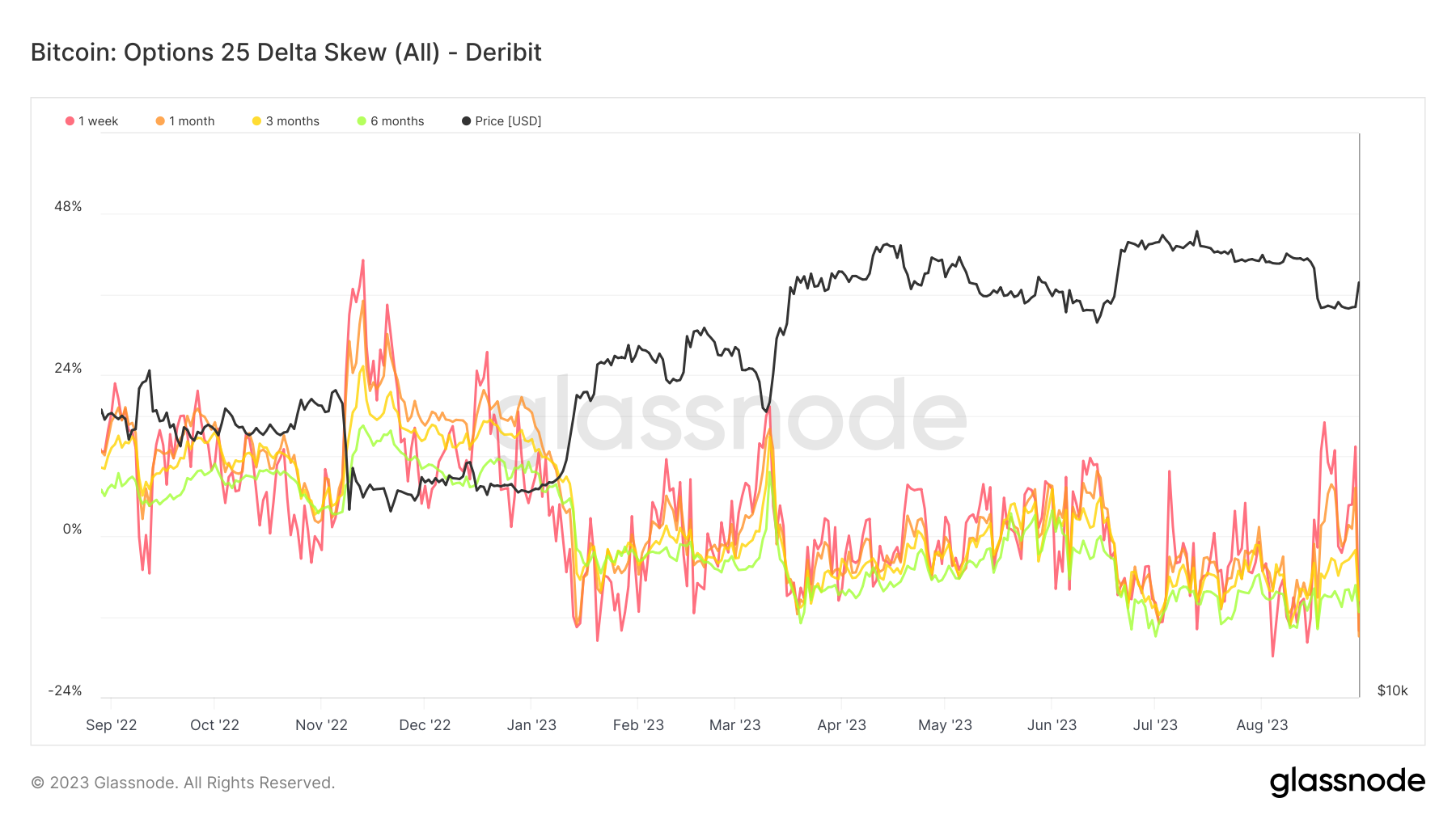

The impact of such volatility is broad-ranging. In the derivatives market, for example, we observe a direct influence on the pricing of both futures and options. In this specific event, the 25-Delta Skew in options reversed completely, rallying from historical lows of -10% to over +10%.

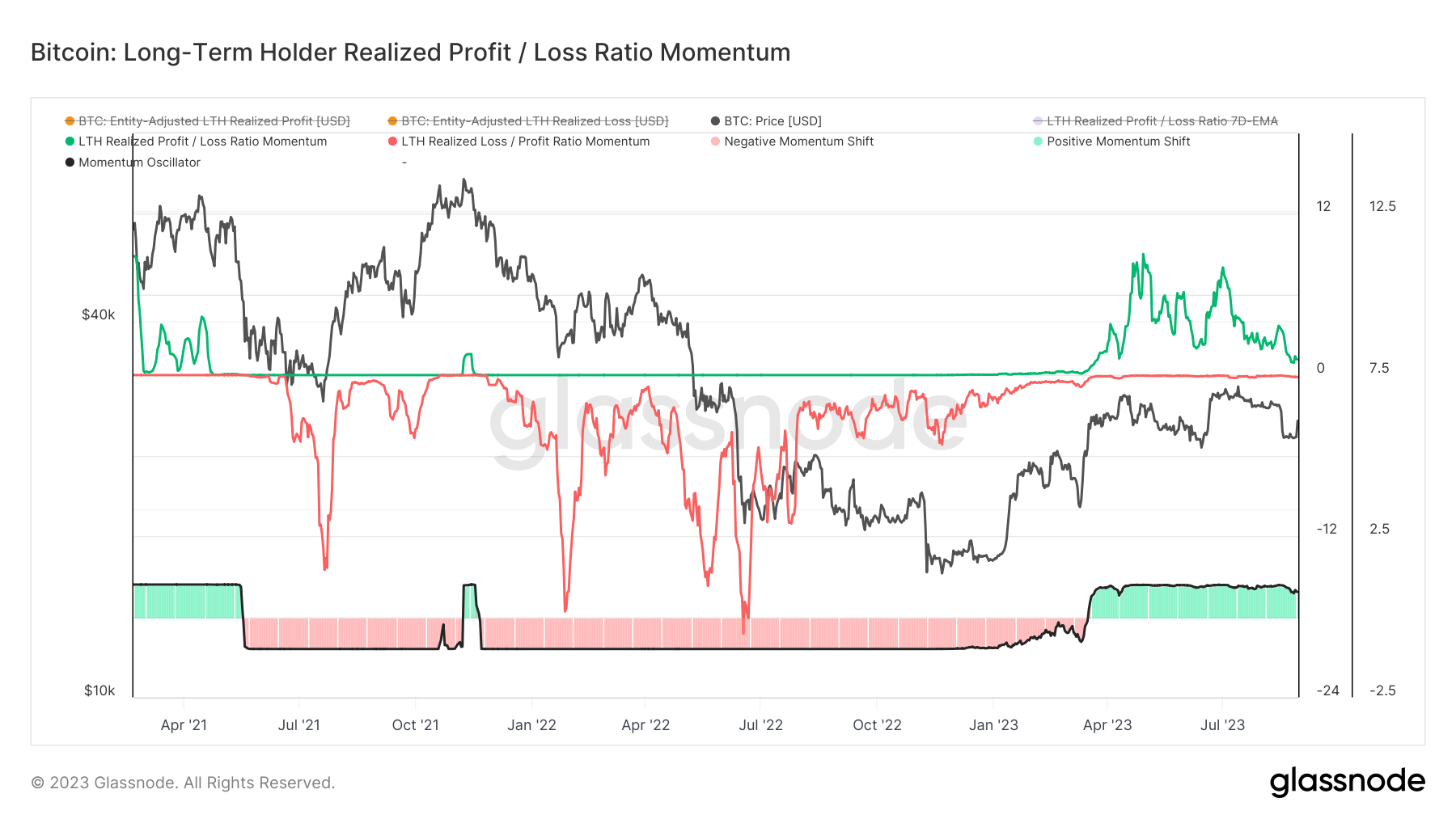

Consider reviewing the Realized Profit/Loss (P/L) Momentum Indicator below, which helps in identifying significant market inflection points related to volatility. A spike in Loss Momentum and dominance could serve as a prelude to more volatile downtrends, as observed in past events like May and Dec 2021. This metric, particularly for Short-Term Holders, could provide valuable insights into how volatility is likely to impact the market in the near future.

In summary, recent volatility underscores the need for risk management in trading high-leverage instruments like futures and options. The focus should be on both seizing opportunities and mitigating risks. As we shift our discussion to practical approaches, the importance of these metrics and events becomes evident in formulating risk management strategies.

Risk Management and Practical Strategies

Below is a table summarizing key risk management strategies for trading Bitcoin futures and options. These strategies offer practical approaches to mitigate potential losses in this volatile market.

| Risk Management Strategy | Description | Application in Bitcoin Futures & Options |

|---|---|---|

| Setting Stop-Losses | Automatically triggers a sell order when a predetermined price is reached. | Commonly used in both traditional and Bitcoin options markets. |

| Using Lower Leverage | Limits potential losses by reducing the multiplication effect on both gains and losses. | Minimizes the impact of volatile market swings on your portfolio. |

| Diversifying with Options | Provides a hedge against adverse market movements. | Discussed in-depth in our earlier article, https://example.com/. |

Conclusion

Understanding these instruments is essential for anyone active in the crypto market. Recent market events underscore the dual nature of volatility—it offers both opportunities and risks. A deep understanding of futures and options, coupled with a solid risk management strategy, is crucial for navigating these volatile markets effectively.

Disclaimer:Past performance is not indicative of future results. This article is intended for informational purposes only, and it does not constitute investment advice. Always conduct thorough research.