Ordinal Theory and the Rise of Bitcoin Inscriptions

Recent weeks have seen an very unexpected trend emerge on the Bitcoin network, being the permanent and immutable inscription of data, directly into the Bitcoin blockchain. Data files that have been inscribed range from images, to audio clips, and even a version of the video game Doom.

This event has inspired a great deal of discussion and debate around the ramifications of this non-monetary application of Bitcoin blockspace. Given the significant surge in interest regarding NFTs on other blockchains over the past 24-months, it can be expected that the emergence of NFT-like collectables on Bitcoin will experience a similar growth trajectory.

In this report, we will explore the fundamental properties of both Ordinal Theory, and Inscriptions, and then analyze how this trend is being expressed within the footprint of Bitcoin on-chain data.

Emergence of Ordinal Theory

The satoshi is the smallest unit of account within the Bitcoin blockchain, equal to 0.00000001 BTC, or one-one-hundred-millionth of a bitcoin. Ordinal theory is a proposed methodology for individually identifying (via a serial number), and tracking each individual satoshi throughout the Bitcoin coin supply. The methodology tracks satoshis as they travel from first minting, through the full lifespan of transactions.

It is important to note that Ordinal Theory is a theoretical concept and methodology overlaid into Bitcoin UTXO set at the social layer. It has no on-chain footprint, and satoshis are not actually serialized at a protocol level.

SegWit and Taproot

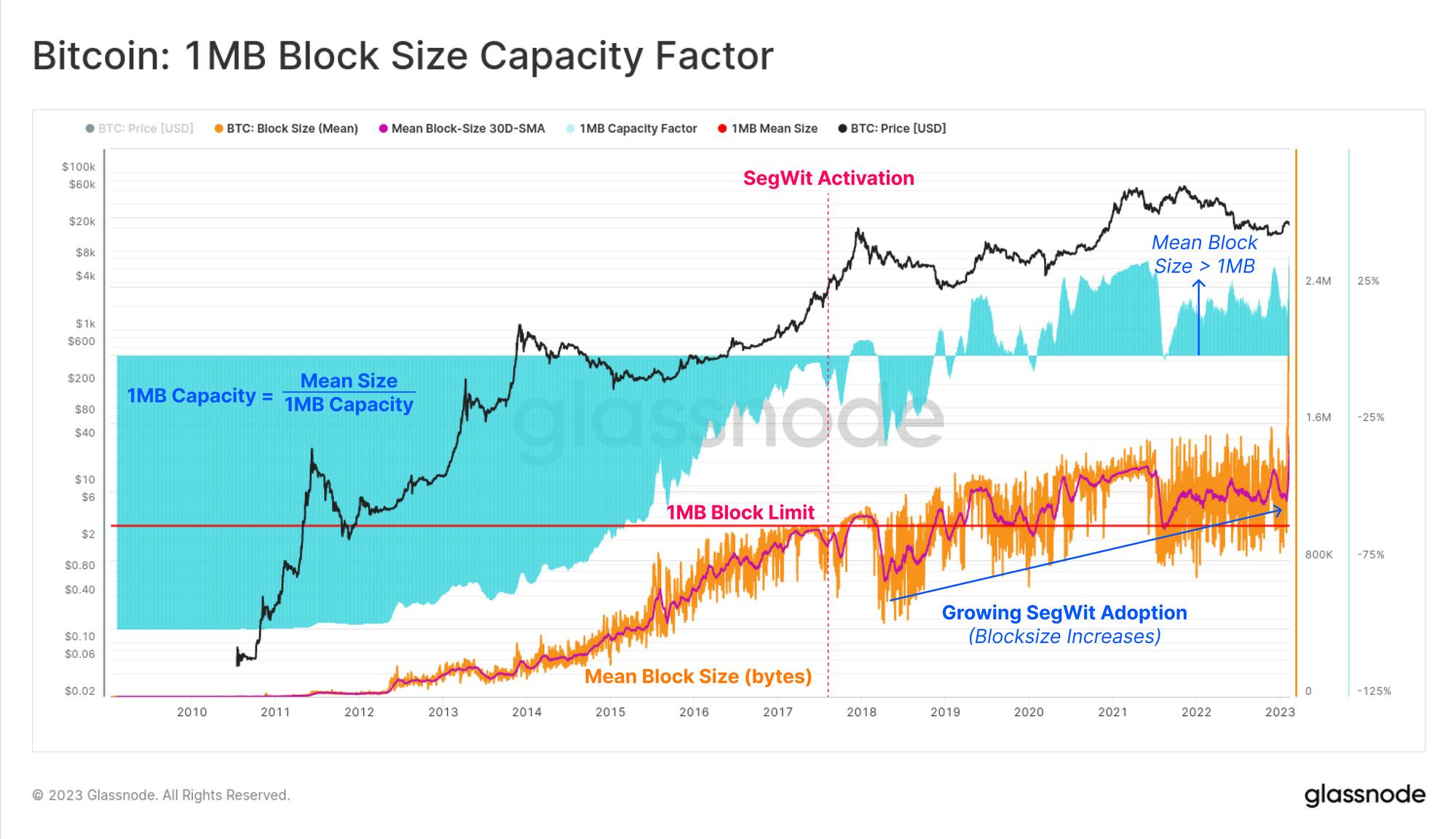

The crescendo of the Bitcoin blocksize debate was the successful implementation of the SegWit upgrade in Aug 2017. Amongst other things, SegWit introduced a split data structure for Bitcoin transactions which acted to both improve transaction data efficiency, and increased the design space for Bitcoin scripts (enabling lightning network for example).

SegWit also established a blocksize measured in terms of Weight Units (wu), where a maximum cap of 4-million weight units (4M wu) per block replaced the prior 1MB max blocksize definition.

The post SegWit Bitcoin transaction data structure has two parts:

- Transaction data containing details of the sender, receiver, inputs, and output. Each vByte of Transaction data counts for 4 wu (four times the weight per vbyte compared to Witness data).

- Witness data containing the cryptographic signatures and scripts. Each vByte of Witness data counts for 1 wu (25% the weight per vbyte compared to Transaction data).

The chart below shows how the average data size of a Bitcoin block surpassed the 1MB ceiling following the SegWit soft fork.

In Nov 2021, the Taproot soft fork was activated, which removed several SegWit era guardrails that had imposed a constraint on the maximum per-transaction witness data footprint. It was this change that was the final piece of the puzzle enabling what we now know to be Inscriptions.

Introducing Inscriptions

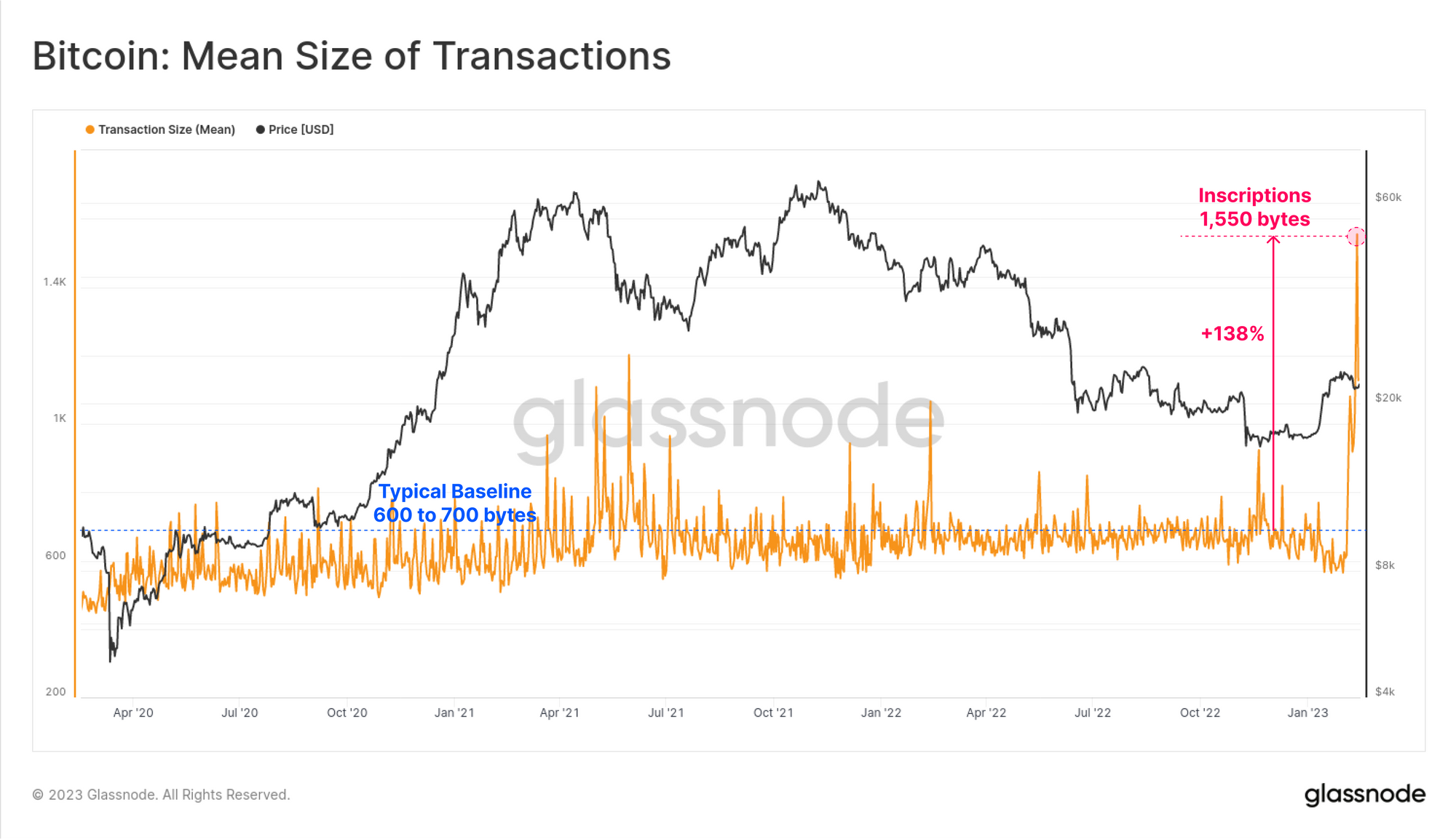

Inscriptions are a new technology which leverages both the discounted Witness data footprint, and the newly unconstrained per-transaction Witness data size. In effect, it is a method to insert arbitrary data such as images, audio files, and even software into the Witness data portion of a transaction. The chart below shows how the average Bitcoin transaction size has increased by 138% in recent weeks, as Inscription transactions with a larger data footprint increase in number.

These Inscriptions are best described as digital artefacts, which differ from NFTs found on other chains. Typically, NFTs found on Ethereum or Solana are a unique token which contains a reference pointer to the target file (such as an image file) hosted elsewhere. Hosting services range from cloud servers, to IPFS, to file-storage blockhains, each with unique counterparty risk trade-offs, and unique to each NFT token. Inscriptions on the other hand actually contain the raw file data, written directly into the Bitcoin blockchain, making them somewhat unique in character.

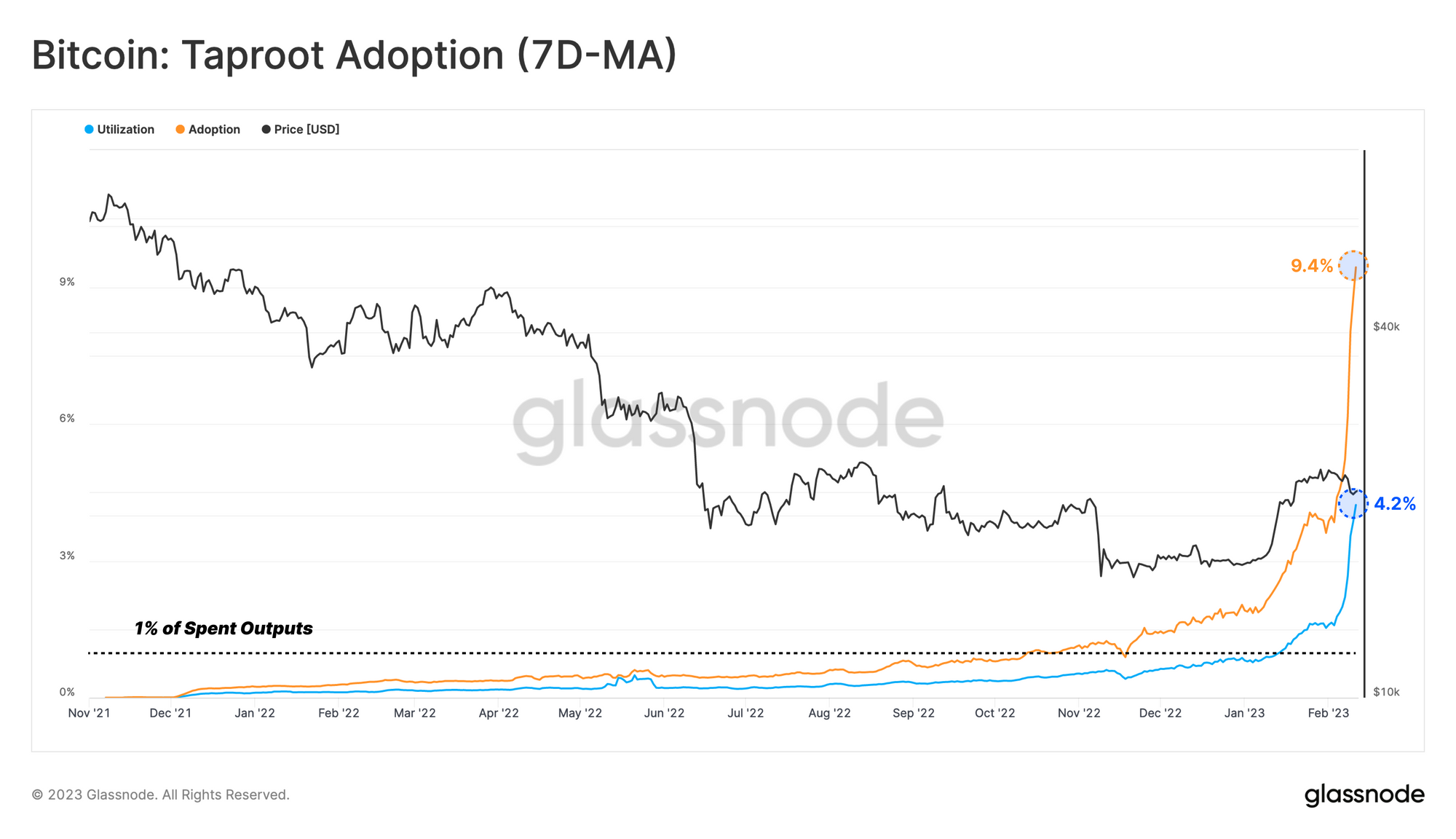

The effect of this new innovation has seen Taproot adoption and utilization spike to all-time-highs of 9.4% and 4.2% respectively (please refer to our research piece for more information on adoption vs utilization).

Social Fungibility vs Protocol Fungibility

Since Ordinals have no on-chain footprint, the protocol level fungibility remains unchanged. However, fungibility at the social layer is altered, with individual sats now having a form of rarity, and a history of inscribed information. Should Ordinal Theory and Inscriptions catch, this effectively alters the perceived value of each satoshi, such that a collector may be willing to pay more than the notional value due to the carried Inscription.

An appropriate analogy here is rare collectable coins. These coins may have a face value of $1.0 (and can be spent as such), but the unique design, minting year, and perhaps previous owner impart a value of more than $1.0, at least for a sub-set of discerning buyers.

The creator of Ordinal Theory and Inscriptions also suggested a notation system to describe the rarity of each Inscription. This is achieved by identifying the position of the sat across four parameters:

- A° - Index of Sat in the Block.

- B’ - Index of the Block in the Difficulty Adjustment Period X/2016

- C’’ - Index of Block in Halving Epoch X/210,000

- D’’’ - Cycle Number

Inscription Excitement

The hype following the mainstream discovery of Inscriptions has been remarkable. The excitement of inscribing digital artefacts into the oldest and most decentralized blockchain has resulted in an explosive increase in transaction counts, congestion in mempools, and climbing average block-sizes.

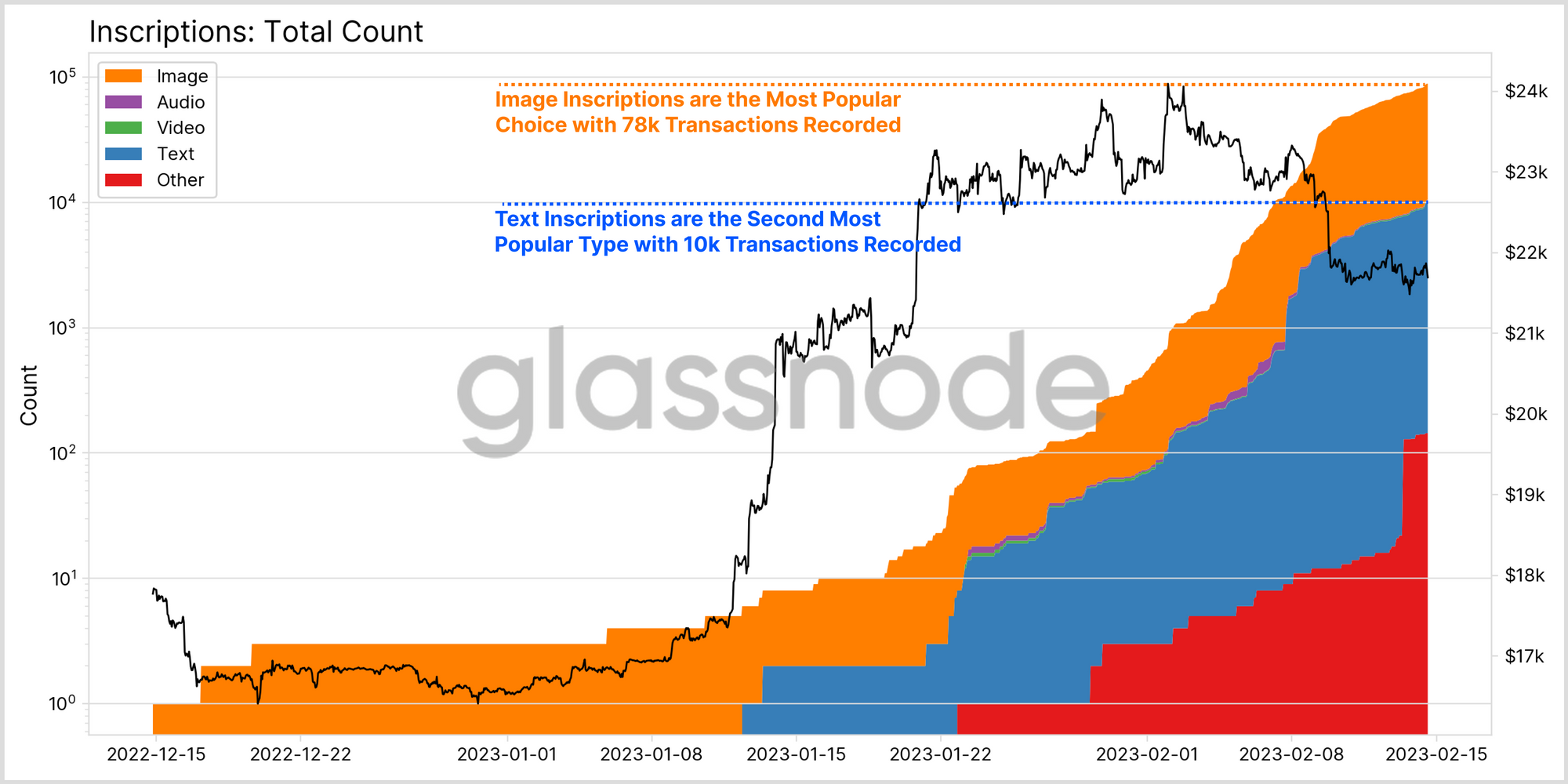

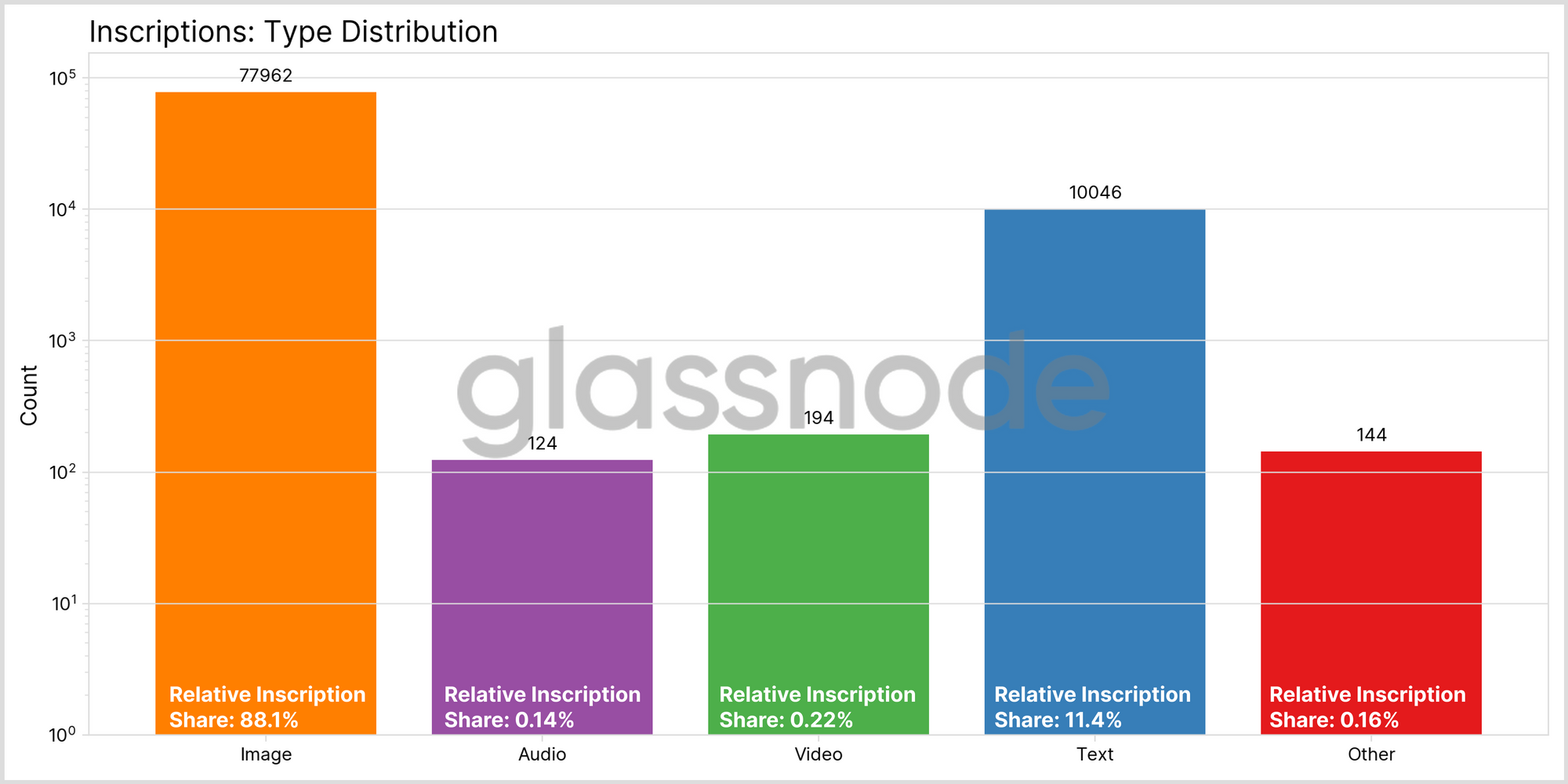

The total number of Inscriptions is above 90k at the time of writing, with the most popular format being image files, with over 78k to date, and text representing over 10k inscriptions (note chart below left hand scale is log).

Breaking down the Transaction Count by its distribution types, images transactions are the most popular, accounting for 88.1% of all Inscription transactions so far. Text files claim the second position, representing 11.4% of all Inscriptions.

When assessing the two most popular Inscription types in combination, their share of the total Inscription Transaction count amounts to 99.5% of all Inscriptions so far.

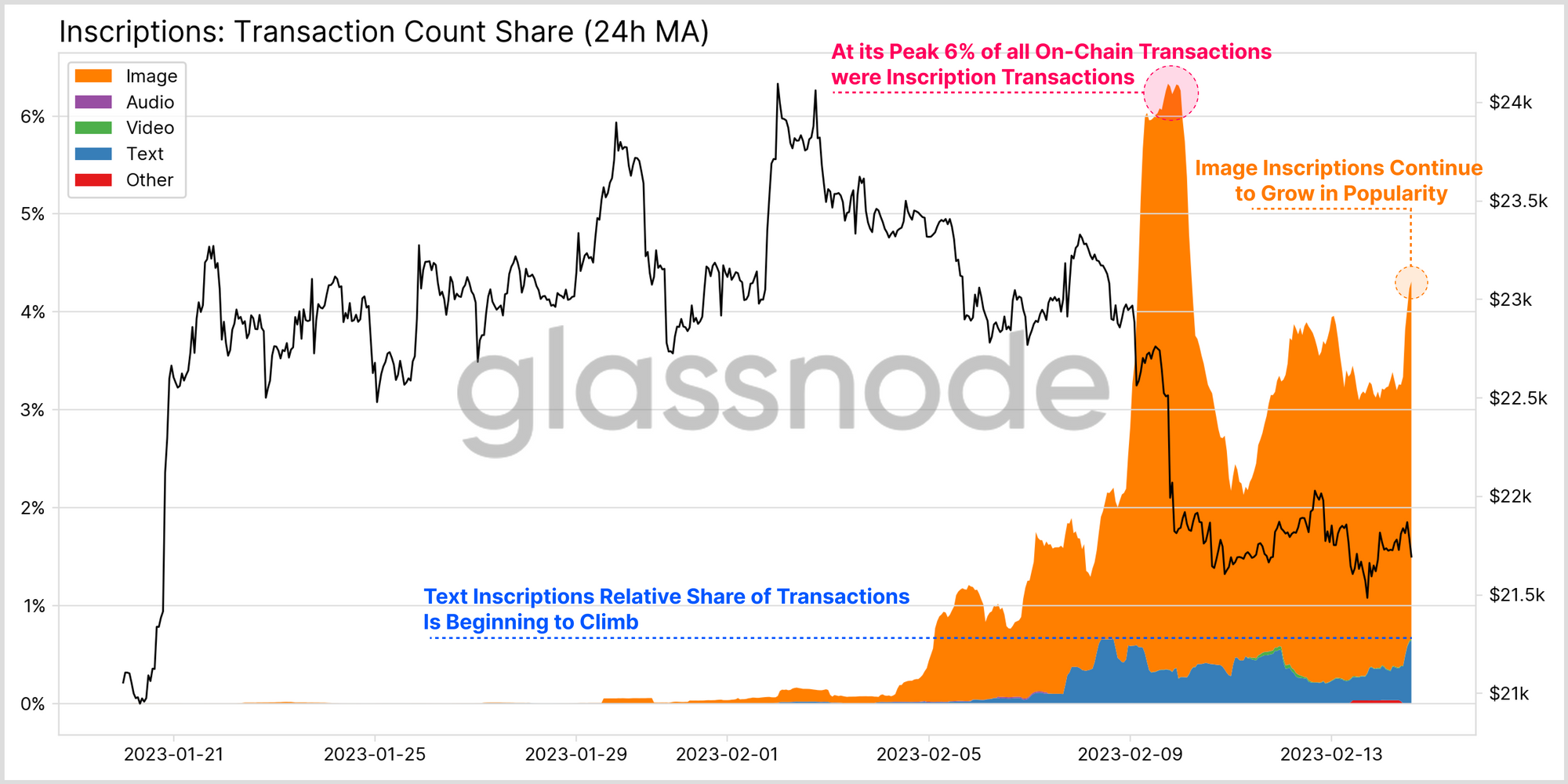

Comparing the count of Inscription transactions as a percentage of all on-chain transactions, an exponential rise is apparent, with Inscriptions now commanding 4.2% of all transactions, down slightly from a peak of 6%.

This is largely dominated by image based Inscriptions whose popularity and dominance continues to rise. Text files are experiencing a steady growth, with text based Inscriptions approaching an ATH dominance of 6.5% of all Inscription transactions.

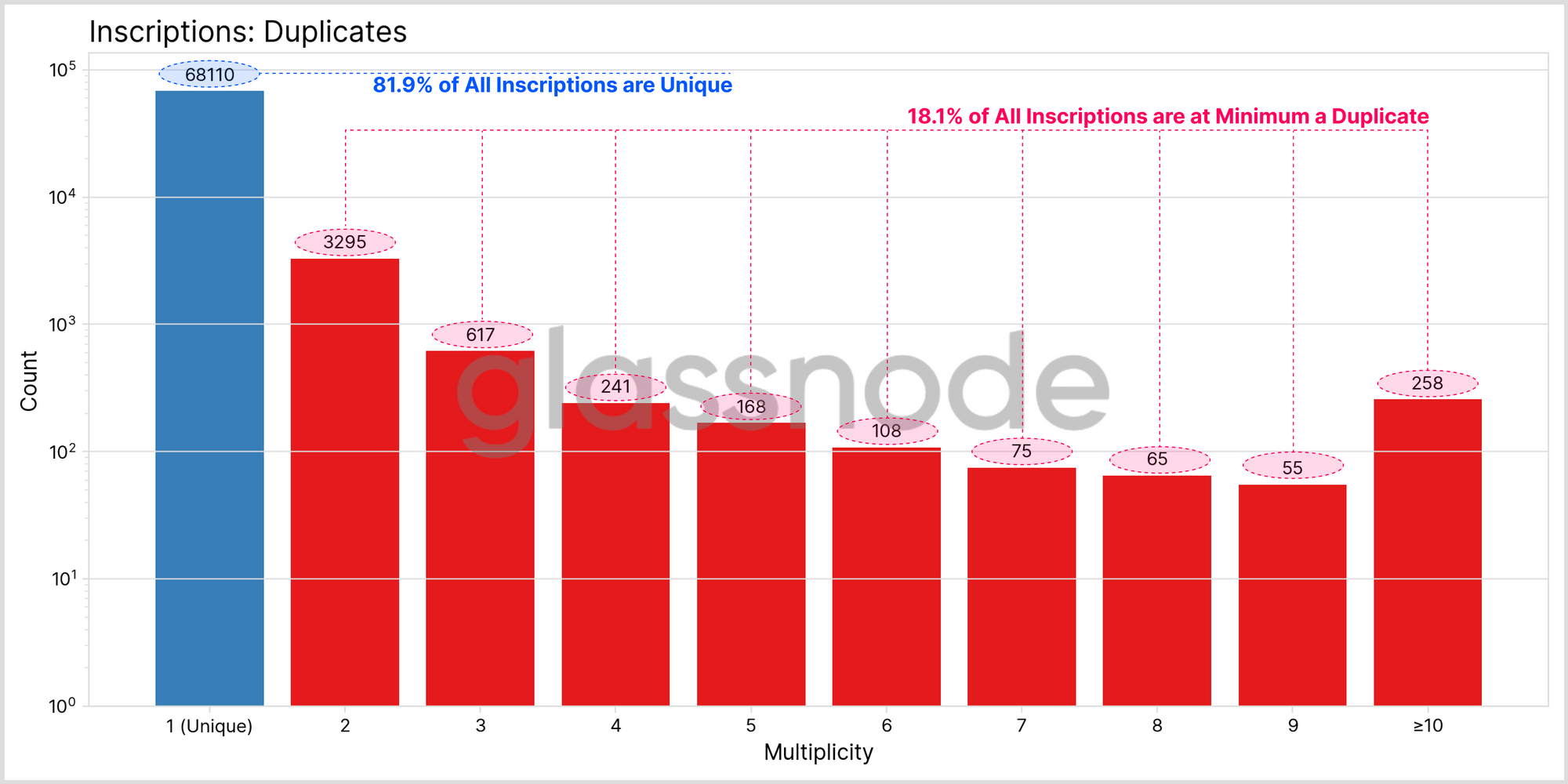

Next, we can analyze the degree of uniqueness amongst Inscriptions by assessing the distribution of duplicated Inscriptions. Currently 68,110 (81.9%) of all recorded inscriptions remain unique with ~15,103 (18.1%) being at minimum, a duplicate.

Assessing the Inscription Impact on Blocksize

One of the more prominent debate topics related to Inscriptions is the longer-term impact on both the total data size of the Bitcoin blockchain, mined block propagation by miners, and impacts on full node sync. Inscriptions, should this trend persist, effectively accelerates the Bitcoin blockhain towards a state of consistently near-full blocks.

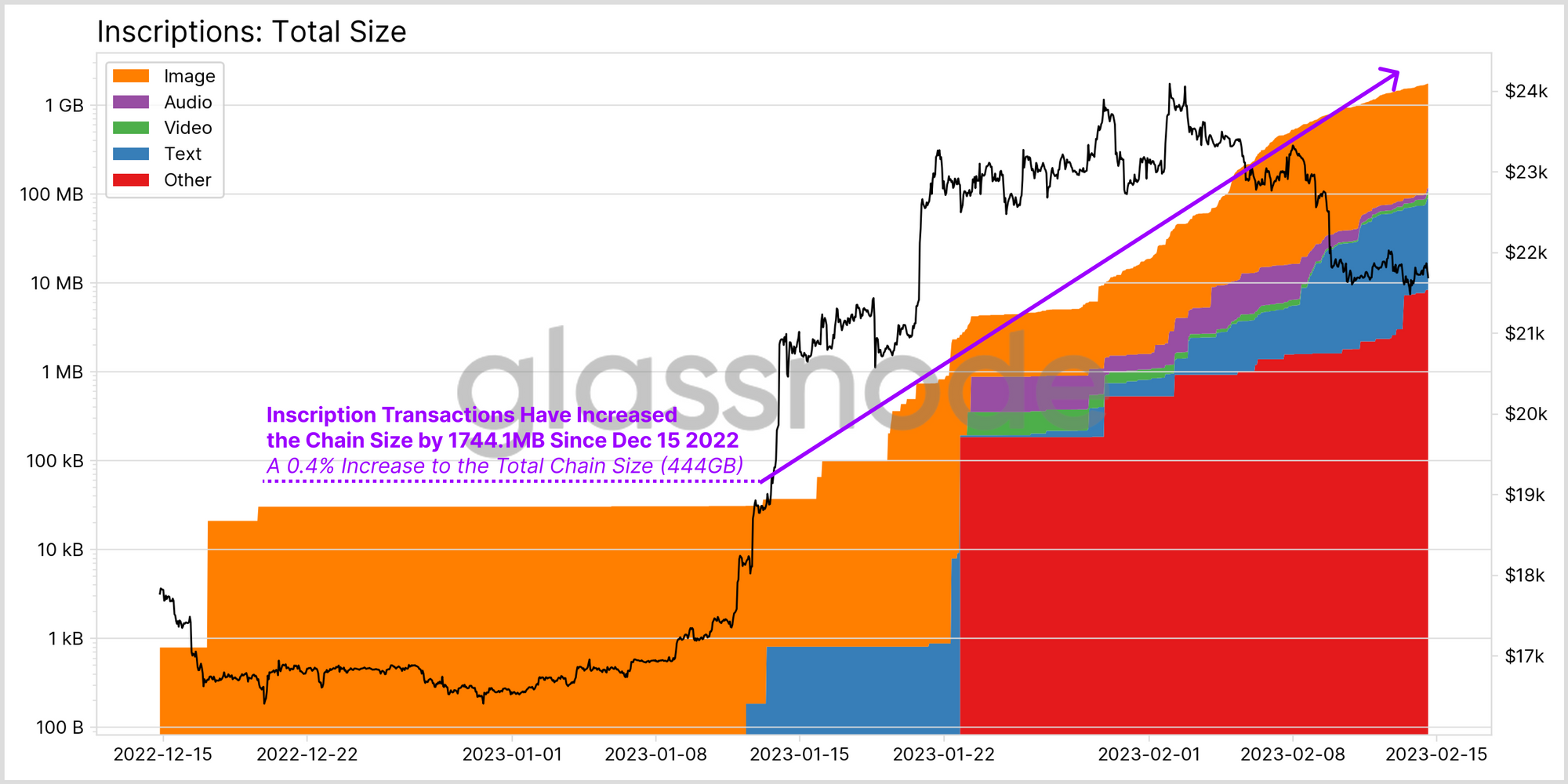

Since Dec 15 2022, all Inscription transactions have increased the chain size by 1.74GB, an increase of 0.4% in relation to the all-time chain size (444GB) at that time.

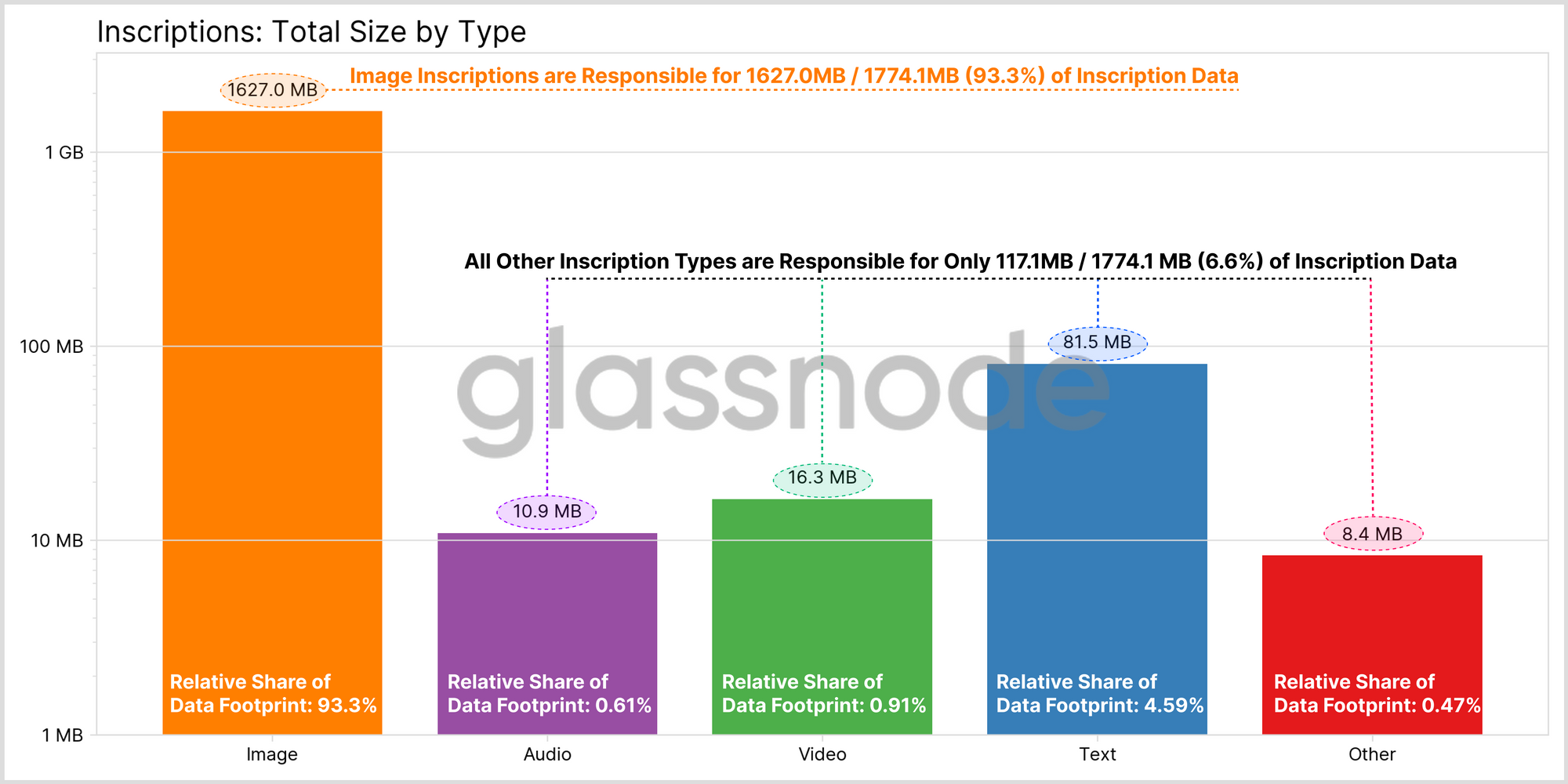

Consistent with the popularity of the Inscription images, the majority of the chain increases can be attributed to image Inscriptions, responsible for 93.3% of all Inscription data whilst Text Inscriptions account for a much smaller relative data footprint of 4.59%.

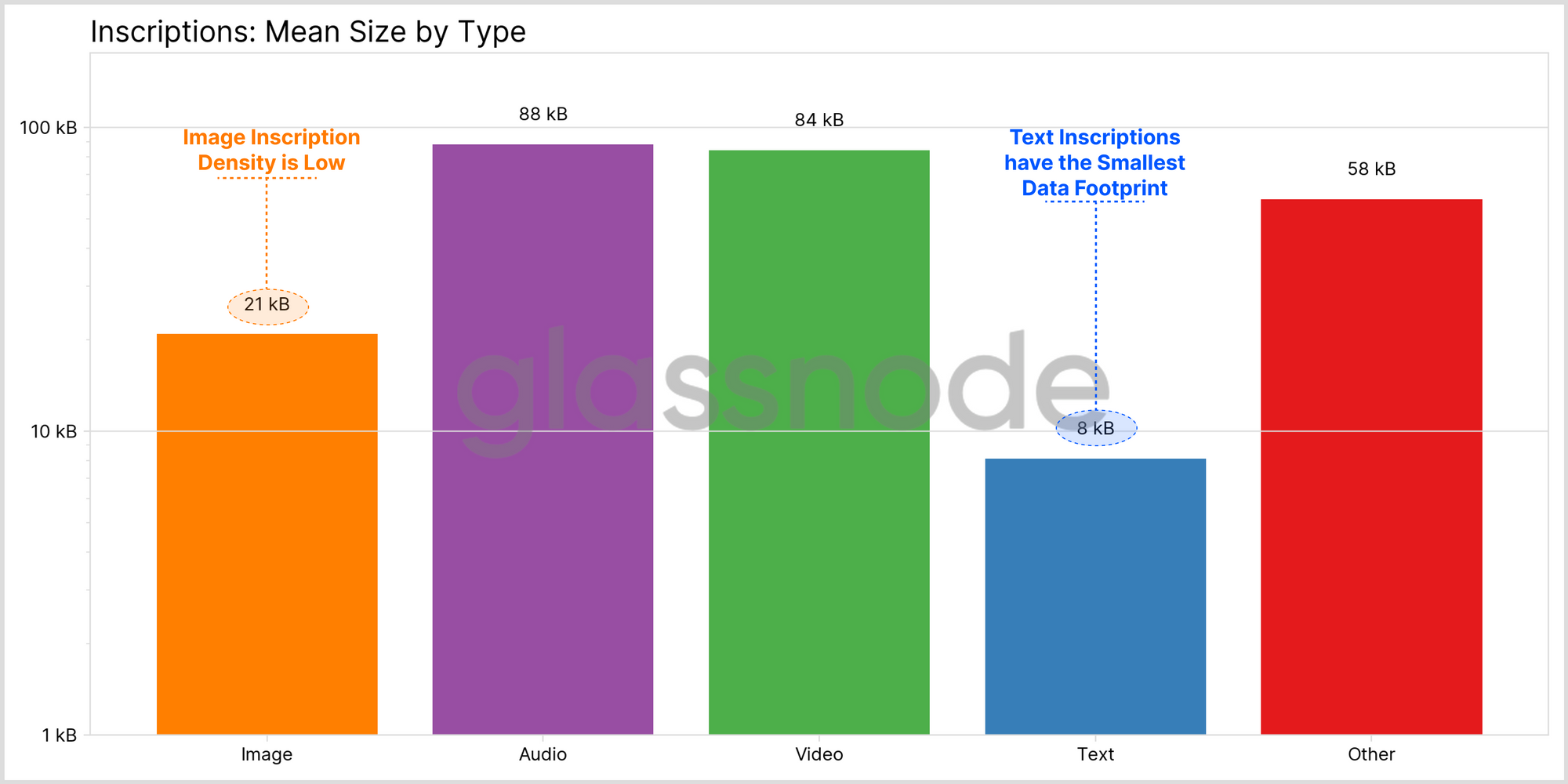

When assessing the mean size of an inscription transaction, image type data density remains low, with each transaction increasing the chain size by 21kB. Similarly, Text Inscriptions have considerably the lightest data footprint with the average transaction 8kB in size.

Despite a negligible presence across the total Inscription footprint, the Audio, Video and Other Inscription types are on average considerably larger per transaction than their counterparts.

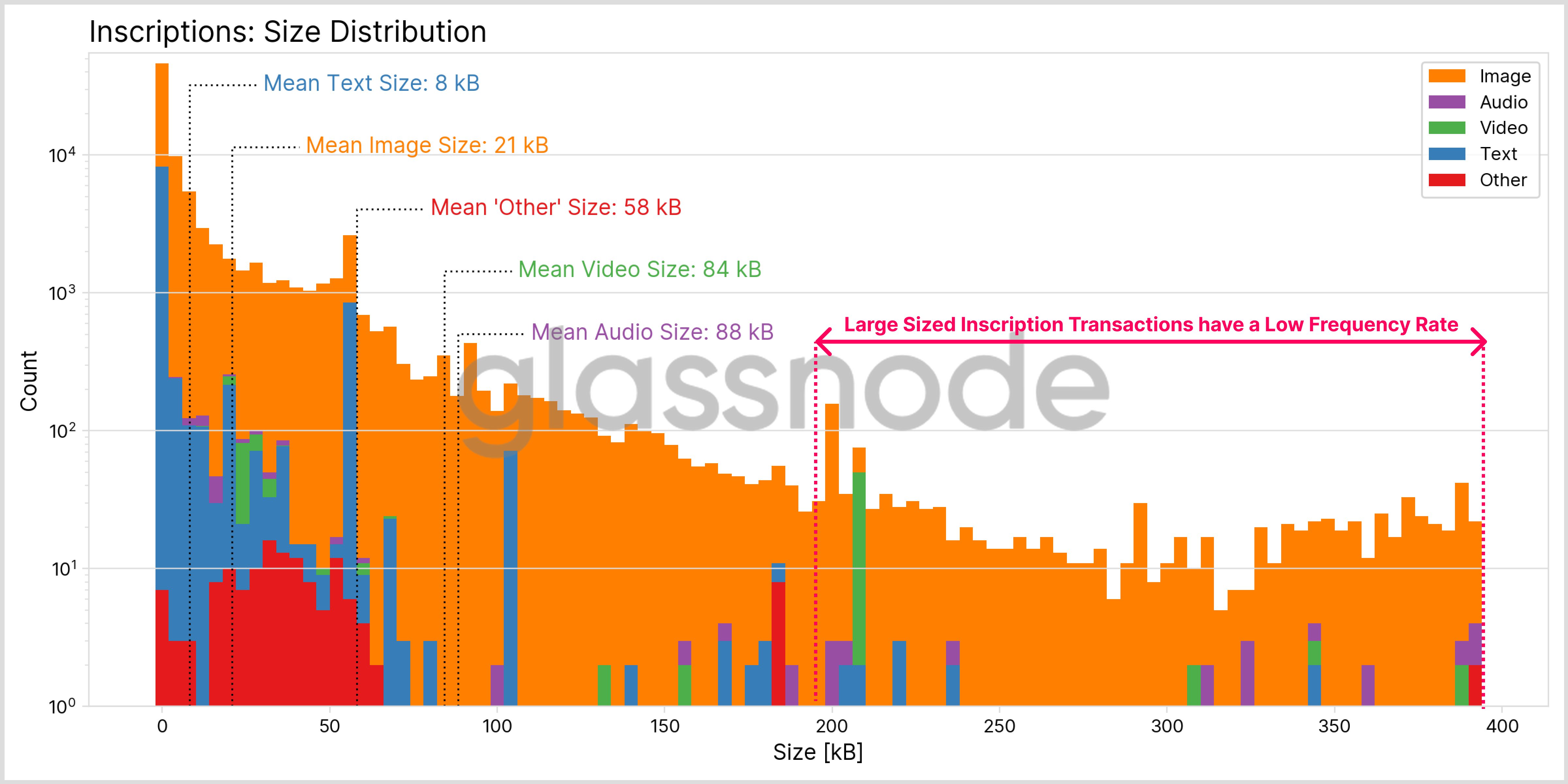

Observing the count of Inscription transactions by size distribution, we note that large sized Inscription transactions have a significantly lower frequency, orders of magnitude lower than smaller sized transactions.

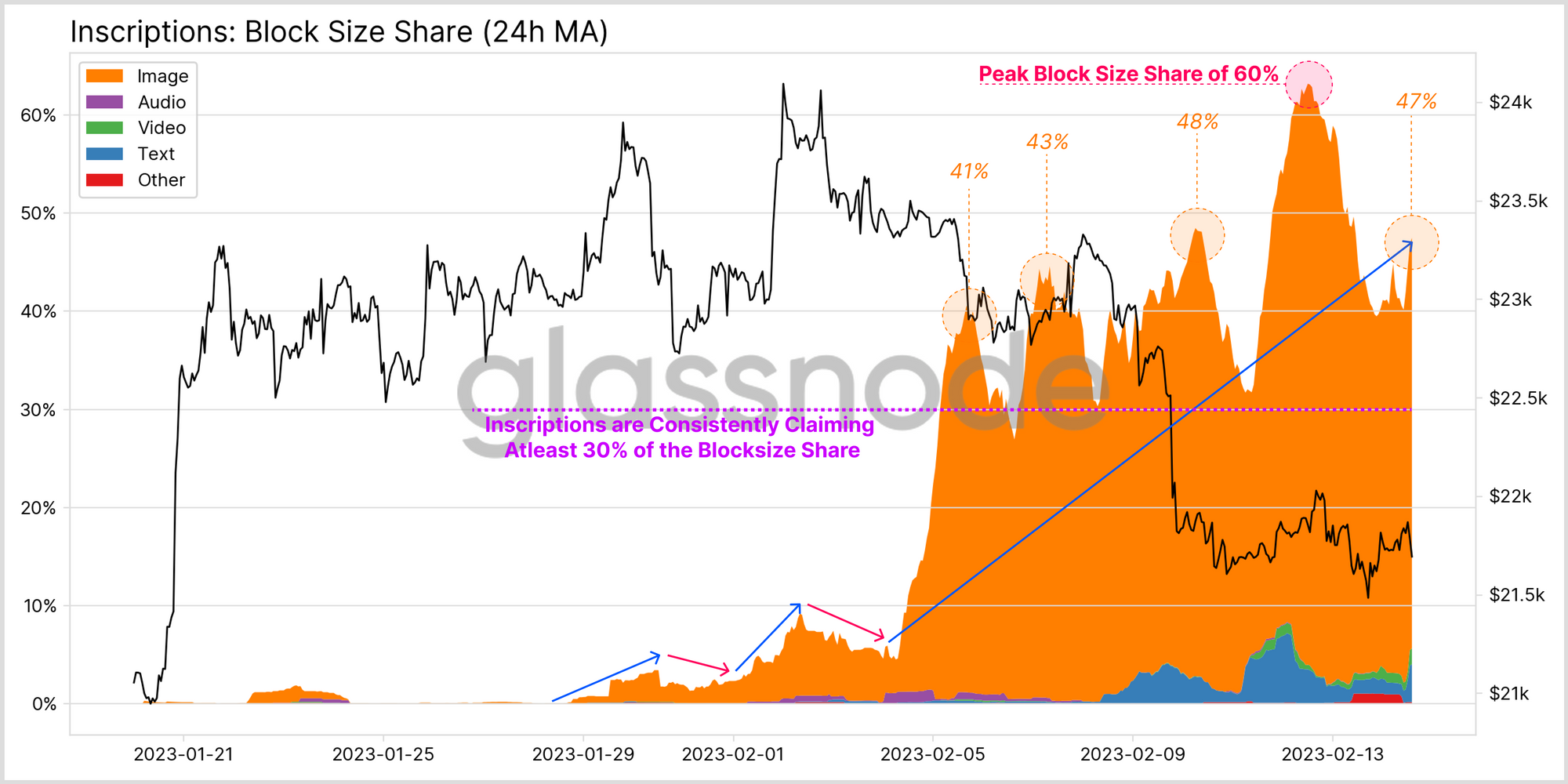

A ravenous rise in the percentage of blockspace consumed by Inscription transactions occurred throughout the month of February, filling 47% of all available Blockspace, and recording a peak of 60%.

When considering the fact that Inscriptions account for 4.2% of all on-chain transactions, yet consume over 47% of used blockspace, it is evident that Inscription are an incredibly data dense class of transactions.

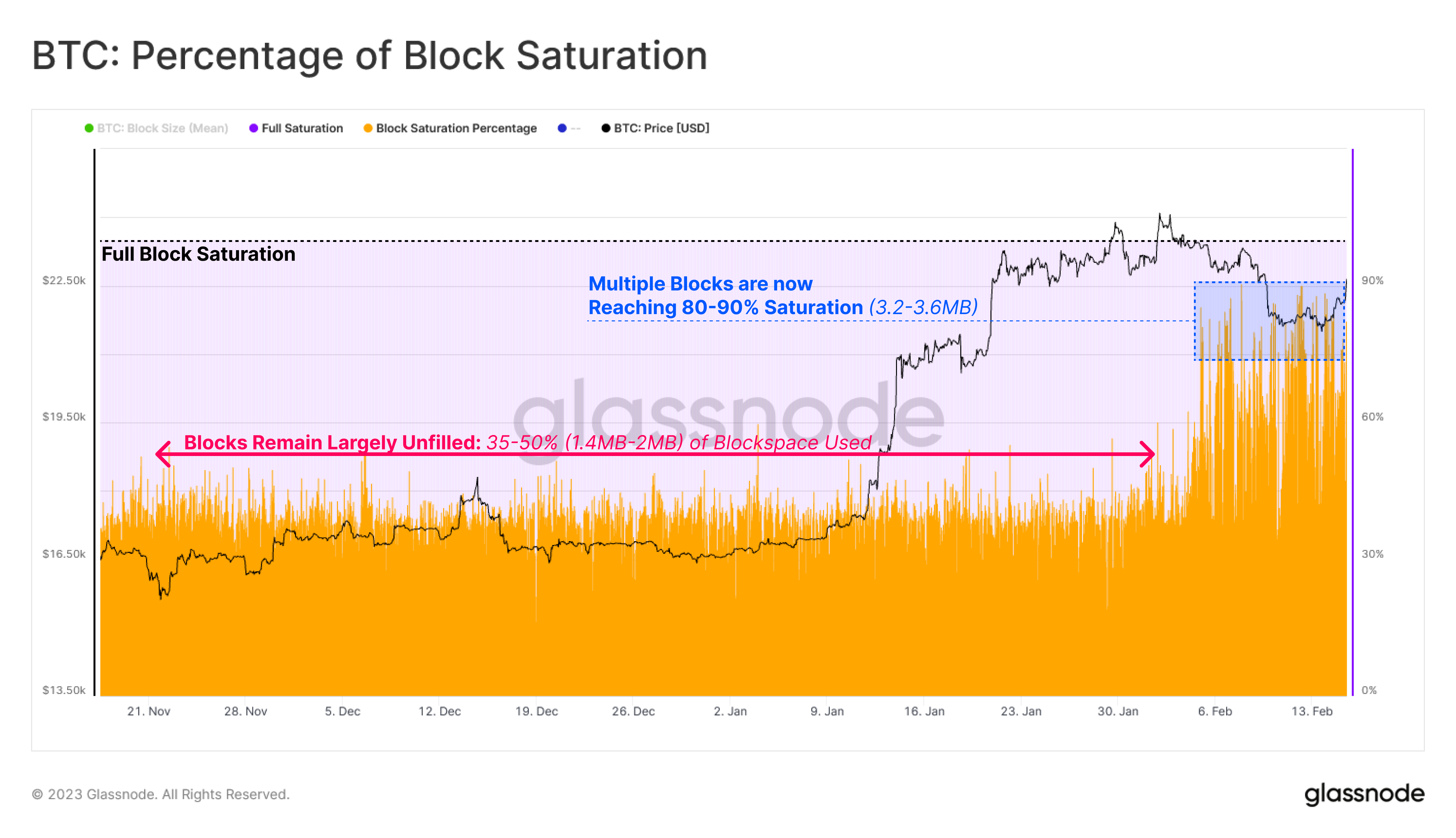

However, in the preceding months prior to this Inscription mania, we note that blocks remained largely unfilled, with only 25-50% of available blockspace used.

This changed dramatically since the emergence of Inscriptions, with blocks now commonly reaching between 80-90% saturation (3.2-3.6MB). Since blockspace cannot be stored for future availability, one could consider Inscriptions as a consumer of blockspace that would have otherwise finalized empty.

Modelling the Impact on Blockchain Size

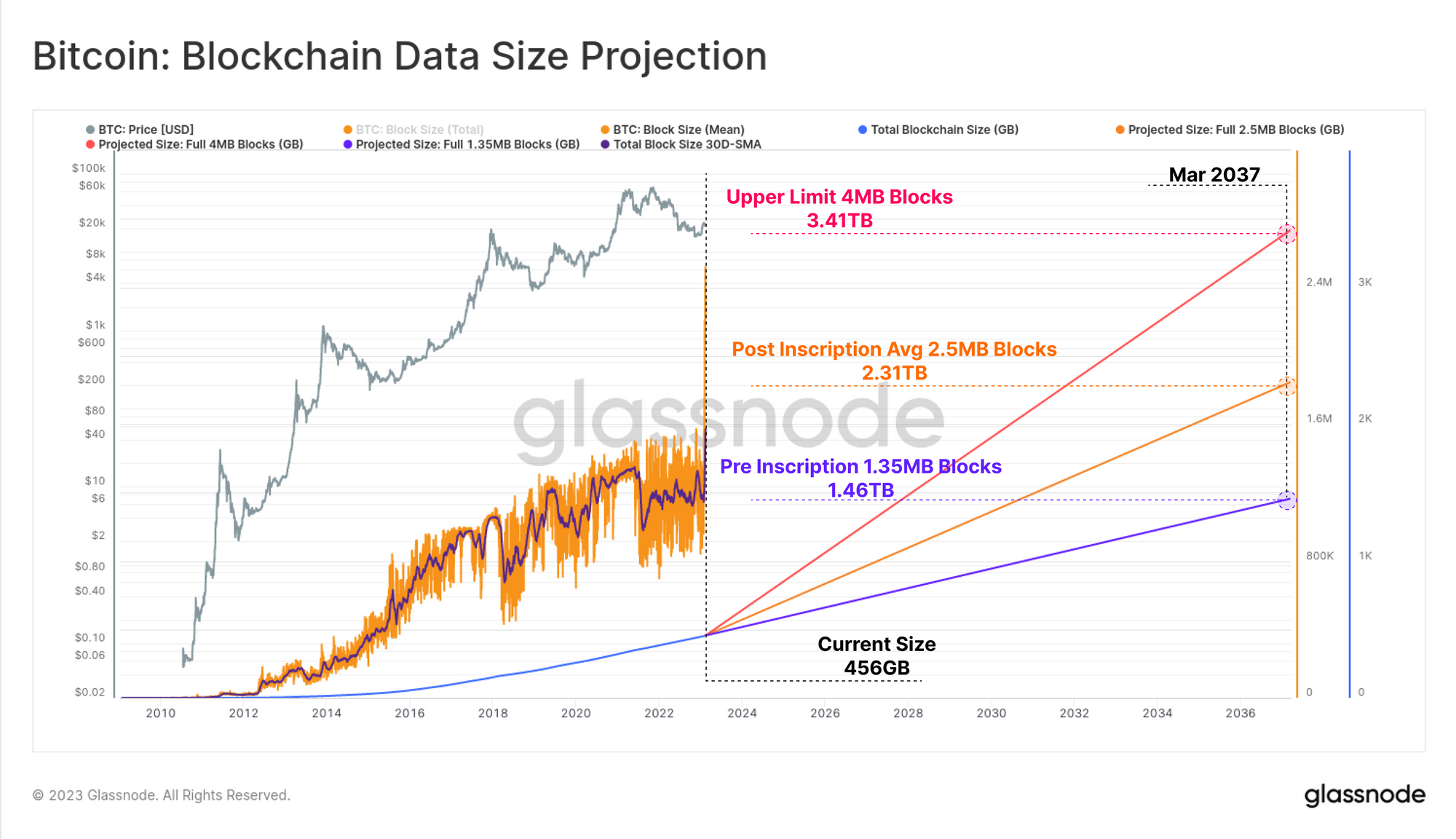

One of the discussion points around Inscriptions is the impact of a heavier data footprint over the long term with respect to full node sync/validation times, and data storage requirements. On this latter point, we can project an additional 14-yrs of Bitcoin history under the following average blocksize assumptions:

- 🟣 Full 1.35MB blocks, simulating the peak pre-Inscription 30-day average blocksize.

- 🟠 Full 2.50MB blocks, simulating the peak post-Inscription average block size.

- 🔴 Full 4.00MB blocks, simulating the theoretical upper bound average blocksize.

If we assume a constant present day cost of data storage of around $0.035/GB for hard drives, this puts the upper bound hard drive cost at around $120 in 2037. This remains well within commodity hardware territory, and ignores all effects of technology deflation over time.

Inscriptions and the Fee Market

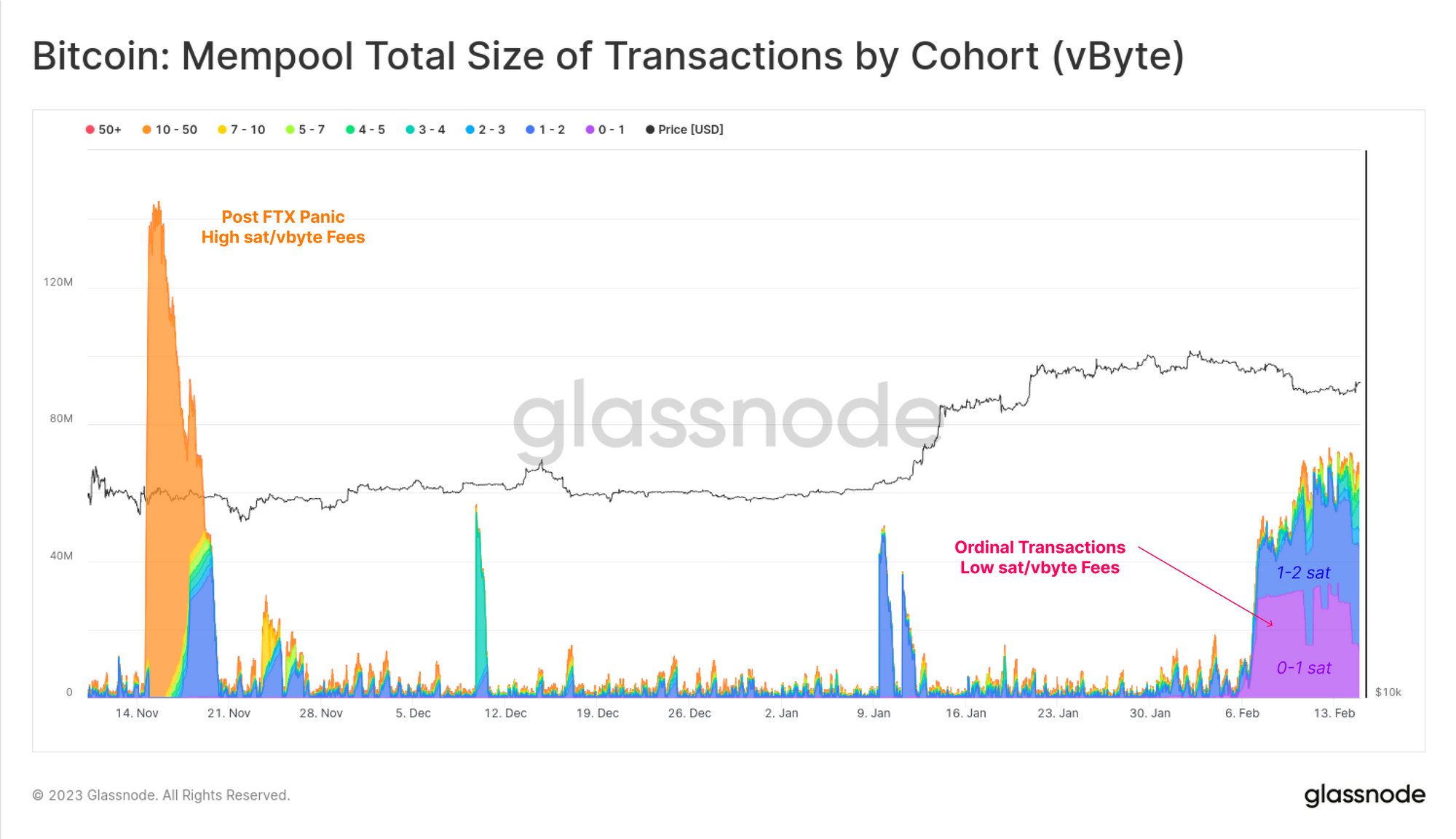

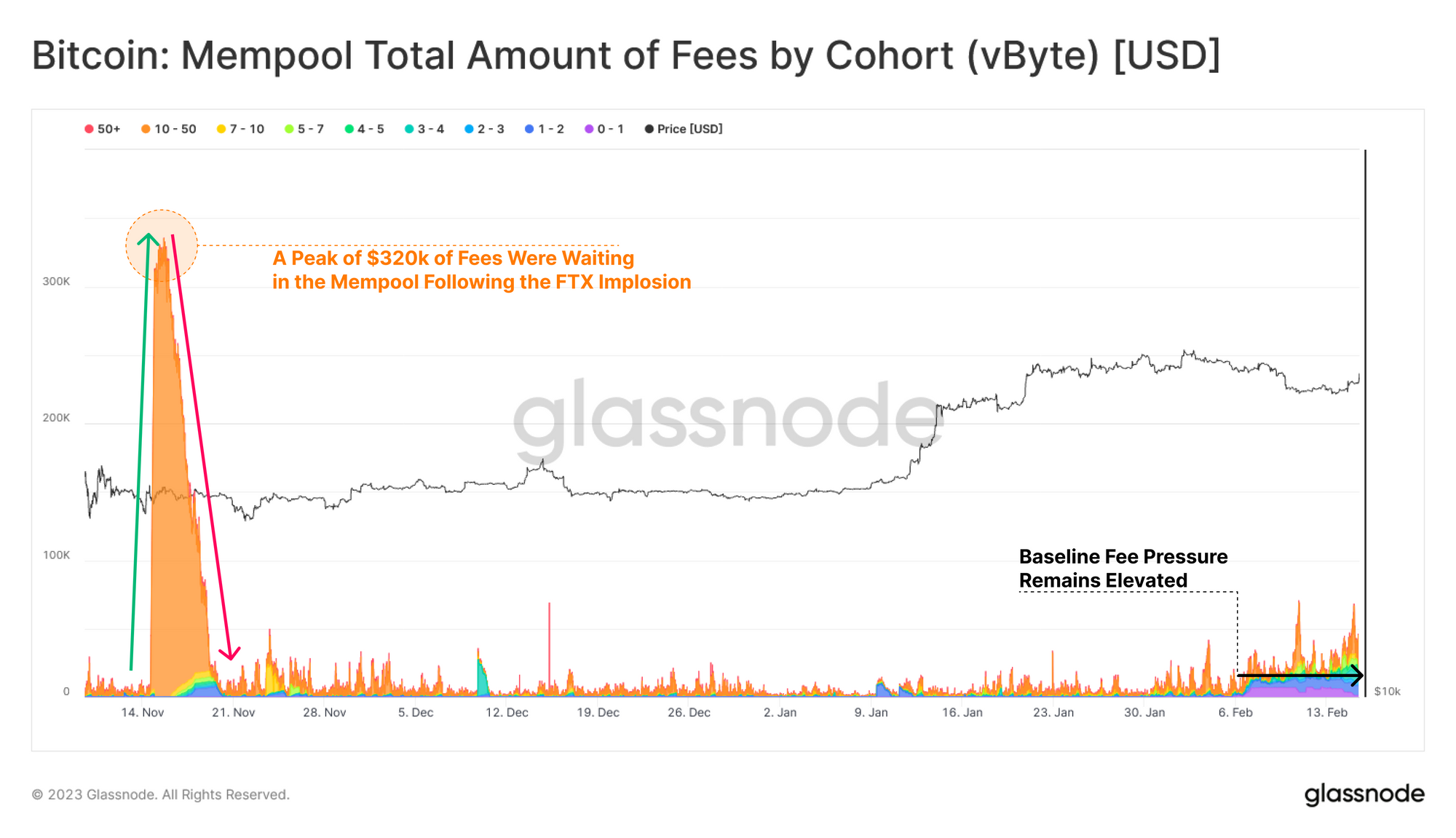

Inscriptions have also had a dramatic effect on Mempool congestion, with our Mempool being filled with many such transactions paying very low fee-rates, typically 1-2 sat/vByte.

A consistent level of demand has been sustained over recent weeks, with the number of low fee paying transactions remaining elevated, and higher fee transactions are regularly mined into blocks.

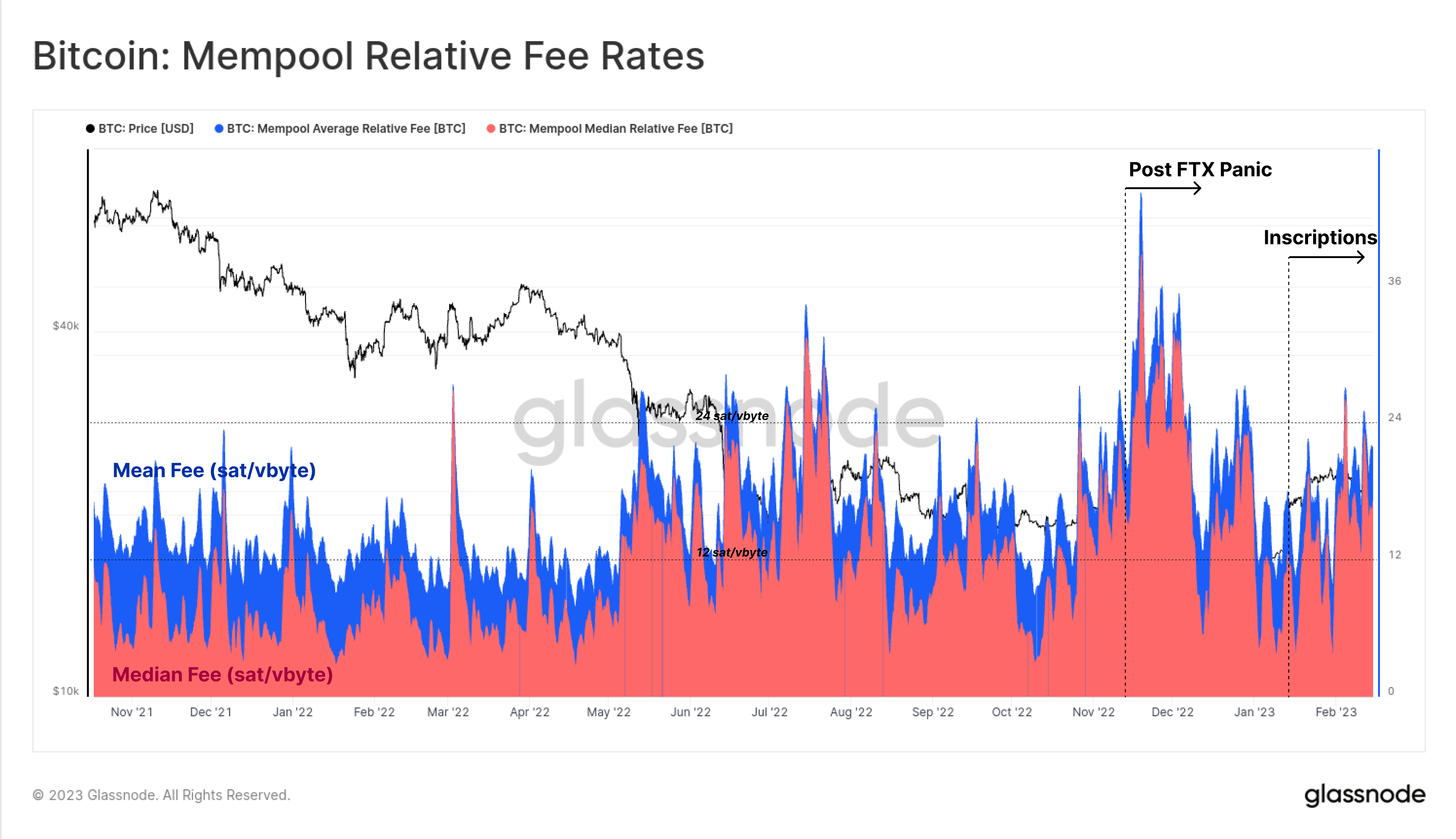

This can be compared to the post-FTX panic, where the mempool was filled with high urgency, high fee rate monetary class transactions. For Mean and Median fee rates paid, Inscriptions have created a net increase in the sat/vbyte fee rate, however much less than the post-FTX panic, and still well within the range over the last 12-months.

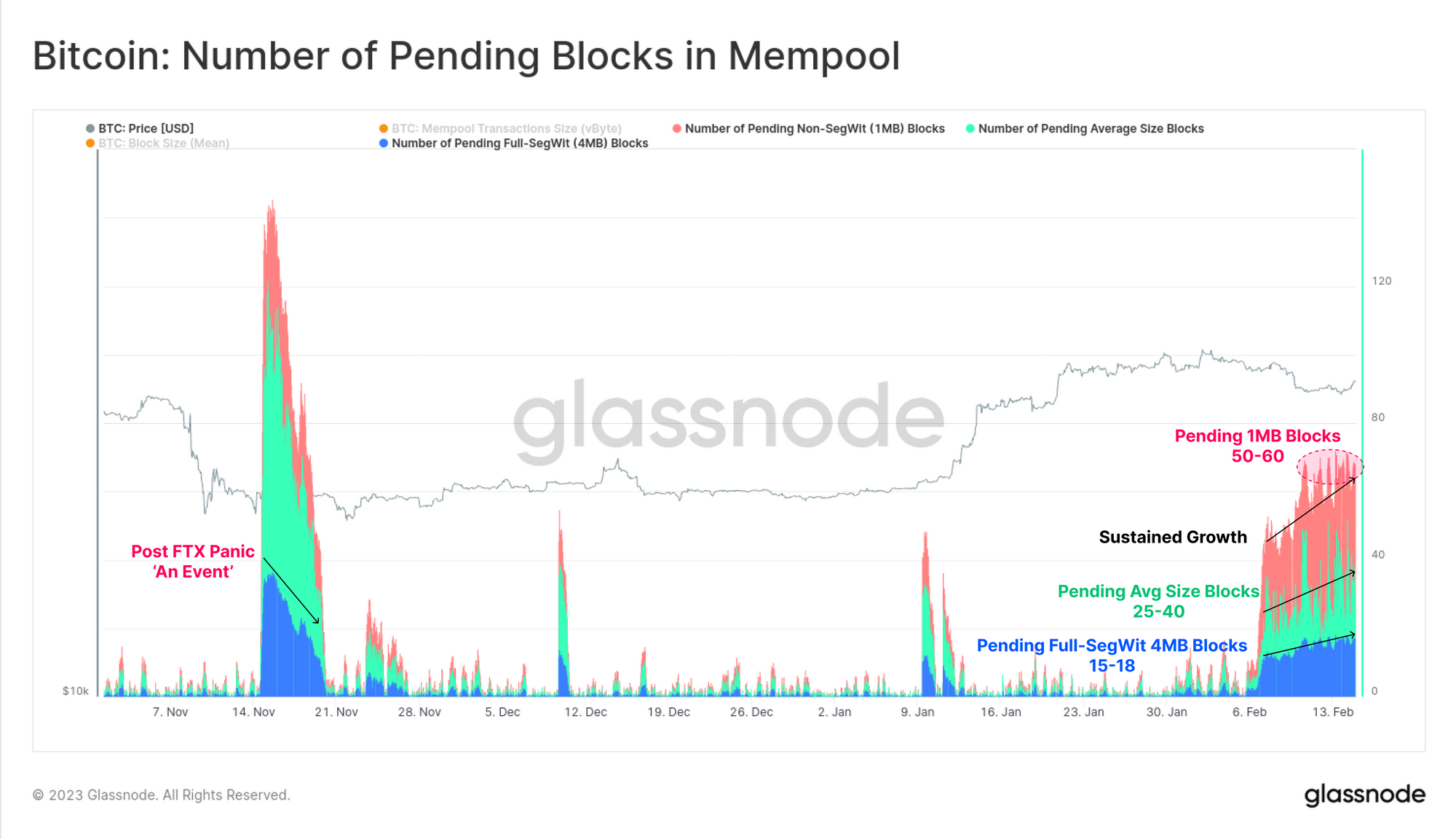

We can also model out the number of pending blocks required to clear the mempool assuming standard 1MB non-SegWit transactions 🔴, full Seg-Wit 4MB blocks 🔵, and using the average hourly blocksize 🟢. A significant difference is noted relative to the post-FTX period, where a large influx of transactions decayed quickly as the panic settled, and transactions were processed.

For Inscriptions, we can actually see gradually growing demand for blockspace, with a sustained growth in the number of pending block required to clear the mempool.

Despite congestion in the mempool, the total value of current fees waiting in the mempool pales in comparison when compared to the FTX implosion. At that time, the source of the majority of fee pressure was emanating from 10 to 50 sat/vByte transactions, most likely due to panic sellers depositing coins at exchanges, margin calls, and exchange withdrawals to self-custody.

The FTX backlog was resolved within a week, whilst Inscriptions have lifted the baseline fee pressure from 1 to around 4 sat/vByte throughout February.

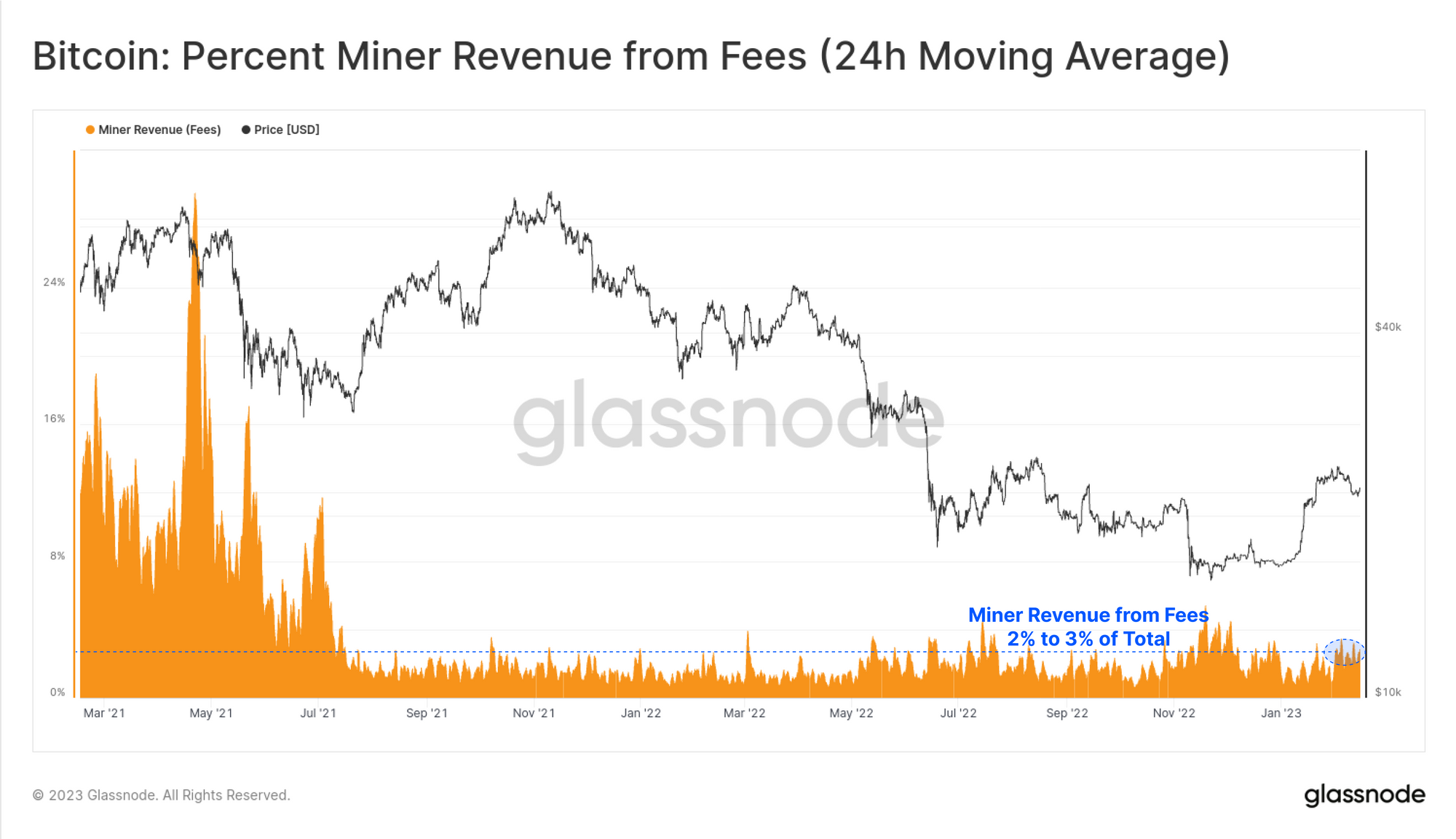

Indeed, the proportion of the total revenue sourced from fees for miners is hovering between 2% and 3%, a far cry from the 8%+ seen prior to the May 2021 sell-off.

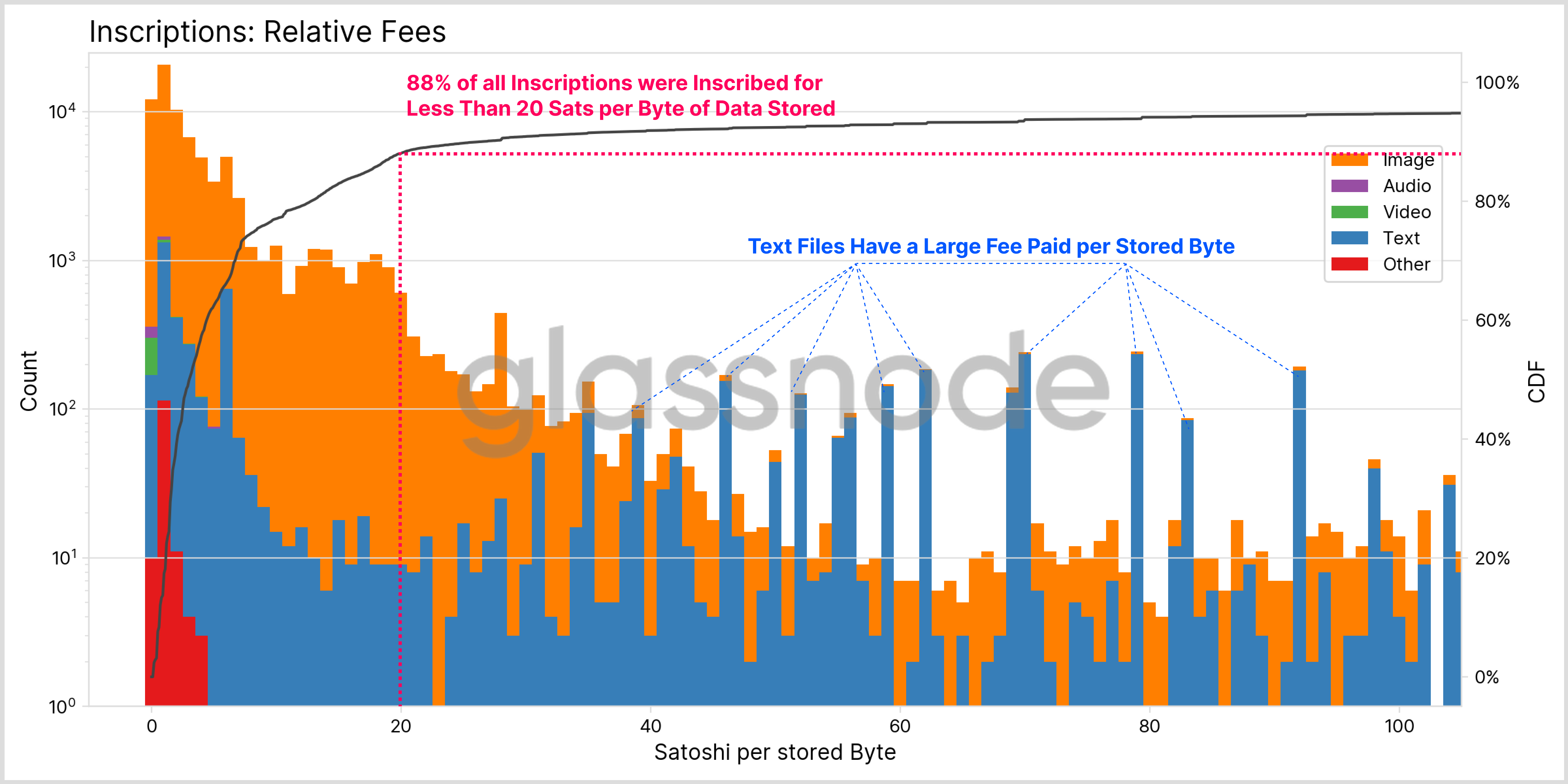

We can also analyze the fee rate paid per byte stored, as a measure of fee-per-byte storage efficiency. The fee paid for 88% of all Inscriptions was less than 20 sats/Byte of data stored. Image inscriptions are on average opting to pay relatively low fee rates, whilst Text inscriptions display a larger degree of variation and are willing to generally pay higher fee rate.

The key observation here is that creators of Inscriptions appear to be sensitive to the absolute value of the fee paid, with the larger data footprint of image files requiring a larger BTC denominated fee even at lower fee rates.

This gives weight to the argument that Inscription volumes are likely to be somewhat self-regulating in response to the economics of a fee market. Unlike classic NFTs where a single transaction can mint the entire set, each Inscription must be created individually, making them relatively expensive to mint.

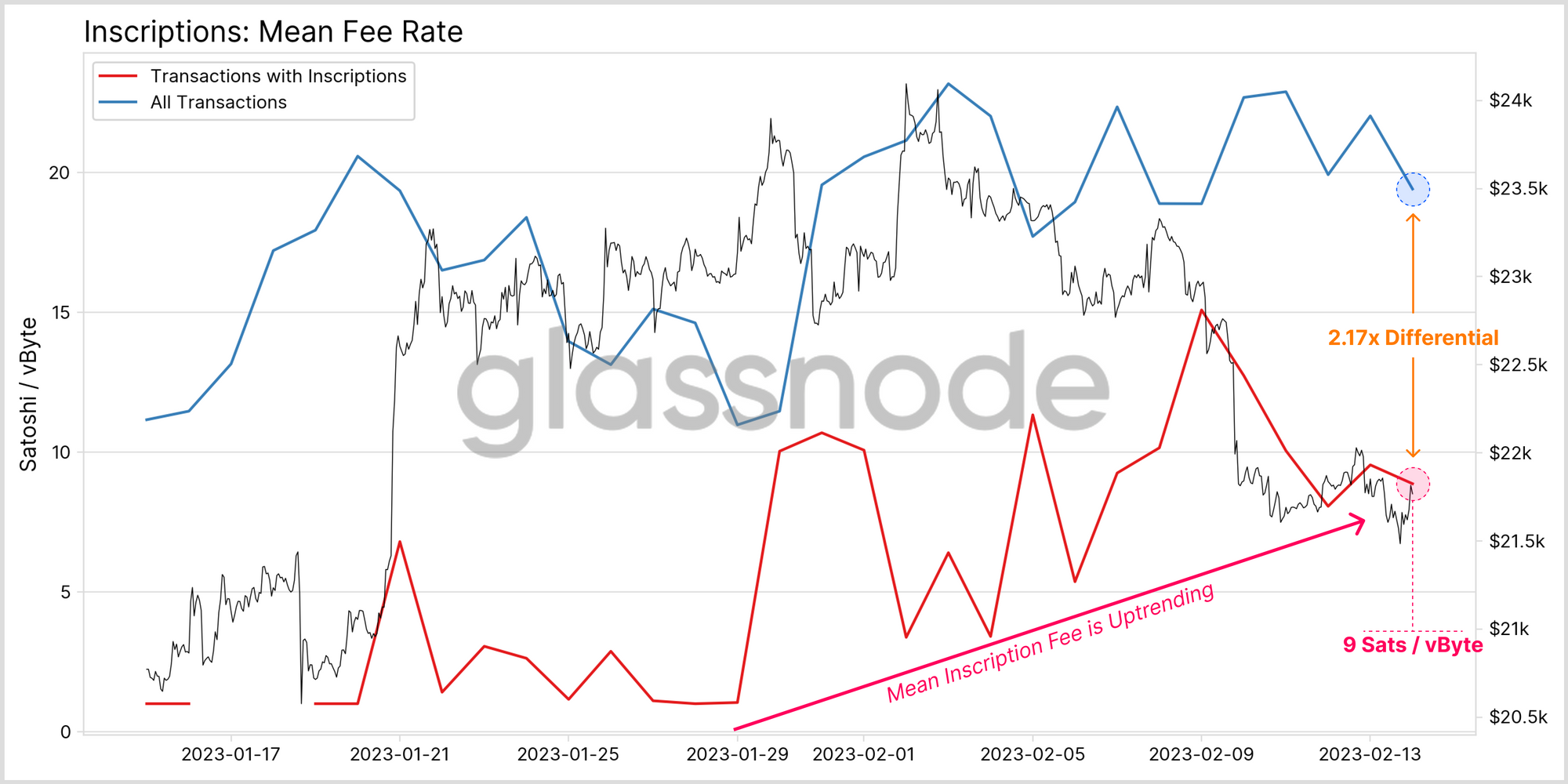

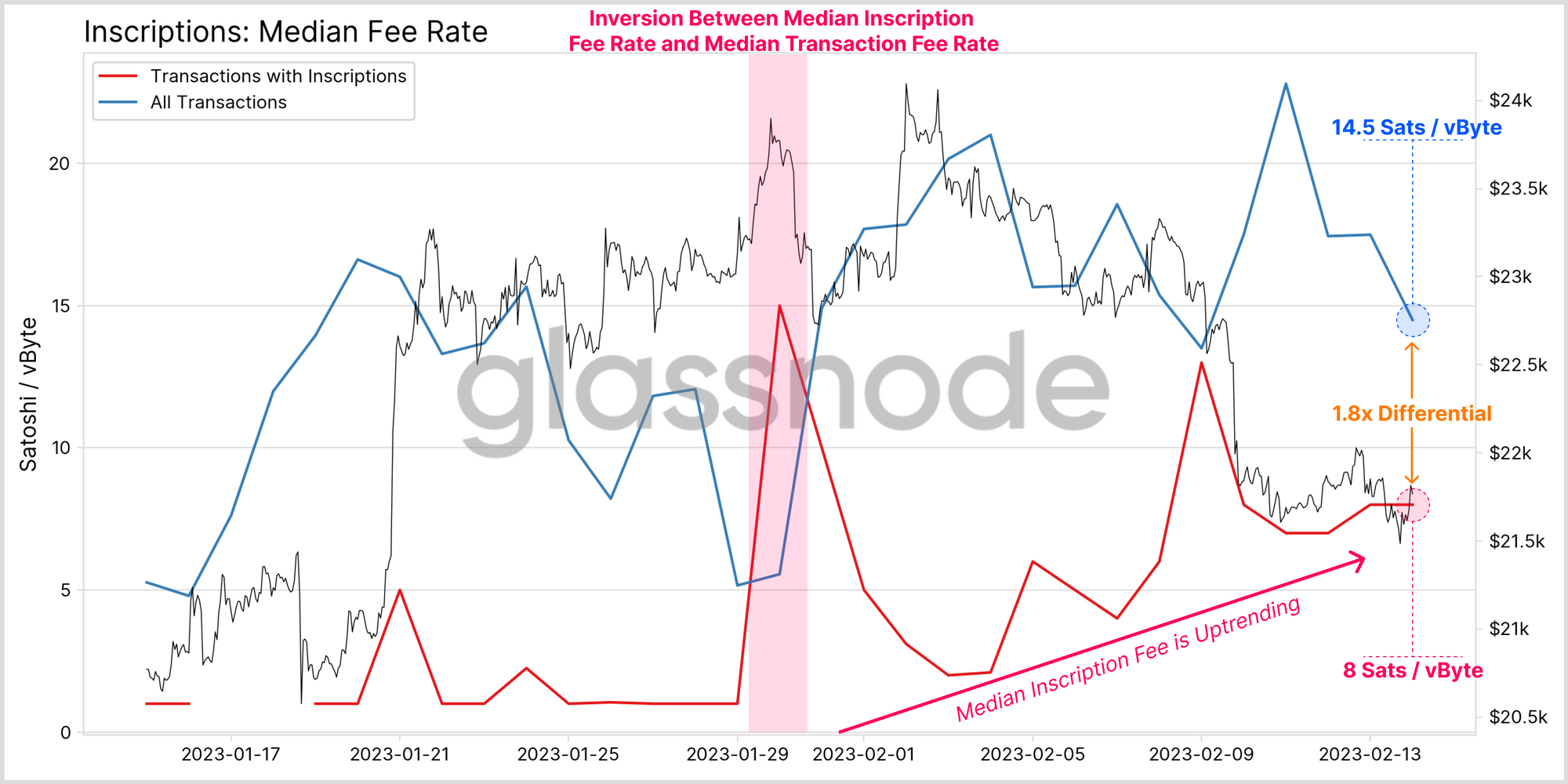

Finally, we can compare the mean transaction fee rate paid by Inscription transactions. An uptrend in the mean inscription fee 🔴 can be seen throughout February, peaking at a rate of 15 sats/vByte. Currently, the average transaction (monetary and Inscriptions) are 2.17x more expensive than their Inscription-only counter part.

Similarly, the median fee rate for Inscriptions is also climbing, reaching 8 sats/vbyte. However, unlike the average fee paid, the median Inscription fee rate is much closer to the median all-type transaction. In late January, the median Inscription actually payed a higher fee rate than monetary transactions, suggesting that the earliest Inscription adopters rushed in, likely seeking to catch a low sub-10k Inscription number.

Thus far, Inscriptions have effectively acted to lift the lowest priority ‘fee floor’ from 1sat/vbyte to between 4 and 8sat/vbyte. However, there is as yet limited evidence of ‘crowding out’ effect with respect to monetary transactions. Due to their larger data footprint, and thus larger absolute fee payed by Inscriptions, these transactions have imposed a slight uplift pressure on the lowest fee band, but not yet an excessive pressure on higher urgency, higher fee rate monetary transactions.

Summary and Conclusions

Ordinals and Inscriptions are a most unexpected event in Bitcoin history, but have resulted in a new, and likely longstanding demand for Bitcoin blockspace. Given the explosive emergence of NFTs on Ethereum and other chains throughout 2021-22, it is reasonable to expect that Inscriptions made on the oldest, and largest blockchain will have a degree of staying power. Image files have shown to be the dominant Inscription type so far, however text based Inscriptions are growing in popularity, in part driven by their lower size and thus lower total fee requirement.

This event has sparked a healthy debate and discussion regarding the impact on the data footprint of both transactions, blocks, and the aggregate blockchain size. As it stands, Inscriptions are currently providing a bid for, and filling blockspace that was was previously underutilized, especially when compared to the last 24-months.

Inscriptions have created congestion in the mempool, and are applying a sustained upwards pressure on fees. However, thus far, this pressure is primarily impacting competition at the lowest fee rate bands, with Inscription creators appearing to be sensitive to the absolute BTC value of the fee paid. As such, there is not yet a strong indication that Inscriptions are ‘crowding out’ monetary transactions, and rather slightly lift the lowest fee rate floor for block inclusion.

Overall, this is a fascinating trend to watch play out in on-chain data, and will be a source of great interest for the market, and us in the on-chain data space moving forwards.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.