Pioneering On-Chain Analysis for the Ethereum Ecosystem

With the addition of more than 500 new ERC-20 tokens, we are expanding our asset range and introducing more granular metrics to provide deeper insights across the Ethereum ecosystem.

We are excited to announce that our analytics platform now supports more than 500 new ERC-20 tokens. This major expansion reinforces Glassnode's commitment to providing the highest quality data and most innovative analysis tools for both Bitcoin and Ethereum markets.

Solidifying Our Leadership in On-Chain Analytics

For years, Glassnode has been the leader in on-chain analytics for Bitcoin, offering fresh insights into the market dynamics that drive the world's first and largest cryptocurrency. Now, we are extending that leadership to the Ethereum ecosystem. With the addition of 500+ ERC-20 tokens, our users can now apply the same depth of analysis to Ethereum-based assets as they do to Bitcoin.

This release includes a wide range of popular and emerging tokens, spanning various sectors. Whether you're interested in well-established DeFi projects, innovative AI-driven tokens, or the latest trends in staking, Glassnode now provides the tools to analyze these assets with the same rigor you expect for Bitcoin.

You can access the full list of supported tokens here.

Enabling In-Depth Analysis with Enhanced Metric Coverage

With the expansion of our ERC-20 token support, we are enabling some of our most popular metrics across these new assets, categorized into key areas for comprehensive market analysis:

- Asset Fundamentals: Track the health and underlying value of assets with metrics such as Active Addresses, New Addresses, Market Cap, Price, Circulating Supply, Supply in Smart Contracts, and Supply of Top 1% Addresses.

- Capital Flows: Gain insights into the movement of assets across the network and exchanges with Transfer Volume (Total, Median, Mean), Transfer Count, Exchange Balances, Netflows, and more.

- Profit and Loss Data: Analyze sentiment, financial outcomes and investor performance using SOPR (Spent Output Profit Ratio), MVRV (Market Value to Realized Value), Realized Profit and Loss, and their detailed breakdowns by wallet size, age, and holding period.

This comprehensive metric coverage allows users to analyze a significant portion of the Ethereum ecosystem with unprecedented depth and detail. Whether you're comparing sectors, identifying market cycles, or predicting shifts in momentum, Glassnode's expanded toolkit offers the depth and precision needed for sophisticated analysis.

30 Days of Free Access to ERC-20 Metrics

To celebrate this major expansion, we are excited to announce that all ERC-20-based token metrics will be available for free for the first 30 days to all Glassnode Studio accounts.

Starting today, this limited-time offer provides our users with a unique opportunity to explore the full potential of our new metrics, test out different strategies, and see firsthand how Glassnode's tools can enhance their market analysis. We encourage everyone to take advantage of this offer to experience the unparalleled depth and quality of our analytics.

Comprehensive Market Analysis, All in One Place

As we continue to evolve and expand our platform, we are making it easier for users to conduct comprehensive market analysis without needing to rely on multiple data providers. Our recent infrastructure upgrade allows us to scale horizontally, quickly integrating more assets and metrics into our platform. This means that investors can now perform detailed analysis of both Bitcoin and Ethereum landscapes from a single, unified platform.

Application Case Study

Applying the Weekly-Monthly Seller Exhaustion Model to ERC-20 Ecosystem

In Q2 of 2024, we incorporated a detailed breakdown of our most popular metrics, focusing on the age of holdings and wallet size distributions, to enhance our understanding of critical market dynamics. This enables our users to make more informed decisions through granular cohort analysis, answering complex questions such as:

- How do short-term investor actions influence asset valuations, particularly when analyzed over holding periods that range from days to months?

- Does the concentration of network wealth in larger wallets suggest a market driven by a few influential investors?

- Are new investors realizing more losses than seasoned holders, indicating potential short-term volatility but also an underlying market strength?

For more information on the Breakdown Metrics, see our product announcement here.

By combining our expanded ERC-20 coverage with the depth provided by the Breakdown Metrics, we can now significantly enhance our clients’ insights into capital flows, asset fundamentals, and market sentiment within the ERC-20 ecosystem.

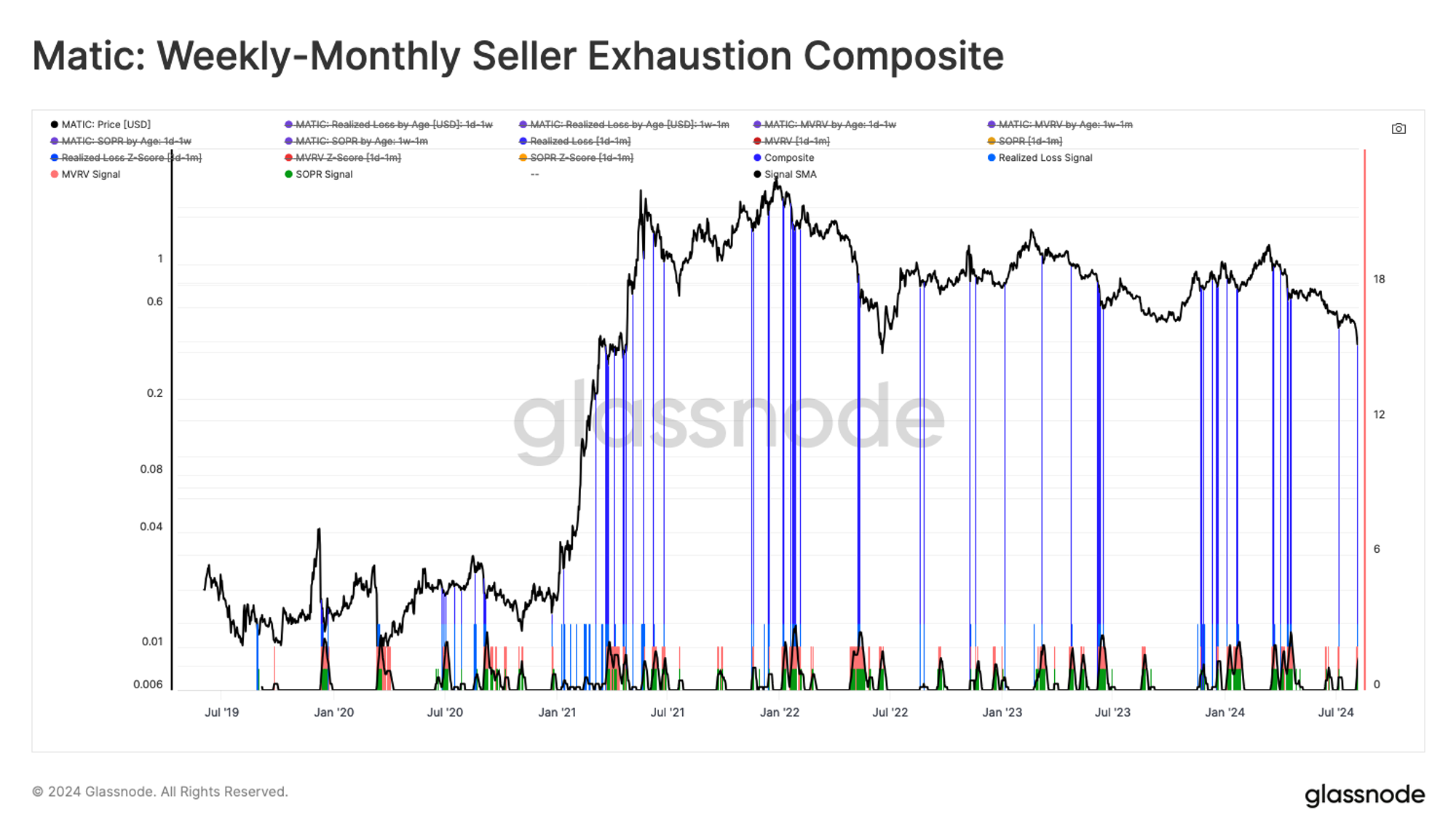

In this case study, we applied the Weekly-Monthly Seller Exhaustion model to the MATIC token. Seller Exhaustion represents a critical point where most market sellers have exited, allowing us to identify potential local bottoms. This model, previously validated within the Bitcoin market, has now been extended to the ERC-20 universe.

For this analysis, we focused on three key metrics:

- MVRV Ratio: Measures the unrealized profit or loss held by investors within a specific cohort, helping to assess overall market sentiment.

- SOPR (Spent Output Profit Ratio): Evaluates the average profit or loss realized by the cohort, providing insight into investor behavior.

- Realized Loss: Isolates the magnitude of losses realized in USD terms by the cohort, indicating periods of heightened sell-side pressure.

These metrics were selected because they offer complementary insights into market sentiment - MVRV reveals unrealized potential, SOPR uncovers realized actions, and Realized Loss highlights critical sell pressure points.

When combined, these metrics allow us to simulate scenarios where significant realized and unrealized losses suggest potential seller exhaustion. This approach helps us gauge when sell-side pressure might be absorbed by new buy-side demand, marking local bottoms in the market. The chart above highlights these periods in blue, showing points where significant loss metrics converge to signal potential bottoms.

Extending the Seller Exhaustion model across ERC-20 tokens offers users a tool that deepens their understanding of market sentiment and provides a data-driven method for identifying local bottoms, thus enhancing trading strategies. With the ability to apply this methodology to all supported ERC-20 tokens across various time frames, we are excited to offer unparalleled depth in on-chain analysis, empowering research teams and traders to navigate the Ethereum ecosystem with greater confidence.

What’s Next: Upcoming Insights and Tools

This is just the first step in our most recent efforts to broaden our coverage and enhance the analytical depth of our platform. Stay tuned for more updates as we continue to innovate and provide our users with the best possible tools for on-chain analysis.