The Week On-Chain (Week 49, 2020)

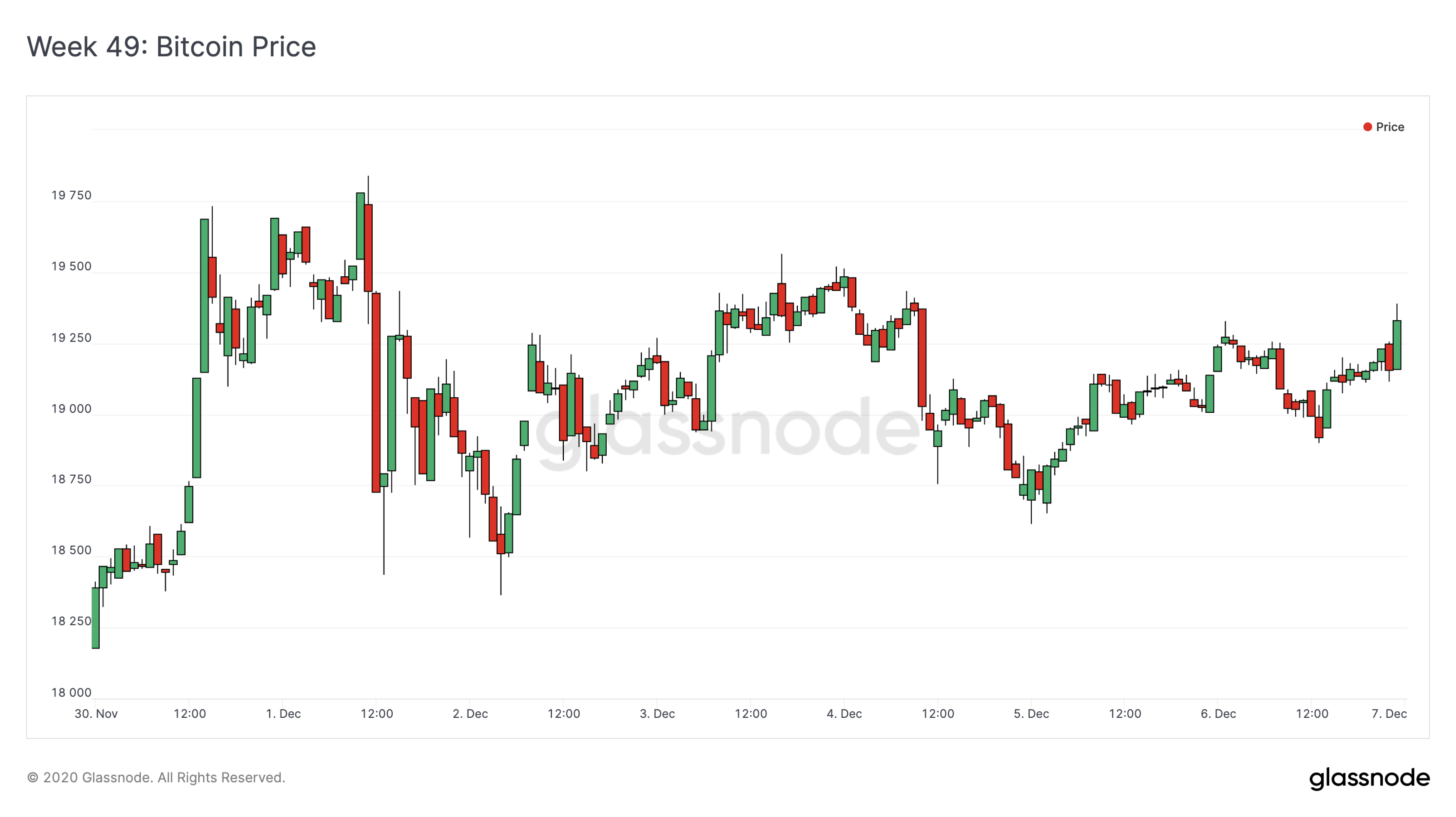

During Week 49, BTC recovered from the previous week's consolidation and stabilized around $19k. On-chain signals suggest that a further correction may be seen before bitcoin breaks above $20k sustainably.

Bitcoin Market Health

BTC had another successful week during Week 49, recovering from the previous week's slump and briefly overtaking its previous all-time high. On Tuesday, it set a new ATH of $19,857, but immediately dropped back down into the $18,000s before slowly rising again, ending the week at $19,050.

For the Bulls

Bitcoin's Reserve Risk is still low, suggesting that the bull market may just be getting started. Reserve Risk is used to assess the confidence of long-term holders relative to the price of BTC; when confidence is high and price is low, Reserve Risk is low, and there is an attractive risk/reward to invest.

Currently, BTC's Reserve Risk is still close to the green zone, indicating that there is high confidence in bitcoin at this price point. This metric is presently even lower than it was during the 2019 bull run, when BTC reached $13k. The fact that it is still so low - even as bitcoin fluctuates around all-time highs - indicates an attractive risk/reward ratio for investing in BTC at this price.

For the Bears

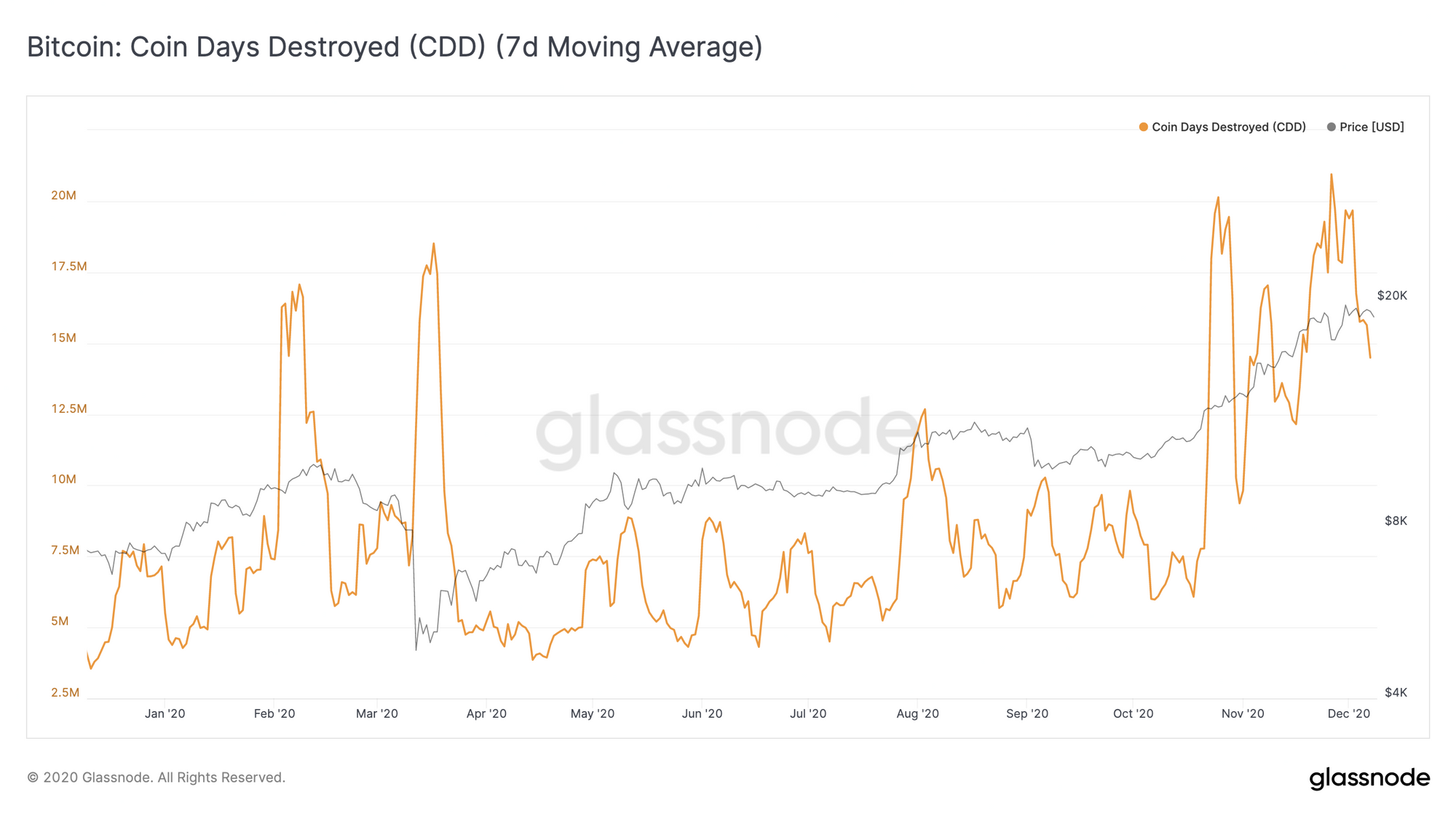

Despite the high confidence in BTC demonstrated by its Reserve Risk value, the number of Coin Days Destroyed (CDD) has been gradually increasing. This generally indicates that older coins are moving, meaning that longer-term holders are selling off some of their BTC and realizing profits.

This sell pressure generated by longer-term holders is currently depressing BTC's price, keeping it from breaking out above $20k. While so many long-term holders remain in a state of significant profit, sideways or downwards price movement can be expected as they realize these profits.

However, while high CDD may suggest that longer-term holders are taking profits, the global top is likely not here yet. Historically, CDD increases during bull runs, but usually peaks before the top. As such, although long-term holders may be selling at current prices (and creating downward price pressure), historical trends suggest that buy pressure will more than make up for this activity in the longer term.

A Comment from Willy Woo

Woo's Take: While on-chain signals for BTC are long-term bullish, investors can anticipate a correction in the coming weeks.

For bullish runs driven by organic investments, SOPR is a useful on-chain metric to signal when a pull back has finished correcting. SOPR measures the profit made by outgoing investors as they offload their coins. Typically SOPR needs to reset to zero before a correction is complete, that’s because investors in a bull market do not like selling at a loss, they’d rather HODL thereby alleviating the sell pressure allowing the bullish to continue.

The chart above shows just how far SOPR needs to retrace until a reset is complete. I’ve marked the corresponding region in the last bull cycle when Bitcoin tested all time highs. In that extremely fast rejection, SOPR took only 7 days to retrace, this one is likely to take longer given the nature of the month long run up, maybe 2-4 more weeks.

Read more from Willy Woo in his newsletter, The Bitcoin Forecast.

Altcoin Feature: PICKLE Tokens are being Withdrawn from Smart Contracts

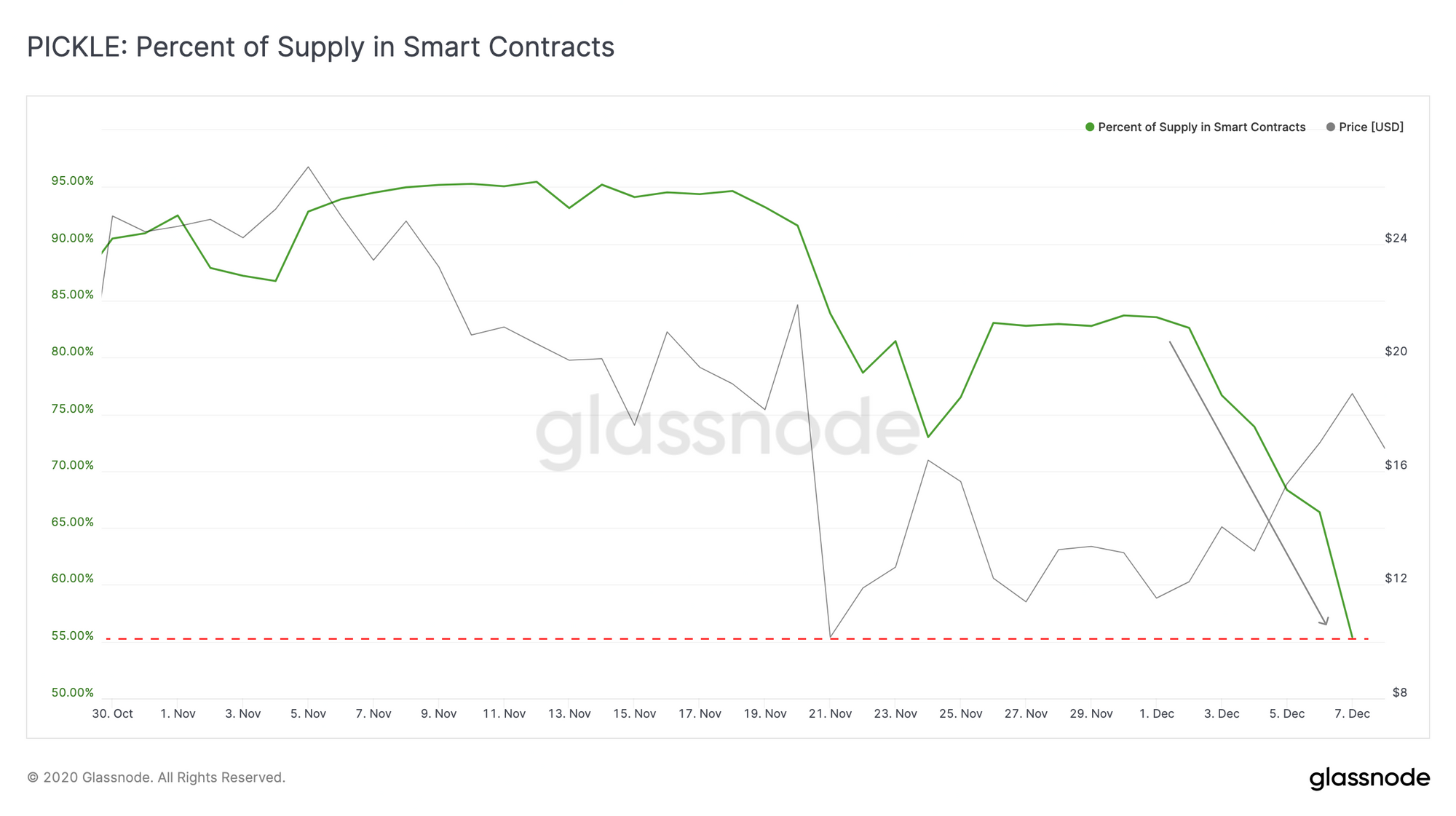

The number of PICKLE tokens being held in smart contracts has been steadily and rapidly decreasing over the past week. The percentage of locked PICKLE has dropped from 82.6% down to 55.4% since 2 December.

This decrease is likely due to the fact that Pickle is no longer distributing token rewards to stakers since the Pickle protocol was hacked on 22 November. However, this number will likely increase again soon when Yearn introduces Pickle vaults.

Under this new model, PICKLE holders will be able to stake their tokens to earn DILL tokens, which can be used to participate in governance votes as well as boosting Yearn vault rewards. In the meantime, however, investors should be aware that the presence of more liquid PICKLE tokens in circulation may have an impact on price.

Which altcoins would you like to see us cover in future editions of The Week On-Chain? Let us know on Twitter.

Weekly Feature: Long-Term Holders Are Selling BTC - Why This Is A Bullish Signal

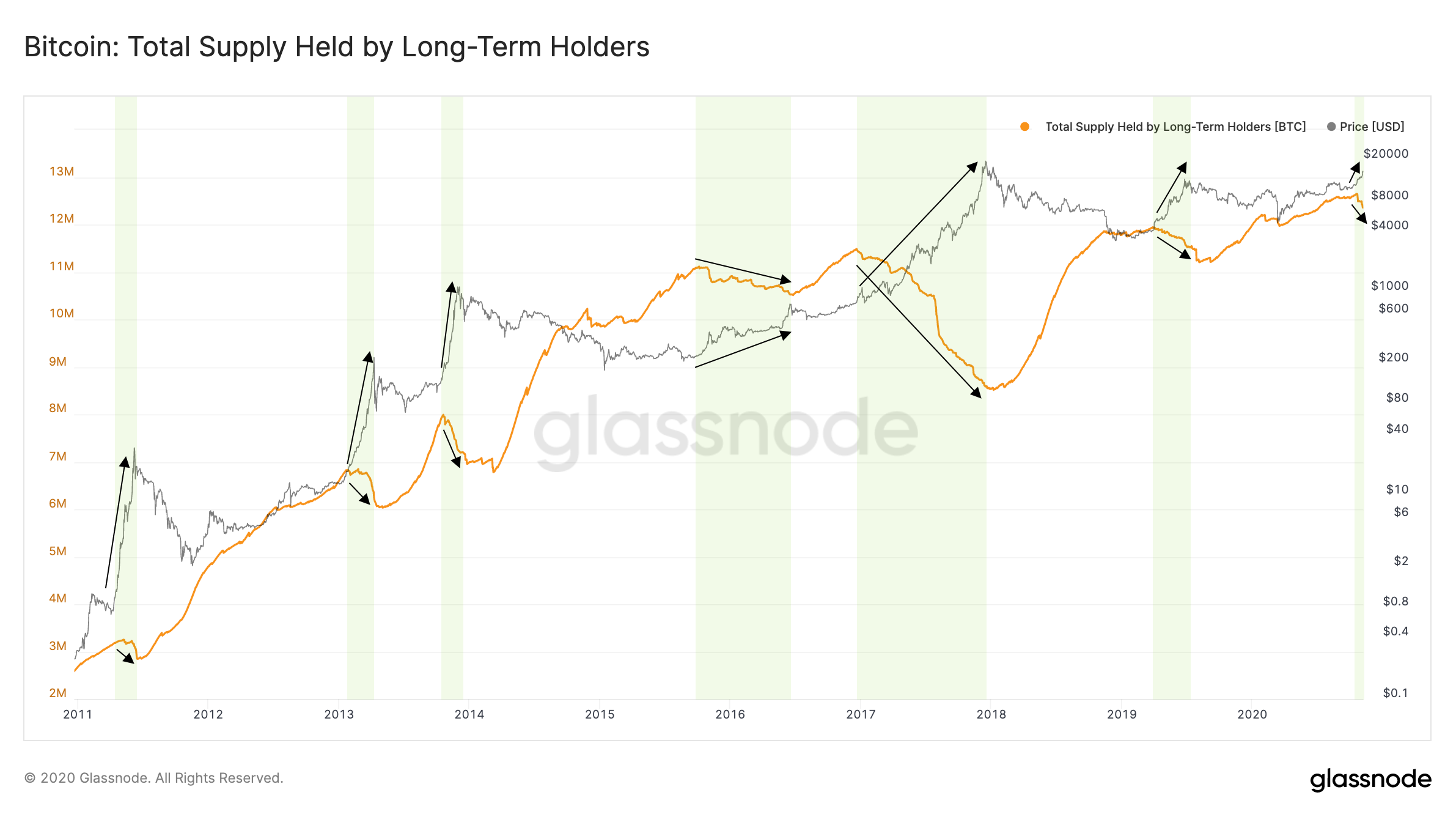

As we recently reported, on-chain metrics show that older coins are being sold as BTC's price increases, indicating that long-term holders are realizing profits.

While a sell-off by long-term holders might seem like a warning sign, this trend has historically been extremely bullish. In fact, as we outlined in a previous analysis, long-term holders have tended to realize profits before and during bull runs.

This suggests that, despite sell pressure from long-term holders, BTC may be in for further price increases before the top is reached.

Read the full analysis to learn more about this trend, and see how the behavior of long-term holders can indicate impending changes in the market.

Product Updates

Metrics and Assets

- Exchange Balance (Percent) (BTC, ETH, ERC-20) - New metric showing the percentage of an asset's total circulating supply held on exchanges.

- Transfer Volume in Profit/Loss (BTC) - Percent of Transfer Volume in Profit, Transfer Volume in Profit, Transfer Volume in Loss

- Uniswap Metrics (ETH, ERC-20) - Number of Transactions on Uniswap, Total Uniswap Volume, Total Uniswap Liquidity

Features

- Uniswap Dashboard - New dashboard featuring Uniswap smart contract data on the Ethereum blockchain.

- Lesen Sie diesen Artikel jetzt auf Deutsch bei unserem offiziellen Partner Bitcoin2Go

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter