A Data-Driven Approach to Identifying Short Opportunities with High Conviction

Discover Glassnode's Bitcoin Sharpe Signal Short, our proprietary trading signal based on on-chain data designed to identify high-confidence shorting opportunities and improve risk-adjusted returns for Bitcoin.

Bitcoin's inherent volatility and potential for significant drawdowns present unique opportunities for strategic short positions. To help institutional investors identify these opportunities with high confidence and improve their risk-adjusted returns, we are excited to introduce the Bitcoin Sharpe Signal Short (BSS Short). Building on the success of the Bitcoin Sharpe Signal Long, our previous automated trading strategy grounded in on-chain data, the BSS Short signal provides our clients with a data-driven approach that effectively leverages market downturns.

The Bitcoin Sharpe Signal Short utilizes on-chain data to pinpoint a high degree of possibility for an imminent market downturn, enabling investors to capitalize on Bitcoin's volatility and periodic price corrections. This tool is designed to help you navigate Bitcoin's cycles and take advantage of the 50 to 90% drawdowns that occur each cycle, maximizing returns from market corrections. For long-only investors, the signal also offers the benefit of reducing exposure during high-risk periods, helping manage volatility and protect portfolios.

With this release, we aim to identify key on-chain metrics that have predictive power to anticipate market downturns as well as metrics that can prevent being caught on the wrong side of a short bet during a market upswing. The signal is available with daily and hourly resolution, catering to a wide variety of investors and trading entities regardless of their preferred timeframe.

Bitcoin Sharpe Signal in a Nutshell

The Bitcoin Sharpe Signal Short is a machine-learning-based strategy designed to identify prime shorting opportunities with high conviction. This strategy adopts a conservative approach, activating only when the model has a high level of confidence in predicting market downturns. The signal provides a clear indicator for when to go short on Bitcoin, ensuring informed decisions.

Historically, when the indicator surges beyond the 0.5 mark, it has been associated with imminent market downturns. Additionally, the signal helps investors avoid bear traps by identifying key metrics that signal potential market upswings, thereby preventing short positions during periods of upward momentum. By leveraging on-chain data, we enable investors to capitalize on Bitcoin's long-term volatility, effectively managing drawdowns and improving risk-adjusted returns.

The Signal’s Performance

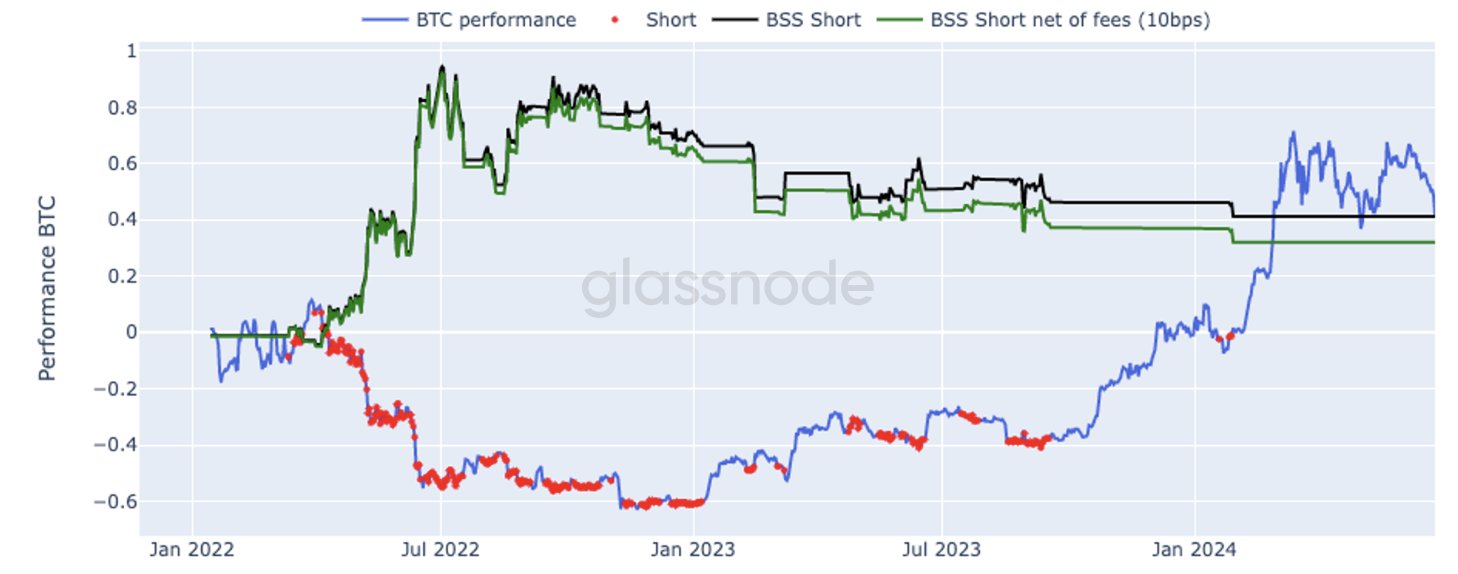

The out-of-sample performance demonstrates that the model effectively captured the bear market of 2022, offering a robust hedge against market downturns. Conversely, the model accurately identified the "risk-on" environments of 2023 and 2024, avoiding false risk signals during that period and providing a reliable indicator for shifting market conditions.

Use Cases and Opportunities

The Bitcoin Sharpe Signal Short is designed for institutional investors, including hedge funds, family offices, trading desks, and other entities engaged in sophisticated trading strategies. While the primary use case is identifying shorting opportunities, the signal also offers valuable insights for managing long-only exposure and strategic hedging.

- Identifying Short Opportunities with High Conviction: The Bitcoin Sharpe Signal Short's main function is to pinpoint high-confidence shorting opportunities. This allows institutional investors to capitalize on significant market corrections, ensuring a substantial, risk-adjusted return.

- Risk Management for Long-Only Investors: Long-only investors can benefit from the signal by reducing exposure during high-risk periods indicated by the signal. This approach helps manage portfolio volatility and protect against significant drawdowns without needing to take short positions directly.

- Strategic Hedging: For investors who use derivatives or other hedging instruments, the signal can be employed to hedge against potential market downturns. This strategic approach helps mitigate risks associated with holding Bitcoin positions, allowing investors to maintain their core holdings while protecting against adverse price movements.

Hourly Resolution

We offer an hourly resolution to the Bitcoin Sharpe Signal Short, providing intraday insights into market positioning. This version of the signal updates on an hourly basis, allowing investors to stay informed about imminent market shifts and make timely trading decisions. By analyzing real-time on-chain data, the model accurately anticipates market downturns, offering a strategic advantage for both short-term traders and those looking to reduce exposure during volatile periods.

Explore More Glassnode Signals in our On-Chain Trading Signals Package

Glassnode offers a suite of advanced signals designed to empower institutional investors with actionable insights and sophisticated trading strategies. Our On-Chain Trading Signals (OTS) Package includes the Bitcoin Sharpe Signal Long and Short, leveraging proprietary on-chain data and advanced analytics. Beyond signals, the OTS Package provides comprehensive trading heuristics, valuable trading insights, and detailed feature transformations, ensuring you have the tools needed to optimize your investment decisions.

The Bitcoin Sharpe Signal Long (BSS) identifies ideal conditions for going long on Bitcoin, minimizing downside risks while capitalizing on upward trends. This signal, part of our OTS Package, analyzes historical data to provide high-confidence indicators for optimal entry points, helping investors maximize their returns during bullish phases.

Complementary to this, the Bitcoin Sharpe Signal Short (BSS Short) provides high-confidence indicators for market downturns, enabling institutional investors to strategically take short positions and reduce exposure during high-risk periods. This tool is designed to enhance risk-adjusted returns by accurately anticipating significant market corrections.

Contact Sales

For more information on the methodology and insights provided by our Data Science team, or to access the OTS Package, please contact our Sales representatives. Our team is ready to provide detailed explanations, personalized demonstrations, and comprehensive support to help you integrate these powerful tools into your trading strategies. Reach out today to discover how Glassnode's advanced signals can enhance your investment decisions and risk management practices.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.