The Week On-chain (Week 35, 2021)

An on-chain divergence has developed between price, on-chain activity and supply dynamics, creating a market structure similar to an early bull impulse.

The Bitcoin market entered price consolidation this week, largely hanging onto the impressive gains since the bottom set in late July. Prices traded between a weekly low of $46,465 and a new local high of $50,461.

As the Bitcoin and wider cryptocurrency market rallies higher, a remarkable on-chain divergence continues to form across both Bitcoin and Ethereum. On-chain activity on both chains has remained quiet relative to bull market highs, even as price momentum continues upwards, and bullish trends in supply dynamics remain in play. This week, we explore and compare a number of on-chain metrics between Bitcoin and Ethereum to characterise this divergence.

Setting the Stage

Before starting our comparative analysis, we will take a quick look at the big picture position of the Bitcoin market following a very month of strong price performance. With prices pushing above $50k, and some notable profit taking covered last week, the market currently sits at the top end of a very high on-chain volume node.

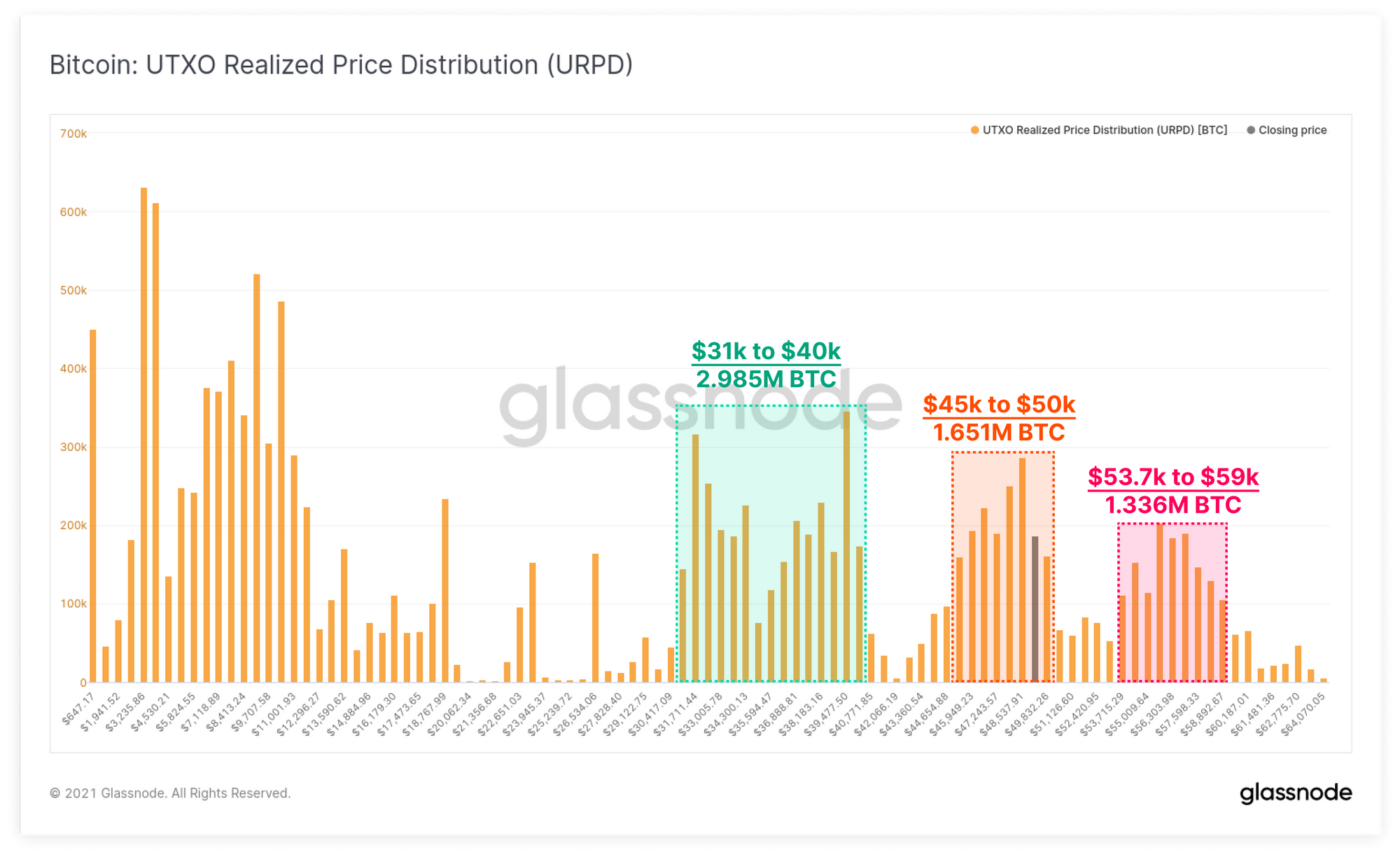

The chart below shows the price bands where the current BTC coin supply was last transacted. Since breaching last cycles $20k ATH, three distinct on-chain volume bands have formed:

- $31k to $40k (Price Floor) where over 2.98M BTC were accumulated, both in Jan 2021, and in the recent 2.5 month long consolidation. This is likely now a very strong underlying support zone.

- $45k to $50k (Current Range) where 1.65M BTC have a cost basis. With price at the top end of this range, it is likely that this too could act as strong price support.

- $53.7k to $59k (Trillion Dollar Asset) where 1.336M BTC were accumulated between March and May and are still holding unrealised losses. These coins are those that remain unshaken by a 50%+ correction in May, but could also become overhead resistance if investors seek to exit at their cost basis.

On net, this indicates that a fairly strong set of high conviction investors remain in the market and is a powerful signal for the bulls.

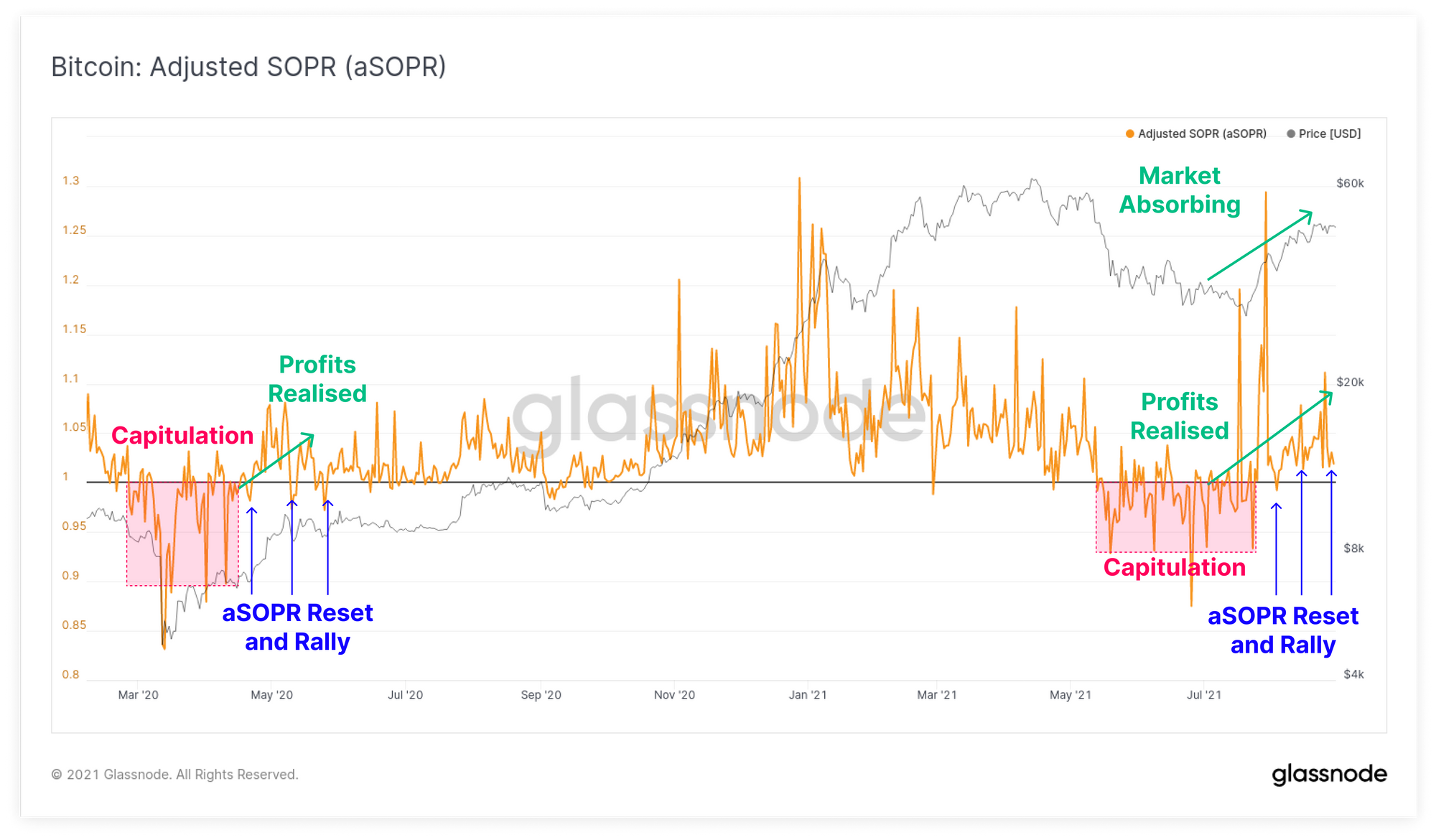

Within this context, profits have continued to be realised throughout August as prices continued to trade higher. This suggests an underlying market strength, capable of absorbing this spent coin supply. The aSOPR metric shows that similar behaviour was observed after the March 2020 sell-off with the following sequence of events:

- Capitulation where losses were realised by panic sellers for an extended period of time.

- Profitability Returns as signalled by aSOPR trading and holding above 1.0. This suggests profits are realised but market strength is sufficient to absorb sell pressure.

- Buyer Conviction Returns as aSOPR resets to 1.0 on a number of occasions, and then bounces higher, suggesting holders of profitable coins prefer to stay dormant, and investors are buying the dip.

Week On-chain Dashboard

The Week On-chain Newsletter now has a live dashboard for all featured charts here. We have also started production for Week On-chain video analysis to provide a deeper dive into the thesis and logic behind each weeks analysis. Visit and subscribe to our YouTube channel, and visit our Video Portal to see our video content.

On-chain Activity Divergence

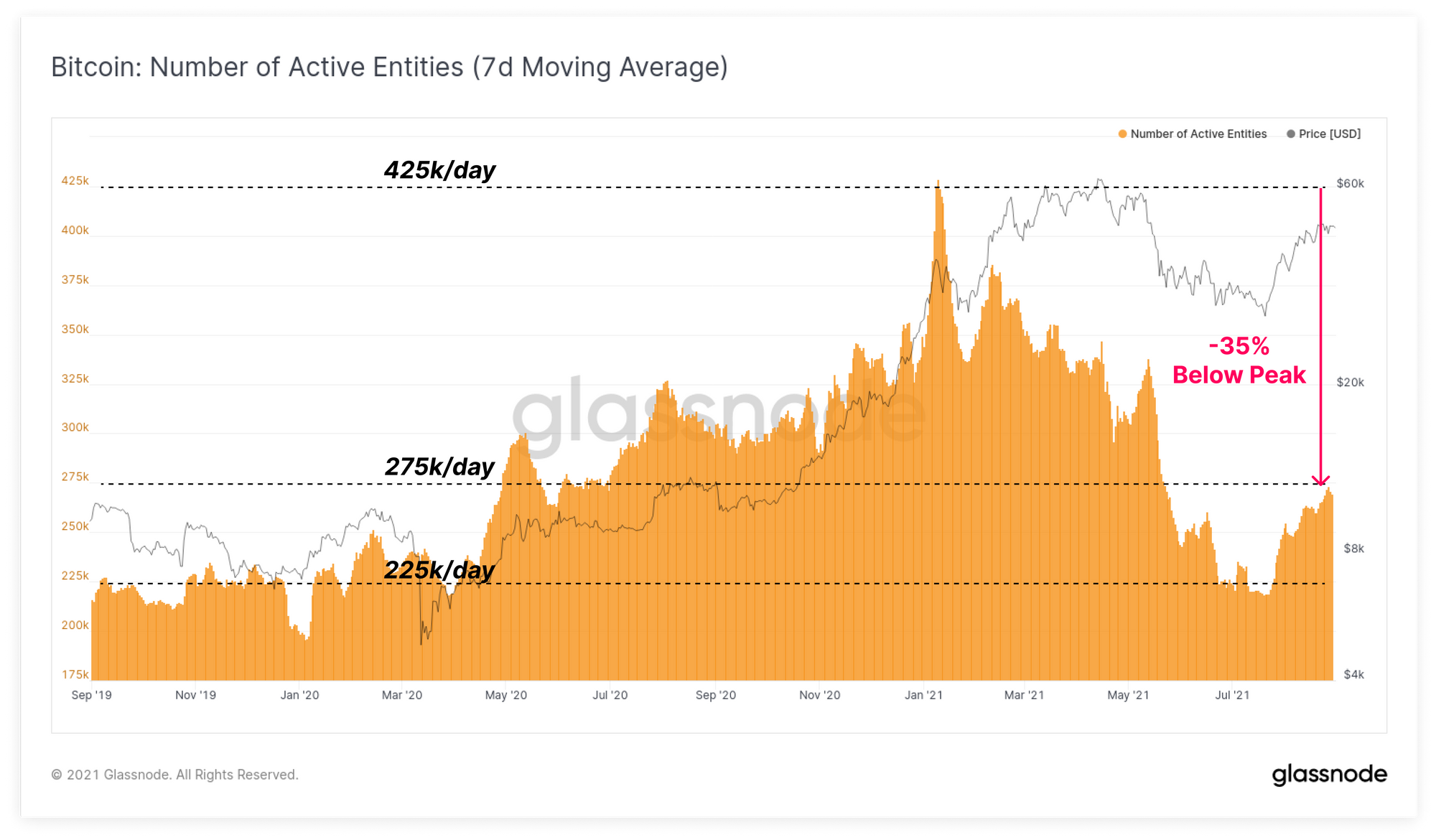

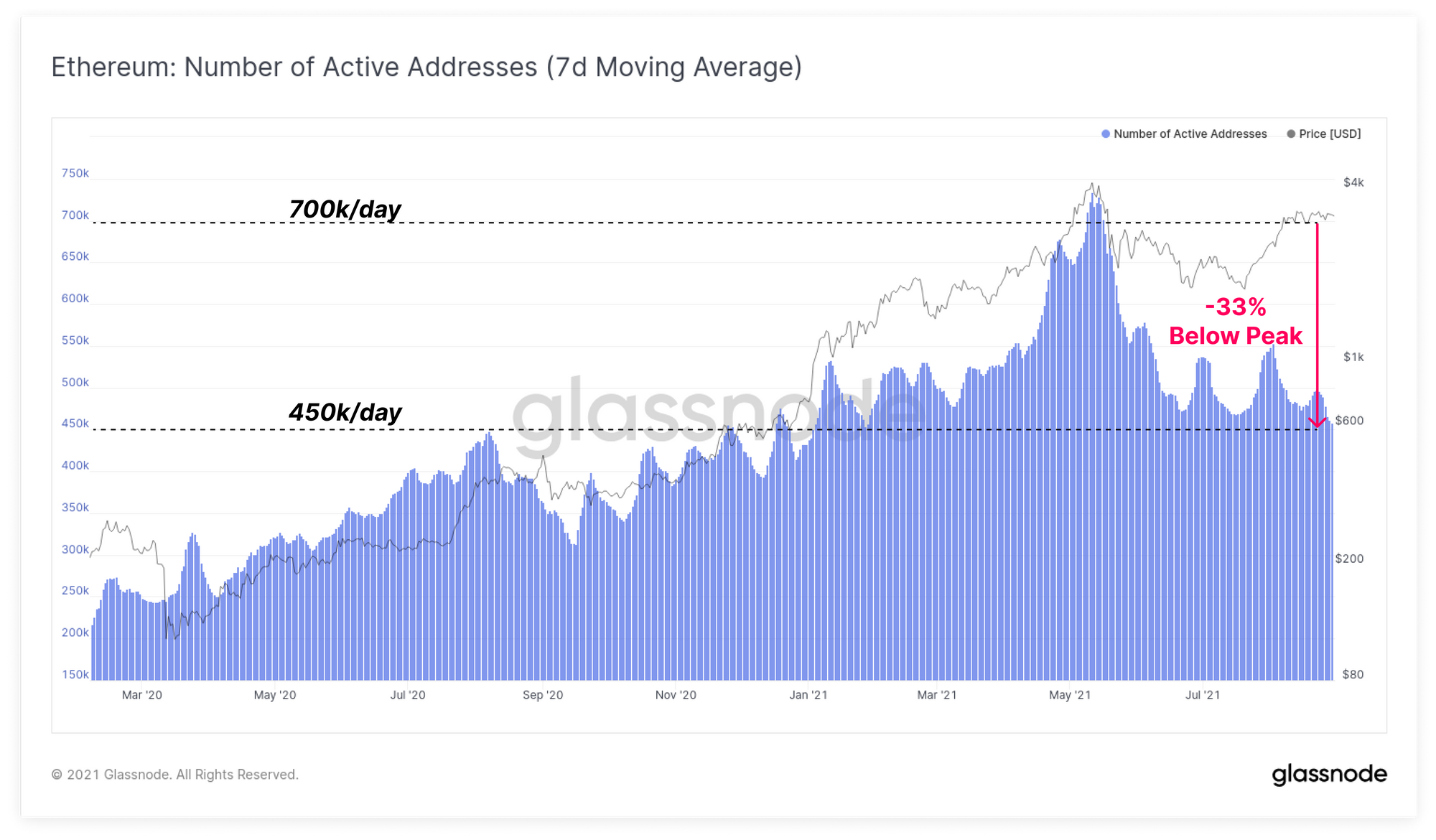

Whilst prices rally, an impressive divergence has been maintained in on-chain activity. Demand for blockspace on both Bitcoin and Ethereum remains well below recent peaks despite prices returning to elevated trading ranges.

Active entities on the Bitcoin network is currently around 275k per day, around 35% below the January peak.

Active addresses on Ethereum are similarly down 33% from the May peak, currently sitting at around 450k addresses per day. It is notable that current activity on both chains is similar to the stable pre-bull accumulation range established in mid to late 2020.

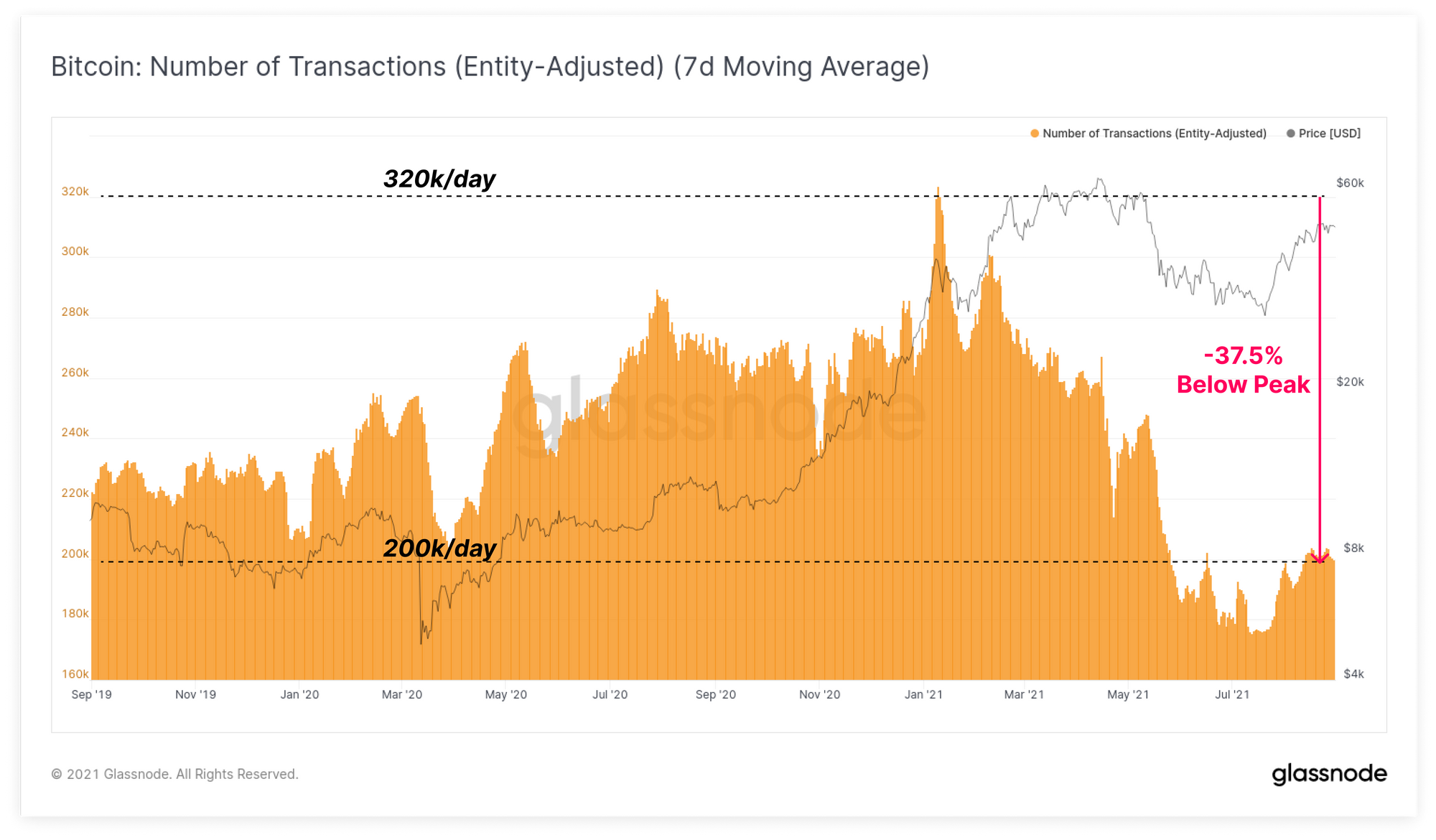

Similar observations can be made regarding transaction counts which provide a proxy for block-space demand. Bitcoin transaction counts are down to around 200k per day, a significant drop of 37.5% below the peak.

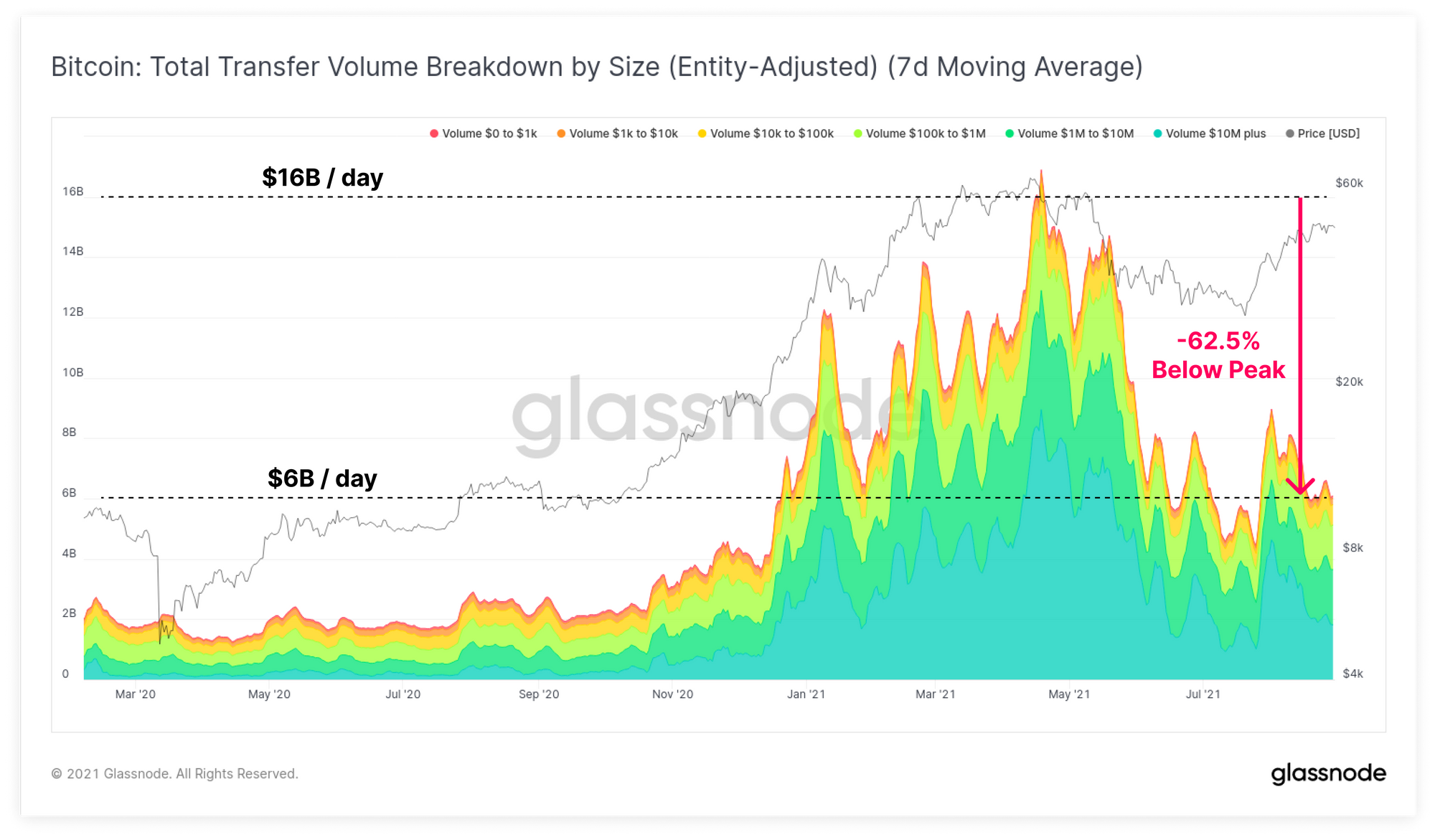

Even more dramatic is the USD denominated on-chain transaction volume which is currently down 62.5% to $6B per day relative to the April ATH. Note that the transaction counts above, and volume below, uses our Entity-Adjusted data, which filters out internal transfers and self-spends and thus reflects the magnitude of economically meaningful volume.

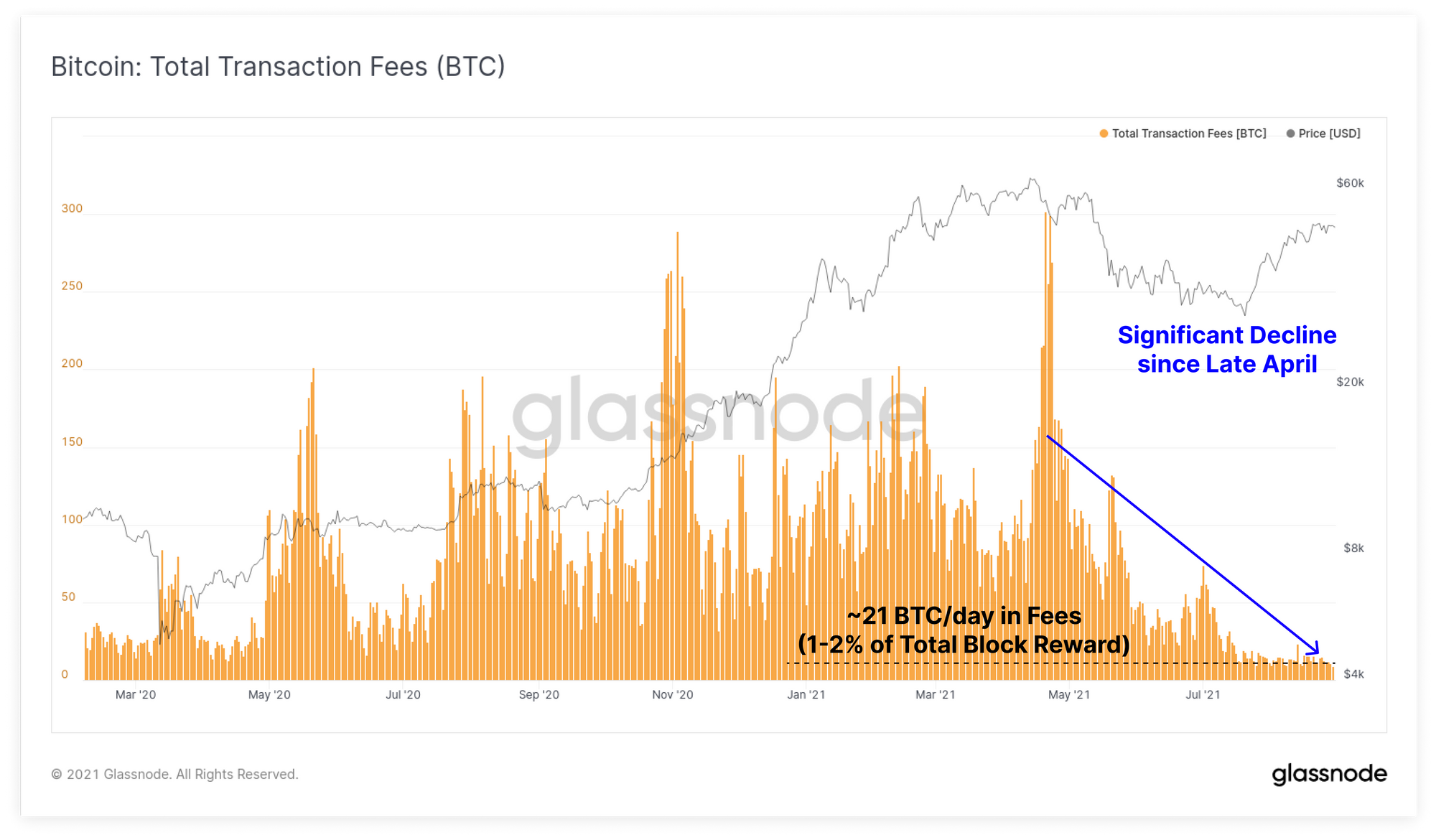

As a result of this slim demand for block-space, Bitcoin network transaction fees have declined considerably, returning to levels that have not been seen in the last year. At present, transaction fees average 21 BTC per day, representing only 1 to 2% of the total block reward.

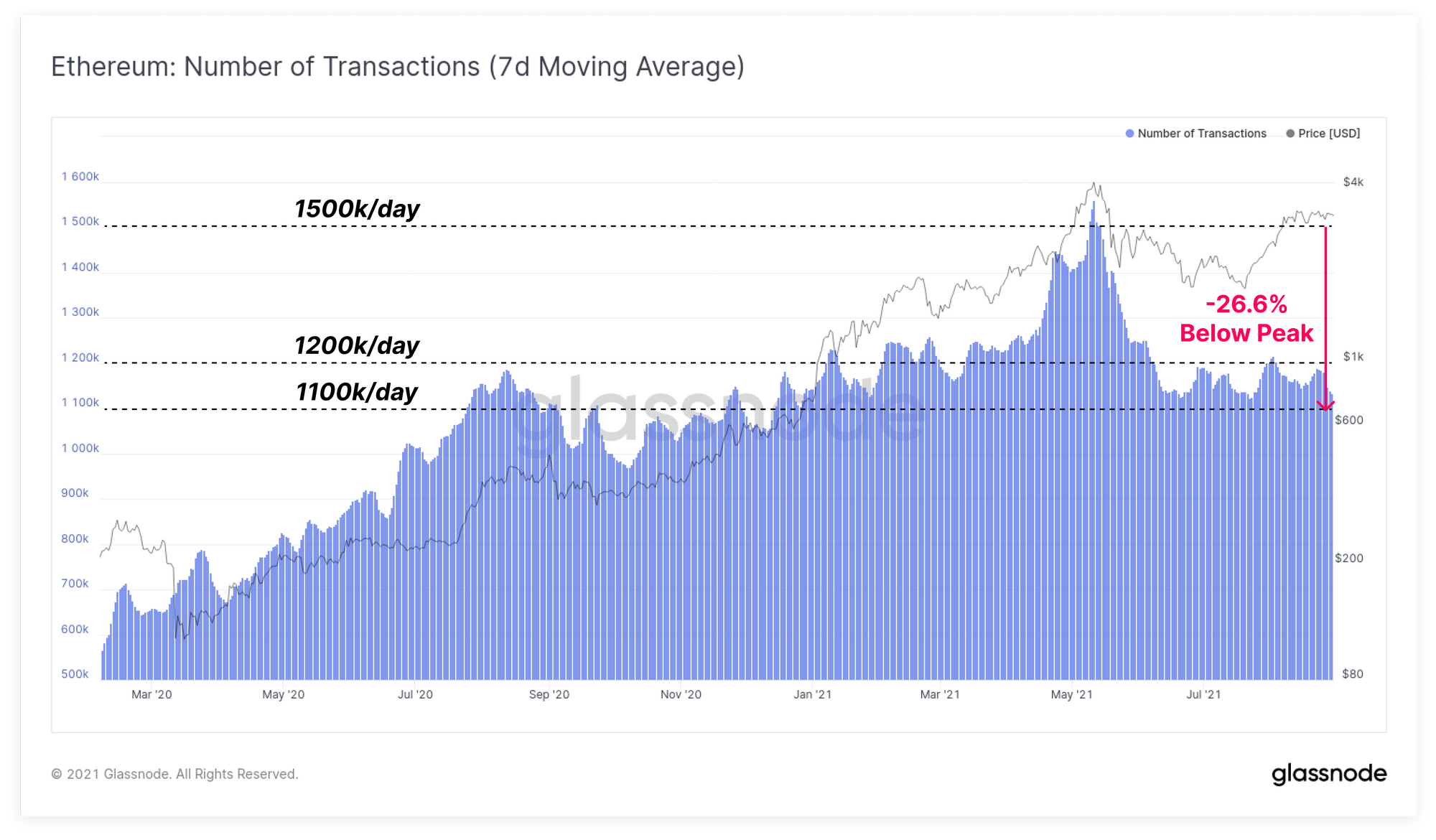

For Ethereum, transaction counts are also down 33% from the highs, with counts actually declining over the course of this week to around 1100k per day.

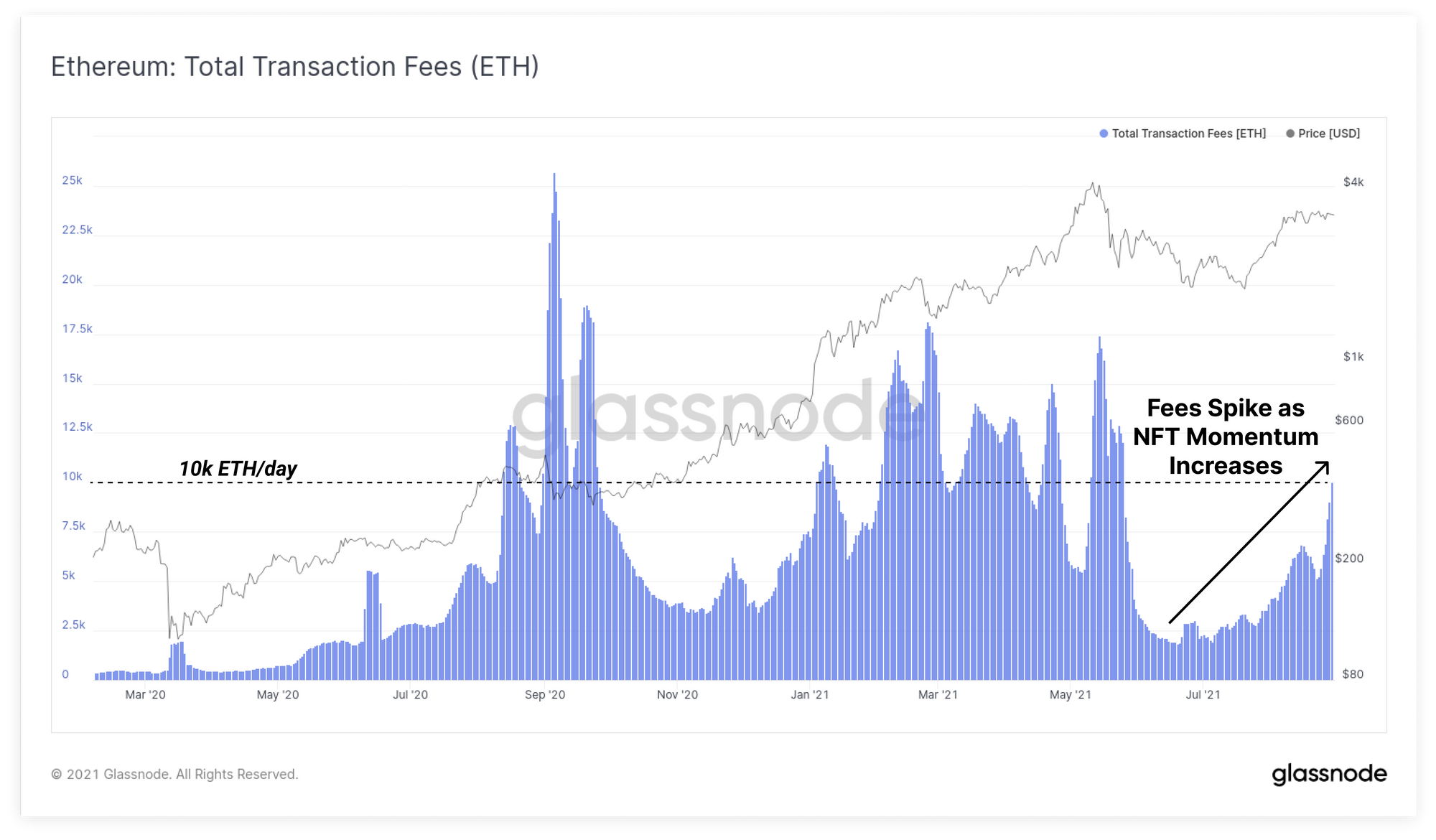

Interestingly, within the Ethereum ecosystem, we are seeing a fairly dramatic divergence in on-chain attention. Whilst transaction counts and active addresses are down, the magnitude of fees paid are trading significantly higher. This is most likely attributed, at least in part, to the strong demand for NFT trading and investing.

Total transaction fees on the Ethereum network currently sit around 10k ETH per day which represents a relatively high level, comparable to 'DeFi summer', and the 2021 Bull.

However the heightened market attention for NFTs has come at a cost, with DeFi tokens appearing to be the losers in the equation. The chart below presents on-chain transaction data for four blue chip DeFi tokens AAVE, COMP, UNI and YFI. The top row presents active addresses interacting with the tokens, and the bottom row the USD value transferred in the tokens.

Across the board, it paints a somewhat bleak picture, with all four seeing structural declines in investor attention, most breaking to new lows this week in particular.

Bullish Supply Dynamics

The question of whether a divergence in on-chain activity is bullish or bearish is a complex one, as more trading volume for digital assets shifts to off-chain exchanges and derivative instruments. Furthermore, technological advances such as transaction batching, SegWit adoption, and usage of Lightning Network and other Layer 2s make it a dynamic problem to solve.

On the other hand, supply dynamics, particularly looking at coin maturity, provides a fairly robust signal in either direction. Whilst observations of accumulation and HODLing is usually a long range indicator (i.e. takes time to play out), the current market trend is historically strong for the bulls.

The following charts present a series of supply dynamics indicators for Bitcoin and Ethereum, and it will become immediately obvious that similarities exist between both chains, and both look very constructive.

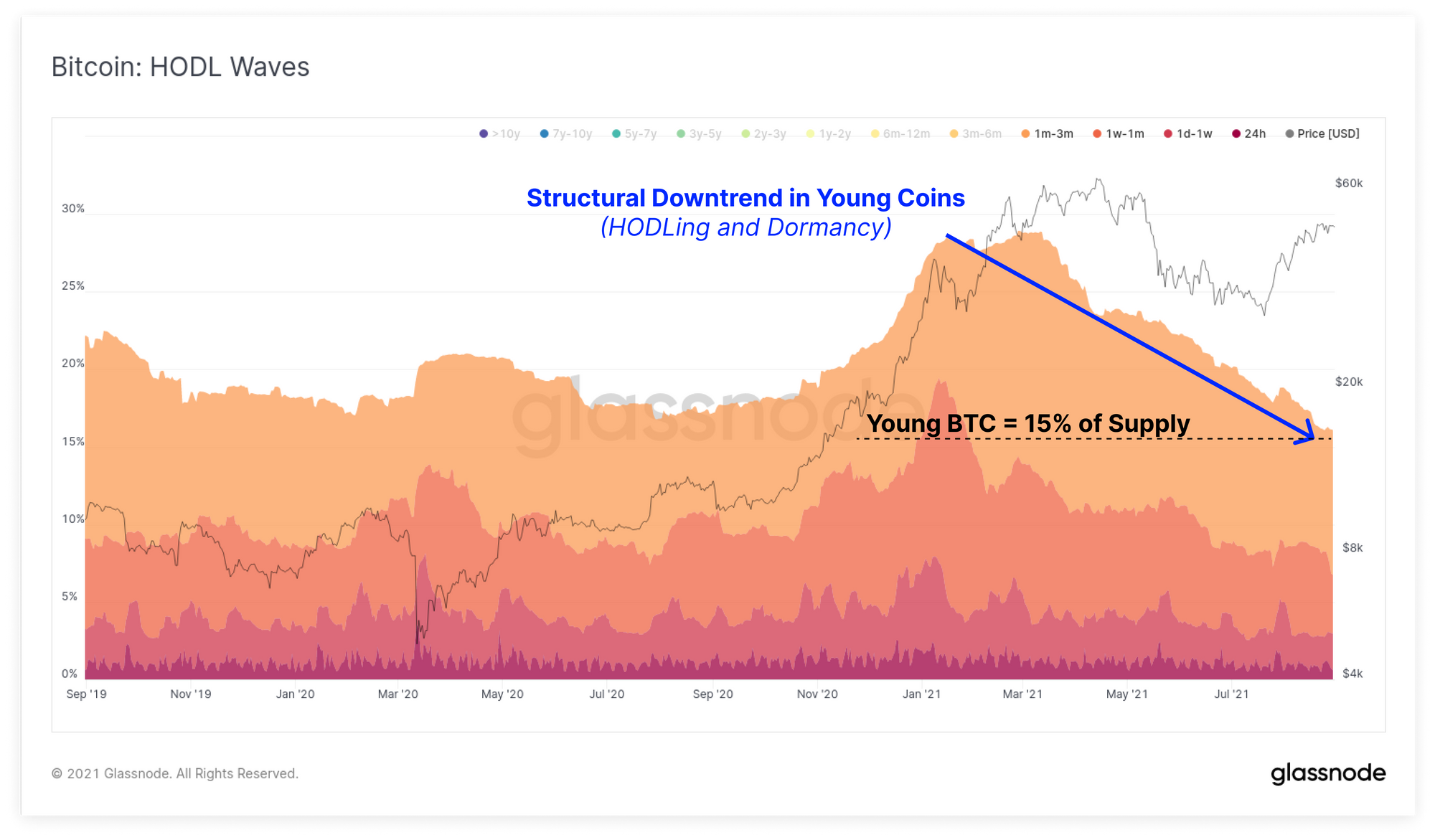

Young coins are those younger than 3 months. They are the most likely to be spent during volatility. A decline in the young coin HODL waves indicates the market is preferring to HODL and not to spend. Young BTC now represent only 15%% of the coin supply and a very strong downtrend is in play.

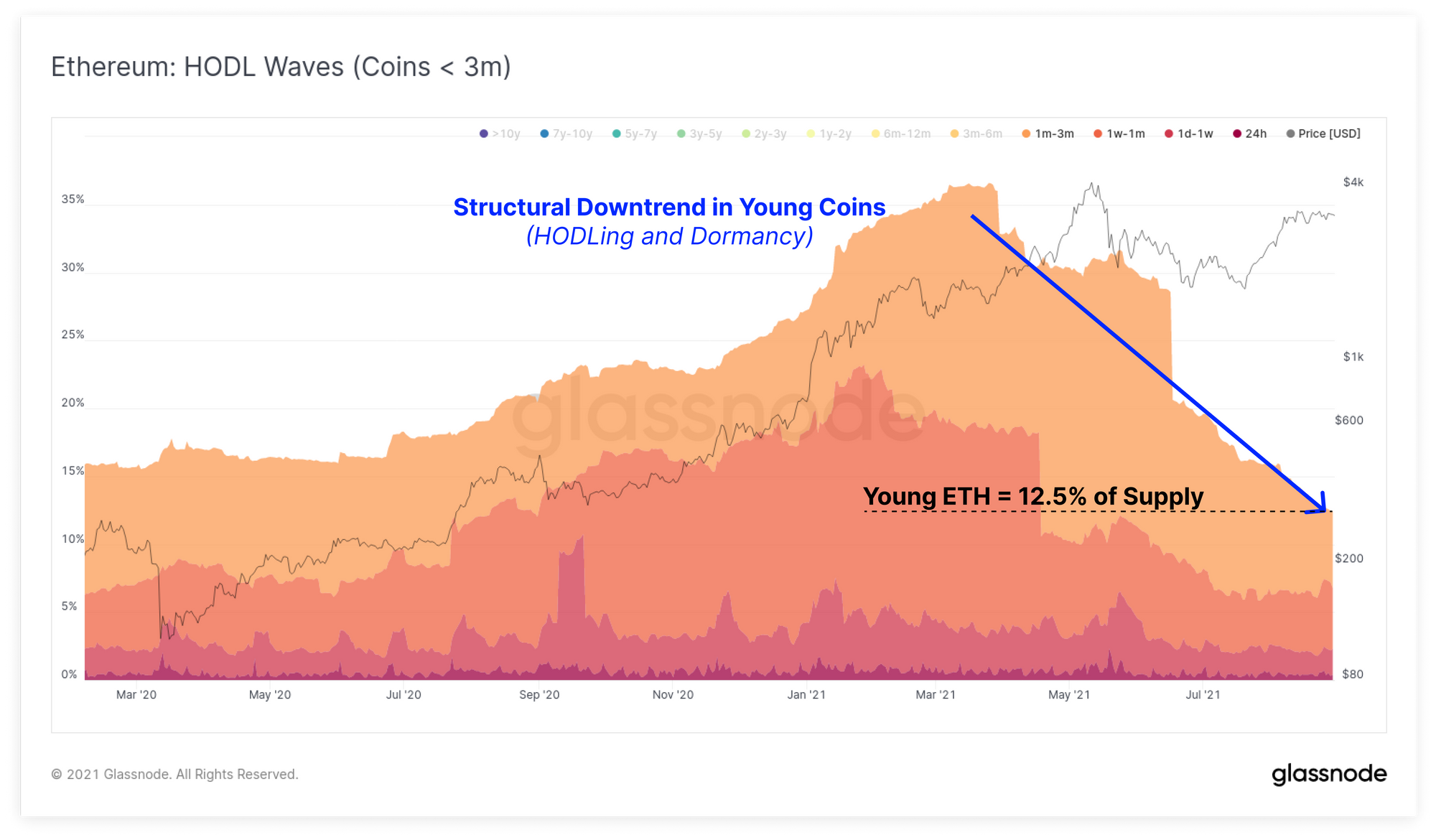

Ethereum HODL waves are almost the same chart, with young coins trending down towards a long term low of 12.5% of the circulating supply.

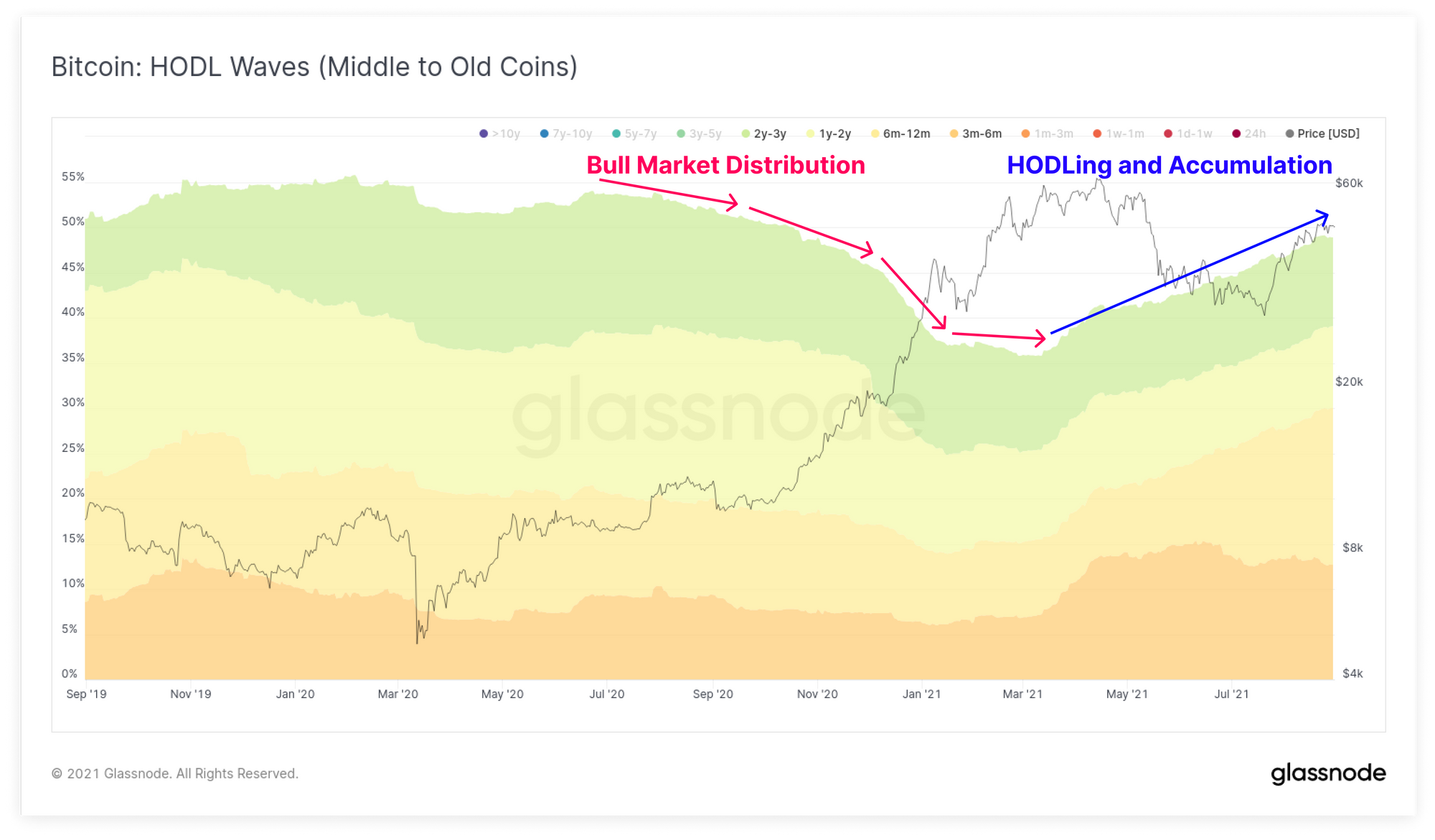

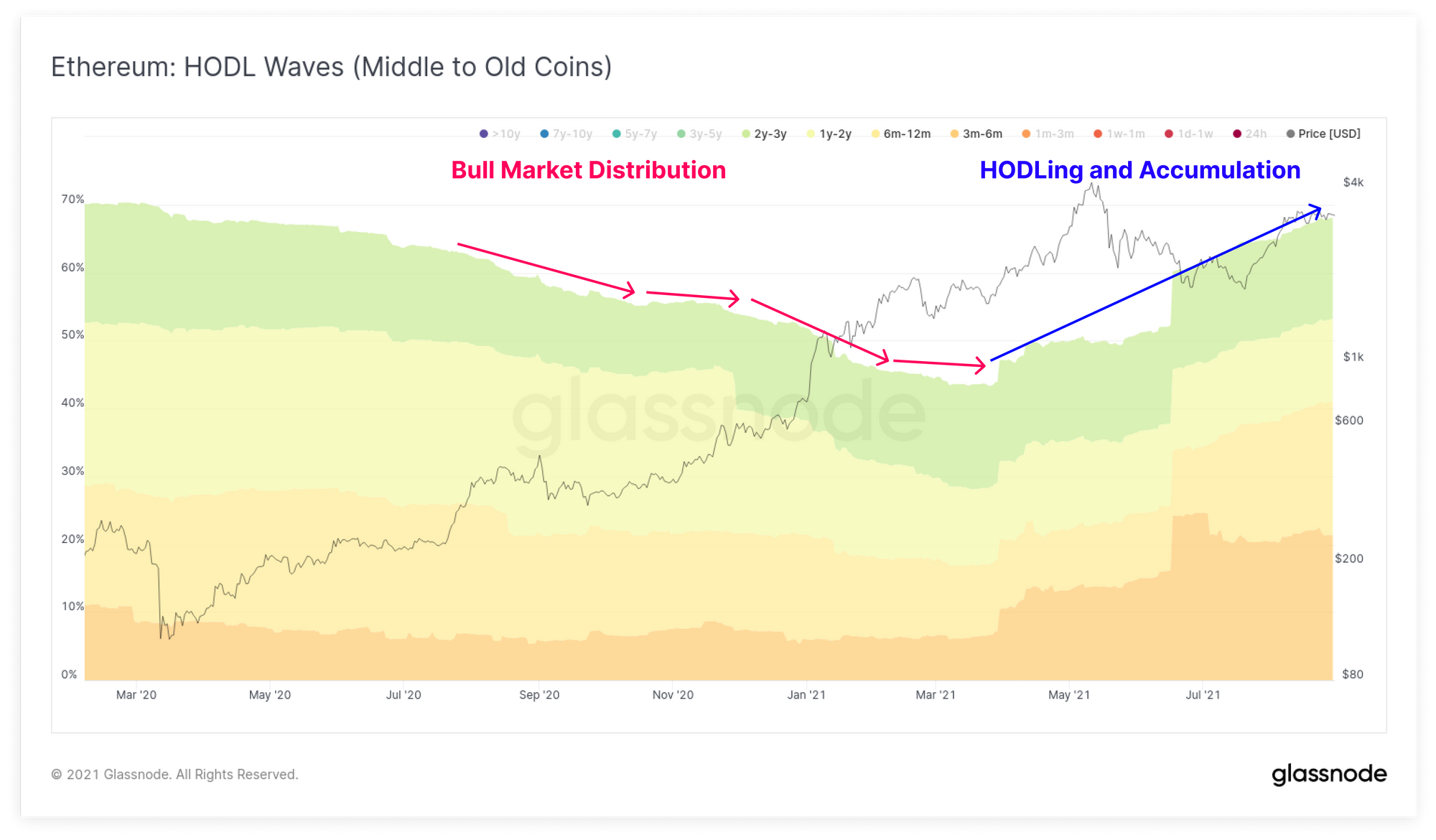

As these young coins mature and age, they transition into Middle Aged (3m to 1y) and old coins (1y+). These mature coins are statistically less likely to be spent, and a climbing proportion of them suggests increasing illiquid supply.

A powerful uptrend in coin maturation is in play for Bitcoin with almost 50% of the coin supply aged between 3m and 3y.

Again, Ethereum supply shows a similar trend with a whopping 70% of the ETH coin supply dormant for at least 3 months. For both assets, these uptrends in older coin supply commenced around March 2021, which therefore reflects a very strong demand to buy and hold throughout this bull market.

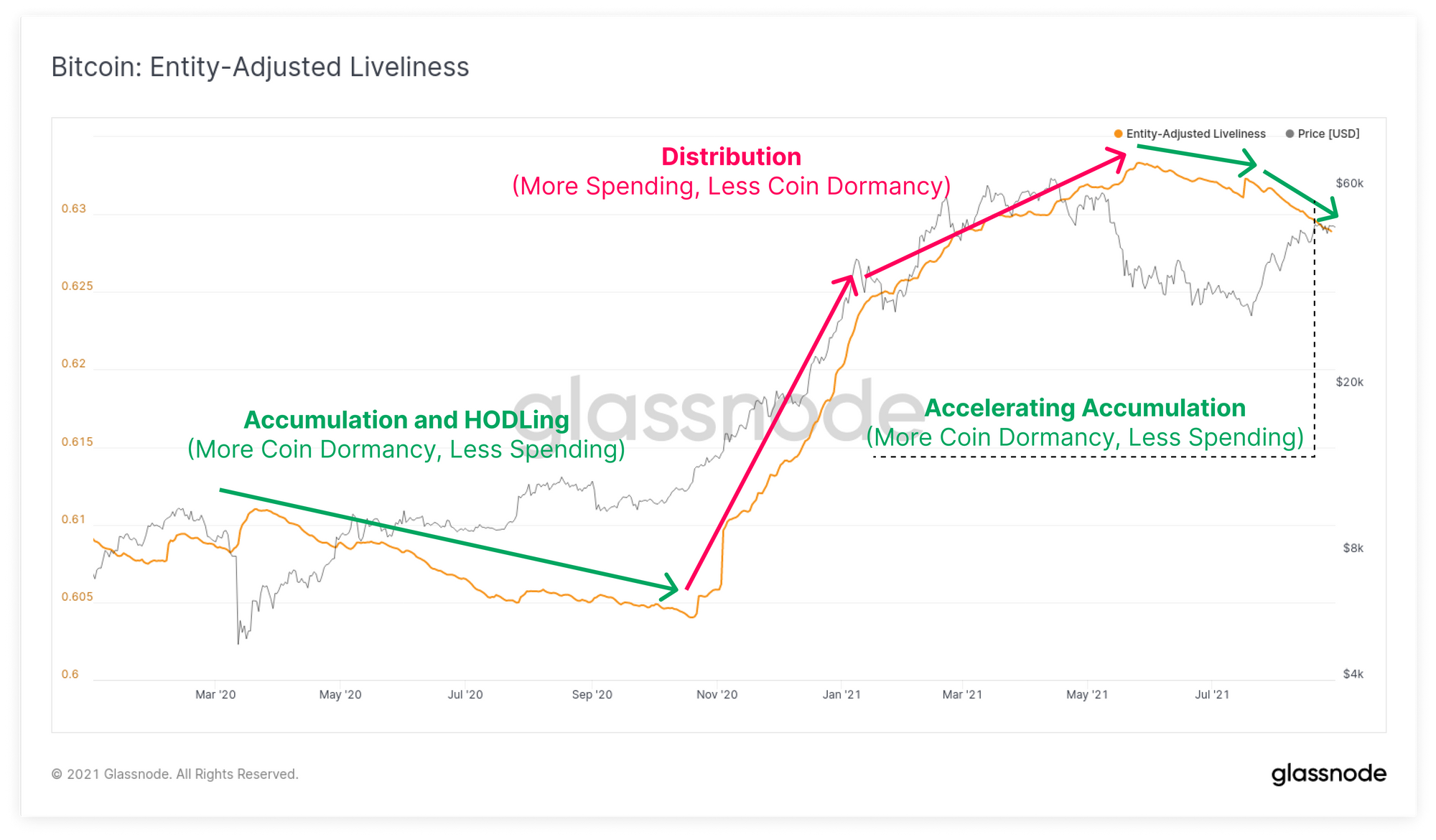

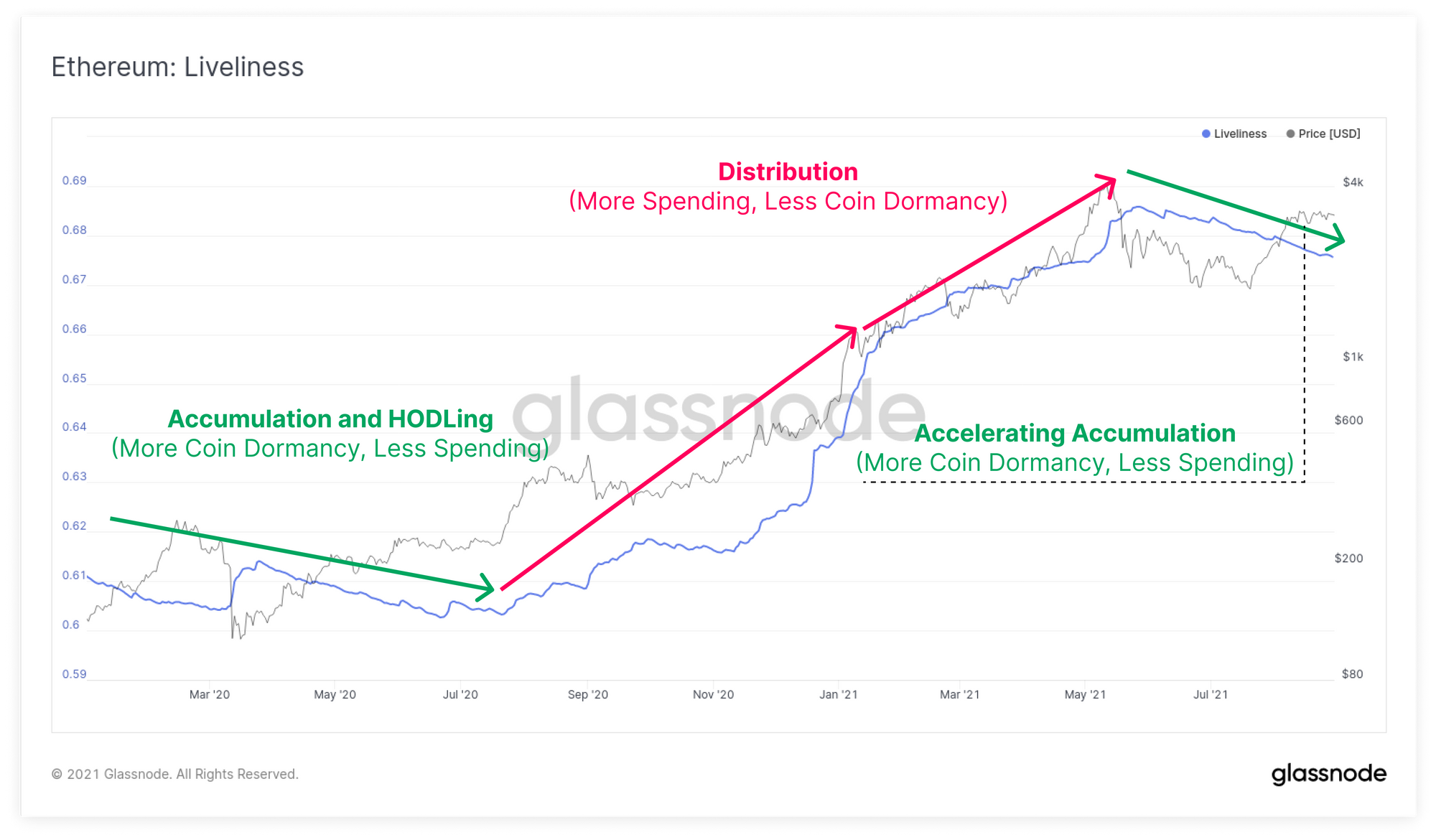

To highlight this change in market behaviour, and in agreement with a minimal desire for long term investors to spend coins, the Liveliness metric for both chains has entered a very strong downtrend. As a quick refresher on Liveliness:

- Liveliness maps out whether more coin days are accumulated (HODLing) or destroyed (spending) by the total coin supply.

- Downtrends suggest accumulation where more dormancy and coin maturity is building up, and less spending is taking place.

- Uptrends suggest spending where old coins are moved, lifespan is destroyed and distribution takes place.

- Steeper trends mean stronger fundamental trends of the above are in play.

Bitcoin liveliness has reentered a downtrend which has accelerated during this price rally.

Ethereum's liveliness metric paints much the same picture, trending strongly down since the May sell-off. Given a huge volume of ETH is transacting at the moment in the NFT movement, it does indicate that much of this volume are the same ETH tokens changing hands.

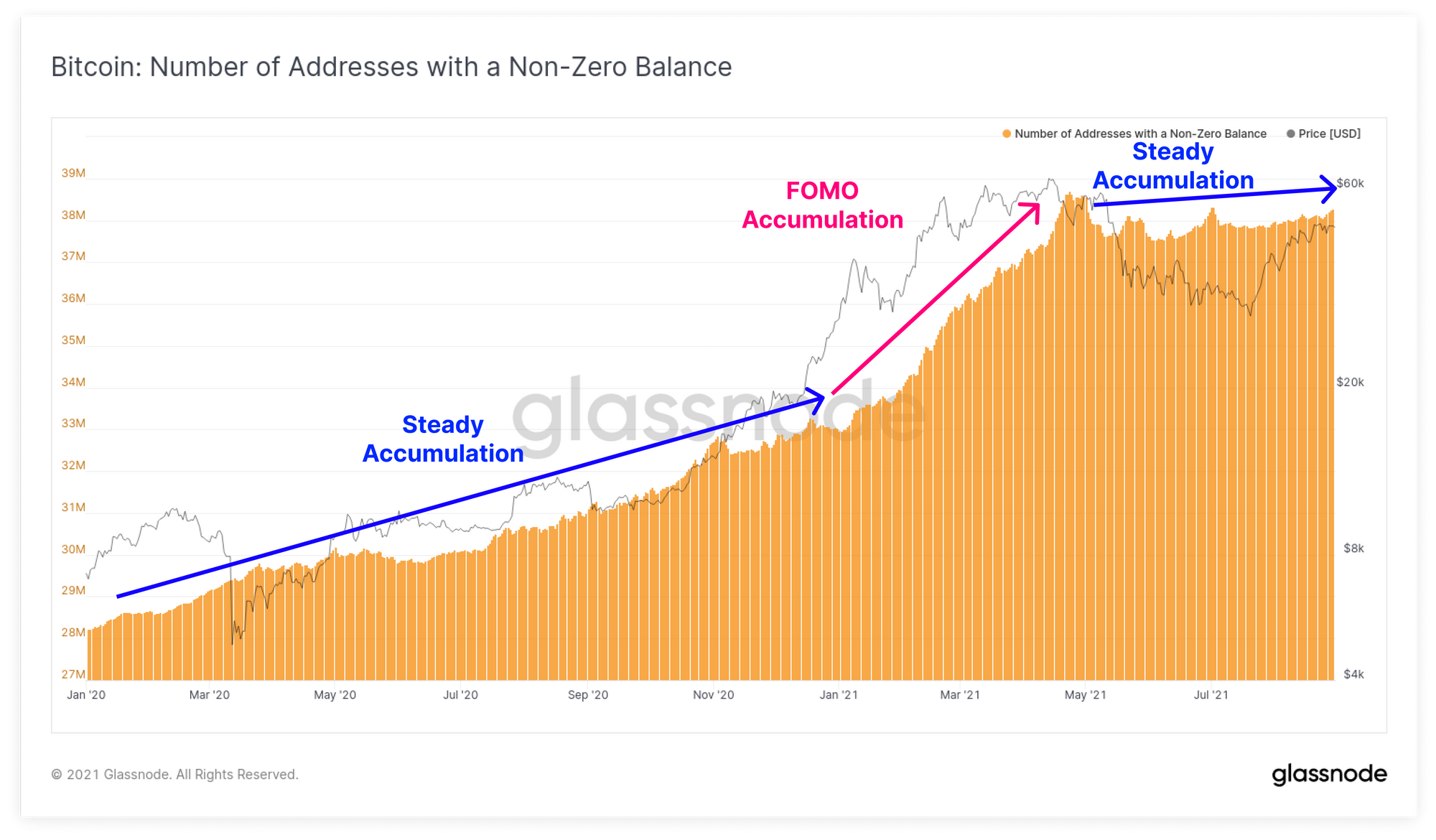

Finally, a good signal of adoption, interest, accumulation and HODLing is the growth in non-zero balances. Bitcoin non-zero addresses have continued to grind higher, having returned to over 38M addresses, and about to take out the ATH.

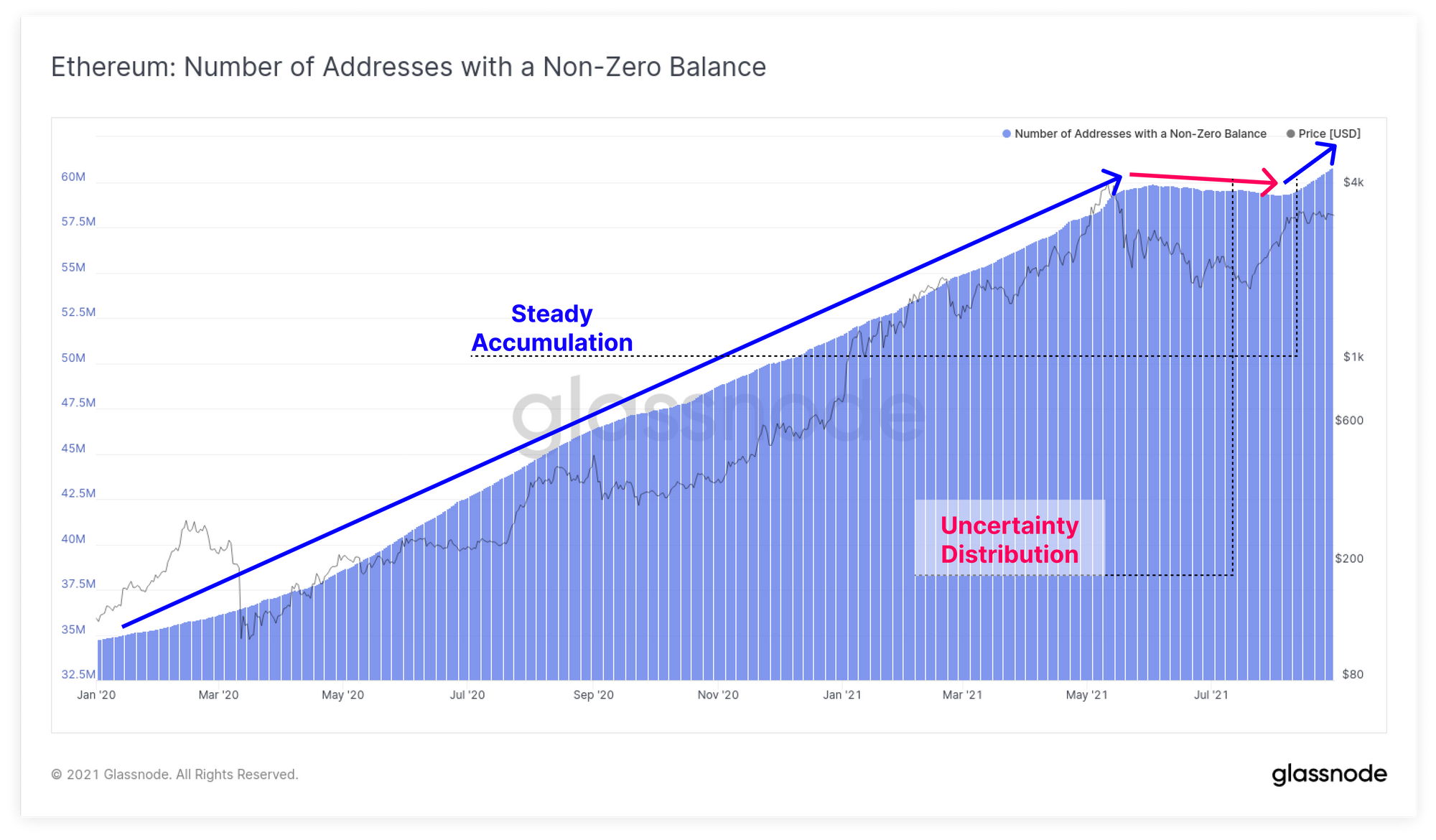

Much like its elder, Ethereum non-zero address counts are also in strong ascent, reaching a new ATH of 60.7M addresses.

Whilst the divergence between price and on-chain activity is historically abnormal for a full scale bull market, it is not an uncommon signature for the pre-bull, and pre-supply-squeeze dynamic. These periods often accompany the end of bear market accumulation where the investors who remain, are the strong hands, those with the highest conviction.

Supply dynamics seem to suggest an extremely robust underlying demand is present, and this should continue to be quite constructive for prices if the trend continues. Aggressive spending of older coins would be a key invalidation signal to watch out for.

Product Updates

Metrics and Assets

- Release Bitcoin Volatility Index metric

- Added share function to Workbench charts

- Added Replace function for Workbench metrics

- Improvements to Workbench 'download chart' function

- Lesen Sie diesen Artikel jetzt auf Deutsch bei unserem offiziellen Partner Bitcoin2Go

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter