The Week On-chain (Week 36, 2021)

The Bitcoin market shows continued strength, as on-chain volumes indicate a growing dominance, and stickiness of institutional transaction sizes and capital inflows.

The Bitcoin market has continued to power higher, breaking out of last weeks consolidation to new multi-month highs. Prices traded up from the weekly low of $46,562 to reach a high of $51,838.

As renewed optimism follows positive price action, on-chain transaction volumes are showing continued growth in dominance by large, institutional sized capital. We are also seeing declines in volume spent by long-term investors, A preference to HODL, and the accumulation of young coins. Miners have also started spending coins this week as hash-rate recovers over 42% since the July lows.

Miners Take Profits Off the Table

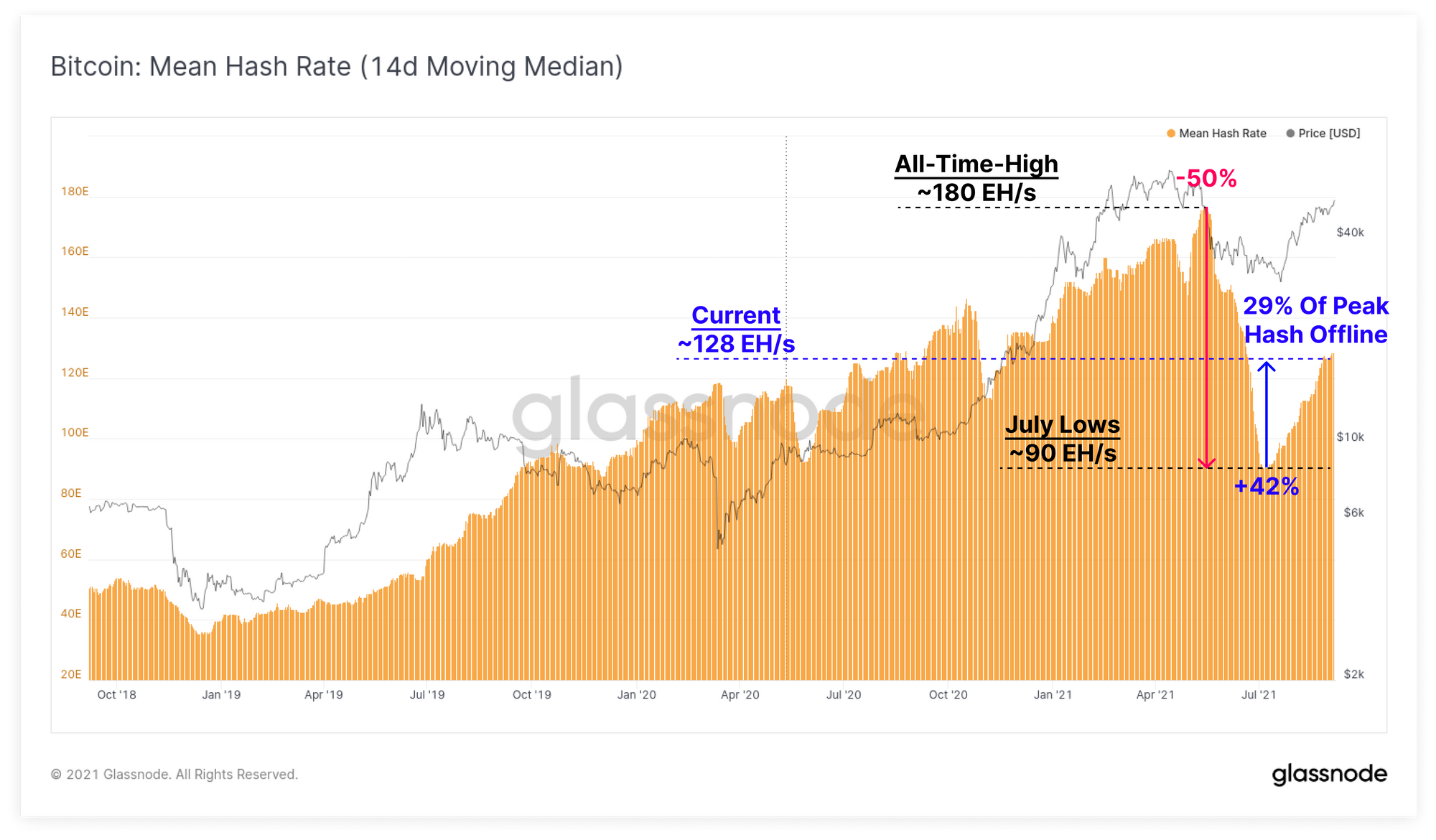

The Bitcoin mining market continues to recover after half of the hash-power came offline during the Great Migration out of China. The 14-day median hash-rate has recovered to 128 EH/s, which is approximately 29% below the all-time-high, and reflects a 42% recovery from the July lows.

The increase in hash-rate is likely a combination of previously obsolete hardware finding a second lease on life, and miners in China successfully relocating, re-establishing or re-homing their hardware and operations.

Competition in the mining market has continuously increased over time, leading the protocol difficulty to consistently rise. This growth has occurred despite the programmatic decline in new BTC issuance with each halving event. As a result, macro BTC rewards per hash have been in a long-term decline.

Whilst miner incomes are denominated in BTC, their CAPEX and OPEX costs are largely denominated in fiat currencies. This makes miner effective revenue subject to price volatility.

With such a large portion of the mining hardware offline, and a global production constraints on ASIC chip manufacture, the current mining market is finding itself slow to respond to elevated coin prices since 2020. There are simply fewer machines fighting over the same number of coins, trading at higher coin prices.

As a result, miner USD revenue per hash has now risen back to July 2019 levels of $380k per Exahash, making operational miners exceptionally profitable on a historical basis.

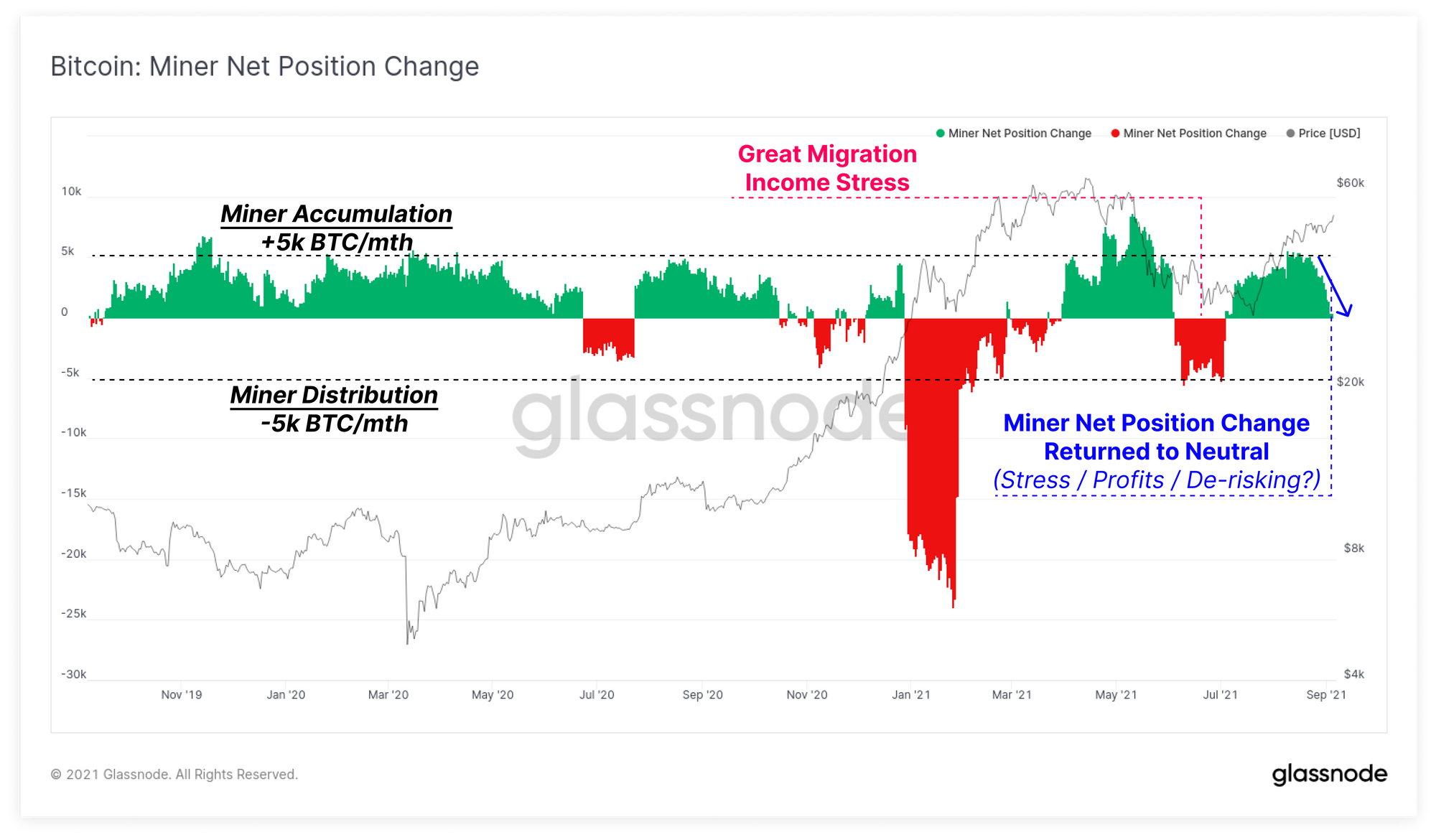

As BTC prices hover around the $50k range over the last few weeks, some of these miners have started spending a portion of their coin balances to lock in profits. This week, around 2,900 BTC have been spent from miner balances, equal to around $145M at a $50k BTC price.

This may be a combination of affected miners in China obtaining fiat liquidity to cover costs, or operational miners taking profits and de-risking after the May sell-off. It is also likely that some of this revenue is earmarked for redeployment into facility expansion, and acquiring hardware from second-hand or new ASIC markets.

Note: the chart below uses our Workbench tool to subtract out the Patoshi coins to reflect the coin balance held by the remainder of the mining market.

In response, the miner net position change has returned to a neutral level, indicating an on-net equilibrium between miner accumulation, and miner spending over the last 30-days. It is typical for the miner net position change metric to oscillate between around +5k and -5k BTC per month, making the current dynamics reasonably expected behaviour, and the market has clearly absorbed the additional sell-side pressure.

Week On-chain Dashboard

The Week On-chain Newsletter now has a live dashboard for all featured charts here. We have also started production for Week On-chain video analysis to provide a deeper dive into the thesis and logic behind each weeks analysis. Visit and subscribe to our YouTube channel, and visit our Video Portal to see our video content.

Transaction Size, On The Rise

A key theme and characteristic of the 2020 to 2021 market cycle has been the increase in institutional sized capital. This trend is increasingly visible on-chain, and even after the 50% correction in May, appears to be a relatively sticky.

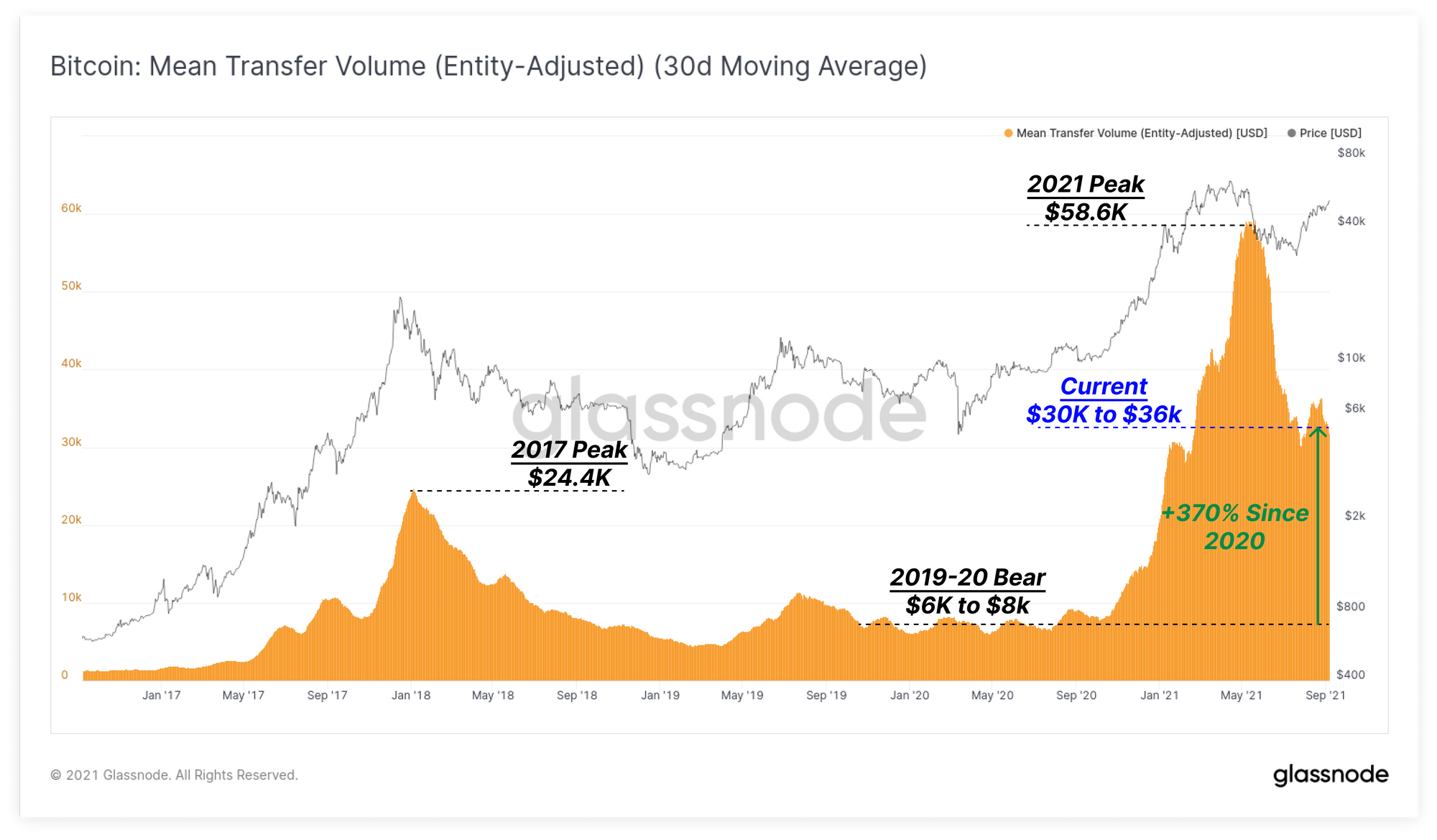

The average USD transaction size in the 2019-20 bear market was typically between $6k to $8k. This period was largely dominated by retail and early investment fund participants.

The 2020-21 bull market saw average transaction sizes increase significantly into a peak of $58.6k during the May sell-off. This has largely cooled off from July onwards, with the current average transaction size between $30k and $36k.

Relative to the 2019-20 period, this represents a significant 370% increase, despite the recent correction, reflecting continued and sticky institutional sized interest.

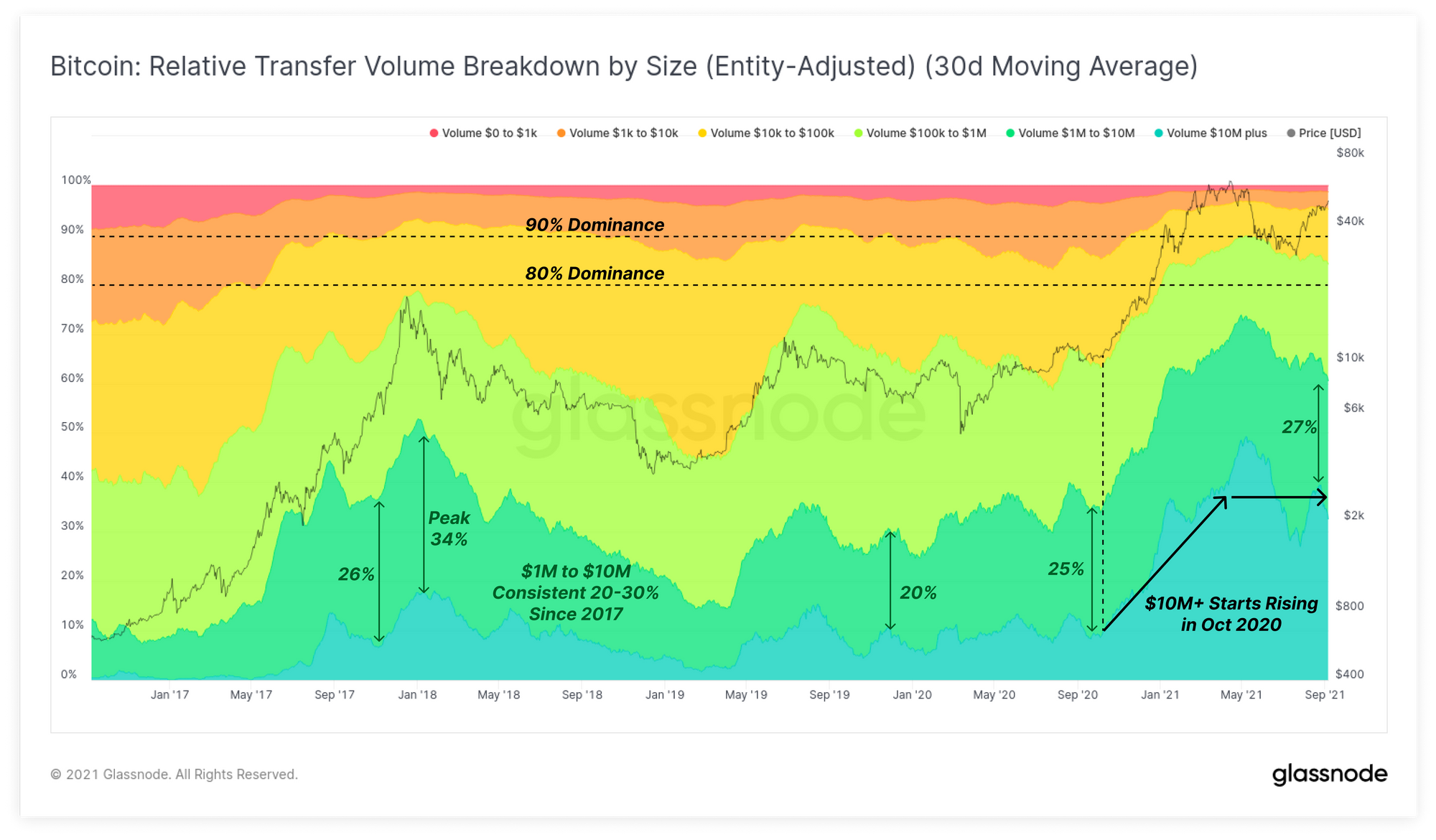

Further support for this observation is found the rising proportion of transaction volume dominance by $100k+ sizes. In the chart below, we can see the gradual squeezing of smaller size capital (<$100k) in yellow-red from 40% dominance in 2017, to represent only 10% to 20% of on-chain volumes today.

Conversely, institutional and high-net-worth size capital of $100k+ in green has expanded significantly over the last 12 months. The cohort moving between $1M and $10M (light green) has consistently represented between 20% to 30% of transaction volume since 2017.

The $10M+ cohort (dark green) however have grown considerably, from only 10% in October 2020, to over 30% dominance today. This reflects a notable growth in large size capital allocation and trading activity. Note that this data is entity adjusted, and thus filters for only economically meaningful activity (excludes self-spends and exchange wallet management for example).

Young Coin Volume Dominates

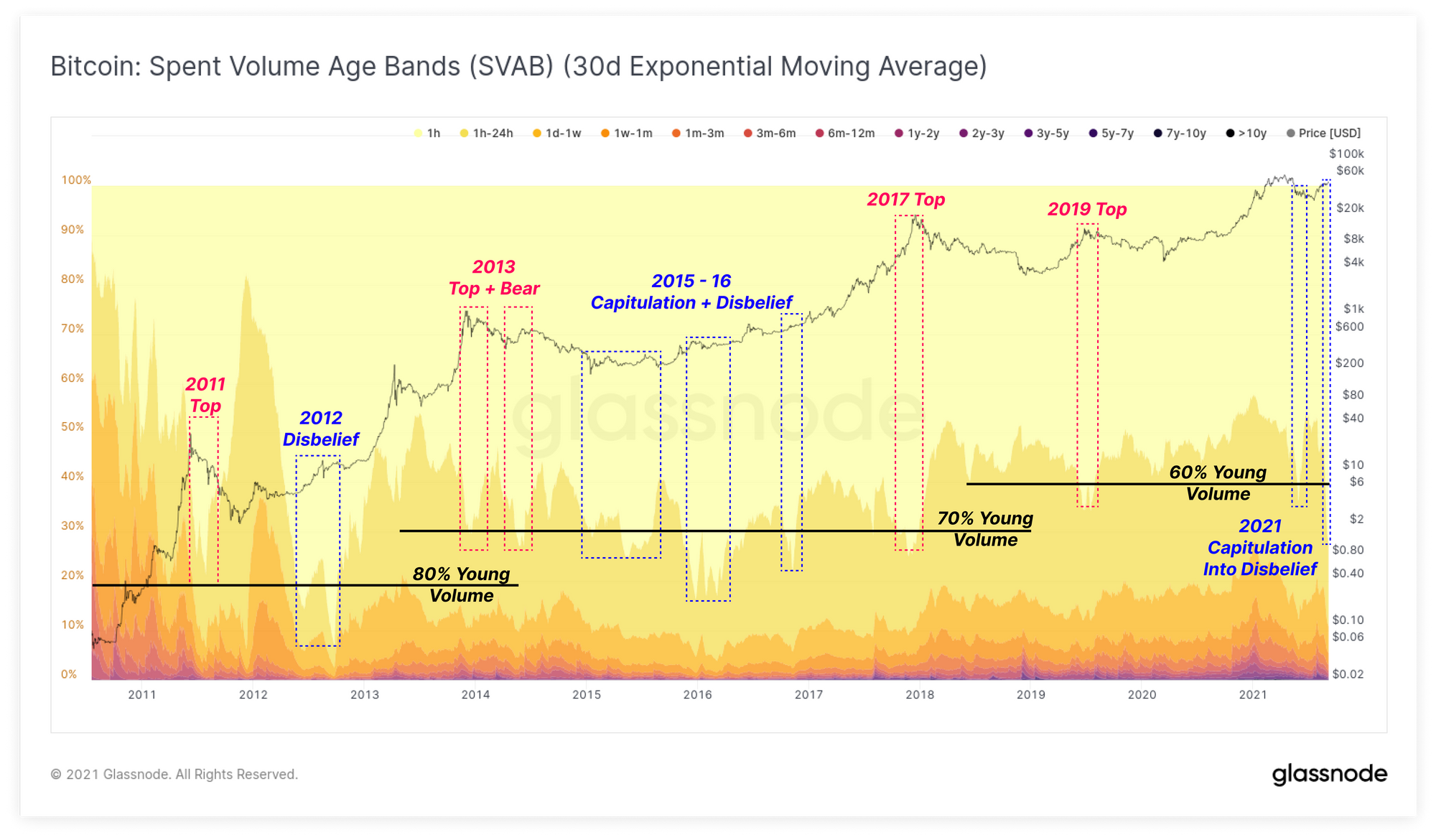

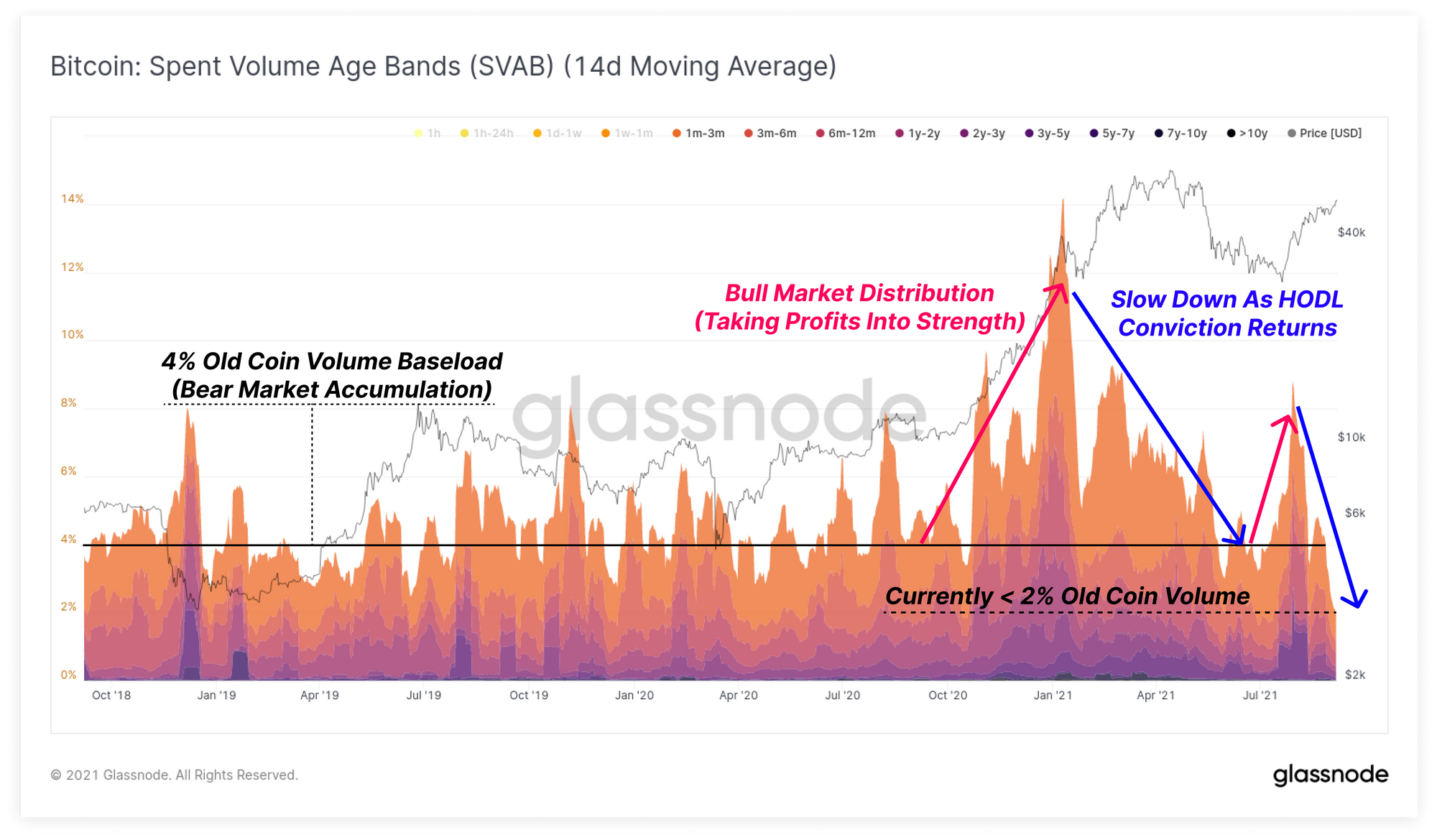

Another observation regarding transaction volumes relates to classification based on coin ages. We have recently released a new metric called the Spent Volume Age Bands (SVAB), which classifies the proportion of daily coin volume by coin age. It is a counterpart to the Spent Output Age Bands (SOAB) metric, which ignores coin volume, and only looks at age brackets in proportion to the daily transaction count.

Some general principles for interpretation of these metrics are:

- When more old coins (> 6m) are spent, there is a higher probability that previously illiquid coins are coming back into liquid circulation. This is most common during capitulation events, and in bull markets as coins are sold into strength.

- When more young coins (1d to 6m) are spent, there is a higher probability that smart money investors and long-term holders are holding, and accumulation is taking place, as 'hot coins' are taken off the market.

- Hot coins are those with lifespans less than 1-week. These dominate day-to-day network traffic and are more likely to be re-spent in response to volatility.

From a macro view we can see that hot/young coin volumes spike and dominate on-chain volumes in three typical occasions:

- Blow off tops where trading, speculation and 'hot money' movements reach a maximum.

- Capitulation events where new buyers are shaken out en mass and coins change hands many times during high volatility. Smart money also tend to step in and accumulate.

- Disbelief rallies at the start of bullish trends as traders sell into the first market strength seen in a long time.

The dominance of hot coin (< 1wk) volume is currently at a relative high of 94% of spent coin volume. Simultaneously, middle and old coin (> 1mth) volume is at an extreme low of less than 2% dominance which is even lower than the bear market base-load seen in 2019-20.

What this suggests is that the vast majority of coins spent at the moment, even as prices breach $50k, are highly liquid coins, and old coins are remarkably dormant. This indicates that conviction to HODL is extremely high and a lack of liquid supply could squeeze spot market prices higher.

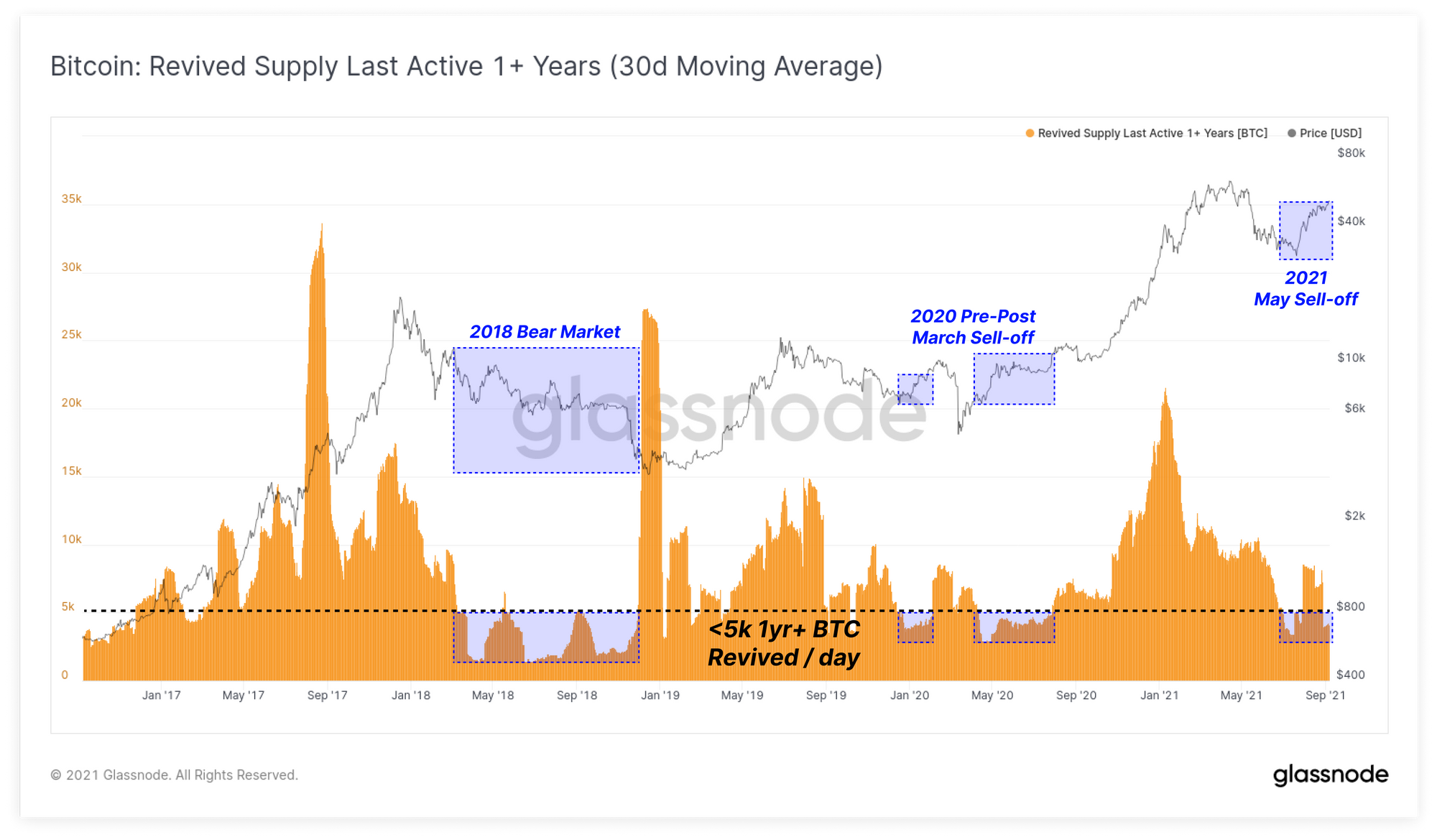

To further confirm this analysis, we can see the volume of revived supply older than 1yr has fallen below 5k BTC per day. This indicates that investors who own coins older than 1yr are spending less, and HODLing more, even as prices rally. Previous events with low revived 1yr+ supply correlate with late stage bear markets and early bull markets.

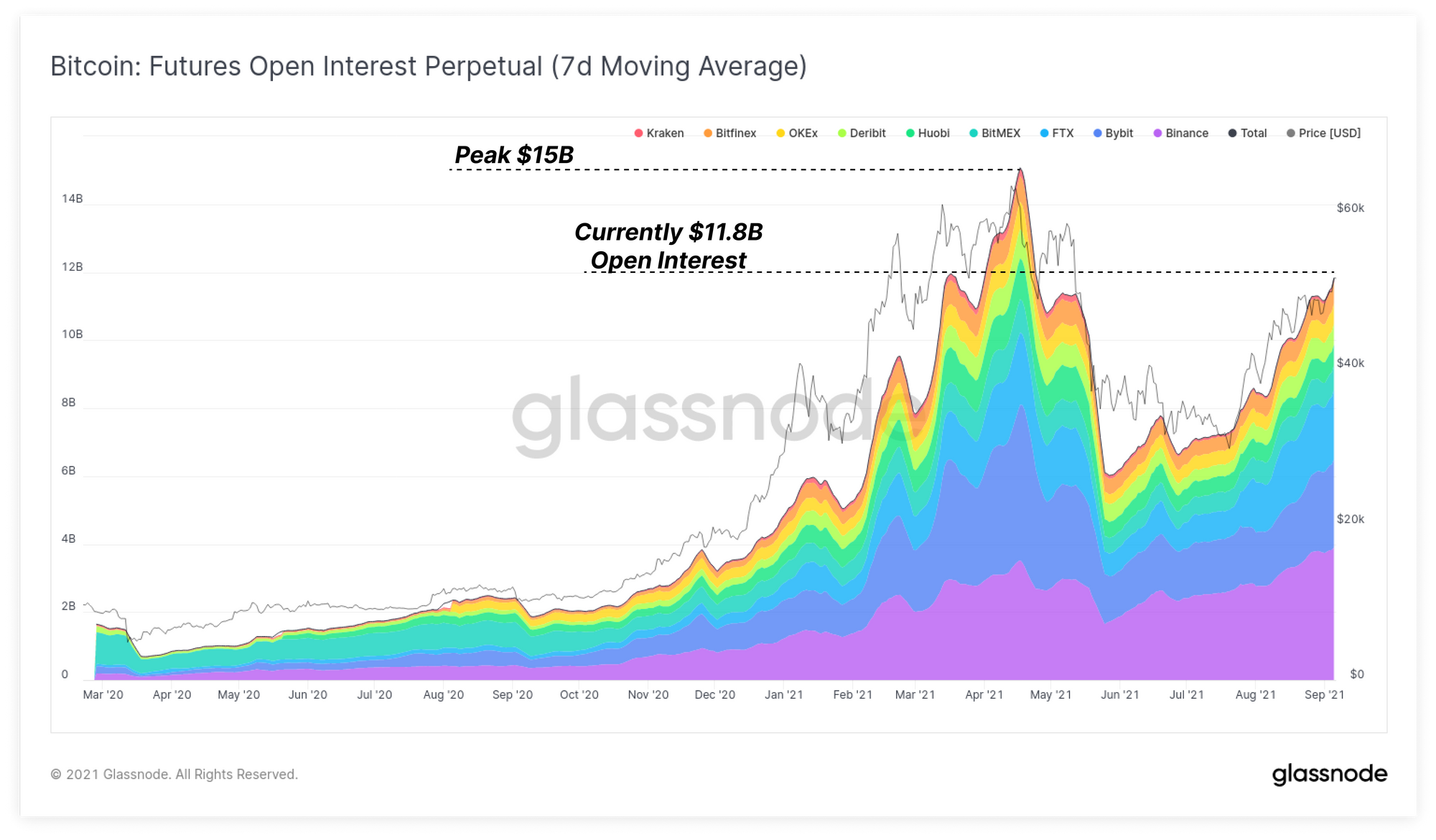

Leverage Reaches New Heights

The final observation this week relates to the derivatives markets. Alongside positive sentiment and conviction to HODL in spot and on-chain markets, we are seeing open interest approach, or reach, new all-time-highs for Bitcoin and Ethereum.

Bitcoin perpetual futures markets currently have over $11.8B in open contracts which is trending strongly towards the April peak of $15B.

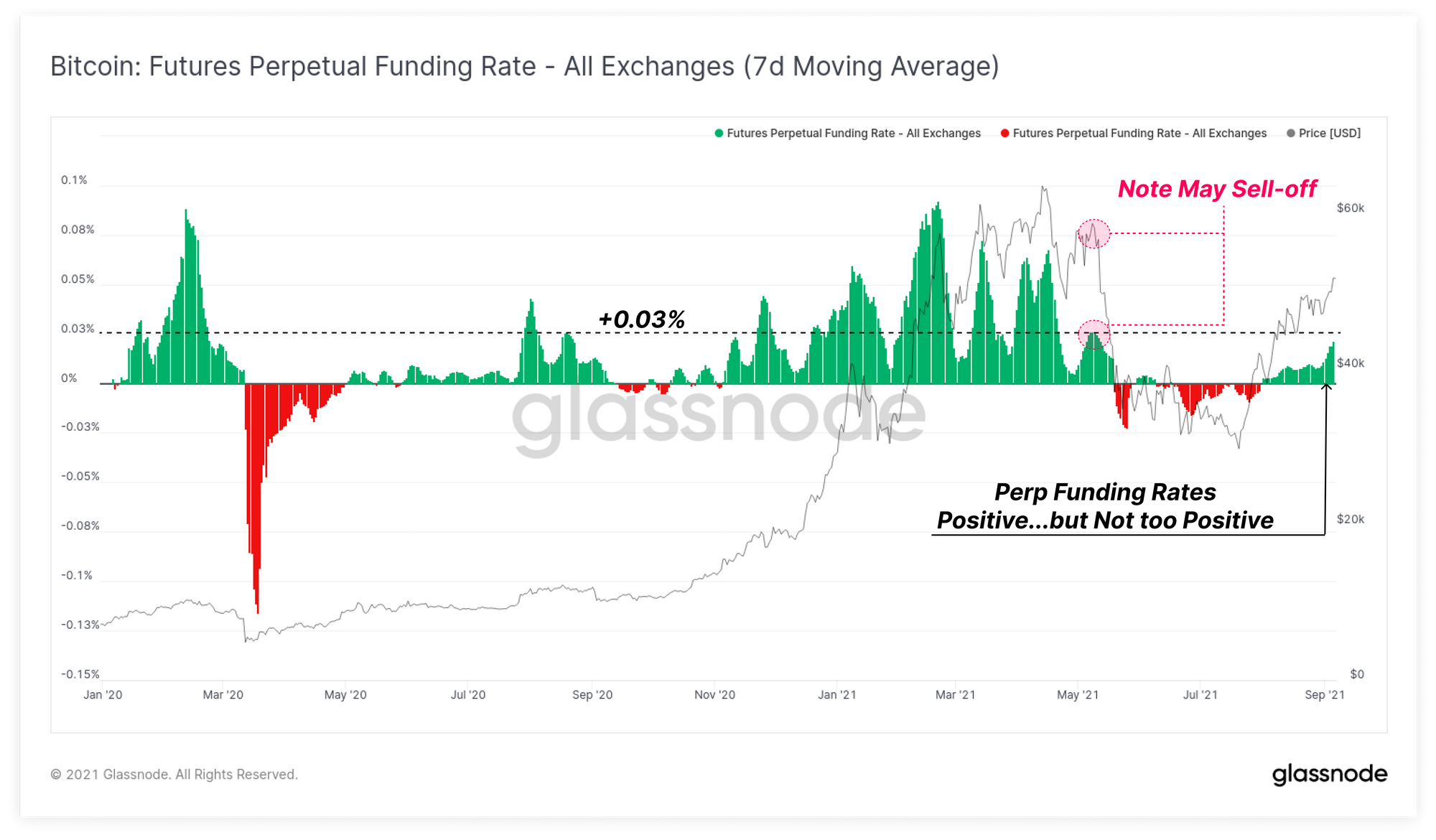

The market appears to be net long in perpetual futures markets with funding rates for BTC hitting approaching 0.03%. Whilst this level of positive lean is not overly high relative to levels seen in Q1 and Q2, it is similar to the funding rate seen just prior to the May sell-off. This could create a shorter term headwind if longs are squeezed out of their positions.

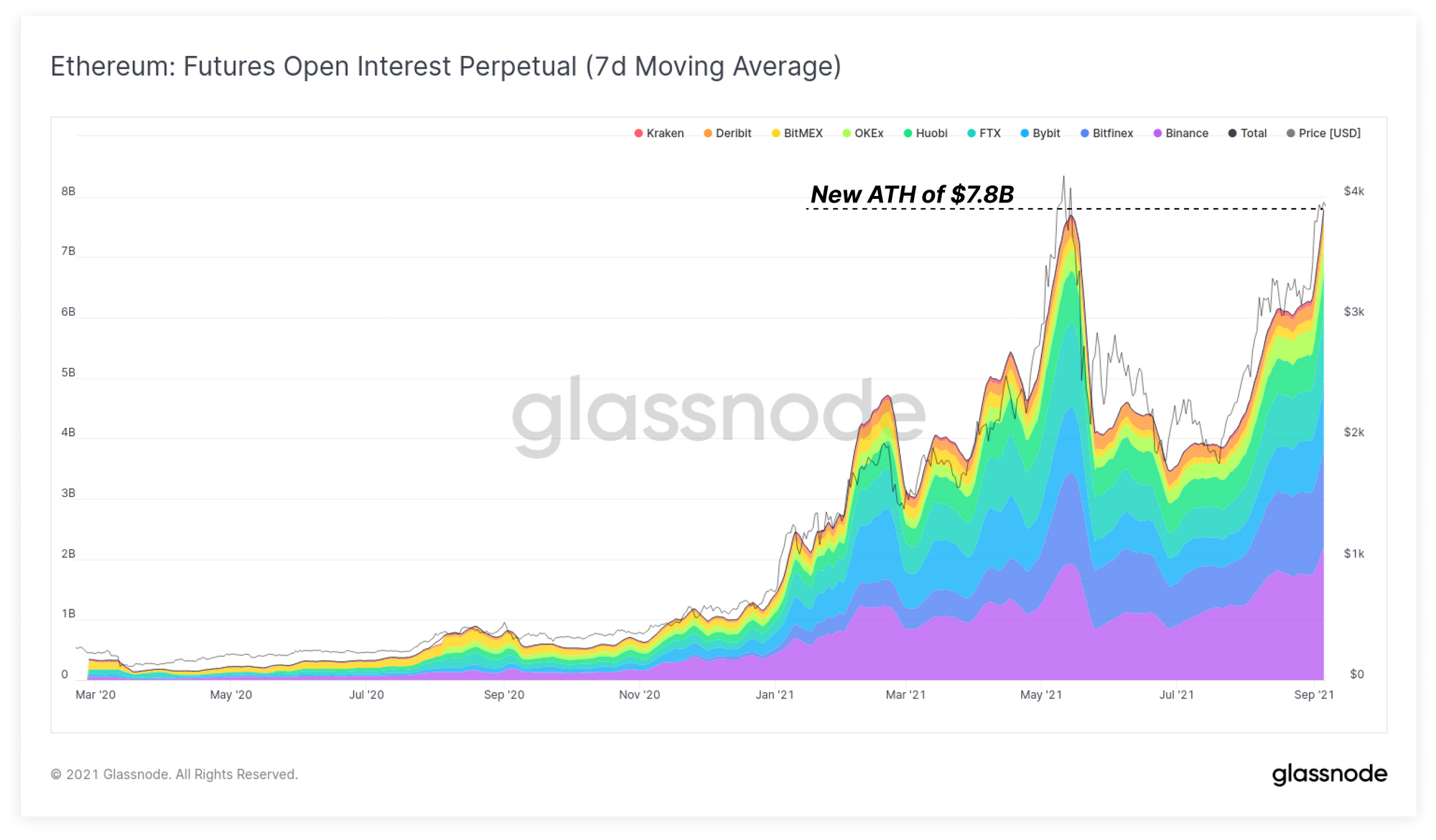

This effect is even more pronounced for Ethereum where perpetual futures open interest has surpassed the previous ATH, hitting $7.8B this week.

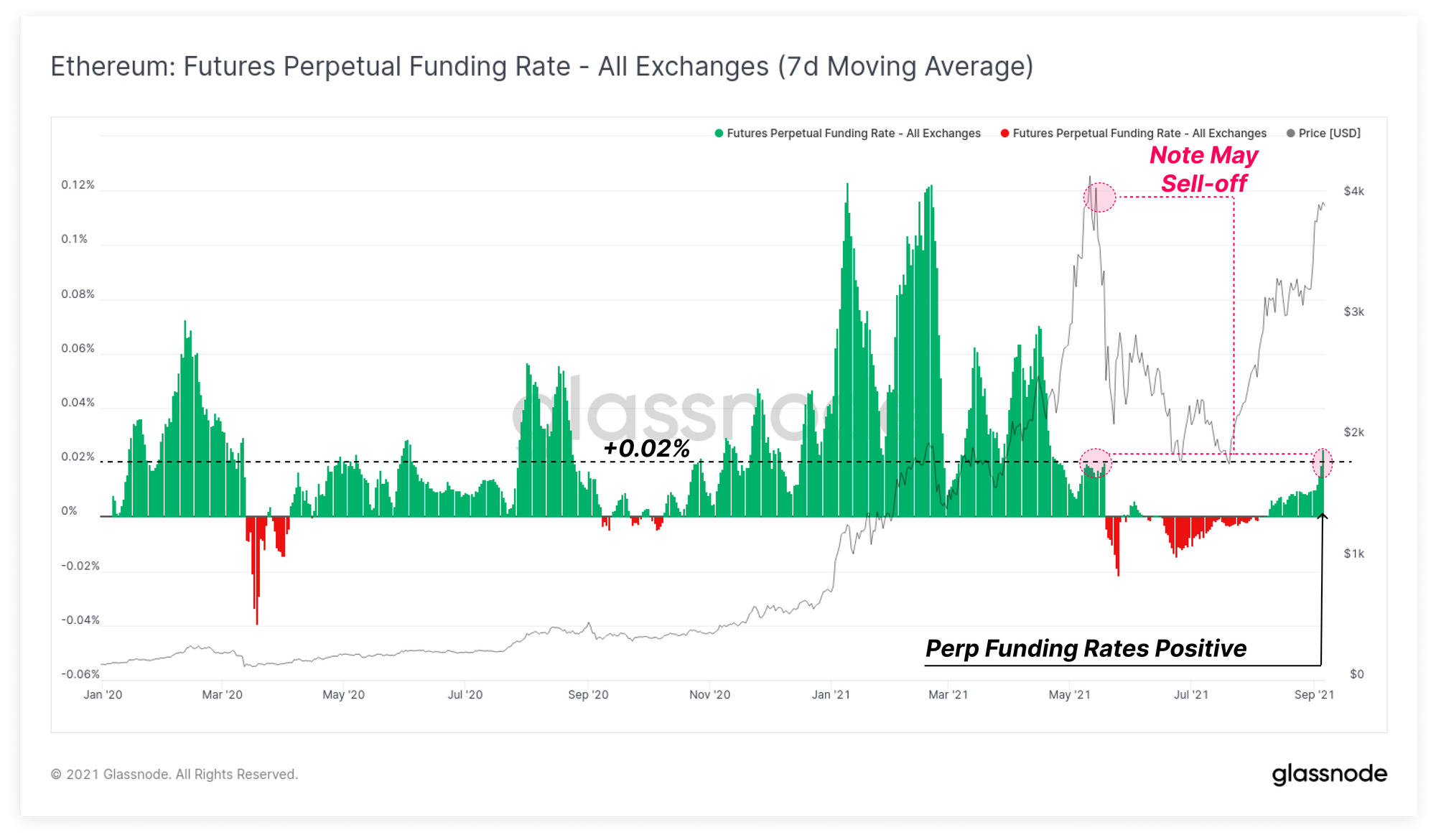

Funding rates for ETH futures have similarly accelerated higher, reaching 0.02%, a level coincident with that seen prior to the May sell-off.

Whilst the supply dynamics in spot markets continue to show strength, caution and awareness is appropriate when of high degrees of leverage has entered derivatives markets. The combination of positive funding rates and high open interest can be an important indicator set for assessing a shorter term risk of cascading long liquidations.

Product Updates

Metrics and Assets

- Release Spent Output Volume Bands SVAB and individual component metrics

- Release Inter-Exchange metrics: Inter-Exchange Transfers and Inter-Exchange Volume

- Released In-House Exchange Metric, Futures Term Structure and Futures Term Structure by Exchange

- Released Revived Supply Metrics for 1y+, 2y+, 3y+ and 5y+

- Additional Workbench functions added

sum(m1, period),log(m1),pow(m1, n),abs(m1), andrange(m1, start, end)

- Lesen Sie diesen Artikel jetzt auf Deutsch bei unserem offiziellen Partner Bitcoin2Go

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter