DeFi Uncovered: Experiments in Money and Value

DeFi's reliance on USD presents a tangled web of risk. Is DeFi on a path to create something better/new, or is DeFi destined to be an incremental improvement to legacy finance?

DeFi exists on a wide spectrum of innovation and decentralization. In an environment where anyone can codify their view in a smart contract, experiments are battle tested in high-stakes coordination games. And perhaps the highest stakes coordination game in human history has been that of currency - specifically centrally issued currencies and the governments, organizations, power structures, and policies that govern them.

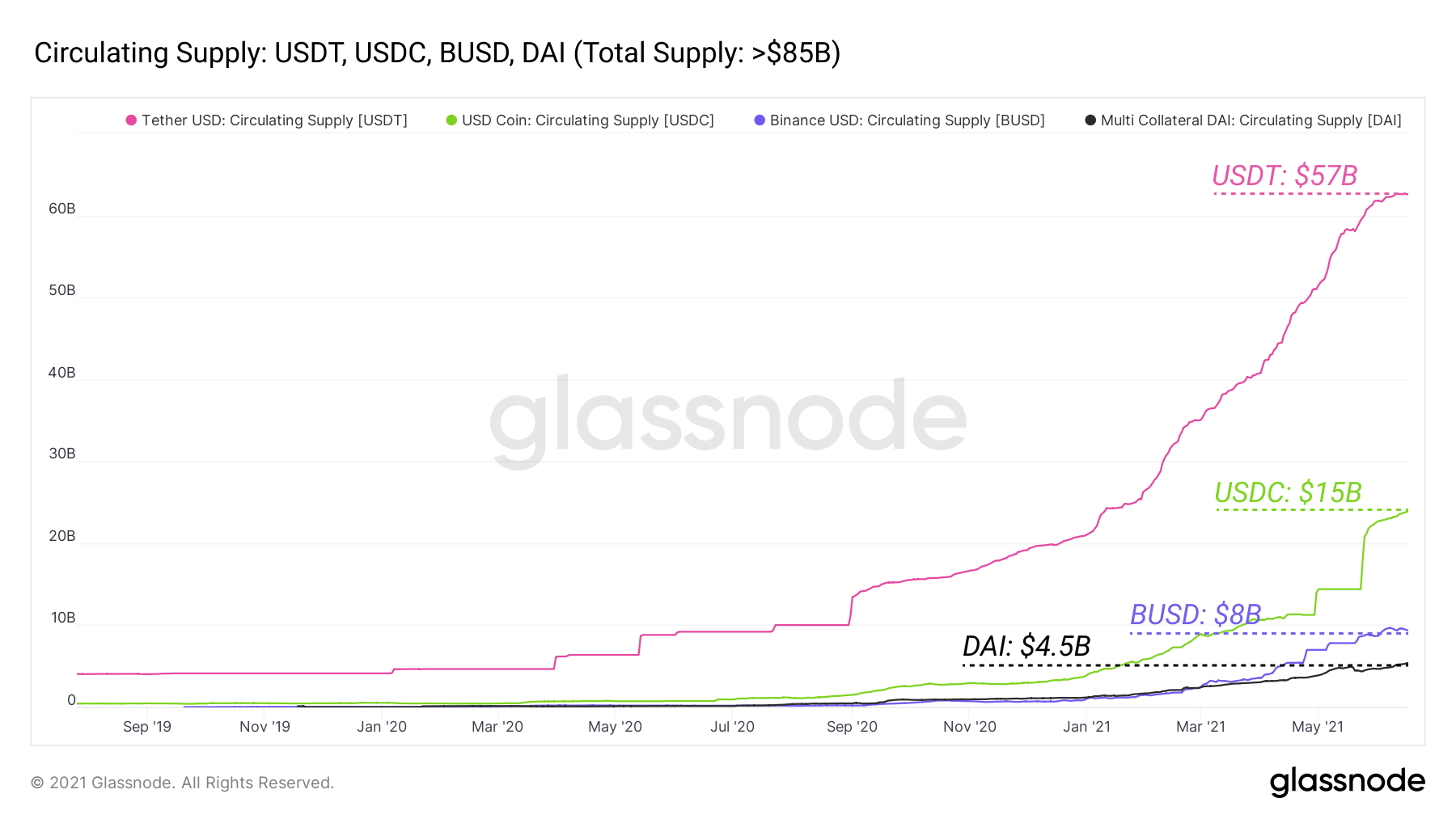

DeFi has built a system with strong reliance on the money games of old. We've tied ourselves to the legacy systems of finance through reliance on the US Dollar as the reserve currency of DeFi. To date, DeFi has pegged over $100B in value to the US Dollar.

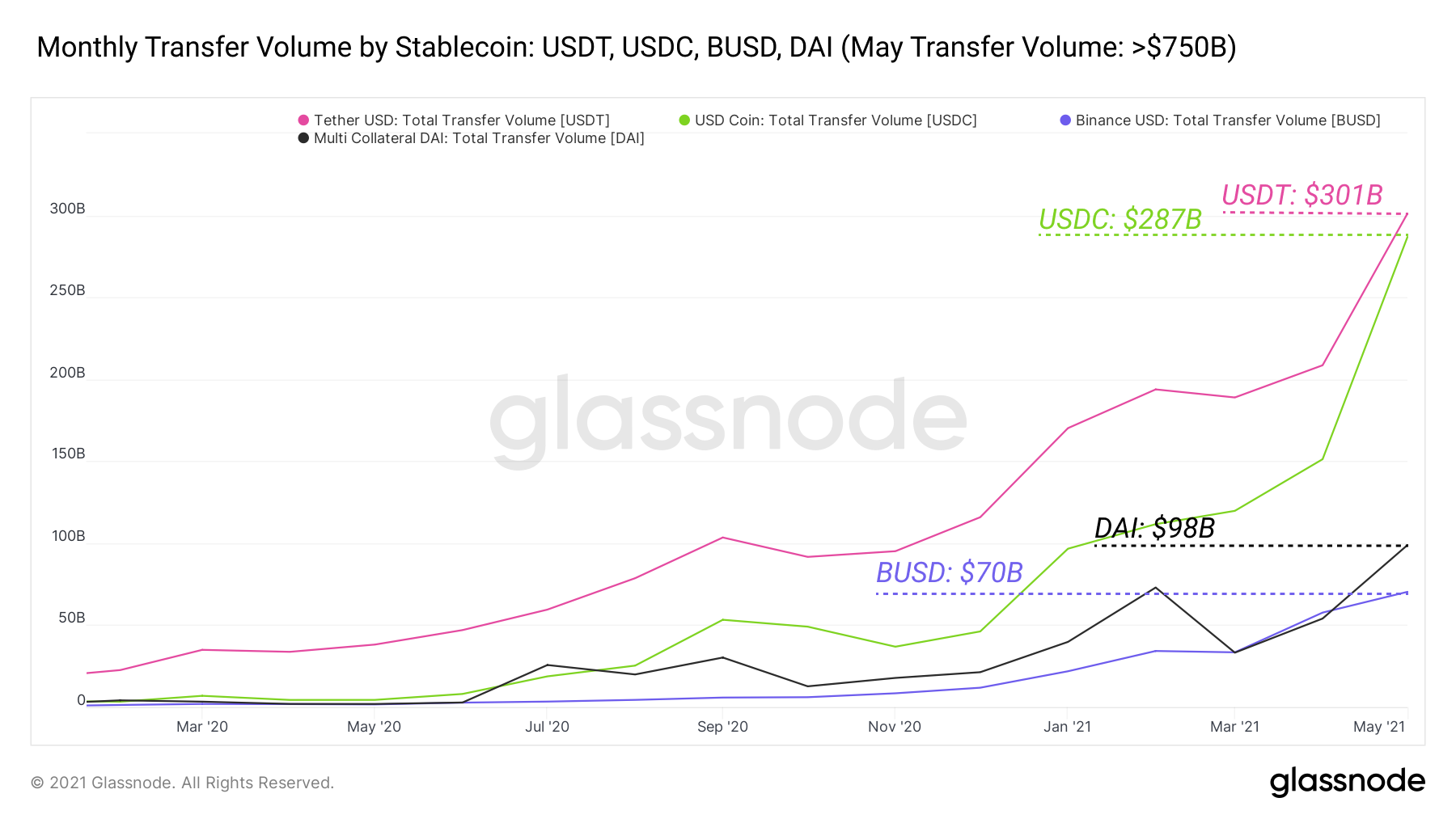

And this growth and reliance on stablecoins in DeFi does not appear to be slowing down. In May alone, over $750B of value were cumulatively transferred through USDT, USDC, DAI, and BUSD on-chain. Take away these USD-pegged stablecoins and DeFi reverts to the stone age - no clear flight to safety, no more lending markets (high reliance on stablecoins), and loss of a favorite farming/liquidity vehicle.

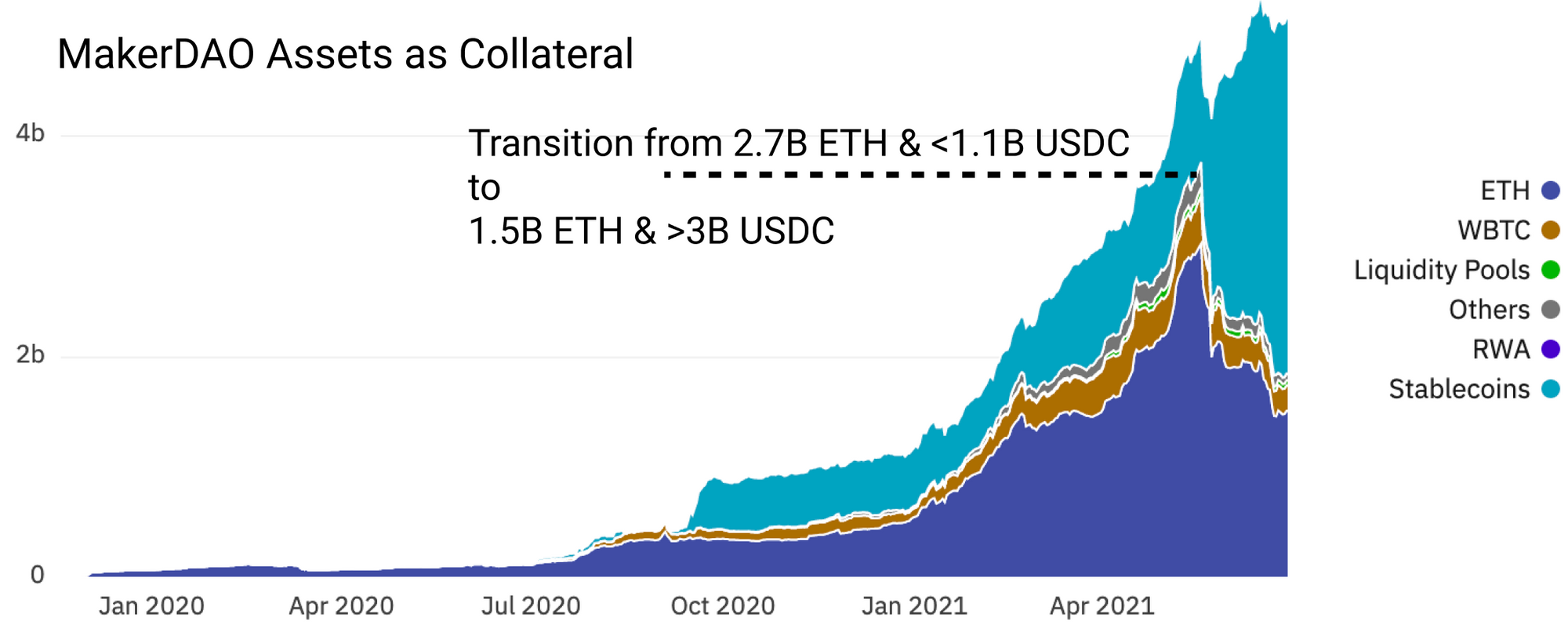

DeFi darling DAI, the stablecoin of MakerDAO has historically been backed by a variety of assets, primarily ETH. Over time it has grown its exposure to USD, using USDC and other centralized stables as a primary means of holding its peg during downturn. Note how moving into May, MakerDAO added significant amounts of USDC to its balance sheet.

Once a key participant in the Bretton Woods system, backing currency with gold, the US Dollar has long abandoned convertibility of USD to gold, entering our new paradigm of floating rate fiat currencies. Governed by a malleable Federal Reserve monetary policy, the policy decisions and risks of USD then directly map onto DeFi because of its reliance on USD-backed stablecoins.

Monetary policy: steps taken by a central bank entity to manage a currency to meet a set of goals - inflation targets, growth targets, employment targets, etc.

Some of the risks of tying DeFi to USD monetary policy include:

- Regulatory pressure: use of USD warrants regulation from those who govern USD, especially in the case of strongly pegged assets like USDT and USDC who hold 1 USD for every 1 USDT or USDC issued.

- Inflation: average ~2% CPI yearly (2% fed target) in the 2010s,.

- Forex risk: risk of asset devaluing relative to currencies like the Euro, Yuan, or other currencies participants may use locally.

- Counterparty (centralization) risk: in a world that proclaims to value decentralization, strong reliance on small groups of individuals in the case of the Federal Reserve, or even smaller groups in the case of Circle and Tether stands in contrast to claims of valuing decentralization.

Moving away from reliance on centralized monetary policy.

A new class of currencies in DeFi are arising that attempt to solve these problems. While we are likely too far along to ever unwind our dependence on USD-pegged stablecoins, we can certainly start to experiment with alternatives. With enough adoption, these alternatives can slowly eat away at pegged stablecoins.

Some of these alternatives abandon a peg altogether, codify monetary policy in smart contracts, and employ varying degrees of community governance and decentralization. These are completely new experiments in monetary policy and value. In this piece we will explore Olympus DAO's OHM, an experiment in money, trust, and community governance. It is one in a class of new currency experiments, brought to the spotlight by its strong relative performance to the broader crypto market during the May/June market downturn (>+45% market cap since the May crash).

Note: these are experiments in monetary policy and should be treated as such - any trade/investment in OHM or similar assets bears an incredibly new and heightened set of risks.

Olympus DAO ($OHM)

OHM is a novel attempt in DeFi at creating a reserve currency free from the shackles of a fiat peg, with the lofty goal of separating itself from a primarily USD backing.

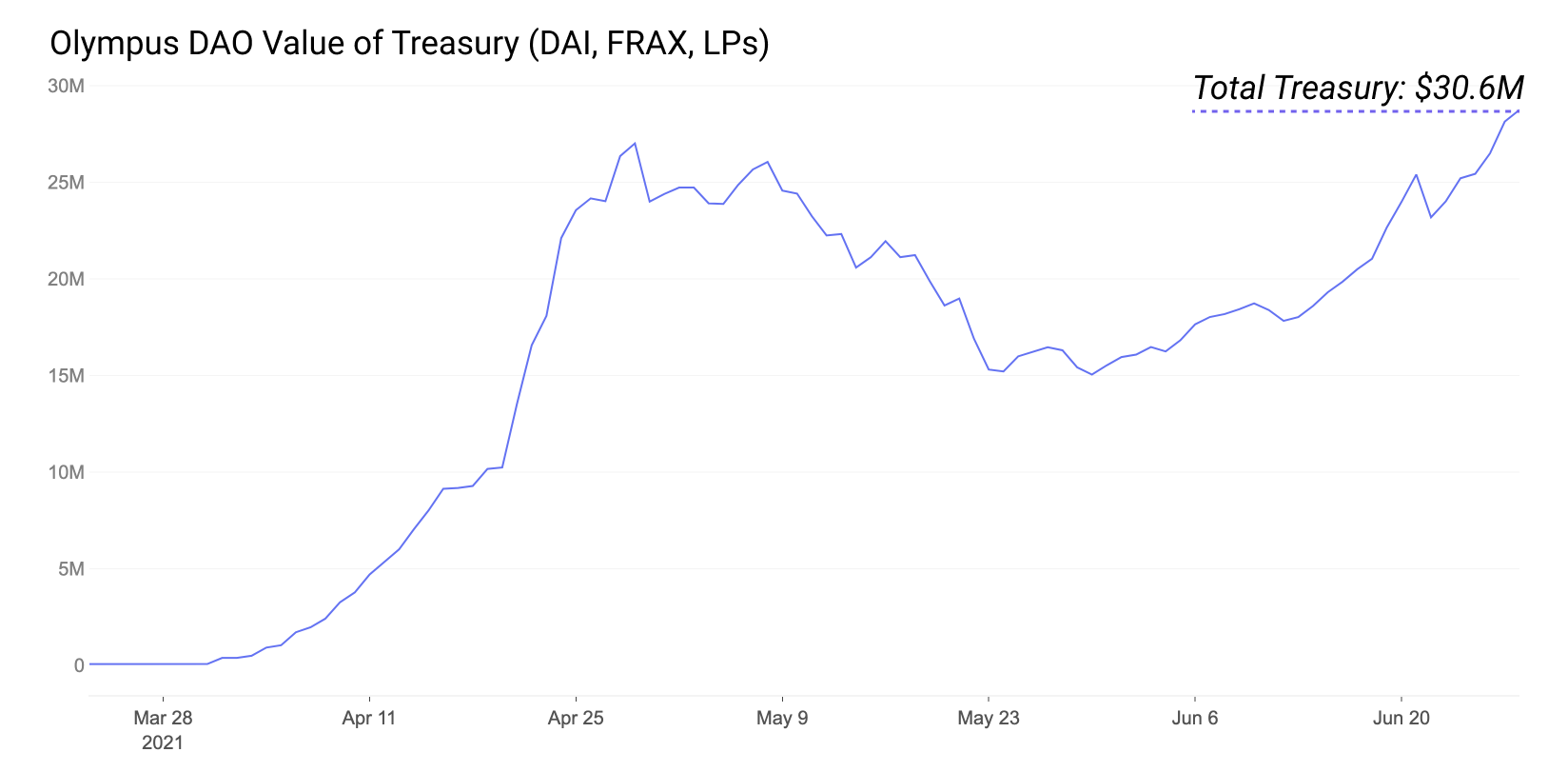

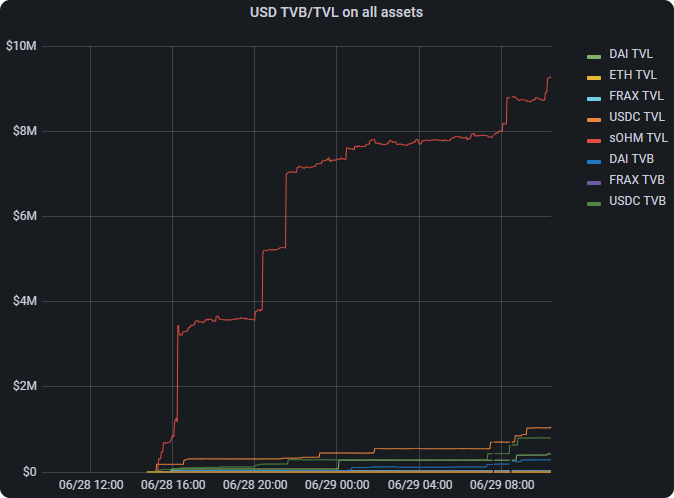

The DAO governs the monetary policy of OHM, a reserve currency currently backed by a treasury of assets, most notably DAI, FRAX, OHM-DAI SLP, OHM-FRAX LP, and SUSHI rewards from the OHM-DAI SLP.

As a reminder, these assets are:

- DAI: stablecoin soft-pegged to USD, backed by a variety of assets, primarily ETH and USDC.

- FRAX: stablecoin that is partially collateralized, partially stabilized algorithmically.

- LP: Uniswap Liquidity Position, SLP: Sushiswap Liquidity Position.

The DAO has codified a rule that for each 1 DAI owned by the treasury, only 1 OHM can be issued. The DAO would buy back and burn OHM should it trade below 1 DAI. This does not mean OHM is pegged to DAI/USD. OHM trades at the value of DAI + a market premium and has shown incredible strength through the May/June DeFi price declines.

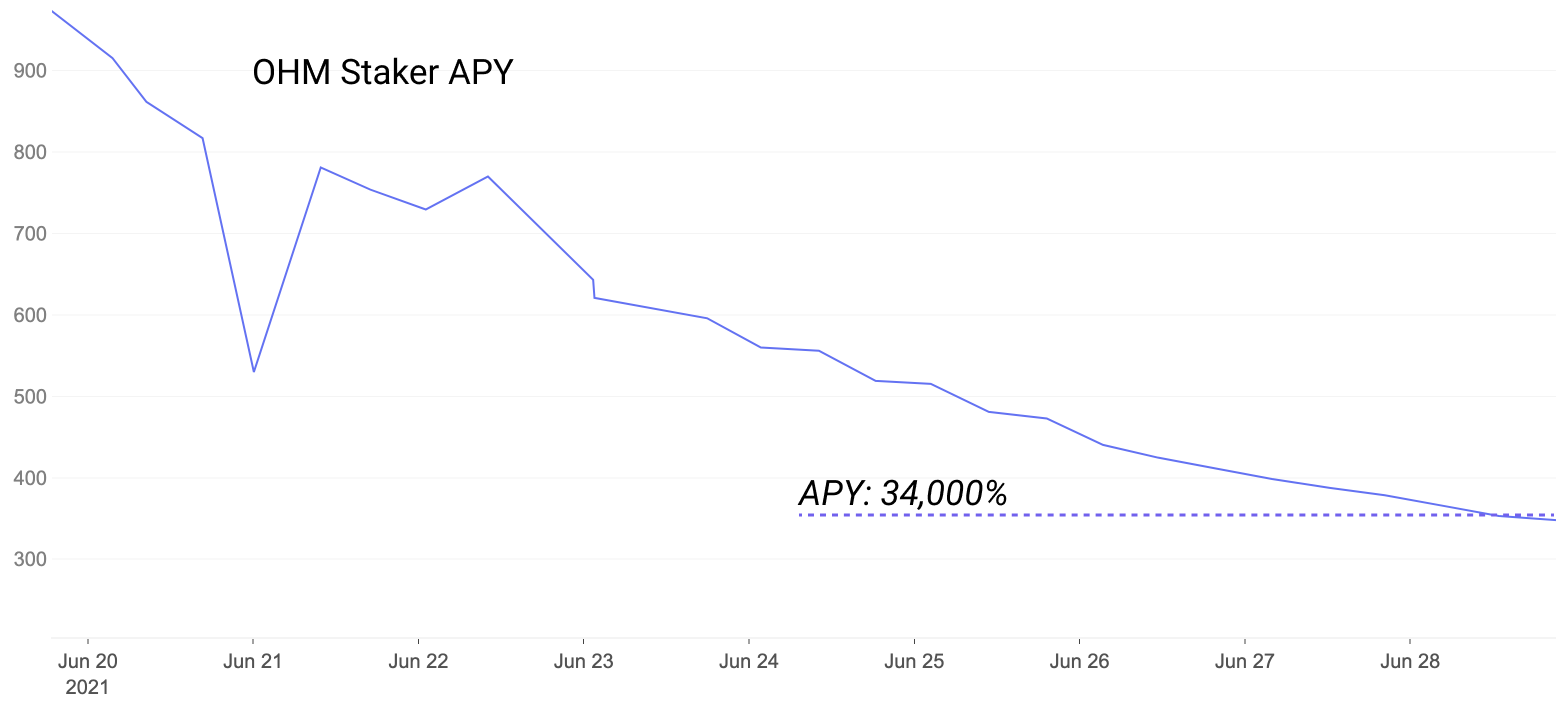

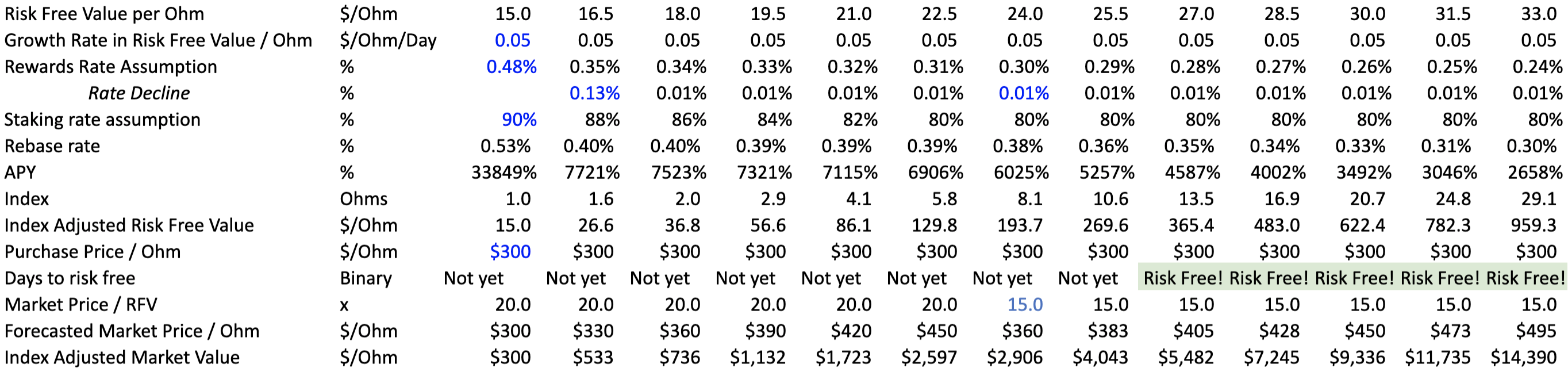

But this pure dollar value of the asset is far from telling the whole story. Currently in issuance mode, the inflation of OHM is high enough such that even OHM buyers who bought the absolute top in dollar terms are in profit. Since the April launch, APY for staking OHM has on average exceeded 100,000%. The APY for OHM stakers now sits around 34,000% APY, down from 40,000% at the beginning of the week and >100,000% in early June and prior months.

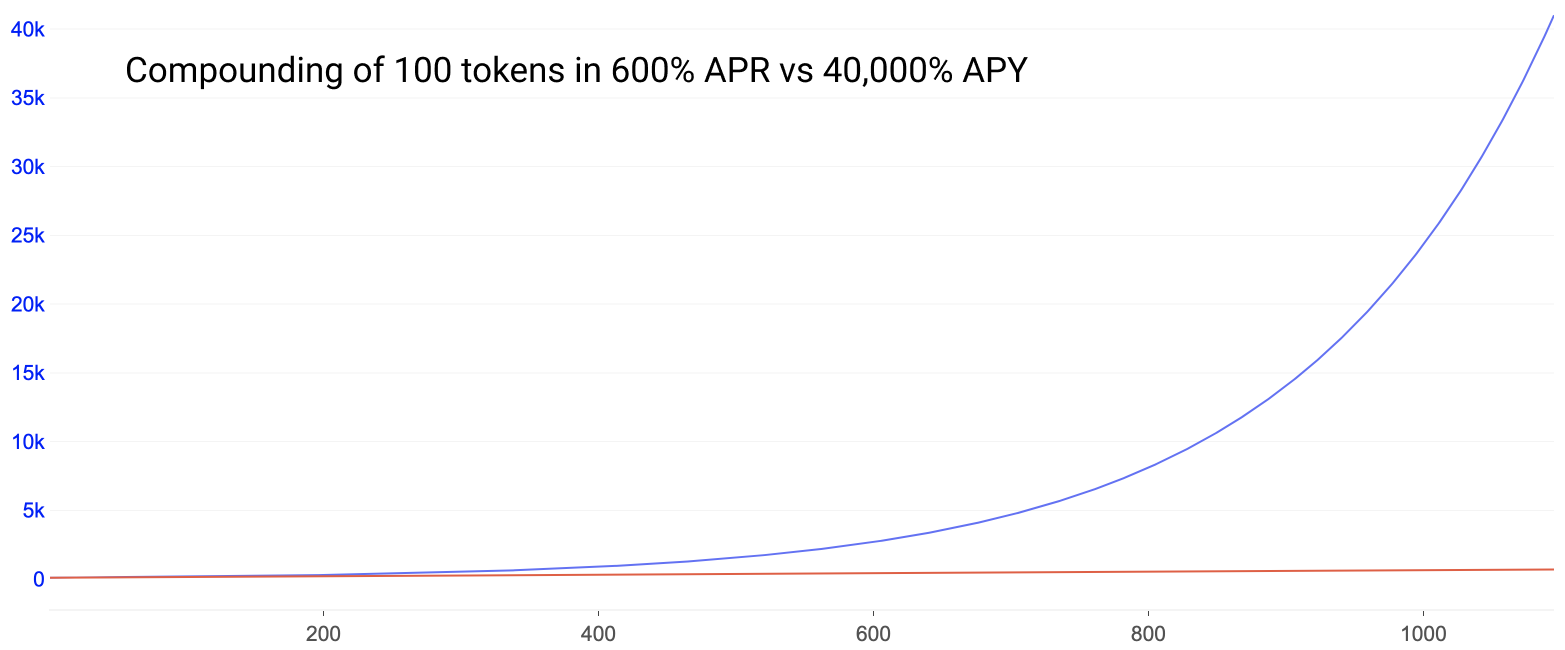

How can this APY be so high? Recall our explanation of APR vs APY in previous pieces. A high APR (reward without compounding) can become a massive APY with regular compounding. And OHM has a mechanism whereby stakers are automatically compounded.

It's important to realize that if OHM sees a price increase and stakers unstake to sell OHM, the APY goes up and there is a corresponding relief in sell pressure. This feedback loop creates powerful incentives for remaining staked.

Every 8 hours the token is rebased and stakers receive ~+0.52% at current rates. That is an APR of ~570%. That APR with compounding every rebase becomes the current rate of ~34,000%.

- Users purchase OHM on the open market or buy bonds (discussed later)

- Users stake OHM to receive sOHM

- sOHM is automatically compounded every rebase, 3 times daily

- Users can sit on their sOHM (3,3), currently receiving ~34,000%+ APY on that 3 times daily rebase or use that sOHM in lending protocols, trade it, etc.

Note in the following chart the growth of 100 OHM. The flat line is the APR which appears flat because it shows growth of 100 OHM to over 1,000 OHM with 600% APR vs the 40,000% APY to 39,000 OHM in 1 year of 3 rebases daily. Stakers automatically receive this 39,000% APY instead of a 600% APR because of auto-compounding built in the staking contract.

The APY is currently highly variable and subject to change from both amount of OHM staked and governance votes by the DAO.

Note that the DAO has near-term future plans to start moving out of this period of massive token inflation. They have plans of short-term lowering the APY but also adding locking periods to boost rewards. Yet more examples of the power of DAO managed monetary policy innovation. This massive APY has of course resulted in inflation of the token, but the price has stayed strong such that market cap has pushed to all-time highs despite deflating asset price.

And remember that there must be at least one DAI in the treasury for every 1 OHM issued, creating a price floor of 1 DAI/OHM.

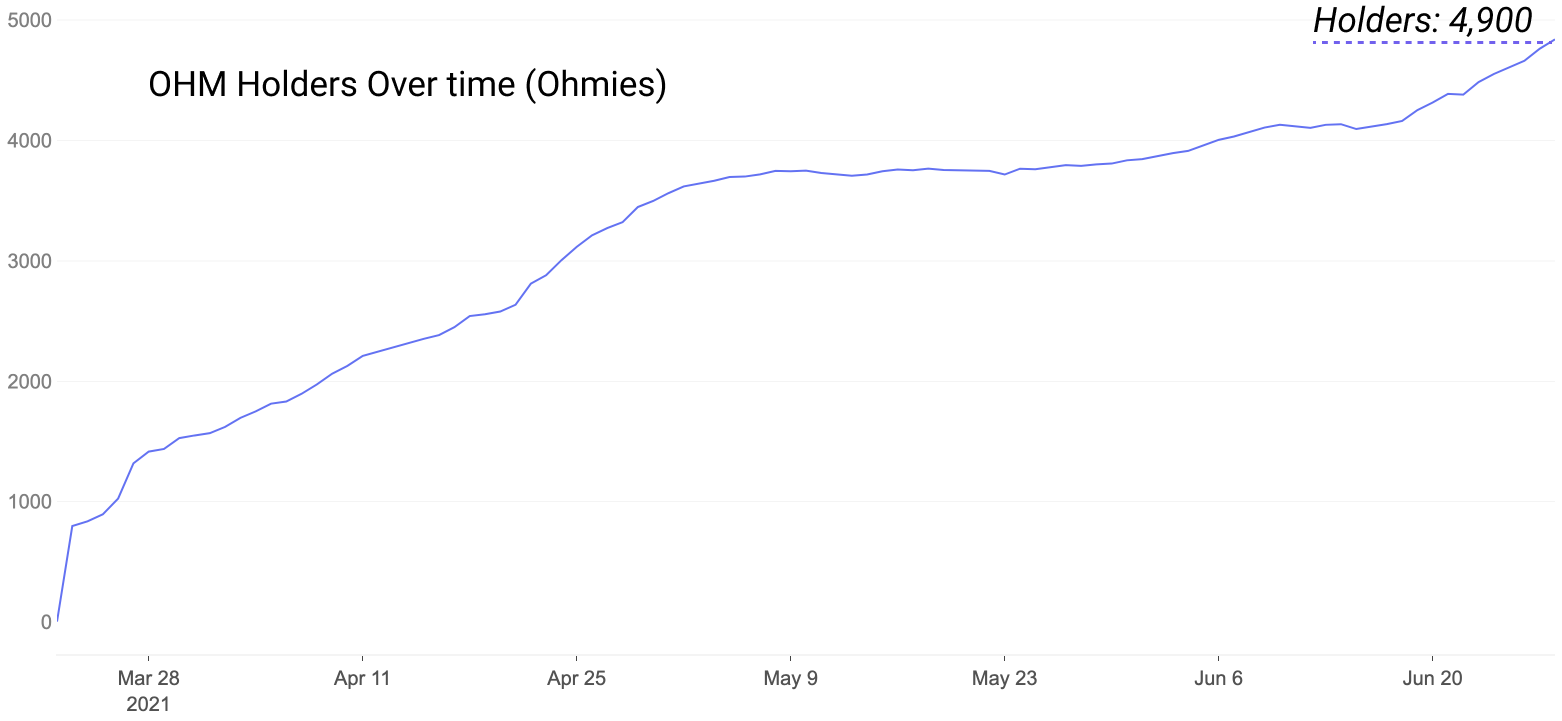

Enough token inflation with low enough price deflation results in profit. This is a marker of increased adoption and unsurprisingly, the number of holders over time continues to rise.

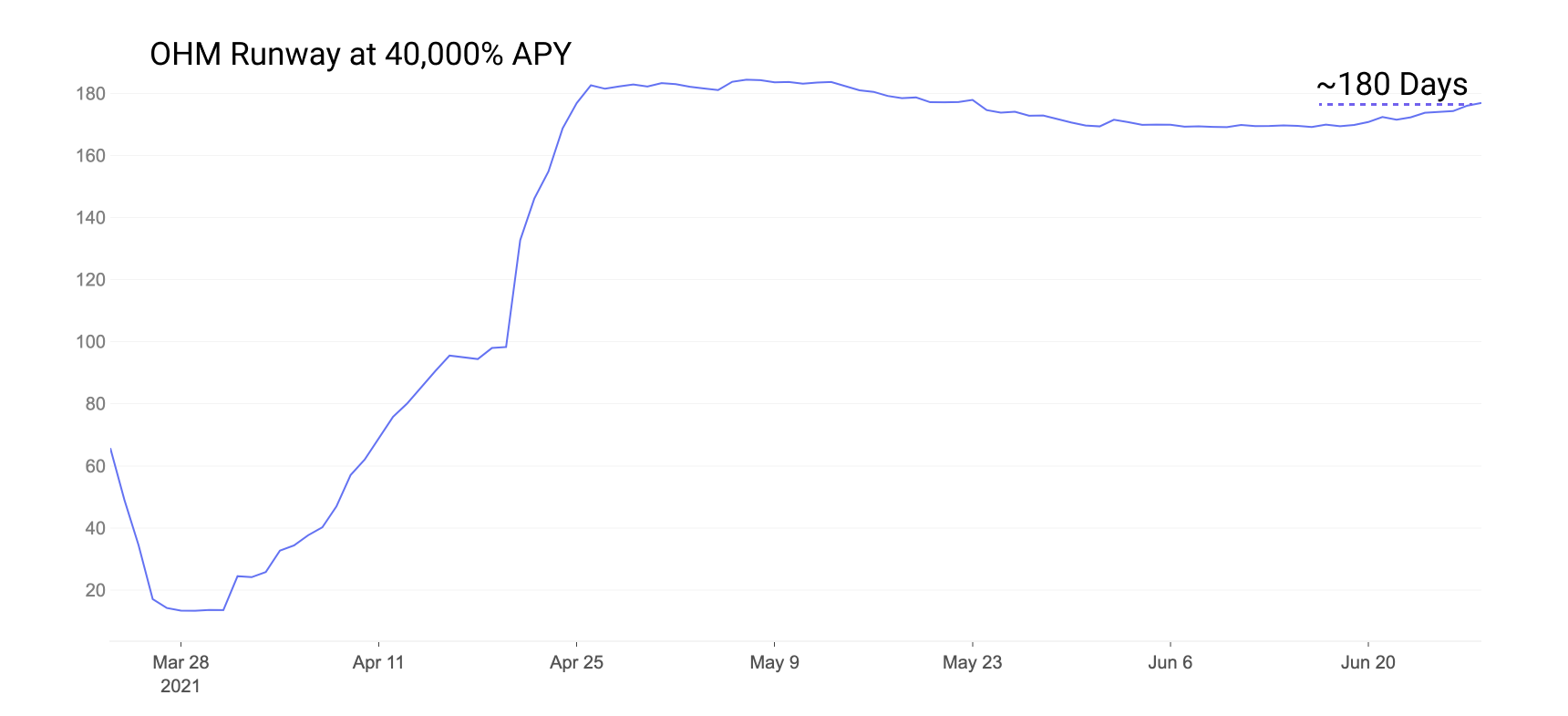

With the idea that only 1 OHM can be issued for every 1 DAI controlled by the DAO, we can understand how such high APY/token inflation can exist. Thus we can calculate a runway for how long issuance of OHM can last at the current APY and DAI ownership by the DAO. At 40,000% APY the OHM can continue issuance for 180 days with the current value of the treasury before the amount of OHM equals the amount of DAI in the treasury. This runway continues to stay flat or increase as the treasury size increases.

Reminder that while the risk-free value of the treasury in DAI is a price floor for OHM, OHM trades with some premium. This premium is up to the market to decide. A bet on the continued growth of the DAO and its treasury, promise of liquidity, yield expectations, and other advantages of the currency command a high premium at present. And future governance votes could easily vote for a % of yield from treasury assets being granted to token holders/stakers, creating more of an incentive for a premium.

The current market value of all treasury owned assets (DAI, FRAX, OHM-DAI SLP, OHM-FRAX LP, OHM, SUSHI) sits at ~$30M+ as aforementioned. This puts OHM's market cap of $175M at a price to net-asset-value (NAV) at nearly 6. This price to NAV can easily expand and contract as issuance and price are currently highly volatile.

In pure "risk-free value" or the value of stablecoins like DAI and FRAX, the treasury currently holds $9.0M. At a circulating supply of 450k OHM, this means 8.6M - 450k = 8.15M can be issued before reaching the price floor.

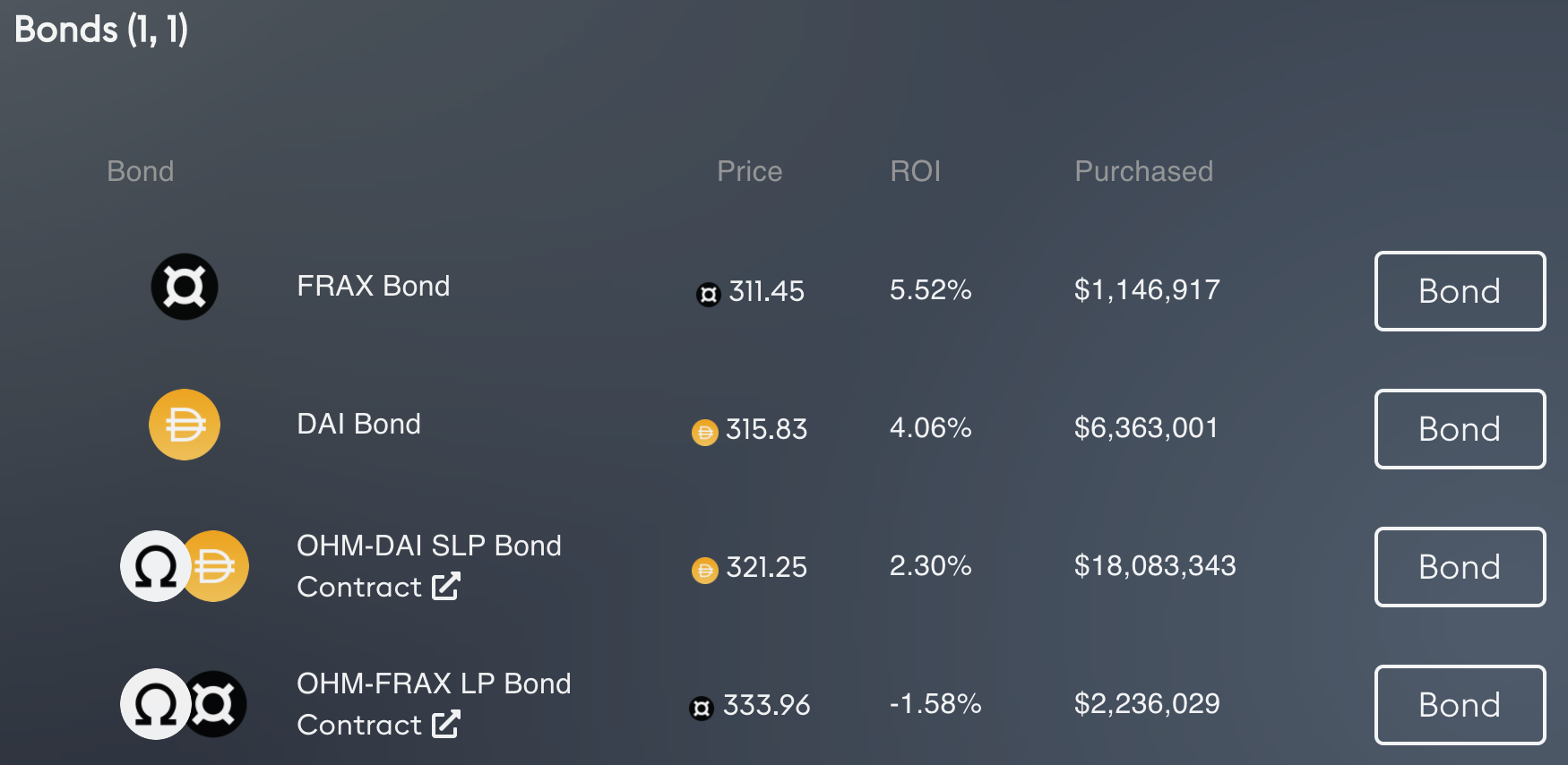

Inevitably you should have asked by now how the DAO earns its DAI, FRAX, and liquidity positions? The DAO has built a clever bonding mechanism. Users can buy bonds with DAI, FRAX, OHM-DAI SLP, or OHM-FRAX LP to receive OHM. These bonds can be bought at a discount to the price of OHM, vesting continuously and fully maturing after 5 days.

During some periods these bonds have been bought at up to a 20% discount (ROI). Savvy traders can build active strategies around these bonds, benefiting both themselves and the DAO Usually they float in the range of a 2-8% discount with 5 day vesting. This is a win-win for the user and protocol. The user receives (potentially) discounted OHM while the protocol grows its treasury of DAI and FRAX + its liquidity in OHM-DAI and OHM-FRAX.

A sample trade would be seeing if the ROI on a bond is > than the 5-day rate of staking OHM since bonds continuously vest over a 5-day period.

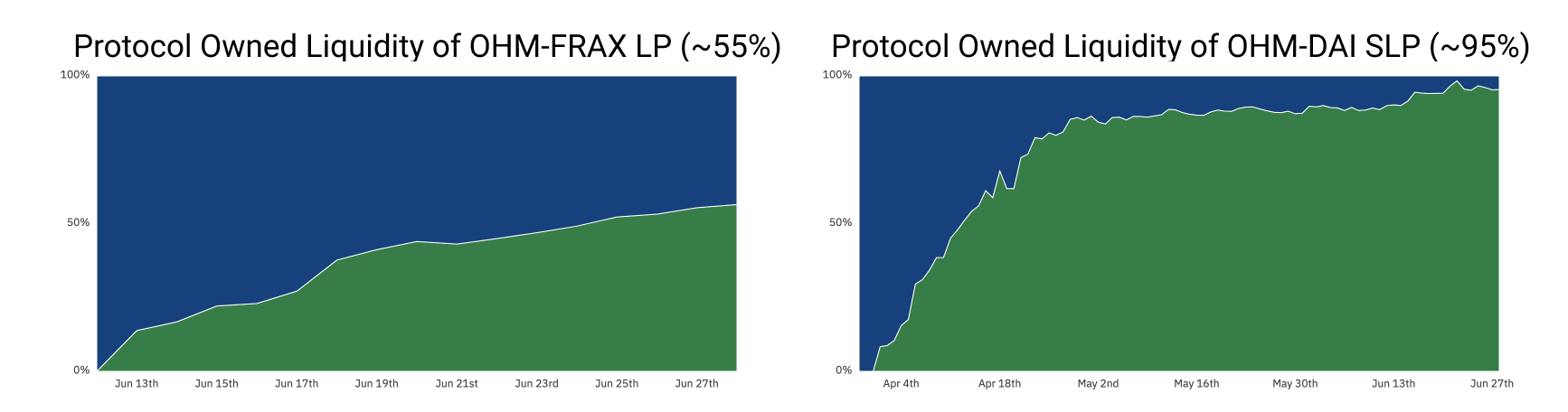

Along with holding >$8M in DAI and FRAX risk-free value, the protocol also controls >90% of the OHM-DAI SLP on Sushiswap and >50% of OHM-FRAX on Uniswap. On Sushiswap this earns the DAO 81% APY in SUSHI rewards + fees and a lower APY in purely Uniswap fees for the OHM-FRAX pool.

You can imagine a future where the DAO continues to actively manage and allocate its balance sheet, backing OHM with a variety of token allocations and strategies.

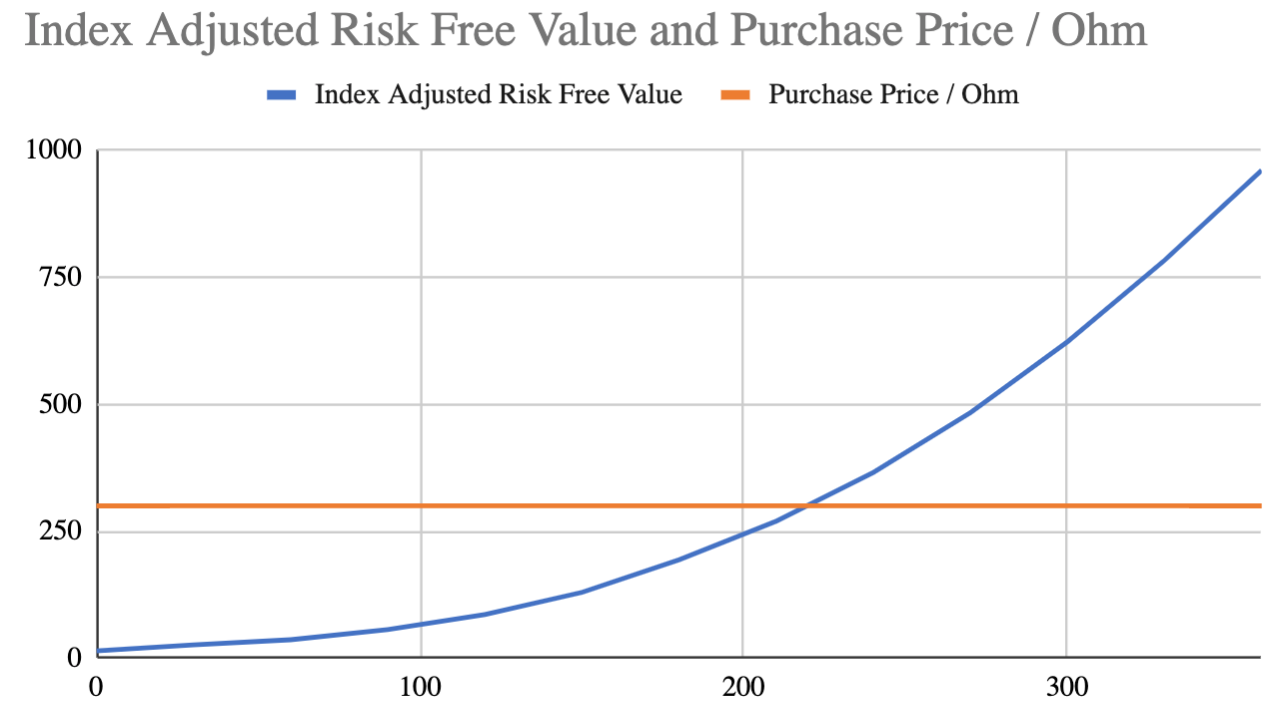

One of the interesting parts about a project like OHM is that there's precedent for how to value it. Assets like bank stocks can use metrics like assets under management (AUM) and price to NAV, where net asset value (NAV) describes the total value of the balance sheet and price is the total value of the stock. In this case, we can observe things like # of OHM outstanding to risk-free value of the OHM treasury (balance sheet). At a certain appreciation of DAO assets and a continued stake, total holdings of a staker can become "risk-free," meaning the risk-free value of their OHM becomes more than their original investment + premium.

This chart is built off a number of assumptions, chiefly that the OHM treasury will continue to grow. Members of the DAO built this model for understanding scenarios in the growth of a staker in the context of the treasury's continuously growing balance sheet.

Current and Future Challenges

Price volatility for a "stablecoin?"

The volatility of the price of OHM calls into question its stability. The asset certainly doesn't claim to be a "stablecoin" but rather a reserve asset. That said, a reserve asset shouldn't experience massive swings. For now, the project is in its issuance phase, not caring about stability of price. Once OHM exits its issuance phase of massive APYs and moves to carefully controlled monetary policy and simply modeled treasury growth, it's very possible the premium moves to being more tightly traded.

Dependence on DAI and exposure to USD

The move of DAI to a strong dependence on USDC as collateral gives exposure to USD that may stand in contrast to the stated goals of the DAO. Should DAI remain a primary asset on the balance sheet, the DAO's exposure to USD continues to grow. Adding FRAX and continuing to collect SUSHI rewards in the SLP are nice steps in the right direction towards decentralizing the treasury's assets. If the DAO is serious about decoupling from USD they can figure out clever ways to continue to dilute their DAI holdings over time.

Smart contract risk

The DAO itself is innovative, with plenty of associated smart contract risks. Additionally, over time the DAO continues to add assets, positions, and more exposure to 3rd party smart contract risk. With sufficient diversification of the treasury any single loss due to smart contract risk on the balance sheet should be relatively muted.

Governance risk

With any radical move to community governance comes risk of coordination attacks. Depending on the true level of decentralization of fund management, should a large enough group of holders some day choose to make decisions that benefit their small group, they could dominate governance votes in that direction.

A future for OHM and unpegged currencies

For now, OHM remains a risk-on bet that unpegged currency with a growing treasury, compounding innovation, and passionate community command enough of a premium in the medium-term to warrant continued growth and participation in 3,3 (buying + staking).

If executed right, all the typical value-adds of DeFi can potentially fall into place for the future of OHM + a few unique value-adds:

- A risk-off asset not exposed to the inflationary, regulatory, or monetary pressures of USD

- Robust lending markets with OHM as collateral and borrow

On Tuesday, OHM was added to its first lending protocol. Rari Capital's Fuse added a dedicated OHM pool with DAI, FRAX, USDC, and ETH available as borrow and collateral. Within a day the OHM pool on Rari's Fuse has attracted $10M+ in collateral, making it the second largest Fuse pool. Users can lend sOHM (staked OHM) to keep compounding their staked OHM while using it as collateral.

- Sources of liquidity across all major DEXs

- Advantages of composability - unique ways to harness bonds, rewards, OHM flashloans, governance, gamification, partnerships, etc.

- Self-governed monetary policy and codified accountability

Closing Remarks

OHM is one of a new class of novel attempts to create reserve and stable currencies without relying on a peg to some central bank currency. The DAO has managed to secure a DAO managed balance sheet of nearly $30M in assets, ~$9M in risk-free value, and over 4,000 stakers engaging with the protocol. This treasury continues to show strong growth amidst a market downturn, sending the total market cap to all-time highs.

It will be fascinating to watch what direction the DAO takes its growing treasury of assets, allocating its funds to benefit the DAO and provide backing to its reserve currency OHM. It remains to be seen if the flexibility of such decentralized money experiments with copious amounts of governance built-in can flourish in competitive environments. This is an experiment in monetary policy, after all.

Uncovering Alpha

This is our weekly segment that briefly discusses some of the most important developments of the prior and upcoming week.

Despite bearish on-chain activity, more innovation than ever is coming to DeFi as 3-12 month dev cycles come to fruition. Each week more and more projects are launched, major updates are pushed, and important ecosystem-changing events draw closer.

- Compound released Compound Treasury. Compound Treasury will offer fixed rate 4% APR for institutions, all USD denominated. Coinbase announced a similar product a day later for 4% returns.

- Kain, found of Synthetix wrote an interesting piece on DAO governance. This marks a fascinating period in DeFi governance where experiments of radical decentralization face clear tradeoffs in leadership and efficiency.

- KeeperDAO launched their V2. With a fresh look and new focus, KeeperDAO's MEV-countering products for all continue to evolve.

- Yearn added support for Curve's Tripool. The strategy is yielding 36% and has already attracted $45M+.

- Rari Capital's Fuse is expanding to Polygon. Dubbed Rake, the expansion of their lending product to Polygon marks another well-regarded project finding its way to Polygon marking more scaling frontrunning of L2 launches like Optimism and Arbitrum.

- Opyn launches their developer kit. Tooling for the modern age - it's cool to see more and more legos being purpose built for use. In this case, it's an options toolkit. Many projects have slowly realized they can create more value by offering the backend to DeFi rather than focusing on user-facing products.

- Alchemix prepares to relaunch alETH having returned >50% of ETH from exploit. About a week ago Alchemix asked for ETH back from their exploit. Those who returned the ETH would be put on a list for an NFT and 1 ALCX for every 1 ETH returned. Having raised >50% of the ETH, they are planning a relaunch of the alETH pool.

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter

Disclaimer: This report does not provide any investment advice. All data is provided for information purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.