BTC Market Pulse: Week 23

BTC’s rally has stalled below $111K, triggering a broad cooldown. Spot signals show fading momentum, derivatives positioning remains cautious, and ETF flows have slowed. On-chain activity and profitability metrics suggest consolidation—not exit—amid a reassessment phase.

Overview

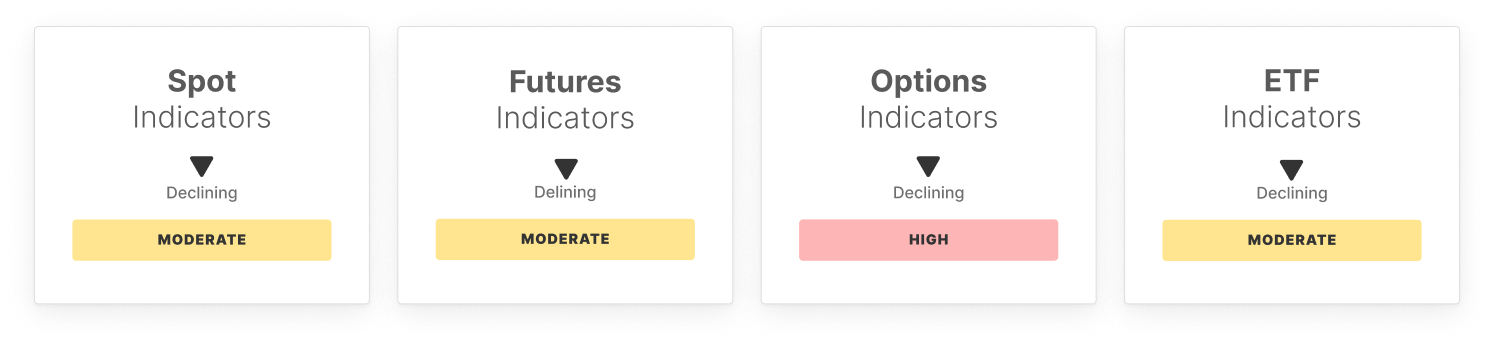

Price failing to keep its positive momentum above $111K has triggered a broad cooldown across the Bitcoin market. Spot market signals—once leading the rally—are now showing visible signs of fatigue. Momentum softened, with RSI retreating toward neutral territory. Spot CVD flipped negative, and trading volume dropped below the statistical low band, confirming a pullback in demand and market participation.

Futures markets continue to build, but positioning remains cautious. Open interest is elevated but not excessive, while long-side funding declined and perpetual CVD reversed sharply, signaling that leveraged longs are reducing exposure. This divergence suggests a tactical unwind rather than a full risk-off shift.

The options market remains active, though sentiment has cooled slightly. Open interest dipped, and 25-delta skew rose but remains negative—still showing call-side bias, albeit with less conviction. Volatility spread remains above the high band, confirming continued speculation on price swings despite fading momentum.

ETF activity reinforces this risk reset. Netflows declined to near statistical lows, and trade volume also fell, indicating reduced TradFi participation. MVRV ratios remain stable, but off their highs, suggesting ETF holders are still in profit, though the pace of accumulation has slowed.

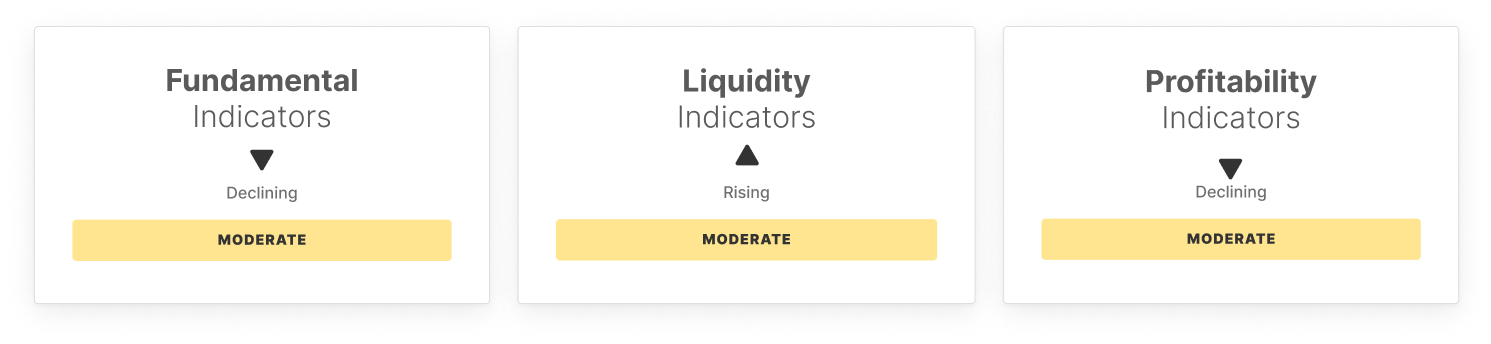

On-chain fundamentals reflect this consolidation phase. Both active addresses and transfer volumes declined modestly, while total fees dropped—implying lighter transaction demand. Liquidity metrics showed modest capital inflows and a persistent long-term holder dominance, but hot capital share remains well below peak levels, indicating new demand has not yet returned forcefully.

Profitability metrics cooled notably. Percent supply in profit pulled back from euphoric highs, realized profit-taking declined, and NUPL slipped further into neutral territory. These suggest that while investors are still in profit, there is growing selectivity in realizing gains—reflecting a market that is reassessing, not exiting.

In aggregate, the market has been trading in a high-risk phase, though not as overheated as the December 2024 euphoria zone. While spot strength has faded and profit-taking has moderated, positioning across futures and options remains relatively contained. For this rally to resume sustainably, renewed demand across both retail and institutional segments will be essential — if not, the current cooling momentum may persist.

Off-Chain Indicators

On-Chain Indicators

- Follow us and reach out on X

- Join our Telegram channel

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies.

Please read our Transparency Notice when using exchange data.