Introducing Proof-of-Reserve Exchange Metrics

We introduce an array of proof-of-reserve metrics to easily monitor the balances of exchanges' on-chain reserves held in self-reported addresses.

Crypto exchanges have traditionally been secretive about the blockchain addresses, holdings, and wallet management practices that control customer funds. However, in the aftermath of the FTX collapse in November 2022, this appears to have started changing.

In a bid for enhanced transparency, and in an attempt to counter practices of fractional reserves, many exchanges have started a process of self-reporting their crypto reserves. The industry commonly refers to this practice as “Proof-of-Reserves”, which involves the verifiable disclosure of both reserves held (on-chain), and matched liabilities (both on- and off-chain).

In the context of this article we only refer to the on-chain reserves as communicated by the exchanges. Liabilities are not reported, as these include a mix of on-chain and off-chain data known only to the exchange.

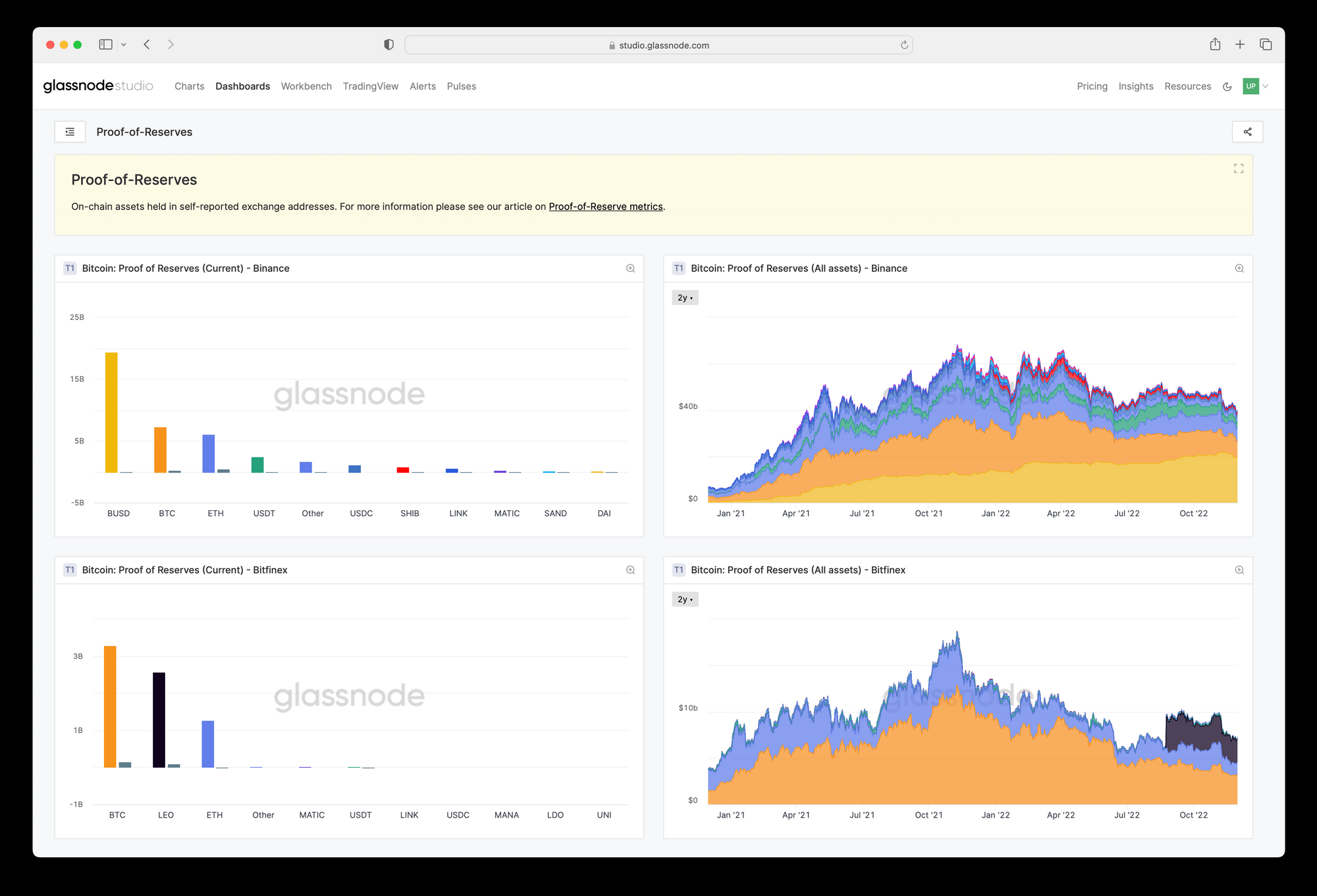

To our knowledge, a total of nine major exchanges have (partially) disclosed addresses to date (30/11/2022): Binance, Bitfinex, BitMEX, Bybit, Crypto.com, Deribit, Huobi, KuCoin, and OKEx.

To provide an easy-to-access view of these proof-of-reserves disclosures, we are monitoring the balances of coins and tokens held within these exchange self-reported addresses, and providing tools to aide in visualization, and verification for Glassnode members, and the community – these newly metrics are freely available to all.

📊 Our comprehensive Proof-of-Reserves dashboard can be found here.

Proof-of-Reserves vs Exchange Balances

At Glassnode we’ve pioneered the on-chain analytics of exchange balances and movements, and provide the most comprehensive suite of metrics across all major exchanges.

However, it is important to highlight that there is a key difference between Exchange Balances, and Proof-of-Reserves metrics.

Exchange Balances

The intuitive view, held by many, is that the process of monitoring exchange balances is a matter of identifying a set of addresses, and tracking the movement of coins in and out. The reality is far more complex.

In fact, the way exchanges operate on-chain is highly complex, involve complicated and dynamic transaction patterns, and wallet management practices, which are unique for each exchange. A web of cold, hot, and one-time wallets are in a constant state of flux, and occasionally undergo complete redesigns, requiring continuous research, heuristic identification, and maintenance by our data and engineering teams.

Understanding, and keeping up with these dynamics however is essential, in order to provide the most accurate exchange metrics possible. Our existing suite of Exchange Balance metrics are the result of these sophisticated data acquisition systems, which use a combination of publicly available information, clustering algorithms, and exchange-specific heuristics.

Exchange balance metrics do not reflect the officially reported numbers by the exchanges themselves, nor do they always provide a bullet-proof, 100% guaranteed quantification of on-chain exchange funds. What Exchange Balance metrics do present is our best estimate of the true balance held on each exchange, quantified as closely, and as verifiably accurate as possible (see below).

Proof-of-Reserves

In contrast, Proof-of-Reserves metrics track only the balance of a (small) set of addresses which are publicly disclosed by the respective exchange. This set of addresses is static and does not change unless an exchange publicly updates their set of proof-of-reserve addresses. There is nothing else that gets included into the proof-of-reserve balances – it is plainly the sum of coins held in addresses officially communicated by exchanges.

Side note: our focus has always been on the most sustainable networks and ecosystems of the space. Therefore we only include Bitcoin and Ethereum (along with all corresponding Ethereum-based tokens) in our proof-of-reserves metrics. Addresses from other blockchains/L1s are not included.

It is important to note that proof-of-reserve addresses are included within our Exchange balance metrics. Therefore, Proof-of-Reserves are strictly a subset of Exchange Balances.

Comparison

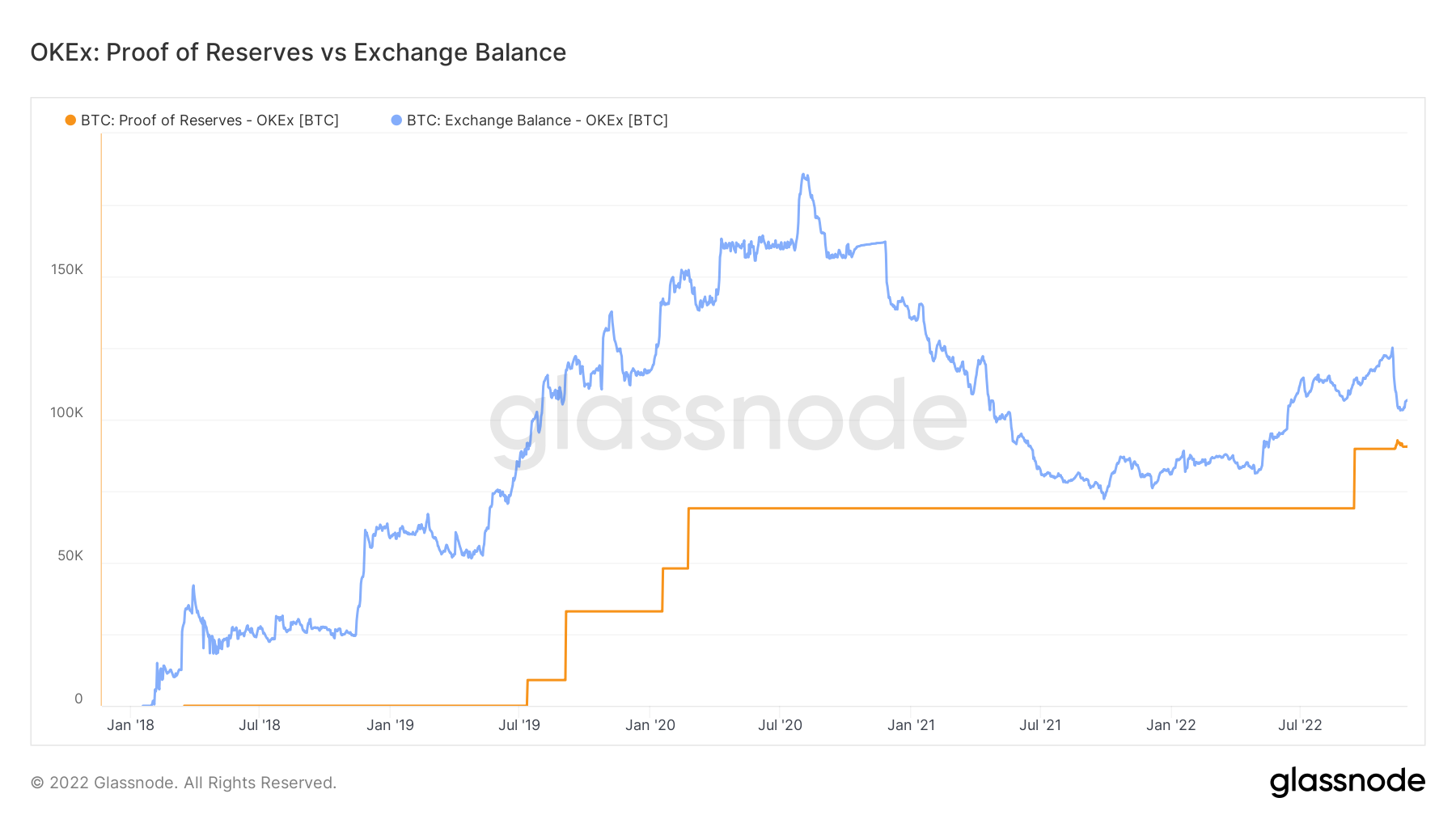

Comparing proof-of-reserves and exchange balances, there are a few notable observations, with a few examples shown below.

Exchange Balances are often more dynamic as they represent a more comprehensive set of addresses, while proof-of-reserve addresses are often only a small subset of (cold) wallets. Below is an example for OKEx, showing Exchange Balances in blue, and Proof-of-Reserves in orange for BTC.

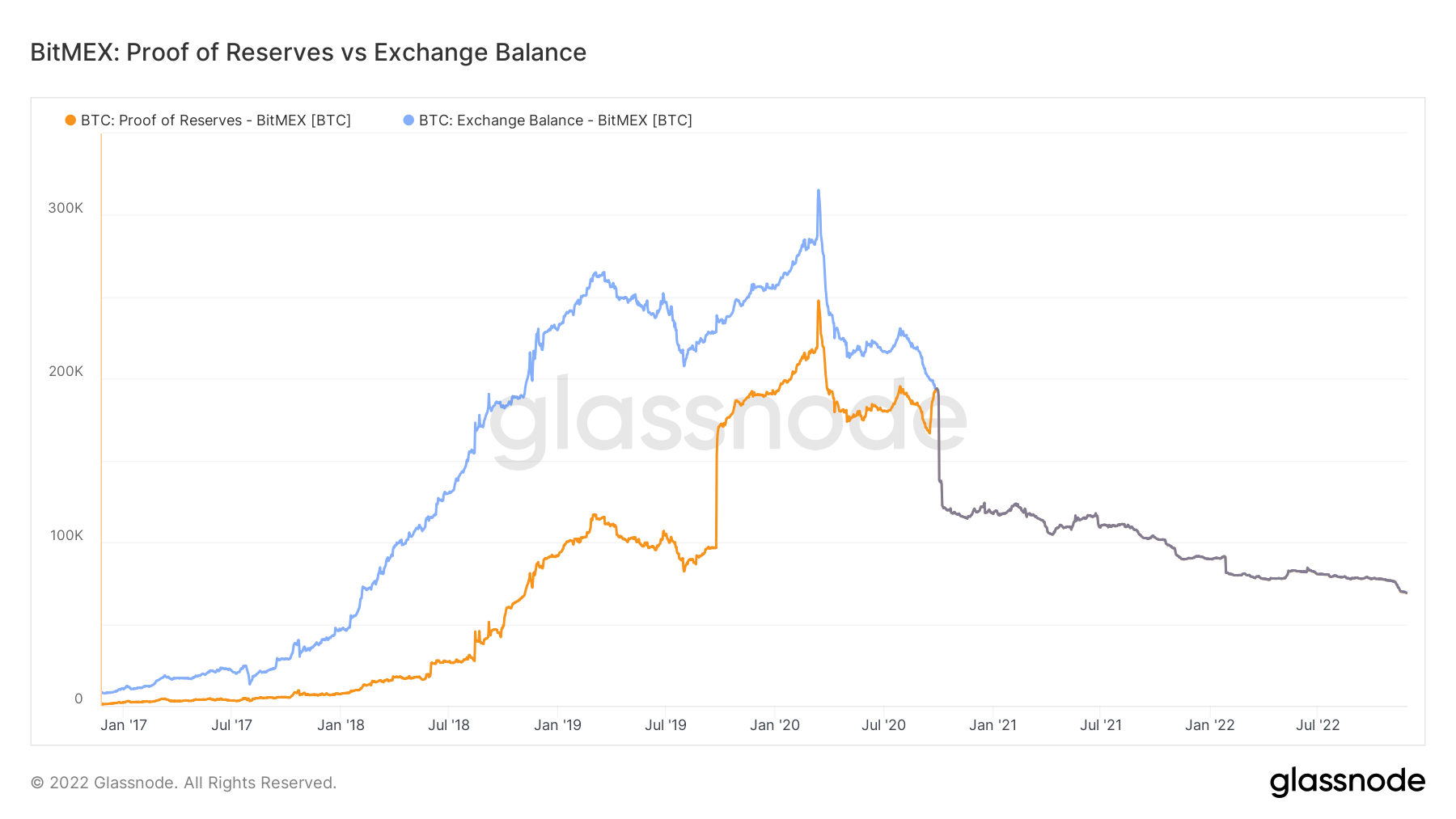

Depending on how comprehensive the officially communicated proof-of-reserve addresses are, the total balance can also be very close to our reported exchange balance. This is in fact a validation for Glassnode’s methodology of accurately tracking exchange balances.

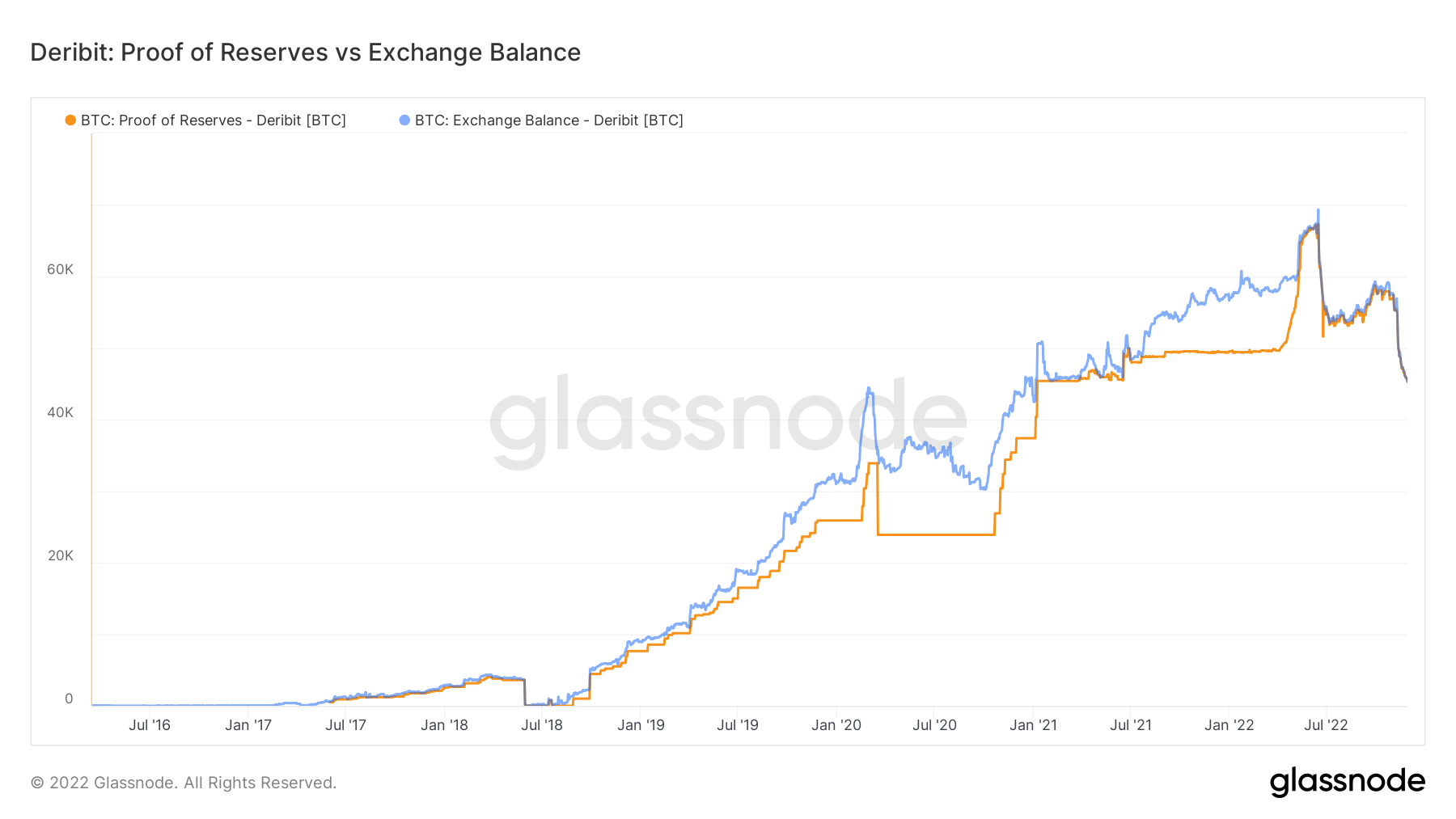

Below we can see examples for BitMEX and Deribit, both of which have very similar Exchange Balance and Proof-of-Reserve traces.

For a full comparison of all proof-of-reserves and exchange balances for each individual exchange, kindly use our Workbench in Studio.

Metrics Overview

- Proof-of-Reserves Dashboard

- Proof-of-Reserves (per asset)

- Proof-of-Reserves (all assets)

- Proof-of-Reserves (current)

A Note to Exchanges

We encourage all exchanges to follow and disclose to the public their list of addresses as part of their proof-of-reserve initiatives. Please do not hesitate to reach out to us if you are doing so, and we will gladly integrate those in our platform for more transparency to our members and the community.

- Follow us and reach out on Twitter

- Join our Telegram channel

- Visit Glassnode Forum for long-form discussions and analysis.

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio