Avenir + Glassnode: Bitcoin's Liquidity Profile

An innovative study by Glassnode and Avenir Group exploring how Bitcoin’s liquidity profile is being reshaped by structural capital flows, institutional demand, and macro-financial integration.

As Bitcoin integrates more deeply with global markets, its behavior is shifting - no longer governed by crypto-native cycles but by global liquidity, regulated access points, and institutional positioning. This report, co-authored by Glassnode and Avenir Group, presents a multi-dimensional analysis of Bitcoin’s market structure through on-chain activity, exchange-based liquidity, and macroeconomic linkages.

Across four chapters, the report introduces a unified liquidity framework that helps decode market conditions with greater precision - and contextualizes Bitcoin's role in a complex, multi-asset world.

A Unified Framework for Analyzing Bitcoin’s Liquidity

The Avenir x Glassnode report introduces a framework that integrates on-chain activity, market microstructure, and macroeconomic linkages into a single analytical view.

Rather than treating these layers in isolation, the report examines how capital moves between them - and how structural imbalances in one domain (such as ETF flows or order book depth) can influence dynamics across the broader market.

Below is a preview of key findings from the study:

On-Chain Liquidity: Demand Scales with Bitcoin’s Market Maturity

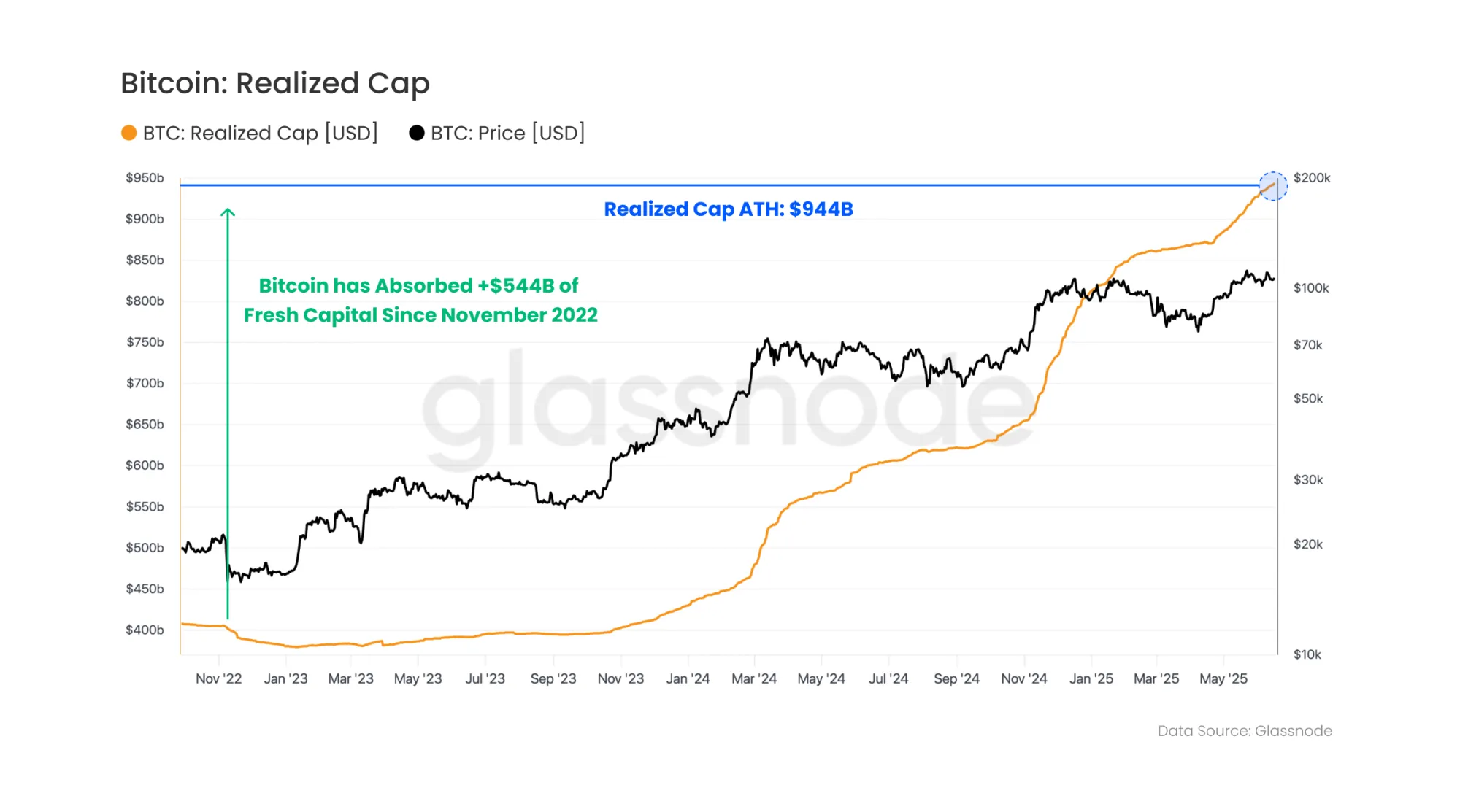

Bitcoin’s price performance since the 2022 cycle low continues to track closely with previous cycles - despite a significantly larger market capitalization. This indicates that capital inflows are scaling in line with the asset’s growth, reinforcing its structural depth.

Realized Cap has surged by over $544B since November 2022, pushing Bitcoin’s network liquidity to an all-time high of $944B. As institutional and sovereign adoption accelerate, on-chain data shows that Bitcoin’s role in the global financial system is expanding - mirroring broader macro liquidity trends.

Off-Chain Market Microstructure: ETFs, Order Books, and Derivatives

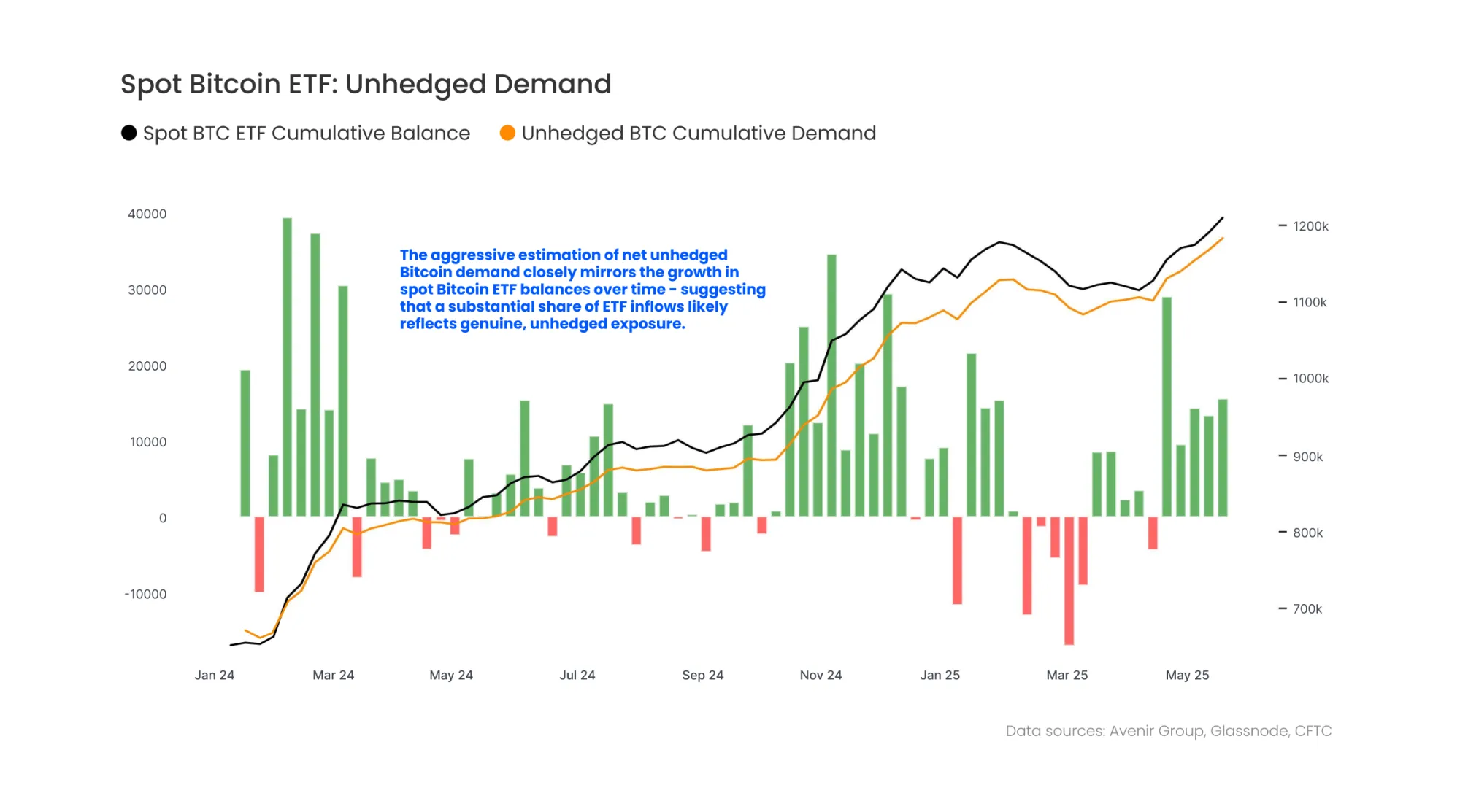

Perhaps the most underexplored layer of Bitcoin market analysis is the off-chain microstructure: the mechanics of how trades execute across spot and derivative venues, and how institutional access vehicles such as ETFs influence flows.

One of the most significant findings in the report is that the majority of inflows into U.S.-listed spot Bitcoin ETFs appear to be unhedged. This suggests that institutional allocators are using these vehicles not for arbitrage or basis trading - but to express directional, long-only exposure. As a result, ETF flows may exert a more lasting effect on price formation than initially assumed.

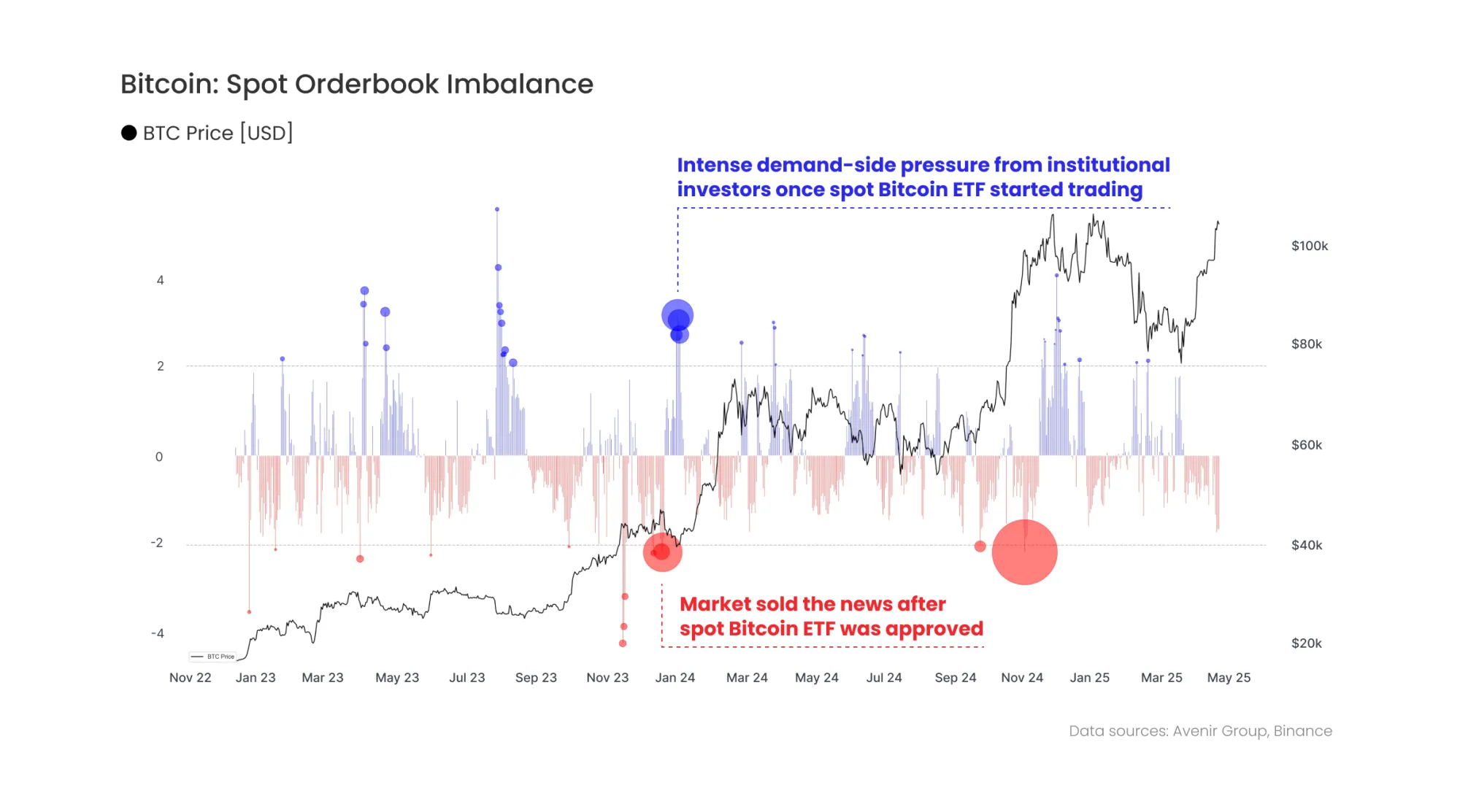

In addition, order book imbalance analysis using z-scores reveals persistent structural dislocations between bids and asks, which can act as early indicators of directional shifts. These imbalances tend to emerge well before trend reversals, offering a tool for more granular risk assessment.

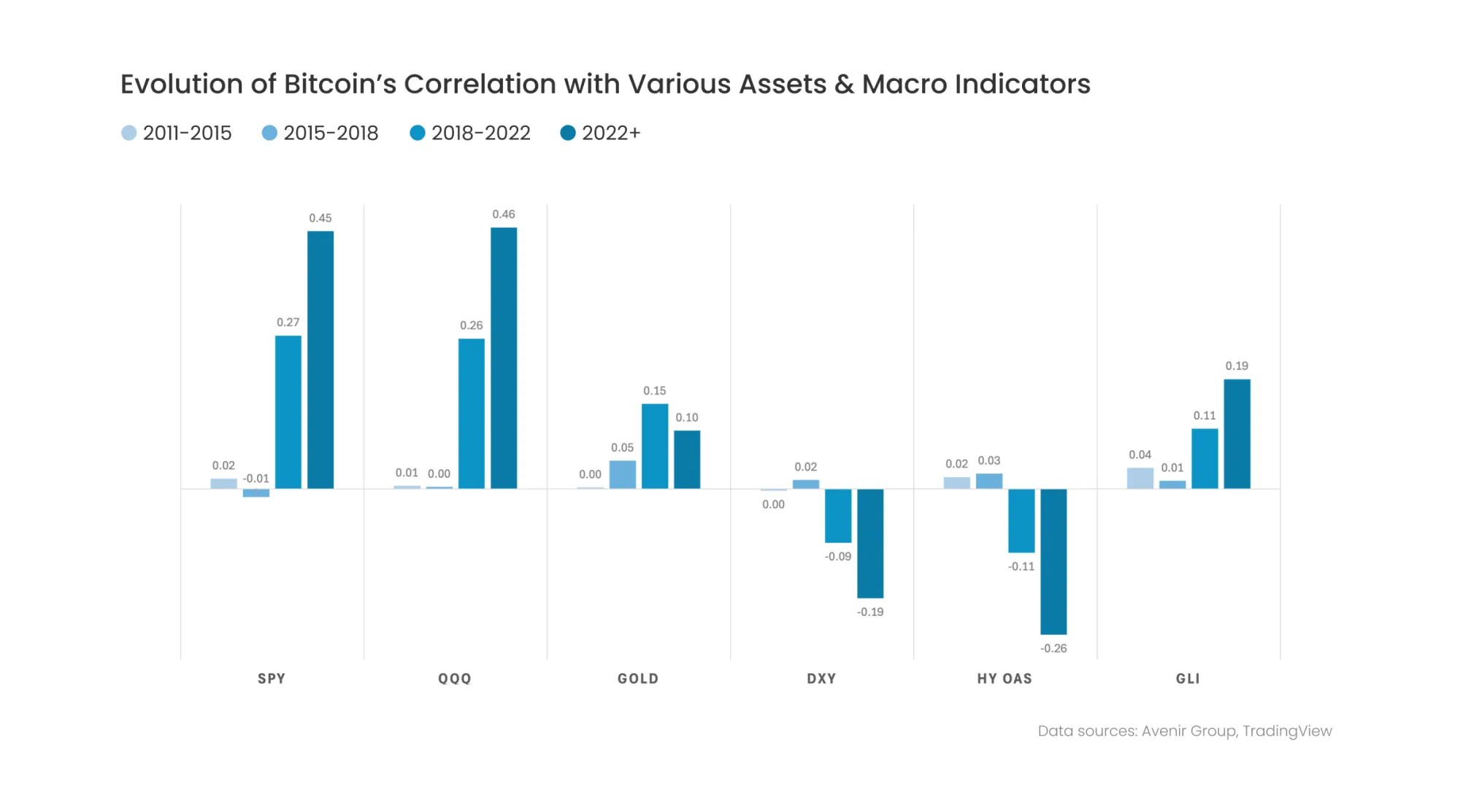

Macro Linkages: Bitcoin Aligns with Global Liquidity and Risk Cycles

Bitcoin's behavior in 2025 shows increasing alignment with macroeconomic variables. Correlation and beta analysis in the report demonstrates that Bitcoin now exhibits:

- A positive beta to global liquidity

- A positive correlation to risk assets like equities

- A negative correlation to the U.S. dollar and credit stress indicators

This represents a shift from Bitcoin’s earlier, more idiosyncratic phase, and places it in the same analytical domain as traditional macro assets. Volatility clustering also supports this observation: Bitcoin’s realized volatility now more closely mirrors equities and gold than commodities or FX.

Discover more in the full report

This Avenir x Glassnode report delivers a thorough institutional assessment of Bitcoin’s evolving liquidity profile. Inside, you'll uncover:

- On-chain indicators of capital inflows and profit-taking regimes

- Exchange-level data, derivatives trends, and limit order book analysis

- Altcoin market fragmentation and liquidity divergence

- Correlations between Bitcoin and traditional macro indicators

- A framework for interpreting Bitcoin as a structurally maturing macro asset

To explore these dynamics in detail, including chart data and methodology, access the full report here.

Glassnode remains committed to providing the highest quality data and analysis to support institutional investors in the world of digital assets. Contact us for bespoke reports, data services, and more. For more reports on the current trends in the crypto markets, please visit Glassnode Insights.