Filecoin’s Economic Failure: Are Miners Really On Strike?

The long-awaited Filecoin network has finally launched. But immediately after its arrival, there are already claims of a miner strike and failed economic model, amid other controversies.

On 15 October, after over 3 years in development, the Filecoin network finally launched. Miners started offering their storage services to the public, and FIL tokens purchased during the presale started vesting.

But soon after the network launched, it became clear that the Filecoin model makes mining financially infeasible without large sums of capital to cover overheads until profitability. Rumours quickly started circulating about Filecoin miners going on strike, in protest of the network's token economics and miner incentives.

On top of these criticisms, the Filecoin team allegedly released between 800,000 and 1.5 million tokens that were supposed to be locked up under a vesting schedule.

The claims of a miner strike and illegitimate token release have been disputed by the Filecoin team. But regardless of whether the "strike" is real or simply the result of FUD and media hype, the network's mechanism design issues are clearly causing some miners to stop offering more storage services, whether or not they are actively striking.

What is Filecoin?

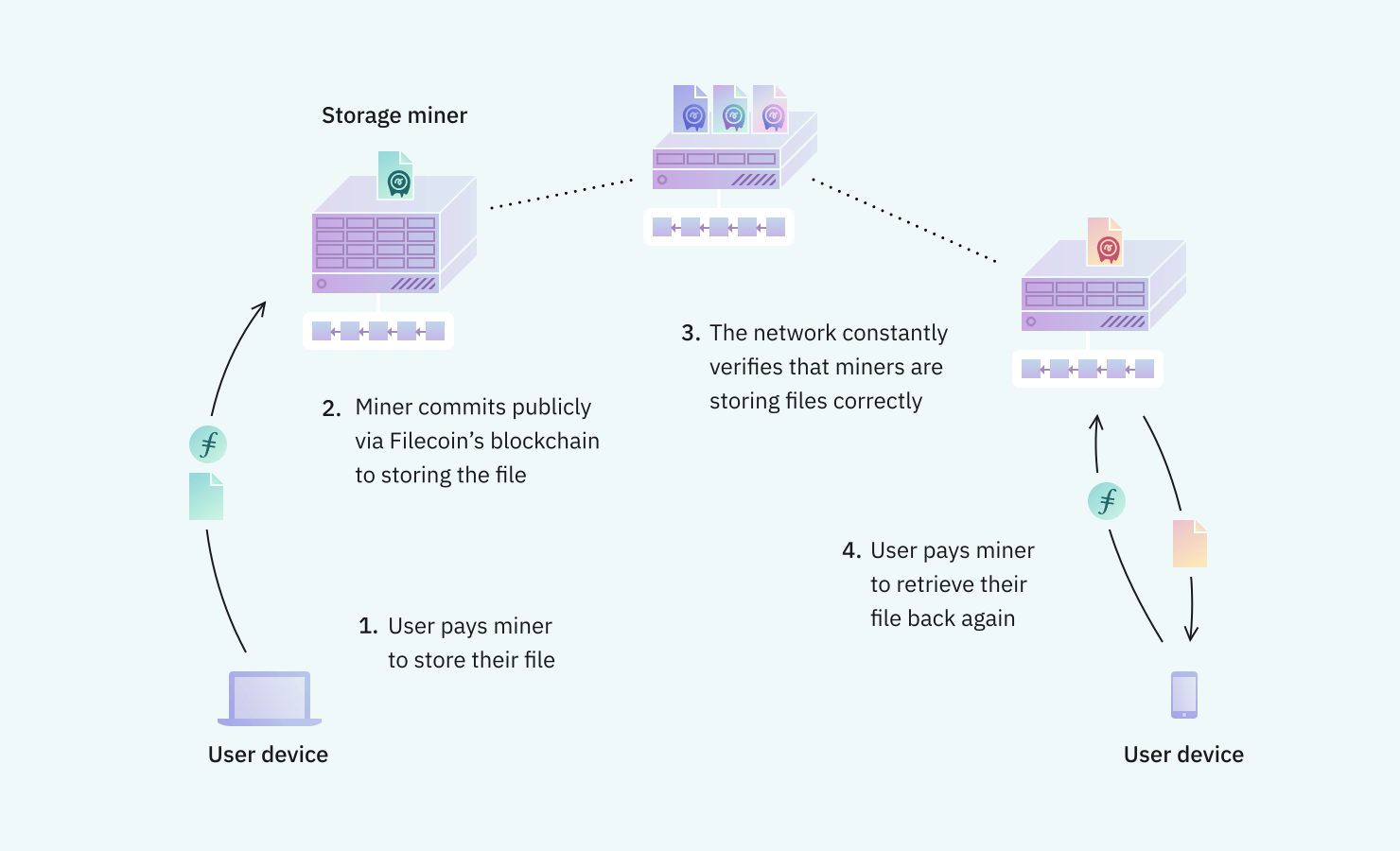

Filecoin is a decentralized file storage network that enables peer-to-peer storage and hosting services, with built-in economic incentives to ensure files are stored reliably and consistently. It acts as an incentivization layer in conjunction with IPFS, a file storage and content addressing protocol which was also created by Protocol Labs.

The Filecoin network is built on its own blockchain with a native token, FIL, acting as the medium of exchange. Users spend FIL to store files, and miners earn FIL in exchange for providing file storage and hosting.

The FIL earned by miners comes from two sources: storage fees (the money users pay to store files) and block rewards (newly minted FIL generated as an additional reward for miners). The process of storing and serving users' files is called "storage mining".

How Does Storage Mining Work?

According to Filecoin's blog, storage mining works as follows:

"In the Filecoin network, nodes have the ability to contract with clients, offering to store their data for an agreed-upon period of time in exchange for filecoin. Nodes that supply storage to the Filecoin network are termed storage miners... When they create a new block, storage miners are rewarded with newly minted filecoin, and by the transaction fees they can levy on other nodes seeking to include messages in the block."

In order to provide storage capacity to the network, miners are required to stake FIL tokens, which are used as collateral to ensure that they uphold their contractual obligations. The amount required to stake depends on a number of factors.

In a process termed sealing, miners must also provide regular computational proofs that the stored files are available. This process requires significant computing power, which ensures that miners maintain ready access to and integrity of the stored data. If they fail to provide these proofs on time, miners' collateral is slashed, and their power (representing the likelihood that they will be elected to mine a block) is reduced.

The Alleged "Miner Strike"

Despite the network's launch being successful from a technical perspective, some stakeholders have pointed out a flaw in the economics of Filecoin mining.

As mentioned above, in order to provide storage capacity, miners must stake FIL to ensure they deliver their services consistently according to users' contracts. This means that miners need to acquire FIL tokens before they can offer storage capacity to the network.

Meanwhile, you need to stake $FIL as collateral for the space provided, this is a guarantee and is slashed if space commitment not honoured (the goal being to insure that data isn’t lost). But that’s a chicken and egg pb, as nobody has $FIL to start mining and get $FIL. (4/n)

— Nico Deva (@NicoDeva_) October 18, 2020

The tweet above identifies a core problem with this model: "nobody has FIL to start mining and get FIL." The tokens are currently difficult to acquire for several reasons:

- Presale vesting - Tokens from the FIL presale are vesting gradually over 6-24 months, meaning the rate of supply increase is incredibly slow, thus restricting the supply available for miners acquire for staking.

- Miner reward vesting - Miner rewards also vest over 6 months, meaning that miners must wait a long time to re-invest their returns and provide more storage. As a result, they must either wait for a long time until their mined FIL vests, or they need to buy FIL to keep ramping up to their full hardware capacity.

- Market price - The current FIL price is high in comparison with returns, making it expensive to buy FIL to stake. Meanwhile, many expect the price to continue decreasing. As such, buying FIL from the market in order to stake it is a capital-intensive and risky decision that may end up costing miners more in losses than they can expect to generate in returns in the near future.

On top of the cost of acquiring FIL, many miners have already dedicated millions of dollars in capital to invest in hardware for the storage and computation necessary to participate in Filecoin mining.

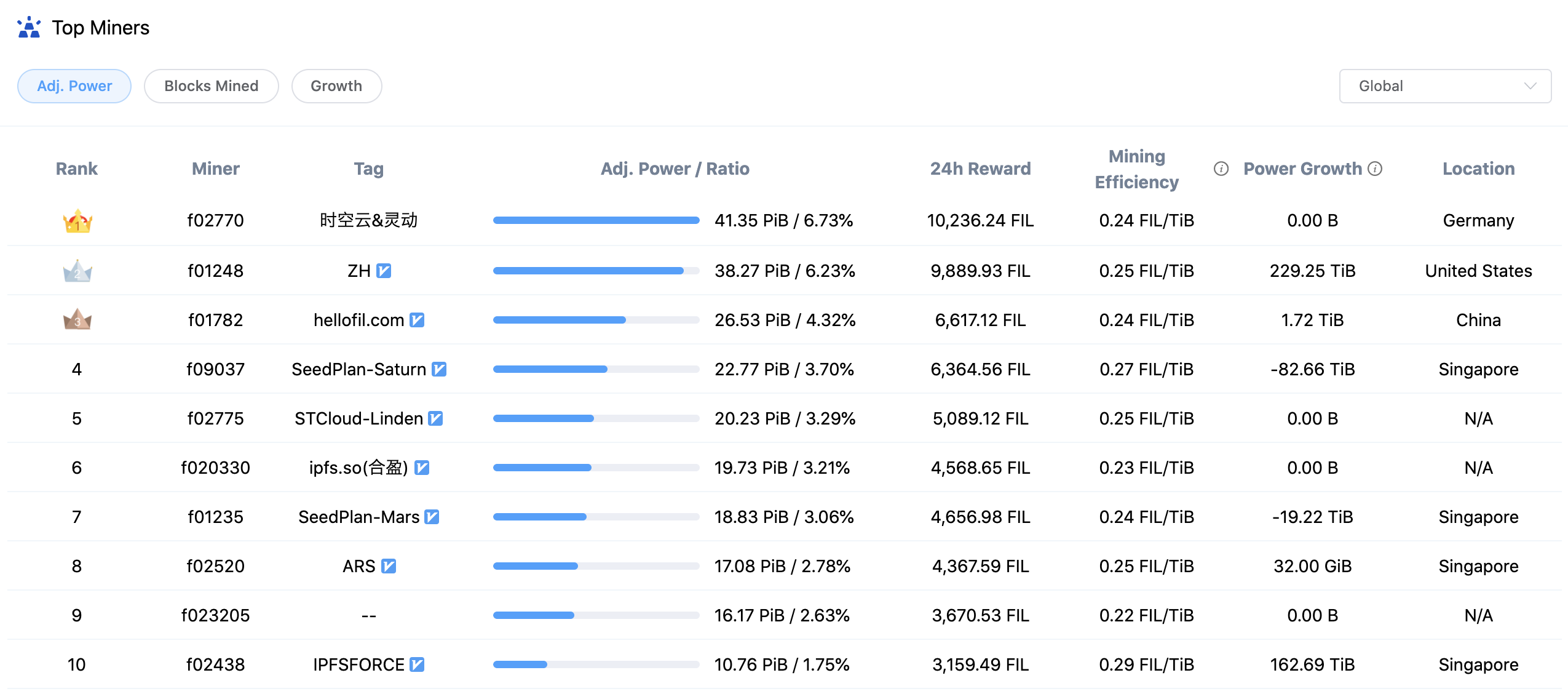

Because of these significant upfront costs and the additional challenge of acquiring FIL, many of the top miners have stopped adding more capacity to the network, while some are even removing capacity (as seen in the zero and negative values in the "power growth" column below).

Are Miners Actually Striking?

Miners' failure to add more capacity to the network has been interpreted by some as miners "going on strike". However, Filecoin's founder, Juan Benet, has denied these allegations:

(7.0) I was asked about a supposed “Miner Strike” -- This is nonsense. There is no strike. Miners are proving their storage just fine. There’s been no power loss out of the ordinary in the network. Miners are following the protocol, and making a TON of money doing so. pic.twitter.com/3U9MN0JGm9

— Juan Benet (@juanbenet) October 19, 2020

He has further stated that "in last 2 weeks, *we* the devs recommended to many miners to slow down growth rate to match their token flow, or pause until they can afford to grow steadily." He claims that, rather than being the result of a strike, "some of miners' growth decrease is from following our advice."

Some miners have also spoken out denying a strike. Chuhang Lai, CEO of Space Cloud Technology, has claimed that "this is not some sort of protest but we have to shut [our servers] down because we really don’t have the tokens as collateral to mine.”

This response paints the stalling of growth as less of a strike, and more of a pragmatic decision in response to the economic factors of FIL mining. But regardless of whether or not this is a strike, the outcome is the same: miners either will not or cannot add more storage capacity to the network until they can acquire more FIL.

Filecoin's Response

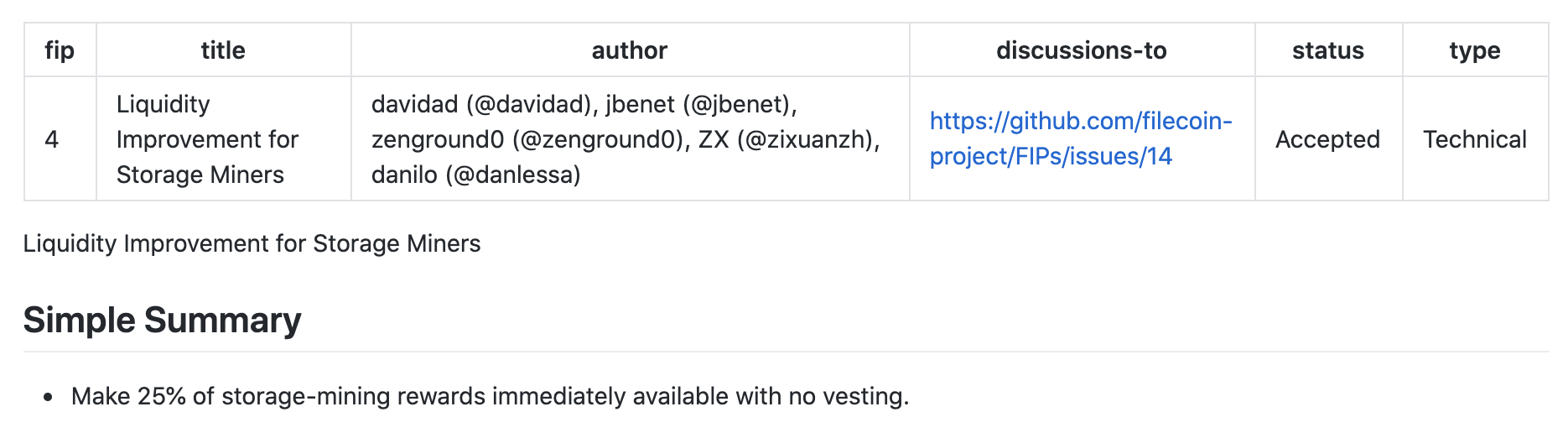

In order to reduce the barrier to entry for miners, the Filecoin team introduced FIP-004 (Filecoin Improvement Proposal #4), which makes 25% of storage-mining rewards immediately available with no vesting. This proposal, which was accepted on 18 October, will make it easier for miners to acquire more FIL collateral with which to expand their storage offering.

According to Xiaoming Zhan, CEO of IPFSMain (one of the largest Filecoin mining operations), "The revision could enable 80% of our mining capacity." However, this amount will vary for different miners depending on how much capital they are willing to commit right now in the hopes of achieving profitability in the future.

What Does This Mean for Filecoin?

Eventual Profitability

If they can keep their cost of operations below their expected future returns, there is no reason why miners shouldn't be able to reach profitability eventually. While they may currently be spending more capital to increase their storage capacity than they are bringing in via mining rewards, this is no different from a startup dedicating capital to achieve growth with the expectation that they can turn this into profit in the future.

It may require significant upfront investment, but as long as miners can stay afloat long enough for their rewards to vest, there is no reason why they should not expect to reach a state of profitability in the future.

If the price of FIL drops between the time that tokens are mined and the time that they actually vest, reaching profitability may take longer, as the rewards will have less market value by the time they vest - but profitability should still eventually be possible.

Lower Capacity

One potential outcome of the shortage of cheap FIL is that storage capacity may remain stagnant, with miners preferring to sell their mining rewards rather than reinvesting them via staking to increase their capacity.

In this case, with more FIL entering circulation (via continually vesting presale tokens and miner rewards being sold) the price of FIL would likely decrease. Eventually, this should reach an equilibrium where FIL is cheap enough to be worth purchasing in order to stake.

At the same time, limited storage supply will increase the value (and therefore the cost) of storage, incentivizing miners to add more capacity to capitalize on increased returns.

Pumpkin Farming: An Example 🎃

Let's say we have a town of pumpkin farmers. In order to grow their pumpkins (provide storage), they have to buy land (hardware) and pay staff (cover operating costs). But they also need to buy pumpkin seeds (FIL) - and if they want to grow more pumpkins (provide more storage), they need to buy and plant more seeds (buy and stake more FIL).

Now let's assume that in our imaginary economy, people pay for pumpkins (storage) not with money, but with pumpkin seeds (FIL). When farmers (miners) generate revenue through selling pumpkins (storage), they can sell these pumpkin seeds (FIL) on the open market in order to realize their returns in a stable currency. But they can also keep some or all of their pumpkin seeds (FIL) to plant (stake) them and grow more pumpkins (provide more storage).

If they think the demand for pumpkins (storage) is going to increase, they may wish to keep their seeds and plant them (stake FIL returns to increase storage capacity). They may also spend more money buying more land (hardware), hiring more staff (increasing operating expenditure), and buying more pumpkin seeds (FIL). This will increase their time to profitability, but will stand them in better stead when the demand for pumpkins (storage) increases.

Alternatively, if they think the demand for pumpkins (storage) is going to stay the same or decrease, they may wish to sell their pumpkin seeds (FIL returns) immediately, as they will not need the seeds (FIL) to grow more pumpkins (increase storage capacity) if no one wants pumpkins (storage).

This is what we are seeing now. For many miners, demand for pumpkins (storage) is not high enough to justify keeping pumpkin seeds (keeping FIL) in order to increase their pumpkin-growing capacity (storage capacity) - let alone buying more pumpkin seeds (buying more FIL).

They also know that the supply of pumpkin seeds (FIL) is going to keep increasing over time, as pumpkin seed suppliers (presale investors) are continually receiving more seeds (FIL) and selling them on the open market. As such, if they hold off on buying more seeds (FIL) to increase their pumpkin-growing capacity (storage capacity), they know they can probably buy pumpkin seeds (FIL) later at lower prices.

There is no incentive to buy more seeds (FIL) to increase capacity right now, unless the farmers (miners) think the price of seeds (FIL) or demand for pumpkins (storage) are going to increase. As a result, they are waiting to buy more seeds (FIL) to grow more pumpkins (provide more storage) later, when there is demand for them.

This is not a failure of the economics of the pumpkin market (Filecoin network); it is simply an issue of supply and demand - and right now, the demand for pumpkins (storage) is not high enough to justify buying more seeds (FIL) to grow more pumpkins (provide more storage capacity).

In time, farmers (miners) will be able to sell enough pumpkins (storage) at their current capacity in order to make back the costs of setting up their farm (buying hardware and running servers) and buying pumpkin seeds (FIL). And if/when the demand for pumpkins (storage) increases, or the supply is not high enough, the price of pumpkins (storage) will increase, allowing farmers (miners) to generate more yield and reinvest that back into more land (hardware) and seeds (FIL) to expand their offering.

Exit Scam Allegations

On top of criticisms of the Filecoin network's economic model, some are questioning the mysterious appearance of 800,000 FIL on major exchanges - tokens which, allegedly, were supposed to be vesting. TRON founder Justin Sun tweeted on the issue:

Exit scam here? 1.5 million $FIL for 200 USD each worth 300 million USD at the high. Now price is below 60 USD. 70% down. No lock-up. No announcement to the community. How much do you sell? @juanbenet @Filecoin Is this ok? @VitalikButerin @SEC_Enforcement https://t.co/qYqJzgolyX pic.twitter.com/hGpMvDxSMO

— Justin Sun🌞 (@justinsuntron) October 16, 2020

According to Forkast.News, Juan Benet has denied these allegations: “Neither [Protocol Labs] or any team members sold any FIL as Justin Sun alleges, nor were there trades of the magnitude he claims.” Benet's justification for the appearance of these tokens is that the transactions were "part of a market stabilization program that has become an industry standard for the benefit of the community."

According to Benet, “these programs engage firms to provide liquidity and stability to the market in the early days after launch, when prices are at risk of being volatile.” However, he did not comment on whether these tokens were supposed to be locked up under a vesting schedule, as alleged by Sun.

Regardless of the facts of the matter, this controversy has added to negative perceptions of the FIL token and the Filecoin network as a whole, representing a potential threat to the network in the early and critical stages of its launch.

Conclusions

Filecoin is undoubtedly facing immense challenges as a result of its economic model, making it difficult or even totally infeasible for all but the most capital-flush of miners to participate. However, it appears that miners are not on strike; they simply have no choice but to slow or halt their growth until mining becomes more profitable.

On top of the system's design struggles, the emerging scandal surrounding the early release of additional tokens certainly hasn't helped Filecoin's public image. But even though the community is raising many doubts, the technical fundamentals of the network remain intact.

Despite the many challenges faced by the Filecoin network so soon after its launch, its capacity will almost certainly continue to grow once the demand for storage increases and the price of FIL reaches a more stable equilibrium with the network's mining economics.

Want to learn more or suggest topics to cover next? Join the discussion on Twitter.

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter