The Character of Capitulation

As the dust settles after the FTX debacle, a key question is whether the sell-off can be better characterized as a simple continuation of the bearish trend, or instead a trigger of a deeper psychological shift amongst investors.

The Bitcoin market has continued to consolidate after a chaotic few weeks, with prices trading within a narrow range, holding just above $16k. As the dust settles following the collapse of FTX, the aggregate response of Bitcoin holders is slowly becoming clearer. A key question is whether the recent sell-off can be better characterized as simply a continuation of the bearish trend, or perhaps a trigger of a deeper psychological shift amongst investors.

In this week's edition, we will explore the scale of both realized and unrealized losses amongst Bitcoin holders, in what is now one of the heaviest capitulation events in history. We shall also analyze the shifting behavioral trends which have occurred since the event, and what this tells us about the bigger picture, and the subsequent effects on investor resolve, and seller exhaustion.

A Behavioral Shift

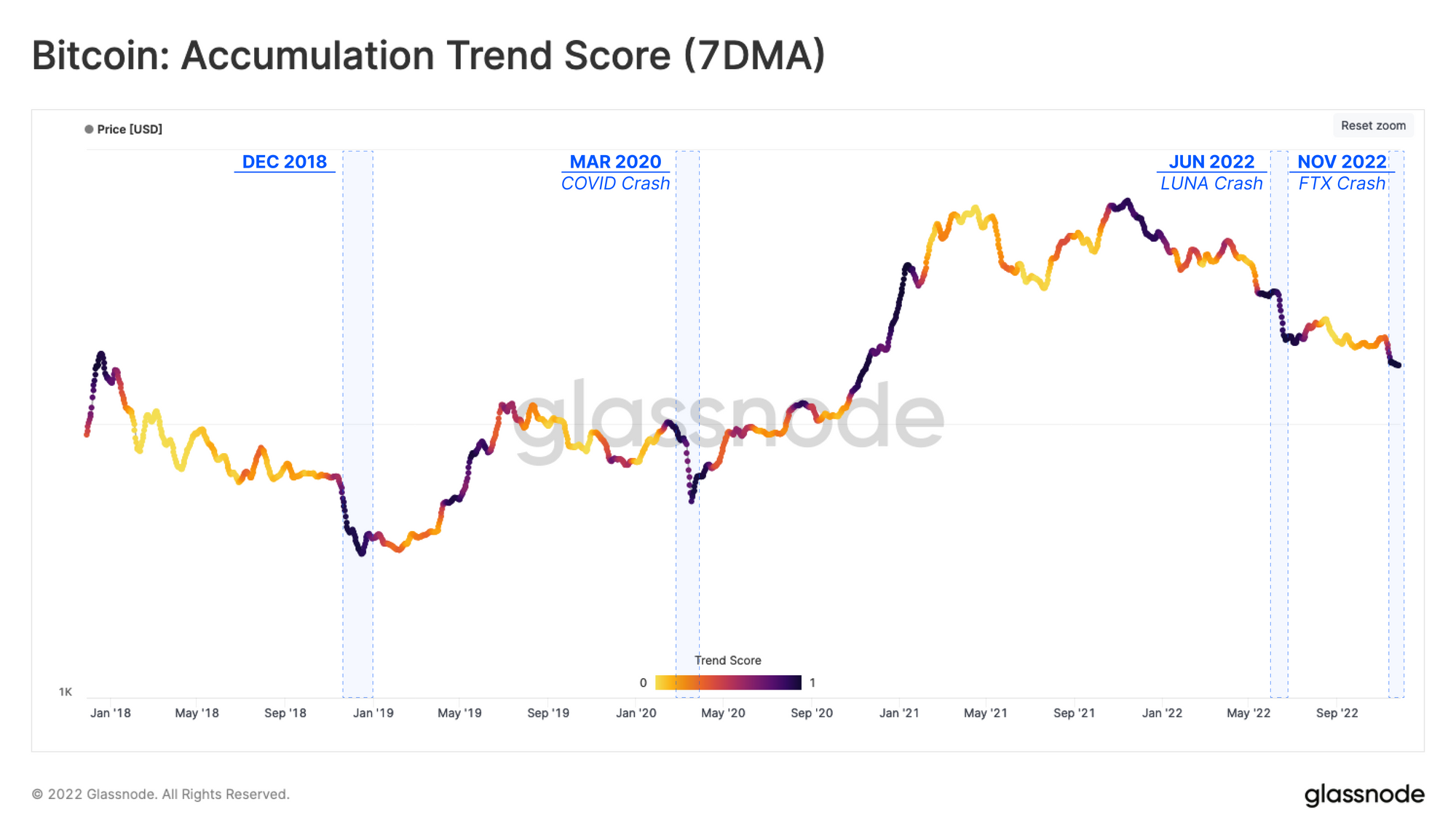

The price of BTC has been trading below the Realized Price ( the cost-basis of the wider market) for over 4.5 months. This has historically correlated with the bottom discovery phase, which can often be visualized and assessed using the Accumulation Trend Score metric.

This tool indicates the relative balance change of entities over the last 30 days, with the scale representing both the size of the balance change and its direction (accumulation to distribution).

- Values approaching 1 🟣 signify that a large portion of the Bitcoin network has been accumulating coins and meaningfully increasing their balance.

- Values approaching 0 🟡 signify that a large portion of the Bitcoin network has been distributing coins and meaningfully decreasing their balance.

From a comparative point of view, the recent strong accumulation score following the recent sell-off resembles that of late 2018. This behavioral shift can be seen immediately following many major sell-off events, including:

- November -December 2018 50% sell-off

- March 2020 COVID Crash

- May 2022 LUNA collapse

- June 2022, when the price first fell below $20k

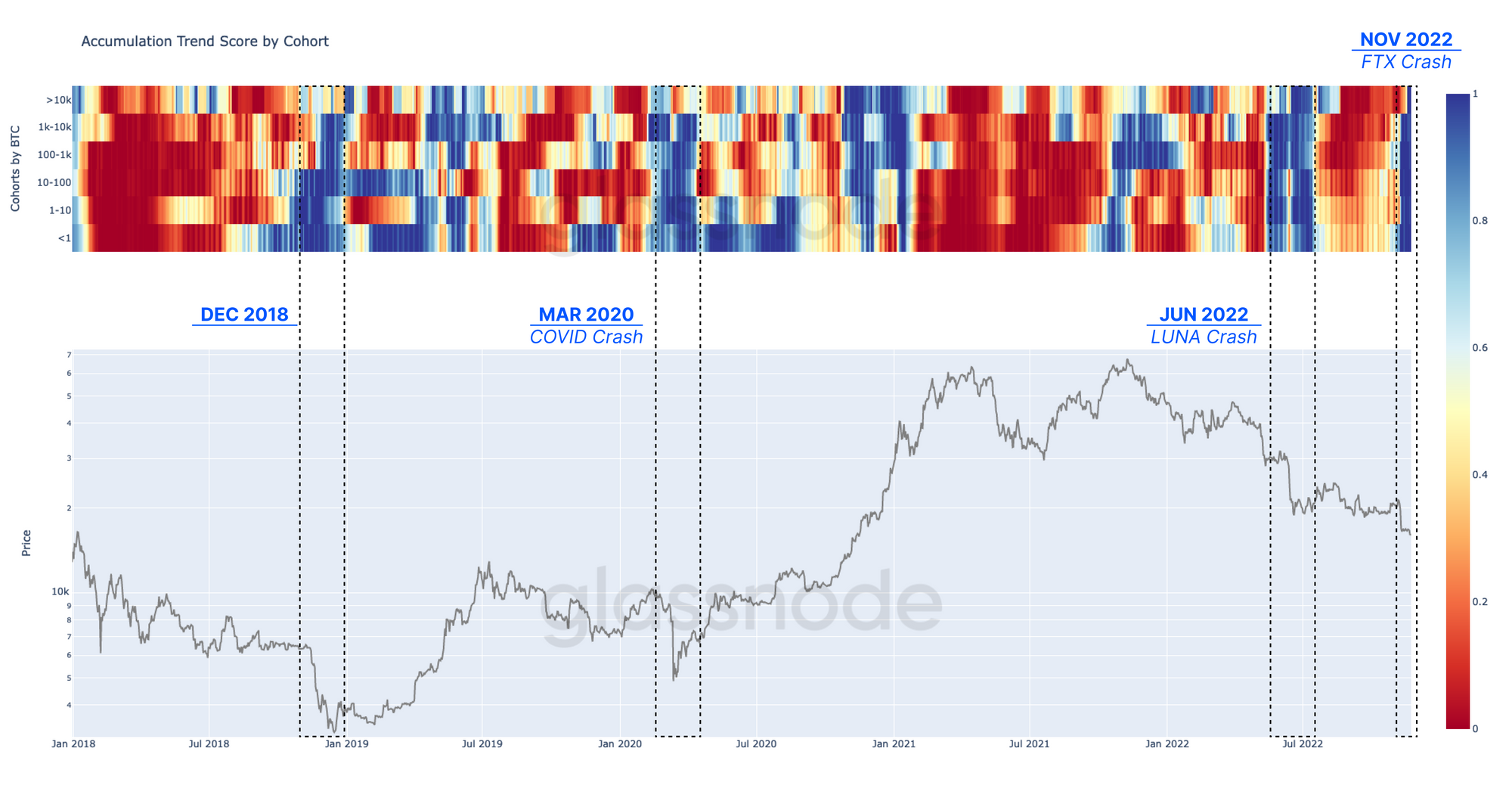

We can break down which specific entities are participating by leveraging the Accumulation 🟦 (and Distribution 🟥) Trend Scores by wallet cohort.

Inspecting the following chart illustrates that almost all cohorts have shifted towards accumulation 🟦 after the recent price contraction. This is a signal of both a perceived opportunity to buy but also a widespread move of coins away from exchanges and towards self-custody (as discussed in WoC 46).

A similar period of widespread accumulation can be observed after all aforementioned sell-off events.

More detailed investigation of various wallet size cohorts can be supplemented with two recently published Glassnode dashboards:

- Address Cohorts (Advanced): showing the total number of addresses and 30-day change of cohort numbers.

- Entities Balance Change (Professional): showing the net holdings and 30-day balance change.

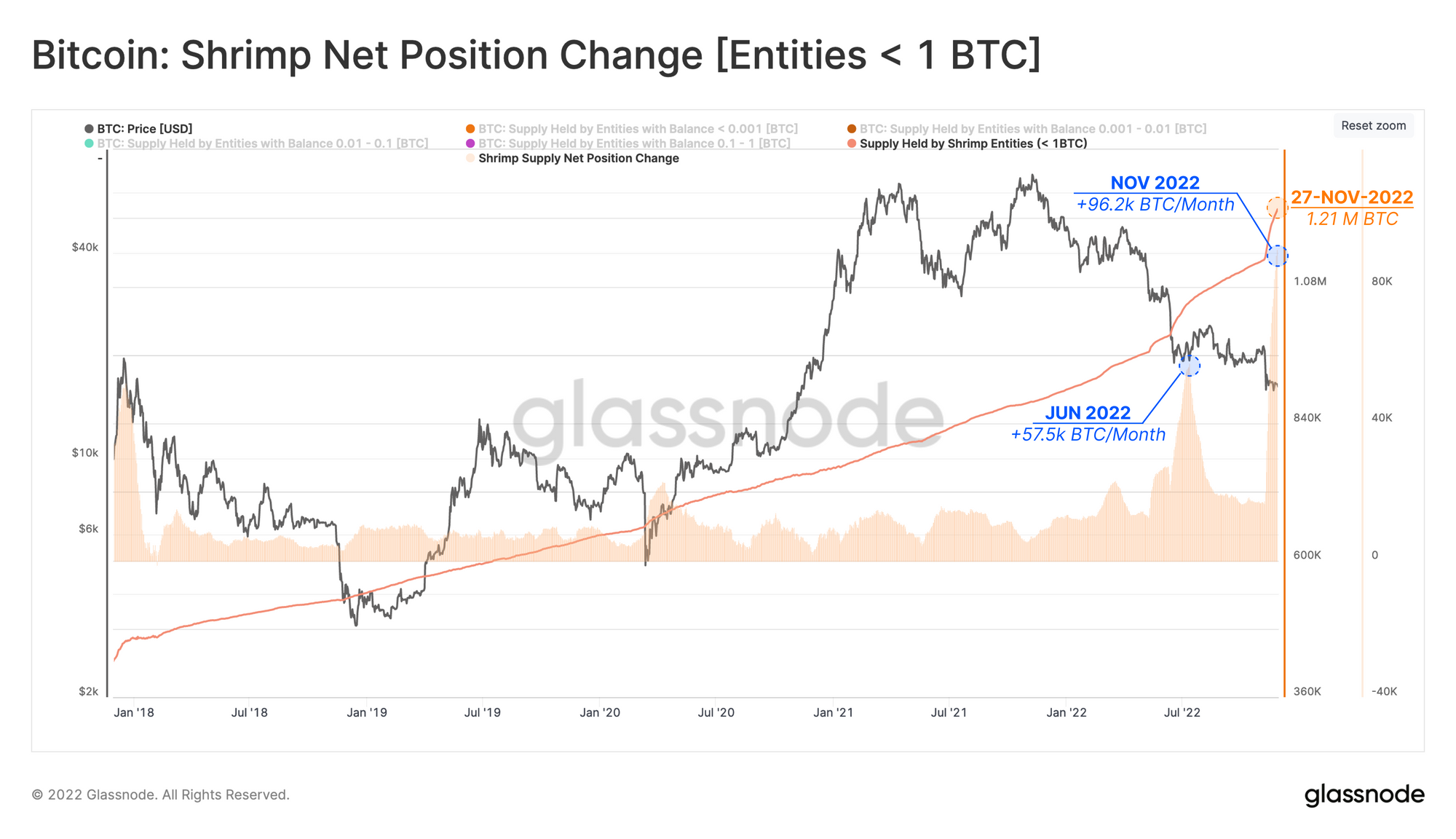

Among all cohorts, the entities holding < 1 BTC (also labelled as Shrimp 🦐) have recorded two distinctive ATH waves of balance increase over the last 5-months. Shrimps have added +96.2k BTC to their holdings since the collapse of FTX, and now hold over 1.21M BTC, equivalent to a non-trivial 6.3% of the circulating supply.

Translations

This Week On-chain is now being translated into Spanish, Italian, Chinese, Japanese, Turkish, French, Portuguese, Farsi, Polish, Arabic, Russian, Vietnamese and Greek.

The Week Onchain Dashboard

The Week Onchain Newsletter has a live dashboard with all featured charts