CoinMarketCap + Glassnode: A Challenging Bear Market

The 2022 bear market has been exceptionally challening for digital asset investors, with Bitcoin and Ethereum down 75% to 85% from the ATHs. In this report with CoinMarketCap Research, we explore the mechanics and performance of BTC, ETH and the wider digital asset ecosystem in 2022.

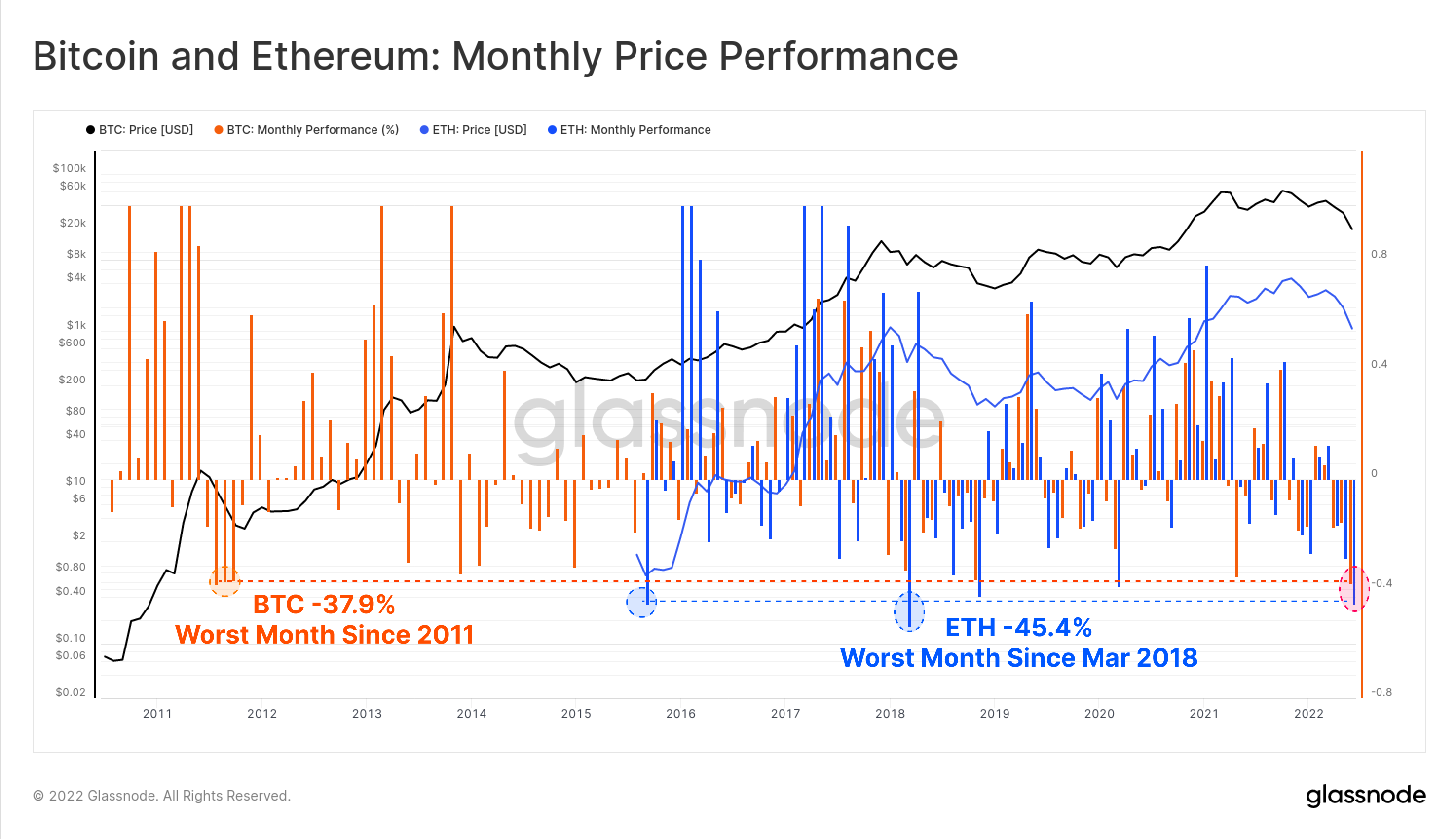

The year-to-date performance of 2022 has been remarkably challenging for investors, seeing BTC prices trade down 75% from the all-time-high, and ETH down over 80%. June in particular has been one of the worst months on record for both assets:

- Bitcoin traded down -37.9% in June which is the worst monthly performance since 2011, a time when BTC prices were below $10.

- Ethereum traded down -45.4% in June which is the second worst performing month in history, beaten only by the month of March during the start of the 2018 bear market.

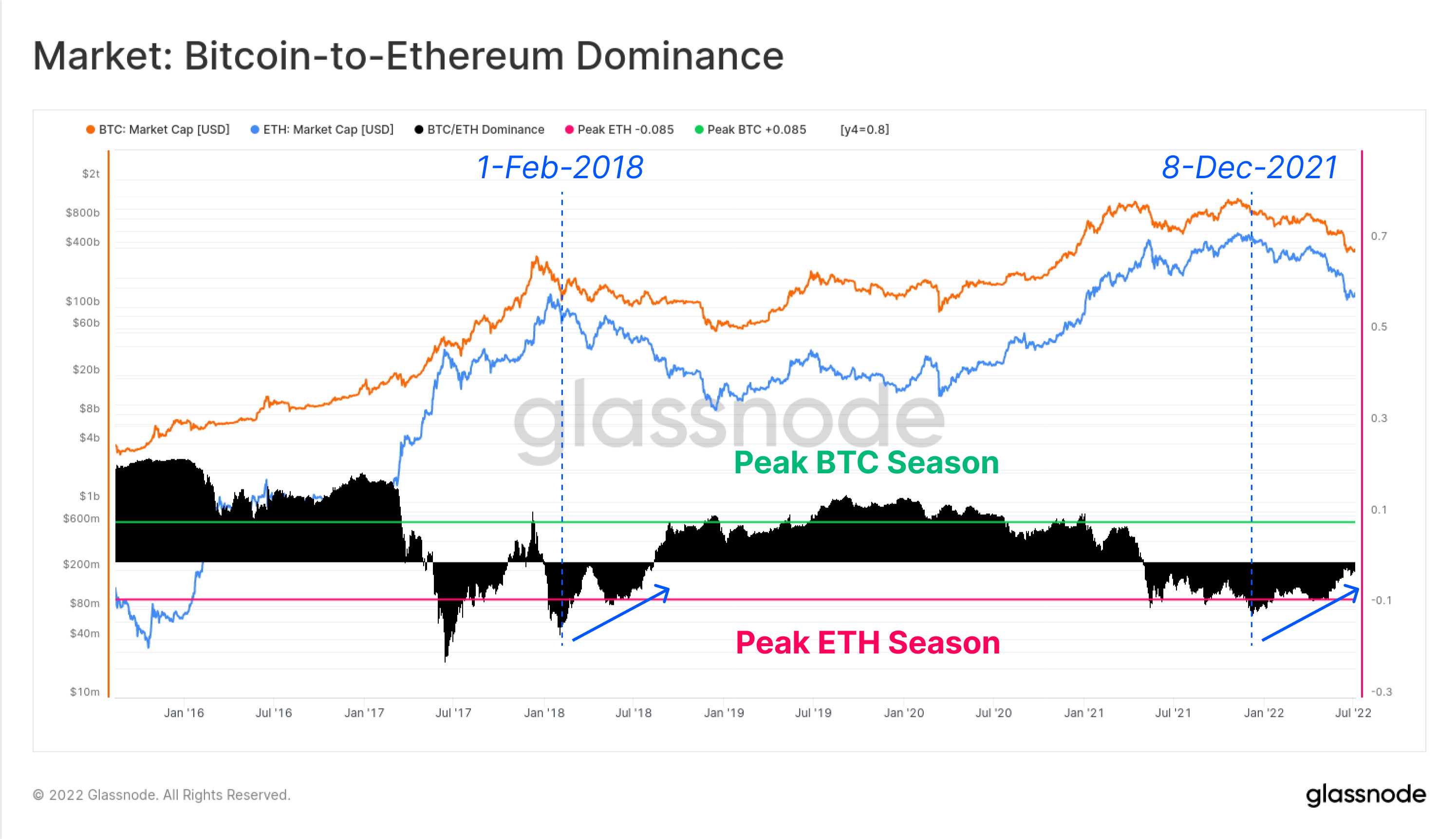

Over the course of 2022, the digital asset market has seen a macro shift towards risk-off sentiment. As in previous bear cycles, this is often reflected in a growing Bitcoin dominance, as investors pull capital towards the large cap end of the risk curve.

The chart below shows the relative dominance between Bitcoin and Ethereum Market Caps, and since early December 2021, capital has been rotating in favour of BTC. This trend is also similar in structure to the early 2018 bear market and was followed by almost three years of relative Bitcoin strength.

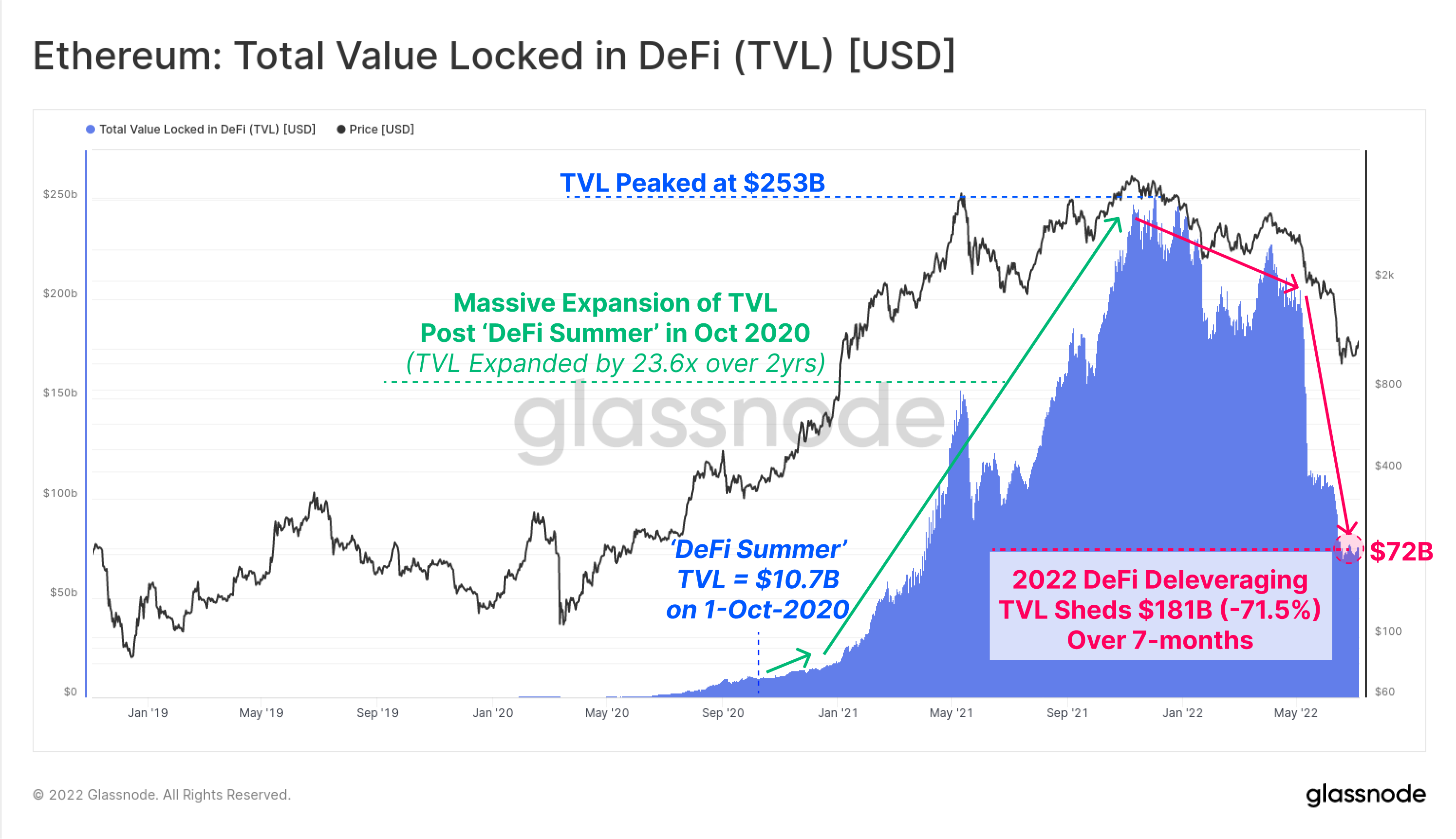

A large driving force of relative ETH weakness is the enormous deleveraging which has taken place in the DeFi sector. In many ways, this is the equal and opposite bear market reaction to the explosive growth seen in on-chain leverage, and yield farming markets over the last 2-years.

The colloquially named 'DeFi Summer' started in Oct-2020, when Compound launched their token farming program, which issued COMP tokens to users of the protocol. This initiated the trend of 'yield farming' within the DeFi sector, and emerged across many layer 1 blockchains and DeFi protocols.

Since DeFi Summer, the Total Value Locked (TVL) in DeFi exploded higher, growing 23.6x over 2-years, expanding from just $10.7B, to over $253B. However, over the last 7-months, a great majority of this TVL has de-leveraged and unwound, falling by a remarkable 71.5%, and shedding $181B in value.

The TVL decline is a function of both falling token valuations, and the reduction of aggregate leverage (both discretionary, and via liquidations). Both have weighed on the ETH price as one of the more liquid exit pathways for investors.

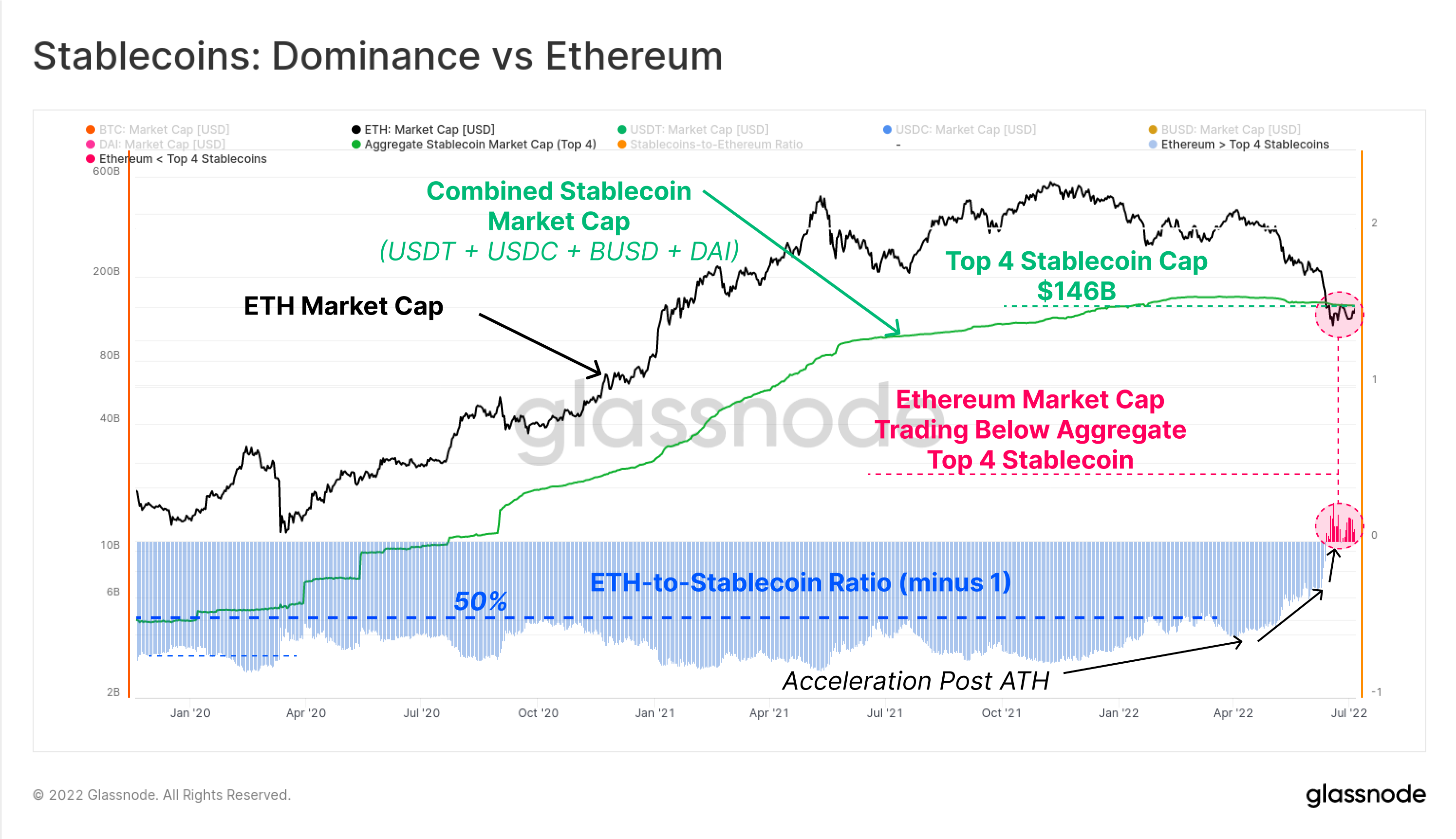

During this de-leveraging process, many investors sought safety in stablecoins, which have rapidly become the preferred quote asset across both centralized exchanges, and decentralized finance. Whilst the Market Cap of Ether is volatile, properly collateralized stablecoins are generally not, and will therefore decline only during periods of net redemptions back to fiat (or originating collateral).

Over the last 2-years, the aggregate market cap of the top 4 stablecoins (USDT, USDC, BUSD and DAI) typically peaked at around 50% of the Ethereum Market Cap. However, with so much value flowing out of volatile crypto-assets, and towards stablecoins, the aggregate value of these stablecoins has now flipped Ethereum.

This is the first time in history such an event has happened, and it goes to show just how dominant stablecoins have become, and how severe the flight to stability has been in 2022.

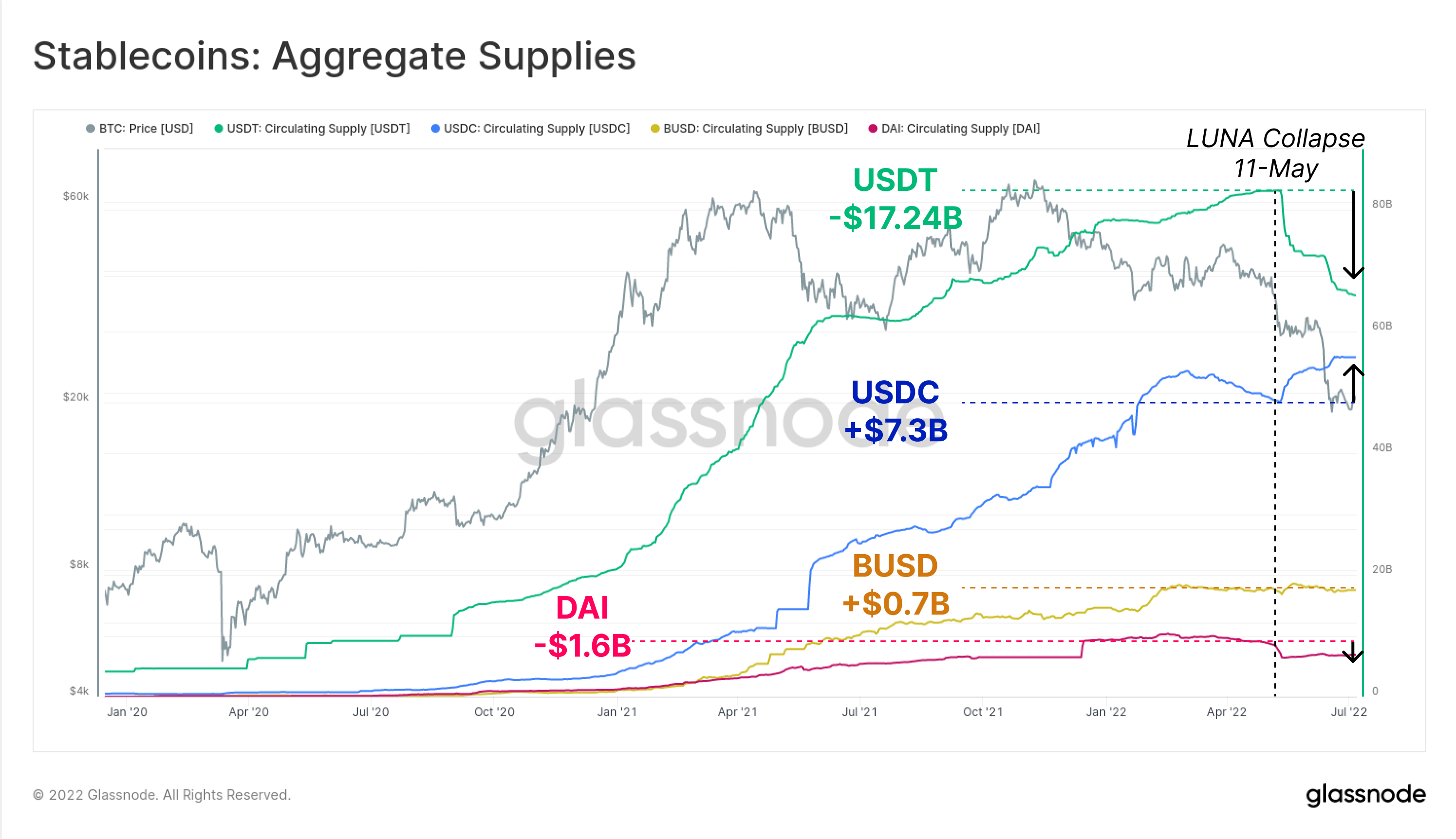

There has also been significant evolution taking place within the stablecoin space itself, especially after the now infamous collapse of LUNA and UST in mid-May 2022.

- The Aggregate Top 4 Stablecoins now spot a market cap of $146B, with USDT, USDC and BUSD occupying respective ranks 3, 4 and 6 amongst all crypto-assets by Market Cap.

- Tether (USDT) in particular has seen its circulating supply decline by an incredible -$17.24 Billion (20% off $83B ATH) since 11-May, as large scale redemptions take place.

- USD Coin (USDC) supplies have risen by $7.3B over the same period of time. This perhaps signals that a shift in market preference is underway, with investors increasingly moving away from USDT, and towards USDC.

- Binance USD (BUSD) supplies have also grown by $0.7B, albeit not quite to the same magnitude as USDC. BUSD dominance in the stablecoin space has seen the most aggressive growth over the last 2-years, as will be shown in the next section.

- DAI supplies have contracted by $1.6B, driven primarily by the de-leveraging event taking place in the DeFi sector, as investors close out loans (or are liquidated) on the MakerDAO platform.

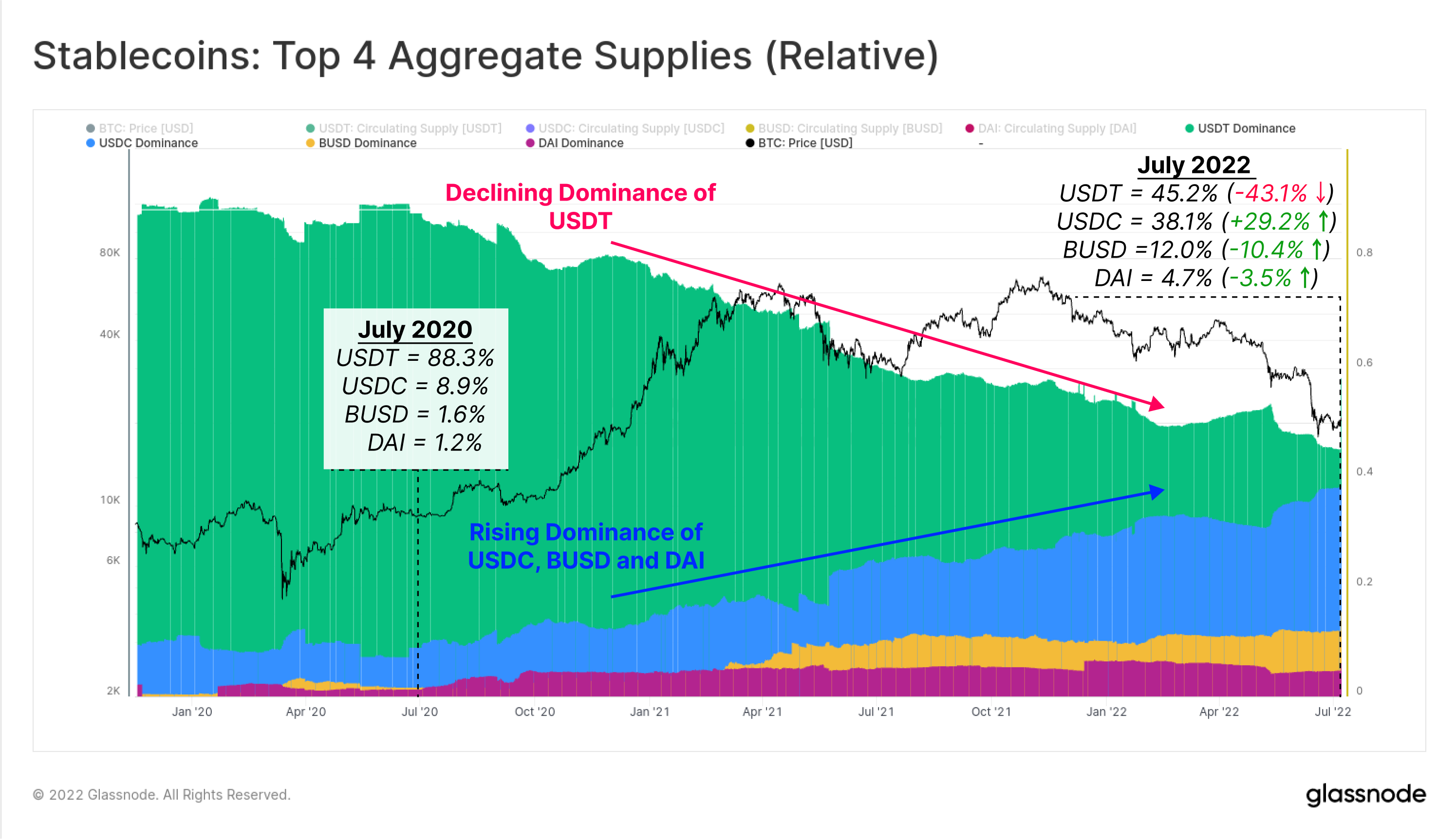

The result of these supply shifts is a notable shift in dominance between the top 4 stablecoins. Two years ago, Tether dominated 88.3% of all stablecoin supplies, and continues to sport the highest trade volume in the industry. However, Tether supply dominance has since been in a persistent macro downtrend, representing just 45.2% of the top 4 stablecoins supplies today.

Competition is rising, and market preference appears to be structurally shifting.

- USDC dominance has increased by 4.3x to capture 38.1% of the market share.

- BUSD dominance has grown the most aggressively, increasing its market share by 7.5x to reach 12% of supplies.

- DAI dominance has increased by 3.9x, now accounting for 4.7% of the top 4 stablecoins.

The Bitcoin Bear Market

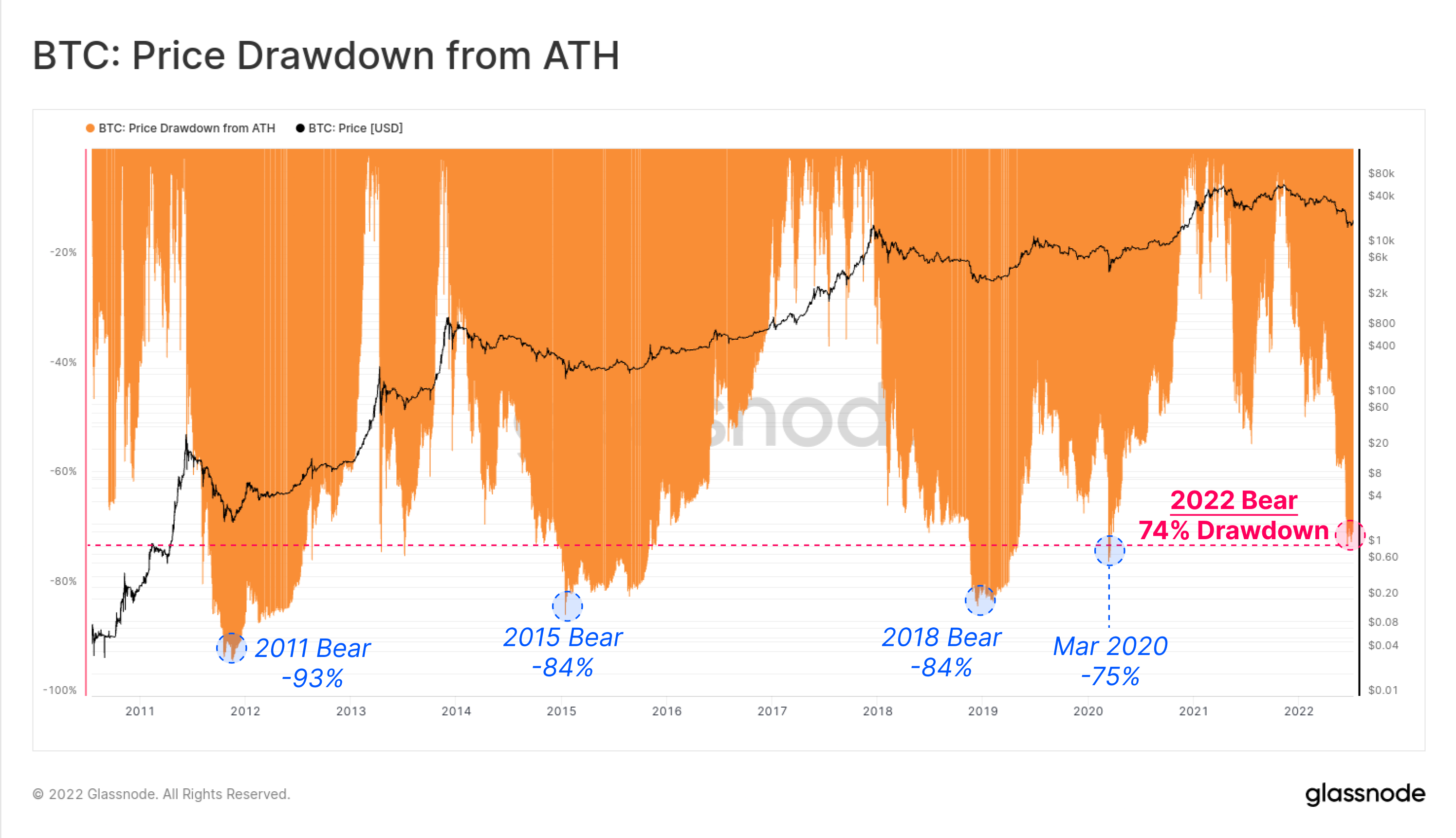

As noted in the introduction, 2022 has been a challenging year, and even the market leader Bitcoin has not come out unscathed. BTC prices have now fallen 74% from the $68.3k ATH, reaching a relative low of $17.6k on 18-June.

So far, the 2022 bear remains the least severe in history from a drawdown perspective, although the scale and magnitude of impact is arguably the largest to date. Over time, Bitcoin bear markets have bottomed at marginally less severe drawdowns each cycle, ranging from -93% in 2011, to -84% in 2015 and 2018, and -75% in March 2020.

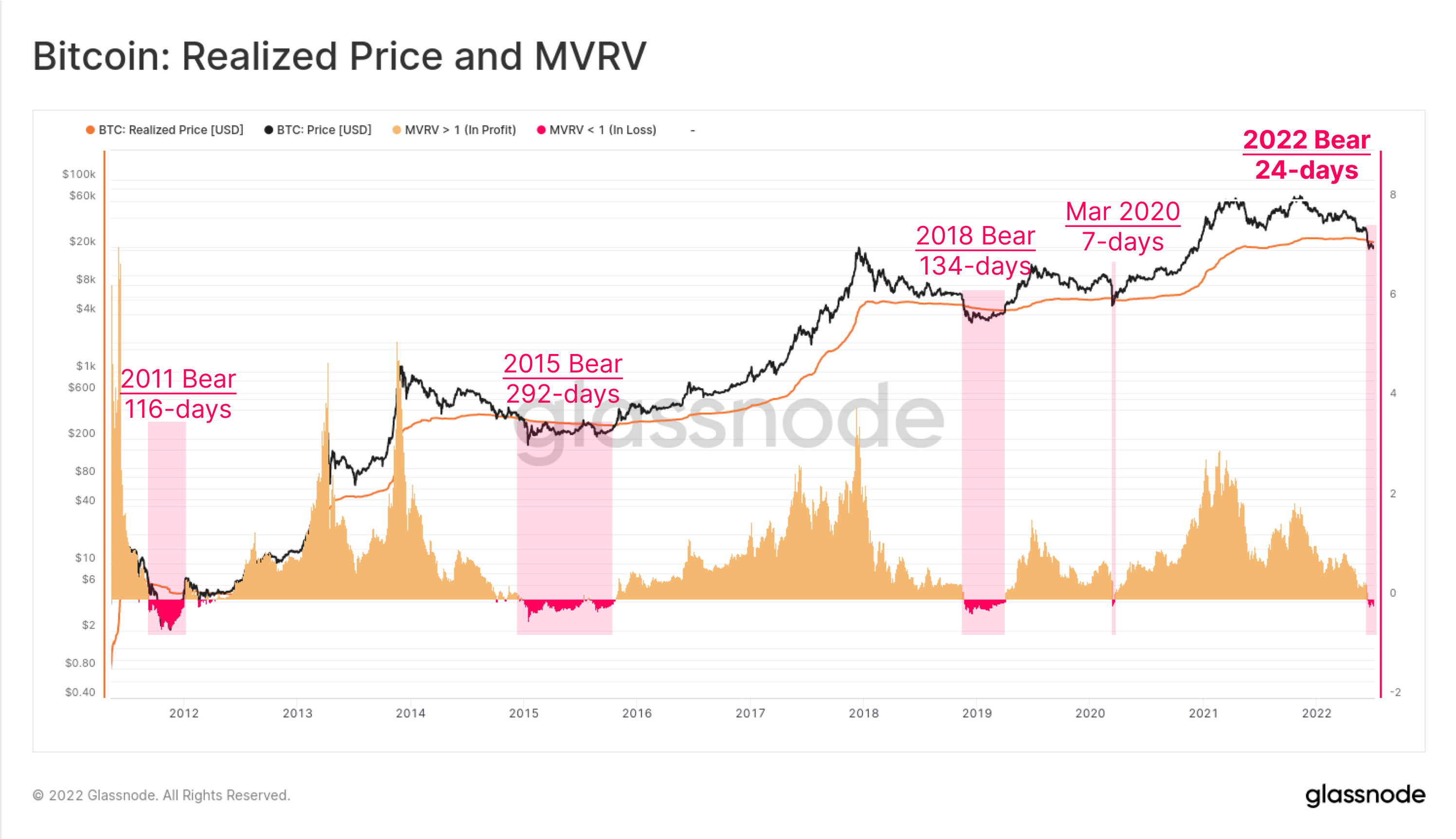

Two classic on-chain metrics, and some of the most widely recognized, are the Realized Price, and its derivative the MVRV Ratio.

- Realized Price is the average price of the Bitcoin supply, valued at the day each coin last transacted on-chain. This is often considered the 'on-chain cost basis' of the market.

- MVRV Ratio is the ratio between the market value (MV, spot price) and the Realized value (RV, realized price), allowing for a visualisation of Bitcoin market cycles, and profitability.

All historical Bitcoin bears have seen prices dip below the Realized Price for an average period of 180-days (excl. March 2020 which lasted just 7-days). When spot prices trade below the realized price, the MVRV Ratio will trade below a value of 1. This signals that the average Bitcoin investor is holding coins below their on-chain cost basis, and is thus is carrying an unrealized loss.

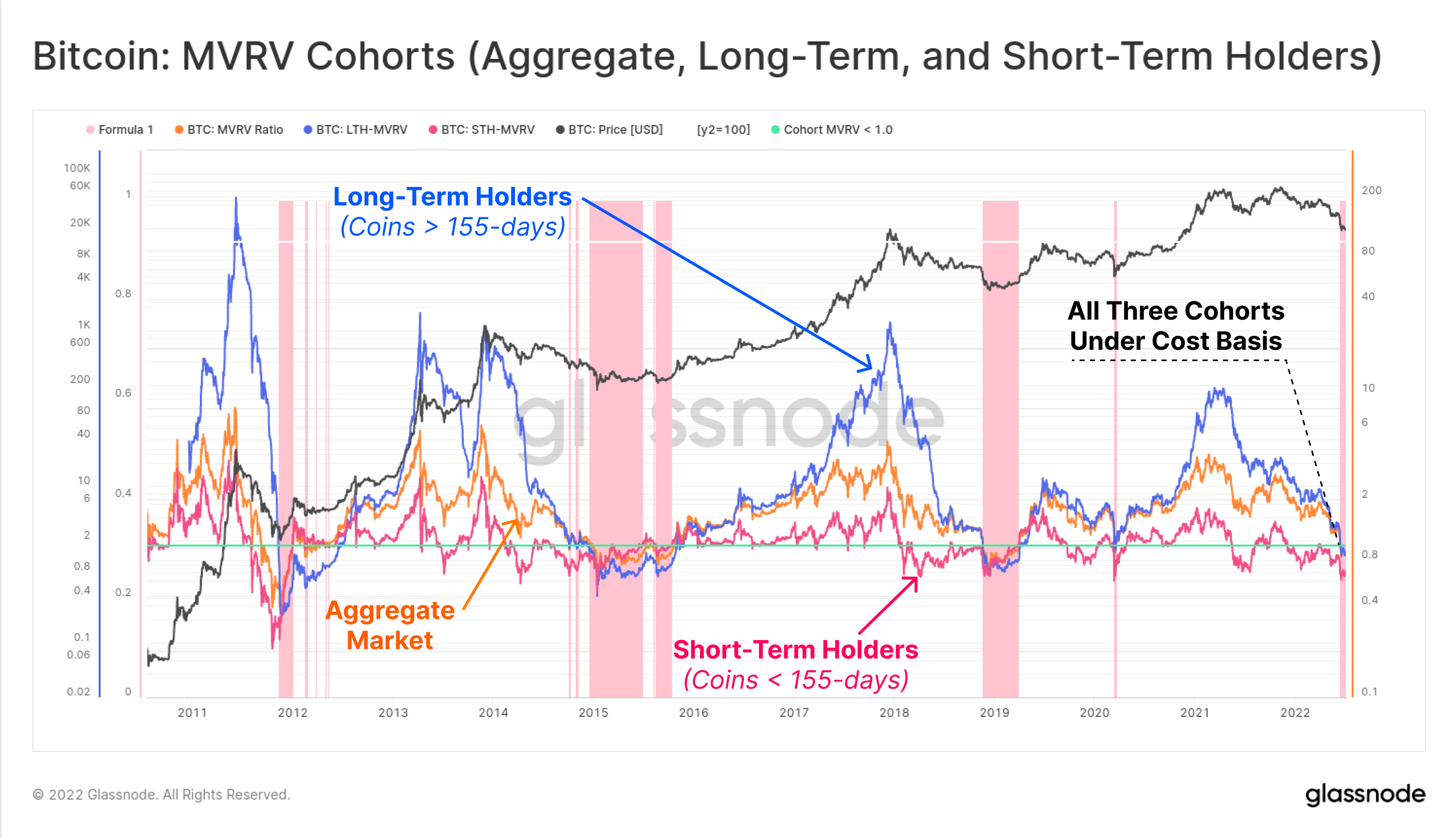

We can also dissect the market based on how long investors have held their coins, and calculate an MVRV for three cohorts:

- The aggregate market (orange) as described above.

- Short-Term Holders (pink) who have held coins less than 155-days, and are statistically most likely to react, and spend coins in the face of market volatility.

- Long-Term Holders (blue) who have held coins for longer than 155-days, and are statistically the least likely to spend their coins. This cohort is often considered synonymous with relatively price insensitive Bitcoin HODLers.

On average, all three Bitcoin cohorts are currently holding coins below their cost basis, and all MVRV Ratios are below 1.

Previous instances where all three cohorts are underwater are shown in red zones below, and it can be seen that such events often correlate with the lows of bear markets. With so many Bitcoin investors at a loss, the market is approaching a form of 'maximum financial pain'.

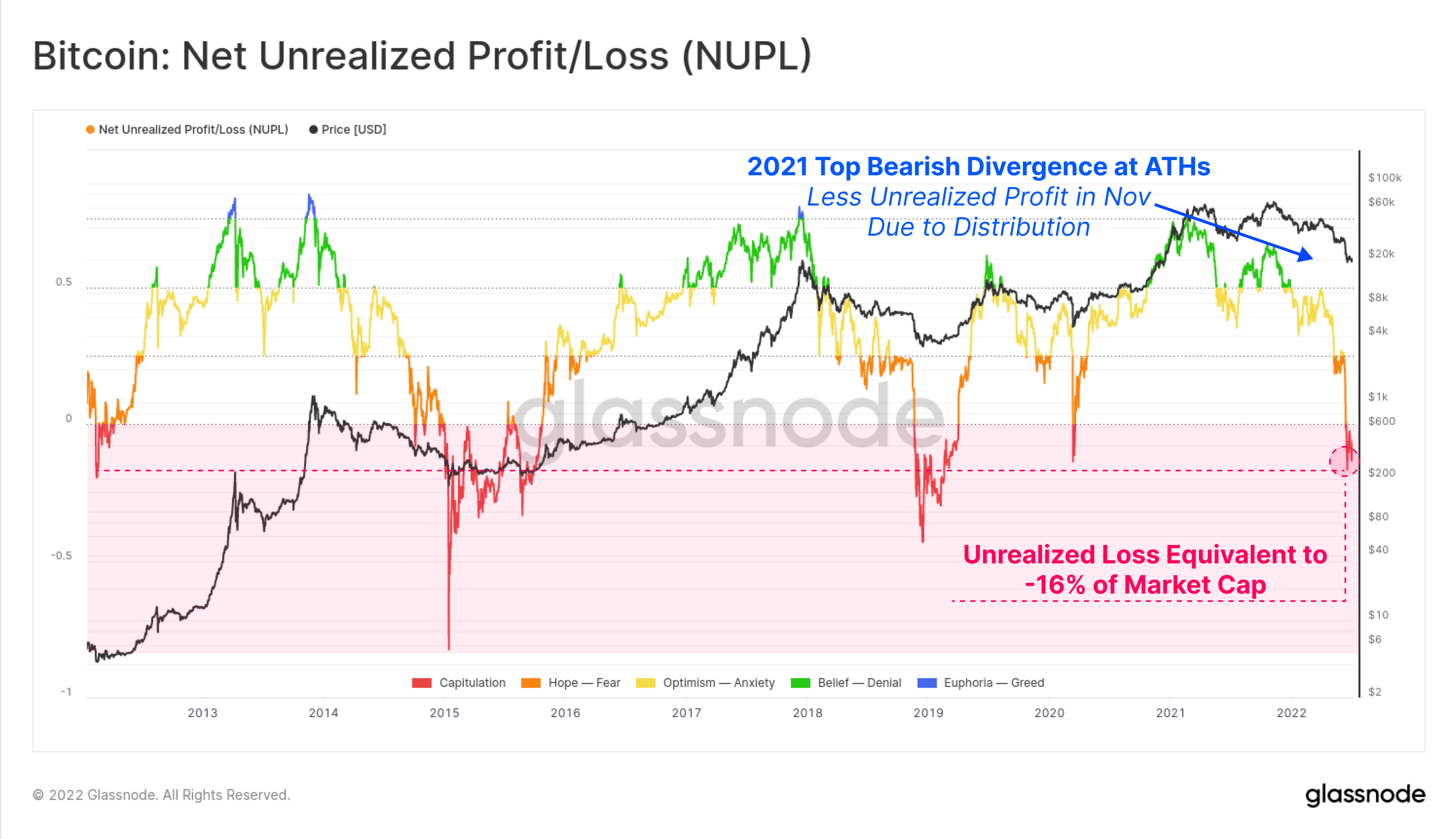

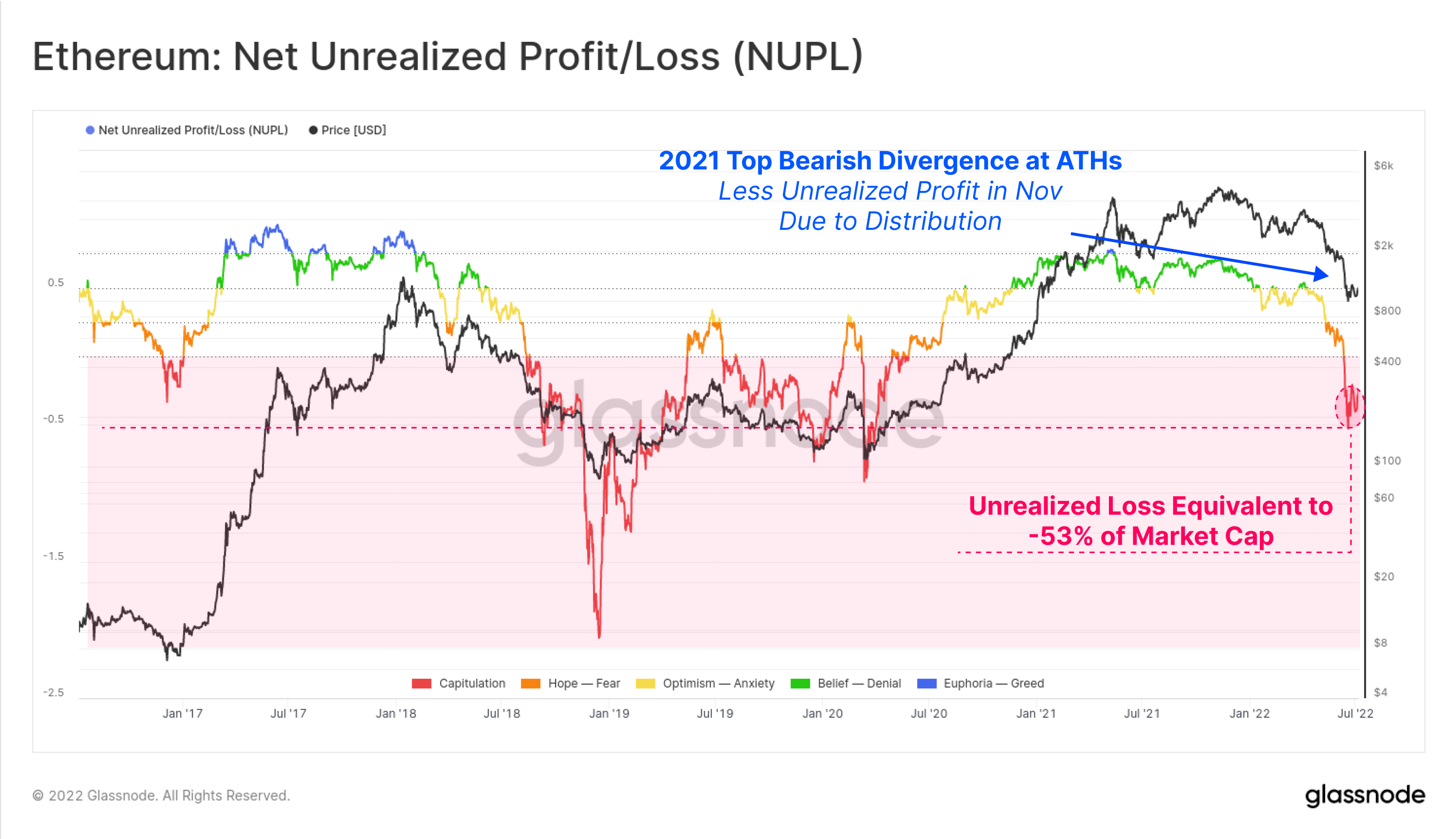

We can also quantify how large the Net Unrealized Loss is via the NUPL metric (presented as a proportion of Market Cap). There are two key insights to be drawn from the 2021-22 cycle:

- A macro bearish divergence can be seen to develop between the April, and November market peaks (shown in blue). This is a result of investors spending their coins during the Aug-Nov 2021 rally, making for a higher aggregate cost basis, and thus a smaller unrealized profit held in the system (i.e. many investors took profits on the way up).

- Unrealized Losses held within the Bitcoin network are currently equivalent to 16% of the current Market Cap. This is at a similar magnitude to historical bear markets, however is slightly less severe than at the 2015 and 2018 lows.

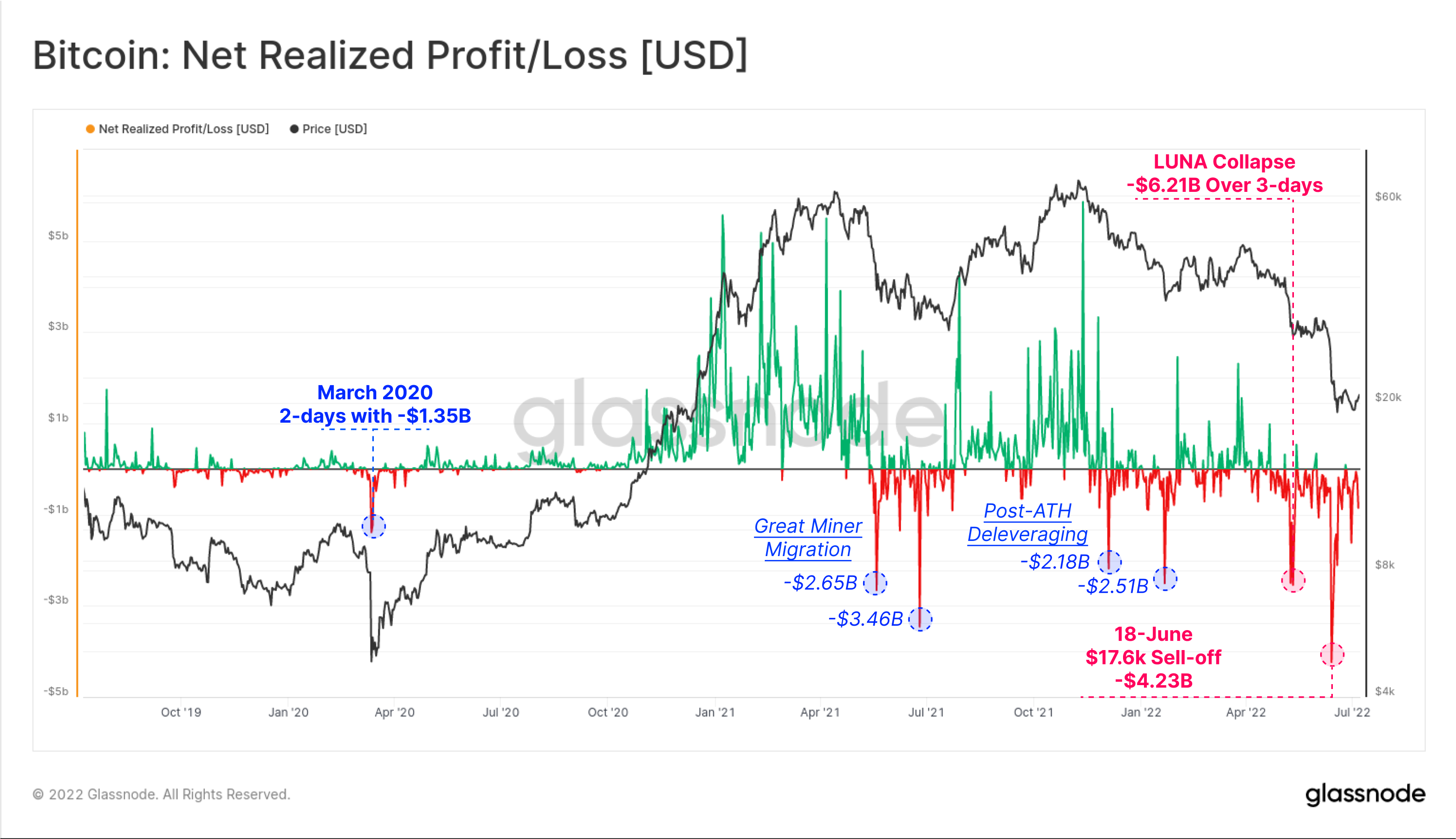

As the Bitcoin market size grows in size, the magnitude of potential USD denominated profit and loss can be expected to increase. Over the course of the 2021-22 cycle, there have been six major 'capitulation' events, where investors realized historically large losses on-chain.

Note that a Realized Loss occurs when an investors who acquired coins at higher prices, spends them at lower prices, locking in the loss. Net Realized Profit/Loss is then calculated by subtracting Realized Losses, from Realized Profits each day.

- May-July 2021 saw prices sell-off to $29k during the Great Miner Migration. During this time, there were two days with net realized losses of $2.65B and $3.46B, both of which were the largest in history at the time.

- Dec 2021 and Jan 2022 saw the market trade down from the $68.3k ATH and experience two deleveraging events. These days realized net losses of $2.18B and $2.51B, respectively.

- May-June 2022 saw credit contagion take hold in the market. As the LUNA-UST project collapsed in mid-May, Bitcoin investors realized net losses in excess of -$6.21B over a three day period. The second event occurred on 18-June as Bitcoin prices fell to $17.6k, and set the current record one-day net realized loss of $4.23B. This occurred as BTC prices broke below the previous cycle ATH for the first time in history.

It can be seen that despite being a marginally smaller drawdown when compared to previous bear markets, the 2021-22 Bitcoin Bear has been punctuated by numerous, very large capitulation events, and steep declines in investor profitability.

The Ethereum Bear Market

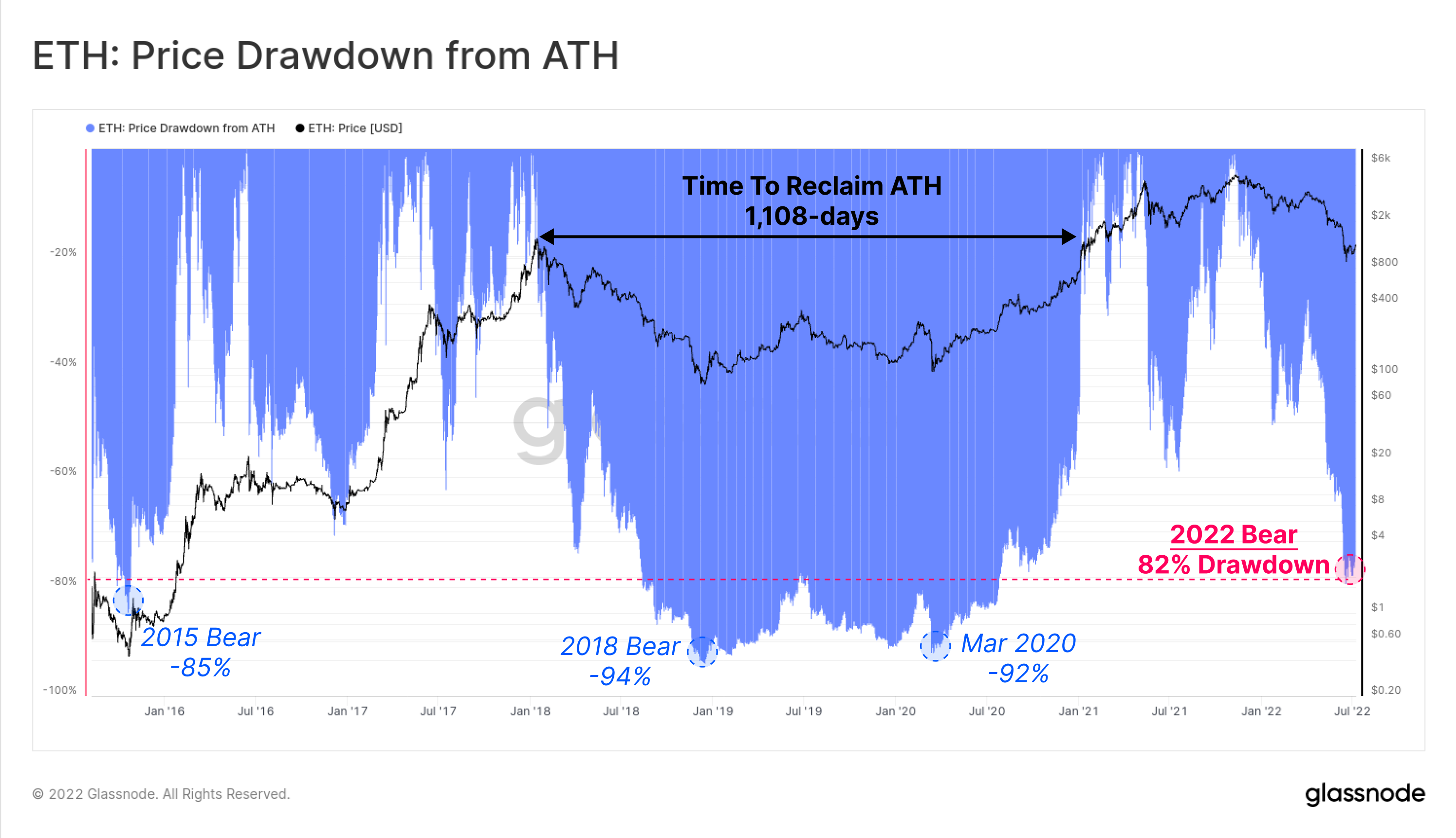

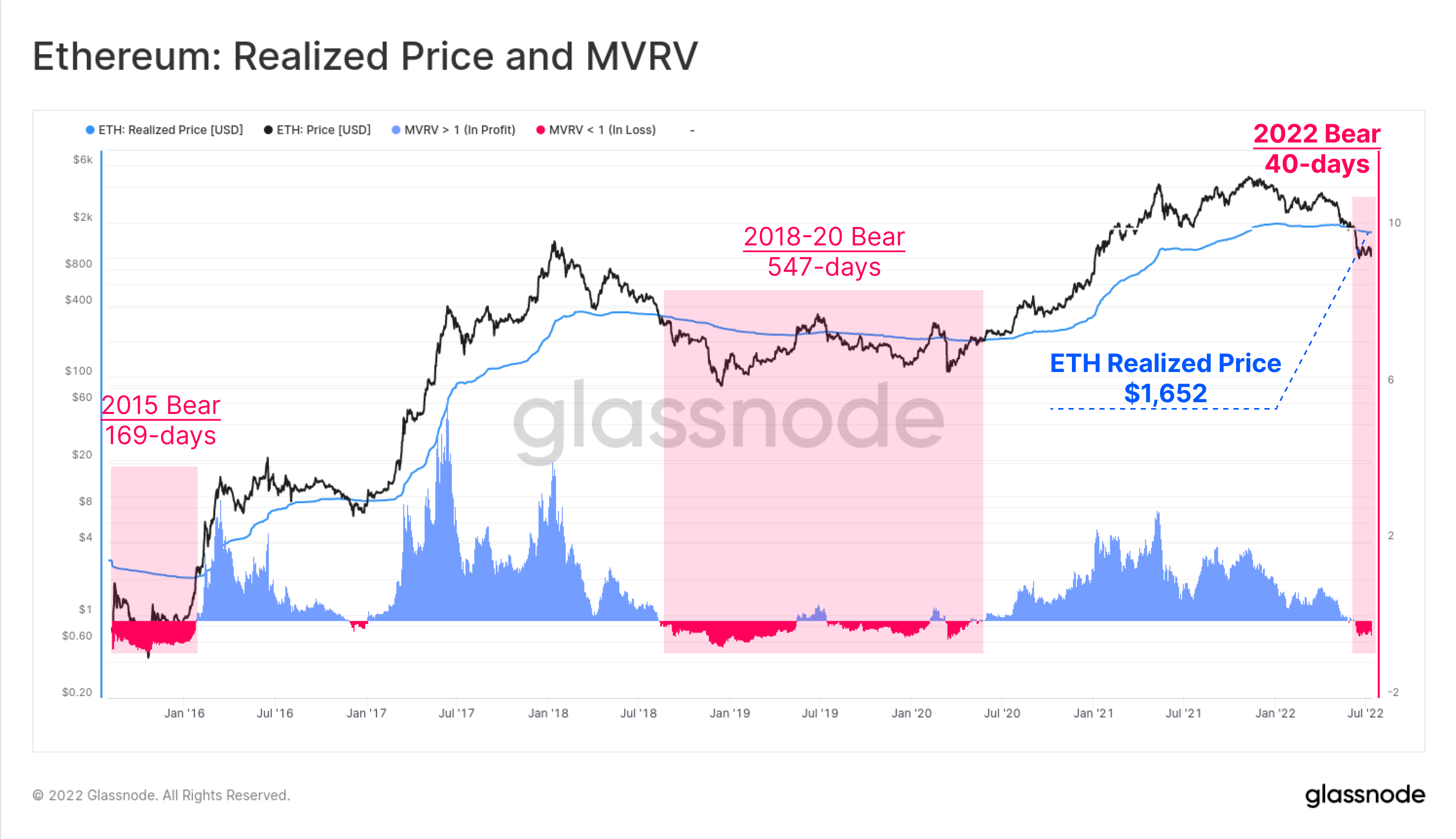

Like Bitcoin, Ethereum investors have also seen an incredible degree of value decline within a relatively short span of time. This is the second major bear market for ETH, having originally launched into the tail end of the 2015 bear market.

The 2018-2020 bear is the closest analogue, and bottomed at a drawdown between 92% and 94%, and took 1,108-days for ETH prices to reclaim the $1,416 ATH. In the 2022 bear market, thus far, ETH has seen an 82% decline below the $4.8k ATH set in Nov-2021.

Ether investors are also holding coins below their on-chain costs basis, as spot prices trade below $1.2k, and the Realized Price hovers above at $1.65k. In the 2018-20 bear market, ETH investors held coins below their cost basis for a lengthy 547-days (with two relief rallies along the way).

This cycle, the Ethereum MVRV Ratio has been trading below 1 for just 40-days so far, which remains quite brief in contrast to the 2018 bear. MVRV fell to a value of 0.416 on 18-June indicating the average ETH investor was holding an unrealized loss of -58.4%.

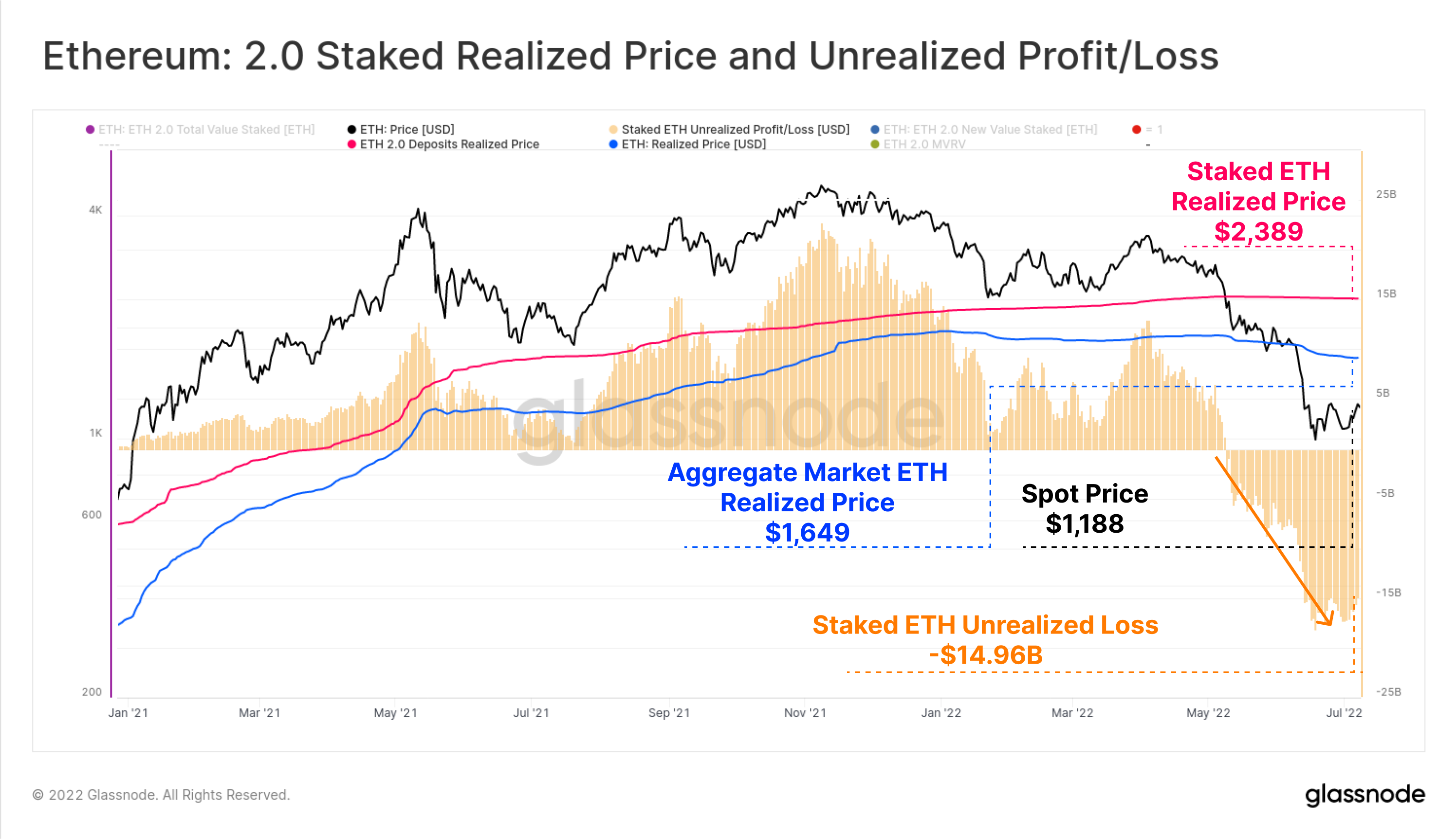

Throughout the 2021-22 cycle, investors have deposited ETH into the 2.0 staking contract in order to become a validator for the Beacon Chain. At this point in time, ETH deposits are one-way, and thus cannot be withdrawn until some time after the Merge.

As a result, we can calculate the Realized Price of ETH 2.0 deposits based on the time the coins were staked. Here we can see that the average deposit price was $2,389, which is 44.8% higher than the broader market realized price at $1,649.

With over 13M ETH staked, this puts the the total unrealized loss held by ETH in the 2.0 deposit contract at $14.96 Billion.

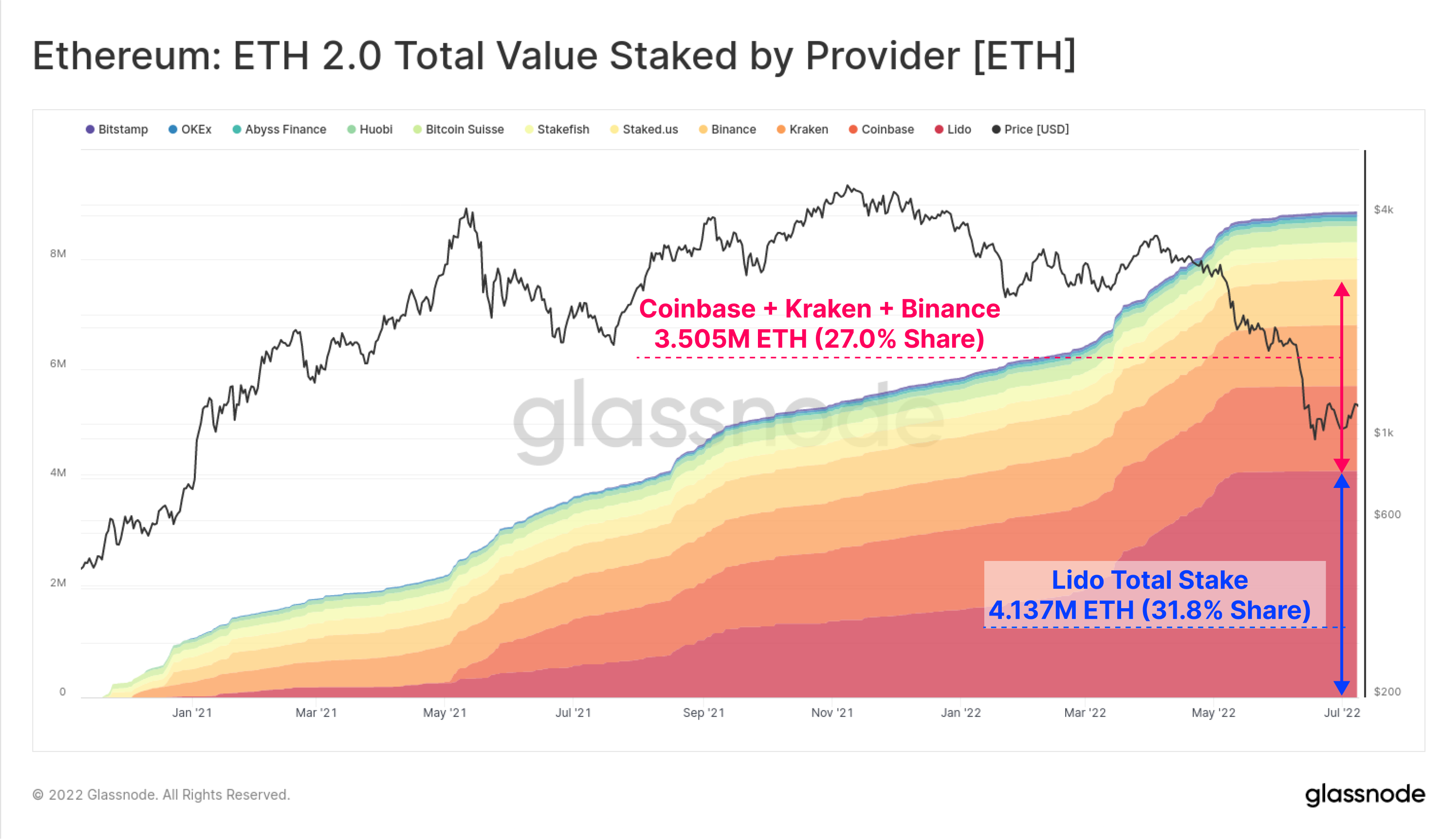

As a quick aside, with such a stark divergence between the Realized Price of liquid ETH, and that of illiquid staked ETH, it is little surprise that investors have come to favour 'liquid staking derivatives'. Products such as the stETH token offered by Lido allow investors to transfer, sell, collateralize, or hedge their staked ETH position.

As a result, the total ETH staked via Lido has swelled to 4.137M ETH, accounting for an incredible 31.8% of the total 13.0M staked ETH. By comparison, the combined deposits of Coinbase, Kraken and Binance represent 3.505M ETH, which is 27.0% of the total.

If we return to aggregate market profitability, we can see that the Net Unrealized Loss for ETH investors is severely worse than their Bitcoin counterparts. A similar bearish divergence can be seen between the 2021 market highs, and the current market is holding losses equivalent to 53% of the Market Cap.

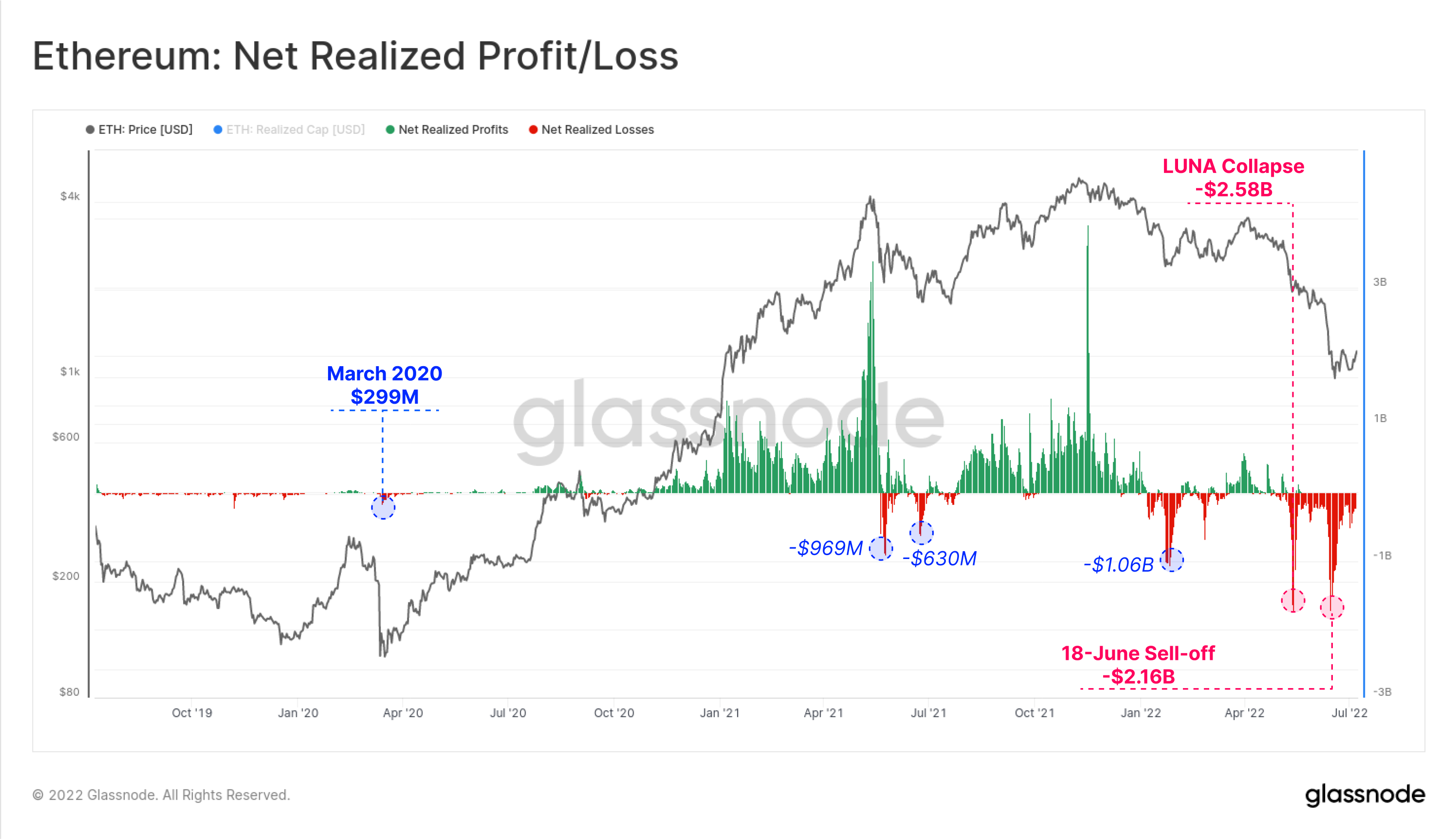

With such extreme negative profitability across the Ethereum holder base, ETH investors have reacted with two historically large capitulation events over the course of May and June. Here we considering only the spending of ETH tokens, and identify one-day capitulations of -$2.58B during the LUNA collapse, and then an additional -$2.16B during the 18-June sell-off event.

These events eclipse the generally sub-$1B capitulations throughout Ethereum history, and are more than 8-times larger than the March 2020 event. This demonstrates that whilst 2022 is a very severe bear market, the scale of capital flowing in-and-out of both Bitcoin and Ethereum is now an order of magnitude larger than it was just 2-years ago.

Mining Stress and Capitulation

In this final section, we will explore the stress building within the Bitcoin and Ethereum mining markets. One of the incredible events of the 2021 cycle was the Great Mining Migration. Between May and June 2021, the industry saw an estimated 52% of the Bitcoin hashrate, located in China, come offline, as a government ban came into full effect.

As a result, many of the affected ASIC mining rigs were sold, transferred, and re-homed, with a great proportion acquired by publicly traded North American companies. Simultaneously, chip shortages after COVID started to ease in the second half of 2021, resulting in hash-rate and mining difficulty V-shape recovering, and breaking to new all-time-highs.

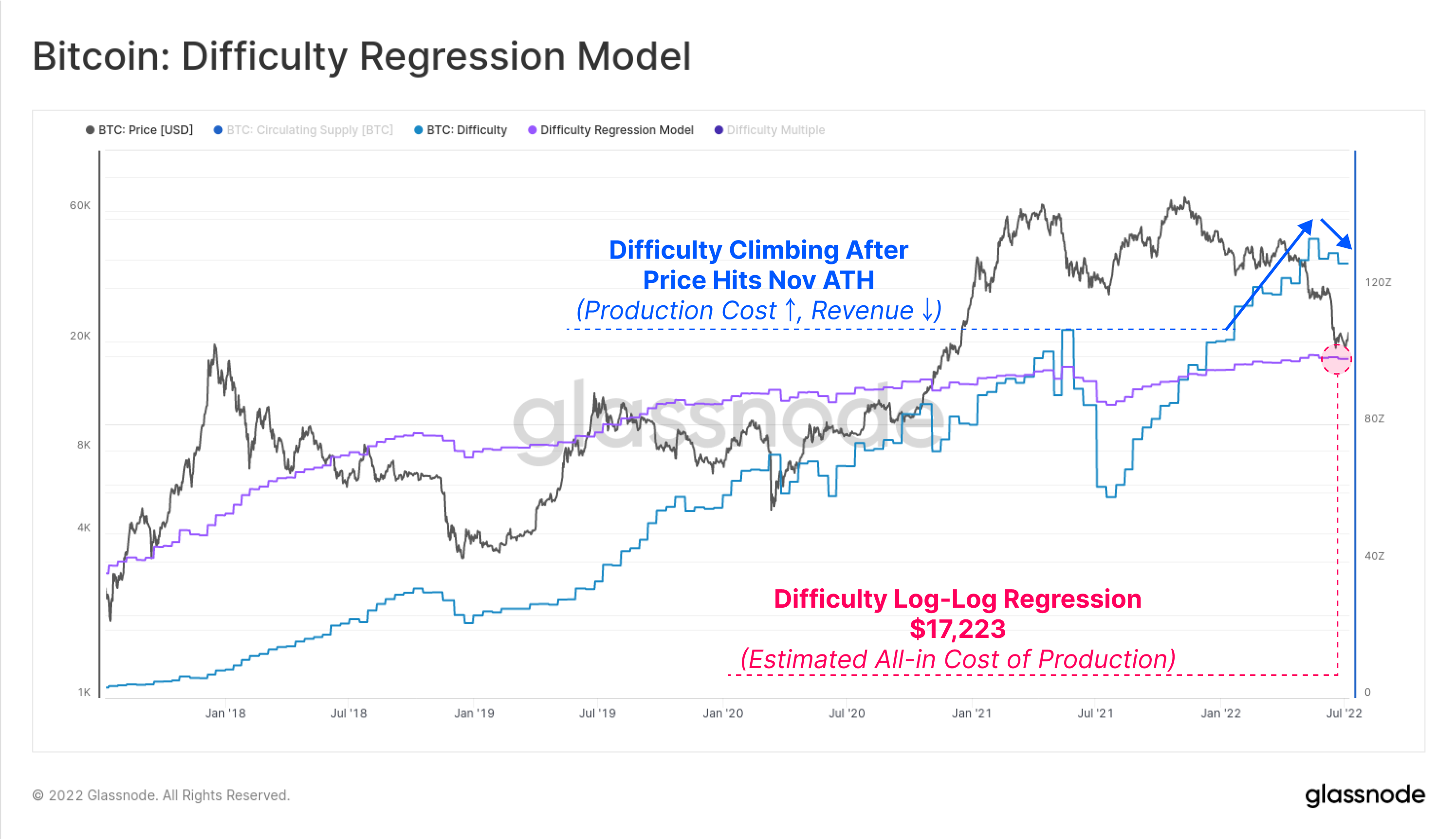

This effectively increased the cost of BTC production, at the exact same time as market prices peaked, and entered the prevailing bear trend. Using a log-log regression model, we can estimate the all-in-average-cost to mine BTC at around $17.2k. Interestingly, the 18-June sell-off event tested this model at $17.6k, signalling Bitcoin prices had returned to their average cost of production, a phenomena many commodities tend to do.

However, this combination also signals that miner stress is now a likely market factor, with production costs climbing, and revenues simultaneously falling.

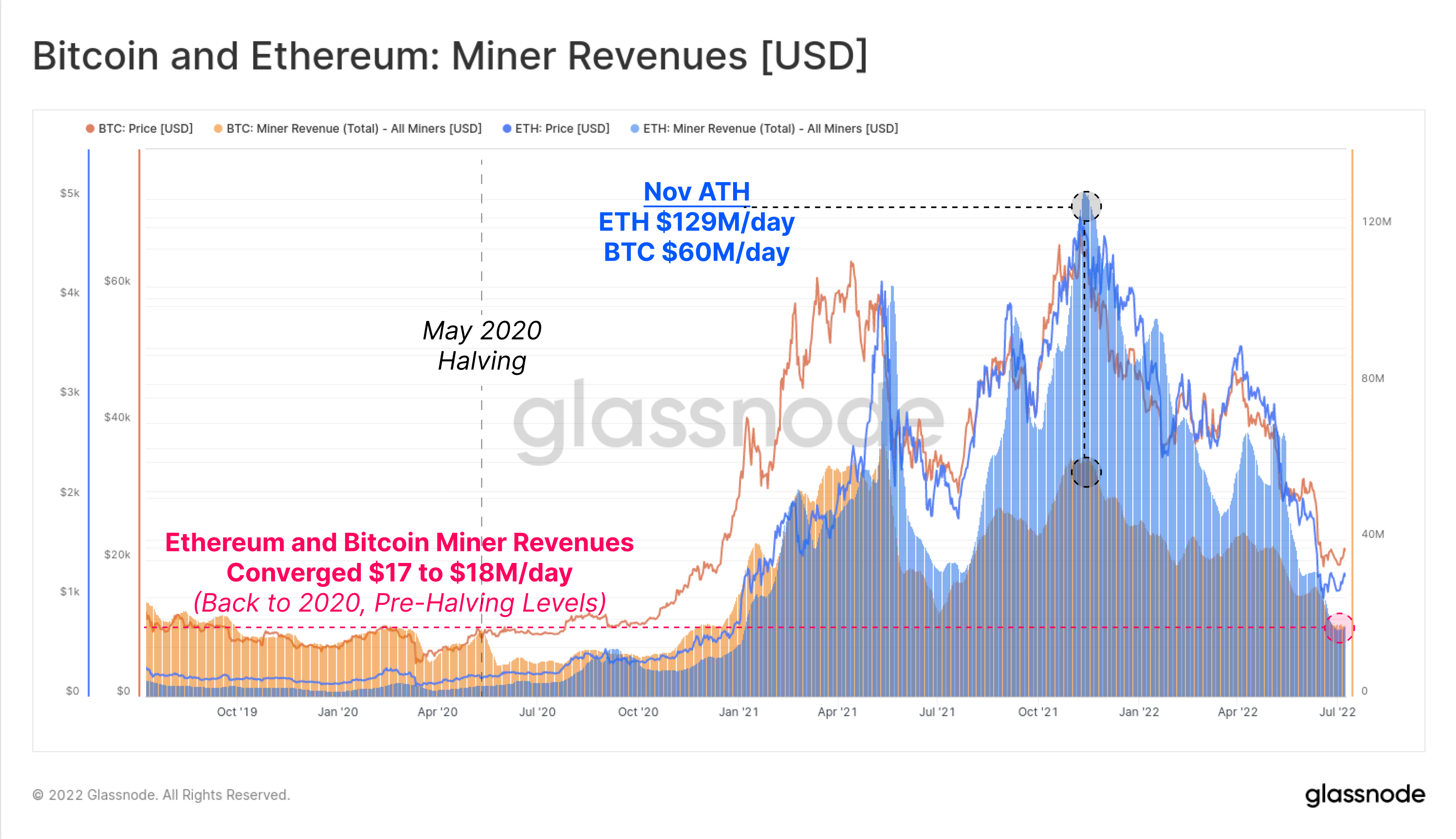

We can see that the aggregate mining revenues for Bitcoin and Ethereum have dropped dramatically, with both converging at around $17M to $18M per day. Ethereum miners are now once again earning less than Bitcoin miners, despite ETH revenues reaching more than double BTC revenues at the Nov 2021 peak.

Bitcoin mining revenues have now returned to 2019-20 levels, and are equivalent to incomes before the May 2020 halving event took place.

One of the first observable signals of Bitcoin miner stress occurred in early-June when the hash-ribbons inverted. This indicated that hash-rate was declining at a significant rate, pushing the faster 30-day moving average below the slower moving 60-day average.

This occurs when Bitcoin miners are switching off their unprofitable mining rigs, as they no longer earn enough to justify continued operation and power consumption.

Similar events in the past can be seen at the 2018 bear market lows, and then again during the back-to-back 'halvings' in 2020 (first, prices halved in the March 2020 sell-off, and then the BTC subsidy halved at the Bitcoin halving event in May). The impact of the Great Migration is also visible between May and July 2021.

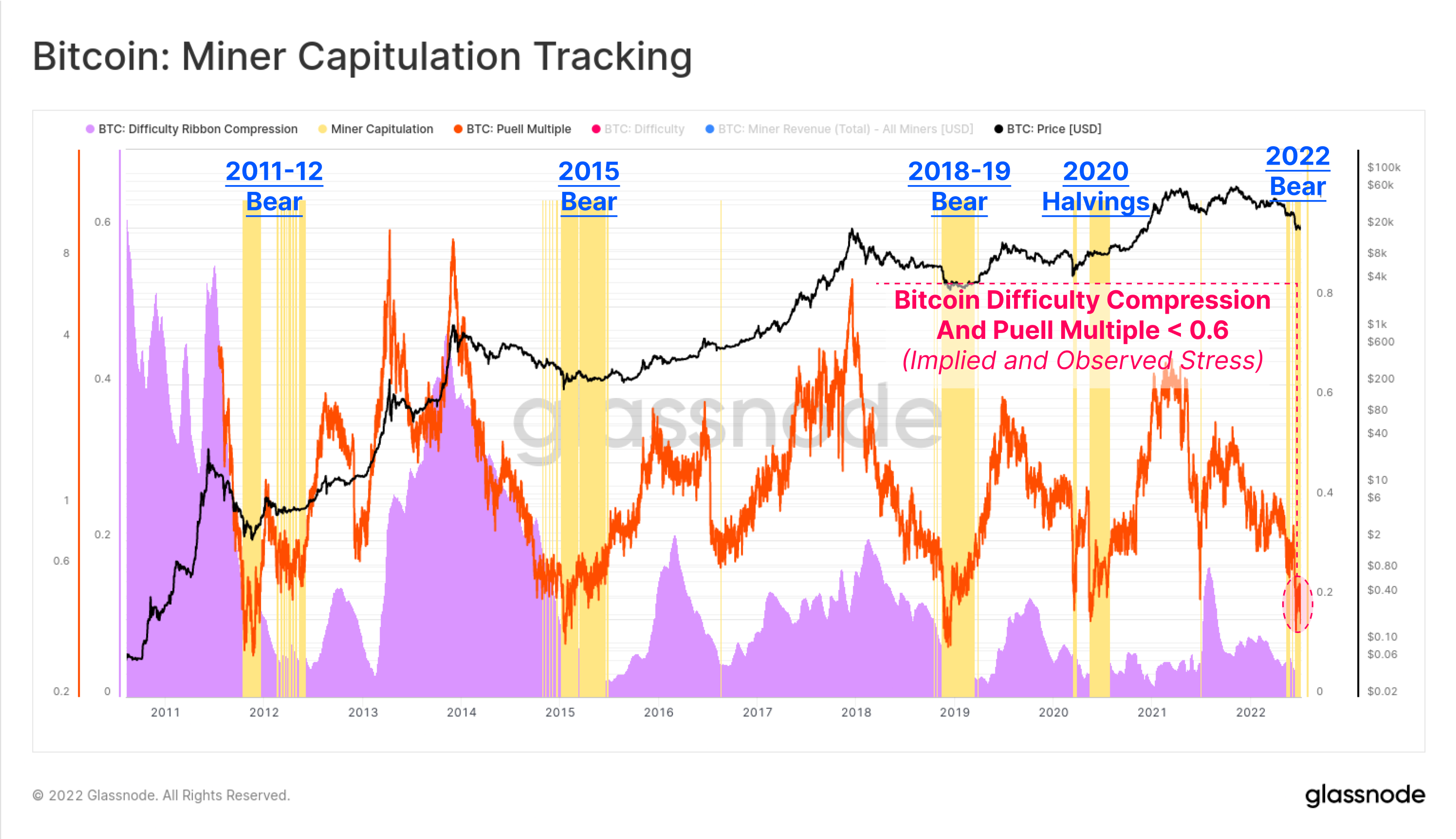

To confirm that miner income stress is in play, we can consult a two part model, which seeks confluence between implied income stress (Puell Multiple) and observed hashrate decline (Difficulty Ribbon Compression).

- The Puell Multiple (orange) tracks aggregate miner income in USD, relative to the 1-year average. Here, we can see that Bitcoin miners are earning just 40% as much as the 12-month average. This implies miner income stress is a likely factor.

- The Difficulty Ribbon Compression (purple) signals that hashrate is indeed coming offline, causing protocol difficulty to fall in a statistically significant way. This is an explicit observation that ASIC rigs are being switched off due to income stress.

- Miner Capitulation Risk (yellow zones) highlight periods where both metrics are signalling meaningful lows, and generally correlate with extreme bear market lows, and an elevated risk of miner capitulation events.

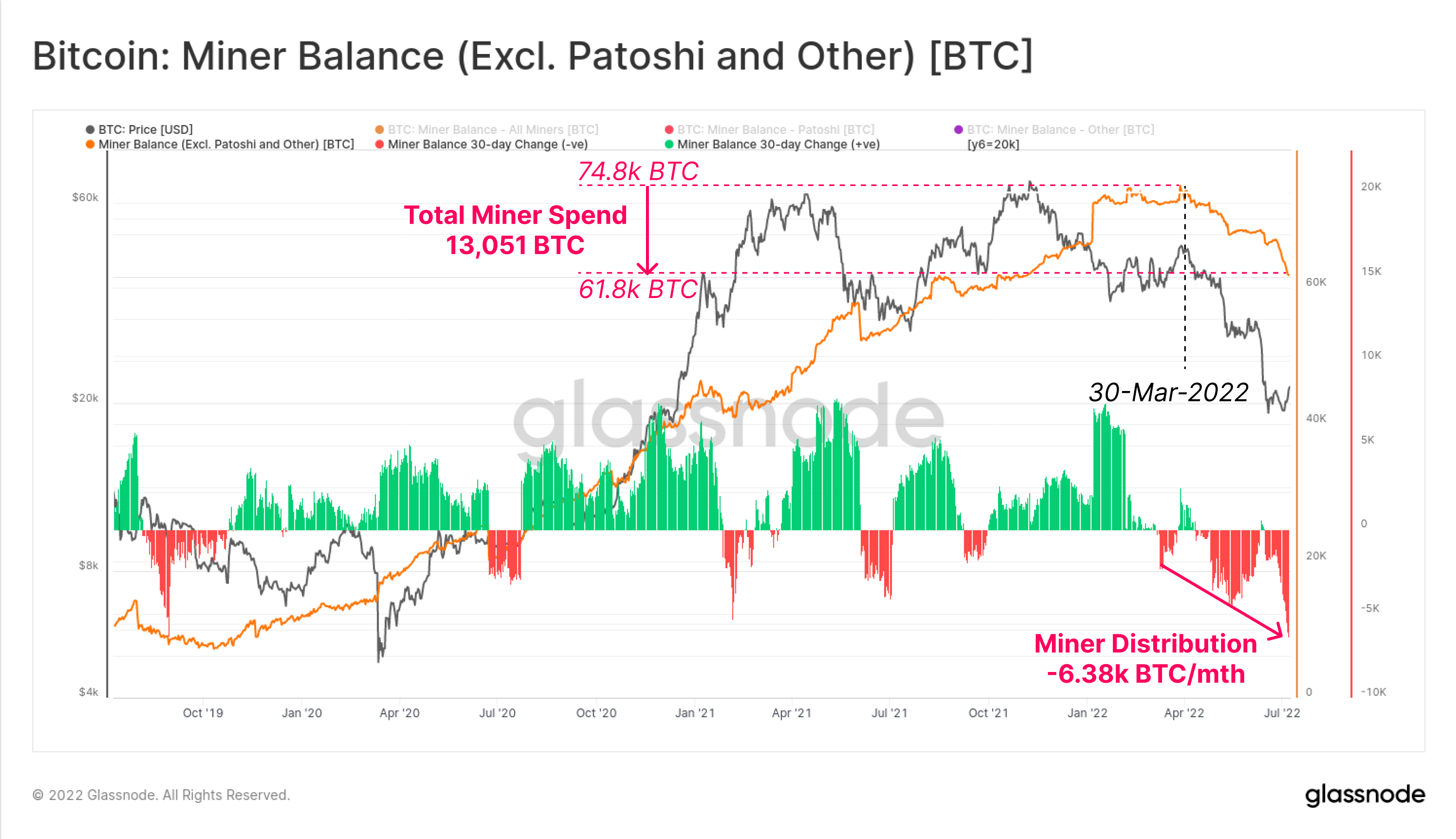

As our last piece of evidence related to Bitcoin miners, we can see that aggregate miner balances have broken their 2-year uptrend and are now in decline. Miner balances have fallen by 13,051 BTC since late March, and they are currently distributing from their stored treasuries at a rate of 6.38k BTC/month.

This is the largest rate of miner distribution since 2019. It could be expected to continue unless prices recover, and/or until miners with stronger balance sheets gain a sufficient dominance of network hashrate. With around 61.8k BTC still held by these miners, the risk of further distribution pressure remains in play.

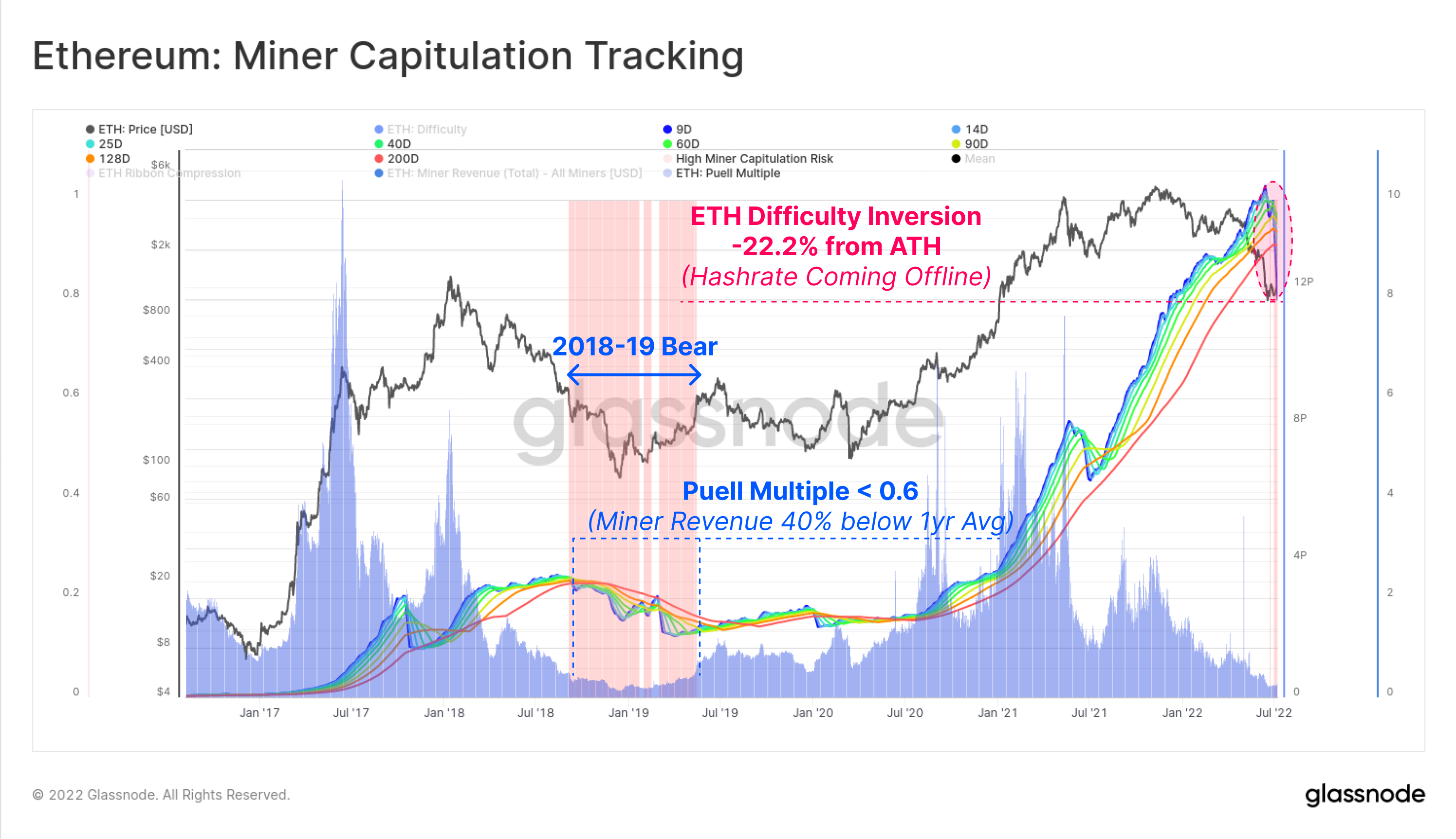

Finally, we can see that Ethereum mining difficulty and hashrate are also experiencing a dramatic decline, dropping by 22.2% from the ATH. The Puell Multiple (blue) has fallen to just 0.3, signalling that aggregate miner revenues are just 30% of the yearly average.

This has created an inversion of the Difficulty Ribbon, and confirms that a significant proportion of miners are under stress, and hashrate is coming offline.

There is one more interesting dynamic affecting Ethereum miners. As the Ethereum community inches ever closer the Merge, the Etheruem blockchain is expected to switch from a Proof-of-Work, to a Proof-of-Stake consensus mechanism. As such, it is likely the market will soon witness a progressive transition, as the predominantly GPU miner cohort, migrate towards either mining other coins, or towards selling their hardware for other applications (gaming, AI etc).

Conclusions

The 2022 bear market has been challenging for all digital asset investors, and has been the source of many structural shifts within the market. The market dominance of USDT has been in decline over the last two years, with a strong shift towards diversity with USDC, and BUSD dominance growing, particularly after the collapse of the LUNA-UST project.

Much of the excess leverage that was accumulated in both on- and off-chain markets has been deleveraged, with the Total Value Locked in DeFi falling by 71.5%. This has added significant downside pressure on the most liquid market leaders, Bitcoin and Ethereum.

As a result, both of the major assets BTC and ETH are down over 75% from ATH, and are trading below their respective Realized Prices. This has been a commonplace in past bear markets, as investors see unrealized profits collapse, and the market trade below their aggregate cost basis. The market has only been in this position since mid-June, and previous bear cycles have taken an average of 180-days before full scale recovery was in effect.

The pressure of low coin prices is greatly affecting the production side, with both Bitcoin and Ethereum miners seeing their operational costs rise, whilst incomes fall significantly. Bitcoin miners still hold some 61.8k BTC on their balance sheets, which remains at risk of (at least partial) distribution to cover their fixed costs. Ethereum miners are also soon to see Proof-of-Work deprecated, as the Merge ports Ethereum over to a Proof-of-Stake consensus mechanism.

All in all, 2022 has thus far been a major resetting of market expectations, a wide ranging de-leveraging, and ideally, the start of a new set of foundations, upon which even taller structures may be built.

- Follow us and reach out on Twitter

- Join our Telegram channel

- Visit Glassnode Forum for long-form discussions and analysis.

- For on-chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on-chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter