Is DeFi Back in Business?

Regulatory conditions in 2023 have been a tug-of-war between positive and negative news, with altcoins and DeFi tokens being most heavily impacted. With MKR and COMP experiencing significant out-performance in recent weeks, we explore how we can extract information from changes in DEX liquidity.

Executive Summary

- Several positive developments in the digital asset industry, as well as developments within the DeFi sector has spurred renewed interest from investors in DeFi tokens.

- The uptick in DeFi token interest has sparked the interest of market makers, who have increased liquidity in the respective pools, indicating a positive outlook for trading and price activities around these token.

- Further analysis of Uniswap's trading volume distribution reveals that a significant portion of trading activity can be attributed to bots, which primarily focus on ETH-Stablecoin pairs.

Altcoins Back in Favour?

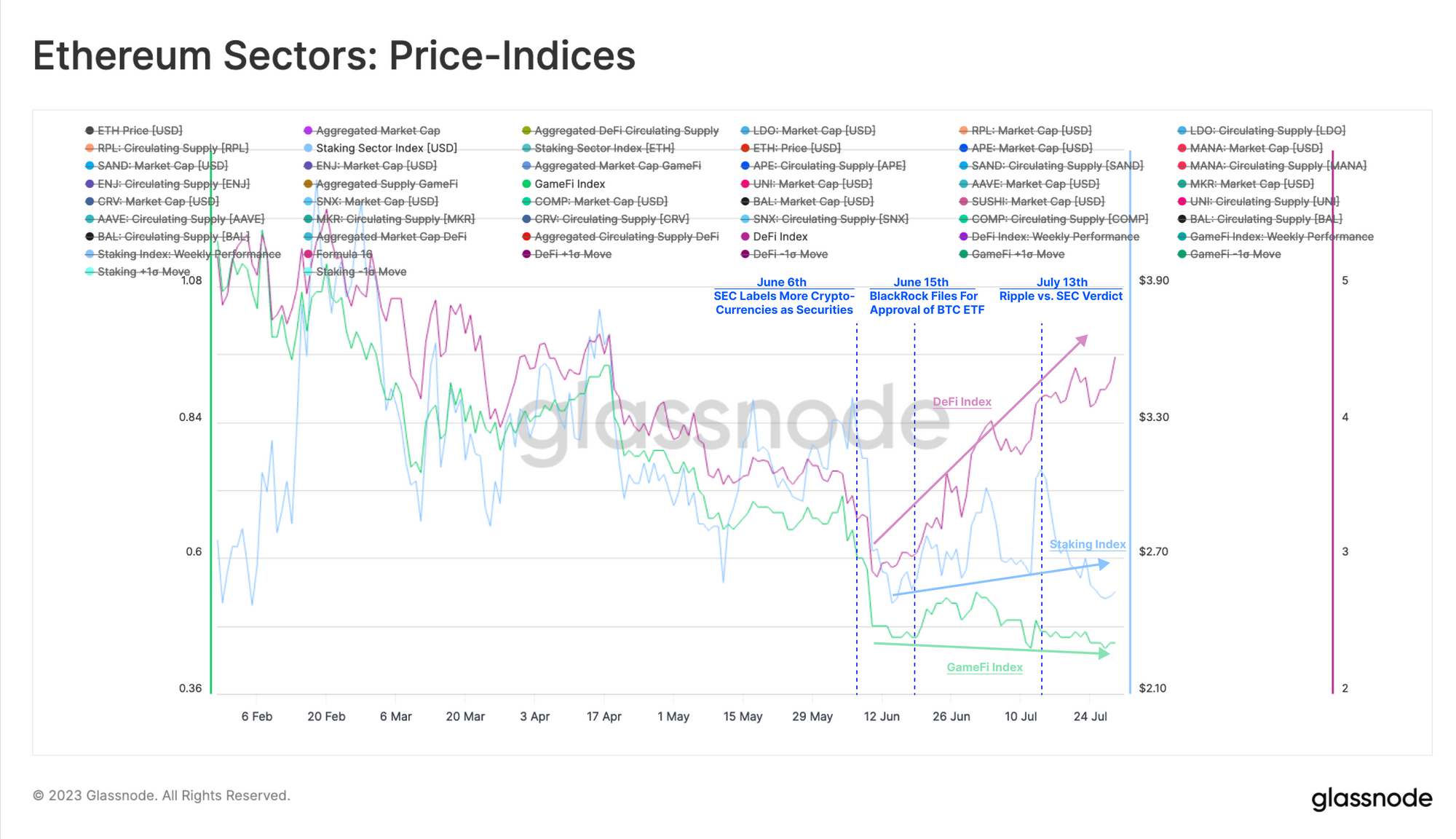

During the past few months, altcoin markets have seen a tug-of-war between positive and negative news events, driven by several key developments:

- In early June, the SEC labelled 68 cryptocurrencies as unregistered securities, putting a damper on market interest in altcoins outside Bitcoin and Ethereum. Many of these tokens had seen poor performance even prior to this news, which we covered in our report 'Dealing With The DeFi Downtrend'.

- The Bitcoin spot ETF filings by financial giants like BlackRock and Fidelity resulted in an uptick in market sentiment, spilling over beyond Bitcoin and into the wider digital asset space.

- Moreover, the verdict of the Ripple Labs vs. SEC case in mid-July, which ruled that the crypto company did not violate federal securities law by selling its XRP token on public exchanges, sent a positive signal for other US-based crypto projects and the industry in general. The XRP victory provided a degree of hope for altcoin investors regarding robustness against further regulatory action.

In particular, tokens related to the DeFi sector have seen the strongest performance, with our DeFi index price rallying 56% since the low set on 11-June. Other key market sectors such as GameFi and Staking have under-performed by comparison.

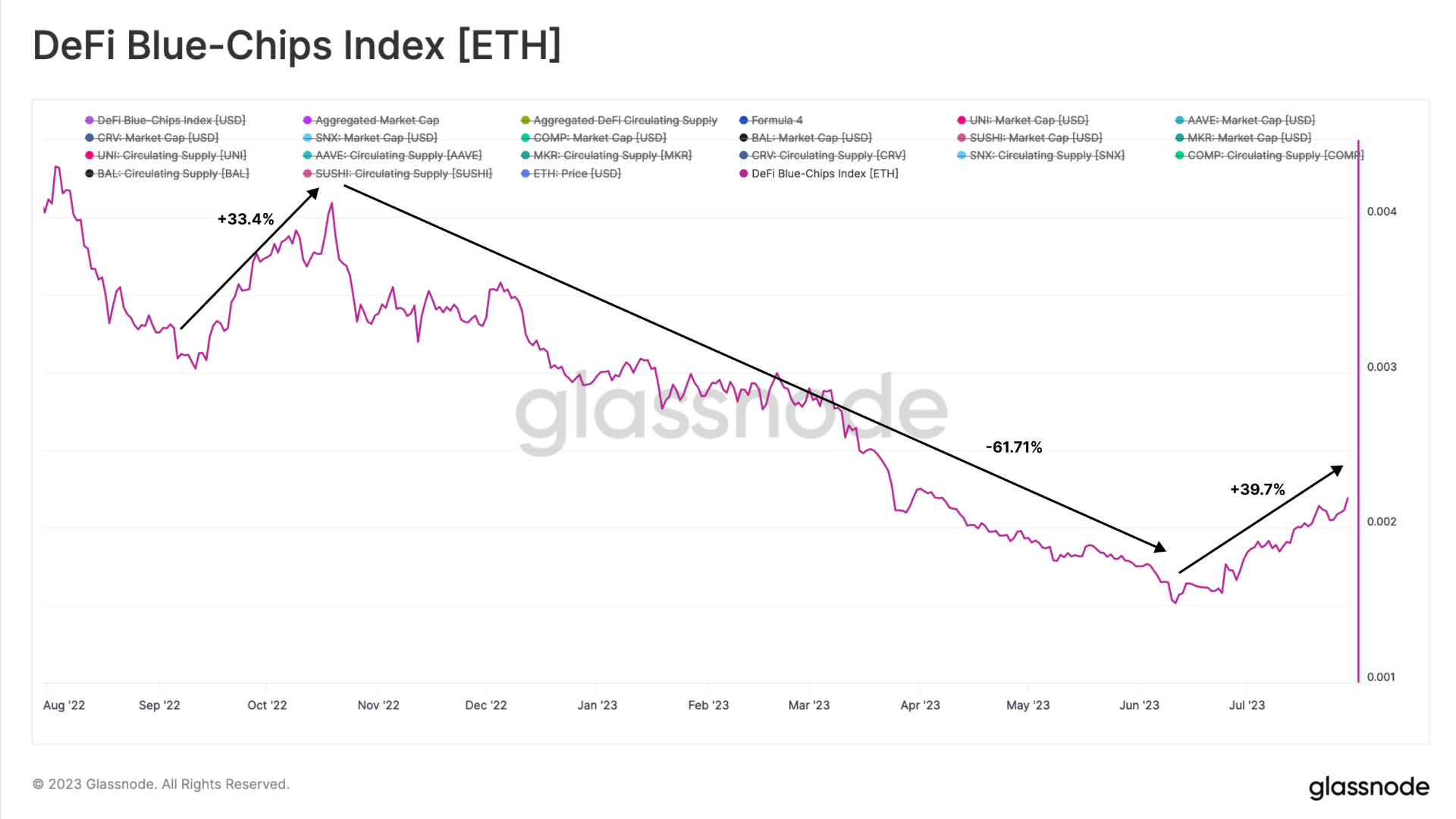

Our DeFi index consists of the top 8 DeFi tokens by market cap, and has established an almost two-month-long uptrend relative to ETH. This is the first outperformance since September 2022, and with very similar performance thus far.

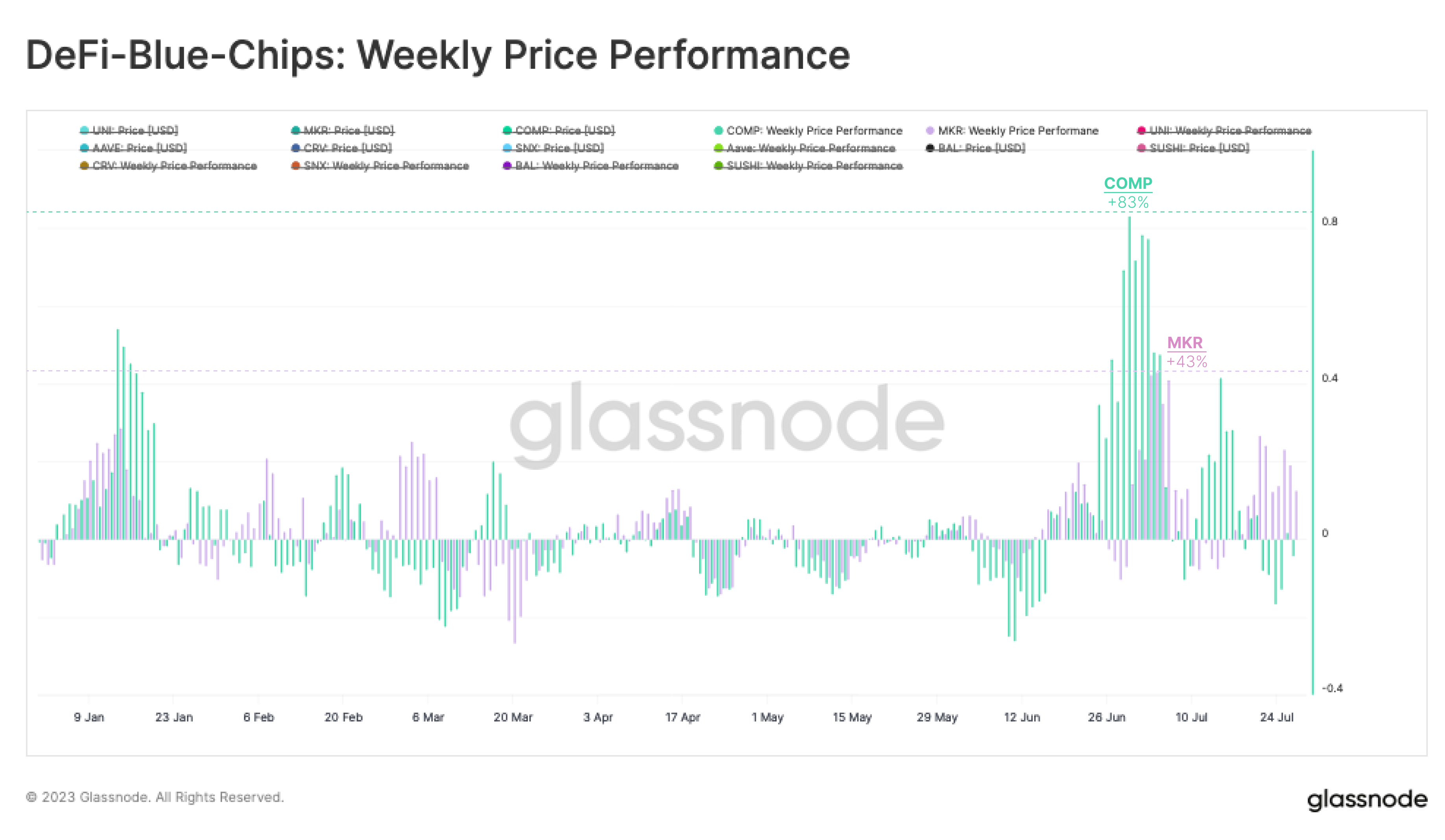

However, if we look at the top eight DeFi tokens separately, two tokens stand out as primary drivers of this trend: MKR and COMP. Upon closer examination, we can seet that the performance may well be closely related to new project fundamentals, rather than wider market developments.

On June 28th, Compound's founder and CEO, Robert Leshner, announced his departure from the lending protocol as well as the launch of a new project that focuses on bringing regulated finance to blockchain networks. Following this announcement, the COMP token surged by up to 83% in one week.

Today, I'm excited to announce the founding of a new company, @superstatefunds

— Robert Leshner (@rleshner) June 28, 2023

Superstate's mission is to create regulated financial products that bridge traditional markets & blockchain ecosystems.

Around the same time, MakerDAO activated its Smart Burn Engine, a buyback program which uses excess DAI owned by the protocol to purchase MKR from a Uniswap pool. The prospect of removing approximately $7 million worth of MKR in one month caused the token's price to increase by up to 43% on the week.

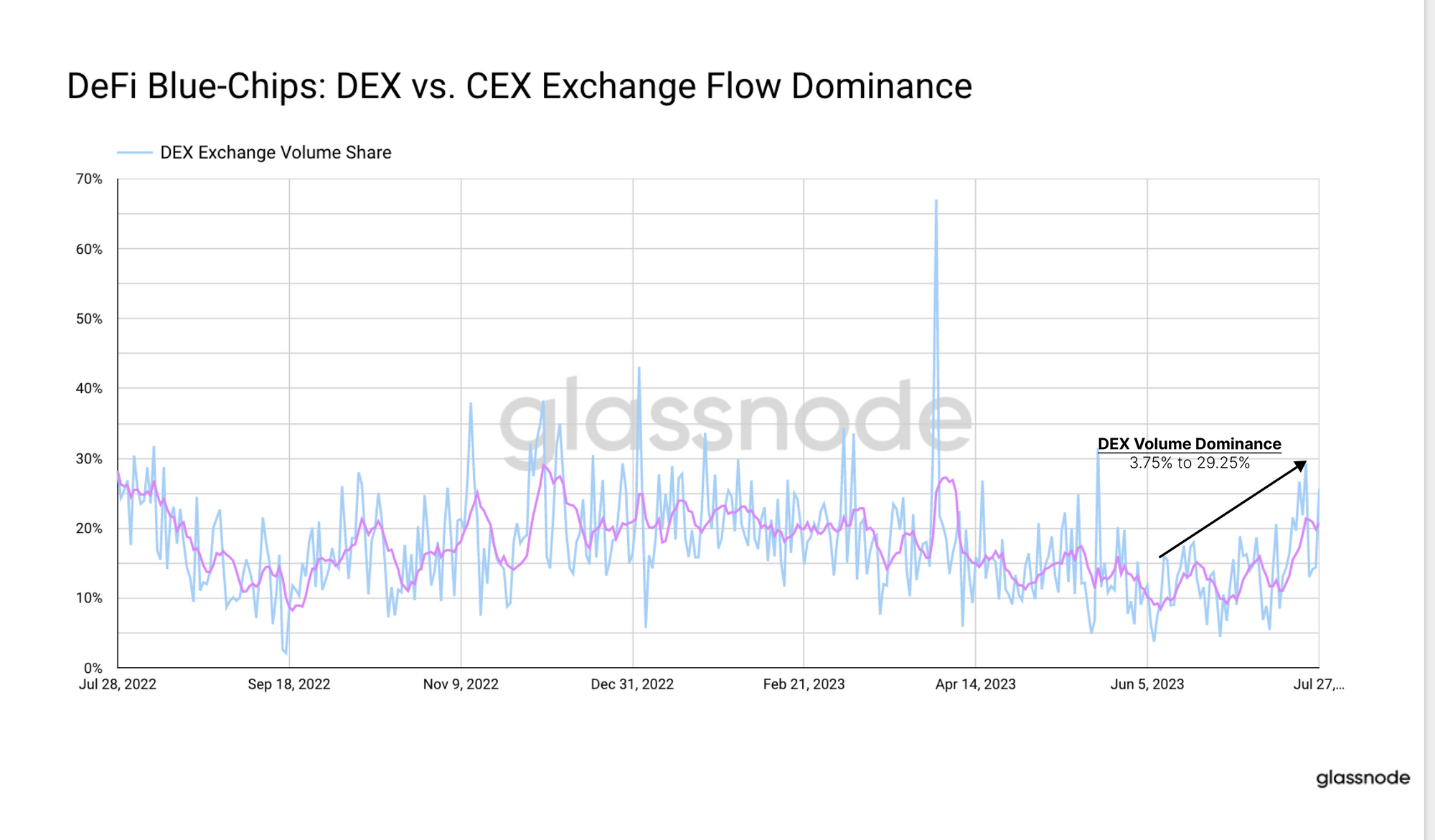

By examining the DEX vs. CEX exchange flows for the top eight DeFi tokens, we can see a renewed interest in DEX activity. The relative share of volume traded on DEXs has increased from 3.75% at the beginning of June to 29.2% today, close to the highs seen during the second half of 2022.

Mixed Types of Uniswap Trading

With this uptick in DEX activity, we can investigate how these recent developments have impacted DEX activity and any potential implications for stakeholders. Our primary focus will be on Uniswap, the leading DEX, which has also been the most significant consumer of gas in the past week.

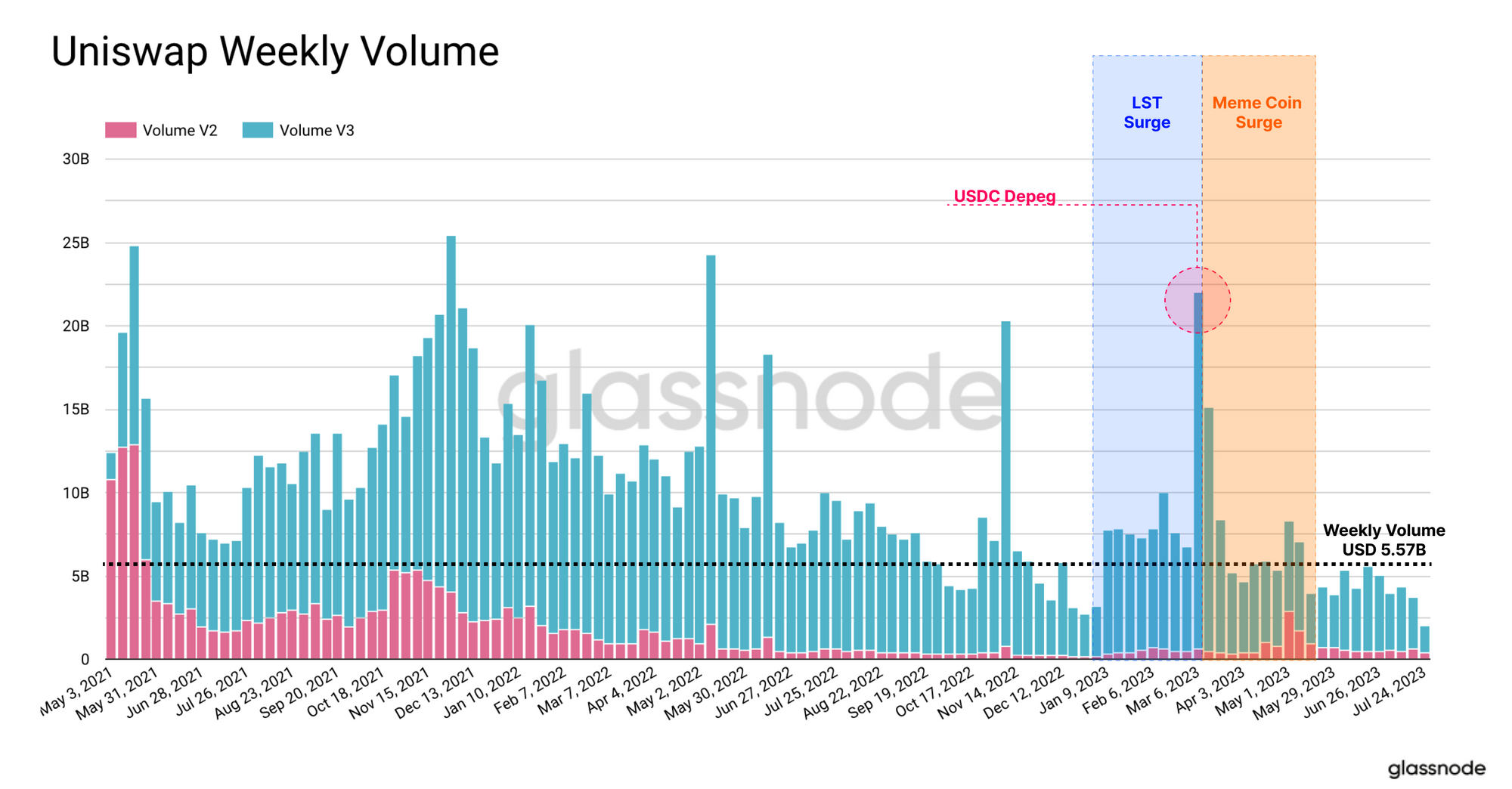

In terms of Uniswap trading volume on Ethereum, the current level of $5.57B/week remains significantly lower than in previous years. There was a volume surge related to interest around Liquid Staking Tokens earlier in 2023, as well as a brief uptick in 'meme-token' which has since faded out.

From this lens, we can see that the recent excitement around the BTC ETF filings and the Ripple vs. SEC verdict has not sparked an appreciable increase in trading activity on Uniswap.

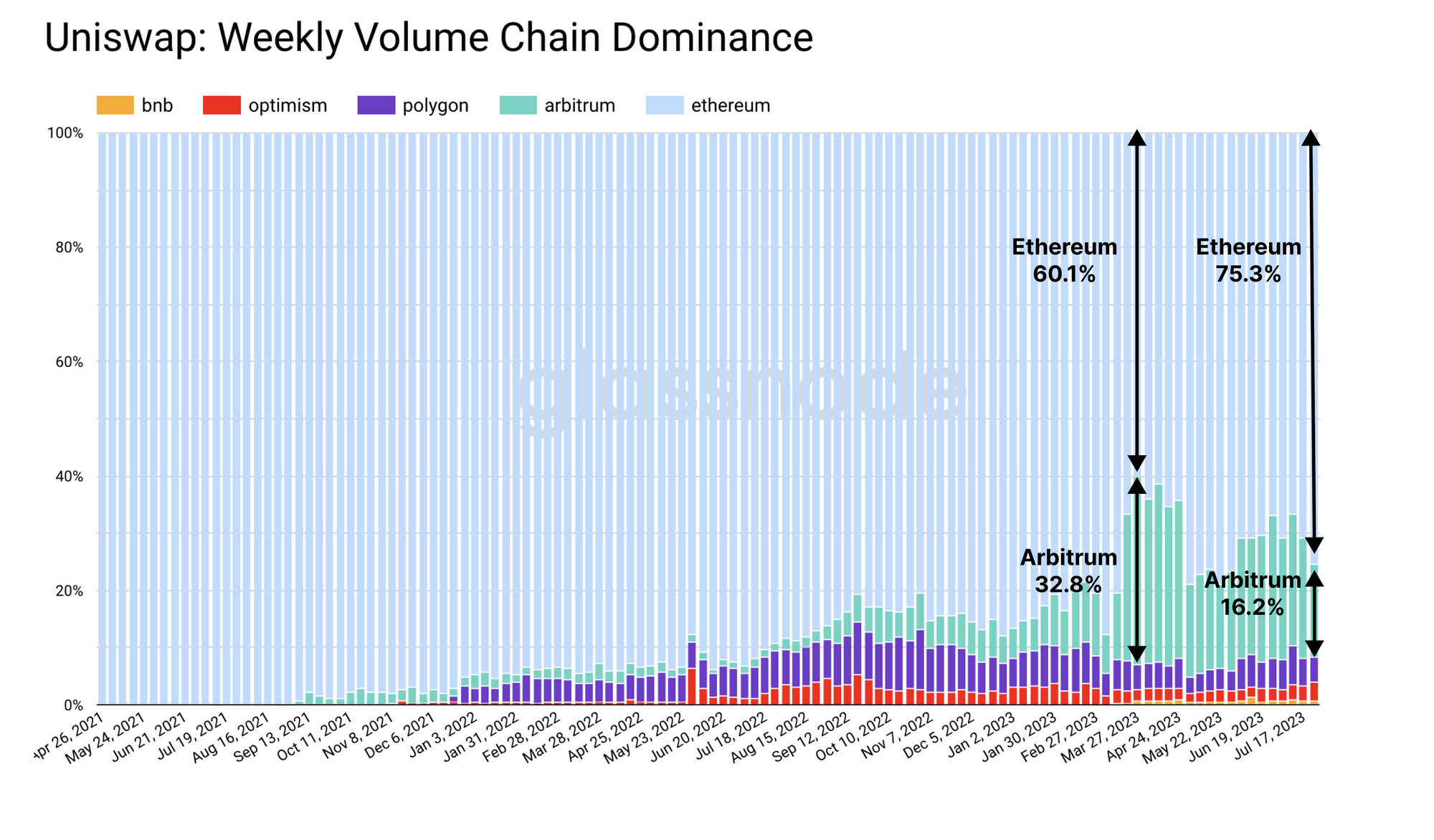

By examining the distribution of Uniswap trade volume across different Layer 2s, we get a clearer picture. It becomes apparent that an appreciable portion of trading has shifted from the Ethereum mainnet across to Arbitrum, attracting up to 32% of volume in March. This trend has remained elevated in June and July, which provides a degree of reasoning for the lower volume on Ethereum we observed above.

Bots vs. Humans

Another way to contextualize Uniswap trading activity is to look at the type of trader executing it. Since 2019, we have seen the emergence of various types of MEV bots, which are automated programs that monitor the blockchain to detect lucrative trades to exploit. For the purposes of this analysis, we will focus only on two types; Arbitrage and Sandwich bots.

- Arbitrage bots aim to profit from price differences between the same token-pair across various DEXs and CEXs.

- Sandwich bots work by inserting their trades in front of the target trader (assume a buyer) which causes an execution at a wider spread. After this, the sandwich bot will sell the asset again to close the spread, maximising value on both sides.

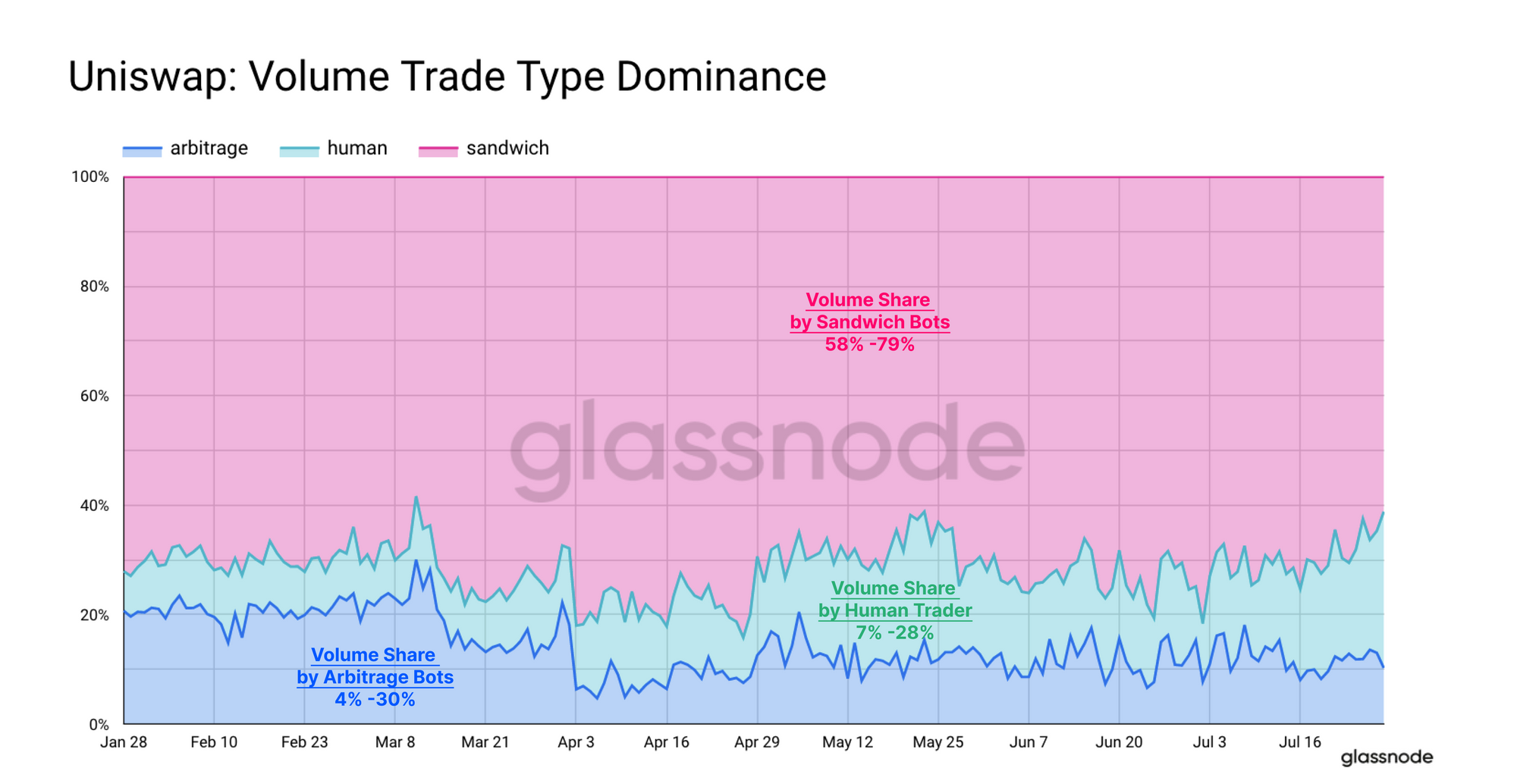

The chart below displays the proportion of volume on Uniswap (on Ethereum) that comes from bot trading versus human trading.

We observe that Sandwich bots generally account for more than 60% of daily volume. The volume share of Arbitrage bots has decreased from roughly 20% to 10% since the beginning of the year. Meanwhile, the share of volume created by human traders has increased up to 30% since the beginning of July, aligning with the period of increased interest in DeFi tokens.

Please note that this clustering is the product of a the first iteration of newly developed heuristics at Glassnode, which are still under active development. For this iteration, we have created rather conservative criteria for labelling bots, especially in regards to Arbitrage bots.

Furthermore take note that different types of bots create different amounts of transactions and volume. For example, a sandwich bot executes at least two trades, creating twice as much trading volume in one trading action as a human trader.

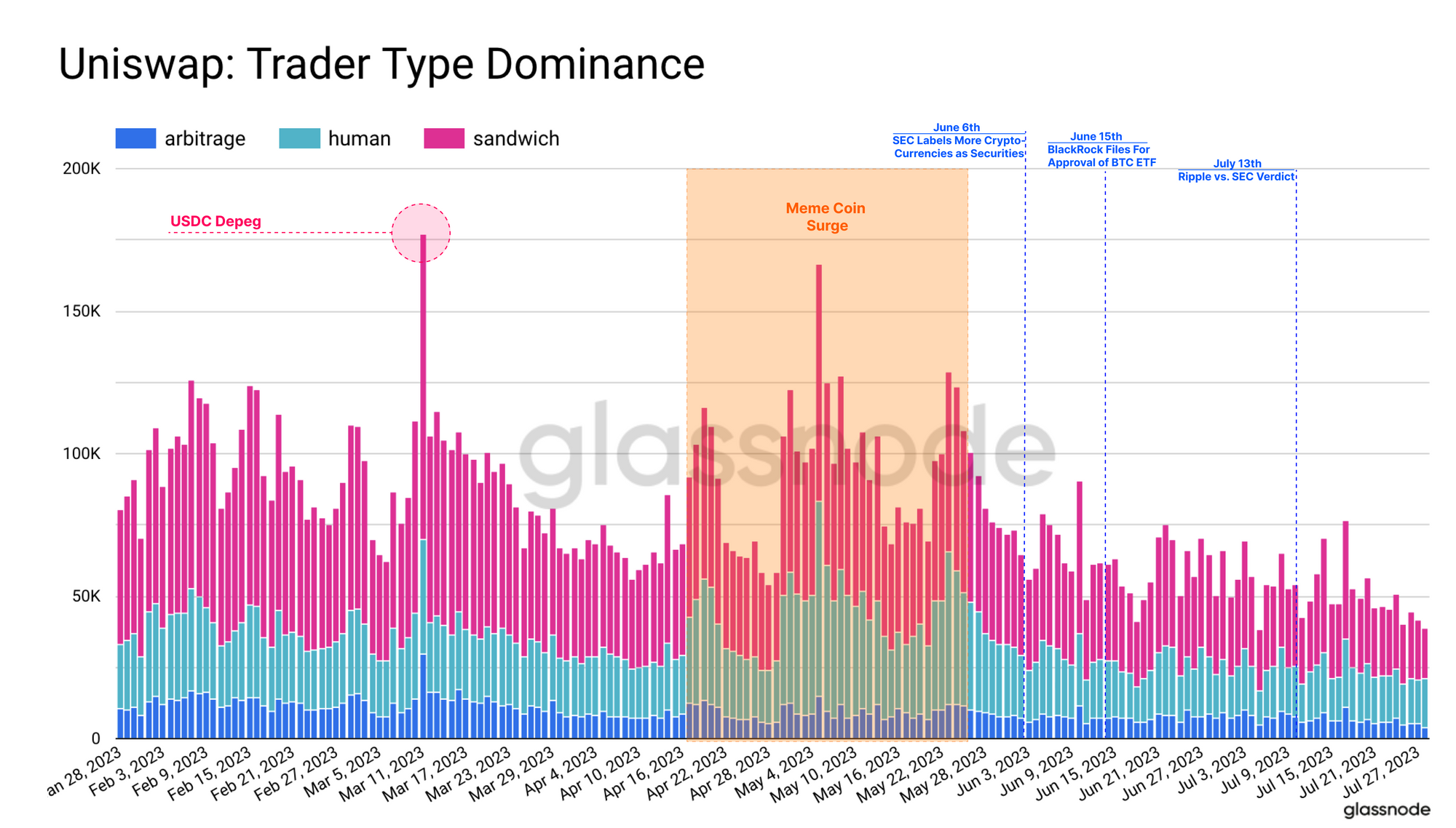

Since the volume can be inflated differently by different type of bot attacks, the daily number of trades by trader types provides a another view into the comparison.

We can see that human traders were very active during major events such as the USDC depeg or the meme-token mania. With greater price volatility and an influx of 'target traders', both Arbitrage and Sandwich bots follow suit, becoming up to three times as active during these upticks in human trading.

The interactive chart below displays the preferred token and pool for each type of trader, with all three trader types clearly prefer the largest and most liquid trading pairs ETH-USDC and ETH-USDT.

Liquidity Pools as Information Markets

Since the introduction of Uniswap V3, liquidity providers could distribute liquidity within specific price ranges within the pool. Rather than spreading liquidity across an infinite price range, liquidity could be more efficiently concentrated around price ranges where the investor expects the highest trade volumes (to capture fees).

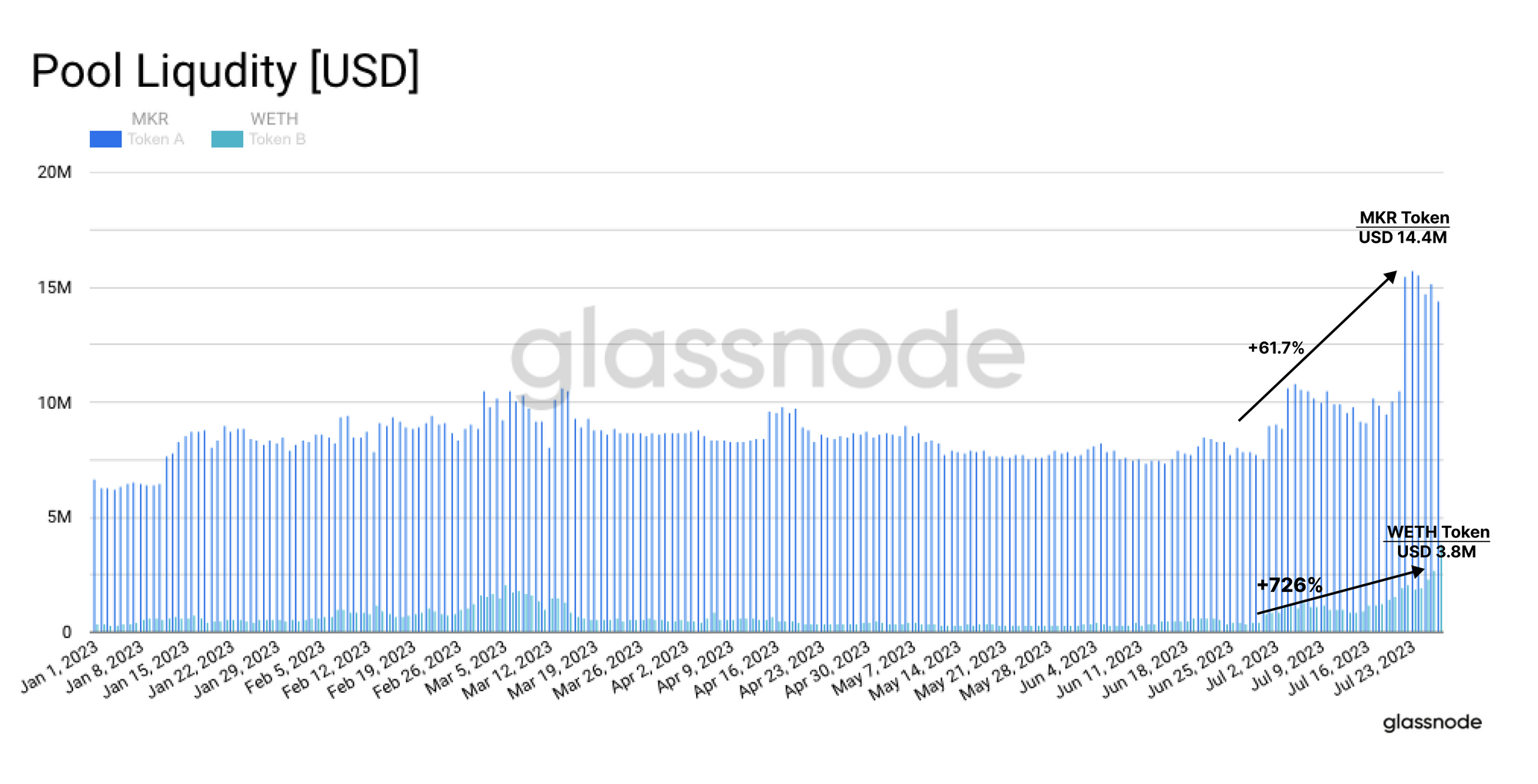

Since the announcement of the Maker buyback program, the most successful liquidity pool for Maker on Uniswap V3 was the MKR/WETH pool, which has experienced a noteworthy increase in liquidity.

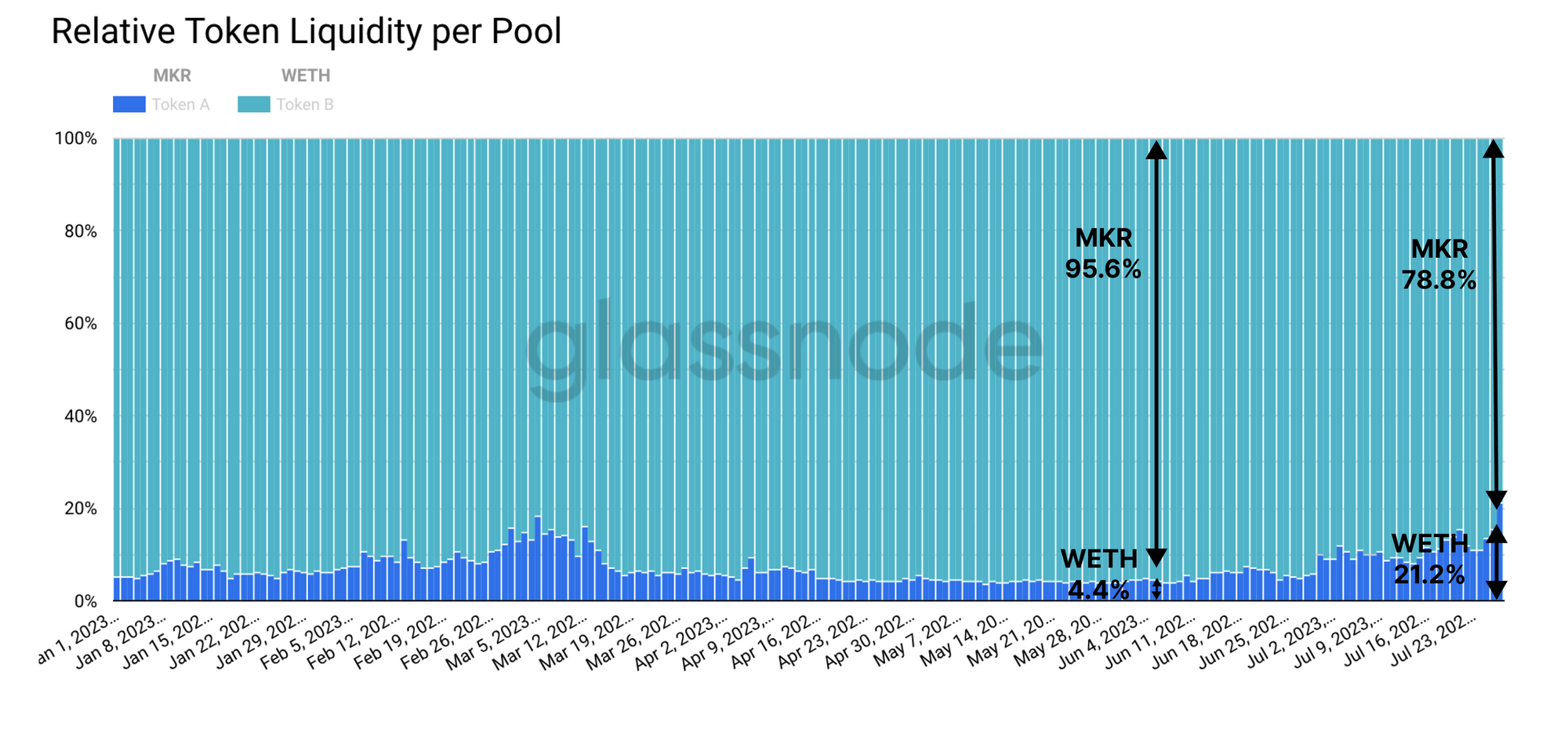

Whilst the pool has traditionally held mostly MKR funds, the liquidity depth of WETH has risen by over 700%. This suggests that liquidity providers are signalling an expectation of higher trade volumes for the MKR-WETH pair.

Upon examining the composition of the pool, we can clearly see an increase in the share of WETH, which now accounts for 21.2% of the total. This is the result of traders increasingly purchasing MKR with WETH, indicating a clear rise in demand for MKR since the start of June.

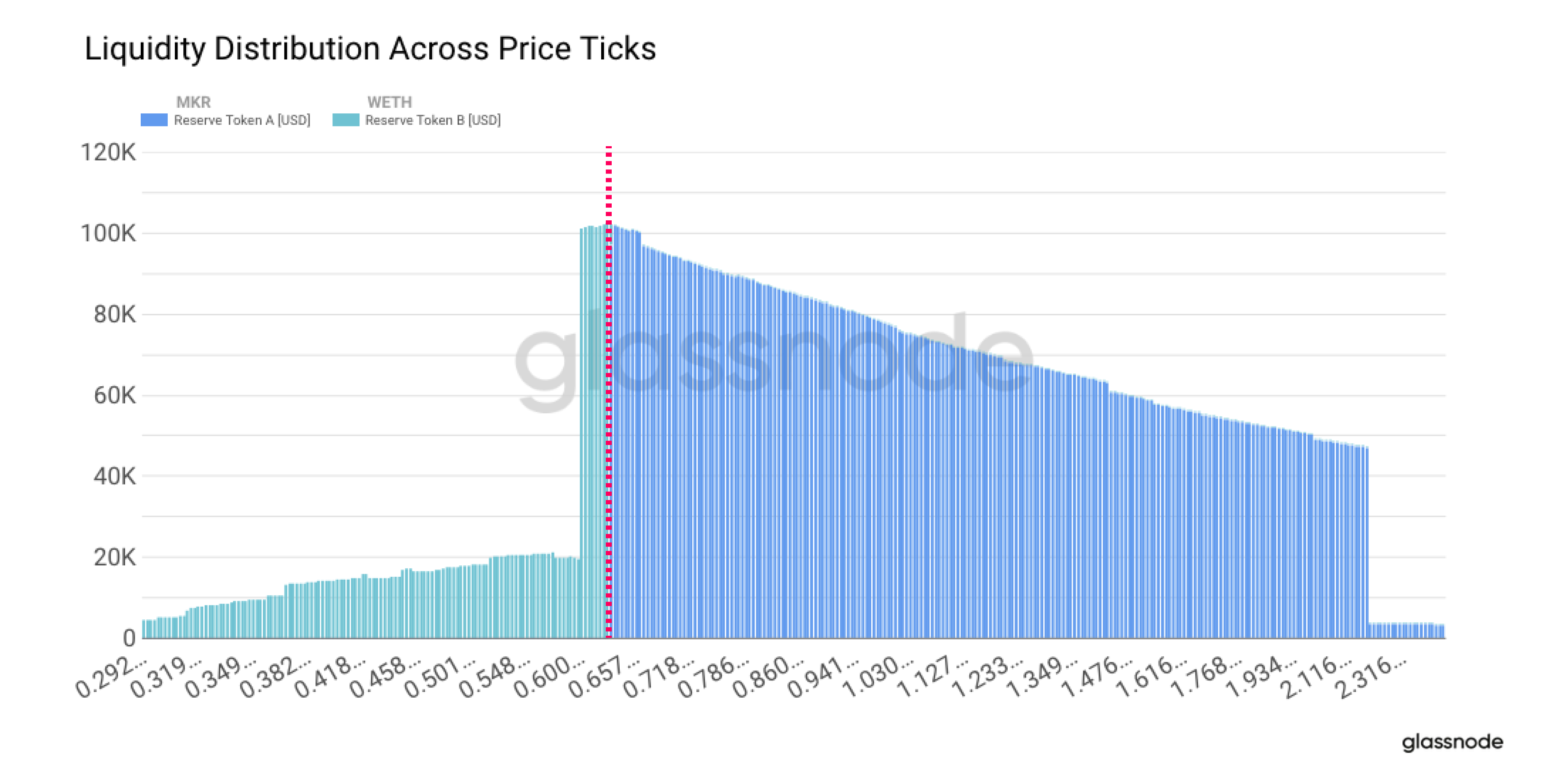

As a final note, we propose an idea on how the liquidity pools of Uniswap could function as a form of information market for the expected price development of tokens. If we take a closer look at MKR-WETH liquidity which is placed out of range, we can clearly see that liquidity is elevated at price ticks much higher than the MKR/ETH exchange rate.

As liquidity providers move their capital up to higher price ranges, they are in a way expressing a form of out-of-the-money option on fee revenue at higher price points. Under the assumption liquidity providers are rational profit-seeking actors, the movement of their liquidity may provide option-market like insight into the expected volatility and expected range for the token of interest.

Summary and Conclusions

The regulatory environment surrounding digital assets has been back-and-forth in 2023, with a varied split of positive and negative news. Over recent weeks, DeFi tokens in particular have experienced out-performance, led by MKR and COMP. However after examining trading activities on Uniswap, it appears that these price increase have not been reflected in an uptick in DEX trading activities.

An explanation for this is both a growing share of trade volume occurring on L2s like Arbitrum, but also by a lighter presence of human traders. With fewer human trades, there is an equally light degree of arbitrage and sandwich bot activity.

In the case of MKR, there has been a notable uptick in market makers providing liquidity in Uniswap pools, signaling a degree of anticipation for increased trade volumes. From this, we propose a concept whereby the distribution of liquidity may well provide information into the expected trade ranges for the token in question.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

- Join our Telegram channel

- Follow us and reach out on Twitter

- Visit Glassnode Forum for long-form discussions and analysis.

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

- For automated alerts on core on-chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter