The Week On-chain (Week 9, 2021)

The Bitcoin market experiences it's second significant correction since breaking the $20k all-time-high. This week, we review how market and on-chain metrics have reset or are cooling off.

The Bitcoin market experiences it's second significant correction since breaking the $20k all-time-high. This week, we review how market and on-chain metrics have reset or are in the process of cooling off.

Bitcoin Market Overview

This week, the Bitcoin market has commenced it's second notable correction since breaking the $20k all-time-high. The week opened with a price high of $57,539 and before trending into an inta-day low of $43,343, representing a 25% correction.

Prices across many markets have become volatile this week, driven largely by a rapid increase in the US 10-year Treasury note yield. Given Bitcoin's increasing adoption as an institutional grade macro asset, it is unsurprising that rapid changes in the time cost of money will influence Bitcoin pricing. Wider market narratives continue to evolve around expectations of inflation vs deflation and central bank policy responses. Bitcoin is likely to continue playing a key role in these discussions amongst institutions and investors.

Correction Resets Market Dynamics

Significant market corrections are positive events in that they flush out speculation, leverage, weak hands and test holder conviction. As the market seeks to set new price floor, we have seen numerous market indicators reset including futures open interest, futures funding rates and the Grayscale GBTC product.

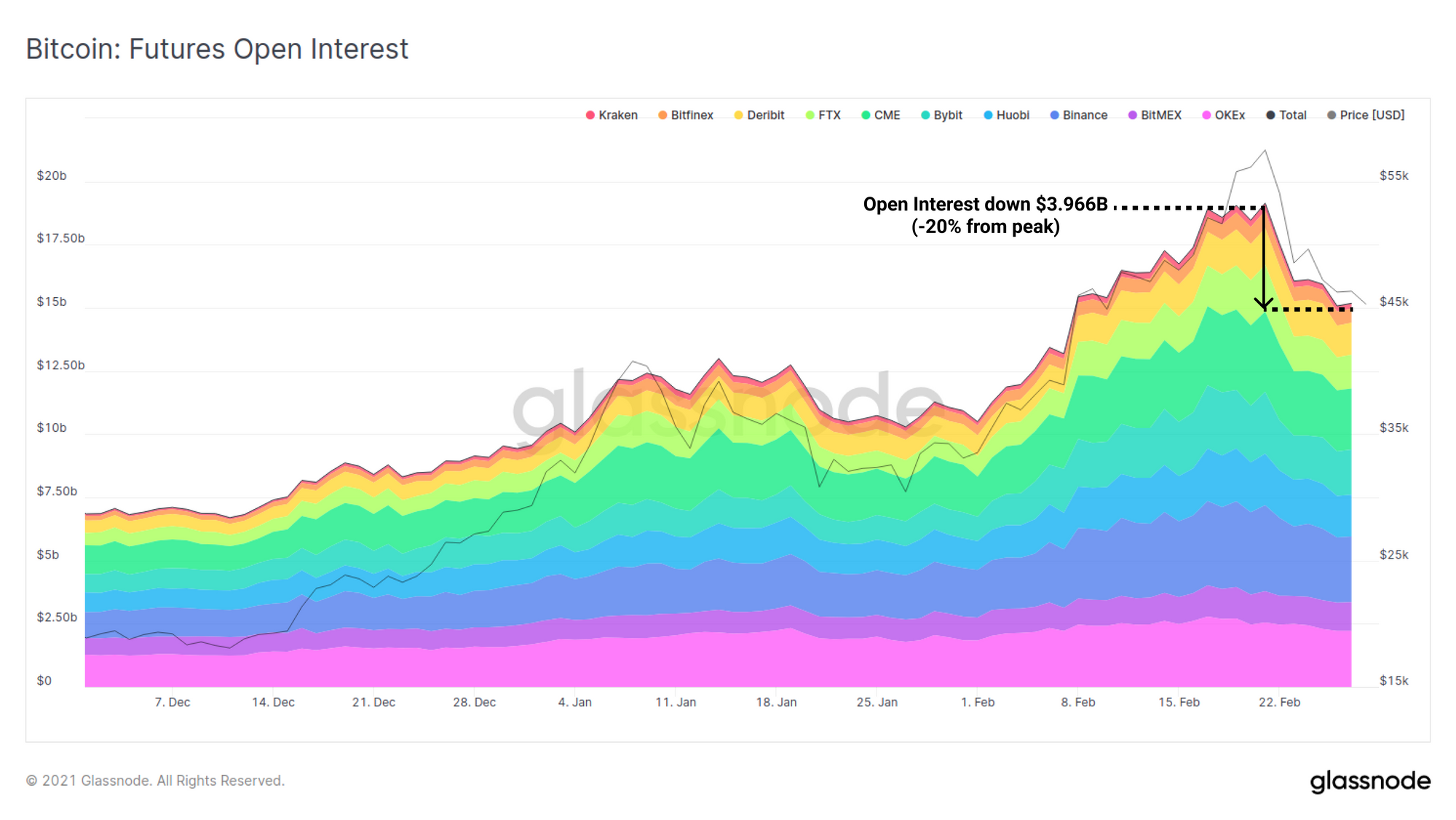

Futures open interest dropped almost $4 Billion from the peak of $18.4 Billion this week, a reduction of 21.7%.

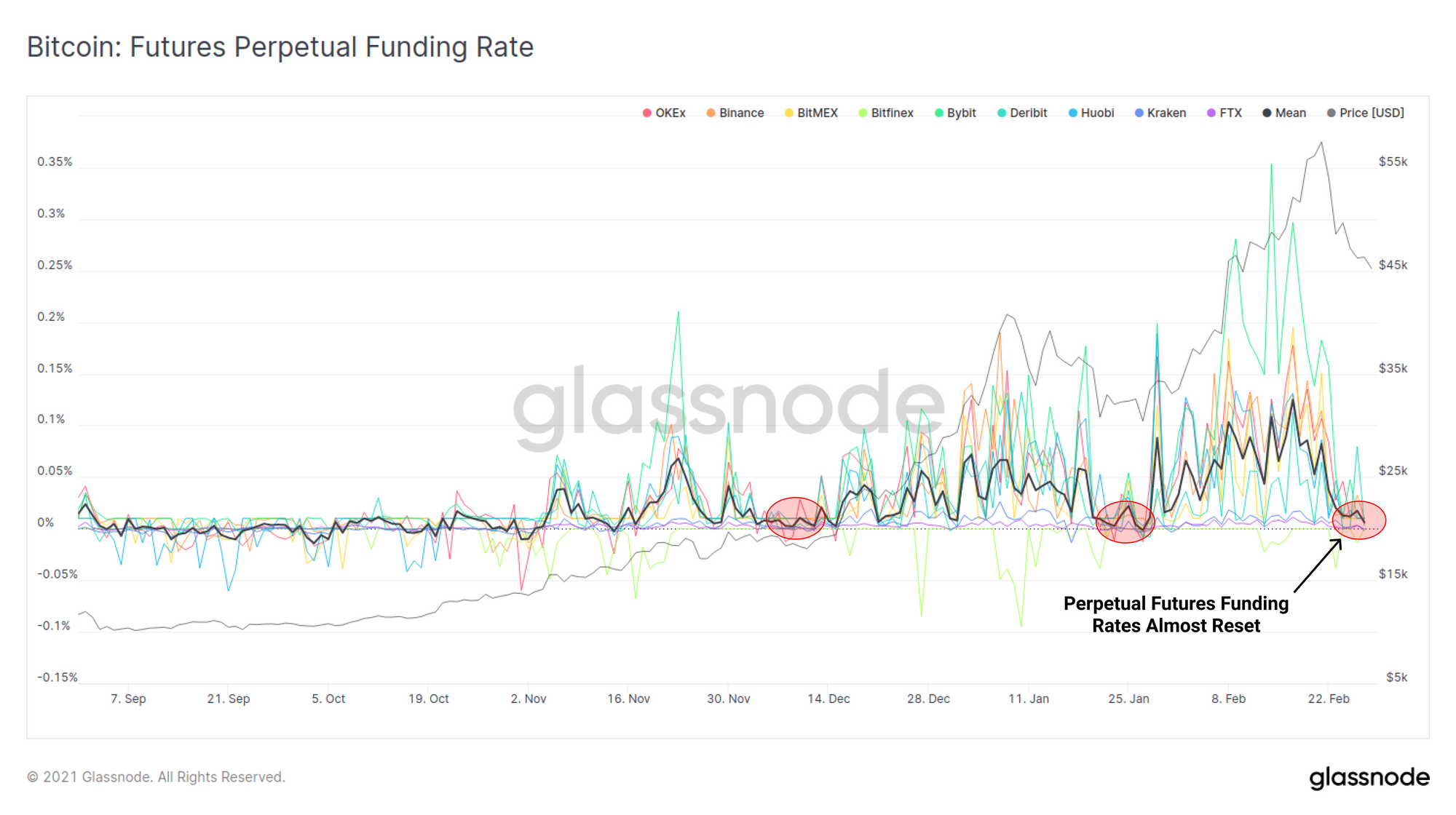

Perpetual futures funding rates have also reset close to zero. Previous combinations of decreasing open interest and a reset of funding rates have indicated a flush in speculative trading has occurred. This increases likelihood of spot market dynamics taking the wheel again. It is important to note however that open interest remains elevated, hovering around $2.50 Billion above the previous peak. There is still notable leverage within the market.

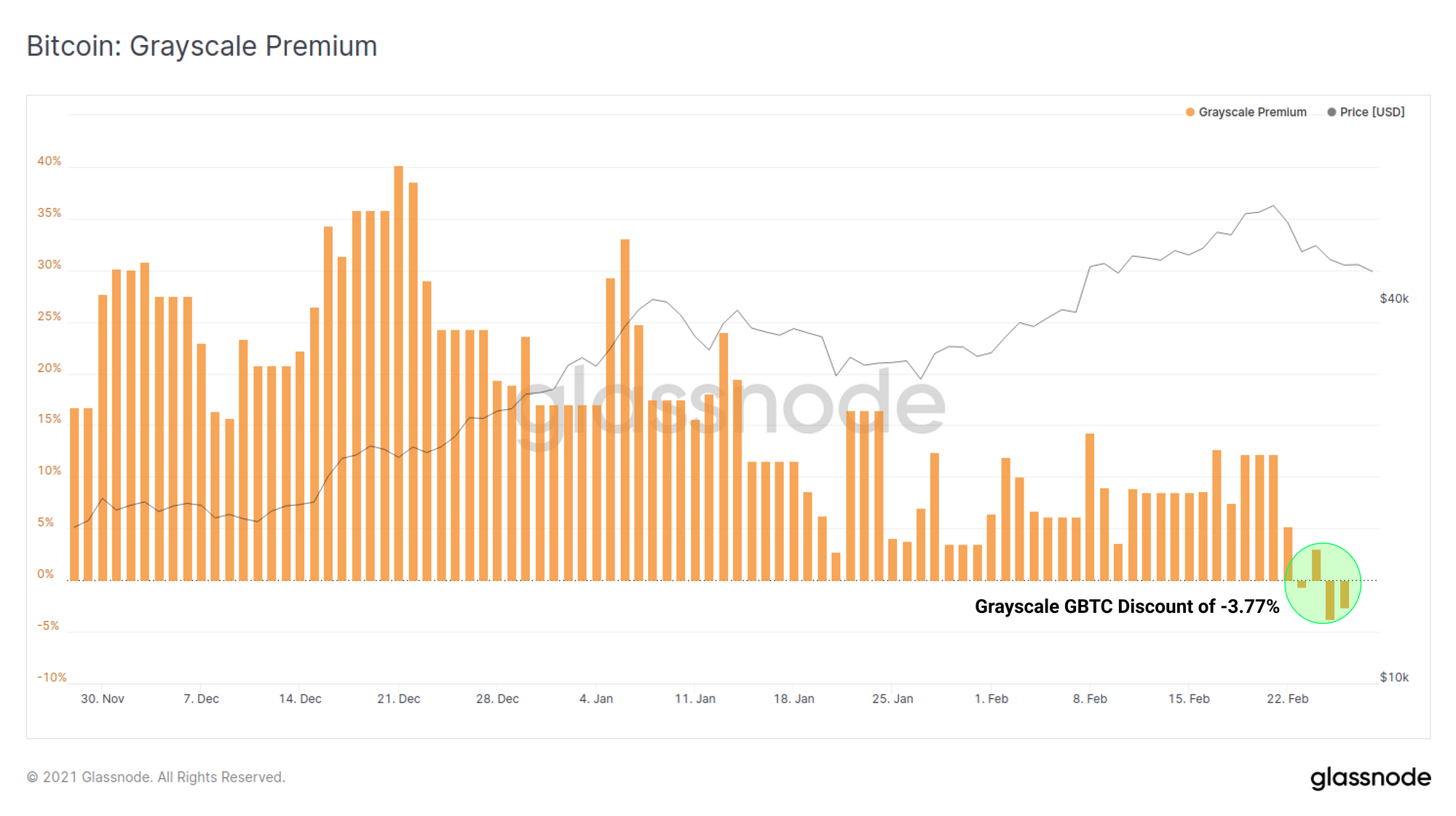

The Grayscale 'premium' has, for the first time, become a Grayscale 'discount', hitting a low of -3.77%. Whilst this price correction is a key driving force, the market is also starting to see the introduction of competitor ETF style products such as Canada's Purpose ETF (Glassnode dashboard available here).

As more institutional BTC products come to market, it is likely that Grayscale's product (and others) will not command as heavy of a premium in the future, as more options are made available for institutions to invest as close arbitrage gaps.

On-chain Metrics Cooling Off

Alongside market dynamics, many on-chain metrics we track have reset or are in the process of cooling off during this correction.

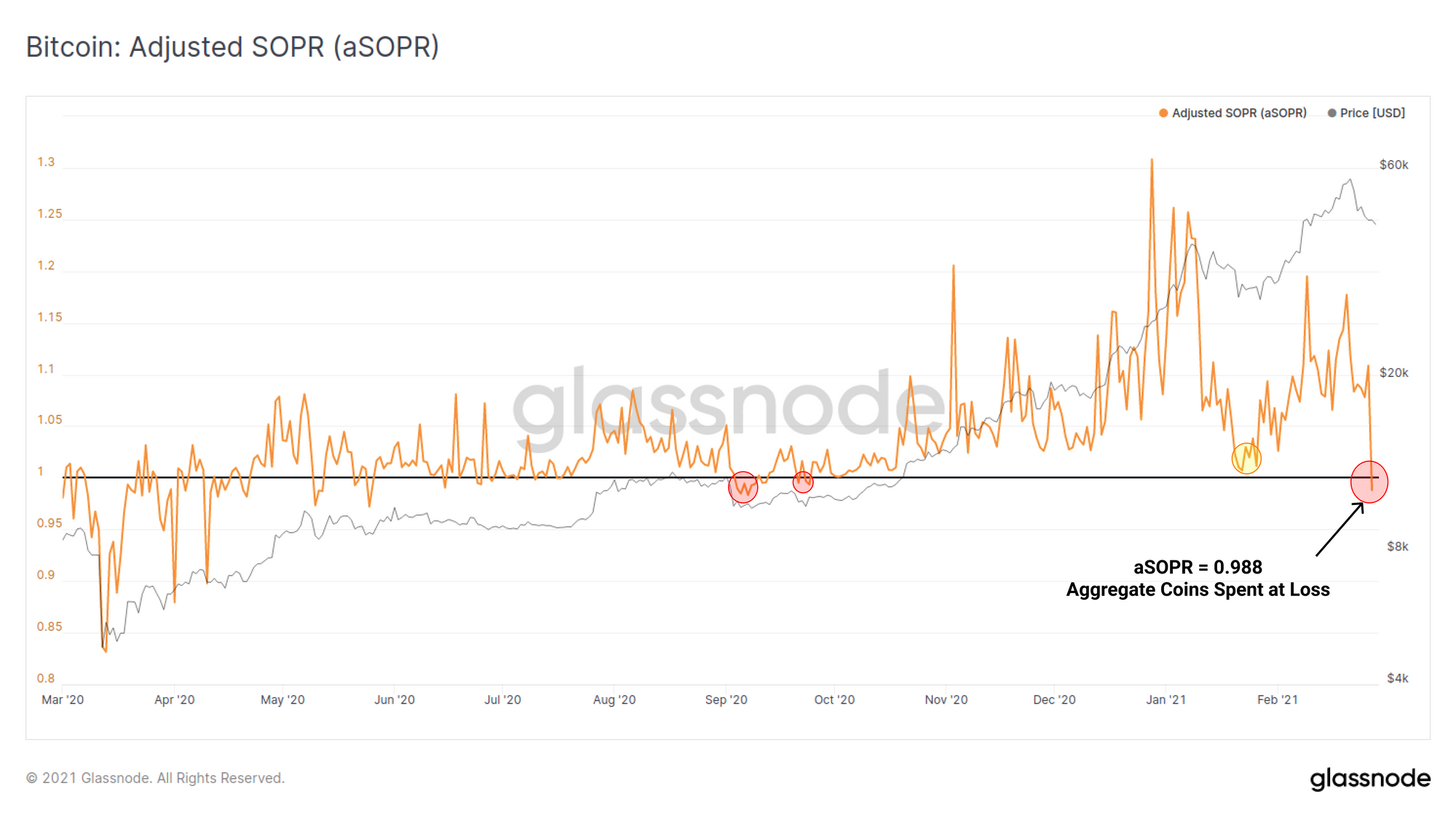

The Adjusted Spent Outputs Profit Ratio (aSOPR) has reset below 1.0 for the first time this bull market, hitting a value of 0.988. The aSOPR metric looks at all coins spent that day and calculates the degree of profit or loss they were in compared to when they were last moved.

When the aSOPR is less than 1.0, it means on aggregate, coins moved that day were at a loss. Low aSOPR values, especially when reset below 1.0, also mean fewer old and profitable coins were spent. This suggests confidence and HODLing strength remains for long term holders.

There is anecdotal and data driven evidence that the market has seen an influx of new retail investors. One example is the increased attention for exchange website logins and sign-ups discussed in our Uncharted Newsletter. As such, this relatively steep aSOPR reset may be our first on-chain indicator of 'panic selling' by new entrants. The previous dip from $42k never quite reset to 1.0 due to strong buy support (with a touch of Elon candle).

Is this time different?

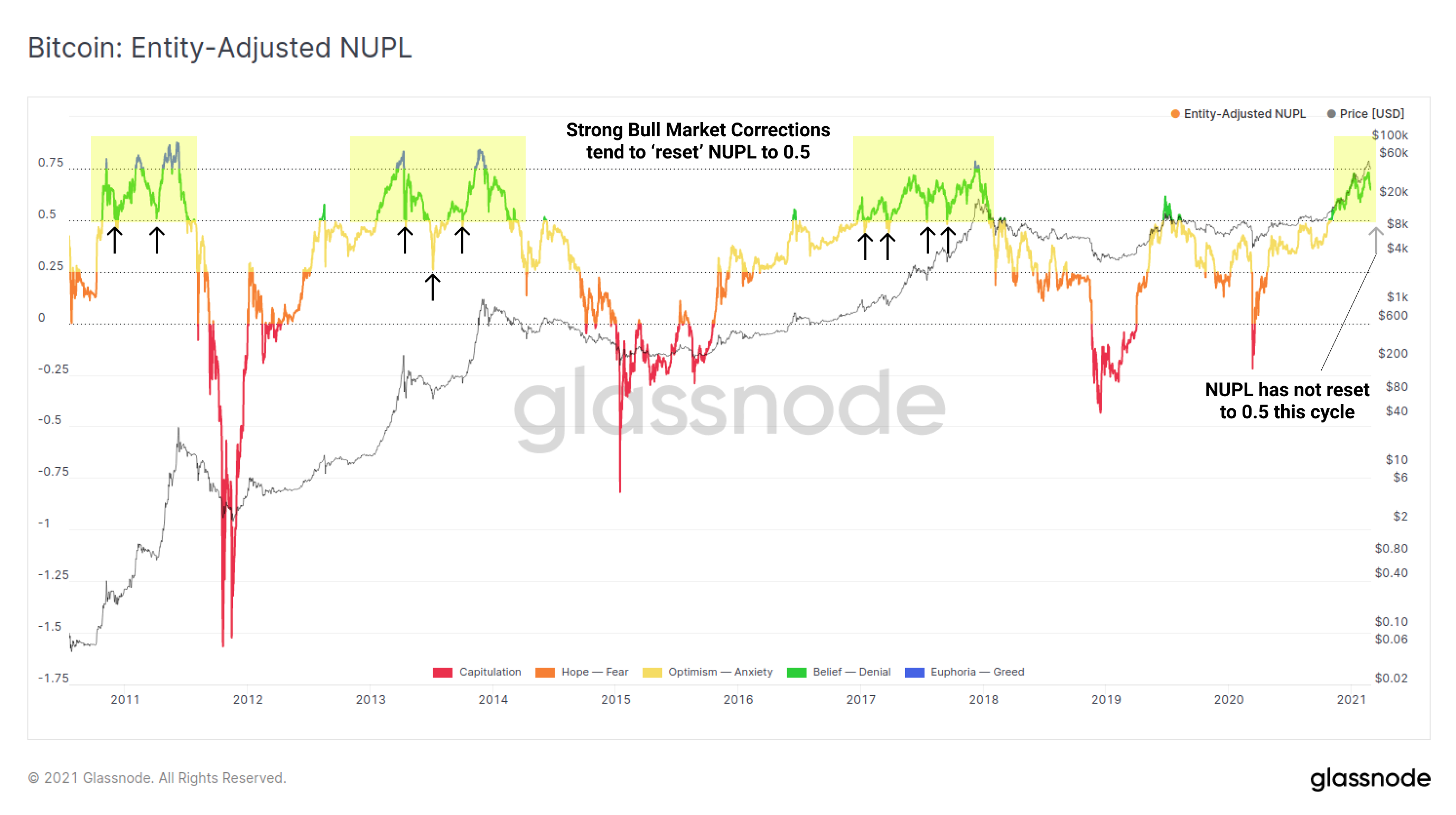

As a demonstration of how powerful this bull market has been, the Net Unrealized Profit and Loss (NUPL) metric has not reset to it's typical bull market support value of 0.5 so far. Previous cycles have seen 'choppy' sideways action for NUPL as we move into the second half of the bull. NUPL value of 0.5 tends to act as a key buy the dip level where the market is in an aggregate profit of 50% of the market cap.

Whilst both corrections this cycle have created the signature sideways and choppy behaviour, it seems buyers are stepping in sooner and fewer HODLers are letting go of their coins this cycle.

Willy Woo demonstrates where potential on-chain price floors may exist using the Realized Price Distribution. This metric calculates the volume of coins transacted on-chain at various price levels. The aim is to find price levels where large volume was accumulated on-chain and thus more likely to be defended. Using this metric, Willy identifies the $45k zone as a potential support level.

UTXO Realized Price Distribution. This is the on-chain, more precise version of volume profile. The peaks represent the price where most coins changed hands.

— Willy Woo (@woonomic) February 27, 2021

$45k upwards is very strong support.

Any dip (if you're are lucky) into $39k is a no-brainer BTFD.

Data: @glassnode pic.twitter.com/Z4xbEr0jTv

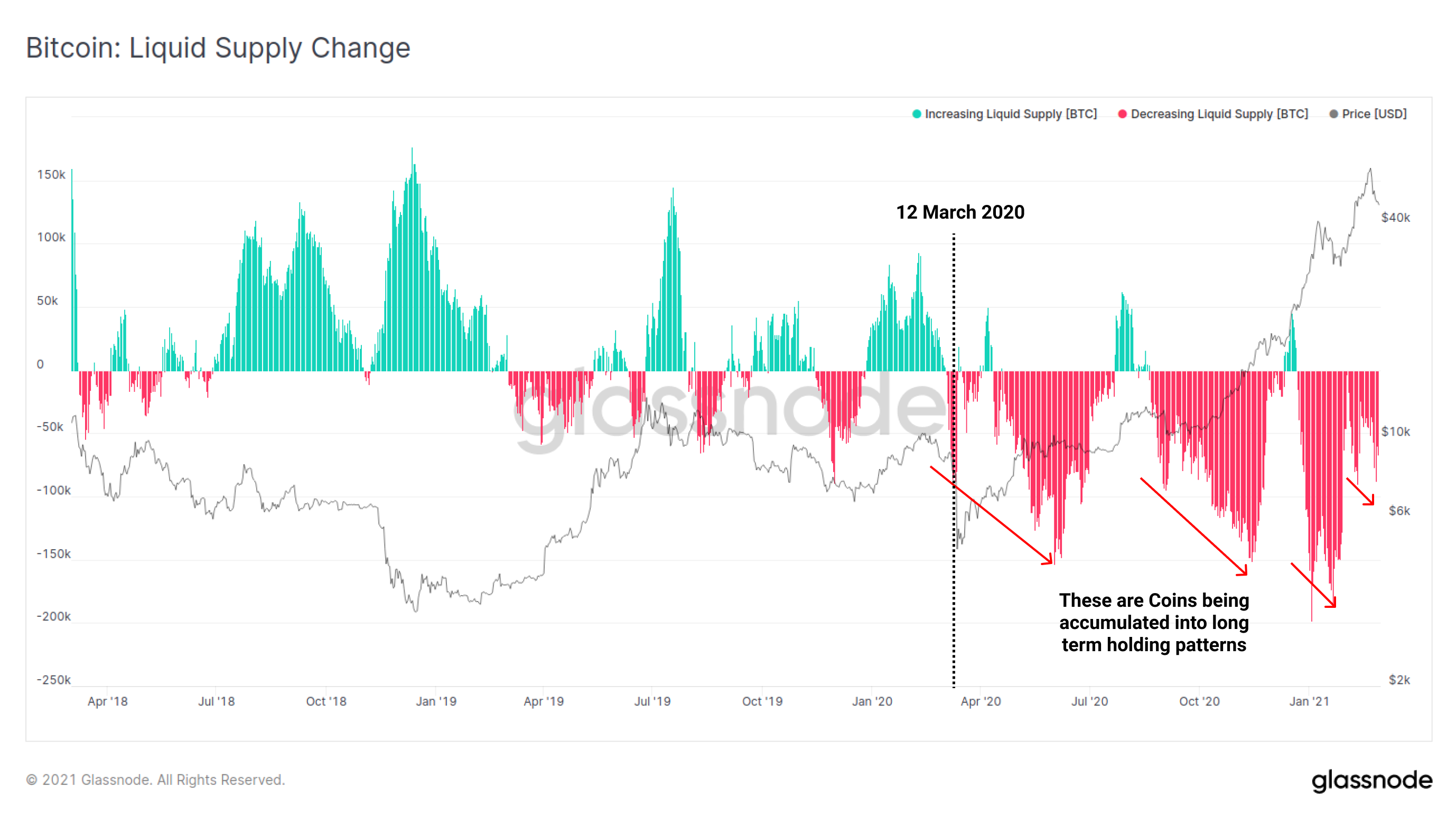

As final evidence that perhaps 'this time is different', the sustained trend and volume of coins being withdrawn into illiquid status continues. The most important observation is the date at which this trend commenced: 12 March 2020.

The trend of coins being withdrawn and locked away into long term holding patterns provides strong evidence that Bitcoin is now viewed as an important macro asset. Whilst on-chain metrics are resetting, and one can argue there is room to go in this correction, there still appears to be significant demand from long-term investors. This is quite unique in both trend and scale compared to Bitcoin's history, especially at this stage in a bull market.

Of course, the risk remains that 'this time is not different' and perhaps NUPL does in fact reset to 0.5. In this instance, with the Realised Price trading at $14,511, this means a 50% profit level would correspond to a price floor of 2.0*14,511 = $29,022. Quite the drop!

Weekly Feature: Liquidity on Uniswap

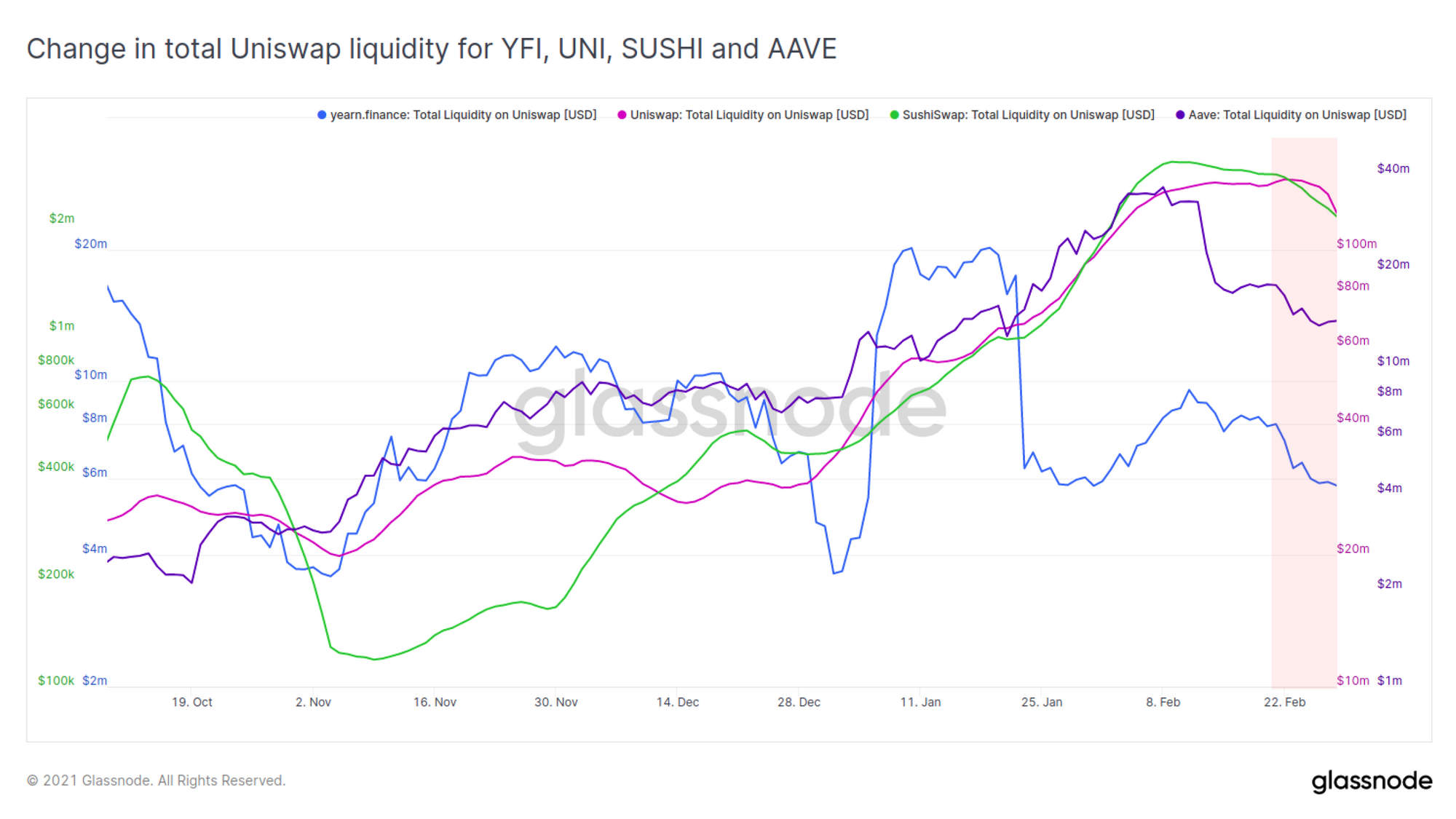

Last week we covered the prevailing fee environment on Ethereum, noting that it is both a vote of confidence for the chain, as well as a constraint for users of the protocol. Over the past week, Ethereum network fees have been somewhat lower than in recent months and we have seen a slight tremor in transaction volume and liquidity interacting with Uniswap. Perhaps users taking advantage of lower fees to reshuffle their assets.

This week $1.04 Billion in liquidity was withdrawn from Uniswap which appears to be spread across an variety of assets. Uniswap transaction counts fell significantly from ~186k to 85k tx/day on 18-Feb, approximately signalling the local top in ETH/USD price. Uniswap transaction volume then surged to $1.76 Billion on 23-Feb before dropping 45% to $0.97 Billion by weeks end.

A Glassnode Uniswap dashboard is available here.

Liquidity withdrawals from Uniswap can be seen across four major DeFi assets as examples: YFI, UNI, SUSHI and AAVE all saw liquidity reserves fall by around 20% to 30% this week.

It must be noted that most Uniswap liquidity and volume values are coming off near all-time-highs so it remains to be seen if these are simply a response to the price correction, or the start of a trend or asset rotation.

Check out Our Latest Newsletter: Uncharted

We have recently started a bi-weekly newsletter, Uncharted. This newsletter covers BTC from both an on-chain and off-chain data perspective, and uses beautiful charts and brief commentaries to give readers an intuitive snapshot of what is happening in the markets.

Check out Uncharted on our Substack, and subscribe now!

Special Offer: Free Month of Glassnode Advanced

We've partnered with ZUBR to offer a free month of Glassnode Advanced to users who sign up and trade crypto perpetuals on their platform.

ZUBR is a derivatives exchange built by HFT-traders, featuring guaranteed microsecond execution of trades with only 0.01% trading fees. They recognize the importance of on-chain data for traders.

Sign up now to gain access to Glassnode's on-chain metrics while utilizing ZUBR's high-end trading infrastructure.

Product Updates

Metrics and Assets

Features

- Double click now resets chart zoom.

- Enabled Metric previews on Dashboards for guest users.

- Lesen Sie diesen Artikel jetzt auf Deutsch bei unserem offiziellen Partner Bitcoin2Go

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter