Buying the Dip: Investors Accumulate and Hodl Before Bitcoin's Halving

On-chain metrics suggest that investors are feeling optimistic in the weeks leading up to Bitcoin's third halving.

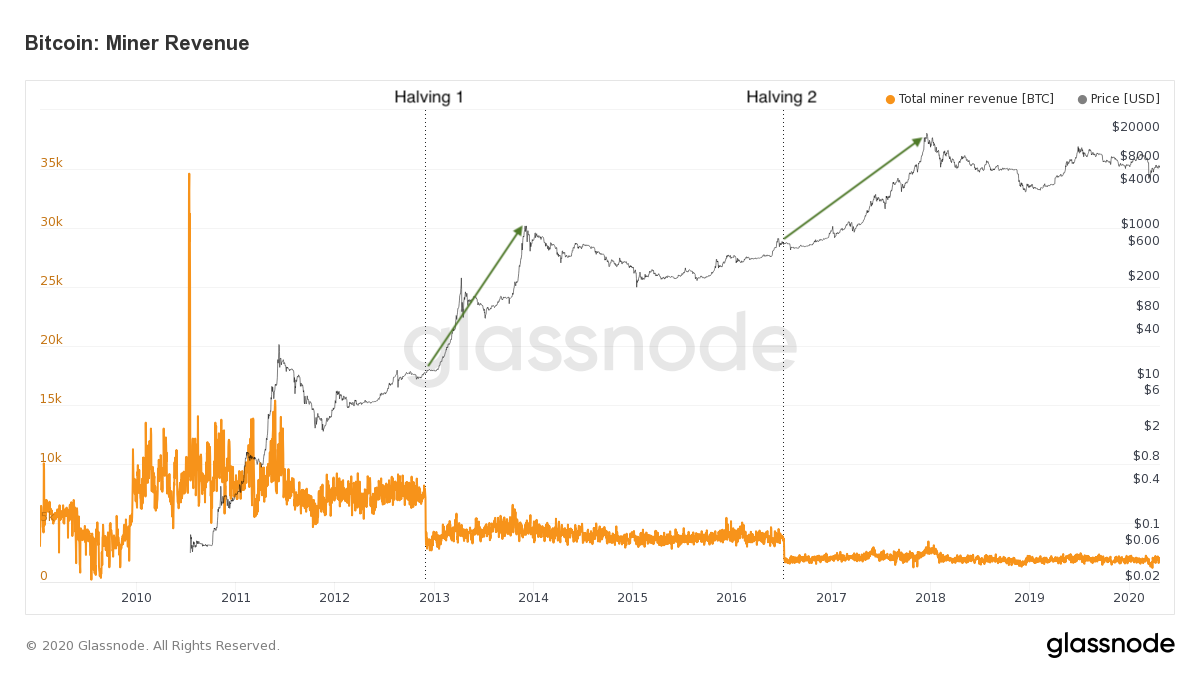

Bitcoin's miner reward halving is just around the corner. Expected to take place on the 12th of May, the event will see BTC's inflation rate cut in half and many analysts expect this supply deficit to be greeted with a significant price rally.

In the weeks leading up to this milestone, a number of on–chain metrics are suggesting that investors agree with this bullish sentiment and are increasing their positions and hodling tight.

Long Term Holders Unfazed by Volatility

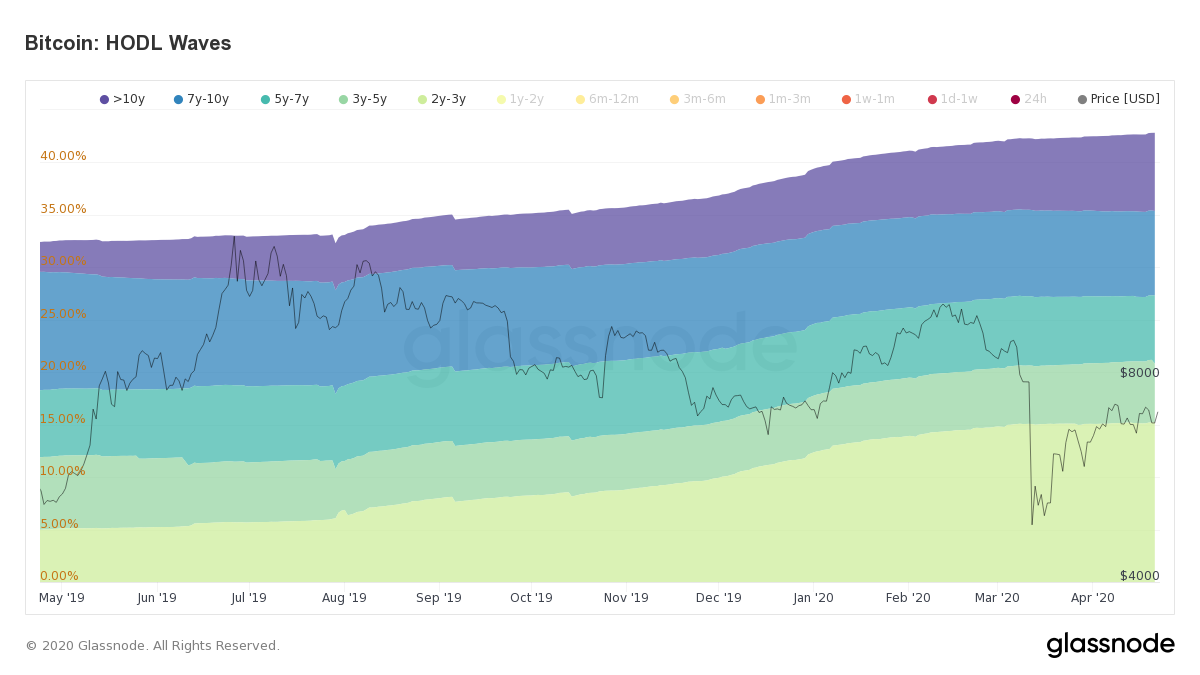

Currently 42.83% of all circulating BTC has not been moved for at least two years. This has increased by 10.4% in the last year and despite March seeing one of the largest market crashes in history, the confidence of long term holders was largely unaffected by Bitcoin's price drop.

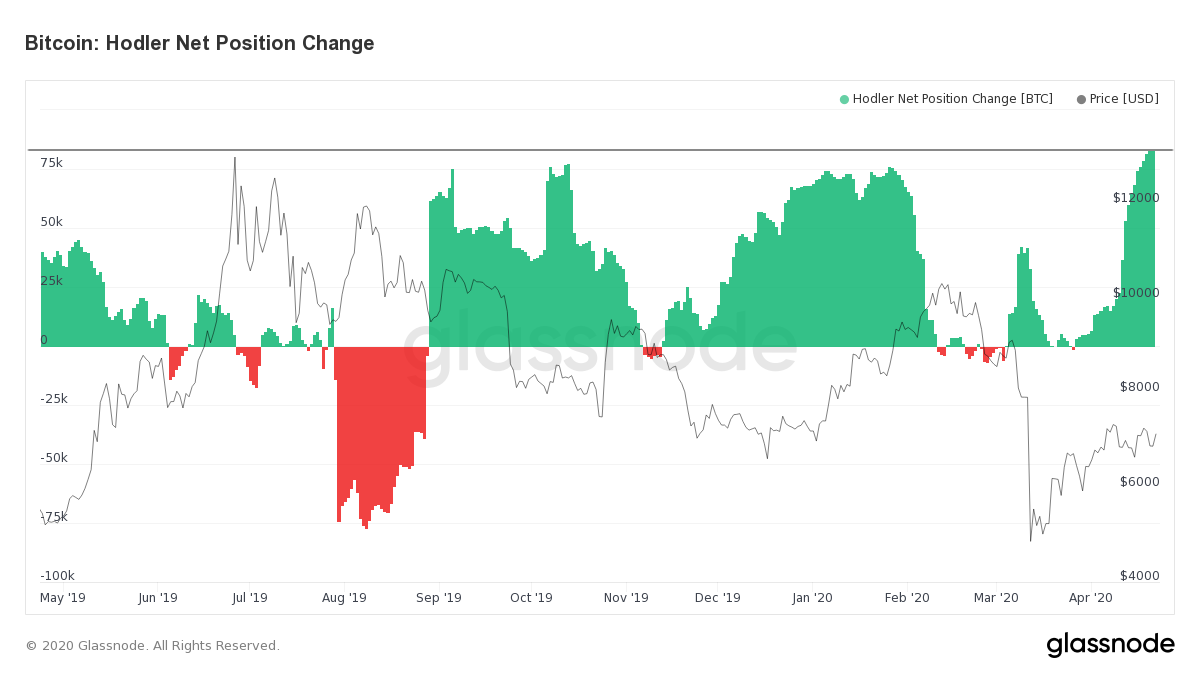

In addition, HODLer Net Position Change remained positive as BTC plummeted and, in the latter half of April, climbed to yearly highs suggesting that not only did long term investors hold steady - they capitalised on the discounted BTC and increased their positions.

A Shift In Strategy

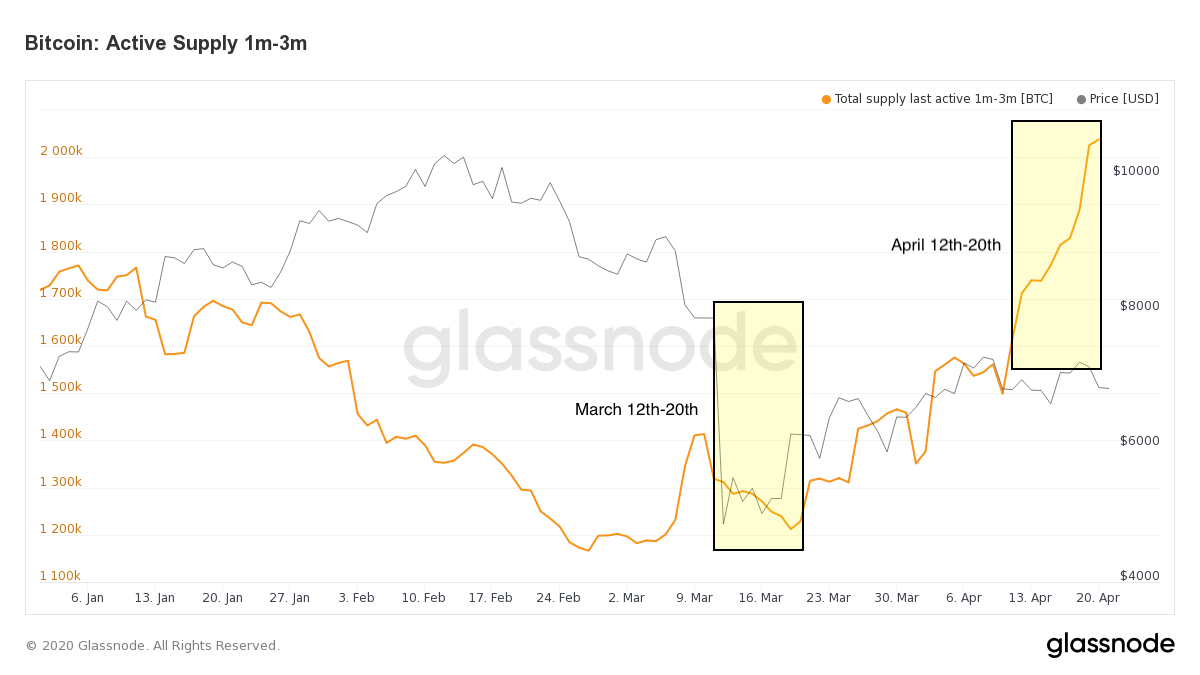

Exactly one month on from the crash, the number of Bitcoin last active between one and three months ago began to spike and now has hit year to date highs - increasing from 1,711,278 to 2,037,503 in just eight days.

This lack of movement has two interesting implications:

1) Traders that bought the bottom have been holding onto their new positions.

2) As the market recovered, there was wider change in sentiment amongst market participants - mid to long term holding strategies became favourable again.

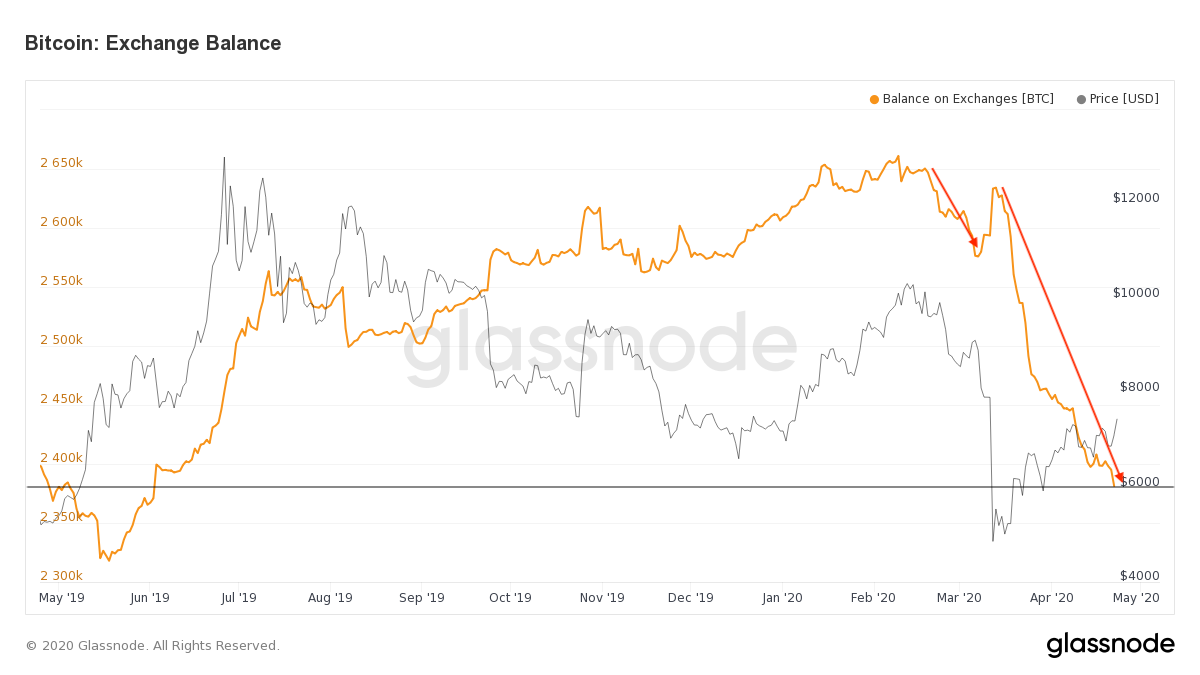

While this could also mean that the BTC sent to exchanges during the pandemonium has been static in their wallets since, exchanges balances have fallen by over 10% since the highs seen in February.

Withdrawal of funds from trading platforms could further reinforce the idea of more bullish long term expectations from traders. This downtrend began on February 18th and was only briefly interrupted by the market responding to Bitcoin's price dive - after which outflow accelerated and the the trend continued.

Retail Interest Increasing and Whales are Returning

Bitcoin adoption is ramping up and fundamentals are strong. This year has seen the total number of addresses holding BTC grow by almost 25% with lower balance brackets are hitting all time highs - suggesting increased interest from the retail sector.

Questioning Bitcoin's fundamentals and adoption?

— Rafael Schultze-Kraft (@n3ocortex) April 23, 2020

The #Bitcoin network has grown almost 25% within the last year.

Addresses holding BTC: +24.2%

Addresses with ≥ 0.01 BTC: +18.5%

Addresses with ≥ 0.1 BTC: +14.6%

Addresses with ≥ 1 BTC: +11.4%https://t.co/QjIK72xt5n pic.twitter.com/59OdPJEO5h

And it's not just the small fish that are accumulating. In an earlier edition of The Week On-Chain, we noted that the number of whales (entities holding at least 1,000 BTC) had hit a 2 year high and was exhibiting an accumulation pattern similar to one that we had seen in the lead up to Bitcoin's previous halving.

Despite the instability and uncertainty in both traditional and crypto markets, on-chain metrics point towards an optimistic outlook from investors as the halving approaches.

Keep monitoring Glassnode's on-chain metrics to see how investors react as we get closer to Bitcoin's third halving.

- Follow us and reach out on Twitter

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter

Disclaimer: This report does not provide any investment advice. All data is provided for information purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.